PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1788512

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1788512

Sports Analytics Market by Offering, Sports Type (Team Sports, Individual Sports, Racing Sports, Virtual Sports ) - Global Forecast to 2030

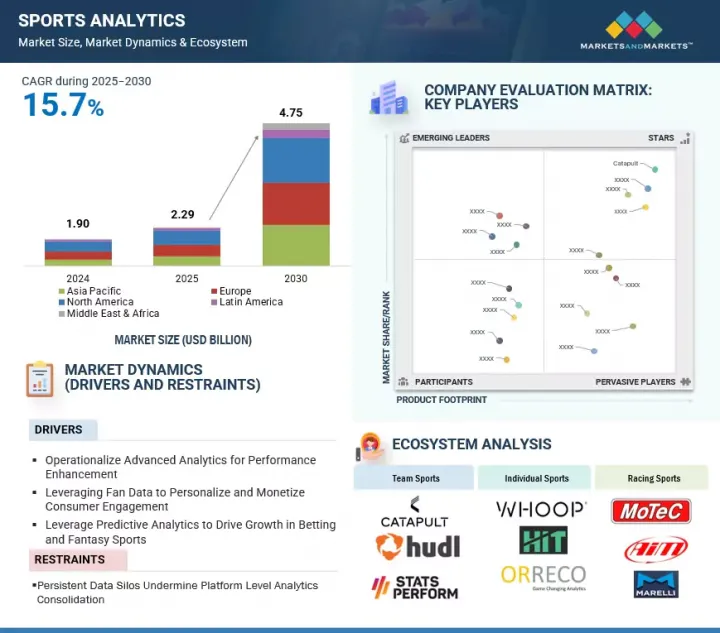

The sports analytics market is experiencing strong growth, projected to rise from USD 2.29 billion in 2025 to USD 4.75 billion by 2030, at a CAGR of 15.7% during the forecast period. As competitive demands intensify, sports organizations are shifting from observational coaching to data-driven performance models.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Offering, Deployment Mode, Sports Type, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Advanced analytics platforms are now central to optimizing training loads, monitoring biomechanics, and refining tactics. AI-powered tools convert real-time physiological and gameplay data into actionable insights that support precision coaching and injury mitigation. By embedding analytics into day-to-day operations, teams unlock consistent performance gains, accelerate player development, and make informed adjustments under pressure. This structured, analytics-first approach is transforming how clubs and federations manage talent, maximize output, and sustain long-term competitive advantages.

"Accelerating Strategic Gains with Predictive Analytics in Competitive Sports"

Predictive analytics tools are experiencing the fastest growth in the sports analytics market, driven by increasing demand for outcome forecasting, injury risk modeling, and real-time decision support. These tools leverage machine learning to analyze historical and live data, enabling more accurate game predictions, player workload management, and strategic planning. Their rapid adoption is especially evident in sports betting, fantasy leagues, and elite team environments seeking competitive advantages. As AI capabilities expand and data quality improves, predictive analytics continue to reshape performance optimization and revenue generation across both professional and commercial sports ecosystems.

"Maximizing Tactical Precision and Talent Development Through Real-time Game Intelligence"

Sports teams and clubs represent the largest end-user segment in the sports analytics market due to their consistent investment in performance optimization, injury prevention, and tactical decision-making. These organizations utilize analytics to gain competitive advantages through real-time player tracking, biometric analysis, and strategy modeling. High adoption across professional leagues, growing interest at the collegiate level, and increasing integration of AI tools further strengthen their market share. With expanding data infrastructure and rising demand for outcome-based performance improvements, teams and clubs continue to be the primary drivers of analytics innovation and implementation in global sports ecosystems.

"North America scales elite performance systems while Asia Pacific fuels analytics-led sports innovation."

North America dominates the global sports analytics market, led by widespread use of performance analysis software, deep integration with league and franchise operations, and early investment in technologies like player tracking and video analytics. Elite teams across the NFL, NBA, and MLB deploy real-time performance models, injury forecasting tools, and tactical video breakdown platforms to optimize athlete output and game strategy. The presence of specialized vendors, mature data infrastructure, and a robust sports-tech ecosystem fosters continuous innovation across both professional and collegiate levels.

In contrast, Asia Pacific is the fastest-growing region, propelled by increased digitization of domestic sports, rising investments in professional leagues, and government-backed sports science initiatives. Markets like India, Japan, and Australia are scaling AI-powered solutions for training load management, predictive injury prevention, and opponent analysis. The region's rapid growth in esports and youth sports programs is also accelerating the adoption of fan engagement analytics and scouting tools. As data-driven strategies become central to competitive success, Asia Pacific is transitioning from emerging to innovation-driven demand, establishing itself as a vital hub for sports analytics expansion.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the sports analytics market.

- By Company: Tier I - 25%, Tier II - 45%, and Tier III - 30%

- By Designation: C-Level Executives - 35%, D-Level Executives - 40%, and Others - 25%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 15%, Middle East & Africa - 10%, and Latin America - 5%

The report includes a study of key players offering sports analytics. The major market players include IBM (US), SAS Institute (US), SAP (Germany), HCL Technologies (India), Salesforce (US), Zebra Technologies (US), Catapult (Australia), EXL (US), Chyron (US), GlobalStep (US), Stats Perform (US), Exasol (Germany), DataArt (US), TruMedia Networks (US), Orreco (Ireland), Sportradar (Switzerland), Whoop (US), Kitman Labs (Ireland), Hudl (US), Trace (US), Kinduct Technologies (Canada), Oracle (US), Uplift Labs (US), SportLogiq (Canada), SportAnalytics (Serbia), L2P Limited (UK), Quant4Sport (UK), Veo Technologies (Denmark), Carv (UK), Real Sports AI (UK), Vekta (US), Zone14 (Austria), SportAI (US), BodyPro (US), HIT Coach (US), Pulse (Various), PunchLab (Italy), Marelli (Italy), MoTeC (Australia), Race Technologies (US), and PandaScore (France).

