PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1795410

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1795410

Polyurethane Adhesives Market by Type, Technology, Application, and Region - Global Forecast to 2030

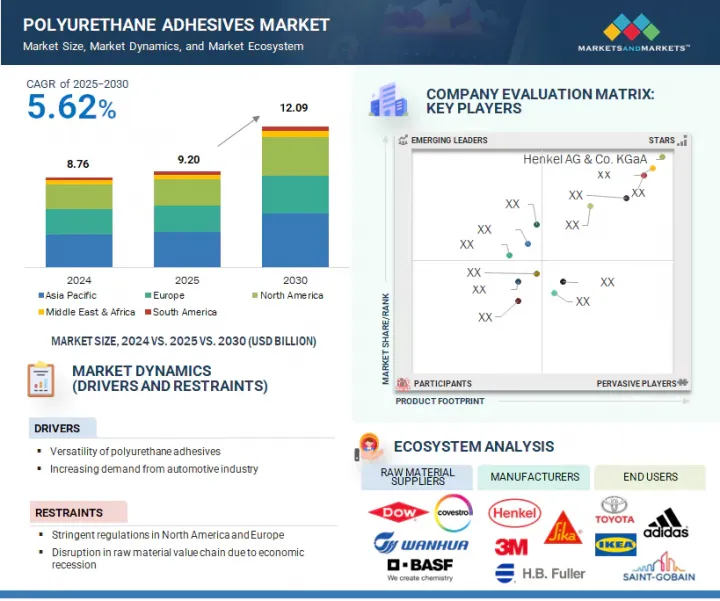

The polyurethane adhesives market size is projected to grow from USD 8.76 billion in 2024 to USD 12.09 billion by 2030 at a CAGR of 5.62%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Technology, and Application |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"The thermoset segment is estimated to lead the polyurethane adhesives market in 2025."

By type, the thermoset segment dominated the polyurethane adhesives market in 2024. The main causative factors for this growth are their superb mechanical strength, good durability, and environmental degradation resistance. These kinds of adhesives find extensive applications in the automotive, construction, and footwear industries, where high stress and permanent bonding are essential. Thermosets are used in a structural application due to the irreversible cross-linked bonds formed upon curing, which have been demonstrated to provide high performance in heat, chemical, and moisture exposure conditions. They are cheap and have the flexibility to be used in various industries, which makes them the preferred adhesive in mass production. With the increasing global demand for durable and high-strength adhesives without diminishing, thermoset PU adhesives will likely sustain their pace in becoming the top-notch type in the polyurethane adhesives market.

"The 100% solids segment is estimated to lead the polyurethane adhesives market in 2025."

By technology, the 100% solids segment is estimated to lead the polyurethane adhesives market in 2025, in terms of value. The growth of this segment can be attributed to the increasing trend in the world of environmental sustainability, worker safety, and low-emission materials. 100% solid adhesives have low emissions of volatile organic compounds (VOCs); thus, the adhesives conform to stringent environmental standards, especially in North America and Europe. The use of low odor, non-flammable, and rapid-curing adhesives is steadily rising in furniture, automotive interior, packaging, and other applications. Since industries and consumers focus on green solutions, manufacturers are moving toward water-based technologies, and this has seen a swift adoption of water-based technology in various fields.

"Middle East & Africa is projected to be the second-fastest-growing region in the polyurethane adhesives market, in terms of value, during the forecast period."

The Middle East & Africa is projected to be the second-fastest-growing market during the forecast period. It is projected to grow at a CAGR of 6.61% between 2025 and 2030. Construction works, expansion of industries, and the diversification of economies based on oil resources are the main factors that propel the region's growth. Nations such as the UAE, Saudi Arabia, and South Africa invest in mega infrastructure and commerce structures, so premium quality adhesives are in high demand. Additionally, the increase in disposable income is driving the demand for PU adhesives in the end-use markets, such as furniture, interior decoration, and packaging, where they are proving to be better in strength, flexibility, and environmental stability. Market growth is also boosted by the region's progressive exposure to foreign investments and the adoption of new technologies.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World - 5%

The key players profiled in the report include Henkel AG & Co. KGaA (Germany), H.B. Fuller (US), Sika AG (Switzerland), Dow Inc. (US), 3M Company (US), Huntsman Corporation (US), Arkema (France), Illinois Tool Works Inc. (US), and Parker-Hannifin Corporation (US), and Jowat SE (Germany).

