PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811757

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811757

Mining Automation Market by Offering (Autonomous Hauling/Mining Trucks, Autonomous Drilling Rigs, Underground LHD Loaders, Tunneling Equipment, Smart Ventilation Systems), Software (Remote Monitoring, Asset Management System) - Global Forecast to 2030

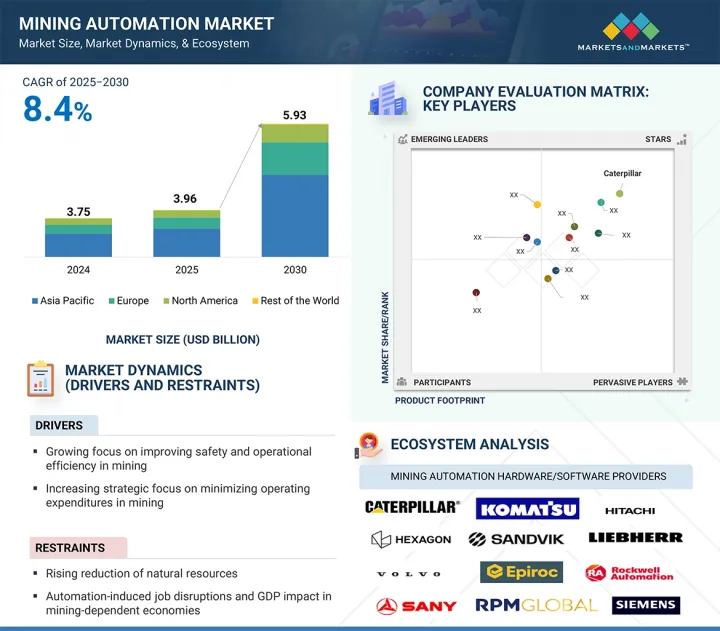

At a CAGR of 8.4%, the global mining automation market is anticipated to grow from USD 3.96 billion in 2025 to USD 5.93 billion in 2030. Automation can help mitigate safety concerns, such as injuries at the mine site, and make mining operations more efficient and safer.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Technique, Workflow, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

By automating mining processes, mine owners can improve efficiency, reduce waste of time and resources, and save costs, ultimately leading to a more competitive position in the mining industry. The need for increased productivity is also driven by declining ore grades, rising costs of minerals, a shortage of skilled labor, and stringent regulatory compliance, making automation an attractive solution to address these challenges.

"Mineral mining to capture prominent share of mining automation market"

The mineral mining encompasses the extraction of industrial minerals such as potash, phosphate, limestone, quartz, silica, and gypsum, which are vital for construction, agriculture, and manufacturing industries. This mineral mining relies heavily on automation to optimize bulk extraction processes, enhancing operational efficiency and reducing manual labor in large-scale operations. Automation technologies such as autonomous haul trucks and smart material handling systems are increasingly integrated to manage the diverse and widespread nature of these deposits. Here, the focus is improving productivity while adhering to environmental regulations governing land use and reclamation.

"Mining process segment to hold second-largest share of mining automation market, by workflow, throughout forecast period"

Mining processes involve various activities after the mine has been completely developed and is ready for use. During this phase, activities such as drilling, blasting, and ore hauling to the dumping points are performed. Recent technological advancements in mining automation have made these tasks more efficient and convenient. Hauling ore from the mining pit to the dumping point is the most important and capital-intensive activity in mining operations. A continuous and efficient hauling cycle is necessary for the overall productivity of mining companies. Advantages such as improved safety and productivity, reduced maintenance costs, efficient fuel consumption, increased tire life, and less downtime are achieved by automating the haulage processes inside a mine.

"Growing adoption of automation to position North America as the third largest market for mining automation"

The mining automation market in North America is witnessing growth as the region has large mining facilities. Canada has made remarkable strides in its mining sector in recent years, emphasizing innovation and adopting mining automation to enhance efficiency, safety, and productivity. As a global leader in mining automation, exemplified by Teck Resources Ltd.'s use of autonomous haulage systems at its Elkview coal mine in British Columbia, Canada, it is at the forefront of technological advancement in the industry. The increasing significance of adopting automation and advanced technologies is pivotal for improving safety, efficiency, and productivity in the Canadian mining sector. The industry's ongoing focus on innovation and automation underscores its critical role in shaping the country's mining future. In summary, Canada's dedication to innovation and automation, particularly in underground mining, signifies significant progress in the sector, with a growing emphasis on enhancing safety, efficiency, and productivity.