Research Coverage

This research report categorizes the Sports Analytics market based on offering (solution (performance analytics software, video analytics platforms, predictive analytics tools, and other solutions)) and services (professional services (training & consulting services, system integration & implementation services, support & maintenance services) and managed services, deployment mode (cloud, on-premises, and hybrid), sports type (team sports (cricket, football (soccer), American football/rugby, basketball, baseball, hockey, volleyball), individual sports individual sports (call tennis, athletics (track & field), golf, swimming, cycling, gymnastics, combat sports (boxing, mixed martial arts (MMA), wrestling, judo), other individual sports), racing sports (Formula 1, MotoGP, National Association for Stock Car Auto Racing (NASCAR), horse racing, and other racing sports), online or virtual sports (fantasy sports, online betting, daily fantasy leagues, online poker & card games and other online sports) and emerging sports (digital extreme sports, paralympic sports, and other emerging sports)), application (on field (player load & movement analysis, player tracking & movement, injury prediction & health monitoring, biomechanical & kinematic analysis, training & recovery optimization, match fitness & performance benchmarking, and other on-field applications)) and off-field (opposition scouting, in-game decision support, fan engagement & experience, sponsorship & marketing ROI, merchandise sales optimization, fan behavior tracking and other off-field applications)), end user (sports teams & clubs, sports academies & colleges, sports leagues/associations & governing bodies, broadcasters & media companies, sponsorship & marketing agencies, sports equipment manufacturers, ad sports betting companies), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the sports analytics market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, and mergers and acquisitions; and recent developments associated with the market. This report also covered the competitive analysis of upcoming startups in the market ecosystem.

Key Benefits of Buying the Report

The report will provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall sports analytics market and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Operationalize Advanced Analytics for Performance Enhancement, Leveraging Fan Data to Personalize and Monetize Consumer Engagement, Leverage Predictive Analytics to Drive Growth in Betting and Fantasy Sports), restraints (Persistent Data Silos Undermine Platform Level Analytics Consolidation), opportunities (Enable Scalable Performance Optimization in Sports through Modular Analytics Deployment, Advance Tactical Precision and Player Development through Specialized Esports Analytics), and challenges (Ensure Data Confidentiality and Integrity with Secure Architectures and Access Control Protocols, Rapid Software Evolution Limits Analytics Accessibility for Smaller Teams)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in sports Analytics

- Market Development: Comprehensive information about lucrative markets - analyzing the market across varied regions

- Market Diversification: Exhaustive information about new solutions & services, untapped geographies, recent developments, and investments in the Sports Analytics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), SAS Institute (US), SAP (Germany), HCL Technologies (India), Salesforce (US), Zebra Technologies (US), Catapult (Australia), EXL (US), Chyron (US), GlobalStep (US), Stats Perform (US), Exasol (Germany), DataArt (US), TruMedia Networks (US), Orreco (Ireland), Sportradar (Switzerland), Whoop (US), Kitman Labs (Ireland), Hudl (US), Trace (US), Kinduct Technologies (Canada), Oracle (US), Uplift Labs (US), SportLogiq (Canada), SportAnalytics (Serbia), L2P Limited (UK), Quant4Sport (UK), Veo Technologies (Denmark), Carv (UK), Real Sports AI (UK), Vekta (US), Zone14 (Austria), SportAI (US), BodyPro (US), HIT Coach (US), Pulse (Various), PunchLab (Italy), Marelli (Italy), MoTeC (Australia), Race Technologies (US), and PandaScore (France).

The report also helps stakeholders understand the pulse of the sports analytics market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPORTS ANALYTICS MARKET

- 4.2 SPORTS ANALYTICS MARKET: TOP THREE SOLUTIONS

- 4.3 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE AND SOLUTION

- 4.4 SPORTS ANALYTICS MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing reliance on advanced analytics to optimize player performance

- 5.2.1.2 Rising adoption of fan data analytics for personalized engagement and revenue growth

- 5.2.1.3 Growing use of predictive analytics in legal sports betting and fantasy sports

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmented data ecosystems undermining cross-functional analytics

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing deployment of modular analytics for performance optimization in emerging sports

- 5.2.3.2 Rising esports sector fueling real-time analytics innovation and audience-centric expansion

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate data security exposing sensitive player movement and tactical analytics

- 5.2.4.2 Frequent software updates disrupting workflow continuity

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF SPORTS ANALYTICS MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PERFORMANCE ANALYTICS SOFTWARE

- 5.5.2 VIDEO ANALYTICS PLATFORMS

- 5.5.3 PREDICTIVE ANALYTICS TOOLS

- 5.5.4 OTHER SOLUTIONS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: IBM AND ESPN TRANSFORM FANTASY FOOTBALL EXPERIENCE WITH SCALABLE, AI-DRIVEN DECISION SUPPORT

