PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1797400

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1797400

Water Recycle and Reuse Market by Equipment, Capacity, End Use, and Water Sources - Global Forecast to 2030

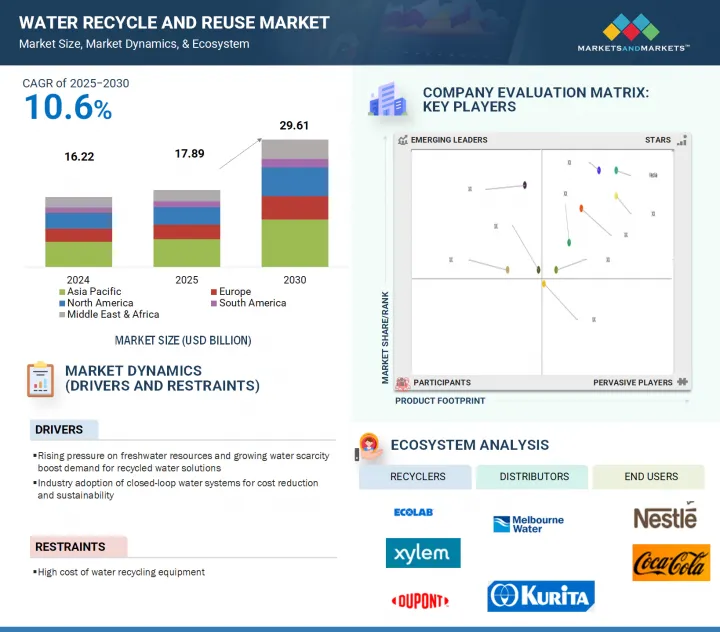

The water recycle and reuse market is projected to grow from USD 17.89 billion in 2025 to USD 29.61 billion by 2030, registering a CAGR of 10.6% during the forecast period. The increasing demand for water recycle and reuse is fueled by the effects of climate change, shrinking freshwater availability, and the need for long-term water security. Increasing urban populations and pressure on existing infrastructure are forcing municipalities and industries to implement better water management practices.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Equipment, Capacity, End Use, Water Source, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

Treatment systems are becoming more compact, affordable, and user-friendly, driven by advancements in technology and the growing demand for stricter environmental regulations and sustainability commitments. This trend is encouraging increased adoption of water reuse practices. In all three end-use sectors (residential, commercial, and industrial), water reuse is on the rise. Residential users are reusing water for landscaping and flushing toilets, commercial users are using it for cooling and cleaning, and industries are utilizing it as process water. These three sectors play a crucial role in market growth.

"Tertiary equipment is projected to register the fastest growth in the water recycle and reuse market in terms of value."

Tertiary equipment is the fastest-growing segment of the water recycle and reuse market, primarily due to the increasing demand for advanced treatment solutions. Applications for water reuse, such as industrial cooling, boiler feedwater, and both direct and indirect potable reuse, are rapidly expanding and require ultra-clean water purification. Tertiary treatment processes, including membrane filtration, ultraviolet (UV) disinfection, activated carbon, and ion exchange, effectively remove fine suspended solids, nutrients, pharmaceuticals, and other micropollutants. This is particularly important in regions with stringent water quality regulations and significant water scarcity. The rising emphasis on resource conservation, sustainable water use, circular economy practices, and zero-discharge initiatives is also driving the demand for tertiary systems that maximize water recovery.

"50,001 to 100,000 liters segment will register the fastest growth in the water recycle and reuse market in terms of value."

The 50,001 to 100,000 liters segment is projected to register the fastest growth in the water recycling and reuse market during the forecast period. This capacity range is well-suited for medium to large-scale applications, including industrial, commercial, and municipal uses. It strikes a balance between scalability and cost, making it an ideal solution for manufacturing plants, commercial complexes, universities, colleges, and mid-sized communities looking to promote sustainable operations. As many regions tighten environmental regulations and face increasing freshwater scarcity, numerous organizations are beginning to implement decentralized water reuse systems within this capacity range. These systems enhance water use efficiency and reduce wastewater discharge. Additionally, government incentives and public-private partnerships are driving and supporting the adoption of decentralized water reuse systems, particularly in urban and peri-urban areas.