Breakdown of Primaries

Various executives from key organizations operating in the mining automation market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in-depth.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 30%, C-level Executives - 45%, and Others - 25%

- By Region: North America - 25%, Europe - 28%, Asia Pacific - 30%, and RoW - 17%

Note: Three tiers of companies have been defined based on their total revenue as of 2024: Tier 1: >USD 5 billion, Tier 2: USD 500 million-USD 5 billion, and Tier 3: <USD 500 million. Other designations include sales managers, marketing managers, and product managers.

Major players profiled in this report are Caterpillar (US), Komatsu (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), AB Volvo (Sweden), Hexagon AB (Sweden), Liebherr-International Deutschland GmbH (Switzerland), Rockwell Automation (US), RPMGlobal Holdings Limited (Australia), SANY Group (China), Siemens (Germany), Trimble Inc. (US), ABB (Switzerland), ATDI SA (France), CiGen (Australia), Coencorp (Canada), Datamine (Australia), GroundHog (US), Haultrax (Australia), Micromine (Australia), SYMX.AI (Canada), STI Engineering (Australia), Zitron (Spain), and MineSense Technologies Ltd. (Canada). These leading companies possess a broad portfolio of products and establish a prominent presence in established and emerging markets.

The study provides a detailed competitive analysis of these key market players, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the mining automation market based on offering, technique, application, workflow, and region. The offering segment includes equipment, software, and communication systems. The technique segment includes underground and surface mining. The application segment comprises mineral mining, metal mining, and coal mining. The workflow segment includes mining process, mine maintenance, and mine development. The market has been segmented into four regions: North America, Asia Pacific, Europe, and Rest of the World (RoW).

Reasons to Buy the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the mining automation market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (growing focus on improving safety and operational efficiency in mining, rising strategic focus on minimizing operating expenditures in mining, Rising preference for fleet management systems by mining companies), restraints (rapid depletion of natural resources, automation-induced job disruptions and GDP impact in mining-dependent economies), opportunities (strategic integration of digital technologies to modernize global mining operations, Strategic shift toward smart connected mining for enhanced operational intelligence, accelerated lithium exploration driven by surging global battery demand), and challenges (strategic integration of digital technologies to modernize global mining operations, Strategic shift toward smart connected mining for enhanced operational intelligence, accelerated lithium exploration driven by surging global battery demand) influencing the growth of the mining automation market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the mining automation market

- Market Development: Comprehensive information about lucrative markets, including the analysis of the mining automation market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in mining automation solutions

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Caterpillar (US), Komatsu (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), and Hitachi Construction Machinery Co., Ltd. (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MINING AUTOMATION MARKET

- 4.2 MINING AUTOMATION MARKET, BY OFFERING

- 4.3 MINING AUTOMATION MARKET, BY APPLICATION

- 4.4 MINING AUTOMATION MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

- 4.5 MINING AUTOMATION MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing focus on enhancing safety and operational efficiency at mining sites

- 5.2.1.2 Rising emphasis of mining firms on minimizing operating expenditure

- 5.2.1.3 Increasing preference for fleet management systems by mining companies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Depletion of natural resources

- 5.2.2.2 Automation-induced job disruptions and GDP impact on mining-dependent economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Inclination of mine operators toward digital technologies

- 5.2.3.2 Growing trend of smart connected mining

- 5.2.3.3 Surging global demand for lithium-ion batteries

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability issues associated with mining automation

- 5.2.4.2 Workforce shortage and skill gaps in operating automated mining systems

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF MINING EQUIPMENT, 2024

- 5.4.2 INDICATIVE PRICING OF MINING AUTOMATION SOFTWARE, 2024

- 5.4.3 PRICING RANGE OF AUTONOMOUS MINING TRUCKS, BY KEY PLAYER, 2024

- 5.4.4 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MINING TRUCKS, 2021-2024

