PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1804844

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1804844

Speech and Voice Recognition Market by Technology (Speaker Identification, Speaker Verification, Automatic Speech), Application (Voice Search, Voice Command, Real Time Transcription, Voice Biometrics, Customer Service), Mode - Global Forecast to 2030

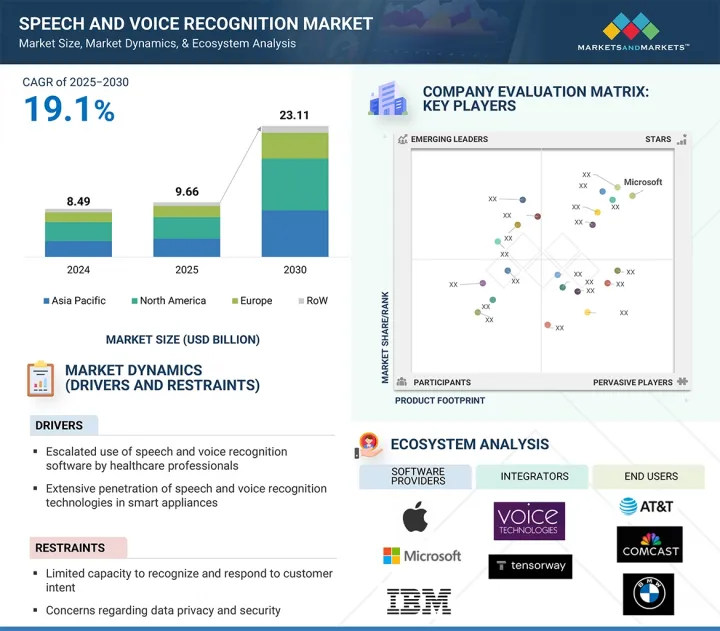

The global speech and voice recognition market is projected to grow from USD 9.66 billion in 2025 to USD 23.11 billion by 2030, at a CAGR of 19.1%. The speech and voice recognition market is growing significantly due to the expanding penetration of voice technology in smart appliances. Devices such as smart TVs, refrigerators, washing machines, thermostats, and lighting systems are increasingly being equipped with built-in voice control features, enabling users to operate them hands-free with simple voice commands. This integration enhances convenience, accessibility, and user experience, making homes more intuitive and connected.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Deployment Mode, Application, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Consumers are drawn to the efficiency and personalization offered by voice-enabled appliances. Additionally, rising demand for energy-efficient and automated home systems is accelerating adoption, while advancements in AI and IoT continue to drive innovation in this space.

"Voice recognition segment to grow at the fastest CAGR during the forecasted period."

Voice recognition is growing at the fastest rate within the speech and voice recognition market due to its increasing adoption across both consumer and enterprise applications. As users seek faster, more intuitive, and hands-free interaction, voice commands are becoming preferred in smartphones, smart speakers, wearables, and automotive systems. The rise of smart homes and IoT ecosystems is further driving demand for voice-activated control. In the enterprise space, sectors like healthcare, customer service, and logistics are leveraging voice recognition to streamline operations, improve documentation, and enhance user engagement. Additionally, remote work and virtual collaboration tools now integrate voice features for real-time transcription and navigation. Continuous advancements in natural language understanding, contextual awareness, and multilingual support have greatly improved voice accuracy and user experience. Moreover, voice recognition plays a critical role in enhancing accessibility for differently-abled users, adding to its broad appeal and accelerating its adoption globally across various use cases.

"Voice search segment dominated the speech and voice recognition market in 2024."

The voice search segment dominated the speech and voice recognition market in 2024 due to its widespread use across smartphones, smart speakers, and web applications. Consumers increasingly prefer voice search for its speed, convenience, and hands-free functionality, especially for tasks like browsing, navigation, and local business inquiries. Major tech players like Google, Apple, Amazon, and Microsoft have deeply integrated voice search into their ecosystems, boosting usage through virtual assistants such as Google Assistant, Siri, Alexa, and Cortana. Additionally, advancements in natural language processing and AI have significantly improved the accuracy and relevance of voice search results, encouraging user adoption. The growing use of voice for e-commerce, media access, and daily tasks has made it a dominant interface, particularly among younger and multilingual user bases. As users seek more conversational and efficient ways to interact with technology, voice search continues to lead the market in both consumer and enterprise applications.

The US is expected to hold the most prominent market share in North America during the forecast period."