"Industrial wastewater segment is projected to register the fastest growth in the water recycle and reuse market in terms of value."

Industrial wastewater is the fastest-growing segment of the water recycling and reuse market, driven by industrialization, increasing water consumption, and pressures from policies aimed at reducing freshwater use. Industries such as textiles, chemicals, oil and gas, food processing, and power generation generate large volumes of wastewater. If left untreated, this wastewater can threaten the environment and deplete freshwater resources in local communities. In response to these challenges, industries are increasingly viewing wastewater recycling as a cost-effective and sustainable solution. By recycling their wastewater, companies can lower water procurement costs, maintain operations in water-scarce areas, and comply with environmental regulations and standards. Recent advancements in treatment technologies, including ultrafiltration, reverse osmosis, and biological treatment systems, are making the treatment of complex industrial wastewater more manageable.

"Industrial segment is projected to register the fastest growth in the water recycle and reuse market in terms of value."

The industrial end-use segment is the fastest-growing sector in the water recycle and reuse market. This growth is driven by the increasing demand for water in manufacturing, chemicals, textiles, food and beverage, and energy-related industries. As industrial activity expands globally, particularly in emerging economies, the consumption of freshwater is rising significantly. To address this challenge, industrial water users are implementing water recycling systems to treat their wastewater for on-site reuse. This not only helps them meet environmental regulatory requirements but also reduces their reliance on municipal water supplies. Companies are adopting these systems to lower costs associated with water procurement and disposal, support sustainability efforts, and ensure long-term access to fresh water. Increased public scrutiny and regulatory pressures regarding industrial water usage have also led to investments in new and advanced treatment technologies.

"Middle East & Africa is the fastest-growing market for water recycle and reuse."

The Middle East & Africa is the fastest-growing market for water recycle and reuse due to extreme water scarcity, urbanization, and industrial demand. Countries such as Saudi Arabia, the UAE, and South Africa face significant water stress and rely on non-conventional water sources to meet their needs. Governments in these regions are making substantial investments in advanced infrastructure and treatment technologies to ensure long-term water security. As mega infrastructure projects continue to develop, populations increase, and demand from sectors such as oil & gas, chemicals, and manufacturing expands, the need for sustainable water management is also rising. This shift is exemplified by initiatives like Saudi Arabia's Vision 2030 and the UAE's Water Security Strategy 2036, where reusing wastewater is a key element of national strategy. The adoption of new technologies, such as membrane bioreactors, reverse osmosis, and smart water systems, is expected to grow rapidly, positioning this region as a focal point for growth in the global water recycling and reuse market.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the water recycle and reuse market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers - 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, the Middle East & Africa - 5%, and South America - 5%

The water recycle and reuse market comprises major players such as Veolia (France), Xylem (US), Ecolab Inc. (US), Fluence Corporation Limited (US), DuPont (US), Hitachi, Ltd. (Japan), KUBOTA Corporation (Japan) ALFA LAVAL (Sweden), Melbourne Water (Australia), and Siemens (Germany). The study includes an in-depth competitive analysis of these key players in the water recycle and reuse market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for water recycle and reuse market on the basis of equipment, capacity, end use, water source, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the water recycle and reuse market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the water recycle and reuse market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (rising pressure on freshwater resources and growing water scarcity boost demand for recycled water solutions), restraints (high cost of installation of water recycling equipment), opportunities (corporate water stewardship initiatives creating new growth opportunities for water reuse), and challenges (health and safety concerns) influencing the growth of the water recycle and reuse market.

- Market Penetration: Comprehensive information on the water recycle and reuse market offered by top players in the global water recycle and reuse market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, product launches, expansions, collaborations, acquisitions, and partnerships in the water recycle and reuse market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the water recycle and reuse market across regions.