- 5.7.2 CASE STUDY 2: ORLANDO MAGIC AND SAS INSTITUTE LEVERAGE ANALYTICS TO OVERCOME REVENUE CHALLENGES

- 5.7.3 CASE STUDY 3: BOSTON CELTICS AND MISSION CLOUD ACCELERATE DATA ANALYTICS AND ENHANCE OPERATIONAL EFFICIENCY THROUGH CLOUD

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Computer vision

- 5.8.1.2 Internet of Things (IoT)

- 5.8.1.3 Edge computing

- 5.8.1.4 Natural language processing (NLP)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Blockchain

- 5.8.2.2 Cloud computing

- 5.8.2.3 Digital twin

- 5.8.2.4 GPS & LPS

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Augmented reality (AR) and virtual reality (VR)

- 5.8.3.2 Geospatial analytics

- 5.8.3.3 5G and advanced connectivity

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS

- 5.9.2.1 North America

- 5.9.2.1.1 US

- 5.9.2.1.2 Canada

- 5.9.2.2 Europe

- 5.9.2.2.1 UK

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 India

- 5.9.2.3.2 China

- 5.9.2.3.3 Japan

- 5.9.2.3.4 South Korea

- 5.9.2.3.5 Australia

- 5.9.2.3.6 New Zealand

- 5.9.2.4 Middle East & Africa

- 5.9.2.4.1 Saudi Arabia

- 5.9.2.4.2 UAE

- 5.9.2.4.3 Qatar

- 5.9.2.4.4 Turkey

- 5.9.2.4.5 South Africa

- 5.9.2.5 Latin America

- 5.9.2.5.1 Brazil

- 5.9.2.1 North America

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 5.10.3 INNOVATION AND PATENT APPLICATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 5.11.2 AVERAGE SELLING PRICE, BY SPORTS TYPE, 2025

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 REGIONAL SPORTS BETTING AND ONLINE FANTASY REVENUE TRENDS (2025-2026)

- 5.17 FUTURE OUTLOOK AND EMERGING USE CASES

- 5.17.1 NEXT-GEN FAN ENGAGEMENT MODELS

- 5.17.2 PERSONALIZED ATHLETE HEALTH AND NUTRITION

- 5.17.3 RISE OF BETTING AND FANTASY SPORTS ANALYTICS

- 5.17.4 INTEGRATION WITH E-SPORTS AND VIRTUAL LEAGUES

- 5.18 BUYER'S PERSPECTIVE ON SPORTS ANALYTICS

- 5.18.1 KEY DECISION CRITERIA FOR CLUBS AND ASSOCIATIONS

- 5.18.2 BUILD VS. BUY ANALYSIS FOR ANALYTICS PLATFORMS

- 5.18.3 ROI AND BUSINESS CASE CONSIDERATIONS

- 5.18.4 PROCUREMENT MODELS AND PRICING TRENDS

6 SPORTS ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: SPORTS ANALYTICS MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 PERFORMANCE ANALYTICS SOFTWARE

- 6.2.1.1 Enhancing player efficiency and tactical accuracy through performance insights

- 6.2.2 VIDEO ANALYTICS PLATFORMS

- 6.2.2.1 Driving tactical precision and visual breakdown for smarter game planning

- 6.2.3 PREDICTIVE ANALYTICS TOOLS

- 6.2.3.1 Optimizing strategic forecasting and outcome modeling with advanced predictive tools

- 6.2.4 OTHER SOLUTIONS

- 6.2.1 PERFORMANCE ANALYTICS SOFTWARE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Aligning analytics execution with strategic objectives through expert-led services

- 6.3.1.2 Training & consulting services

- 6.3.1.3 System integration & implementation services

- 6.3.1.4 Support & maintenance services

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Ensuring seamless operations and scalable performance through managed analytics services

- 6.3.1 PROFESSIONAL SERVICES

7 SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: SPORTS ANALYTICS MARKET DRIVERS

- 7.2 CLOUD

- 7.2.1 ENABLING SCALABLE, REAL-TIME ANALYTICS WITH FLEXIBLE CLOUD-BASED INFRASTRUCTURE

- 7.3 ON-PREMISES

- 7.3.1 DELIVERING DATA CONTROL AND COMPLIANCE THROUGH ON-PREMISES DEPLOYMENT MODELS

- 7.4 HYBRID

- 7.4.1 BALANCING FLEXIBILITY AND CONTROL IN SPORTS ANALYTICS WITH HYBRID DEPLOYMENT

8 SPORTS ANALYTICS MARKET, BY SPORTS TYPE

- 8.1 INTRODUCTION

- 8.1.1 SPORTS TYPE: SPORTS ANALYTICS MARKET DRIVERS

- 8.2 TEAM SPORTS

- 8.2.1 ENHANCING TACTICAL COORDINATION AND SCALABLE FAN ENGAGEMENT THROUGH SPORTS INTELLIGENCE TOOLS

- 8.2.2 CRICKET

- 8.2.3 FOOTBALL (SOCCER)

- 8.2.4 AMERICAN FOOTBALL

- 8.2.5 BASKETBALL

- 8.2.6 BASEBALL

- 8.2.7 HOCKEY

- 8.2.8 VOLLEYBALL

- 8.2.9 OTHER TEAM SPORTS

- 8.3 INDIVIDUAL SPORTS

- 8.3.1 PERSONALIZED PERFORMANCE OPTIMIZATION DRIVING ANALYTICS ADOPTION IN INDIVIDUAL SPORTS

- 8.3.2 TENNIS

- 8.3.3 ATHLETICS (TRACK & FIELD)

