PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1794022

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1794022

Environmental Remediation Market by Environmental Medium (Soil, Groundwater), Site Type (Private, Public), Technology (Air Sparging, Soil Washing, Chemical Treatment, Bioremediation, Electrokinetic Remediation, Excavation) - Global Forecast to 2030

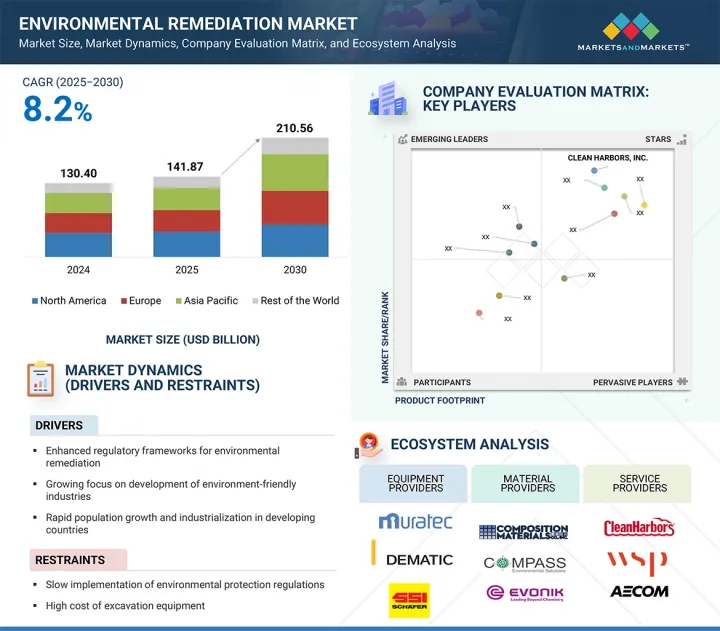

The environmental remediation market is expected to expand from USD 141.87 billion in 2025 to USD 210.56 billion by 2030, growing at a CAGR of 8.2%. The environmental remediation market is expanding, fueled by rapid population growth and increasing industrialization in developing countries, which are intensifying pressure on land and water resources.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type of Contaminant, Environmental Medium, Site Type, Technology, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

This urban and industrial development is causing widespread contamination, creating an urgent need for soil and groundwater cleanup. Furthermore, the oil & gas industry continues to consistently demand remediation services due to ongoing environmental risks like spills, leaks, and site deterioration.

"Groundwater segment is projected to record the highest CAGR during the forecast period"

The groundwater segment is expected to grow rapidly within the environmental remediation market, driven by increasing concerns over drinking water safety and the long-term effects of subsurface contamination. Sources such as leaking underground storage tanks, industrial discharges, and chemical spills have caused widespread groundwater pollution with contaminants like volatile organic compounds (VOCs), heavy metals, and PFAS. This has led to greater investments in groundwater monitoring, risk assessment, and remediation technologies such as pump-and-treat, in-situ chemical oxidation, and bioremediation. The combination of environmental urgency and regulatory pressure makes the groundwater segment a quickly expanding field within the remediation market.

"Chemical treatment technology will grow at a significant rate during the forecast period"

Chemical treatment technology is expected to see significant growth in the environmental remediation market because of its ability to quickly neutralize toxic contaminants in soil and groundwater. It is especially effective for complex sites affected by industrial solvents, heavy metals, PFAS, and other persistent pollutants. With increasing demand for rapid site cleanup, particularly in urban and brownfield areas, and rising regulatory pressures, chemical methods are becoming more popular. Advances in in-situ chemical oxidation and stabilization are improving efficiency and lowering secondary risks, making chemical treatment a preferred and scalable solution for various contamination challenges.

"Europe will hold the second-largest market share in the environmental remediation market in 2025"

Europe has a highly developed and well-regulated market for environmental remediation, driven by strict environmental policies, a history of industrial activity, and a strong regional emphasis on sustainability and circular economy principles. The European Union (EU) enforces comprehensive environmental laws through directives like the Environmental Liability Directive (ELD) and the Waste Framework Directive, which require polluters to prevent, reduce, and repair environmental damage. Many European countries have created national and regional systems for managing contaminated sites, including brownfield redevelopment, post-industrial cleanup, and restoring ecologically sensitive areas.