- Market Capacity: Recycling capacity of the companies are provided wherever available with upcoming capacities for the water recycle and reuse market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the water recycle and reuse market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOTS

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants from primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WATER RECYCLE AND REUSE MARKET

- 4.2 WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT

- 4.3 WATER RECYCLE AND REUSE MARKET, BY CAPACITY

- 4.4 WATER RECYCLE AND REUSE MARKET, BY END USE

- 4.5 WATER RECYCLE AND REUSE MARKET, BY WATER SOURCE

- 4.6 WATER RECYCLE AND REUSE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising pressure on freshwater resources and growing water scarcity boost demand for recycled water solutions

- 5.2.1.2 Industry adoption of closed-loop water systems for cost reduction and sustainability

- 5.2.1.3 Strict environmental regulations boosting water recycling across major economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of installation of water recycling equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of potable reuse programs

- 5.2.3.2 Corporate water stewardship initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Maintaining quality of recycled water

- 5.2.4.2 Health and safety concerns

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.4 IMPACT ON WATER RECYCLE AND REUSE MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 WASTEWATER COLLECTION

- 6.3.2 TREATMENT

- 6.3.3 DISTRIBUTION AND STORAGE

- 6.3.4 END USERS

- 6.4 IMPACT OF 2025 US TARIFF - WATER RECYCLE AND REUSE MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON REGION

- 6.4.4.1 North America

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON EQUIPMENT

- 6.5 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.6 INDICATIVE PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING OF WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2024

- 6.6.2 INDICATIVE PRICING OF WATER RECYCLE AND REUSE MARKET AMONG KEY PLAYERS, EQUIPMENT, 2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.9.3 INSIGHTS

- 6.9.4 LEGAL STATUS OF PATENTS

- 6.9.5 JURISDICTION ANALYSIS

- 6.9.6 TOP APPLICANTS

- 6.9.7 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 842121)

- 6.10.2 EXPORT SCENARIO (HS CODE 842121)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF ANALYSIS

- 6.13 STANDARDS AND REGULATORY LANDSCAPE

- 6.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13.2 STANDARDS

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT OF NEW ENTRANTS

- 6.14.2 THREATS OF SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 MACROECONOMIC OUTLOOK

- 6.16.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 6.17 CASE STUDY ANALYSIS

