PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1816006

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1816006

Trade Surveillance System Market by Application (Surveillance & Analytics, Risk & Compliance, Reports & Monitoring, Case Management) and End User (Financial Institutions, Capital Market, Digital Asset Exchange) - Global Forecast to 2030

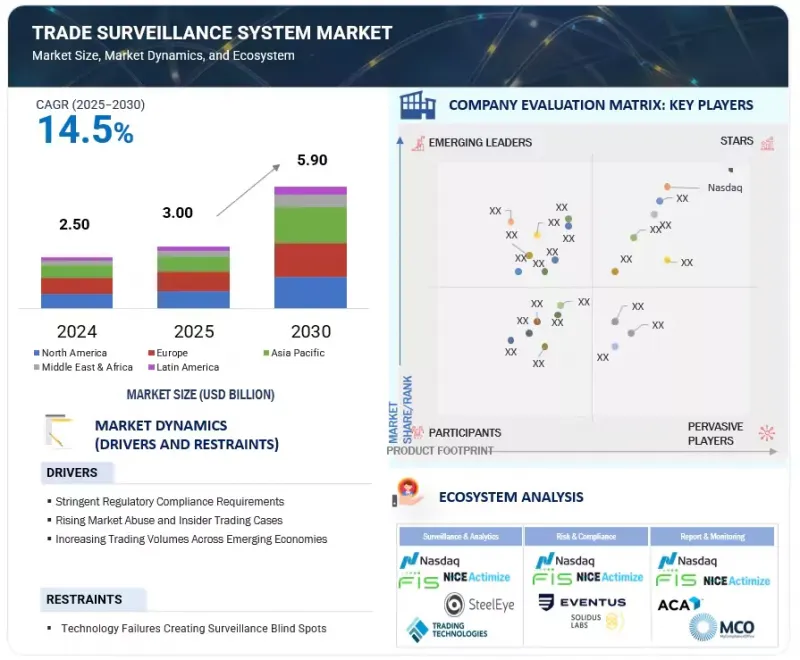

The global trade surveillance system market is expected to grow from USD 3.00 billion in 2025 to USD 5.90 billion by 2030 at a compounded annual growth rate (CAGR) of 14.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Offering, Applications, Deployment Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Increased regulatory focus and supportive policies are driving the adoption of trade surveillance systems globally. Regulators enforce stricter compliance standards to prevent market abuse, insider trading, and fraud, prompting financial institutions to invest in AI-driven monitoring, real-time analytics, and cloud-enabled platforms. These investments enhance transparency, operational efficiency, and risk management.

However, many firms still rely on legacy trading and monitoring systems, which pose significant challenges. Upgrading to modern trade surveillance platforms requires substantial time, technical expertise, and financial resources. As a result, the complexity and cost of integration act as key restraints for the trade surveillance system market.

"Based on the deployment mode, the on-premises segment is expected to hold the largest market during forecast period"

On-premises trade surveillance gives organizations direct ownership and control over their monitoring systems, offering a high degree of customization to meet specific operational, security, and compliance needs. By hosting the infrastructure internally, firms can design and configure the platform to align precisely with existing workflows, data management policies, and integration requirements. This level of control allows fine-tuning of surveillance rules, alert thresholds, and investigative processes to reflect unique trading patterns and regulatory obligations across jurisdictions.

Sensitive trading data is retained within the organization's network, minimizing exposure to third-party storage environments and enabling the application of proprietary cybersecurity measures. This proves beneficial for institutions handling highly confidential or market-sensitive information, where data sovereignty and privacy regulations demand strict oversight. On-premises deployment also allows organizations to dictate their own system maintenance, update schedules, and disaster recovery protocols, ensuring operational continuity despite external disruptions.

Performance optimization is another key benefit, as firms can allocate dedicated computing resources to process high volumes of trade data without dependency on external bandwidth or shared infrastructure. Integration with in-house legacy systems is often more seamless, reducing the complexity and risk associated with third-party connectivity. Vendors delivering on-premises solutions emphasize providing robust installation support, flexible configuration options, and ongoing technical assistance to ensure sustained performance and compliance alignment. In essence, on-premises trade surveillance combines operational independence with tailored capability, empowering firms to safeguard compliance while maintaining complete control over their technology environment.