Extensive primary interviews were conducted with key industry experts in the environmental remediation market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from equipment suppliers to Tier 1 companies and service providers. The break-up of the primaries is as follows:

- By Company Type: Tier 1-50%, Tier 2-20%, and Tier 3-30%

- By Designation: C-level Executives-20%, Directors-30%, and Others-50%

- By Region: Asia Pacific-40%, Europe-30%, North America-20%, and RoW-10%

The environmental remediation market is led by several globally established players, including CLEAN HARBORS, INC. (US), WSP (Canada), AECOM (US), Jacobs Solutions Inc. (US), Tetra Tech, Inc. (US), DEME Group NV. (Belgium), ENTACT (US), Terra Systems (US), HDR, Inc. (US), Bechtel Corporation (US), Fluor Corporation (US), Environmental Logic (US), Montrose Environmental Group, Inc. (US), Oxyle (Switzerland), ecoSPEARS Inc. (US), Allonnia (US), Carbogenics (Scotland), Allied Microbiota (US), Aclarity, Inc. (US), Ecolive s.r.o. (Slovakia), Novobiom S.P.R.L (Belgium), Oxi Ambiental SA (Brazil), Weber Ambiental (Brazil), Amentum Services, Inc. (US), Northstar Environmental Services (US), and In-Situ Oxidative Technologies, Inc. (ISOTEC) (US).

The study includes an in-depth competitive analysis of these key players in the environmental remediation market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the environmental remediation market based on type of contaminant (microbial, organic, inorganic), environmental medium (soil, groundwater), site type (private, public), technology (air sparging, soil washing, chemical treatment, bioremediation, electrokinetic remediation, excavation, permeable reactive barriers, in situ grouting, phytoremediation, pump and treat, soil vapor extraction, in-situ vitrification, thermal treatment), and application (mining & forestry, oil & gas, agriculture, automotive, landfills and waste disposal sites, manufacturing, industrial, and chemical production/processing, construction and land development). It also covers the market's drivers, restraints, opportunities, and challenges. The report provides a detailed overview of the market across four main regions (North America, Europe, Asia Pacific, and RoW). Additionally, it includes an ecosystem analysis of key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (enhanced regulatory frameworks for environmental remediation, growing focus on development of environment-friendly industries, rapid population growth and industrialization in developing countries), restraints (slow implementation of environmental protection regulations, high cost of excavation equipment), opportunities (development of advanced remediation technologies, continuous demand generation from oil & gas industry), challenges (inconsistencies in government regulations in many countries, technical and non-technical challenges at complex sites)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product & service launches

- Market Development: Comprehensive information about lucrative markets through the analysis of the environmental remediation market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the environmental remediation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as CLEAN HARBORS, INC. (US), WSP (Canada), AECOM (US), Jacobs Solutions Inc. (US), Tetra Tech, Inc. (US), DEME Group NV. (Belgium), ENTACT (US), Terra Systems (US), HDR, Inc. (US), Bechtel Corporation (US), Fluor Corporation (US), Environmental Logic (US), Montrose Environmental Group, Inc. (US), Oxyle (Switzerland), ecoSPEARS Inc. (US), and Allonnia (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENVIRONMENTAL REMEDIATION MARKET

- 4.2 ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM AND SITE TYPE

- 4.3 ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY

- 4.4 ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION

- 4.5 ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Enhanced regulatory frameworks for environmental remediation

- 5.2.1.2 Growing focus on development of environment-friendly industries

- 5.2.1.3 Rapid population growth and industrialization in developing countries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Slow implementation of environmental protection regulations

- 5.2.2.2 High cost of excavation equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of advanced remediation technologies

- 5.2.3.2 Continuous demand generation from oil & gas industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Inconsistencies in government regulations in many countries