- 6.17.1 ADVANCED MEMBRANE BIOREACTOR SYSTEM ENABLES WATER REUSE AT COCA-COLA FEMSA'S ALCORTA PLANT

- 6.17.2 FRIESLANDCAMPINA'S WATER REUSE AND PRODUCT RECOVERY PARTNERSHIP WITH VEOLIA

- 6.17.3 LOS ANGELES COUNTY STORMWATER-TO-SEWER DIVERSION PROGRAM

7 WATER RECYCLE AND REUSE MARKET, BY WATER SOURCE

- 7.1 INTRODUCTION

- 7.2 MUNICIPAL WASTEWATER

- 7.2.1 URBAN MUNICIPAL WASTEWATER REUSE EXPANDS TO MEET RISING DEMAND AND WATER SCARCITY CHALLENGES

- 7.3 INDUSTRIAL WASTEWATER

- 7.3.1 RISING INDUSTRIAL WATER DEMAND TO DRIVE ADOPTION OF ON-SITE AND CENTRALIZED REUSE SYSTEMS

- 7.4 AGRICULTURAL DRAINAGE

- 7.4.1 AGRICULTURAL DRAINAGE REUSE GAINS GROUND AMID WATER SCARCITY AND SUSTAINABLE IRRIGATION NEEDS

- 7.5 STORMWATER RUNOFF

- 7.5.1 URBAN STORMWATER REUSE EXPANDS THROUGH GREEN INFRASTRUCTURE AND INTEGRATED DRAINAGE SOLUTIONS

8 WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT

- 8.1 INTRODUCTION

- 8.2 PRIMARY EQUIPMENT

- 8.2.1 PRIMARY TREATMENT FUELS COST-EFFECTIVE AND EFFICIENT WASTEWATER REUSE OPERATIONS

- 8.2.2 SCREENS

- 8.2.3 GRIT CHAMBER

- 8.2.4 PRIMARY CLARIFIERS

- 8.3 SECONDARY EQUIPMENT

- 8.3.1 INCREASED ORGANIC LOAD AND EFFLUENT REGULATIONS DRIVING NEED FOR ADVANCED SECONDARY TREATMENT SOLUTIONS

- 8.3.2 AERATION TANKS

- 8.3.3 SECONDARY CLARIFIERS

- 8.3.4 BIOREACTORS

- 8.3.5 AIR BLOWERS/DIFFUSERS

- 8.4 TERTIARY EQUIPMENT

- 8.4.1 POTABLE AND INDUSTRIAL REUSE REQUIREMENTS FUELS DEMAND

- 8.4.2 MEMBRANE FILTRATION SYSTEMS

- 8.4.3 DISINFECTION SYSTEMS

- 8.4.4 SAND/MULTIMEDIA FILTERS

- 8.4.5 ACTIVATED CARBON FILTERS

- 8.4.6 ION EXCHANGE SYSTEMS

9 WATER RECYCLE AND REUSE MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- 9.2 <25,000 LITERS

- 9.2.1 COST-EFFECTIVE WATER SOLUTIONS DRIVING ADOPTION IN SMALL FACILITIES

- 9.3 25,001-50,000 LITERS

- 9.3.1 DEMAND FOR 25,001-50,000 LITERS CAPACITY TREATMENT PLANTS INCREASING IN ARID REGIONS

- 9.4 50,001-100,000 LITERS

- 9.4.1 URBANIZATION AND INDUSTRIALIZATION FUEL DEMAND FOR MID-SCALE WATER TREATMENT SYSTEMS

- 9.5 ABOVE 100,000 LITERS

- 9.5.1 MEGA INFRASTRUCTURE PROJECTS BOOSTING DEMAND FOR LARGE-CAPACITY WATER TREATMENT PLANT

10 WATER RECYCLE AND REUSE MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 RESIDENTIAL

- 10.2.1 RISING WATER SCARCITY SPURS RESIDENTIAL REUSE INITIATIVES ACROSS GREEN COMMUNITIES

- 10.3 COMMERCIAL

- 10.3.1 RISING SUSTAINABILITY GOALS DRIVE COMMERCIAL ADOPTION OF RECYCLED WATER

- 10.4 INDUSTRIAL

- 10.4.1 INDUSTRIAL WATER REUSE ACCELERATES WITH LARGE-SCALE PROJECTS

11 WATER RECYCLE AND REUSE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Growing reuse of municipal wastewater in China driven by infrastructure

- 11.2.2 JAPAN

- 11.2.2.1 Government initiatives on water reclamation projects to support market

- 11.2.3 INDIA

- 11.2.3.1 Government initiatives and policies toward clean and green cities fueling demand

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Government practices toward water recycling and water management to drive market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Federal and state funding propelling large-scale water reuse projects

- 11.3.2 CANADA

- 11.3.2.1 Industrial reuse in mining and oil sands driving demand for water recycle and reuse in Canada

- 11.3.3 MEXICO

- 11.3.3.1 Increasing awareness of sustainability goals to drive demand

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Strong environmental regulations encouraging advanced wastewater treatment and reuse

- 11.4.2 ITALY

- 11.4.2.1 Adoption of advanced treatment technologies boosting water recovery efficiency

- 11.4.3 FRANCE

- 11.4.3.1 Innovative water reuse projects to secure drinking water supplies

- 11.4.4 UK

- 11.4.4.1 Push for Net-Zero Water Utilities

- 11.4.5 SPAIN

- 11.4.5.1 Robust infrastructure and technological advancements driving sustainable water management

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Extreme water stress to drive need for water recycling and reuse

- 11.5.1.2 UAE

- 11.5.1.2.1 Government mandates promoting treated wastewater use

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Agriculture sector to drive demand for recycled water

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 ARGENTINA

- 11.6.1.1 Agricultural irrigation needs increasing reliance on treated wastewater

- 11.6.2 BRAZIL

- 11.6.2.1 Corporate sustainability initiatives promoting industrial water reuse and zero-liquid discharge practices.

