PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1790683

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1790683

Heat Pump Market by Technology, Refrigerant, Type, Rated Capacity, End User, Application, and Region - Global Forecast to 2030

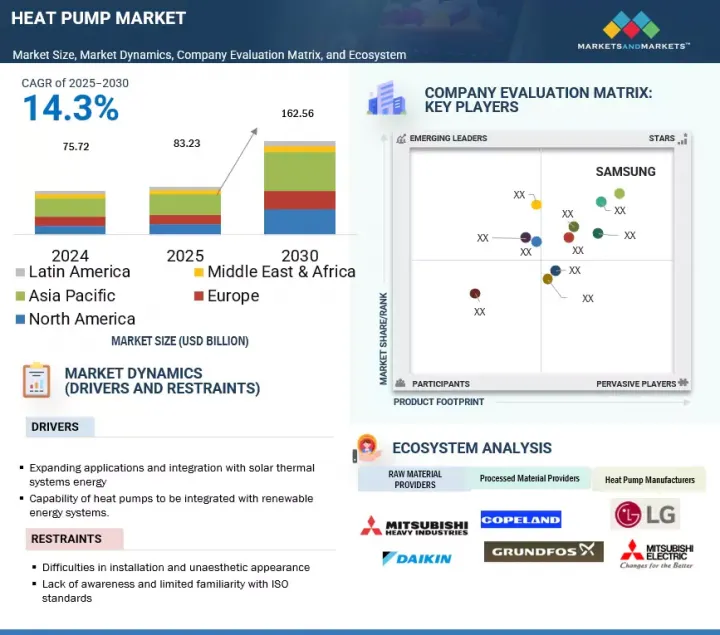

The global heat pump market is estimated to reach USD 162.56 billion by 2030 from an estimated USD 83.23 billion in 2025, at a CAGR of 14.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) and Volume (Units) |

| Segments | Heat pump market by technology, type, refrigerant, rated capacity, end User, application, and region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Heat pumps can be integrated with renewable energy sources such as solar and wind power, enabling more sustainable and eco-friendly heating and cooling solutions, which align with the global trend towards renewable energy adoption.

"Air-to-water heat pumps to be fastest-growing segment from 2025 to 2030"

The air-to-water segment is estimated to account for the second-largest share during the forecast period. Air-to-water heat pumps are used for a broader range of applications beyond the residential sector. Use of air-to-water pumps has extended into commercial buildings, industrial settings, and recreation facilities (swimming pools), considerably broadening the uptake of this technology. This signifies a shift in heating and cooling applications using air-to-water heat pumps, leading to the increased demand for heat pumps across the region.

"Reversible heat pumps to be second-fastest growing segment during forecast period"

In the heat pump market, the reversible heat pumps segment is projected to witness the second-highest CAGR during the forecast period. Their high coefficient of performance, normally between 3 and 5, shows that they can gain between 300% and 500% more heating or cooling output than the energy input." Hence, the energy efficiency aspect is a significant selling point for customers on both the residential and commercial sides. The long-term cost savings and eco-friendly impact fuel the demand for reversible systems in both developing and developed markets.

"Europe is expected to be the second-fastest growing region in the heat pump market."

Europe is expected to be the second-fastest growing heat pump market during the forecast period. The region's commitment to reducing reliance on imported fossil fuels and a move toward increasing the use of renewable energy has helped to foster excitement around heat pumps. Heat pumps have lower operating costs, especially when combined with renewable electricity sources such as solar, and are becoming popular in the residential and industrial sectors. Europe's aggressive decarbonization goals, high levels of government incentivization, climate policy, and ongoing advances in technology in the heating sector are fueling the increased demand for heat pumps in the region.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 60%, Tier 2 - 25%, and Tier 3 - 15%

By Designation: C-Level - 35%, Director Level - 25%, and Others - 40%

By Region: Americas - 13%, Europe - 16%, Asia Pacific - 56%, Middle East & Africa - 15%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million.

Others include sales managers, engineers, and regional managers.

SAMSUNG (South Korea), DENSO CORPORATION (Japan), Midea (China), Panasonic Holdings Corporation (Japan), Mitsubishi Electric Corporation (Japan), LG Electronics (South Korea), Lennox International Inc. (US), Fujitsu General (Japan), Daikin Industries, Ltd. (Japan), Carrier (US), Johnson Controls (Ireland), Thermax Limited (India), GEA Group Aktiengesellschaft (Germany), Trane Technologies plc, (Ireland), Bosch Thermotechnology Corp. (Germany), Guangzhou Sprsun New Energy Technology Development Co., Ltd. (China), GLEN DIMPLEX GROUP (Ireland), NIBE Industry AB (Ireland), Rheem Manufacturing Company (US), Energen Hybrid Systems Limited (NewZealand), Evo Energy Technologies (Australia), Namma Swadeshi (India), EcoTech Solutions (India), Dandelion Energy (US), and Zealux Electric Limited (China) are the key players in the heat pump market. The study includes an in-depth competitive analysis of these key players in the heat pump market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report defines, describes, and forecasts the global heat pump market by technology, type, refrigerant, rated capacity, end user, application, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the heat pump market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, mergers & acquisitions; and recent developments associated with the heat pump market. This report covers the competitive analysis of upcoming startups in the heat pump ecosystem.