- 5.2.4.2 Technical and non-technical challenges at complex sites

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 THREAT OF NEW ENTRANTS

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 DEMOLITION, REMEDIATION, AND ENHANCEMENT OF FORMER PIRBRIGHT INSTITUTE FOR RESIDENTIAL REDEVELOPMENT IN COMPTON, BERKSHIRE

- 5.8.2 REMEDIATION AND ENABLING WORKS FOR LOMBARD SQUARE, PLUMSTEAD WEST THAMESMEAD

- 5.8.3 MONTROSE DELIVERS RAPID AND SCALABLE PFAS TREATMENT TO RESTORE SAFE DRINKING WATER IN KATHERINE

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Geosynthetics

- 5.9.1.2 Excavation and Disposal

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Nanoremediation

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Microbial remediation

- 5.9.3.2 Heterogeneous photocatalysis

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS, BY SITE TYPE

- 5.10.1.1 Indicative pricing analysis of environmental remediation for private sites, by key player (2024)

- 5.10.1.2 Indicative pricing analysis of environmental remediation for public sites, by key player (2024)

- 5.10.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.10.2.1 Average selling price of environmental remediation for private sites, by region (2021-2024)

- 5.10.2.2 Pricing trend of environmental remediation for private sites, by region (2021-2024)

- 5.10.2.3 Average selling price of environmental remediation for public sites, by region (2021-2024)

- 5.10.2.4 Pricing trend of environmental remediation for public sites, by region (2021-2024)

- 5.10.1 INDICATIVE PRICING ANALYSIS, BY SITE TYPE

- 5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.13.3 REGULATIONS

- 5.13.3.1 North America

- 5.13.3.2 Europe

- 5.13.3.3 Asia Pacific

- 5.13.3.4 RoW

- 5.14 TRADE ANALYSIS

- 5.14.1 EXPORT DATA FOR HS CODE 8430

- 5.14.2 IMPORT DATA FOR HS CODE 8430

- 5.15 IMPACT OF 2025 US TARIFFS-ENVIRONMENTAL REMEDIATION MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON APPLICATION INDUSTRIES

- 5.16 IMPACT OF AI ON ENVIRONMENTAL REMEDIATION MARKET

6 ENVIRONMENTAL REMEDIATION MARKET, BY TYPE OF CONTAMINANT

- 6.1 INTRODUCTION

- 6.2 MICROBIOLOGICAL CONTAMINANTS

- 6.3 ORGANIC CONTAMINANTS

- 6.4 INORGANIC CONTAMINANTS

7 ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM

- 7.1 INTRODUCTION

- 7.2 SOIL

- 7.2.1 INCREASING DEMAND FOR SOIL REMEDIATION IN MANUFACTURING AND ENERGY INDUSTRIES TO DRIVE MARKET GROWTH

- 7.3 GROUNDWATER

- 7.3.1 GROWING NEED FOR REMEDIATION MEASURES TO IMPROVE GROUNDWATER QUALITY TO BOOST MARKET GROWTH

8 ENVIRONMENTAL REMEDIATION MARKET, BY SITE TYPE

- 8.1 INTRODUCTION

- 8.2 PRIVATE

- 8.2.1 STRICT ENVIRONMENTAL REGULATIONS BOOST DEMAND FOR ENVIRONMENTAL REMEDIATION SERVICES

- 8.3 PUBLIC

- 8.3.1 GOVERNMENT INITIATIVES BOOST DEMAND FOR ENVIRONMENTAL REMEDIATION SERVICES

9 ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 AIR SPARGING

- 9.2.1 GROUNDWATER CLEANUP PROGRAMS FUEL EXPANSION OF AIR SPARGING SOLUTIONS IN ENVIRONMENTAL REMEDIATION MARKET

- 9.3 SOIL WASHING

- 9.3.1 RISING BROWNFIELD REDEVELOPMENT AND LAND REUSE PROJECTS ACCELERATE DEMAND FOR SOIL WASHING TECHNOLOGY

- 9.4 CHEMICAL TREATMENT

- 9.4.1 RISING EMPHASIS ON IN SITU CHEMICAL TECHNOLOGIES IN LONG-TERM GROUNDWATER CONTAMINATION MANAGEMENT TO DRIVE GROWTH

