PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808082

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808082

Hydrochloric Acid Electrolysis Market by Technology, Application (Polyurethane Industry, PVC Production or Chlorination, Fumed Silica Production, Agrochemical, Other Applications), and Region - Global Forecast to 2030

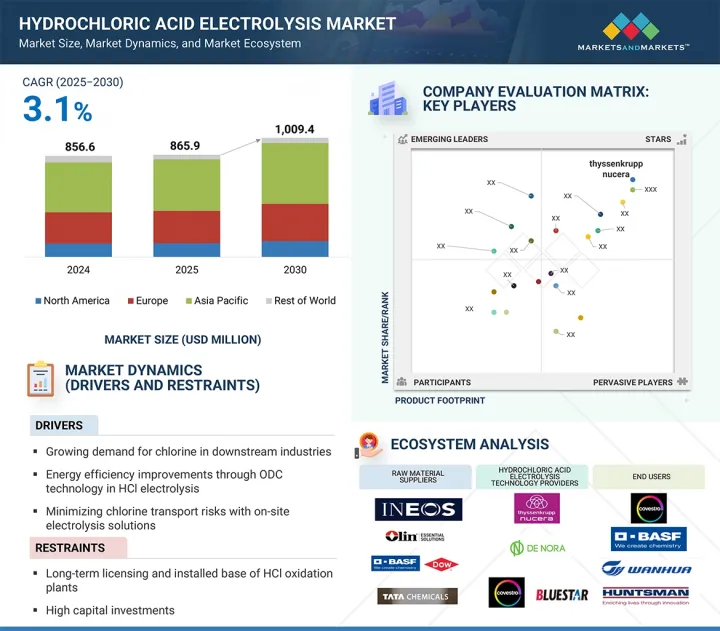

The hydrochloric acid electrolysis market is expected to reach USD 1,009.4 million by 2030 from USD 865.9 million in 2025, at a CAGR of 3.1% during the forecast period. This continuous growth is attributed to the rising interest in sustainable production of chemicals, recycling and reuse of both chlorine and hydrogen recovery as by-products of hydrochloric acid, and the reuse of other environmentally harmful processes, such as mercury-based electrolysis, which most countries are phasing out.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Type, Filler Type, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, and Rest of the World |

Polyurethane (MDI/TDI), PVC, and specialty chemicals industries are adopting HCL electrolysis systems in their processes to enhance efficiency, minimize waste, and meet tougher environmental regulations. Even the adoption of technology is becoming more economical, especially in membrane and diaphragm-based electrolysis systems, and its applicability has increased in scope to cover a broader spectrum of applications and geographies.

"Diaphragm technology to be second fastest-growing segment in hydrochloric acid electrolysis market"

The second-fastest growing technology in the hydrochloric acid (HCL) electrolysis market is the diaphragm technology, and its growth is attributed to the inexpensive nature of technology, its availability in the industry, and the ability to facilitate processes that do not require high investments in capital. Although membrane technology is superior in terms of efficiency and environmental concerns, diaphragm cells present a good economic substitute to chemical manufacturers in cases where chlorine and hydrogen do not require the strictest purity and also in those areas where its application is needed. The technology uses the porous diaphragm to separate the anode and the cathode compartments, which do not mix gases, but enables the possibility of ions passing through. Its ease of design, low maintenance demands, and ability to fit on the existing infrastructure make it appealing to small-scale and mid-sized chemical plants that are interested in recovering chlorine in HCL without the high initial investments of the membrane systems. With increased interest in recycling HCL by-products and companies balancing between budget and ability to process large volumes, the use of the diaphragm technology will continue to grow as a viable, cost-effective solution.

"PVC production or chlorination to be second fastest-growing segment in hydrochloric acid electrolysis market"

The second-fastest growing application in the hydrochloric acid (HCL) electrolysis market is PVC production or chlorination, since it forms significant quantities of HCL as a by-product when hydrocarbons, such as ethylene, are chlorinated. With increasing worldwide demand for polyvinyl chloride (PVC) due to the growth in construction and the packaging industry, the generation of HCL is also increasing, which needs adequate, sustainable solutions to deal with and recycle it. Manufacturers can produce high-purity chlorine and hydrogen through HCL electrolysis and recycle the by-product in the upstream chlorination processes, decreasing the cost of raw materials and impacting the environment. Such a closed loop can not only promote operational efficiency but also fit the industry sustainability objectives and regulatory constraints to minimize hazardous waste. As PVC manufacture involves chlorinated processes, and the use of chlorine is holding up well, HCL electrolysis is rapidly growing in this application.