Key Benefits of Buying the Report

- The report includes the analysis of key drivers (Growing use of heat pumps beyond traditional heating and cooling applications, Capability of heat pumps to be integrated with renewable energy systems, Implementation of government policies and initiatives to promote use of energy-efficient heating and cooling systems), restraints (Difficulties in installation and unaesthetic appearance, Limited public awareness regarding benefits of heat pumps and lack of knowledge about heat pump standards among system vendors), opportunities (High focus of manufacturers on integrating IoT, ML, and AI technologies into heat pumps, Positive outlook toward use of geothermal energy, Increased sales of heat pumps in Europe), and challenges (Dependency on energy source for heat pump efficiency, High installation cost) influencing the growth of the heat pump market.

- Product Development/Innovation: The heat pump market is witnessing significant product development and innovation, driven by the growing demand for environmentally friendly, safe, and sustainable products. Companies are investing in developing advanced heat pump technologies for various applications.

- Market Development: SAMSUNG announced its partnership with Etopia, a UK-based smart building company, to deploy heat pumps in the residential sector in the UK. SAMSUNG will deploy 6,000 TDS plus heat pumps as part of the five-year smart home project in the UK.

- Market Diversification: Panasonic Holdings Corporation announced that it would invest about USD 150 million in its Czech plant by the fiscal year ending in March 2026 to strengthen the production of air-to-water heat pumps (A2W), which have been experiencing growing demand in Europe.

- Competitive Assessment: It includes an in-depth assessment of market shares, growth strategies, and service offerings of leading players, such as SAMSUNG (South Korea), DENSO CORPORATION (Japan), Midea (China), Panasonic Holdings Corporation (Japan), and Mitsubishi Electric Corporation (Japan), among others, in the heat pump market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 PRIMARY AND SECONDARY DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 SUPPLY-SIDE ANALYSIS

- 2.3.3.1 Supply-side assumptions

- 2.3.3.2 Supply-side calculations

- 2.3.4 DEMAND-SIDE ANALYSIS

- 2.3.4.1 Demand-side assumptions

- 2.3.4.2 Demand-side calculations

- 2.4 GROWTH PROJECTION

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEAT PUMP MARKET

- 4.2 HEAT PUMP MARKET, BY END USER

- 4.3 HEAT PUMP MARKET, BY TECHNOLOGY

- 4.4 HEAT PUMP MARKET, BY TYPE

- 4.5 HEAT PUMP MARKET, BY APPLICATION

- 4.6 HEAT PUMP MARKET, BY REFRIGERANT TYPE

- 4.7 HEAT PUMP MARKET, BY RATED CAPACITY

- 4.8 HEAT PUMP MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Transition to sustainable heating technologies

- 5.2.1.2 Government-led initiatives to promote use of sustainable and energy-efficient HVAC technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of installation

- 5.2.2.2 Space constraints associated with ground-source systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emphasis on embedding IoT, ML, and AI technologies into heat pump systems

- 5.2.3.2 Enhanced performance of CO2 heat pumps

- 5.2.4 CHALLENGES

- 5.2.4.1 High installation cost

- 5.2.4.2 Dependency on energy source

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF HEAT PUMPS, BY TECHNOLOGY, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF HEAT PUMPS, BY REGION, 2022-2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

- 5.5.3 DISTRIBUTORS

- 5.5.4 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Photovoltaic-thermal solar-assisted heat pump systems

- 5.7.1.2 Hybrid heat pumps

- 5.7.1.3 Air-to-air heat pumps

- 5.7.1.4 Air-to-water heat pumps

- 5.7.1.5 Water-source heat pumps

- 5.7.1.6 Ground-source heat pumps

- 5.7.1.7 Solid-state heat pumps

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Thermal storage

- 5.7.2.2 Smart controls and automation technologies

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Heat recovery ventilation (HRV) systems

- 5.7.3.2 IoT devices

- 5.7.1 KEY TECHNOLOGIES

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 841861)

- 5.8.2 IMPORT SCENARIO (HS CODE 841861)