- 8.3.4 GOLF

- 8.3.5 SWIMMING

- 8.3.6 CYCLING

- 8.3.7 GYMNASTICS

- 8.3.8 COMBAT SPORTS

- 8.3.8.1 Boxing

- 8.3.8.2 Mixed martial arts (MMA)

- 8.3.8.3 Wrestling

- 8.3.8.4 Judo

- 8.3.9 OTHER INDIVIDUAL SPORTS

- 8.4 RACING SPORTS

- 8.4.1 IMPROVING TACTICAL ACCURACY AND COMPETITIVE CONSISTENCY IN RACE ENVIRONMENTS

- 8.4.2 FORMULA 1

- 8.4.3 MOTOGP

- 8.4.4 NATIONAL ASSOCIATION FOR STOCK CAR AUTO RACING (NASCAR)

- 8.4.5 HORSE RACING

- 8.4.6 OTHER RACING SPORTS

- 8.5 ONLINE OR VIRTUAL SPORTS

- 8.5.1 DRIVING ENGAGEMENT AND MONETIZATION THROUGH REAL-TIME COMPETITIVE INTELLIGENCE

- 8.5.2 FANTASY SPORTS

- 8.5.3 ONLINE BETTING

- 8.5.4 DAILY FANTASY SPORTS

- 8.5.5 ONLINE POKER & CARD GAMES

- 8.5.6 OTHER ONLINE SPORTS

- 8.6 EMERGING SPORTS

- 8.6.1 BUILDING DATA-FIRST GROWTH MODELS FOR NICHE AND HYBRID SPORTS FORMATS

- 8.6.2 DIGITAL EXTREME SPORTS

- 8.6.3 PARALYMPIC SPORTS

- 8.6.4 OTHER EMERGING SPORTS

9 SPORTS ANALYTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATION: SPORTS ANALYTICS MARKET DRIVERS

- 9.2 ON-FIELD

- 9.2.1 MAXIMIZING ON-FIELD PERFORMANCE THROUGH TACTICAL INSIGHTS AND REAL-TIME DECISION SUPPORT

- 9.2.2 PLAYER PERFORMANCE ANALYSIS

- 9.2.3 TACTICAL AND POSITIONAL ANALYSIS

- 9.2.4 GAME STRATEGY OPTIMIZATION

- 9.2.5 FATIGUE AND WORKLOAD MONITORING

- 9.2.6 OPPONENT SCOUTING AND MATCH PREPARATION

- 9.2.7 INJURY RISK PREDICTION

- 9.2.8 OTHER ON-FIELD APPLICATIONS

- 9.3 OFF-FIELD

- 9.3.1 OPTIMIZING OFF-FIELD DECISIONS THROUGH STRATEGIC, OPERATIONAL, AND COMMERCIAL ANALYTICS

- 9.3.2 FAN ENGAGEMENT ANALYTICS

- 9.3.3 SPONSORSHIP VALUATION AND ROI TRACKING

- 9.3.4 TICKETING AND ATTENDANCE FORECASTING

- 9.3.5 SOCIAL MEDIA AND SENTIMENT ANALYSIS

- 9.3.6 MERCHANDISE SALES OPTIMIZATION

- 9.3.7 OTHER OFF-FIELD APPLICATIONS

10 SPORTS ANALYTICS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USER: SPORTS ANALYTICS MARKET DRIVERS

- 10.1.2 SPORTS TEAMS & CLUBS

- 10.1.2.1 Leveraging data to enhance competitive performance and guide tactical, physical, and talent decisions

- 10.1.3 SPORTS ACADEMIES & COLLEGES

- 10.1.3.1 Driving athlete development and curriculum design through integrated performance and training analytics

- 10.1.4 SPORTS LEAGUES & GOVERNING BODIES

- 10.1.4.1 Optimizing competition integrity and strategic growth through data-driven oversight

- 10.1.5 BROADCASTERS & MEDIA COMPANIES

- 10.1.5.1 Enhancing viewer experience and content strategy through real-time performance and audience analytics

- 10.1.6 SPONSORSHIP & MARKETING AGENCIES

- 10.1.6.1 Using fan engagement and performance data to maximize sponsorship and campaign outcomes

- 10.1.7 SPORTS EQUIPMENT MANUFACTURERS

- 10.1.7.1 Driving product innovation and athlete-centric solutions through data insights and performance trends

- 10.1.8 SPORTS BETTING COMPANIES

- 10.1.8.1 Maximizing competitive advantage through real-time data and predictive analytics in betting operations

- 10.1.9 OTHER END USERS

11 SPORTS ANALYTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: SPORTS ANALYTICS MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Integrating sports analytics for performance optimization and enhanced betting insights

- 11.2.4 CANADA

- 11.2.4.1 Advancing sports analytics with virtual and fantasy sports

- 11.3 EUROPE

- 11.3.1 EUROPE: SPORTS ANALYTICS MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Empowering data-centric engagement through strategic collaborations

- 11.3.4 GERMANY

- 11.3.4.1 Advancing competitive edge through integrated predictive analytics

- 11.3.5 FRANCE

- 11.3.5.1 Transforming tactical dynamics and academy outcomes via advanced analytics

- 11.3.6 ITALY

- 11.3.6.1 Optimizing coaching and recruitment methodologies with data-driven intelligence

- 11.3.7 SPAIN

- 11.3.7.1 Elevating tactical intelligence and fan connection through data modeling

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: SPORTS ANALYTICS MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Leveraging analytics for optimized athlete performance and enhanced data-driven decisions