Research Coverage

The polyurethane adhesives market is segmented by type, technology, application, and region. It provides value estimations (USD Million) for the overall market size across various areas. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies.

Reasons to Buy this Report

This research report is focused on various levels of analysis, industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the polyurethane adhesives market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on polyurethane adhesives offered by top players in the global market

- Analysis of key drivers: (Versatility of polyurethane adhesives, increasing demand from automotive industry), restraints (stringent regulations in North America and Europe, disruption in raw material value chain due to economic recession), opportunities (growing urbanization and construction industry, greater opportunities in Asia Pacific and Middle East), and challenges (application determined by various external factors) influencing the growth of polyurethane adhesives market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the polyurethane adhesives market

- Market Development: Comprehensive information about lucrative emerging markets across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global polyurethane adhesives market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the polyurethane adhesives market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY TECHNOLOGY

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYURETHANE ADHESIVES MARKET

- 4.2 POLYURETHANE ADHESIVES MARKET, BY REGION

- 4.3 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TYPE AND KEY COUNTRY

- 4.4 POLYURETHANE ADHESIVES MARKET, BY APPLICATION AND REGION

- 4.5 POLYURETHANE ADHESIVES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Versatility of polyurethane adhesives

- 5.2.1.2 Increasing demand from automotive industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations in North America and Europe

- 5.2.2.2 Disruption in raw material value chain due to economic recession

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid urbanization and growing construction industry

- 5.2.3.2 Opportunities in Asia Pacific and Middle East

- 5.2.4 CHALLENGES

- 5.2.4.1 External factors influencing applications

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT FROM NEW ENTRANTS

- 5.3.2 THREAT FROM SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 RAW MATERIAL SUPPLIERS

- 5.6.2 POLYURETHANE ADHESIVE MANUFACTURERS

- 5.6.3 DISTRIBUTION NETWORKS

- 5.6.4 END USERS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF POLYURETHANE ADHESIVES, BY KEY PLAYER, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 One-component, moisture-cured polyurethane adhesives

- 5.10.1.2 Two-component polyurethane adhesives

- 5.10.1.3 Reactive hot melt polyurethane adhesives (RHM/PUR hot melts)

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Primer & surface treatment technologies

- 5.10.2.2 Green chemistry & bio-based polyols

- 5.10.1 KEY TECHNOLOGIES

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MOISTURE-CURE POLYURETHANE ADHESIVES INTRODUCED AS ALTERNATIVE THAT FORMS HIGHLY ELASTIC, DURABLE BONDS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 3506)

- 5.12.2 EXPORT SCENARIO (HS CODE 3506)

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY FRAMEWORK

- 5.13.2.1 REACH Regulation (European Union)

- 5.13.2.2 Circular Economy Action Plan (European Union)

- 5.13.2.3 Clean Air Act (United States)

- 5.13.2.4 TSCA (Toxic Substances Control Act) (United States)

- 5.13.2.5 ISO 9001 and ISO 14001 Standards (Global)

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 DOCUMENT TYPES

- 5.16.3 TOP APPLICANTS

- 5.16.4 JURISDICTION ANALYSIS

- 5.17 US 2025 TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.18 IMPACT OF AI/GEN AI ON POLYURETHANE ADHESIVES MARKET