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 ARGENTINA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2021-2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Equipment Footprint

- 12.5.5.4 Capacity footprint

- 12.5.5.5 End use footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 VEOLIA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ECOLAB INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 XYLEM

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 DUPONT

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 HITACHI, LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 KUBOTA CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Other developments

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 ALFA LAVAL

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Other developments

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 THERMAX LIMITED

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.8.3.2 Other developments

- 13.1.8.4 MnM view

- 13.1.8.4.1 Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 PENTAIR

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Other developments

- 13.1.9.4 MnM view

- 13.1.9.4.1 Right to win

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 AQUATECH

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Right to win

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.1 VEOLIA

- 13.2 OTHER PLAYERS

- 13.2.1 ION EXCHANGE

- 13.2.2 PRAJ INDUSTRIES

- 13.2.3 FLUENCE CORPORATION LIMITED

- 13.2.4 DELOACH INDUSTRIES, INC.

- 13.2.5 KOVALUS SEPARATION SOLUTIONS

- 13.2.6 VORTEX ENGINEERING LTD

- 13.2.7 AQUA-AEROBIC SYSTEMS, INC.

- 13.2.8 HYDRO INTERNATIONAL LTD.

- 13.2.9 ECOLOGIX ENVIRONMENTAL SYSTEMS, LLC

- 13.2.10 BIOMICROBICS, INC

- 13.2.11 NEWTERRA

- 13.2.12 MITA WATER TECHNOLOGIES S.R.L.

- 13.2.13 ALAR

- 13.2.14 PARKSON CORPORATION

- 13.2.15 BIOKUBE

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INDICATIVE PRICING OF WATER RECYCLE AND REUSE MARKET, EQUIPMENT, 2024 (USD/UNIT)

- TABLE 2 INDICATIVE PRICING OF WATER RECYCLE AND REUSE MARKE AMONG KEY PLAYERS, EQUIPMENT, 2024, (USD/UNIT)

- TABLE 3 WATER RECYCLE AND REUSE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 WATER RECYCLE AND REUSE MARKET: KEY TECHNOLOGIES

- TABLE 5 WATER RECYCLE AND REUSE MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 6 WATER RECYCLE AND REUSE MARKET: ADJACENT TECHNOLOGIES

- TABLE 7 WATER RECYCLE AND REUSE MARKET: TOTAL NUMBER OF PATENTS

- TABLE 8 WATER RECYCLE AND REUSE: LIST OF MAJOR PATENT OWNERS

- TABLE 9 WATER RECYCLE AND REUSE: LIST OF MAJOR PATENTS, 2015-2024

- TABLE 10 WATER RECYCLE AND REUSE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 TARIFF RELATED TO WATER RECYCLE AND REUSE MARKET

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 STANDARDS AND REGULATIONS FOR PLAYERS IN THE WATER RECYCLE AND REUSE MARKET

- TABLE 18 IMPACT OF PORTER'S FIVE FORCES ON WATER RECYCLE AND REUSE MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE (%)

- TABLE 20 KEY BUYING CRITERIA, BY END USE

- TABLE 21 GDP TRENDS AND FORECASTS, BY KEY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 22 WATER RECYCLE AND REUSE MARKET, BY WATER SOURCE, 2021-2024 (USD MILLION)

- TABLE 23 WATER RECYCLE AND REUSE MARKET, BY WATER SOURCE, 2025-2030 (USD MILLION)

- TABLE 24 WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 25 WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 26 WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 27 WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 28 WATER RECYCLE AND REUSE MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 29 WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 30 WATER RECYCLE AND REUSE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 WATER RECYCLE AND REUSE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 33 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 34 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 35 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 37 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 39 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 40 CHINA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 41 CHINA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 42 JAPAN: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 43 JAPAN: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 44 INDIA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 45 INDIA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 46 SOUTH KOREA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 47 SOUTH KOREA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 48 REST OF ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 49 REST OF ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 53 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 55 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 57 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 58 US: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 59 US: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 60 CANADA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 61 CANADA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 62 MEXICO: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 63 MEXICO: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 64 EUROPE: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 EUROPE: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 EUROPE: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 67 EUROPE: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 68 EUROPE: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 69 EUROPE: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 70 EUROPE: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 71 EUROPE: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 72 GERMANY: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 73 GERMANY: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 74 ITALY: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 75 ITALY: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 76 FRANCE: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 77 FRANCE: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 78 UK: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 79 UK: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 80 SPAIN: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 81 SPAIN: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 82 REST OF EUROPE: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 83 REST OF EUROPE: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 88 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 92 SAUDI ARABIA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 93 SAUDI ARABIA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 94 UAE: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 95 UAE: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 96 REST OF GCC COUNTRIES: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 97 REST OF GCC COUNTRIES: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 98 SOUTH AFRICA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 99 SOUTH AFRICA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 100 REST OF MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 101 REST OF MIDDLE EAST & AFRICA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 102 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY COUNTRY, 2025-2030(USD MILLION)