"Based on the offering, the services segment is expected to grow at the highest CAGR during the forecast period"

Services are vital in ensuring trade surveillance solutions operate at peak efficiency, deliver consistent compliance outcomes, and adapt to evolving market and regulatory conditions. A well-structured services portfolio equips institutions with the guidance, technical expertise, and ongoing support necessary to extract maximum value from their surveillance investments.

Specialized training and consulting services help compliance teams understand detection methodologies, optimize alert configurations, and interpret system outputs effectively. Efficient deployment and integration services ensure seamless connectivity between the surveillance platform and existing infrastructure, including order management systems, data feeds, and reporting tools. Ongoing support and maintenance services safeguard system performance and reliability. Regular updates address evolving compliance requirements, enhance detection capabilities, and incorporate technological advancements such as machine learning improvements. Responsive technical support ensures that issues are resolved quickly, preventing gaps in monitoring coverage.

"Europe will account for the largest market share, while Asia Pacific will emerge as the fastest-growing market during the forecast period"

Europe is among the largest markets for trade surveillance systems, driven by stringent regulatory frameworks such as MiFID II, the Markets in Financial Instruments Directive, and ongoing enforcement by national financial authorities. Financial institutions in the United Kingdom, Germany, and France are investing heavily in AI-powered monitoring, real-time analytics, and integrated communication surveillance to ensure compliance and prevent market abuse. Well-established exchanges, advanced technological infrastructure, and strong regulatory oversight contribute to the region's leading position.

In contrast, the Asia Pacific region is the fastest-growing trade surveillance market, with a high CAGR driven by the rapid adoption of electronic trading, derivatives, and digital assets. Singapore, Hong Kong, Australia, and Japan prioritize modern surveillance technologies, including cloud-based platforms, AI-driven anomaly detection, and big data analytics, to address increasing market complexity and regulatory requirements. Expanding fintech ecosystems, rising investor awareness, and government initiatives to enhance market integrity fuel strong demand, making the Asia Pacific a high-potential growth region for trade surveillance solutions.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant trade surveillance system market companies were interviewed to gain insights into this market.

- By Company: Tier I: 40%, Tier II: 25%, and Tier III: 35%

- By Designation: C-Level Executives: 25%, Director Level: 37%, and Others: 38%

- By Region: North America: 34%, Europe: 30%, Asia Pacific: 18%, Rest of World: 18%

Some of the significant trade surveillance system market vendors are NiCE (US), Nasdaq (US), FIS (US), IPC Systems (US), and Nexi S.p.A (Italy), Crisil (India), ACA Group (US), Acuity Knowledge Partners (UK), LSEG (UK), TradingHub (UK), Trading Technologies (US), Ionixx Technologies ((US), KX (US), b-next (Germany), Eventus (US), BroadPeak Partners (US), Solidus Labs (US), SteelEye (US), OneMarketData (US), MyComplianceOffice (US), S3 (US), Trapets (Sweden), Trillium Surveyor (US), Scila (US), and Aquis Exchange (UK).

Research Coverage

The market report covered the trade surveillance system market across segments. We estimated the market size and growth potential for many segments based on solution type, service type, applications, deployment type, end user, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to Buy this Report

This research provides the most accurate revenue estimates for the entire trade surveillance industry and its subsegments, benefiting established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to position their companies better and develop effective go-to-market strategies. The report outlines key market drivers, restraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights into the following pointers:

- Analysis of key drivers (stringent regulatory compliance requirements), restraints (technology failures creating surveillance blind spots), opportunities (integration of AI and machine learning to reduce false favorable rates), and challenges (integration across disparate systems), influencing the growth of the trade surveillance system market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the trade surveillance system market

- Market Development: In-depth details regarding profitable markets, examining the global trade surveillance system market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new software and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the trade surveillance system industry, such as NiCE (US), Nasdaq (US), FIS (US), IPC Systems (US), Nexi S.p.A (Italy), Crisil (India), ACA Group (US), Acuity Knowledge Partners (UK), LSEG (UK), TradingHub (UK), Trading Technologies (US), Ionixx Technologies ((US), KX (US), b-next (Germany), Eventus (US), BroadPeak Partners (US), Solidus Labs (US), SteelEye (US), OneMarketData (US), MyComplianceOffice (US), S3 (US), Trapets (Sweden), Trillium Surveyor (US), Scila (US), and Aquis Exchange (UK)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF TRADE SURVEILLANCE SYSTEM MARKET