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 THREAT OF NEW ENTRANTS

- 5.11.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 PATENT ANALYSIS

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CITY SUITES HOTEL INSTALLED DAIKIN VRV IV+ HEAT PUMP SYSTEM WITH INDIVIDUAL ROOM CONTROLS TO REDUCE ENERGY CONSUMPTION AND ENHANCE GUEST EXPERIENCE

- 5.14.2 CORONADO BREWING REPLACED FOSSIL BOILERS WITH HTHPS THAT REDUCED CO2 EMISSIONS AND ENERGY COSTS

- 5.14.3 HOTEL DEPLOYED A. O. SMITH VOLTEX HYBRID ELECTRIC HEAT PUMP WATER HEATER TO REDUCE ENERGY CONSUMPTION AND COST

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON HEAT PUMP MARKET

- 5.16.1 ADOPTION OF AI/GEN AI FOR HEAT PUMPS

- 5.16.2 IMPACT OF AI/GEN AI ON HEAT PUMP SUPPLY CHAIN, BY REGION

- 5.17 IMPACT OF 2025 US TARIFF ON HEAT PUMP MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USER

6 HEAT PUMP MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 HEATING

- 6.2.1 WATER HEATING

- 6.2.1.1 Growing adoption of renewable energy sources to boost segmental growth

- 6.2.2 DISTRICT AND SPACE HEATING

- 6.2.2.1 Pressing need to reduce carbon footprint to fuel market growth

- 6.2.1 WATER HEATING

- 6.3 HEATING AND COOLING

- 6.3.1 IMPLEMENTATION OF ADVANCED TECHNOLOGIES AND SUSTAINABLE METHODS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

7 HEAT PUMP MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 RESIDENTIAL

- 7.2.1 GOVERNMENT INCENTIVES TO BOOST ADOPTION OF HEAT PUMPS TO FUEL MARKET GROWTH

- 7.3 COMMERCIAL

- 7.3.1 GROWING NEED TO ADOPT RENEWABLE ENERGY SOURCES FOR HEATING TO BOOST DEMAND

- 7.4 INDUSTRIAL

- 7.4.1 GLOBAL EFFORTS TO ENHANCE SUSTAINABILITY AND LOWER CARBON EMISSIONS TO FOSTER SEGMENTAL GROWTH

8 HEAT PUMP MARKET, BY RATED CAPACITY

- 8.1 INTRODUCTION

- 8.2 UP TO 10 KW

- 8.2.1 RISING PREFERENCE FOR SUSTAINABLE ALTERNATIVES TO CONVENTIONAL HEATING SYSTEMS TO BOOST DEMAND

- 8.3 10-20 KW

- 8.3.1 GROWING APPLICATION IN LARGE MULTI-FAMILY HOMES AND APARTMENT COMPLEXES TO FUEL MARKET GROWTH

- 8.4 20-30 KW

- 8.4.1 INCREASING DEPLOYMENT IN SMALL COMMERCIAL BUILDINGS TO FOSTER SEGMENTAL GROWTH

- 8.5 ABOVE 30 KW

- 8.5.1 GROWING EMPHASIS ON OFFERING OPTIMAL ENERGY UTILIZATION AND COST-EFFECTIVENESS TO DRIVE MARKET

9 HEAT PUMP MARKET, BY REFRIGERANT

- 9.1 INTRODUCTION

- 9.2 R410A

- 9.2.1 EASE OF HEAT DISSIPATION AND ENHANCED HEAT TRANSFER EFFICIENCY TO BOOST DEMAND

- 9.3 R407C

- 9.3.1 INCREASED USE OF ECO-FRIENDLY REFRIGERANTS IN HEAT PUMPS TO FUEL DEMAND

- 9.4 R744

- 9.4.1 RISING DEPLOYMENT IN NEW-GENERATION HEAT PUMP TECHNOLOGIES TO BOOST DEMAND

- 9.5 R290

- 9.5.1 EXPANDING RETROFIT MARKET FOR HEATING AND COOLING SYSTEMS TO DRIVE DEMAND

- 9.6 R717

- 9.6.1 INCORPORATION OF ADVANCED CONTAINMENT TECHNOLOGIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 9.7 OTHER REFRIGERANTS

10 HEAT PUMP MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 AIR-TO-AIR HEAT PUMPS

- 10.2.1 RISING DEMAND FOR SMART THERMOSTATS FOR REMOTE MONITORING TO DRIVE MARKET

- 10.3 AIR-TO-WATER HEAT PUMPS

- 10.3.1 GROWING DEMAND FOR CLEAN AND GREEN ALTERNATIVES TO TRADITIONAL FOSSIL FUEL-BASED HEATING METHODS TO DRIVE MARKET