6 POLYURETHANE ADHESIVES MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 AUTOMOTIVE

- 6.2.1 RISING DEMAND FOR LIGHTWEIGHT VEHICLES TO BOOST MARKET

- 6.3 BUILDING & CONSTRUCTION

- 6.3.1 INCREASING DEMAND FOR ADHESIVES FROM RESIDENTIAL HOUSING SEGMENT TO DRIVE MARKET

- 6.4 PACKAGING

- 6.4.1 INCREASING USE OF FLEXIBLE LAMINATES IN FOOD, MEDICAL, AND E-COMMERCE SEGMENTS TO PROPEL MARKET

- 6.5 LEATHER & FOOTWEAR

- 6.5.1 FLEXIBILITY, STRENGTH, AND DURABILITY OF POLYURETHANE ADHESIVES TO SUPPORT MARKET GROWTH

- 6.6 GENERAL INDUSTRIAL

- 6.6.1 NON-TOXICITY AND ECO-FRIENDLINESS OF POLYURETHANE ADHESIVES TO DRIVE MARKET

- 6.7 FURNITURE & DECORATION

- 6.7.1 RAPID GROWTH IN CONSTRUCTION INDUSTRY TO DRIVE MARKET

- 6.8 OTHERS

7 POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 100% SOLIDS

- 7.2.1 NEED FOR LOW VOC EMISSIONS TO BOOST MARKET

- 7.3 SOLVENT-BORNE

- 7.3.1 COMPATIBILITY OF SOLVENT-BORNE ADHESIVES WITH VARIOUS SUBSTRATES TO DRIVE MARKET

- 7.4 DISPERSION

- 7.4.1 INCREASING GOVERNMENT REGULATIONS FOR VOC EMISSIONS TO PROPEL MARKET

- 7.5 OTHERS

8 POLYURETHANE ADHESIVES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 THERMOSET

- 8.2.1 RISING DEMAND FOR THERMOSET POLYURETHANE ADHESIVES ACROSS INDUSTRIES TO BOOST MARKET

- 8.2.2 POLYESTER RESIN

- 8.2.3 POLYETHER RESIN

- 8.3 THERMOPLASTIC

- 8.3.1 DEMAND FOR ADJUSTABLE SEALING TEMPERATURES AND CUSTOM FORMULATIONS TO DRIVE MARKET

- 8.3.2 ALIPHATIC RESIN

9 POLYURETHANE ADHESIVES MARKET, BY SUBSTRATE

- 9.1 INTRODUCTION

- 9.2 METAL

- 9.2.1 METAL OFFERS STRUCTURAL BONDING AND CORROSION-RESISTANT SUBSTRATES

- 9.3 PLASTIC

- 9.3.1 PLASTIC OFFERS FLEXIBILITY AND COMPATIBILITY WITH LOW-ENERGY SURFACES

- 9.4 WOOD

- 9.4.1 WOOD OFFERS MOISTURE RESISTANCE AND DEEP PENETRATION

- 9.5 GLASS

- 9.5.1 GLASS OFFERS CLARITY, ELASTICITY, AND WEATHER STABILITY ACROSS VARIOUS FORMULATIONS

- 9.6 PAPER

- 9.6.1 PAPER IS USED MAINLY FOR ITS LIGHTWEIGHT, FLEXIBLE BONDING FOR PACKAGING

10 POLYURETHANE ADHESIVES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Developments in construction industry to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Infrastructural developments to boost demand

- 10.2.3 SOUTH KOREA

- 10.2.3.1 Growth in automotive industry to fuel demand

- 10.2.4 INDIA

- 10.2.4.1 Government initiatives to boost economy and contribute to market growth

- 10.2.5 TAIWAN

- 10.2.5.1 Growth in construction industry to influence market growth

- 10.2.6 THAILAND

- 10.2.6.1 Growing automotive sector to contribute to market growth

- 10.2.7 MALAYSIA

- 10.2.7.1 Favorable business policies to spur market growth

- 10.2.8 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Changing trends in food packaging industry to boost demand

- 10.3.2 FRANCE

- 10.3.2.1 Growth in construction and automotive industries to boost market

- 10.3.3 ITALY

- 10.3.3.1 Aerospace and automotive industries to offer growth potential

- 10.3.4 UK

- 10.3.4.1 Implementation of innovative and energy-efficient technologies in household appliances to drive market