- 9.4.2 CHEMICAL PRECIPITATION

- 9.4.3 ION EXCHANGE

- 9.4.4 CARBON ABSORPTION/ADSORPTION

- 9.4.5 CHEMICAL REDUCTION

- 9.4.6 CHEMICAL OXIDATION

- 9.4.7 PFAS (PFOS AND PFOA) REMEDIATION

- 9.5 BIOREMEDIATION

- 9.5.1 GROWING R&D IN MICROBIAL REMEDIATION AND SYSTEMS BIOLOGY SPURS MARKET EXPANSION FOR BIOREMEDIATION TECHNOLOGIES

- 9.5.2 BIOAUGMENTATION

- 9.5.3 BIODEGRADATION

- 9.5.4 BIOSTIMULATION

- 9.5.5 BIOVENTING

- 9.5.6 BIOREACTORS

- 9.5.7 COMPOSTING

- 9.6 ELECTROKINETIC REMEDIATION

- 9.6.1 ELECTROKINETIC REMEDIATION GAINING MOMENTUM AS A SCALABLE SOLUTION FOR HEAVY METAL AND HYDROCARBON-CONTAMINATED SITES

- 9.7 EXCAVATION

- 9.7.1 ADVANCED MAPPING AND REAL-TIME MONITORING STRENGTHEN ROLE OF EXCAVATION IN HIGH-RISK SITE REMEDIATION

- 9.8 PERMEABLE REACTIVE BARRIERS

- 9.8.1 ADVANCED MATERIALS AND TRENCHLESS TECHNOLOGIES PROPEL GROWTH OF PRBS IN COMPLEX GROUNDWATER REMEDIATION

- 9.9 IN SITU GROUTING

- 9.9.1 COST-EFFECTIVE REMEDIATION FOR HEAVY METALS, PFAS, AND NAPL-IMPACTED SITES DRIVING IMPORTANCE

- 9.10 PHYTOREMEDIATION

- 9.10.1 PHYTOREMEDIATION GAINS TRACTION AS ECO-FRIENDLY CLEANUP METHOD FOR METAL AND RADIOLOGICAL CONTAMINATION

- 9.11 PUMP AND TREAT

- 9.11.1 RISING VOC CONTAMINATION SPURS GROWTH IN PUMP AND TREAT GROUNDWATER SOLUTIONS

- 9.12 SOIL VAPOR EXTRACTION

- 9.12.1 LEGACY WASTE SITE CLEANUPS ACCELERATE MARKET ADOPTION OF SOIL VAPOR EXTRACTION SYSTEMS

- 9.13 IN SITU VITRIFICATION

- 9.13.1 ISV ADOPTION GROWING IN HIGH-RISK CONTAMINATED SITES AMID RISING NUCLEAR AND CHEMICAL CLEANUP NEEDS

- 9.14 THERMAL TREATMENT

- 9.14.1 HIGH-IMPACT SOLUTION FOR DEEP SOIL AND GROUNDWATER REMEDIATION IN COMPLEX SITES

- 9.14.2 THERMAL DESORPTION

10 ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 MINING & FORESTRY

- 10.2.1 GROWING NEED TO CONSERVE ABANDONED MINING SITES DRIVING DEMAND FOR REMEDIATION

- 10.3 OIL & GAS

- 10.3.1 TECHNOLOGICAL ADVANCEMENTS ACCELERATE PRECISION AND EFFICIENCY IN OIL & GAS SITE CLEANUP

- 10.4 AGRICULTURE

- 10.4.1 RISING NEED TO RESTORE SOIL FERTILITY TO CREATE LUCRATIVE OPPORTUNITIES IN AGRICULTURE

- 10.5 AUTOMOTIVE

- 10.5.1 FEDERAL FUNDING INITIATIVES DRIVE AUTOMOTIVE CONTAMINATION CLEANUP

- 10.6 LANDFILLS & WASTE DISPOSAL SITES

- 10.6.1 RISING URBAN REDEVELOPMENT AND LAND REUSE FUEL REMEDIATION OF LEGACY LANDFILL SITES

- 10.7 MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING

- 10.7.1 STRICTER INDUSTRIAL POLLUTION STANDARDS PROPEL DEMAND FOR REMEDIATION SOLUTIONS IN MANUFACTURING AND CHEMICAL PRODUCTION

- 10.8 CONSTRUCTION & LAND DEVELOPMENT

- 10.8.1 BROWNFIELD REDEVELOPMENT AND URBAN EXPANSION DRIVE DEMAND FOR PRE-CONSTRUCTION REMEDIATION

11 ENVIRONMENTAL REMEDIATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Federal funding and legal settlements catalyze growth in US market

- 11.2.3 CANADA

- 11.2.3.1 Large-scale infrastructure and industrial waste projects propel market growth

- 11.2.4 MEXICO

- 11.2.4.1 Industrial modernization and global partnerships propel growth of Mexico's environmental remediation market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Legacy industrial pollution and river restoration projects drive expansion of Germany's environmental cleanup sector