- 4.2 TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING (2025 VS 2030)

- 4.3 TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE (2025 VS 2030)

- 4.4 TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION (2025 VS 2030)

- 4.5 TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE (2025 VS 2030)

- 4.6 TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE (2025 VS 2030)

- 4.7 TRADE SURVEILLANCE SYSTEM MARKET, BY END USER (2025 VS 2030)

- 4.8 TRADE SURVEILLANCE SYSTEM MARKET: REGIONAL MIX

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent regulatory compliance requirements

- 5.2.1.2 Rising market abuse and insider trading cases

- 5.2.1.3 Increasing trading volumes across emerging nations

- 5.2.1.4 Increasing demand for 360-degree trade surveillance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technology failures creating surveillance blind spots

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surveillance for crypto and digital assets

- 5.2.3.2 Integration of AI and machine learning to reduce false positive rates

- 5.2.3.3 Growing inclination to adopt cloud-based deployments in trade surveillance

- 5.2.3.4 Demand for low-latency reporting and time-series databases

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration across disparate systems

- 5.2.4.2 Monitoring and mitigating risks from colocation-driven trade manipulation

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 BRINGING RISK INSIGHTS, MONITORING TOOLS, AND GROWTH TO KKPS WITH NASDAQ

- 5.3.2 AUSTRALIAN BANK TACKLES FINANCIAL FRAUD WITH AN INTEGRATED SURVEILLANCE SOLUTION

- 5.3.3 DMA ENHANCES COMPLIANCE CONTROL WITH STEELEYE

- 5.3.4 UPGRADING UK BANK TRADE SURVEILLANCE

- 5.3.5 FALCONX STRENGTHENS INSTITUTIONAL CRYPTO TRADING WITH SOLIDUS LABS PARTNERSHIP

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE, BY REGION, 2023-2025

- 5.6.2 INDICATIVE PRICING, BY KEY PLAYER, 2024

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 AI

- 5.8.1.2 Machine learning

- 5.8.1.3 Real-time processing

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Enterprise integration

- 5.8.2.2 Compliance management

- 5.8.2.3 Data analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Blockchain

- 5.8.3.2 Cloud infrastructure

- 5.8.3.3 Natural language processing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS, BY REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.9.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.9.3.1 General Data Protection Regulation

- 5.9.3.2 SEC Rule 17a-4

- 5.9.3.3 ISO/IEC 27001

- 5.9.3.4 System and Organization Controls 2 Type II

- 5.9.3.5 Financial Industry Regulatory Authority

- 5.9.3.6 Freedom of Information Act

- 5.9.3.7 Health Insurance Portability and Accountability Act

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 IMPACT OF AI/GEN AI ON TRADE SURVEILLANCE SYSTEM MARKET

- 5.15.1 CASE STUDIES

- 5.15.1.1 SIX combats market abuse with AI-based technology

- 5.15.2 VENDOR INITIATIVES

- 5.15.2.1 Revolutionizing Trade Surveillance with AI-Powered Precision and Contextual Intelligence

- 5.15.2.2 Driving Next-Gen Trade Surveillance with AI-Powered Precision and Proactive Risk Management

- 5.15.1 CASE STUDIES

- 5.16 TRADE SURVEILLANCE SYSTEM MARKET, BY ASSET CLASS

- 5.16.1 EQUITY SURVEILLANCE

- 5.16.2 FIXED INCOME MONITORING

- 5.16.3 DERIVATIVES TRACKING

- 5.16.4 COMMODITIES

- 5.16.5 FOREIGN EXCHANGE

- 5.16.6 DIGITAL ASSETS

6 TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 TRANSFORMING TRADE SURVEILLANCE INTO PROACTIVE, HIGH-PRECISION COMPLIANCE FRAMEWORKS