- 10.3.5 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Growth in major end-use industries to boost demand

- 10.4.2 CANADA

- 10.4.2.1 Automotive sector to drive demand for polyurethane adhesives

- 10.4.3 MEXICO

- 10.4.3.1 Growing use of polyurethane adhesives in automotive industry to drive market

- 10.4.1 US

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Rapid growth in automotive industry to boost demand for polyurethane adhesives

- 10.5.2 ARGENTINA

- 10.5.2.1 Rapid growth in economy to propel market

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Increasing car sales to support market

- 10.6.1.2 Rest of GCC Countries

- 10.6.1.1 Saudi Arabia

- 10.6.2 SOUTH AFRICA

- 10.6.2.1 Rising awareness about advantages of polyurethane adhesives among local manufacturers to drive market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Technology footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMES

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSION

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 HENKEL AG & CO. KGAA

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansion

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 H.B. FULLER COMPANY

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansion

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DOW

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SIKA AG

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 3M COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 HUNTSMAN INTERNATIONAL LLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.7 ARKEMA

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 ILLINOIS TOOL WORKS INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 JOWAT SE

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 PARKER HANNIFIN CORP

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.1 HENKEL AG & CO. KGAA

- 12.2 OTHER PLAYERS

- 12.2.1 DYMAX

- 12.2.2 FRANKLIN INTERNATIONAL

- 12.2.3 HEXCEL CORPORATION

- 12.2.4 SCOTT BADER COMPANY LTD

- 12.2.5 MAPEI

- 12.2.6 MASTER BOND

- 12.2.7 PIDILITE INDUSTRIES LTD

- 12.2.8 DELO

- 12.2.9 PERMABOND

- 12.2.10 PARSON ADHESIVES, INC.

- 12.2.11 SOUDAL GROUP

- 12.2.12 DAUBERT CHEMICAL COMPANY

- 12.2.13 IMAWELL

- 12.2.14 AKZO NOBEL N.V.

- 12.2.15 HELMITIN ADHESIVES

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 STRUCTURAL ADHESIVES MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 STRUCTURAL ADHESIVES MARKET, BY REGION

- 13.4.1 ASIA PACIFIC

- 13.4.2 NORTH AMERICA

- 13.4.3 EUROPE

- 13.4.4 SOUTH AMERICA

- 13.4.5 MIDDLE EAST & AFRICA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 POLYURETHANE ADHESIVES MARKET: RISK ASSESSMENT

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON POLYURETHANE ADHESIVES MARKET

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 5 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 6 AVERAGE SELLING PRICE OF POLYURETHANE ADHESIVES FOR KEY APPLICATIONS, BY KEY PLAYER, 2024 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE TREND OF POLYURETHANE ADHESIVES, BY REGION, 2022-2030 (USD/KG)

- TABLE 8 ROLE OF COMPANIES IN POLYURETHANE ADHESIVES MARKET ECOSYSTEM

- TABLE 9 IMPORT DATA FOR HS CODE 3506-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 3506-COMPLIANT PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 POLYURETHANE ADHESIVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 17 POLYURETHANE ADHESIVES MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2025

- TABLE 18 TOTAL COUNT PATENTS AT VARIOUS STAGES, 2014-2024

- TABLE 19 LIST OF MAJOR PATENTS IN POLYURETHANE ADHESIVES MARKET, 2014-2024

- TABLE 20 PATENTS FILED BY MITSUI CHEMICALS INC.