The US dominates the speech and voice recognition market in North America due to its advanced technological infrastructure, high adoption of AI-driven solutions, and presence of key global players such as Apple, Google, Amazon, Microsoft, and IBM. These companies drive continuous innovation in voice assistants, cloud-based speech services, and smart device integration. The US also leads in R&D investments, startup activity, and deployment of speech technologies across sectors like healthcare, finance, retail, and automotive. Additionally, growing demand for contactless solutions, voice biometrics, and personalized digital experiences has accelerated adoption. Strong consumer demand, regulatory support for accessibility, and enterprise digitalization further reinforce the US's leadership in this market.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the speech and voice recognition marketplace.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, and RoW - 5%

The study includes an in-depth competitive analysis of these key players in the speech and voice recognition market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the speech and voice recognition market by technology, deployment mode, application, vertical, and region (North America, Europe, Asia Pacific). The report covers detailed information regarding major factors influencing market growth, such as drivers, restraints, challenges, and opportunities. A thorough analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, contracts, partnerships, and agreements. Product and service launches, acquisitions, and recent developments associated with the speech and voice recognition market. This report covers a competitive analysis of upcoming startups in the speech and voice recognition market ecosystem.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the speech and voice recognition market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Escalated use of speech and voice recognition software by healthcare professionals, extensive penetration of speech and voice recognition technologies in smart appliances, increasing demand for speech and voice recognition technologies for transcription, increasing adoption of voice based biometric systems in financial service providers), restraints (Limitation of software to understand contextual relation of words in different languages, Limited capacity to recognize and respond to customer intent), opportunities (Customer preference for cloud-based speech-to-text software, Increasing popularity of online shopping, Development of personalized applications for users), and challenges (Creating unique vocabulary for various industries, Increased errors due to background noise) influencing the growth of the speech and voice recognition market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the speech and voice recognition market

- Market Development: Comprehensive information about lucrative markets with an analysis of the speech and voice recognition market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the speech and voice recognition market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the speech and voice recognition market, such as Apple Inc. (US), Microsoft (US), IBM (US), Alphabet (US), and Amazon (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key data from secondary sources

- 2.1.2.2 List of key secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 Key industry insights

- 2.1.3.3 List of primary interview participants

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPEECH AND VOICE RECOGNITION MARKET

- 4.2 SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY

- 4.3 SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION

- 4.4 SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL AND REGION

- 4.5 SPEECH AND VOICE RECOGNITION MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Mounting demand for advanced healthcare technologies

- 5.2.1.2 Growing consumption of smart home appliances

- 5.2.1.3 Rising need for real-time transcription in virtual meetings and industrial settings

- 5.2.1.4 Increasing adoption of voice biometric systems in financial services sector

- 5.2.1.5 Rising integration of AI into speech and voice recognition systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inability to identify homophones and understand terms in different languages

- 5.2.2.2 Limitations in gathering datasets for establishing approach that accurately converts speech to text

- 5.2.2.3 Multilingual and intent recognition challenges of voice assistants

- 5.2.2.4 Concerns regarding data privacy and security

- 5.2.2.5 High cost of high-end voice recognition systems deployed in automobiles

- 5.2.2.6 Requirement for high R&D investment in neural networks and deep learning technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Customer preference for cloud-based speech-to-text software

- 5.2.3.2 Growing popularity of online shopping

- 5.2.3.3 Development of personalized, human-centric technologies

- 5.2.3.4 Integration of speech and voice recognition technology with mobile applications

- 5.2.3.5 Development of speech and voice recognition software for micro-linguistics and local languages

- 5.2.3.6 Application of speech and voice recognition technologies in service robotics

- 5.2.3.7 Reliance on cutting-edge technologies to educate disabled students

- 5.2.3.8 Increasing R&D of autonomous vehicles

- 5.2.3.9 Consumer preference for technologically advanced products

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in creating unique vocabulary for various industries

- 5.2.4.2 Limited awareness regarding availability and benefits of voice assistant technologies

- 5.2.4.3 Increased errors due to background noise

- 5.2.4.4 Lack of standardized platform for developing customized products

- 5.2.4.5 Slow network speeds posing challenge to cloud-based speech recognition services

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF AUTOMATIC SPEECH RECOGNITION TECHNOLOGY OFFERED BY KEY PLAYERS, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF SPEECH AND VOICE RECOGNITION SYSTEMS, BY TECHNOLOGY, 2020-2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF AUTOMATIC SPEECH RECOGNITION TECHNOLOGY, BY REGION, 2020-2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 SESTEK HELPS TEKNOSA INCREASE FIRST-CALL RESOLUTION RATE AND SHORTEN CALL DURATIONS AT CONTACT CENTER