- 11.4.4 JAPAN

- 11.4.4.1 Olympic-focused investment and institutional partnerships accelerate analytics adoption across sports

- 11.4.5 INDIA

- 11.4.5.1 Real-time performance analysis accelerates team strategy and player development nationwide

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Maximizing competitive gains through data-driven decisions in esports

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Integrated analytics adoption and collaboration drive sporting excellence

- 11.4.8 SINGAPORE

- 11.4.8.1 National data exchange enhances athlete performance and institutional planning

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 SAUDI ARABIA

- 11.5.3.1 Vision 2030 and club-tech partnerships drive analytics-led sports innovation

- 11.5.4 UAE

- 11.5.4.1 Advancing talent and increasing fan engagement through targeted analytics adoption

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Digital integration and youth development propel sports analytics momentum

- 11.5.6 QATAR

- 11.5.6.1 Embedding advanced sports analytics for enhanced talent and fan experiences

- 11.5.7 TURKEY

- 11.5.7.1 Elevating sports growth through targeted club and federation analytics partnerships

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: SPORTS ANALYTICS MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Institutional backing and club innovation accelerate data-driven athletic advancements

- 11.6.4 MEXICO

- 11.6.4.1 Sports analytics advances tactical precision and fan engagement in Mexican leagues

- 11.6.5 ARGENTINA

- 11.6.5.1 Elevating sports through tactical intelligence and federated data innovation

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT COMPARISON

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY TEAM SPORTS

- 12.5.1.1 Sportscode (Hudl)

- 12.5.1.2 Catapult Pro Video (Catapult)

- 12.5.1.3 Kitman Labs Intelligence Platform (Kitman Labs)

- 12.5.1.4 Veo Analytics (Veo Technologies)

- 12.5.1.5 Sportlogiq iCE Platform (Sportlogiq)

- 12.5.2 PRODUCT COMPARATIVE ANALYSIS, BY INDIVIDUAL SPORTS

- 12.5.2.1 MoTeC i2 [MoTeC (Bosch Company)]

- 12.5.2.2 Uplift Vision (Uplift Labs)

- 12.5.2.3 Orreco Zone (Orreco)

- 12.5.2.4 BodyPro Platform (BodyPro)

- 12.5.2.5 Vekta Platform (Vekta)

- 12.5.3 PRODUCT COMPARATIVE ANALYSIS, BY ONLINE OR VIRTUAL SPORTS

- 12.5.3.1 Opta AI Studio (Stats Perform)

- 12.5.3.2 Radar360 Analytics Platform (Sportradar)

- 12.5.3.3 Esports Fantasy (Pandascore)

- 12.5.3.4 SportAI Platform (SportAI)

- 12.5.3.5 Playtest Analytics (GlobalStep)

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY TEAM SPORTS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Sports type footprint

- 12.7.5.5 End user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 IBM

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 SAP

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches and enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 SAS INSTITUTE

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 HCLTECH

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches and enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 ZEBRA TECHNOLOGIES

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 GLOBALSTEP

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches and enhancements

- 13.2.6.3.2 Deals

- 13.2.7 STATS PERFORM

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches and enhancements

- 13.2.7.3.2 Deals

- 13.2.8 SPORTRADAR

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches and enhancements

- 13.2.8.3.2 Deals

- 13.2.9 HUDL

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product launches and enhancements

- 13.2.9.3.2 Deals

- 13.2.10 EXL

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.11 CHYRON

- 13.2.12 CATAPULT

- 13.2.1 IBM

- 13.3 OTHER PLAYERS

- 13.3.1 MOTEC (BOSCH)

- 13.3.2 SPORTS ANALYTICS WORLD

- 13.3.3 VEKTA

- 13.3.4 BODYPRO (HEALTHCENTRAL NETWORK)

- 13.3.5 ZONE14

- 13.3.6 SPORTLOGIQ

- 13.3.7 UPLIFT LABS

- 13.3.8 KITMAN LABS

- 13.3.9 ORRECO

- 13.3.10 TRUMEDIA NETWORKS

- 13.3.11 VEO TECHNOLOGIES

- 13.3.12 SPORTANALYTICS

- 13.3.13 SPORTAI

- 13.3.14 RACE TECHNOLOGY

- 13.3.15 PANDASCORE

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 AI IN SPORTS MARKET - GLOBAL FORECAST TO 2030

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 AI in sports market, by offering

- 14.2.2.2 AI in sports market, by end user

- 14.2.2.3 AI in sports market, by region

- 14.3 AI IN MEDIA MARKET - GLOBAL FORECAST TO 2030

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 AI in media market, by offering

- 14.3.2.2 AI in media market, by application

- 14.3.2.3 AI in media market, by end user

- 14.3.2.4 AI in media market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 SPORTS ANALYTICS MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 4 SPORTS ANALYTICS MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 5 SPORTS ANALYTICS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PATENTS FILED, 2016-2025

- TABLE 12 LIST OF TOP PATENTS IN SPORTS ANALYTICS MARKET, 2024-2025

- TABLE 13 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- TABLE 14 AVERAGE SELLING PRICE, BY SPORTS TYPE, 2025

- TABLE 15 SPORTS ANALYTICS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON SPORTS ANALYTICS MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 REGIONAL SPORTS BETTING AND ONLINE FANTASY REVENUE TRENDS, 2025-2026