- TABLE 21 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 22 POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 23 POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 24 POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 25 POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 POLYURETHANE ADHESIVES MARKET IN AUTOMOTIVE, BY REGION, 2020-2024 (KILOTON)

- TABLE 27 POLYURETHANE ADHESIVES MARKET IN AUTOMOTIVE, BY REGION, 2025-2030 (KILOTON)

- TABLE 28 POLYURETHANE ADHESIVES MARKET IN AUTOMOTIVE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 POLYURETHANE ADHESIVES MARKET IN AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 POLYURETHANE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2020-2024 (KILOTON)

- TABLE 31 POLYURETHANE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2025-2030 (KILOTON)

- TABLE 32 POLYURETHANE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 POLYURETHANE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 POLYURETHANE ADHESIVES MARKET IN PACKAGING, BY REGION, 2020-2024 (KILOTON)

- TABLE 35 POLYURETHANE ADHESIVES MARKET IN PACKAGING, BY REGION, 2025-2030 (KILOTON)

- TABLE 36 POLYURETHANE ADHESIVES MARKET IN PACKAGING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 POLYURETHANE ADHESIVES MARKET IN PACKAGING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 POLYURETHANE ADHESIVES MARKET IN LEATHER & FOOTWEAR, BY REGION, 2020-2024 (KILOTON)

- TABLE 39 POLYURETHANE ADHESIVES MARKET IN LEATHER & FOOTWEAR, BY REGION, 2025-2030 (KILOTON)

- TABLE 40 POLYURETHANE ADHESIVES MARKET IN LEATHER & FOOTWEAR, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 POLYURETHANE ADHESIVES MARKET IN LEATHER & FOOTWEAR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 POLYURETHANE ADHESIVES MARKET IN GENERAL INDUSTRIAL, BY REGION, 2020-2024 (KILOTON)

- TABLE 43 POLYURETHANE ADHESIVES MARKET IN GENERAL INDUSTRIAL, BY REGION, 2025-2030 (KILOTON)

- TABLE 44 POLYURETHANE ADHESIVES MARKET IN GENERAL INDUSTRIAL, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 POLYURETHANE ADHESIVES MARKET IN GENERAL INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 POLYURETHANE ADHESIVES MARKET IN FURNITURE & DECORATION, BY REGION, 2020-2024 (KILOTON)

- TABLE 47 POLYURETHANE ADHESIVES MARKET IN FURNITURE & DECORATION, BY REGION, 2025-2030 (KILOTON)

- TABLE 48 POLYURETHANE ADHESIVES MARKET IN FURNITURE & DECORATION, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 POLYURETHANE ADHESIVES MARKET IN FURNITURE & DECORATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 POLYURETHANE ADHESIVES MARKET IN OTHERS, BY REGION, 2020-2024 (KILOTON)

- TABLE 51 POLYURETHANE ADHESIVES MARKET IN OTHERS, BY REGION, 2025-2030 (KILOTON)

- TABLE 52 POLYURETHANE ADHESIVES MARKET IN OTHERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 POLYURETHANE ADHESIVES MARKET IN OTHERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (KILOTON)

- TABLE 55 POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (KILOTON)

- TABLE 56 POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 57 POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 58 100% SOLIDS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 59 100% SOLIDS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 60 100% SOLIDS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 100% SOLIDS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 SOLVENT-BORNE: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 63 SOLVENT-BORNE: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 64 SOLVENT-BORNE: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 SOLVENT-BORNE: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 DISPERSION: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 67 DISPERSION: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 68 DISPERSION: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 DISPERSION: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 OTHERS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 71 OTHERS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 72 OTHERS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 OTHERS: POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 75 POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 76 POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 77 POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 THERMOSET POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 79 THERMOSET POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 80 THERMOSET POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 THERMOSET POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 THERMOPLASTIC POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 83 THERMOPLASTIC POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 84 THERMOPLASTIC POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 THERMOPLASTIC POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 87 POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 88 POLYURETHANE ADHESIVES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 POLYURETHANE ADHESIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 91 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 92 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 93 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (KILOTON)

- TABLE 95 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (KILOTON)

- TABLE 96 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 97 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 99 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 100 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 101 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (KILOTON)

- TABLE 103 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (KILOTON)

- TABLE 104 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 107 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 108 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 109 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (KILOTON)

- TABLE 111 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (KILOTON)

- TABLE 112 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 113 EUROPE: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 115 EUROPE: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 116 EUROPE: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 117 EUROPE: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (KILOTON)

- TABLE 119 EUROPE: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (KILOTON)