- TABLE 104 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 105 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 106 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 107 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 108 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 109 SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 110 ARGENTINA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 111 ARGENTINA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 112 BRAZIL: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 113 BRAZIL: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 114 REST OF SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, END USE, 2021-2024 (USD MILLION)

- TABLE 115 REST OF SOUTH AMERICA: WATER RECYCLE AND REUSE MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 116 WATER RECYCLE AND REUSE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 117 WATER RECYCLE AND REUSE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 118 WATER RECYCLE AND REUSE MARKET: REGION FOOTPRINT

- TABLE 119 WATER RECYCLE AND REUSE MARKET: EQUIPMENT FOOTPRINT

- TABLE 120 WATER RECYCLE AND REUSE MARKET: CAPACITY FOOTPRINT

- TABLE 121 WATER RECYCLE AND REUSE MARKET: END USE FOOTPRINT

- TABLE 122 WATER RECYCLE AND REUSE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 123 WATER RECYCLE AND REUSE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 124 WATER RECYCLE AND REUSE MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 125 WATER RECYCLE AND REUSE MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 126 WATER RECYCLE AND REUSE MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 127 WATER RECYCLE AND REUSE MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 128 VEOLIA: COMPANY OVERVIEW

- TABLE 129 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 VEOLIA: DEALS, JANUARY 2021-JUNE 2025

- TABLE 131 VEOLIA: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 132 VEOLIA: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 133 ECOLAB INC.: COMPANY OVERVIEW

- TABLE 134 ECOLAB INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 ECOLAB INC.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 136 ECOLAB INC.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 137 XYLEM: COMPANY OVERVIEW

- TABLE 138 XYLEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 XYLEM: DEALS, JANUARY 2021-JUNE 2025

- TABLE 140 XYLEM: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 141 XYLEM: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 142 DUPONT: COMPANY OVERVIEW

- TABLE 143 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 DUPONT: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 145 DUPONT: DEALS, JANUARY 2021-JUNE 2025

- TABLE 146 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 147 HITACHI, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 HITACHI, LTD.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 149 HITACHI, LTD.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 150 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 151 KUBOTA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 KUBOTA CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 153 KUBOTA CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 154 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 155 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 ALFA LAVAL: DEALS, JANUARY 2021-JUNE 2025

- TABLE 157 ALFA LAVAL: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 158 THERMAX LIMITED.: COMPANY OVERVIEW

- TABLE 159 THERMAX LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 THERMAX LIMITED: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 161 THERMAX LIMITED: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 162 PENTAIR: COMPANY OVERVIEW

- TABLE 163 PENTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 PENTAIR: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 165 AQUATECH: COMPANY OVERVIEW

- TABLE 166 AQUATECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 AQUATECH: DEALS, JANUARY 2021-JUNE 2025

- TABLE 168 ION EXCHANGE: COMPANY OVERVIEW

- TABLE 169 PRAJ INDUSTRIES: COMPANY OVERVIEW

- TABLE 170 FLUENCE CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 171 DELOACH INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 172 KOVALUS SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 173 VORTEX ENGINEERING LTD: COMPANY OVERVIEW

- TABLE 174 AQUA-AEROBIC SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 175 HYDRO INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 176 ECOLOGIX ENVIRONMENTAL SYSTEMS, LLC: COMPANY OVERVIEW

- TABLE 177 BIOMICROBICS, INC: COMPANY OVERVIEW

- TABLE 178 NEWTERRA: COMPANY OVERVIEW

- TABLE 179 MITA WATER TECHNOLOGIES S.R.L.: COMPANY OVERVIEW

- TABLE 180 ALAR: COMPANY OVERVIEW

- TABLE 181 PARKSON CORPORATION: COMPANY OVERVIEW

- TABLE 182 BIOKUBE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 WATER RECYCLE AND REUSE MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 WATER RECYCLE AND REUSE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 WATER RECYCLE AND REUSE MARKET: DATA TRIANGULATION