- 6.2.2 REAL-TIME MONITORING

- 6.2.2.1 Instant detection and response through real-time trade monitoring

- 6.2.3 HISTORICAL SURVEILLANCE

- 6.2.3.1 Detecting complex market misconduct through historical surveillance

- 6.3 SERVICES

- 6.3.1 TRAINING & CONSULTING

- 6.3.1.1 Strengthening compliance outcomes through training and consulting

- 6.3.2 DEPLOYMENT & INTEGRATION

- 6.3.2.1 Building a scalable framework for end-to-end trade surveillance

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Proactive performance management for reliable surveillance operations

- 6.3.1 TRAINING & CONSULTING

7 TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 7.2 SURVEILLANCE & ANALYTICS

- 7.2.1 DETECTING RISKS AND PATTERNS WITH INTELLIGENT TRADE SURVEILLANCE ANALYTICS

- 7.2.2 MARKET ABUSE DETECTION

- 7.2.3 ALERT GENERATION & PRIORITIZATION

- 7.2.4 BEHAVIORAL PATTERN DETECTION

- 7.3 RISK & COMPLIANCE

- 7.3.1 ENHANCING COMPLIANCE FRAMEWORKS FOR MARKET TRANSPARENCY

- 7.3.2 RISK SCORING MODELS

- 7.3.3 PRE-TRADE RISK CHECKS

- 7.3.4 TRADE RECONSTRUCTION

- 7.4 REPORTS & MONITORING

- 7.4.1 ENHANCING COMPLIANCE ACCURACY VIA INTELLIGENT ALERTS AND ONGOING RISK TRACKING

- 7.4.2 REGULATORY REPORTING AUTOMATION

- 7.4.3 CUSTOM REPORT GENERATION

- 7.4.4 REAL TIME ALERT & ESCALATION MANAGEMENT

- 7.5 CASE MANAGEMENT

- 7.5.1 STREAMLINING INVESTIGATIONS THROUGH INTELLIGENT CASE MANAGEMENT

- 7.5.2 CASE ASSIGNMENT & TRACKING

- 7.5.3 EVIDENCE ATTACHMENT & ANNOTATION

- 7.6 OTHER APPLICATIONS

8 TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT TYPE: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 8.2 CLOUD-BASED

- 8.2.1 ENHANCING TRADE SURVEILLANCE AGILITY AND COMPLIANCE WITH CLOUD-BASED SOLUTIONS

- 8.3 ON-PREMISES

- 8.3.1 ENSURING CONTROL, CUSTOMIZATION, AND SECURITY WITH ON-PREMISES TRADE SURVEILLANCE

9 TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 9.2 LARGE ENTERPRISES

- 9.2.1 ENABLING SCALABLE, COMPLIANT, AND INSIGHT-DRIVEN SURVEILLANCE FOR LARGE ENTERPRISES

- 9.3 SMES

- 9.3.1 SUPPORTING SMES IN MEETING REGULATORY DEMANDS WITHOUT HEAVY OVERHEADS

10 TRADE SURVEILLANCE SYSTEM MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USERS: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 10.2 FINANCIAL INSTITUTIONS

- 10.2.1 ACCURATE, REAL-TIME OVERSIGHT FOR COMPLEX TRADING ECOSYSTEMS

- 10.2.2 INVESTMENT BANKS

- 10.2.3 INSTITUTIONAL BROKERS

- 10.2.4 OTHER FINANCIAL INSTITUTIONS

- 10.3 CAPITAL MARKETS

- 10.3.1 DRIVING MARKET INTEGRITY THROUGH ADVANCED OVERSIGHT IN CAPITAL MARKETS

- 10.3.2 REGULATORS

- 10.3.3 MARKET CENTERS & STOCK EXCHANGES

- 10.3.4 OTHER CAPITAL MARKET END USERS

- 10.4 DIGITAL ASSET EXCHANGE

- 10.4.1 STRENGTHENING COMPLIANCE AND TRANSPARENCY IN DIGITAL ASSET ECOSYSTEM

- 10.4.2 BLOCKCHAIN

- 10.4.3 CRYPTOCURRENCY EXCHANGES

11 TRADE SURVEILLANCE SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Regulatory reforms drive advanced trade surveillance

- 11.2.4 CANADA

- 11.2.4.1 Optimizing compliance and market integrity through trade surveillance systems

- 11.3 EUROPE

- 11.3.1 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Data-driven regulation accelerates advanced trade surveillance in the UK