- TABLE 120 EUROPE: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 121 EUROPE: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 123 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 124 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (KILOTON)

- TABLE 127 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (KILOTON)

- TABLE 128 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 131 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 132 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 135 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 136 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 139 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 140 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 141 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 142 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (KILOTON)

- TABLE 143 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (KILOTON)

- TABLE 144 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 145 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 147 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 148 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 149 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (KILOTON)

- TABLE 151 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (KILOTON)

- TABLE 152 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 153 SOUTH AMERICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 164 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (KILOTON)

- TABLE 167 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (KILOTON)

- TABLE 168 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: POLYURETHANE ADHESIVES MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 170 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 171 POLYURETHANE ADHESIVES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 172 POLYURETHANE ADHESIVES MARKET: REGION FOOTPRINT

- TABLE 173 POLYURETHANE ADHESIVES MARKET: TYPE FOOTPRINT

- TABLE 174 POLYURETHANE ADHESIVES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 175 POLYURETHANE ADHESIVES MARKET: APPLICATION FOOTPRINT

- TABLE 176 POLYURETHANE ADHESIVES MARKET: KEY STARTUPS/SMES

- TABLE 177 POLYURETHANE ADHESIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 178 POLYURETHANE ADHESIVES MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 179 POLYURETHANE ADHESIVES MARKET: EXPANSION, JANUARY 2020-DECEMBER 2024

- TABLE 180 POLYURETHANE ADHESIVES MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 181 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 182 HENKEL AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 183 HENKEL AG & CO. KGAA: EXPANSION

- TABLE 184 HENKEL AG & CO. KGAA: OTHER DEVELOPMENTS

- TABLE 185 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 186 H.B. FULLER COMPANY: PRODUCTS OFFERED

- TABLE 187 H.B. FULLER COMPANY: DEALS

- TABLE 188 H.B. FULLER COMPANY: EXPANSION

- TABLE 189 DOW: COMPANY OVERVIEW

- TABLE 190 DOW: PRODUCTS OFFERED

- TABLE 191 DOW: DEALS

- TABLE 192 SIKA AG: COMPANY OVERVIEW

- TABLE 193 SIKA AG: PRODUCTS OFFERED

- TABLE 194 SIKA AG: DEALS

- TABLE 195 3M COMPANY: COMPANY OVERVIEW

- TABLE 196 3M COMPANY: PRODUCTS OFFERED

- TABLE 197 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 198 HUNTSMAN INTERNATIONAL LLC: PRODUCTS OFFERED

- TABLE 199 ARKEMA: COMPANY OVERVIEW

- TABLE 200 ARKEMA: PRODUCTS OFFERED

- TABLE 201 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 202 ILLINOIS TOOL WORKS INC.: PRODUCTS OFFERED

- TABLE 203 JOWAT SE: COMPANY OVERVIEW

- TABLE 204 JOWAT SE: PRODUCTS OFFERED

- TABLE 205 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 206 PARKER HANNIFIN CORP: PRODUCTS OFFERED

- TABLE 207 DYMAX: COMPANY OVERVIEW

- TABLE 208 FRANKLIN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 209 HEXCEL CORPORATION: COMPANY OVERVIEW

- TABLE 210 SCOTT BADER COMPANY LTD: COMPANY OVERVIEW

- TABLE 211 MAPEI: COMPANY OVERVIEW

- TABLE 212 MASTER BOND: COMPANY OVERVIEW

- TABLE 213 PIDILITE INDUSTRIES LTD: COMPANY OVERVIEW

- TABLE 214 DELO: COMPANY OVERVIEW

- TABLE 215 PERMABOND: COMPANY OVERVIEW

- TABLE 216 PARSON ADHESIVES, INC.: COMPANY OVERVIEW

- TABLE 217 SOUDAL GROUP: COMPANY OVERVIEW

- TABLE 218 DAUBERT CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 219 IMAWELL: COMPANY OVERVIEW