- 5.4.5 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MINING TRUCKS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial intelligence

- 5.8.1.2 Digital twin

- 5.8.1.3 Internet of Things

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Cloud computing

- 5.8.2.2 5G

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 SATCOM

- 5.8.3.2 Advanced imaging

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 8429)

- 5.10.2 EXPORT SCENARIO (HS CODE 8429)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ROCKWELL AUTOMATION OFFERS CONTROL SYSTEMS AND VISUALIZATION SOLUTIONS TO MINIMIZE DOWNTIME AND OPERATIONAL COST IN MINING PLANT

- 5.12.2 KOMATSU PROVIDES AUTONOMOUS HAULAGE SYSTEM TO ENHANCE PRODUCTIVITY AND SAFETY IN COPPER MINE

- 5.12.3 ROCKWELL AUTOMATION DEPLOYS FACTORYTALK SUITE AT AMRUN BAUXITE MINE TO IMPROVE OPERATIONAL VISIBILITY

- 5.12.4 SANDVIK AB IMPLEMENTS MINING EQUIPMENT IN VELADERO GOLD MINE TO INCREASE PRODUCTIVITY

- 5.12.5 CATERPILLAR OFFERS AUTONOMOUS DRILLS AND TRUCKS TO CREATE CONNECTED VALUE CHAIN IN GUDAI-DARRI MINE

- 5.12.6 HEXAGON OFFERS OPERATIONS MANAGEMENT SOLUTIONS TO STREAMLINE OPERATIONS AT MINING SITES OF ANGLO AMERICAN PLATINUM

- 5.12.7 KOMATSU DEPLOYS LHD AT EI SANTO MINE SITE TO MEET CUSTOMIZED FINANCING AND TECHNICAL REQUIREMENTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON MINING AUTOMATION MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 AI USE CASES

- 5.16.3 FUTURE OF AI/GEN AI IN MINING AUTOMATION ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON MINING INDUSTRY

6 MINING AUTOMATION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 EQUIPMENT

- 6.2.1 AUTONOMOUS HAULING/MINING TRUCKS

- 6.2.1.1 Strategic focus on maximizing asset utilization and mitigating workforce-related risks to boost demand

- 6.2.2 AUTONOMOUS DRILLING RIGS

- 6.2.2.1 Strong emphasis on enhancing ore recovery and reducing downtime to accelerate adoption

- 6.2.3 UNDERGROUND LHD LOADERS

- 6.2.3.1 Need to overcome depth, space, and safety constraints in underground mining to propel segmental growth

- 6.2.4 TUNNELLING EQUIPMENT

- 6.2.4.1 Ability to reduce tunnel lining costs to promote deployment

- 6.2.5 SMART VENTILATION SYSTEMS

- 6.2.5.1 Necessity to eliminate risk of gas leaks or explosions to fuel segmental growth

- 6.2.6 PUMPING STATIONS

- 6.2.6.1 Urgency to address water accumulation challenges in mines to foster segmental growth

- 6.2.7 OTHER EQUIPMENT

- 6.2.7.1 Hybrid shovels

- 6.2.7.2 Mining dozers

- 6.2.7.3 Wheeled loaders

- 6.2.7.4 Mining excavators

- 6.2.1 AUTONOMOUS HAULING/MINING TRUCKS

- 6.3 SOFTWARE

- 6.3.1 WORKFORCE SAFETY & MANAGEMENT SOFTWARE

- 6.3.1.1 High priority need to safeguard personnel and optimize resource allocation to drive demand

- 6.3.2 ENVIRONMENT MONITORING SOFTWARE

- 6.3.2.1 Stringent safety regulations focused on sustainable mining practices to support market growth

- 6.3.3 FLEET & EQUIPMENT MANAGEMENT SOFTWARE

- 6.3.3.1 Greater emphasis on seamless mining operations to contribute to segmental growth

- 6.3.4 REMOTE MONITORING SOFTWARE

- 6.3.4.1 Proficiency in protecting miners from hazardous conditions to boost demand

- 6.3.5 DATA MANAGEMENT SOFTWARE

- 6.3.5.1 Shift from conventional management to fact-based, decision-driven management to create opportunities