- 11.3.4 GERMANY

- 11.3.4.1 AI adoption and regulatory pressure driving trade surveillance transformation

- 11.3.5 FRANCE

- 11.3.5.1 Enhanced data transparency and multi-asset oversight

- 11.3.6 ITALY

- 11.3.6.1 Consob-driven AI and regulatory reforms accelerating Italy's trade surveillance market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Trade market shifts toward algorithmic trading and stricter oversight

- 11.4.4 JAPAN

- 11.4.4.1 Foreign investor dominance and crypto oversight reshaping Japan's trade surveillance

- 11.4.5 INDIA

- 11.4.5.1 Growing retail investor base reshaping India's market and strengthening trade surveillance imperatives

- 11.4.6 AUSTRALIA & NEW ZEALAND

- 11.4.6.1 Regulatory reforms and cross-venue complexity driving need for trade surveillance

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GCC COUNTRIES

- 11.5.3.1 KSA

- 11.5.3.1.1 Regulatory reforms driving market integrity

- 11.5.3.2 UAE

- 11.5.3.2.1 UAE's growth as a trading hub boosts surveillance adoption

- 11.5.3.3 Rest of GCC Countries

- 11.5.3.1 KSA

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Complex and fast-paced environment necessitates oversight

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Brazil reshaping market oversight amid surging complexity

- 11.6.4 MEXICO

- 11.6.4.1 Strengthening market integrity through advanced surveillance systems

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 REVENUE ANALYSIS, 2020-2024

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 BRAND/PRODUCT COMPARISON

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Offering footprint

- 12.5.5.4 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.7.1 COMPANY VALUATION

- 12.7.2 FINANCIAL METRICS

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 12.8.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 NICE

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 NASDAQ

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 FIS

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 IPC SYSTEMS

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 ACA GROUP

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 CRISIL

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Deals

- 13.2.7 NEXI S.P.A

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Deals

- 13.2.8 ACUITY KNOWLEDGE PARTNERS

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Deals

- 13.2.9 LSEG

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 TRADINGHUB

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Deals

- 13.2.1 NICE

- 13.3 OTHER PLAYERS

- 13.3.1 TRADING TECHNOLOGIES

- 13.3.2 IONIXX TECHNOLOGIES

- 13.3.3 KX

- 13.3.4 B-NEXT

- 13.3.5 MYCOMPLIANCEOFFICE

- 13.3.6 ONEMARKETDATA

- 13.3.7 EVENTUS

- 13.3.8 BROADPEAK PARTNERS

- 13.3.9 STEELEYE

- 13.3.10 SOLIDUS LABS

- 13.3.11 S3

- 13.3.12 TRAPETS

- 13.3.13 TRILLIUM SURVEYOR

- 13.3.14 SCILA

- 13.3.15 AQUIS EXCHANGE

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 ANTI-MONEY LAUNDERING (AML) MARKET

- 14.3 VIDEO SURVEILLANCE MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 TRADE SURVEILLANCE MARKET: FACTOR ANALYSIS

- TABLE 3 TRADE SURVEILLANCE MARKET: ASSUMPTIONS

- TABLE 4 TRADE SURVEILLANCE SYSTEM MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, YOY GROWTH %)

- TABLE 5 TRADE SURVEILLANCE SYSTEM MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, YOY GROWTH %)

- TABLE 6 TRADE SURVEILLANCE MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 7 INDICATIVE PRICING ANALYSIS OF TRADE SURVEILLANCE SOLUTIONS, BY KEY PLAYER, 2024