"Europe to be second fastest-growing regional market for hydrochloric acid electrolysis"

Europe is the second fastest-growing region of the hydrochloric acid (HCL) electrolysis market owing to a good regulatory framework to ensure sustainable and mercury-free chemical processes, and growing industry commitments to circular economy approaches. The region is rapidly abandoning conventional mercury-based electrolysis as stated at the Minamata Convention and the REACH regulation, which is encouraging a transition toward more cleaner technologies such as membrane-based HCL electrolysis. Major European-based chemical manufacturers are installing electrolysis plants to extract chlorine from HCL waste products, in MDI, TDI, and PVC production, to limit waste, minimize emissions, and boost supply chain security.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Note: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 billion; Tier 2: USD 500 million-1 billion; and Tier 3: <USD 500 million

Companies Covered: thyssenkrupp nucera (Germany), Industrie De Nora S.p.A. (Italy), Covestro AG (Germany), and Bluestar (Beijing) Chemical Machinery Co., Ltd. (China), among others, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the hydrochloric acid electrolysis market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the hydrochloric acid electrolysis market based on technology (membrane technology and diaphragm technology), application (polyurethane Industry (MDI/TDI), PVC production or chlorination, fumed silica production, agrochemical, and other applications), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the hydrochloric acid electrolysis market. A detailed analysis of the key industry players has been done to provide insights into their business overviews, products offered, and key strategies, such as partnerships and expansions, associated with the hydrochloric acid electrolysis market.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall hydrochloric acid electrolysis market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for chlorine in downstream industries), restraints (High capital investments), opportunities (Sustainability and circular economy practices), and challenges (Market fragmentation and knowledge gaps).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product/technology & service launches in the hydrochloric acid electrolysis market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the hydrochloric acid electrolysis market across varied regions.

Market Diversification: Exhaustive information about new products/technologies & services, untapped geographies, recent developments, and investments in the hydrochloric acid electrolysis market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as thyssenkrupp nucera (Germany), Industrie De Nora S.p.A. (Italy), Covestro AG (Germany), and Bluestar (Beijing) Chemical Machinery Co., Ltd. (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 GROWTH FORECAST

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROCHLORIC ACID ELECTROLYSIS MARKET

- 4.2 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY TECHNOLOGY

- 4.3 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION

- 4.4 ASIA PACIFIC: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION & COUNTRY

- 4.5 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for chlorine in downstream industries

- 5.2.1.2 Energy efficiency improvements through ODC technology in hydrochloric acid electrolysis

- 5.2.1.3 Minimizing chlorine transport risks with on-site electrolysis solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Long-term licensing and installed base of hydrogen chloride oxidation plants

- 5.2.2.2 High capital investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Sustainability and circular economy practices

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility in energy prices

- 5.2.4.2 Market fragmentation and knowledge gaps

- 5.2.4.3 Regulatory and safety compliance

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGY, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA (HS CODE 280110)

- 5.8.2 EXPORT DATA (HS CODE 280110)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Diaphragm (Porous) Electrolysis

- 5.9.1.2 Membrane Cell Electrolysis

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Gas Treatment Technologies

- 5.9.2.2 Gas Separation Technologies

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Hydrochloric Acid Recovery & Regeneration Systems

- 5.9.3.2 Electrodialysis (ED) and Ion Exchange Technologies

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ADVANCES IN HYDROCHLORIC ACID GAS-PHASE ELECTROLYSIS EMPLOYING OXYGEN-DEPOLARIZED CATHODE

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 IMPACT OF AI/GEN AI ON HYDROCHLORIC ACID ELECTROLYSIS MARKET

- 5.13.1 INTRODUCTION

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 MACROECONOMIC ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 GDP TRENDS AND FORECASTS

- 5.17 IMPACT OF 2025 US TARIFF: HYDROCHLORIC ACID ELECTROLYSIS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 MEMBRANE ELECTROLYSIS