- TABLE 20 SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 21 SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 22 SPORTS ANALYTICS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 23 SPORTS ANALYTICS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 24 SOLUTIONS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 SOLUTIONS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 PERFORMANCE ANALYTICS SOFTWARE: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 PERFORMANCE ANALYTICS SOFTWARE: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 VIDEO ANALYTICS PLATFORMS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 VIDEO ANALYTICS PLATFORMS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 PREDICTIVE ANALYTICS TOOLS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 PREDICTIVE ANALYTICS TOOLS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 OTHER SOLUTIONS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 OTHER SOLUTIONS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 SPORTS ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 35 SPORTS ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 36 SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 39 SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 40 PROFESSIONAL SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 PROFESSIONAL SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 TRAINING & CONSULTING SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 TRAINING & CONSULTING SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 SUPPORT & MAINTENANCE SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 SUPPORT & MAINTENANCE SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 MANAGED SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 MANAGED SERVICES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 51 SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 52 CLOUD: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 CLOUD: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 ON-PREMISES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 ON-PREMISES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 HYBRID: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 HYBRID: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2020-2024 (USD MILLION)

- TABLE 59 SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2025-2030 (USD MILLION)

- TABLE 60 SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2020-2024 (USD MILLION)

- TABLE 61 SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2025-2030 (USD MILLION)

- TABLE 62 TEAM SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 TEAM SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 CRICKET: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 CRICKET: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 FOOTBALL (SOCCER): SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 FOOTBALL (SOCCER): SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 AMERICAN FOOTBALL: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 AMERICAN FOOTBALL: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 BASKETBALL: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 BASKETBALL: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 BASEBALL: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 BASEBALL: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 HOCKEY: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 HOCKEY: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 VOLLEYBALL: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 VOLLEYBALL: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 OTHER TEAM SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 OTHER TEAM SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 81 SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 82 INDIVIDUAL SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 INDIVIDUAL SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 TENNIS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 TENNIS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 ATHLETICS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 ATHLETICS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 GOLF: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 GOLF: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 SWIMMING: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 SWIMMING: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 CYCLING: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 CYCLING: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 GYMNASTICS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 GYMNASTICS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 COMBAT SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 COMBAT SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 OTHER INDIVIDUAL SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 OTHER INDIVIDUAL SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2020-2024 (USD MILLION)

- TABLE 101 SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2025-2030 (USD MILLION)

- TABLE 102 RACING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 RACING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 FORMULA 1: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 FORMULA 1: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 MOTOGP: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 107 MOTOGP: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 NATIONAL ASSOCIATION FOR STOCK CAR AUTO RACING (NASCAR): SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 109 NATIONAL ASSOCIATION FOR STOCK CAR AUTO RACING (NASCAR): SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 HORSE RACING: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 111 HORSE RACING: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 OTHER RACING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 113 OTHER RACING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 115 SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 116 ONLINE OR VIRTUAL SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 117 ONLINE OR VIRTUAL SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 FANTASY SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 119 FANTASY SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 ONLINE BETTING: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 121 ONLINE BETTING: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 DAILY FANTASY SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 123 DAILY FANTASY SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 ONLINE POKER & CARD GAMES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 125 ONLINE POKER & CARD GAMES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 OTHER ONLINE SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 127 OTHER ONLINE SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2020-2024 (USD MILLION)

- TABLE 129 SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2025-2030 (USD MILLION)

- TABLE 130 EMERGING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 131 EMERGING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 132 DIGITAL EXTREME SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 133 DIGITAL EXTREME SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 134 PARALYMPIC SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 135 PARALYMPIC SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 136 OTHER EMERGING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 137 OTHER EMERGING SPORTS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 SPORTS ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 139 SPORTS ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 ON-FIELD: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 141 ON-FIELD: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 142 OFF-FIELD: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 143 OFF-FIELD: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 SPORTS ANALYTICS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 145 SPORTS ANALYTICS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 SPORTS TEAMS & CLUBS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 147 SPORTS TEAMS & CLUBS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 148 SPORTS ACADEMIES & COLLEGES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 149 SPORTS ACADEMIES & COLLEGES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 SPORTS LEAGUES & GOVERNING BODIES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 151 SPORTS LEAGUES & GOVERNING BODIES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 152 BROADCASTERS & MEDIA COMPANIES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 153 BROADCASTERS & MEDIA COMPANIES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 154 SPONSORSHIP & MARKETING AGENCIES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 155 SPONSORSHIP & MARKETING AGENCIES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 156 SPORTS EQUIPMENT MANUFACTURERS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 157 SPORTS EQUIPMENT MANUFACTURERS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 158 SPORTS BETTING COMPANIES: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 159 SPORTS BETTING COMPANIES: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 160 OTHER END USERS: SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 161 OTHER END USERS: SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 162 SPORTS ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 163 SPORTS ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 164 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 165 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 166 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 167 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 168 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 169 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 170 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 171 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 172 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 173 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 175 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 176 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2020-2024 (USD MILLION)

- TABLE 177 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2025-2030 (USD MILLION)

- TABLE 178 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2020-2024 (USD MILLION)

- TABLE 179 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2025-2030 (USD MILLION)

- TABLE 180 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 181 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 182 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2020-2024 (USD MILLION)

- TABLE 183 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2025-2030 (USD MILLION)

- TABLE 184 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 185 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2020-2024 (USD MILLION)

- TABLE 187 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2025-2030 (USD MILLION)