- 5.7.2 SESTEK ASSISTS AGENTS AT AL BARAKA BANK CONTACT CENTER TO SIGNIFICANTLY IMPROVE EFFICIENCY AND REDUCE WORKLOAD

- 5.7.3 MICROSOFT TRANSLATOR APPLICATION FACILITATES MULTILINGUAL PARENT-TEACHER COMMUNICATION AT CHINOOK MIDDLE SCHOOL

- 5.7.4 IBM WATSON HELPS BRADESCO BANK REDUCE RESPONSE TIME USING SPEECH RECOGNITION AI BOT

- 5.7.5 ALEXA AIDS HAWAII PACIFIC HEALTH IN ENHANCING PATIENT EXPERIENCE BY QUERY RESOLUTION

- 5.7.6 CHATBOT BY ROANUZ ANSWERS USER QUERIES QUICKLY

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Natural language processing

- 5.10.1.2 Voice activity detection

- 5.10.2 ADJACENT TECHNOLOGIES

- 5.10.2.1 Cloud computing

- 5.10.2.2 Edge AI

- 5.10.3 COMPLEMENTARY TECHNOLOGIES

- 5.10.3.1 Internet of Things (IoT)

- 5.10.3.2 Smart wearables

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 851989)

- 5.12.2 EXPORT SCENARIO (HS CODE 851989)

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 CODES AND STANDARDS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF AI ON SPEECH AND VOICE RECOGNITION MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 AI USE CASES IN SPEECH AND VOICE RECOGNITION MARKET

- 5.16 IMPACT OF 2025 US TARIFF ON SPEECH AND VOICE RECOGNITION MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON VERTICALS

6 SPEECH AND VOICE RECOGNITION TYPES

- 6.1 INTRODUCTION

- 6.2 AI-BASED

- 6.3 NON-AI-BASED

7 SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 VOICE RECOGNITION

- 7.2.1 SPEAKER IDENTIFICATION

- 7.2.1.1 Growing trend of automatic information processing and telecommunication technology to fuel segmental growth

- 7.2.2 SPEAKER VERIFICATION

- 7.2.2.1 Increasing adoption in banks and financial services to prevent fraudulent attempts to boost segmental growth

- 7.2.1 SPEAKER IDENTIFICATION

- 7.3 AUTOMATIC SPEECH RECOGNITION

- 7.3.1 RISING DEPLOYMENT OF VOICE-CONTROLLED TECHNOLOGIES TO ENHANCE TRUST AND CUSTOMER ENGAGEMENT TO AUGMENT SEGMENTAL GROWTH

8 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.2 CLOUD-BASED

- 8.2.1 LOW OPERATION AND MAINTENANCE EXPENSES AND QUICKER DEPLOYMENTS TO FUEL SEGMENTAL GROWTH

- 8.3 ON-PREMISES

- 8.3.1 GROWING CONCERNS OVER DATA PRIVACY AND SECURITY TO BOLSTER SEGMENTAL GROWTH

9 SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 VOICE SEARCH

- 9.2.1 ABILITY TO PROVIDE QUICK, HANDS-FREE ACCESS TO INFORMATION, NAVIGATION, AND SERVICES TO FUEL SEGMENTAL GROWTH

- 9.3 VOICE COMMAND

- 9.3.1 RAPID ADVANCES IN NATURAL LANGUAGE PROCESSING TO ACCELERATE SEGMENTAL GROWTH

- 9.4 REAL-TIME TRANSCRIPTION

- 9.4.1 RISE IN HYBRID WORK, VIRTUAL EVENTS, AND DIGITAL LEARNING ENVIRONMENTS TO BOLSTER SEGMENTAL GROWTH

- 9.5 VOICE BIOMETRICS

- 9.5.1 GROWING CYBERSECURITY THREATS AND DEMAND FOR SEAMLESS AUTHENTICATION TO FOSTER SEGMENTAL GROWTH

- 9.6 CUSTOMER SERVICE

- 9.6.1 MOUNTING DEMAND FOR TOUCH-FREE SOLUTIONS TO EXPEDITE SEGMENTAL GROWTH

- 9.7 SECURITY AUTHENTICATION

- 9.7.1 INCREASING DEPENDENCE ON DIGITAL PLATFORMS TO AUGMENT SEGMENTAL GROWTH

10 SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.2.1 VEHICLE CONTROL

- 10.2.1.1 Requirement for voice interfaces in connected vehicles to boost segmental growth

- 10.2.2 VEHICLE INSURANCE

- 10.2.2.1 Emphasis on automating and humanizing customer engagement to fuel segmental growth