- 11.3.3 UK

- 11.3.3.1 Rising urban waste and regulatory pressure spur expansion of environmental remediation

- 11.3.4 FRANCE

- 11.3.4.1 Government-led water pollution control initiatives drive market growth in France

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Strategic ecosystem restoration and infrastructure projects fuel demand for remediation in China

- 11.4.3 JAPAN

- 11.4.3.1 Increasing government initiatives to curb pollutants

- 11.4.4 INDIA

- 11.4.4.1 National Green Tribunal and river revitalization projects boost India's push toward proactive environmental remediation

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 High-impact restoration projects to drive ANZ environmental remediation market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Oil spill recovery and mining waste management fuel demand for environmental remediation in MEA

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Natural resource contamination and growing industrial activities fuel South America's environmental remediation market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION & FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Environmental medium footprint

- 12.7.5.4 Site type footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CLEAN HARBORS, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 WSP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 AECOM

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 JACOBS SOLUTIONS INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 TETRA TECH, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 DEME GROUP NV

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Other developments

- 13.1.7 ENTACT

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 TERRA SYSTEMS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 HDR, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 BECHTEL CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 FLUOR CORPORATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Other developments

- 13.1.1 CLEAN HARBORS, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 ENVIRONMENTAL LOGIC

- 13.2.2 MONTROSE ENVIRONMENTAL GROUP, INC.

- 13.2.3 OXYLE

- 13.2.4 ECOSPEARS INC.

- 13.2.5 ALLONNIA

- 13.2.6 CARBOGENICS

- 13.2.7 ALLIED MICROBIOTA

- 13.2.8 ACLARITY, INC.

- 13.2.9 EKOLIVE S.R.O.

- 13.2.10 NOVOBIOM S.P.R.L

- 13.2.11 OXI AMBIENTAL SA

- 13.2.12 WEBER AMBIENTAL

- 13.2.13 AMENTUM SERVICES, INC.

- 13.2.14 NORTHSTAR ENVIRONMENTAL SERVICES

- 13.2.15 IN-SITU OXIDATIVE TECHNOLOGIES, INC. (ISOTEC)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 ENVIRONMENTAL REMEDIATION MARKET: RISK ANALYSIS

- TABLE 2 ROLE OF PLAYERS IN ENVIRONMENTAL REMEDIATION ECOSYSTEM

- TABLE 3 ENVIRONMENTAL REMEDIATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 6 COST ESTIMATIONS FOR ENVIRONMENTAL REMEDIATION, BY SITE TYPE VS. TECHNOLOGY

- TABLE 7 SERVICE COST RANKING, BY TECHNOLOGY TYPE (DESCENDING ORDER)