- 6.3.6 ASSET MANAGEMENT SOFTWARE

- 6.3.6.1 Critical necessity to ensure equipment reliability in extreme mining conditions to stimulate adoption

- 6.3.1 WORKFORCE SAFETY & MANAGEMENT SOFTWARE

- 6.4 COMMUNICATION SYSTEMS

- 6.4.1 WIRELESS MESH NETWORKS

- 6.4.1.1 Easy installation and low maintenance costs to contribute to segmental growth

- 6.4.2 NAVIGATION SYSTEMS

- 6.4.2.1 Potential to help operators navigate safely through mines to fuel demand

- 6.4.3 RFID TAGS

- 6.4.3.1 Need for real-time tracking of mining equipment and personnel to drive adoption

- 6.4.1 WIRELESS MESH NETWORKS

7 MINING AUTOMATION MARKET, BY TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 UNDERGROUND MINING

- 7.2.1 PARAMOUNT NEED TO ENSURE SECURE AND CONTROLLED ENVIRONMENT FOR UNDERGROUND OPERATORS TO DRIVE MARKET

- 7.3 SURFACE MINING

- 7.3.1 STRATEGIC ADOPTION OF AUTOMATION TO REDUCE COSTS AND BOOST PRODUCTIVITY TO FUEL MARKET GROWTH

8 MINING AUTOMATION MARKET, BY WORKFLOW

- 8.1 INTRODUCTION

- 8.2 MINE DEVELOPMENT

- 8.2.1 TUNNEL BORING

- 8.2.1.1 Exploration of rich mineral reserves to spur demand

- 8.2.2 ACCESS ROAD CONSTRUCTION

- 8.2.2.1 Necessity for safe and efficient means of transport to and from tunnel sites to propel market

- 8.2.3 SITE PREPARATION & CLEARING

- 8.2.3.1 Growing trend of modular infrastructure deployment to accelerate market growth

- 8.2.1 TUNNEL BORING

- 8.3 MINING PROCESS

- 8.3.1 AUTONOMOUS HAULAGE

- 8.3.1.1 Strong focus on productivity gains and cost savings to spur demand

- 8.3.2 AUTOMATED DRILLING

- 8.3.2.1 Potential to address drilling-related challenges to spike demand

- 8.3.1 AUTONOMOUS HAULAGE

- 8.4 MINE MAINTENANCE

- 8.4.1 HVAC INSTALLATION & MAINTENANCE

- 8.4.1.1 Need to improve ventilation and ensure operational continuity in mining sites to fuel market growth

- 8.4.2 MINE DEWATERING

- 8.4.2.1 Rising use of dewatering systems to reduce risk of flooding to contribute to segmental growth

- 8.4.1 HVAC INSTALLATION & MAINTENANCE

9 MINING AUTOMATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MINERAL MINING

- 9.2.1 ELEVATING DEMAND FOR MINERALS FROM CONSTRUCTION, AGRICULTURE, AND MANUFACTURING INDUSTRIES TO DRIVE MARKET

- 9.3 METAL MINING

- 9.3.1 RISING DEMAND FOR METALS TO MANUFACTURE ELECTRONICS AND EV PARTS TO PROMOTE MARKET GROWTH

- 9.4 COAL MINING

- 9.4.1 SURGING USE OF REMOTE-OPERATED MACHINERY TO MINIMIZE HUMAN EXPOSURE TO SUPPORT MARKET GROWTH

10 MINING AUTOMATION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising adoption of digital technologies in mining operations to accelerate market growth

- 10.2.3 CANADA

- 10.2.3.1 Presence of rich mineral and metal reserves to fuel demand

- 10.2.4 MEXICO

- 10.2.4.1 Mineral wealth and favorable regulatory policies to foster market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 TURKEY

- 10.3.2.1 Mineral deposits of coal, iron ore, copper, manganese, gold, silver, lead, and zinc to create opportunities

- 10.3.3 SWEDEN

- 10.3.3.1 Strategic integration of autonomous haulage and AI-driven systems to propel market

- 10.3.4 GERMANY

- 10.3.4.1 Elevating adoption of electric vehicles and renewable energy systems to promote market growth