- 10.4 WATER-SOURCE HEAT PUMPS

- 10.4.1 EMPHASIS ON ENHANCING SYSTEM DESIGN AND TECHNOLOGY ADVANCEMENTS TO SUPPORT MARKET GROWTH

- 10.5 GROUND-SOURCE (GEOTHERMAL) HEAT PUMPS

- 10.5.1 GOVERNMENT-LED SUBSIDIES FOR BOOSTING DEPLOYMENT OF GEOTHERMAL HEAT PUMPS TO DRIVE MARKET

- 10.6 HYBRID HEAT PUMPS

- 10.6.1 SEAMLESS INTEGRATION WITH EXISTING INFRASTRUCTURE TO BOOST DEMAND

- 10.7 PHOTOVOLTAIC-THERMAL (PVT) HEAT PUMPS

- 10.7.1 REDUCED RELIANCE ON CENTRALIZED ENERGY SOURCES TO FOSTER MARKET GROWTH

11 HEAT PUMP MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 REVERSIBLE HEAT PUMPS

- 11.2.1 GLOBAL EMPHASIS ON IMPLEMENTING ENERGY EFFICIENCY REGULATIONS TO DRIVE MARKET

- 11.3 NON-REVERSIBLE HEAT PUMPS

- 11.3.1 RISING DEMAND FOR COST-EFFECTIVE AND SUSTAINABLE TECHNOLOGIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

12 HEAT PUMP MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Expanding industrialization and infrastructure development to boost demand

- 12.2.2 INDIA

- 12.2.2.1 Emphasis on constructing green structures to drive market

- 12.2.3 JAPAN

- 12.2.3.1 Integration of IoT and application of AI and ML in manufacturing and designing process to offer lucrative growth opportunities

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Government-led investments in smart energy infrastructure and integrated energy systems to fuel market growth

- 12.2.5 AUSTRALIA

- 12.2.5.1 Initiatives to phase out gas hot water systems to boost demand

- 12.2.6 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 FRANCE

- 12.3.1.1 Favorable policies and national climate initiatives to support market growth

- 12.3.2 ITALY

- 12.3.2.1 Government-led initiatives to boost adoption of green energy to fuel market growth

- 12.3.3 GERMANY

- 12.3.3.1 Rising gas prices and energy security concerns to support market growth

- 12.3.4 UK

- 12.3.4.1 Emphasis on achieving net-zero emissions by 2050 to foster market growth

- 12.3.5 SPAIN

- 12.3.5.1 Emphasis on renovating existing buildings to drive market

- 12.3.6 REST OF EUROPE

- 12.3.1 FRANCE

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Increasing investments in installation of energy-efficient technologies in new infrastructure development projects to drive market

- 12.4.2 CANADA

- 12.4.2.1 Emphasis on offering market-feasible net-zero energy solutions by 2030 and reducing electricity demand to boost demand

- 12.4.1 US

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Increasing investments in industrial sector to boost demand

- 12.5.1.2 UAE

- 12.5.1.2.1 Growing consciousness about sustainable and environmentally friendly practices to boost demand

- 12.5.1.3 Rest of GCC

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Expanding transportation industry to foster market growth

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC

- 12.6 LATIN AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Growing use of non-fossil fuel energy sources to boost demand

- 12.6.2 MEXICO

- 12.6.2.1 Growing demand for energy-efficient devices in residential, commercial, and industrial sectors to fuel market growth

- 12.6.3 REST OF LATIN AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 MARKET EVALUATION FRAMEWORK, 2020-2024

- 13.5 REVENUE ANALYSIS, 2020-2024

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- 13.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.8.5.1 Company footprint

- 13.8.5.2 Company market footprint

- 13.8.5.3 Region footprint

- 13.8.5.4 Technology footprint

- 13.8.5.5 Type footprint

- 13.8.5.6 Rated capacity footprint

- 13.8.5.7 Refrigerant footprint

- 13.8.5.8 End user footprint

- 13.8.5.9 Application footprint

- 13.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- 13.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.9.5.1 List of key startups/SMEs

- 13.9.5.2 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.10 COMPETITIVE SCENARIOS

- 13.10.1 PRODUCT LAUNCHES

- 13.10.2 DEALS

- 13.10.3 EXPANSIONS

- 13.10.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SAMSUNG

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 DENSO CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.2.1 Expansions

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths/Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses/Competitive threats

- 14.1.3 MIDEA

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 PANASONIC HOLDINGS CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.3.4 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 MITSUBISHI ELECTRIC CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.3.4 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 LG ELECTRONICS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/ Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.6.3.4 Other developments

- 14.1.7 LENNOX INTERNATIONAL INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/ Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 FUJITSU GENERAL

- 14.1.8.1 Business overview

- 14.1.8.2 Products/ Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.9 DAIKIN INDUSTRIES, LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/ Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Expansions