- TABLE 8 LIST OF MAJOR PATENTS, 2016-2022

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 TRADE SURVEILLANCE SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 16 TRADE SURVEILLANCE SYSTEM MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 18 TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 19 TRADE SURVEILLANCE SYSTEM SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 20 TRADE SURVEILLANCE SYSTEM SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 22 TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 23 TRADE SURVEILLANCE SYSTEM SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 TRADE SURVEILLANCE SYSTEM SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 TRAINING & CONSULTING SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 TRAINING & CONSULTING SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 32 TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 SURVEILLANCE & ANALYTICS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 SURVEILLANCE & ANALYTICS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 RISK & COMPLIANCE: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 RISK & COMPLIANCE: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 REPORTS & MONITORING: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 REPORTS & MONITORING: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 CASE MANAGEMENT: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 CASE MANAGEMENT: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER APPLICATIONS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 44 TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 45 CLOUD-BASED TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 CLOUD-BASED TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 ON-PREMISES TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 ON-PREMISES TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 50 TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 51 LARGE ENTERPRISES: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 LARGE ENTERPRISES: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 SMES: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 SMES: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 56 TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 57 FINANCIAL INSTITUTIONS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 FINANCIAL INSTITUTIONS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 CAPITAL MARKETS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 CAPITAL MARKETS: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 DIGITAL ASSET EXCHANGE: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 DIGITAL ASSET EXCHANGE: TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 TRADE SURVEILLANCE SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 US: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 80 US: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 81 CANADA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 82 CANADA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 84 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 86 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 88 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 90 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 92 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 94 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 96 EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 UK: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 98 UK: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 GERMANY: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 100 GERMANY: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 102 FRANCE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 103 ITALY: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 104 ITALY: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 105 REST OF EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 106 REST OF EUROPE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 CHINA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 122 CHINA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 123 JAPAN: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 124 JAPAN: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 125 INDIA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 126 INDIA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 127 ANZ: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 128 ANZ: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 GCC COUNTRIES: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 146 GCC COUNTRIES: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 147 GCC COUNTRIES: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 148 GCC COUNTRIES: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 KSA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 150 KSA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 151 UAE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 152 UAE: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 153 REST OF GCC COUNTRIES: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 154 REST OF GCC COUNTRIES: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 155 SOUTH AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 156 SOUTH AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST AND AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST AND AFRICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 160 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 162 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 163 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 164 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 166 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 168 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 170 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 172 LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 BRAZIL: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 174 BRAZIL: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 175 MEXICO: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 176 MEXICO: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: TRADE SURVEILLANCE SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 179 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 180 TRADE SURVEILLANCE SYSTEM MARKET: DEGREE OF COMPETITION, 2024

- TABLE 181 TRADE SURVEILLANCE SYSTEM MARKET: REGION FOOTPRINT

- TABLE 182 TRADE SURVEILLANCE SYSTEM MARKET: OFFERING FOOTPRINT

- TABLE 183 TRADE SURVEILLANCE SYSTEM MARKET: END-USER FOOTPRINT

- TABLE 184 TRADE SURVEILLANCE SYSTEM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 TRADE SURVEILLANCE SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 TRADE SURVEILLANCE SYSTEM MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, NOVEMBER 2023-MAY 2025

- TABLE 187 TRADE SURVEILLANCE SYSTEM MARKET: DEALS, APRIL 2025-JUNE 2025

- TABLE 188 NICE: COMPANY OVERVIEW

- TABLE 189 NICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 NICE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 191 NICE: DEALS

- TABLE 192 NASDAQ: COMPANY OVERVIEW

- TABLE 193 NASDAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 NASDAQ: PRODUCT ENHANCEMENTS

- TABLE 195 NASDAQ: DEALS

- TABLE 196 FIS: COMPANY OVERVIEW

- TABLE 197 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 FIS: PRODUCT LAUNCHES

- TABLE 199 FIS: DEALS

- TABLE 200 IPC SYSTEMS: COMPANY OVERVIEW

- TABLE 201 IPC SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 IPC SYSTEMS: PRODUCT LAUNCHES

- TABLE 203 IPC SYSTEMS: DEALS

- TABLE 204 ACA GROUP: COMPANY OVERVIEW

- TABLE 205 ACA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ACA GROUP: PRODUCT ENHANCEMENTS

- TABLE 207 ACA GROUP: DEALS

- TABLE 208 CRISIL: COMPANY OVERVIEW

- TABLE 209 CRISIL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 CRISIL: DEALS

- TABLE 211 NEXI S.P.A: COMPANY OVERVIEW

- TABLE 212 NEXI S.P.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 NEXI S.P.A: DEALS

- TABLE 214 ACUITY KNOWLEDGE PARTNERS: COMPANY OVERVIEW

- TABLE 215 ACUITY KNOWLEDGE PARTNERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 ACUITY KNOWLEDGE PARTNERS: DEALS