- TABLE 220 AKZO NOBEL N.V.: COMPANY OVERVIEW

- TABLE 221 HELMITIN ADHESIVES: COMPANY OVERVIEW

- TABLE 222 STRUCTURAL ADHESIVES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 223 STRUCTURAL ADHESIVES MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 224 STRUCTURAL ADHESIVES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 225 STRUCTURAL ADHESIVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 226 ASIA PACIFIC: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (KILOTON)

- TABLE 227 ASIA PACIFIC: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (KILOTON)

- TABLE 228 ASIA PACIFIC: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (USD MILLION)

- TABLE 229 ASIA PACIFIC: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- TABLE 230 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 231 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 232 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 233 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 234 EUROPE: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (KILOTON)

- TABLE 235 EUROPE: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (KILOTON)

- TABLE 236 EUROPE: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (USD MILLION)

- TABLE 237 EUROPE: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- TABLE 238 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (KILOTON)

- TABLE 239 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (KILOTON)

- TABLE 240 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (USD MILLION)

- TABLE 241 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (KILOTON)

- TABLE 243 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (KILOTON)

- TABLE 244 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2021-2023 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: STRUCTURAL ADHESIVES MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 POLYURETHANE ADHESIVES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP, (SUPPLY SIDE) - COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (TOP-DOWN)

- FIGURE 7 POLYURETHANE ADHESIVES MARKET: DATA TRIANGULATION

- FIGURE 8 CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 GROWTH PROJECTIONS BASED ON DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 THERMOSET TO BE LEADING SEGMENT IN 2024

- FIGURE 11 100% SOLIDS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 AUTOMOTIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET IN 2024

- FIGURE 14 POLYURETHANE ADHESIVES MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE BY 2030

- FIGURE 16 THERMOSET SEGMENT AND CHINA ACCOUNTED FOR SIGNIFICANT SHARE IN 2024

- FIGURE 17 AUTOMOTIVE SEGMENT TO LEAD MARKET ACROSS REGIONS

- FIGURE 18 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 POLYURETHANE ADHESIVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 POLYURETHANE ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 23 POLYURETHANE ADHESIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE OF POLYURETHANE ADHESIVES FOR KEY APPLICATIONS, BY KEY PLAYER, 2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF POLYURETHANE ADHESIVES, BY REGION, 2022-2030 (USD/KG)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 POLYURETHANE ADHESIVES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 IMPORT DATA FOR HS CODE 3506-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR HS CODE 3506-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 PATENTS REGISTERED FOR POLYURETHANE ADHESIVES, 2014-2024

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 32 LEGAL STATUS OF PATENTS FILED, 2014-2024

- FIGURE 33 MAXIMUM PATENTS FILED IN US, 2014-2024 (%)

- FIGURE 34 IMPACT OF AI/GEN AI ON POLYURETHANE ADHESIVES MARKET

- FIGURE 35 AUTOMOTIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 100% SOLIDS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 THERMOSET SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET SNAPSHOT

- FIGURE 40 EUROPE: POLYURETHANE ADHESIVES MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: POLYURETHANE ADHESIVES MARKET SNAPSHOT

- FIGURE 42 MARKET SHARE ANALYSIS, 2024

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 44 POLYURETHANE ADHESIVES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 POLYURETHANE ADHESIVES MARKET: COMPANY FOOTPRINT

- FIGURE 46 POLYURETHANE ADHESIVES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 BRAND COMPARISON

- FIGURE 48 POLYURETHANE ADHESIVES MARKET: EV/EBITDA OF KEY PLAYERS

- FIGURE 49 POLYURETHANE ADHESIVES MARKET: COMPANY VALUATION OF KEY PLAYERS

- FIGURE 50 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 51 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 52 DOW: COMPANY SNAPSHOT

- FIGURE 53 SIKA AG: COMPANY SNAPSHOT

- FIGURE 54 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 55 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- FIGURE 56 ARKEMA: COMPANY SNAPSHOT

- FIGURE 57 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

- FIGURE 58 PARKER HANNIFIN CORP: COMPANY SNAPSHOT