- 10.3.5 POLAND

- 10.3.5.1 Rising demand for metals and rare-earth materials to drive market

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Mining modernization and automation efforts to accelerate market growth

- 10.4.3 INDIA

- 10.4.3.1 Increasing efforts to digitize mines to drive market

- 10.4.4 AUSTRALIA

- 10.4.4.1 Presence of abundant and diverse mineral reserves to facilitate market growth

- 10.4.5 INDONESIA

- 10.4.5.1 Launch of 5G smart mining technology to contribute to market growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Brazil

- 10.5.2.1.1 Presence of gold mines to boost adoption

- 10.5.2.2 Peru

- 10.5.2.2.1 Strategic investments and growing importance of mining automation to drive market

- 10.5.2.3 Chile

- 10.5.2.3.1 Presence of high-quality iron ore beds to fuel market growth

- 10.5.2.4 Rest of South America

- 10.5.2.1 Brazil

- 10.5.3 MIDDLE EAST

- 10.5.3.1 GCC

- 10.5.3.1.1 Increasing adoption of Industry 4.0 and digital technologies to create opportunities

- 10.5.3.2 Rest of Middle East

- 10.5.3.1 GCC

- 10.5.4 AFRICA

- 10.5.4.1 South Africa

- 10.5.4.1.1 Government initiatives promoting safe mining practices to support market growth

- 10.5.4.2 Rest of Africa

- 10.5.4.1 South Africa

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2024

- 11.5 PRODUCT COMPARISON

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Technique footprint

- 11.7.5.4 Equipment footprint

- 11.7.5.5 Software footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 CATERPILLAR

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 KOMATSU

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 SANDVIK AB

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 EPIROC AB

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.3.3 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 HITACHI CONSTRUCTION MACHINERY CO., LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 AB VOLVO

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 HEXAGON AB

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Expansions

- 12.1.8 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Expansions

- 12.1.9 ROCKWELL AUTOMATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 RPMGLOBAL HOLDINGS LIMITED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.11 SANY GROUP

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Expansions

- 12.1.11.3.3 Other developments

- 12.1.12 SIEMENS

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 TRIMBLE INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.14 ABB

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.1 CATERPILLAR

- 12.2 OTHER PLAYERS

- 12.2.1 ATDI SA

- 12.2.2 CIGEN

- 12.2.3 COENCORP

- 12.2.4 DATAMINE

- 12.2.5 GROUNDHOG

- 12.2.6 HAULTRAX

- 12.2.7 MICROMINE

- 12.2.8 SYMX.AI

- 12.2.9 STI ENGINEERING

- 12.2.10 ZITRON

- 12.2.11 MINESENSE TECHNOLOGIES LTD.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MINING AUTOMATION MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 PRICING RANGE OF MINING EQUIPMENT, 2024 (USD MILLION)

- TABLE 3 INDICATIVE PRICING OF MINING AUTOMATION SOFTWARE, 2024 (USD)

- TABLE 4 PRICING RANGE OF AUTONOMOUS MINING TRUCKS OFFERED BY KEY PLAYERS, 2024 (USD MILLION)

- TABLE 5 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MINING TRUCKS, 2021-2024 (USD MILLION)

- TABLE 6 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MINING TRUCKS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 7 ROLE OF COMPANIES IN MINING AUTOMATION ECOSYSTEM

- TABLE 8 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 9 IMPORT DATA FOR HS CODE 8429-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 8429-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 STANDARDS: MINING AUTOMATION

- TABLE 17 IMPACT OF PORTER'S FIVE FORCES

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR OFFERINGS

- TABLE 19 KEY BUYING CRITERIA FOR OFFERINGS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 22 MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 23 MINING AUTOMATION MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 24 MINING AUTOMATION MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 25 MINING AUTOMATION MARKET FOR EQUIPMENT, 2021-2024 (UNITS)

- TABLE 26 MINING AUTOMATION MARKET FOR EQUIPMENT, 2025-2030 (UNITS)