- 14.1.9.3.3 Other developments

- 14.1.10 CARRIER

- 14.1.10.1 Business overview

- 14.1.10.2 Products/ Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Expansions

- 14.1.10.3.4 Other developments

- 14.1.11 JOHNSON CONTROLS

- 14.1.11.1 Business overview

- 14.1.11.2 Products/ Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Deals

- 14.1.11.3.3 Expansions

- 14.1.11.3.4 Other developments

- 14.1.12 THERMAX LIMITED

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 GEA GROUP AKTIENGESELLSCHAFT

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Other developments

- 14.1.14 TRANE TECHNOLOGIES PLC

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Deals

- 14.1.14.3.3 Expansions

- 14.1.14.3.4 Other developments

- 14.1.15 BOSCH THERMOTECHNOLOGY CORP.

- 14.1.15.1 Business overview

- 14.1.15.2 Products/ Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches

- 14.1.15.3.2 Other developments

- 14.1.1 SAMSUNG

- 14.2 OTHER PLAYERS

- 14.2.1 GUANGZHOU SPRSUN NEW ENERGY TECHNOLOGY DEVELOPMENT CO., LTD.

- 14.2.2 GLEN DIMPLEX GROUP

- 14.2.3 NIBE

- 14.2.4 RHEEM MANUFACTURING COMPANY

- 14.2.5 ENERGEN HYBRID SYSTEMS LIMITED

- 14.2.6 EVO ENERGY TECHNOLOGIES

- 14.2.7 NAMMASWADESHI

- 14.2.8 ECOTECH SOLUTIONS

- 14.2.9 DANDELION ENERGY

- 14.2.10 ZEALUX ELECTRIC LIMITED

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 HEAT PUMP MARKET SNAPSHOT

- TABLE 2 BENEFITS OF SMART THERMOSTATS OFFERED BY KEY PLAYERS

- TABLE 3 REFRIGERANTS AND THEIR COMMON APPLICATIONS

- TABLE 4 AVERAGE HEAT PUMP INSTALLATION COST, BY TYPE (USD)

- TABLE 5 PRICING RANGE OF HEAT PUMPS, BY TECHNOLOGY, 2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF HEAT PUMPS, BY REGION 2022-2024 (USD)

- TABLE 7 ROLE OF COMPANIES IN HEAT PUMP ECOSYSTEM

- TABLE 8 EXPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD)

- TABLE 9 IMPORT SCENARIO FOR HS CODE 841861-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD)

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REGULATIONS

- TABLE 17 HEAT PUMP MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 19 KEY BUYING CRITERIA, BY END USER

- TABLE 20 LIST OF KEY PATENTS, 2023-2024

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 22 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON APPLICATIONS DUE TO TARIFF IMPACT

- TABLE 23 HEAT PUMP MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 24 HEAT PUMP MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 HEAT PUMP MARKET, BY HEATING, 2020-2024 (USD MILLION)

- TABLE 26 HEAT PUMP MARKET, BY HEATING, 2025-2030 (USD MILLION)

- TABLE 27 HEATING: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 HEATING: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 WATER HEATING: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 WATER HEATING: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 DISTRICT AND SPACE HEATING: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 DISTRICT AND SPACE HEATING: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 HEATING AND COOLING: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 HEATING AND COOLING: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 36 HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 37 RESIDENTIAL: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 RESIDENTIAL: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 COMMERCIAL: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 COMMERCIAL: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 INDUSTRIAL: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 INDUSTRIAL: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 44 HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 45 UP TO 10 KW: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 UP TO 10 KW: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 10-20 KW: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 10-20 KW: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 20-30 KW: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 20-30 KW: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 ABOVE 30 KW: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 ABOVE 30 KW: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 HEAT PUMP MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 54 HEAT PUMP MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 55 R410A: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 R410A: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 R407C: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 R407C: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 R744: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 R744: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 R290: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 R290: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 R717: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 R717: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 OTHER REFRIGERANTS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 OTHER REFRIGERANTS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 HEAT PUMP MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 68 HEAT PUMP MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 69 HEAT PUMP MARKET, BY TECHNOLOGY, 2020-2024 (MILLION UNITS)

- TABLE 70 HEAT PUMP MARKET, BY TECHNOLOGY, 2025-2030 (MILLION UNITS)