- TABLE 188 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 189 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 190 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 191 NORTH AMERICA: SPORTS ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 192 US: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 193 US: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 194 CANADA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 195 CANADA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 196 EUROPE: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 197 EUROPE: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 198 EUROPE: SPORTS ANALYTICS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 199 EUROPE: SPORTS ANALYTICS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 200 EUROPE: SPORTS ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 201 EUROPE: SPORTS ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 202 EUROPE: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 USD MILLION)

- TABLE 203 EUROPE: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 204 EUROPE: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 205 EUROPE: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 206 EUROPE: SPORTS ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 207 EUROPE: SPORTS ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 208 EUROPE: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2020-2024 (USD MILLION)

- TABLE 209 EUROPE: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2025-2030 (USD MILLION)

- TABLE 210 EUROPE: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2020-2024 (USD MILLION)

- TABLE 211 EUROPE: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2025-2030 (USD MILLION)

- TABLE 212 EUROPE: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 213 EUROPE: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 214 EUROPE: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2020-2024 (USD MILLION)

- TABLE 215 EUROPE: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2025-2030 (USD MILLION)

- TABLE 216 EUROPE: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 217 EUROPE: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 218 EUROPE: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2020-2024 (USD MILLION)

- TABLE 219 EUROPE: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2025-2030 (USD MILLION)

- TABLE 220 EUROPE: SPORTS ANALYTICS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 221 EUROPE: SPORTS ANALYTICS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 222 EUROPE: SPORTS ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 223 EUROPE: SPORTS ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 224 UK: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 225 UK: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 226 GERMANY: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 227 GERMANY: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 228 FRANCE: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 229 FRANCE: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 230 ITALY: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 231 ITALY: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 232 SPAIN: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 233 SPAIN: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 234 REST OF EUROPE: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 235 REST OF EUROPE: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 236 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 237 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 238 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 239 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 240 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 241 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 242 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 243 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 244 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 245 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 246 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 247 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 248 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2020-2024 (USD MILLION)

- TABLE 249 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2025-2030 (USD MILLION)

- TABLE 250 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2020-2024 (USD MILLION)

- TABLE 251 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2025-2030 (USD MILLION)

- TABLE 252 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 253 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 254 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2020-2024 (USD MILLION)

- TABLE 255 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2025-2030 (USD MILLION)

- TABLE 256 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 257 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 258 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2020-2024 (USD MILLION)

- TABLE 259 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2025-2030 (USD MILLION)

- TABLE 260 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 261 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 262 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 263 ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 264 CHINA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 265 CHINA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 266 JAPAN: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 267 JAPAN: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 268 INDIA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 269 INDIA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 270 SOUTH KOREA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 271 SOUTH KOREA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 272 AUSTRALIA & NEW ZEALAND: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 273 AUSTRALIA & NEW ZEALAND: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 274 SINGAPORE: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 275 SINGAPORE: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 290 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2020-2024 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2025-2030 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2020-2024 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2025-2030 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2020-2024 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2025-2030 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2020-2024 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2025-2030 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 305 MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 306 SAUDI ARABIA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 307 SAUDI ARABIA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 308 UAE: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 309 UAE: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 310 SOUTH AFRICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 311 SOUTH AFRICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 312 QATAR: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 313 QATAR: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 314 TURKEY: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 315 TURKEY: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 318 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 319 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 320 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 321 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 322 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 323 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 324 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 USD MILLION)

- TABLE 325 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 326 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 327 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 328 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 329 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 330 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2020-2024 (USD MILLION)

- TABLE 331 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY SPORTS TYPE, 2025-2030 (USD MILLION)

- TABLE 332 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2020-2024 (USD MILLION)

- TABLE 333 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY TEAM SPORTS, 2025-2030 (USD MILLION)

- TABLE 334 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 335 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY INDIVIDUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 336 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2020-2024 (USD MILLION)

- TABLE 337 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY RACING SPORTS, 2025-2030 (USD MILLION)

- TABLE 338 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2020-2024 (USD MILLION)

- TABLE 339 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY ONLINE OR VIRTUAL SPORTS, 2025-2030 (USD MILLION)

- TABLE 340 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2020-2024 (USD MILLION)

- TABLE 341 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY EMERGING SPORTS, 2025-2030 (USD MILLION)

- TABLE 342 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 343 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 344 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 345 LATIN AMERICA: SPORTS ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 346 BRAZIL: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 347 BRAZIL: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 348 MEXICO: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 349 MEXICO: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 350 ARGENTINA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 351 ARGENTINA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 352 REST OF LATIN AMERICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 353 REST OF LATIN AMERICA: SPORTS ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 354 OVERVIEW OF STRATEGIES ADOPTED BY KEY SPORTS ANALYTICS VENDORS, 2021-2025

- TABLE 355 SPORTS ANALYTICS MARKET: DEGREE OF COMPETITION

- TABLE 356 SPORTS ANALYTICS MARKET: REGIONAL FOOTPRINT (12 PLAYERS)

- TABLE 357 SPORTS ANALYTICS MARKET: OFFERING FOOTPRINT (12 PLAYERS)

- TABLE 358 SPORTS ANALYTICS MARKET: SPORTS TYPE FOOTPRINT (12 PLAYERS)

- TABLE 359 SPORTS ANALYTICS MARKET: END USER FOOTPRINT (12 PLAYERS)

- TABLE 360 SPORTS ANALYTICS MARKET: KEY STARTUPS/SMES, 2024

- TABLE 361 SPORTS ANALYTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 362 SPORTS ANALYTICS MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2022-JULY 2025