- TABLE 27 EQUIPMENT: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 28 EQUIPMENT: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 29 EQUIPMENT: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 EQUIPMENT: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 MINING AUTOMATION MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 32 MINING AUTOMATION MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 33 SOFTWARE: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 34 SOFTWARE: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 35 SOFTWARE: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 SOFTWARE: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 MINING AUTOMATION MARKET, BY COMMUNICATION SYSTEM, 2021-2024 (USD MILLION)

- TABLE 38 MINING AUTOMATION MARKET, BY COMMUNICATION SYSTEM, 2025-2030 (USD MILLION)

- TABLE 39 COMMUNICATION SYSTEMS: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 40 COMMUNICATION SYSTEMS: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 41 COMMUNICATION SYSTEMS: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 COMMUNICATION SYSTEMS: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 44 MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 45 UNDERGROUND MINING: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 46 UNDERGROUND MINING: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 47 UNDERGROUND MINING: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 UNDERGROUND MINING: MINING AUTOMATION MARKET: BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 SURFACE MINING: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 50 SURFACE MINING: MINING AUTOMATION MARKET: BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 51 SURFACE MINING: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 SURFACE MINING: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 MINING AUTOMATION MARKET, BY WORKFLOW, 2021-2024 (USD MILLION)

- TABLE 54 MINING AUTOMATION MARKET, BY WORKFLOW, 2025-2030 (USD MILLION)

- TABLE 55 MINE DEVELOPMENT: MINING AUTOMATION MARKET, BY PROCESS TYPE, 2021-2024 (USD MILLION)

- TABLE 56 MINE DEVELOPMENT: MINING AUTOMATION MARKET, BY PROCESS TYPE, 2025-2030 (USD MILLION)

- TABLE 57 MINING PROCESS: MINING AUTOMATION MARKET, BY PROCESS TYPE, 2021-2024 (USD MILLION)

- TABLE 58 MINING PROCESS: MINING AUTOMATION MARKET, BY PROCESS TYPE, 2025-2030 (USD MILLION)

- TABLE 59 MINE MAINTENANCE: MINING AUTOMATION MARKET, BY PROCESS TYPE, 2021-2024 (USD MILLION)

- TABLE 60 MINE MAINTENANCE: MINING AUTOMATION MARKET, BY PROCESS TYPE, 2025-2030 (USD MILLION)

- TABLE 61 MINING AUTOMATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 MINING AUTOMATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 MINERAL MINING: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 MINERAL MINING: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 METAL MINING: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 METAL MINING: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 COAL MINING: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 COAL MINING: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: MINING AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: MINING AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: MINING AUTOMATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: MINING AUTOMATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 US: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 80 US: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 81 US: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 82 US: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 83 CANADA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 84 CANADA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 85 CANADA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 86 CANADA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 87 MEXICO: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 88 MEXICO: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 89 MEXICO: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 90 MEXICO: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: MINING AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: MINING AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: MINING AUTOMATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: MINING AUTOMATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 TURKEY: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 100 TURKEY: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 101 TURKEY: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 102 TURKEY: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 103 SWEDEN: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 104 SWEDEN: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 105 SWEDEN: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 106 SWEDEN: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 107 GERMANY: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 108 GERMANY: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 109 GERMANY: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 110 GERMANY: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 111 POLAND: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 112 POLAND: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 113 POLAND: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 114 POLAND: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 115 REST OF EUROPE: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 116 REST OF EUROPE: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 118 REST OF EUROPE: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MINING AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MINING AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MINING AUTOMATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MINING AUTOMATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 CHINA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 128 CHINA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 129 CHINA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 130 CHINA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 131 INDIA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 132 INDIA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 133 INDIA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 134 INDIA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 135 AUSTRALIA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 136 AUSTRALIA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 137 AUSTRALIA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 138 AUSTRALIA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 139 INDONESIA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 140 INDONESIA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 141 INDONESIA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 142 INDONESIA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 147 ROW: MINING AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 ROW: MINING AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 149 ROW: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 150 ROW: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 151 ROW: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 152 ROW: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 153 ROW: MINING AUTOMATION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 ROW: MINING AUTOMATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 SOUTH AMERICA: MINING AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 156 SOUTH AMERICA: MINING AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH AMERICA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 158 SOUTH AMERICA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH AMERICA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 160 SOUTH AMERICA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: MINING AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST: MINING AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 167 AFRICA: MINING AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 AFRICA: MINING AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 AFRICA: MINING AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 170 AFRICA: MINING AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 171 AFRICA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 172 AFRICA: MINING AUTOMATION MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 173 MINING AUTOMATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JULY 2025