- 10.2.1 VEHICLE CONTROL

- 10.3 COMMERCIAL

- 10.3.1 CALL CENTER AUTHENTICATION

- 10.3.1.1 Ability to support faster, frictionless verification to augment segmental growth

- 10.3.2 IT SECURITY

- 10.3.2.1 Use to strengthen identity management and reduce reliance on passwords or physical tokens to drive market

- 10.3.3 TIME & ATTENDANCE SYSTEMS

- 10.3.3.1 Focus on automating employee check-ins and limiting manual errors to bolster segmental growth

- 10.3.4 ENTERPRISE ROBOTICS

- 10.3.4.1 Ability to enhance productivity and reduce training requirements of workers to accelerate segmental growth

- 10.3.1 CALL CENTER AUTHENTICATION

- 10.4 CONSUMER ELECTRONICS

- 10.4.1 MOBILE DEVICE CONTROL

- 10.4.1.1 Rapid digitalization and smartphone adoption to contribute to segmental growth

- 10.4.2 WEARABLE DEVICE CONTROL

- 10.4.2.1 Focus on automated control to enhance functionality and user engagement to boost segmental growth

- 10.4.1 MOBILE DEVICE CONTROL

- 10.5 BFSI

- 10.5.1 FRAUD IDENTIFICATION

- 10.5.1.1 Reliance on voice recognition systems to verify identity and flag suspicious behavior to foster segmental growth

- 10.5.2 MOBILE BANKING

- 10.5.2.1 Focus on enhancing security and simplifying user interactions to contribute to segmental growth

- 10.5.3 UNSTAFFED BANK BRANCHES

- 10.5.3.1 Adoption of speech and voice recognition systems to provide secure interactions to boost segmental growth

- 10.5.1 FRAUD IDENTIFICATION

- 10.6 GOVERNMENT

- 10.6.1 VERIFICATION

- 10.6.1.1 Use of voice recognition technologies to identify persons of interest to bolster segmental growth

- 10.6.2 IDENTIFICATION

- 10.6.2.1 Ability to function remotely and quickly to drive adoption in time-sensitive and sensitive environments

- 10.6.1 VERIFICATION

- 10.7 RETAIL

- 10.7.1 FRAUD INVESTIGATION

- 10.7.1.1 Adoption of voice recognition systems to identify individuals involved in suspicious transactions to drive market

- 10.7.2 POINT OF SALE TRANSACTION

- 10.7.2.1 Integration of speech recognition to enable secure, hands-free transactions to accelerate segmental growth

- 10.7.3 ROBOTIC KIOSK

- 10.7.3.1 Strong focus on providing highly interactive, human-like experiences in retail and service environments to fuel segmental growth

- 10.7.1 FRAUD INVESTIGATION

- 10.8 HEALTHCARE

- 10.8.1 PATIENT MEDICAL RECORD ACCESS

- 10.8.1.1 Emphasis on improving workflow and reducing time spent on manual data entry to foster segmental growth

- 10.8.2 SPECIAL-PURPOSE ROBOTS

- 10.8.2.1 Use to enable natural interaction with patients and medical staff to expedite segmental growth

- 10.8.1 PATIENT MEDICAL RECORD ACCESS

- 10.9 MILITARY

- 10.9.1 ACCESS CONTROL SYSTEMS

- 10.9.1.1 Ability to enhance security and streamline authentication to contribute to segmental growth

- 10.9.2 BORDER MANAGEMENT SYSTEMS

- 10.9.2.1 Need to strengthen identity verification and detect potential threats more efficiently to fuel segmental growth

- 10.9.1 ACCESS CONTROL SYSTEMS

- 10.10 LEGAL

- 10.10.1 DOCUMENT TRANSCRIPTION

- 10.10.1.1 Reliance on speech recognition to improve accuracy and accessibility of legal transcriptions to foster segmental growth

- 10.10.1 DOCUMENT TRANSCRIPTION

- 10.11 EDUCATION

- 10.11.1 LANGUAGE LEARNING

- 10.11.1.1 Deployment of speech recognition technologies to enable real-time pronunciation feedback and speech assessment to drive market

- 10.11.2 EDUCATION FOR DISABLED & E-LEARNING

- 10.11.2.1 Requirement for hands-free interaction and voice-controlled navigation to augment segmental growth

- 10.11.1 LANGUAGE LEARNING

- 10.12 OTHER VERTICALS

11 SPEECH AND VOICE RECOGNITION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Growing focus on increasing productivity and efficiency across enterprises to drive market