- 6.2.1 RAPID ADOPTION OF MEMBRANE ELECTROLYSIS DRIVEN BY EFFICIENCY AND SUSTAINABILITY

- 6.2.2 ODC (OXYGEN-DEPOLARIZED CATHODE) TECHNOLOGY

- 6.3 DIAPHRAGM ELECTROLYSIS

- 6.3.1 MERCURY-FREE CHEMICAL PRODUCTION TO DRIVE DEMAND FOR DIAPHRAGM ELECTROLYSIS

- 6.4 MERCURY ELECTROLYSIS

- 6.4.1 PHASE-OUT OF MERCURY TECHNOLOGY DUE TO ENVIRONMENTAL CONCERNS AND REGULATORY ACTION

7 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 POLYURETHANE INDUSTRY (MDI/TDI/HDI)

- 7.2.1 ENVIRONMENTAL PRESSURES AND CIRCULAR MANUFACTURING TO DRIVE MARKET

- 7.3 PVC PRODUCTION & CHLORINATION

- 7.3.1 HIGH CHLORINE DEMAND IN PVC PRODUCTION TO PROPEL MARKET

- 7.4 FUMED SILICA PRODUCTION

- 7.4.1 SUSTAINABILITY AND CIRCULAR CHLORINE UTILIZATION TO DRIVE MARKET

- 7.5 AGROCHEMICAL

- 7.5.1 SUSTAINABILITY AND REGULATORY COMPLIANCE TO DRIVE DEMAND

- 7.6 OTHER APPLICATIONS

8 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 ASIA PACIFIC

- 8.2.1 CHINA

- 8.2.1.1 Strong demand for chlorine in key industrial segments to drive market

- 8.2.1 CHINA

- 8.3 EUROPE

- 8.3.1 GERMANY

- 8.3.1.1 Stringent environmental regulations to drive market

- 8.3.2 SPAIN

- 8.3.2.1 Strategic geographic advantage to drive market

- 8.3.3 HUNGARY

- 8.3.3.1 Industry leadership and strategic investments to drive the market

- 8.3.4 FRANCE

- 8.3.4.1 Circular economy goals to drive market

- 8.3.5 PORTUGAL

- 8.3.5.1 EU funding support to drive market

- 8.3.1 GERMANY

- 8.4 NORTH AMERICA

- 8.4.1 US

- 8.4.1.1 Government-backed sustainability initiatives to drive market

- 8.4.1 US

- 8.5 REST OF THE WORLD

- 8.5.1 SAUDI ARABIA

- 8.5.1.1 Petrochemical industry expansion to drive market

- 8.5.1 SAUDI ARABIA

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.3 REVENUE ANALYSIS

- 9.4 MARKET RANKING ANALYSIS

- 9.5 COMPANY VALUATION AND FINANCIAL METRICS

- 9.6 BRAND/PRODUCT COMPARISON

- 9.6.1 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.6.1.1 Company footprint

- 9.6.1.2 Region footprint

- 9.6.1.3 Technology footprint

- 9.6.1.4 Application footprint

- 9.6.1 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.7 COMPETITIVE SCENARIO

- 9.7.1 DEALS

- 9.7.2 EXPANSIONS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 THYSSENKRUPP NUCERA

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Solutions/Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Expansions

- 10.1.1.4 MnM view

- 10.1.1.4.1 Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses and competitive threats

- 10.1.2 COVESTRO AG

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Solutions/Services offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Deals

- 10.1.2.3.2 Expansions

- 10.1.2.4 MnM view

- 10.1.2.4.1 Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses and competitive threats

- 10.1.3 WANHUA

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Solutions/Services offered

- 10.1.3.3 MnM view

- 10.1.3.3.1 Right to win

- 10.1.3.3.2 Strategic choices

- 10.1.3.3.3 Weaknesses and competitive threats

- 10.1.4 HUNTSMAN INTERNATIONAL LLC

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Solutions/Services offered

- 10.1.4.3 MnM view

- 10.1.4.3.1 Right to win

- 10.1.4.3.2 Strategic choices

- 10.1.4.3.3 Weaknesses and competitive threats

- 10.1.5 BLUESTAR (BEIJING) CHEMICAL MACHINERY CO. LTD.