- TABLE 8 INDICATIVE PRICING ANALYSIS OF ENVIRONMENTAL REMEDIATION FOR PRIVATE SITES, BY KEY PLAYER, 2024 (USD/M3)

- TABLE 9 INDICATIVE PRICING ANALYSIS OF ENVIRONMENTAL REMEDIATION FOR PUBLIC SITES, BY KEY PLAYER, 2024 (USD/M3)

- TABLE 10 PRICING TREND OF ENVIRONMENTAL REMEDIATION FOR PRIVATE SITES, BY REGION, 2021-2024 (USD/M3)

- TABLE 11 PRICING TREND OF ENVIRONMENTAL REMEDIATION FOR PUBLIC SITES, BY REGION, 2021-2024 (USD/M3)

- TABLE 12 LIST OF APPLIED/GRANTED PATENTS RELATED TO ENVIRONMENTAL REMEDIATION, MAY 2025-JUNE 2025

- TABLE 13 ENVIRONMENTAL REMEDIATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 STANDARDS

- TABLE 19 EXPORT DATA FOR HS CODE 8430 FOR TOP COUNTRIES (USD MILLION), 2021-2024

- TABLE 20 IMPORT DATA FOR HS CODE 8430 FOR TOP COUNTRIES (USD MILLION), 2021-2024

- TABLE 21 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 23 ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 24 SOIL: ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 25 SOIL: ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 26 GROUNDWATER: ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 27 GROUNDWATER: ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 28 ENVIRONMENTAL REMEDIATION MARKET, BY SITE TYPE, 2021-2024 (USD MILLION)

- TABLE 29 ENVIRONMENTAL REMEDIATION MARKET, BY SITE TYPE, 2025-2030 (USD MILLION)

- TABLE 30 ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 31 ENVIRONMENTAL REMEDIATION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 32 AIR SPARGING: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 33 AIR SPARGING: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 34 SOIL WASHING: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 35 SOIL WASHING: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 36 CHEMICAL TREATMENT: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 37 CHEMICAL TREATMENT: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 38 BIOREMEDIATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 39 BIOREMEDIATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 40 ELECTROKINETIC REMEDIATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 41 ELECTROKINETIC REMEDIATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 42 EXCAVATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 43 EXCAVATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 44 PERMEABLE REACTIVE BARRIERS: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 45 PERMEABLE REACTIVE BARRIERS: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 46 IN SITU GROUTING: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 47 IN SITU GROUTING: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 48 PHYTOREMEDIATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 49 PHYTOREMEDIATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 50 PUMP AND TREAT: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 51 PUMP AND TREAT: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 52 SOIL VAPOR EXTRACTION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 53 SOIL VAPOR EXTRACTION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 54 IN SITU VITRIFICATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 55 IN SITU VITRIFICATION: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 56 THERMAL TREATMENT: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2021-2024 (USD MILLION)

- TABLE 57 THERMAL TREATMENT: ENVIRONMENTAL REMEDIATION MARKET, BY ENVIRONMENTAL MEDIUM, 2025-2030 (USD MILLION)

- TABLE 58 ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 59 ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 67 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR MINING & FORESTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR OIL & GAS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR AGRICULTURE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR LANDFILLS & WASTE DISPOSAL SITES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR MANUFACTURING, INDUSTRIAL, AND CHEMICAL PRODUCTION/PROCESSING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET FOR CONSTRUCTION & LAND DEVELOPMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 130 ENVIRONMENTAL REMEDIATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 ENVIRONMENTAL REMEDIATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 US: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 US: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 CANADA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 CANADA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 MEXICO: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 MEXICO: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 EUROPE: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 EUROPE: ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 GERMANY: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 GERMANY: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 UK: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 UK: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 FRANCE: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 151 FRANCE: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 152 REST OF EUROPE: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 REST OF EUROPE: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 CHINA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 159 CHINA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 160 JAPAN: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 JAPAN: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 INDIA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 INDIA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 164 AUSTRALIA & NEW ZEALAND: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 165 AUSTRALIA & NEW ZEALAND: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 171 REST OF THE WORLD: ENVIRONMENTAL REMEDIATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 SOUTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 175 SOUTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 176 OVERVIEW OF STRATEGIES ADOPTED BY ENVIRONMENTAL REMEDIATION PROVIDERS