- 11.2.2 CANADA

- 11.2.2.1 High deployment of voice-activated biometrics in banking sector to augment market growth

- 11.2.3 MEXICO

- 11.2.3.1 Rising consumer preference for innovative technologies to bolster market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Burgeoning demand for voice-enabled payment solutions to boost market growth

- 11.3.2 GERMANY

- 11.3.2.1 Increasing reliance on AI and cognitive technologies in enterprises to fuel market growth

- 11.3.3 FRANCE

- 11.3.3.1 Significant focus on improving air traffic control to contribute to market growth

- 11.3.4 ITALY

- 11.3.4.1 Mounting adoption of AI-driven solutions across industries to augment market growth

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 JAPAN

- 11.4.1.1 Rising integration of AI into innovative robotic devices to bolster market growth

- 11.4.2 CHINA

- 11.4.2.1 Mounting adoption of advanced technologies to accelerate market growth

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Advanced digital infrastructure and strong commitment to AI development to foster market growth

- 11.4.4 INDIA

- 11.4.4.1 Large-scale technological development and increasing number of mobile and internet users to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 JAPAN

- 11.5 ROW

- 11.5.1 MIDDLE EAST

- 11.5.1.1 Mounting adoption of voice assistant devices to augment market growth

- 11.5.2 AFRICA

- 11.5.2.1 Increasing mobile penetration and need for inclusive digital solutions to drive market

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Rising internet penetration to contribute to market growth

- 11.5.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY COMPANIES, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Technology footprint

- 12.5.5.4 Deployment mode footprint

- 12.5.5.5 Application footprint

- 12.5.5.6 Vertical footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MICROSOFT

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 IBM

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 ALPHABET

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 AMAZON.COM, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 APPLE INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 BAIDU INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 IFLYTEK CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 SESTEK

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 SPEAK2WEB

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 VERINT SYSTEMS INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.11 SPEECHMATICS

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Deals

- 13.1.12 DEEPGRAM

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.13 VOICEITT

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 VOICEGAIN

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.15 SENSORY INC.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.16 ASSEMBLYAI, INC.

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches

- 13.1.16.3.2 Deals

- 13.1.17 VERBIT.AI

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product launches

- 13.1.17.3.2 Deals

- 13.1.18 OTTER.AI INC

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Product launches

- 13.1.19 REV

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.1 MICROSOFT

- 13.2 OTHER PLAYERS

- 13.2.1 RAYTHEON BBN TECHNOLOGIES

- 13.2.2 M2SYS TECHNOLOGY

- 13.2.3 SOLVENTUM

- 13.2.4 VALIDSOFT

- 13.2.5 LUMENVOX, LLC

- 13.2.6 SPEECH PROCESSING SOLUTIONS GMBH

- 13.2.7 UNIPHORE

- 13.2.8 ISPEECH, INC.

- 13.2.9 GOVIVACE INC

- 13.2.10 CONVAI

- 13.2.11 DOLBEY AND COMPANY, INC

- 13.2.12 SOUNDHOUND AI INC.

- 13.2.13 ELEVENLABS

- 13.2.14 BELITSOFT

- 13.2.15 VERBIO TECHNOLOGIES, S.L.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 SPEECH AND VOICE RECOGNITION MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 PRIMARY INTERVIEW PARTICIPANTS, BY COMPANY AND END USER

- TABLE 4 SPEECH AND VOICE RECOGNITION MARKET: RISK ANALYSIS

- TABLE 5 ROLE OF COMPANIES IN SPEECH AND VOICE RECOGNITION ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF AUTOMATIC SPEECH RECOGNITION TECHNOLOGY PROVIDED BY KEY PLAYERS, 2024 (USD/HR)

- TABLE 7 AVERAGE SELLING PRICE TREND OF SPEECH AND VOICE RECOGNITION SYSTEMS, BY TECHNOLOGY, 2020-2024 (USD/HR AND USD/1,000 TRANSACTIONS)

- TABLE 8 AVERAGE SELLING PRICE TREND OF AUTOMATIC SPEECH RECOGNITION TECHNOLOGY, BY REGION, 2020-2024 (USD/HR)

- TABLE 9 AVERAGE SELLING PRICE TREND OF VOICE RECOGNITION TECHNOLOGY, BY REGION, 2020-2024 (USD/1,000 TRANSACTIONS)

- TABLE 10 IMPACT OF PORTER'S FIVE FORCES, 2024

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 LIST OF KEY PATENTS, 2017-2025