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Solutions/Services offered

- 10.1.5.3 MnM view

- 10.1.6 BASF

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Solutions/Services offered

- 10.1.6.3 MnM view

- 10.1.7 SADARA

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Solutions/Services offered

- 10.1.7.3 MnM view

- 10.1.1 THYSSENKRUPP NUCERA

11 ADJACENT & RELATED MARKET

- 11.1 INTRODUCTION

- 11.2 LIMITATIONS

- 11.3 HYDROCHLORIC ACID MARKET

- 11.3.1 MARKET DEFINITION

- 11.3.2 HYDROCHLORIC ACID MARKET, BY GRADE

- 11.3.3 HYDROCHLORIC ACID MARKET, BY APPLICATION

- 11.3.4 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY

- 11.3.5 HYDROCHLORIC ACID MARKET, BY REGION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 ROLES OF COMPANIES IN HYDROCHLORIC ACID ELECTROLYSIS ECOSYSTEM

- TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 5 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 6 INDICATIVE PRICING ANALYSIS OF HYDROCHLORIC ACID OFFERED BY KEY PLAYERS, BY TECHNOLOGY, 2024 (USD/KILOGRAMS)

- TABLE 7 AVERAGE SELLING PRICE OF HYDROCHLORIC ACID ELECTROLYSIS OF KEY PLAYERS, BY REGION, 2023-2030 (USD/KILOGRAMS)

- TABLE 8 IMPORT DATA RELATED TO HS CODE 280110-CHLORINE, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA RELATED TO HS CODE 280110 - CHLORINE, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 HYDROCHLORIC ACID ELECTROLYSIS MARKET: LIST OF KEY PATENTS, 2020-2024

- TABLE 11 HYDROCHLORIC ACID ELECTROLYSIS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 HYDROCHLORIC ACID ELECTROLYSIS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 15 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 16 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 17 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY TECHNOLOGY, 2023-2030 (KILOTON)

- TABLE 18 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 19 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 20 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 21 HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 22 CHINA: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 23 CHINA: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 24 EUROPE: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 EUROPE: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 26 EUROPE: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 27 EUROPE: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 28 GERMANY: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 29 GERMANY: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 30 SPAIN: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 31 SPAIN: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 32 HUNGARY: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 33 HUNGARY: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 34 FRANCE: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 35 FRANCE: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 36 PORTUGAL: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 37 PORTUGAL: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 38 US: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 39 US: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 40 SAUDI ARABIA: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 41 SAUDI ARABIA: HYDROCHLORIC ACID ELECTROLYSIS MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 42 HYDROCHLORIC ACID ELECTROLYSIS MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2019-2025

- TABLE 43 HYDROCHLORIC ACID ELECTROLYSIS MARKET: REGION FOOTPRINT

- TABLE 44 HYDROCHLORIC ACID ELECTROLYSIS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 45 HYDROCHLORIC ACID ELECTROLYSIS MARKET: APPLICATION FOOTPRINT

- TABLE 46 HYDROCHLORIC ACID ELECTROLYSIS MARKET: DEALS, JANUARY 2019- APRIL 2025

- TABLE 47 HYDROCHLORIC ACID ELECTROLYSIS MARKET: EXPANSIONS, JANUARY 2019- APRIL 2025

- TABLE 48 THYSSENKRUPP NUCERA: COMPANY OVERVIEW

- TABLE 49 THYSSENKRUPP NUCERA: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED

- TABLE 50 THYSSENKRUPP NUCERA: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 51 COVESTRO AG: COMPANY OVERVIEW

- TABLE 52 COVESTRO AG: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED

- TABLE 53 COVESTRO AG: DEALS, JANUARY 2021-JULY 2025

- TABLE 54 COVESTRO AG: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 55 WANHUA: COMPANY OVERVIEW

- TABLE 56 WANHUA: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED

- TABLE 57 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 58 HUNTSMAN INTERNATIONAL LLC: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED

- TABLE 59 BLUESTAR (BEIJING) CHEMICAL MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 60 BLUESTAR(BEIJING)CHEMICAL MACHINERY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED

- TABLE 61 BASF: COMPANY OVERVIEW

- TABLE 62 BASF: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED

- TABLE 63 SADARA: COMPANY OVERVIEW

- TABLE 64 SADARA: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED

- TABLE 65 HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2023 (USD MILLION)

- TABLE 66 HYDROCHLORIC ACID MARKET, BY GRADE, 2024-2029 (USD MILLION)

- TABLE 67 HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2023(KILOTON)