- TABLE 217 LSEG: COMPANY OVERVIEW

- TABLE 218 LSEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 LSEG: DEALS

- TABLE 220 TRADINGHUB: COMPANY OVERVIEW

- TABLE 221 TRADINGHUB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 TRADINGHUB: DEALS

- TABLE 223 ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 224 ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 225 ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 226 ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 227 VIDEO SURVEILLANCE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 228 VIDEO SURVEILLANCE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 229 VIDEO SURVEILLANCE MARKET, BY SYSTEM TYPE, 2020-2023 (USD MILLION)

- TABLE 230 VIDEO SURVEILLANCE MARKET, BY SYSTEM TYPE, 2024-2030 (USD MILLION)

List of Figures

- FIGURE 1 TRADE SURVEILLANCE SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 TRADE SURVEILLANCE SYSTEM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 TRADE SURVEILLANCE SYSTEM MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE-COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 TRADE SURVEILLANCE SYSTEM MARKET: DEMAND-SIDE APPROACH

- FIGURE 10 GLOBAL TRADE SURVEILLANCE SYSTEM MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 11 TRADE SURVEILLANCE SYSTEM MARKET: OVERVIEW OF FASTEST-GROWING SEGMENTS, 2025-2030

- FIGURE 12 TRADE SURVEILLANCE SYSTEM MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISING NEED FOR FINANCIAL CRIME DETECTION AND REGULATORY COMPLIANCE TO DRIVE MARKET GROWTH

- FIGURE 14 SOLUTIONS TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 DEPLOYMENT & INTEGRATION SERVICES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 SURVEILLANCE & ANALYTICS TO DOMINATE APPLICATIONS MARKET

- FIGURE 17 CLOUD-BASED SURVEILLANCE TO REGISTER GREATER MARKET SHARE

- FIGURE 18 LARGE ENTERPRISES SEGMENT TO DOMINATE ADOPTION TRENDS

- FIGURE 19 FINANCIAL INSTITUTIONS TO RETAIN HIGH MARKET SHARE TILL 2030

- FIGURE 20 ASIA PACIFIC TO EMERGE AS GROWTH HOTSPOT FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 21 TRADE SURVEILLANCE SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 TRADE SURVEILLANCE SYSTEM MARKET ECOSYSTEM

- FIGURE 23 TRADE SURVEILLANCE SYSTEMS MARKET: SUPPLY CHAIN

- FIGURE 24 AVERAGE SELLING PRICE OF TRADE SURVEILLANCE SOLUTIONS, BY REGION (2023-2025)

- FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2014-2024

- FIGURE 26 TRADE SURVEILLANCE SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 29 TRADE SURVEILLANCE SYSTEMS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 LEADING GLOBAL TRADE SURVEILLANCE SYSTEM MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUND, 2025

- FIGURE 31 IMPACT OF AI/GEN AI ON TRADE SURVEILLANCE SYSTEM MARKET

- FIGURE 32 SOLUTIONS SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 33 SURVEILLANCE & ANALYTICS TO HOLD LARGEST SHARE TILL 2030

- FIGURE 34 CLOUD SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 35 LARGE ENTERPRISES SEGMENT TO RETAIN GREATER MARKET SHARE

- FIGURE 36 FINANCIAL INSTITUTIONS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET BY 2030

- FIGURE 38 EUROPE: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 40 TRADE SURVEILLANCE SYSTEM MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 41 TRADE SURVEILLANCE SYSTEM: MARKET SHARE ANALYSIS, 2024

- FIGURE 42 TRADE SURVEILLANCE SYSTEM MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 43 TRADE SURVEILLANCE SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 TRADE SURVEILLANCE SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 45 TRADE SURVEILLANCE SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 COMPANY VALUATION OF KEY VENDORS

- FIGURE 47 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 NICE: COMPANY SNAPSHOT

- FIGURE 50 NASDAQ: COMPANY SNAPSHOT

- FIGURE 51 FIS: COMPANY SNAPSHOT

- FIGURE 52 CRISIL: COMPANY SNAPSHOT

- FIGURE 53 NEXI S.P.A: COMPANY SNAPSHOT

- FIGURE 54 LSEG: COMPANY SNAPSHOT