- FIGURE 9 TERTIARY EQUIPMENT SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 ABOVE 100,000 LITERS CAPACITY SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 11 INDUSTRIAL END USE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 12 MUNICIPAL WASTEWATER SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN WATER RECYCLE AND REUSE MARKET DURING FORECAST PERIOD

- FIGURE 14 GROWING USE OF WATER RECYCLE AND REUSE IN INDUSTRIAL SECTOR TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 TERTIARY EQUIPMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 50,001-100,000 LITERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 MUNICIPAL WASTEWATER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 INDIA TO BE FASTEST-GROWING MARKET FOR WATER RECYCLE AND REUSE DURING FORECAST PERIOD

- FIGURE 20 WATER RECYCLE AND REUSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 USE OF GENERATIVE AI IN WATER RECYCLE AND REUSE MARKET

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 WATER RECYCLE AND REUSE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 WATER RECYCLE AND REUSE MARKET: INVESTMENT AND FUNDING SCENARIO, 2021 VS 2023 (USD MILLION)

- FIGURE 25 INDICATIVE PRICING OF WATER RECYCLE AND REUSE MARKET AMONG KEY PLAYERS, BY EQUIPMENT, 2024 (USD/UNIT)

- FIGURE 26 WATER RECYCLE AND REUSE MARKET: ECOSYSTEM

- FIGURE 27 PATENTS GRANTED OVER LAST 10 YEARS, 2015-2024

- FIGURE 28 WATER RECYCLE AND REUSE MARKET: LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 29 PATENTS ANALYSIS FOR WATER RECYCLE AND REUSE, BY JURISDICTION, 2015-2024

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 31 IMPORTS OF WATER RECYCLE AND REUSE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 32 EXPORTS OF WATER RECYCLE AND REUSE, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 33 WATER RECYCLE AND REUSE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE

- FIGURE 35 KEY BUYING CRITERIA, BY END USE

- FIGURE 36 MUNICIPAL WASTEWATER WAS LARGEST SEGMENT OF WATER RECYCLE AND REUSE MARKET IN 2024

- FIGURE 37 TERTIARY EQUIPMENT TO BE LARGEST SEGMENT OF WATER RECYCLE AND REUSE MARKET DURING FORECAST PERIOD

- FIGURE 38 ABOVE 100,000 LITERS SEGMENT TO LEAD WATER RECYCLE AND REUSE MARKET DURING FORECAST PERIOD

- FIGURE 39 INDUSTRIAL SEGMENT TO LEAD WATER RECYCLE AND REUSE MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA-PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: WATER RECYCLE AND REUSE MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: WATER RECYCLE AND REUSE MARKET SNAPSHOT

- FIGURE 43 EUROPE: WATER RECYCLE AND REUSE MARKET SNAPSHOT

- FIGURE 44 WATER RECYCLE AND REUSE MARKET SHARE ANALYSIS, 2024

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024 (USD BILLION)

- FIGURE 46 WATER RECYCLE AND REUSE MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 47 WATER RECYCLE AND REUSE MARKET: COMPANY FOOTPRINT

- FIGURE 48 WATER RECYCLE AND REUSE MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 49 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY WATER RECYCLE AND REUSE

- FIGURE 50 WATER RECYCLE AND REUSE MARKET: EV/EBITDA OF KEY COMPANIES, 2025

- FIGURE 51 WATER RECYCLE AND REUSE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2025

- FIGURE 52 VEOLIA: COMPANY SNAPSHOT

- FIGURE 53 ECOLAB INC.: COMPANY SNAPSHOT

- FIGURE 54 XYLEM: COMPANY SNAPSHOT

- FIGURE 55 DUPONT: COMPANY SNAPSHOT

- FIGURE 56 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 57 KUBOTA CORPORATION.: COMPANY SNAPSHOT

- FIGURE 58 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 59 THERMAX LIMITED: COMPANY SNAPSHOT

- FIGURE 60 PENTAIR: COMPANY SNAPSHOT