- TABLE 68 HYDROCHLORIC ACID MARKET, BY GRADE, 2024-2029 (KILOTON)

- TABLE 69 HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 HYDROCHLORIC ACID MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 71 HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 72 HYDROCHLORIC ACID MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 73 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 74 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 75 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 76 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 77 HYDROCHLORIC ACID MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 78 HYDROCHLORIC ACID MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 HYDROCHLORIC ACID MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 80 HYDROCHLORIC ACID MARKET, BY REGION, 2024-2029 (KILOTON)

List of Figures

- FIGURE 1 HYDROCHLORIC ACID ELECTROLYSIS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HYDROCHLORIC ACID ELECTROLYSIS MARKETMARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 HYDROCHLORIC ACID ELECTROLYSIS MARKETMARKET: DATA TRIANGULATION

- FIGURE 6 MEMBRANE ELECTROLYSIS TO BE LARGER SEGMENT OF HYDROCHLORIC ACID ELECTROLYSIS MARKET DURING FORECAST PERIOD

- FIGURE 7 POLYURETHANE INDUSTRY (MDI/TDI/HDI) TO BE LARGEST HYDROCHLORIC ACID ELECTROLYSIS DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC DOMINATED HYDROCHLORIC ACID ELECTROLYSIS MARKET IN 2024

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING HYDROCHLROC ACID ELECTROLYSIS MARKET DURING FORECAST PERIOD

- FIGURE 10 MEMBRANE ELECTROLYSIS TO LEAD HYDROCHLORIC ACID ELECTROLYSIS MARKET DURING FORECAST PERIOD

- FIGURE 11 POLYURETHANE INDUSTRY (MDI/TDI/HDI) TO LEAD HYDROCHLORIC ACID ELECTROLYSIS MARKET DURING FORECAST PERIOD

- FIGURE 12 POLYURETHANE INDUSTRY (MDI/TDI/HDI) ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC IN 2024

- FIGURE 13 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 HYDROCHLORIC ACID ELECTROLYSIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 16 HYDROCHLORIC ACID ELECTROLYSIS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 17 HYDROCHLORIC ACID ELECTROLYSIS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE TREND OF HYDROCHLORIC ACID ELECTROLYSIS OFFERED BY KEY PLAYERS, 2024 (USD/KILOGRAMS)

- FIGURE 19 AVERAGE SELLING PRICE OF HYDROCHLORIC ACID ELECTROLYSIS, BY REGION, 2023-2030 (USD/KILOGRAMS)

- FIGURE 20 IMPORT DATA FOR HS CODE 280110-CHLORINE, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 21 EXPORT DATA FOR HS CODE 280110 - CHLORINE, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 22 LIST OF MAJOR PATENTS APPLIED AND GRANTED RELATED TO HYDROCHLORIC ACID ELECTROLYSIS, 2015-2024

- FIGURE 23 MAJOR PATENTS APPLIED AND GRANTED RELATED TO HYDROCHLORIC ACID ELECTROLYSIS, BY COUNTRY/REGION, 2015-2024

- FIGURE 24 IMPACT OF AI/GEN AI ON HYDROCHLORIC ACID ELECTROLYSIS MARKET

- FIGURE 25 HYDROCHLORIC ACID ELECTROLYSIS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 28 MEMBRANE ELECTROLYSIS SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2025

- FIGURE 29 POLYURETHANE INDUSTRY (MDI/TDI/HDI) SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 30 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF HYDROCHLORIC ACID ELECTROLYSIS MARKET THROUGH 2030

- FIGURE 32 HYDROCHLORIC ACID ELECTROLYSIS MARKET: REVENUE ANALYSIS OF TOP PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 33 MARKET RANKING ANALYSIS OF TOP PLAYERS

- FIGURE 34 COMPANY VALUATION (USD BILLION), 2025

- FIGURE 35 FINANCIAL MATRIX (EV/EBITDA), 2025

- FIGURE 36 YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2025

- FIGURE 37 HYDROCHLORIC ACID ELECTROLYSIS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 38 HYDROCHLORIC ACID ELECTROLYSIS MARKET: COMPANY FOOTPRINT

- FIGURE 39 THYSSENKRUPP NUCERA: COMPANY SNAPSHOT

- FIGURE 40 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 41 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- FIGURE 42 BASF: COMPANY SNAPSHOT