- TABLE 14 IMPORT DATA FOR HS CODE 851989-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 EXPORT DATA FOR HS CODE 851989-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 MFN TARIFF FOR HS CODE 851989-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 SPEECH AND VOICE RECOGNITION CODES AND STANDARDS

- TABLE 22 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR SPEECH AND VOICE RECOGNITION TECHNOLOGY

- TABLE 25 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON VERTICALS DUE TO TARIFF IMPACT

- TABLE 26 SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 27 SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 28 VOICE RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 VOICE RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 VOICE RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 31 VOICE RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 32 VOICE RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 33 VOICE RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 34 AUTOMATIC SPEECH RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 35 AUTOMATIC SPEECH RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 36 AUTOMATIC SPEECH RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 37 AUTOMATIC SPEECH RECOGNITION: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 38 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 39 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 40 CLOUD-BASED: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 41 CLOUD-BASED: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 42 ON-PREMISES: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 43 ON-PREMISES: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 44 SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 45 SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 46 SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 47 SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 48 AUTOMOTIVE: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 49 AUTOMOTIVE: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 AUTOMOTIVE: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 51 AUTOMOTIVE: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 52 AUTOMOTIVE: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 AUTOMOTIVE: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 AUTOMOTIVE: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 AUTOMOTIVE: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 COMMERCIAL: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 57 COMMERCIAL: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 COMMERCIAL: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 59 COMMERCIAL: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 60 COMMERCIAL: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 COMMERCIAL: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 COMMERCIAL: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 COMMERCIAL: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 CONSUMER ELECTRONICS: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 BFSI: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 73 BFSI: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 BFSI: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 75 BFSI: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 76 BFSI: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 BFSI: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 BFSI: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 BFSI: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 GOVERNMENT: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 GOVERNMENT: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 GOVERNMENT: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 83 GOVERNMENT: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 84 GOVERNMENT: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 GOVERNMENT: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 GOVERNMENT: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 GOVERNMENT: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 RETAIL: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 RETAIL: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 RETAIL: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 91 RETAIL: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 92 RETAIL: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 RETAIL: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 RETAIL: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 RETAIL: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 HEALTHCARE: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 HEALTHCARE: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 HEALTHCARE: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 99 HEALTHCARE: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 HEALTHCARE: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 HEALTHCARE: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 HEALTHCARE: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 HEALTHCARE: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 MILITARY: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 MILITARY: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 MILITARY: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 107 MILITARY: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 108 MILITARY: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 MILITARY: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 MILITARY: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 MILITARY: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 LEGAL: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 LEGAL: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 LEGAL: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 115 LEGAL: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 116 LEGAL: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 LEGAL: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 LEGAL: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 LEGAL: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 EDUCATION: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 EDUCATION: SPEECH AND VOICE RECOGNITION MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 EDUCATION: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 123 EDUCATION: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 124 EDUCATION: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 EDUCATION: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 EDUCATION: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 EDUCATION: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 OTHER VERTICALS: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 129 OTHER VERTICALS: SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 130 OTHER VERTICALS: SPEECH RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 OTHER VERTICALS: SPEECH RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 132 OTHER VERTICALS: VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 133 OTHER VERTICALS: VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 134 SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 141 EUROPE: SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 143 EUROPE: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: SPEECH AND VOICE RECOGNITION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 148 ROW: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 ROW: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 ROW: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 151 ROW: SPEECH AND VOICE RECOGNITION MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 152 SPEECH AND VOICE RECOGNITION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JUNE 2025

- TABLE 153 SPEECH AND VOICE RECOGNITION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 154 SPEECH AND VOICE RECOGNITION MARKET: REGION FOOTPRINT

- TABLE 155 SPEECH AND VOICE RECOGNITION MARKET: TECHNOLOGY FOOTPRINT

- TABLE 156 SPEECH AND VOICE RECOGNITION MARKET: DEPLOYMENT MODE FOOTPRINT

- TABLE 157 SPEECH AND VOICE RECOGNITION MARKET: APPLICATION FOOTPRINT

- TABLE 158 SPEECH AND VOICE RECOGNITION MARKET: VERTICAL FOOTPRINT

- TABLE 159 SPEECH AND VOICE RECOGNITION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 160 SPEECH AND VOICE RECOGNITION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 161 SPEECH AND VOICE RECOGNITION MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 162 SPEECH AND VOICE RECOGNITION MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 163 MICROSOFT: COMPANY OVERVIEW

- TABLE 164 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 MICROSOFT: PRODUCT LAUNCHES