- TABLE 174 MINING AUTOMATION MARKET: DEGREE OF COMPETITION

- TABLE 175 MINING AUTOMATION MARKET: REGION FOOTPRINT

- TABLE 176 MINING AUTOMATION MARKET: TECHNIQUE FOOTPRINT

- TABLE 177 MINING AUTOMATION MARKET: EQUIPMENT FOOTPRINT

- TABLE 178 MINING AUTOMATION MARKET: SOFTWARE FOOTPRINT

- TABLE 179 MINING AUTOMATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 180 MINING AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 181 MINING AUTOMATION MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 182 MINING AUTOMATION MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 183 MINING AUTOMATION MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 184 MINING AUTOMATION MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 185 CATERPILLAR: COMPANY OVERVIEW

- TABLE 186 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 CATERPILLAR: PRODUCT LAUNCHES

- TABLE 188 KOMATSU: COMPANY OVERVIEW

- TABLE 189 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 KOMATSU: DEALS

- TABLE 191 KOMATSU: EXPANSIONS

- TABLE 192 SANDVIK AB: COMPANY OVERVIEW

- TABLE 193 SANDVIK AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 SANDVIK AB: DEALS

- TABLE 195 SANDVIK AB: OTHER DEVELOPMENTS

- TABLE 196 EPIROC AB: COMPANY OVERVIEW

- TABLE 197 EPIROC AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 EPIROC AB: DEALS

- TABLE 199 EPIROC AB: EXPANSIONS

- TABLE 200 EPIROC AB: OTHER DEVELOPMENTS

- TABLE 201 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 202 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCT LAUNCHES

- TABLE 204 HITACHI CONSTRUCTION MACHINERY CO., LTD.: DEALS

- TABLE 205 AB VOLVO: COMPANY OVERVIEW

- TABLE 206 AB VOLVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 AB VOLVO: DEALS

- TABLE 208 HEXAGON AB: COMPANY OVERVIEW

- TABLE 209 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 211 HEXAGON AB: DEALS

- TABLE 212 HEXAGON AB: EXPANSIONS

- TABLE 213 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH: COMPANY OVERVIEW

- TABLE 214 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH: PRODUCT LAUNCHES

- TABLE 216 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH: DEALS

- TABLE 217 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH: EXPANSIONS

- TABLE 218 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 219 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 RPMGLOBAL HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 221 RPMGLOBAL HOLDINGS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 RPMGLOBAL HOLDINGS LIMITED: PRODUCT LAUNCHES

- TABLE 223 RPMGLOBAL HOLDINGS LIMITED: DEALS

- TABLE 224 SANY GROUP: COMPANY OVERVIEW

- TABLE 225 SANY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 SANY GROUP: PRODUCT LAUNCHES

- TABLE 227 SANY GROUP: EXPANSIONS

- TABLE 228 SANY GROUP: OTHER DEVELOPMENTS

- TABLE 229 SIEMENS: COMPANY OVERVIEW

- TABLE 230 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SIEMENS: DEALS

- TABLE 232 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 233 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 235 ABB: COMPANY OVERVIEW

- TABLE 236 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 MINING AUTOMATION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MINING AUTOMATION MARKET: RESEARCH DESIGN

- FIGURE 3 MINING AUTOMATION MARKET: RESEARCH APPROACH

- FIGURE 4 MINING AUTOMATION MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MINING AUTOMATION MARKET: TOP-DOWN APPROACH

- FIGURE 6 MINING AUTOMATION MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 MINING AUTOMATION MARKET: DATA TRIANGULATION