- TABLE 71 AIR-TO-AIR HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 AIR-TO-AIR HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 AIR-TO-WATER HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 AIR-TO-WATER HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 WATER-SOURCE HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 WATER-SOURCE HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 GROUND-SOURCE (GEOTHERMAL) HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 GROUND-SOURCE (GEOTHERMAL) HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 HYBRID HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 HYBRID HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 PHOTOVOLTAIC-THERMAL (PVT) HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 PHOTOVOLTAIC-THERMAL (PVT) HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 HEAT PUMP MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 84 HEAT PUMP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 REVERSIBLE HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 REVERSIBLE HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 NON-REVERSIBLE HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 NON-REVERSIBLE HEAT PUMPS: HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 HEAT PUMP MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 HEAT PUMP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 HEAT PUMP MARKET, BY REGION, 2020-2024 (MILLION UNITS)

- TABLE 92 HEAT PUMP MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 93 ASIA PACIFIC: HEAT PUMP MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HEAT PUMP MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HEAT PUMP MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: HEAT PUMP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: HEAT PUMP MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 98 ASIA PACIFIC: HEAT PUMP MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 100 ASIA PACIFIC: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 102 ASIA PACIFIC: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HEAT PUMP MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HEAT PUMP MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: HEAT PUMP MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: HEAT PUMP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 CHINA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 110 CHINA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 111 CHINA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 112 CHINA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113 INDIA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 114 INDIA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 115 INDIA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 116 INDIA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 117 JAPAN: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 118 JAPAN: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 119 JAPAN: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 120 JAPAN: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121 SOUTH KOREA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 122 SOUTH KOREA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 123 SOUTH KOREA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 124 SOUTH KOREA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 125 AUSTRALIA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 126 AUSTRALIA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 127 AUSTRALIA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 128 AUSTRALIA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: HEAT PUMP MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 134 EUROPE: HEAT PUMP MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: HEAT PUMP MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 136 EUROPE: HEAT PUMP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: HEAT PUMP MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 138 EUROPE: HEAT PUMP MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 140 EUROPE: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 142 EUROPE: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 143 EUROPE: HEAT PUMP MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 144 EUROPE: HEAT PUMP MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 146 EUROPE: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 EUROPE: HEAT PUMP MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 148 EUROPE: HEAT PUMP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 FRANCE: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 150 FRANCE: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 151 FRANCE: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 152 FRANCE: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 153 ITALY: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 154 ITALY: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 155 ITALY: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 156 ITALY: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 GERMANY: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 158 GERMANY: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 159 GERMANY: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 160 GERMANY: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 161 UK: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 162 UK: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 163 UK: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 164 UK: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 SPAIN: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 166 SPAIN: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 167 SPAIN: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 168 SPAIN: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 170 REST OF EUROPE: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 171 REST OF EUROPE: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 172 REST OF EUROPE: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 173 NORTH AMERICA: HEAT PUMP MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 174 NORTH AMERICA: HEAT PUMP MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 175 NORTH AMERICA: HEAT PUMP MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 176 NORTH AMERICA: HEAT PUMP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 177 NORTH AMERICA: HEAT PUMP MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 178 NORTH AMERICA: HEAT PUMP MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 179 NORTH AMERICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 180 NORTH AMERICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 182 NORTH AMERICA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: HEAT PUMP MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 184 NORTH AMERICA: HEAT PUMP MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 186 NORTH AMERICA: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: HEAT PUMP MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 188 NORTH AMERICA: HEAT PUMP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 189 US: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 190 US: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 191 US: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 192 US: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 193 CANADA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 194 CANADA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 195 CANADA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 196 CANADA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 213 GCC: HEAT PUMP MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 214 GCC: HEAT PUMP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215 SAUDI ARABIA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 216 SAUDI ARABIA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 217 SAUDI ARABIA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 218 SAUDI ARABIA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 219 UAE: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 220 UAE: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 221 UAE: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 222 UAE: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 223 REST OF GCC: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 224 REST OF GCC: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 225 REST OF GCC: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 226 REST OF GCC: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 227 SOUTH AFRICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 228 SOUTH AFRICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 229 SOUTH AFRICA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 230 SOUTH AFRICA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 232 REST OF MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST & AFRICA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: HEAT PUMP MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 236 LATIN AMERICA: HEAT PUMP MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 237 LATIN AMERICA: HEAT PUMP MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 238 LATIN AMERICA: HEAT PUMP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 239 LATIN AMERICA: HEAT PUMP MARKET, BY REFRIGERANT, 2020-2024 (USD MILLION)

- TABLE 240 LATIN AMERICA: HEAT PUMP MARKET, BY REFRIGERANT, 2025-2030 (USD MILLION)