- TABLE 166 IBM: COMPANY OVERVIEW

- TABLE 167 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 IBM: PRODUCT LAUNCHES

- TABLE 169 ALPHABET: COMPANY OVERVIEW

- TABLE 170 ALPHABET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 ALPHABET: PRODUCT LAUNCHES

- TABLE 172 AMAZON.COM, INC.: COMPANY OVERVIEW

- TABLE 173 AMAZON.COM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 AMAZON.COM, INC.: PRODUCT LAUNCHES

- TABLE 175 AMAZON.COM, INC.: DEALS

- TABLE 176 APPLE INC.: COMPANY OVERVIEW

- TABLE 177 APPLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 APPLE INC.: PRODUCT LAUNCHES

- TABLE 179 BAIDU INC.: COMPANY OVERVIEW

- TABLE 180 BAIDU INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 BAIDU INC.: PRODUCT LAUNCHES

- TABLE 182 BAIDU INC.: DEALS

- TABLE 183 IFLYTEK CORPORATION: COMPANY OVERVIEW

- TABLE 184 IFLYTEK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 IFLYTEK CORPORATION: PRODUCT LAUNCHES

- TABLE 186 SESTEK: COMPANY OVERVIEW

- TABLE 187 SESTEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 SESTEK: PRODUCT LAUNCHES

- TABLE 189 SPEAK2WEB: COMPANY OVERVIEW

- TABLE 190 SPEAK2WEB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 VERINT SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 192 VERINT SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 VERINT SYSTEMS INC.: PRODUCT LAUNCHES

- TABLE 194 VERINT SYSTEMS INC.: DEALS

- TABLE 195 SPEECHMATICS: COMPANY OVERVIEW

- TABLE 196 SPEECHMATICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SPEECHMATICS: PRODUCT LAUNCHES

- TABLE 198 SPEECHMATICS: DEALS

- TABLE 199 DEEPGRAM: COMPANY OVERVIEW

- TABLE 200 DEEPGRAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 DEEPGRAM: PRODUCT LAUNCHES

- TABLE 202 VOICEITT: COMPANY OVERVIEW

- TABLE 203 VOICEITT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 VOICEGAIN: COMPANY OVERVIEW

- TABLE 205 VOICEGAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 VOICEGAIN: PRODUCT LAUNCHES

- TABLE 207 SENSORY INC.: COMPANY OVERVIEW

- TABLE 208 SENSORY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SENSORY INC.: PRODUCT LAUNCHES

- TABLE 210 ASSEMBLYAI, INC.: COMPANY OVERVIEW

- TABLE 211 ASSEMBLYAI, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 ASSEMBLYAI, INC.: PRODUCT LAUNCHES

- TABLE 213 ASEEMBLYAI, INC.: DEALS

- TABLE 214 VERBIT.AI: COMPANY OVERVIEW

- TABLE 215 VERBIT.AI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 VERBIT.AI: PRODUCT LAUNCHES

- TABLE 217 VERBIT: DEALS

- TABLE 218 OTTER.AI INC: COMPANY OVERVIEW

- TABLE 219 OTTER.AI INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 OTTER.AI INC: PRODUCT LAUNCHES

- TABLE 221 REV: COMPANY OVERVIEW

- TABLE 222 REV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 SPEECH AND VOICE RECOGNITION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION CONSIDERED

- FIGURE 3 SPEECH AND VOICE RECOGNITION MARKET: RESEARCH FLOW

- FIGURE 4 SPEECH AND VOICE RECOGNITION MARKET: RESEARCH DESIGN

- FIGURE 5 SPEECH AND VOICE RECOGNITION MARKET: RESEARCH APPROACH

- FIGURE 6 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 7 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 8 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 SPEECH AND VOICE RECOGNITION MARKET: BOTTOM-UP APPROACH

- FIGURE 11 SPEECH AND VOICE RECOGNITION MARKET SIZE ESTIMATION

- FIGURE 12 SPEECH AND VOICE RECOGNITION MARKET: TOP-DOWN APPROACH

- FIGURE 13 SPEECH AND VOICE RECOGNITION MARKET: DATA TRIANGULATION

- FIGURE 14 SPEECH AND VOICE RECOGNITION MARKET: RESEARCH ASSUMPTIONS

- FIGURE 15 SPEECH AND VOICE RECOGNITION MARKET: RESEARCH LIMITATIONS

- FIGURE 16 AUTOMATIC SPEECH RECOGNITION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 17 CLOUD-BASED SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 BFSI SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 19 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN SPEECH AND VOICE RECOGNITION MARKET DURING FORECAST PERIOD