- FIGURE 8 MINING AUTOMATION MARKET SIZE, IN TERMS OF VALUE, 2021-2030

- FIGURE 9 UNDERGROUND MINING SEGMENT TO HOLD LARGER SHARE OF MINING AUTOMATION MARKET, BY TECHNIQUE, IN 2025

- FIGURE 10 EQUIPMENT SEGMENT TO HOLD PROMINENT SHARE OF MINING AUTOMATION MARKET, BY OFFERING, IN 2025

- FIGURE 11 MINE DEVELOPMENT SEGMENT TO CAPTURE MAJORITY OF MINING AUTOMATION MARKET SHARE, BY WORKFLOW, IN 2025

- FIGURE 12 ASIA PACIFIC DOMINATED MINING AUTOMATION MARKET IN 2024

- FIGURE 13 RISING NEED FOR SAFETY AND PRODUCTIVITY IN MINING TO DRIVE MARKET

- FIGURE 14 EQUIPMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 15 MINERAL MINING SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 16 METAL MINING SEGMENT AND US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2024

- FIGURE 17 INDIA TO BE FASTEST-GROWING MARKET FOR MINING AUTOMATION FROM 2025 TO 2030

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS- CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MINING TRUCKS, 2021-2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MINING TRUCKS, BY REGION, 2021-2024

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 MINING AUTOMATION ECOSYSTEM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 30 IMPORT SCENARIO FOR HS CODE 8429-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 31 EXPORT SCENARIO FOR HS CODE 8429-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR OFFERINGS

- FIGURE 34 KEY BUYING CRITERIA FOR OFFERINGS

- FIGURE 35 AI USE CASES IN MINING AUTOMATION

- FIGURE 36 MINING AUTOMATION MARKET, BY OFFERING

- FIGURE 37 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 MINING AUTOMATION MARKET, BY EQUIPMENT

- FIGURE 39 MINING AUTOMATION MARKET, BY SOFTWARE

- FIGURE 40 MINING AUTOMATION MARKET, BY COMMUNICATION SYSTEM

- FIGURE 41 MINING AUTOMATION MARKET, BY TECHNIQUE

- FIGURE 42 UNDERGROUND MINING TECHNIQUE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 MINING AUTOMATION MARKET, BY WORKFLOW

- FIGURE 44 MINE MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 MINING AUTOMATION MARKET, BY APPLICATION

- FIGURE 46 METAL MINING APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 MINING AUTOMATION MARKET, BY REGION

- FIGURE 48 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MINING AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: MINING AUTOMATION MARKET SNAPSHOT

- FIGURE 50 US TO LEAD NORTH AMERICAN MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 51 EUROPE: MINING AUTOMATION MARKET SNAPSHOT

- FIGURE 52 SWEDEN TO REGISTER HIGHEST CAGR IN EUROPEAN MINING AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 53 ASIA PACIFIC: MINING AUTOMATION MARKET SNAPSHOT

- FIGURE 54 AUSTRALIA TO ACCOUNT FOR LARGEST SHARE OF MINING AUTOMATION MARKET IN ASIA PACIFIC IN 2030

- FIGURE 55 ROW: MINING AUTOMATION MARKET SNAPSHOT

- FIGURE 56 AFRICA TO REGISTER HIGHEST CAGR IN MINING AUTOMATION MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 57 MINING AUTOMATION MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 58 MINING AUTOMATION MARKET SHARE ANALYSIS, 2024

- FIGURE 59 PRODUCT COMPARISON

- FIGURE 60 COMPANY VALUATION

- FIGURE 61 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 62 MINING AUTOMATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 MINING AUTOMATION MARKET: COMPANY FOOTPRINT

- FIGURE 64 MINING AUTOMATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 CATERPILLAR: COMPANY SNAPSHOT

- FIGURE 66 KOMATSU: COMPANY SNAPSHOT

- FIGURE 67 SANDVIK AB: COMPANY SNAPSHOT

- FIGURE 68 EPIROC AB: COMPANY SNAPSHOT

- FIGURE 69 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 70 AB VOLVO: COMPANY SNAPSHOT

- FIGURE 71 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 72 LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH: COMPANY SNAPSHOT

- FIGURE 73 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 74 RPMGLOBAL HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 75 SIEMENS: COMPANY SNAPSHOT

- FIGURE 76 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 77 ABB: COMPANY SNAPSHOT