- TABLE 241 LATIN AMERICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 242 LATIN AMERICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 243 LATIN AMERICA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 244 LATIN AMERICA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 245 LATIN AMERICA: HEAT PUMP MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 246 LATIN AMERICA: HEAT PUMP MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 248 LATIN AMERICA: HEAT PUMP MARKET FOR HEATING, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 249 LATIN AMERICA: HEAT PUMP MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 250 LATIN AMERICA: HEAT PUMP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 251 BRAZIL: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 252 BRAZIL: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 253 BRAZIL: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 254 BRAZIL: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 255 MEXICO: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 256 MEXICO: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 257 MEXICO: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 258 MEXICO: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 259 REST OF LATIN AMERICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2020-2024 (USD MILLION)

- TABLE 260 REST OF LATIN AMERICA: HEAT PUMP MARKET, BY RATED CAPACITY, 2025-2030 (USD MILLION)

- TABLE 261 REST OF LATIN AMERICA: HEAT PUMP MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 262 REST OF LATIN AMERICA: HEAT PUMP MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 263 HEAT PUMP MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JULY 2025

- TABLE 264 HEAT PUMP MARKET: DEGREE OF COMPETITION

- TABLE 265 MARKET EVALUATION FRAMEWORK, 2020-2024

- TABLE 266 HEAT PUMP MARKET: REGION FOOTPRINT

- TABLE 267 HEAT PUMP MARKET: TECHNOLOGY FOOTPRINT

- TABLE 268 HEAT PUMP MARKET: TYPE FOOTPRINT

- TABLE 269 HEAT PUMP MARKET: RATED CAPACITY FOOTPRINT

- TABLE 270 HEAT PUMP MARKET: REFRIGERANT FOOTPRINT

- TABLE 271 HEAT PUMP MARKET: END USER FOOTPRINT

- TABLE 272 HEAT PUMP MARKET: APPLICATION FOOTPRINT

- TABLE 273 HEAT PUMP MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 274 HEAT PUMP MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 275 HEAT PUMP MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 276 HEAT PUMP MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 277 HEAT PUMP MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 278 HEAT PUMP MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025:

- TABLE 279 SAMSUNG: COMPANY OVERVIEW

- TABLE 280 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 SAMSUNG: PRODUCT LAUNCHES

- TABLE 282 SAMSUNG: DEALS

- TABLE 283 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 284 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 DENSO CORPORATION: EXPANSIONS

- TABLE 286 MIDEA: COMPANY OVERVIEW

- TABLE 287 MIDEA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 MIDEA: PRODUCT LAUNCHES

- TABLE 289 MIDEA: DEALS

- TABLE 290 MIDEA: EXPANSIONS

- TABLE 291 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 292 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 294 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 295 PANASONIC HOLDINGS CORPORATION: EXPANSIONS

- TABLE 296 PANASONIC HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- TABLE 297 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 298 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 300 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 301 MITSUBISHI ELECTRIC CORPORATION: EXPANSIONS

- TABLE 302 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 303 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 304 LG ELECTRONICS: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 305 LG ELECTRONICS: PRODUCT LAUNCHES

- TABLE 306 LG ELECTRONICS: DEALS

- TABLE 307 LG ELECTRONICS: EXPANSIONS

- TABLE 308 LG ELECTRONICS: OTHER DEVELOPMENTS

- TABLE 309 LENNOX INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 310 LENNOX INTERNATIONAL INC.: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 311 LENNOX INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 312 LENNOX INTERNATIONAL INC.: DEALS

- TABLE 313 FUJITSU GENERAL: COMPANY OVERVIEW

- TABLE 314 FUJITSU GENERAL: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 315 FUJITSU GENERAL: DEALS

- TABLE 316 DAIKIN INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 317 DAIKIN INDUSTRIES, LTD.: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 318 DAIKIN INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 319 DAIKIN INDUSTRIES, LTD.: EXPANSIONS

- TABLE 320 DAIKIN INDUSTRIES, LTD.: OTHER DEVELOPMENTS

- TABLE 321 CARRIER: COMPANY OVERVIEW

- TABLE 322 CARRIER: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 323 CARRIER: PRODUCT LAUNCHES

- TABLE 324 CARRIER: DEALS

- TABLE 325 CARRIER: EXPANSIONS

- TABLE 326 CARRIER: OTHER DEVELOPMENTS

- TABLE 327 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 328 JOHNSON CONTROLS: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 329 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 330 JOHNSON CONTROLS: DEALS

- TABLE 331 JOHNSON CONTROLS: EXPANSIONS

- TABLE 332 JOHNSON CONTROLS: OTHER DEVELOPMENTS

- TABLE 333 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 334 THERMAX LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 336 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 GEA GROUP AKTIENGESELLSCHAFT: DEALS

- TABLE 338 GEA GROUP AKTIENGESELLSCHAFT: OTHER DEVELOPMENTS

- TABLE 339 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

- TABLE 340 TRANE TECHNOLOGIES PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 TRANE TECHNOLOGIES PLC: PRODUCT LAUNCHES