- FIGURE 20 RAPID ADVANCES IN AI AND NATURAL LANGUAGE PROCESSING TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 21 VOICE RECOGNITION SEGMENT TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 22 VOICE SEARCH SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 23 CONSUMER ELECTRONICS SEGMENT AND NORTH AMERICA TO HOLD LARGEST SHARES OF SPEECH AND VOICE RECOGNITION MARKET IN 2030

- FIGURE 24 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL SPEECH AND VOICE RECOGNITION MARKET FROM 2025 TO 2030

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 USE OF VOICE RECOGNITION TECHNOLOGY TO PREVENT IDENTITY THEFT IN BANKING AND FINANCE

- FIGURE 27 DRIVERS: IMPACT ANALYSIS

- FIGURE 28 RESTRAINTS: IMPACT ANALYSIS

- FIGURE 29 OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 30 CHALLENGES: IMPACT ANALYSIS

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 ECOSYSTEM ANALYSIS

- FIGURE 33 AVERAGE SELLING PRICE OF AUTOMATIC SPEECH RECOGNITION TECHNOLOGY OFFERED BY KEY PLAYERS, 2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF SPEECH AND VOICE RECOGNITION SYSTEMS, BY TECHNOLOGY, 2020-2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF AUTOMATIC SPEECH RECOGNITION TECHNOLOGY, BY REGION, 2020-2024

- FIGURE 36 AVERAGE SELLING PRICE TREND OF VOICE RECOGNITION TECHNOLOGY, BY REGION, 2020-2024

- FIGURE 37 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 38 PORTER'S FIVE FORCES ANALYSIS, 2024

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 41 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 42 IMPORT DATA FOR HS CODE 851989-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 43 EXPORT DATA FOR HS CODE 851989-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 44 AI USE CASES IN SPEECH AND VOICE RECOGNITION MARKET

- FIGURE 45 SPEECH AND VOICE RECOGNITION TYPES

- FIGURE 46 SPEECH AND VOICE RECOGNITION MARKET, BY TECHNOLOGY

- FIGURE 47 VOICE RECOGNITION TECHNOLOGY TO RECORD HIGHER CAGR THAN SPEECH RECOGNITION TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 48 VOICE RECOGNITION PHASE PROCESS

- FIGURE 49 SPEAKER VERIFICATION PROCESS

- FIGURE 50 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE

- FIGURE 51 CLOUD-BASED SEGMENT TO DOMINATE SPEECH AND VOICE RECOGNITION MARKET BETWEEN 2025 AND 2030

- FIGURE 52 SPEECH AND VOICE RECOGNITION MARKET, BY APPLICATION

- FIGURE 53 VOICE SEARCH SEGMENT TO ACCOUNT FOR LARGEST SHARE OF SPEECH AND VOICE RECOGNITION MARKET IN 2030

- FIGURE 54 CONSUMER ELECTRONICS SEGMENT TO DOMINATE SPEECH AND VOICE RECOGNITION MARKET DURING FORECAST PERIOD

- FIGURE 55 SPEECH AND VOICE RECOGNITION MARKET, BY REGION

- FIGURE 56 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN SPEECH AND VOICE RECOGNITION MARKET FROM 2025 TO 2030

- FIGURE 57 NORTH AMERICA: SPEECH AND VOICE RECOGNITION MARKET SNAPSHOT

- FIGURE 58 EUROPE: SPEECH AND VOICE RECOGNITION MARKET SNAPSHOT

- FIGURE 59 ASIA PACIFIC: SPEECH AND VOICE RECOGNITION MARKET SNAPSHOT

- FIGURE 60 ROW: SPEECH AND VOICE RECOGNITION MARKET SNAPSHOT

- FIGURE 61 SPEECH AND VOICE RECOGNITION MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 62 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SPEECH AND VOICE RECOGNITION TECHNOLOGIES, 2024

- FIGURE 63 SPEECH AND VOICE RECOGNITION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 64 SPEECH AND VOICE RECOGNITION MARKET: COMPANY FOOTPRINT

- FIGURE 65 SPEECH AND VOICE RECOGNITION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 66 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 67 IBM: COMPANY SNAPSHOT

- FIGURE 68 ALPHABET: COMPANY SNAPSHOT

- FIGURE 69 AMAZON.COM, INC.: COMPANY SNAPSHOT

- FIGURE 70 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 71 BAIDU INC.: COMPANY SNAPSHOT

- FIGURE 72 IFLYTEK CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 VERINT SYSTEMS INC.: COMPANY SNAPSHOT