- TABLE 177 ENVIRONMENTAL REMEDIATION MARKET SHARE ANALYSIS, 2024

- TABLE 178 ENVIRONMENTAL REMEDIATION MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 179 ENVIRONMENTAL REMEDIATION MARKET: ENVIRONMENTAL MEDIUM FOOTPRINT, 2024

- TABLE 180 ENVIRONMENTAL REMEDIATION MARKET: SITE TYPE FOOTPRINT, 2024

- TABLE 181 ENVIRONMENTAL REMEDIATION MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 182 ENVIRONMENTAL REMEDIATION MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 183 ENVIRONMENTAL REMEDIATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 184 ENVIRONMENTAL REMEDIATION MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 185 ENVIRONMENTAL REMEDIATION MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 186 ENVIRONMENTAL REMEDIATION MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 187 CLEAN HARBORS, INC.: BUSINESS OVERVIEW

- TABLE 188 CLEAN HARBORS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 189 CLEAN HARBORS, INC.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 190 CLEAN HARBORS, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 191 WSP: BUSINESS OVERVIEW

- TABLE 192 WSP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 WSP: DEALS, JANUARY 2021-JUNE 2025

- TABLE 194 AECOM: BUSINESS OVERVIEW

- TABLE 195 AECOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 AECOM: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 197 AECOM: DEALS, JANUARY 2021-JUNE 2025

- TABLE 198 AECOM: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 199 JACOBS SOLUTIONS INC.: BUSINESS OVERVIEW

- TABLE 200 JACOBS SOLUTIONS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 JACOBS SOLUTIONS INC.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 202 TETRA TECH, INC.: BUSINESS OVERVIEW

- TABLE 203 TETRA TECH, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 TETRA TECH, INC.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 205 DEME GROUP NV: BUSINESS OVERVIEW

- TABLE 206 DEME GROUP NV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 207 DEME GROUP NV: DEALS, JANUARY 2021-JUNE 2025

- TABLE 208 DEME GROUP NV: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 209 ENTACT: BUSINESS OVERVIEW

- TABLE 210 ENTACT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 ENTACT: DEALS, JANUARY 2021-JUNE 2025

- TABLE 212 TERRA SYSTEMS: BUSINESS OVERVIEW

- TABLE 213 TERRA SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 214 TERRA SYSTEMS: DEALS, JANUARY 2021-JUNE 2025

- TABLE 215 HDR, INC.: BUSINESS OVERVIEW

- TABLE 216 HDR, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 217 HDR, INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 218 BECHTEL CORPORATION: BUSINESS OVERVIEW

- TABLE 219 BECHTEL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 220 BECHTEL CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 221 FLUOR CORPORATION: BUSINESS OVERVIEW

- TABLE 222 FLUOR CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 FLUOR CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

List of Figures

- FIGURE 1 ENVIRONMENTAL REMEDIATION MARKET: RESEARCH DESIGN

- FIGURE 2 ENVIRONMENTAL REMEDIATION MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 3 ENVIRONMENTAL REMEDIATION MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 4 ENVIRONMENTAL REMEDIATION MARKET: BOTTOM-UP APPROACH

- FIGURE 5 ENVIRONMENTAL REMEDIATION MARKET: TOP-DOWN APPROACH

- FIGURE 6 ENVIRONMENTAL REMEDIATION MARKET: DATA TRIANGULATION

- FIGURE 7 SOIL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 8 PRIVATE SITES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 BIOREMEDIATION TECHNOLOGY TO GROW AT HIGH CAGR

- FIGURE 10 OIL & GAS TO HOLD LARGEST SHARE OF APPLICATIONS MARKET TILL 2030

- FIGURE 11 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 RISING INDUSTRIAL CONTAMINATION AND STRICTER CLEANUP MANDATES ARE DRIVING MARKET GROWTH

- FIGURE 13 SOIL REMEDIATION AND PRIVATE SITE TYPE SEGMENT TO HOLD LARGE MARKET SHARE IN 2025

- FIGURE 14 BIOREMEDIATION TECHNOLOGY TO DOMINATE MARKET BY 2030

- FIGURE 15 OIL & GAS TO HOLD THE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 CHINA TO WITNESS HIGHEST CAGR IN GLOBAL ENVIRONMENTAL REMEDIATION MARKET DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ENVIRONMENTAL REMEDIATION MARKET

- FIGURE 18 IMPACT ANALYSIS: DRIVERS

- FIGURE 19 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: CHALLENGES

- FIGURE 22 ENVIRONMENTAL REMEDIATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 ENVIRONMENTAL REMEDIATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 ENVIRONMENTAL REMEDIATION MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 ENVIRONMENTAL REMEDIATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 28 AVERAGE SELLING PRICE OF ENVIRONMENTAL REMEDIATION FOR PRIVATE SITES, BY REGION, 2021-2024 (USD/M3)

- FIGURE 29 AVERAGE SELLING PRICE OF ENVIRONMENTAL REMEDIATION FOR PUBLIC SITES, BY REGION, 2021-2024 (USD/M3)

- FIGURE 30 ENVIRONMENTAL REMEDIATION MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 31 EXPORT DATA FOR HS CODE 8430 FOR TOP COUNTRIES (USD MILLION), 2021-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 8430 FOR TOP COUNTRIES (USD MILLION), 2021-2024

- FIGURE 33 IMPACT OF AI ON ENVIRONMENTAL REMEDIATION INDUSTRY

- FIGURE 34 GROUNDWATER SEGMENT TO GROW AT HIGHER CAGR TILL 2030

- FIGURE 35 PRIVATE SITES TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 BIOREMEDIATION TECHNOLOGY SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2030

- FIGURE 37 OIL & GAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2030

- FIGURE 38 ASIA PACIFIC TO WITNESS FASTEST GROWTH DURING THE FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: ENVIRONMENTAL REMEDIATION MARKET SNAPSHOT

- FIGURE 40 US TO HOLD LARGEST MARKET SHARE OF NORTH AMERICAN MARKET TILL 2030

- FIGURE 41 EUROPE: ENVIRONMENTAL REMEDIATION MARKET SNAPSHOT

- FIGURE 42 UK TO DOMINATE EUROPEAN ENVIRONMENTAL REMEDIATION MARKET DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC: ENVIRONMENTAL REMEDIATION MARKET SNAPSHOT

- FIGURE 44 CHINA TO LEAD ENVIRONMENTAL REMEDIATION MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 45 MIDDLE EAST & AFRICA TO GROW AT HIGH CAGR DURING FORECAST PERIOD

- FIGURE 46 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN ENVIRONMENTAL REMEDIATION MARKET, 2021-2024 (USD MILLION)

- FIGURE 47 ENVIRONMENTAL REMEDIATION MARKET: SHARE OF KEY PLAYERS

- FIGURE 48 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 49 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 ENVIRONMENTAL REMEDIATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 ENVIRONMENTAL REMEDIATION MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 53 ENVIRONMENTAL REMEDIATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 CLEAN HARBORS, INC.: COMPANY SNAPSHOT

- FIGURE 55 WSP: COMPANY SNAPSHOT

- FIGURE 56 AECOM: COMPANY SNAPSHOT

- FIGURE 57 JACOBS SOLUTIONS INC.: COMPANY SNAPSHOT

- FIGURE 58 TETRA TECH, INC.: COMPANY SNAPSHOT

- FIGURE 59 DEME GROUP NV: COMPANY SNAPSHOT

- FIGURE 60 FLUOR CORPORATION: COMPANY SNAPSHOT