- TABLE 363 SPORTS ANALYTICS MARKET: DEALS, 2022-JULY 2025

- TABLE 364 IBM: COMPANY OVERVIEW

- TABLE 365 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 366 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 367 IBM: DEALS

- TABLE 368 SAP: COMPANY OVERVIEW

- TABLE 369 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 370 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 371 SAP: DEALS

- TABLE 372 SAS INSTITUTE: COMPANY OVERVIEW

- TABLE 373 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 SAS INSTITUTE: DEALS

- TABLE 375 HCLTECH: COMPANY OVERVIEW

- TABLE 376 HCLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 HCLTECH: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 378 HCLTECH: DEALS

- TABLE 379 ZEBRA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 380 ZEBRA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 381 ZEBRA TECHNOLOGIES: DEALS

- TABLE 382 GLOBALSTEP: COMPANY OVERVIEW

- TABLE 383 GLOBALSTEP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 384 GLOBALSTEP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 385 GLOBALSTEP: DEALS

- TABLE 386 STATS PERFORM: COMPANY OVERVIEW

- TABLE 387 STATS PERFORM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 388 STATS PERFORM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 389 STATS PERFORM: DEALS

- TABLE 390 SPORTRADAR: COMPANY OVERVIEW

- TABLE 391 SPORTRADAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 392 SPORTRADAR: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 393 SPORTRADAR: DEALS

- TABLE 394 HUDL: COMPANY OVERVIEW

- TABLE 395 HUDL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 396 HUDL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 397 HUDL: DEALS

- TABLE 398 EXL: COMPANY OVERVIEW

- TABLE 399 EXL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 AI IN SPORTS MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 401 AI IN SPORTS MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 402 AI IN SPORTS MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 403 AI IN SPORTS MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 404 AI IN SPORTS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 405 AI IN SPORTS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 406 AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 407 AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 408 AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2019-2023 (USD MILLION)

- TABLE 409 AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2024-2030 (USD MILLION)

- TABLE 410 AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2019-2023 (USD MILLION)

- TABLE 411 AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2024-2030 (USD MILLION)

- TABLE 412 AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 413 AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 414 AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 415 AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024-2030 (USD MILLION)

List of Figures

- FIGURE 1 SPORTS ANALYTICS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 SPORTS ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM OFFERINGS IN SPORTS ANALYTICS MARKET

- FIGURE 5 APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTION/SERVICE COMPANIES OF SPORTS ANALYTICS MARKET

- FIGURE 6 APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF SPORTS ANALYTICS MARKET

- FIGURE 7 APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF SPORTS ANALYTICS THROUGH OVERALL IT SPENDING

- FIGURE 8 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 9 ON-FIELD APPLICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 10 TEAM SPORTS SEGMENT TO LEAD MARKET IN 2025

- FIGURE 11 SPORTS LEAGUES & GOVERNING BODIES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 RISING ADOPTION OF FAN DATA ANALYTICS FOR PERSONALIZED ENGAGEMENT AND REVENUE GROWTH TO DRIVE MARKET

- FIGURE 14 PREDICTIVE ANALYTICS TOOLS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CLOUD AND VIDEO ANALYTICS PLATFORMS SEGMENTS TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2025

- FIGURE 16 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 17 SPORTS ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 SPORTS ANALYTICS MARKET EVOLUTION

- FIGURE 19 SPORTS ANALYTICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 SPORTS ANALYTICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 SPORTS ANALYTICS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 22 NUMBER OF PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 23 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 24 AVERAGE SELLING PRICE, BY SPORTS TYPE, 2025

- FIGURE 25 SPORTS ANALYTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 28 SPORTS ANALYTICS MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 29 SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN SOLUTIONS SEGMENT DURING FORECAST PERIOD

- FIGURE 30 PREDICTIVE ANALYTICS TOOLS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN PROFESSIONAL SERVICES SEGMENT DURING FORECAST PERIOD

- FIGURE 32 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 CLOUD SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 ONLINE OR VIRTUAL SPORTS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 HOCKEY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 GOLF SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 NASCAR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 DAILY FANTASY LEAGUES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 DIGITAL EXTREME SPORTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 OFF-FIELD SEGMENT TO REGISTER HIGHER CAGR THAN ON-FIELD SEGMENT DURING FORECAST PERIOD

- FIGURE 41 SPORT LEAGUES & GOVERNING BODIES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 INDIA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: SPORTS ANALYTICS MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: SPORTS ANALYTICS MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN SPORTS ANALYTICS MARKET, 2020-2024

- FIGURE 47 SHARE OF LEADING COMPANIES IN SPORTS ANALYTICS MARKET, 2024

- FIGURE 48 PRODUCT COMPARATIVE ANALYSIS (TEAM SPORTS)

- FIGURE 49 PRODUCT COMPARATIVE ANALYSIS (INDIVIDUAL SPORTS)

- FIGURE 50 PRODUCT COMPARATIVE ANALYSIS (ONLINE OR VIRTUAL SPORTS)

- FIGURE 51 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 53 SPORTS ANALYTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 SPORTS ANALYTICS MARKET: COMPANY FOOTPRINT (12 PLAYERS)

- FIGURE 55 SPORTS ANALYTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 IBM: COMPANY SNAPSHOT

- FIGURE 57 SAP: COMPANY SNAPSHOT

- FIGURE 58 HCLTECH: COMPANY SNAPSHOT

- FIGURE 59 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 60 SPORTRADAR: COMPANY SNAPSHOT

- FIGURE 61 EXL: COMPANY SNAPSHOT