- TABLE 342 TRANE TECHNOLOGIES PLC: DEALS

- TABLE 343 TRANE TECHNOLOGIES PLC: EXPANSIONS

- TABLE 344 TRANE TECHNOLOGIES PLC: OTHER DEVELOPMENTS

- TABLE 345 BOSCH THERMOTECHNOLOGY CORP.: COMPANY OVERVIEW

- TABLE 346 BOSCH THERMOTECHNOLOGY CORP.: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 347 BOSCH THERMOTECHNOLOGY CORP.: PRODUCT LAUNCHES

- TABLE 348 BOSCH THERMOTECHNOLOGY CORP.: OTHER DEVELOPMENTS

List of Figures

- FIGURE 1 HEAT PUMP MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HEAT PUMP MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARIES

- FIGURE 5 HEAT PUMP MARKET: TOP-DOWN APPROACH

- FIGURE 6 HEAT PUMP MARKET: BOTTOM-UP APPROACH

- FIGURE 7 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF HEAT PUMPS

- FIGURE 8 HEAT PUMP MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 INDUSTRY CONCENTRATION, 2024

- FIGURE 10 HEAT PUMP MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 11 HEAT PUMP MARKET: DATA TRIANGULATION

- FIGURE 12 AIR-TO-AIR HEAT PUMPS SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 13 NON-REVERSIBLE HEAT PUMPS SEGMENT TO HOLD LARGER SHARE IN 2030

- FIGURE 14 R410A SEGMENT TO LEAD MARKET IN 2030

- FIGURE 15 UP TO 10 KW SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 16 RESIDENTIAL SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 17 HEATING SEGMENT TO LEAD MARKET IN 2030

- FIGURE 18 ASIA PACIFIC HELD DOMINANT POSITION IN 2024

- FIGURE 19 INTEGRATION OF IOT TECHNOLOGY INTO HEAT PUMPS TO OFFER LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 20 RESIDENTIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 21 AIR-TO-AIR HEAT PUMPS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 22 REVERSIBLE SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 23 HEATING SEGMENT TO GARNER LARGER MARKET SHARE IN 2030

- FIGURE 24 R410A SEGMENT TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 25 UP TO 10 KW SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 26 NORTH AMERICA TO EXHIBIT HIGHEST CAGR IN HEAT PUMP MARKET DURING FORECAST PERIOD

- FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 HEAT PUMP SALES, BY REGION/COUNTRY, 2019-2023

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF HEAT PUMPS, BY REGION, 2022-2024

- FIGURE 31 HEAT PUMP MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 32 HEAT PUMP ECOSYSTEM ANALYSIS

- FIGURE 33 EXPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024 (USD)

- FIGURE 34 IMPORT DATA FOR HS CODE 841861-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024 (USD)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 37 KEY BUYING CRITERIA, BY END USER

- FIGURE 38 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO

- FIGURE 40 IMPACT OF AI/GEN AI ON HEAT PUMP SUPPLY CHAIN, BY REGION

- FIGURE 41 HEATING SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 42 RESIDENTIAL SEGMENT DOMINATED MARKET IN 2024

- FIGURE 43 UP TO 10 KW SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 44 R410A SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 45 AIR-TO-AIR HEAT PUMP SECURED LARGEST MARKET SHARE IN 2024

- FIGURE 46 NON-REVERSIBLE HEAT PUMP SEGMENT TO GARNER LARGER MARKET SHARE IN 2024

- FIGURE 47 HEAT PUMP MARKET, BY REGION, 2024

- FIGURE 48 NORTH AMERICA TO REGISTER HIGHEST CAGR IN GLOBAL HEAT PUMP MARKET DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC: HEAT PUMP MARKET SNAPSHOT

- FIGURE 50 EUROPE: HEAT PUMP MARKET SNAPSHOT

- FIGURE 51 HEAT PUMP MARKET SHARE ANALYSIS, 2024

- FIGURE 52 HEAT PUMP MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 COMPANY VALUATION

- FIGURE 55 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 56 HEAT PUMP MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 57 HEAT PUMP MARKET: COMPANY FOOTPRINT

- FIGURE 58 HEAT PUMP MARKET: COMPANY MARKET FOOTPRINT

- FIGURE 59 HEAT PUMP MARKET: COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 60 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 61 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 MIDEA: COMPANY SNAPSHOT

- FIGURE 63 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 LG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 66 LENNOX INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 67 FUJITSU GENERAL: COMPANY SNAPSHOT

- FIGURE 68 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 69 CARRIER: COMPANY SNAPSHOT

- FIGURE 70 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 71 THERMAX LIMITED: COMPANY SNAPSHOT

- FIGURE 72 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 73 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT