PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851862

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851862

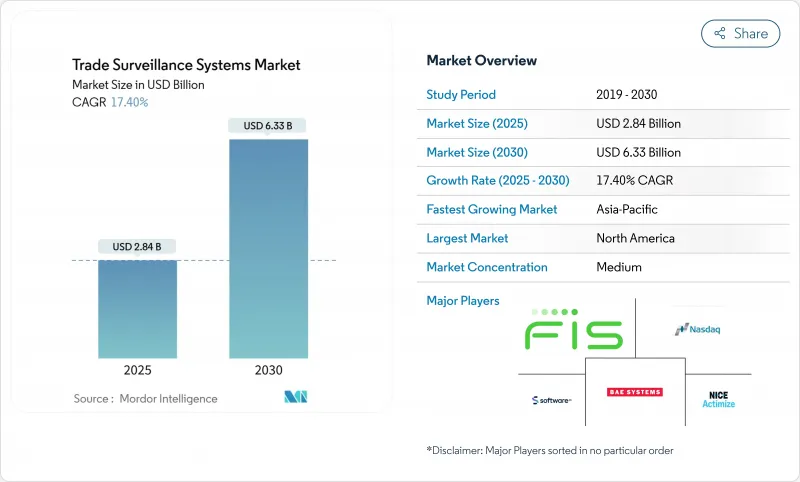

Trade Surveillance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Trade Surveillance Systems Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 6.33 billion by 2030, at a CAGR of 17.40% during the forecast period (2025-2030).

Heightened reporting mandates such as the United States' Consolidated Audit Trail (CAT) and Europe's evolving MiFID II framework are the core catalysts. Institutions now need near-real-time analytics that screen more than 150,000 transactions per second and spot suspicious patterns with 97.5% accuracy, pushing vendors toward high-performance, AI-driven architectures. Cloud deployment lowers upfront capital requirements, while hybrid models address data-sovereignty concerns. Rapid growth in crypto and tokenized assets adds complexity, forcing surveillance platforms to expand beyond traditional equities and derivatives.

Global Trade Surveillance Systems Market Trends and Insights

Rapid Expansion of Multi-Asset Electronic Trading Venues

High-frequency and algorithmic strategies now drive more than half of US equity volumes, creating surveillance blind spots that legacy rule sets struggle to cover. Firms must correlate order books across equities, fixed income, options, and commodities while accounting for millisecond latency gaps that enable cross-venue arbitrage. The shift from dealer models to fully automated order-driven venues in London illustrates how liquidity gains coexist with higher market-abuse risk. Vendors respond by unifying data feeds and embedding venue-specific calibrations that flag spoofing and layering across fragmented markets.

Mandatory CAT and Other Post-Trade Transparency Mandates

The CAT regime obliges US brokers to report every equity and option event under one schema. A March 2025 amendment trimmed personal data fields yet preserved unique identifiers, saving firms USD 12 million yearly while keeping regulators fully informed. Similar pressure builds in Europe, where MiFIR 3 introduces digital-token identifiers and new effective-date tags, compelling upgrades to handle richer payloads. Institutions, therefore, treat surveillance as foundational compliance infrastructure rather than optional risk tooling.

High Integration Complexity with Legacy Front-, Middle- and Back-Office Systems

Nearly 92% of UK institutions still rely on mainframes that batch-process trade files overnight, a cadence incompatible with second-by-second surveillance. Bridging message protocols, field taxonomies, and clock synchronisation requires multi-year roadmaps, often involving 50-plus internal teams. Disconnects cause incomplete data feeds and missed alerts, forcing parallel run periods where old and new platforms coexist until regulators certify data integrity.

Other drivers and restraints analyzed in the detailed report include:

- AI/ML-Powered Anomaly Detection Reducing False Positives and Cost

- Cloud-Native SaaS Delivery Lowering Total Cost of Ownership

- Shortage of Trade-Surveillance Data-Science Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions held 62.2% of the trade surveillance systems market share in 2024, underscoring the primacy of end-to-end platforms that integrate order, execution, and communications data. The segment benefits from high switching costs and continual rule updates, positioning vendors for recurring licensing revenue. The trade surveillance systems market size attached to solutions is projected to lift steadily as banks renew enterprise licences before key regulatory deadlines.

Services, though smaller, grow at 18.2% CAGR as institutions outsource model tuning and regulatory mapping. Managed-service contracts fill in-house talent gaps and provide 24-hour coverage across regions. Providers bundle implementation, behavioural-model calibration, and post-go-live testing, a package that mid-tier brokers consider more cost-effective than hiring specialised quants.

On-premise deployments retained a 54.6% share in 2024, reflecting data-sovereignty obligations and auditor preference for systems housed within firewalls. Yet the trade surveillance systems market size attributed to cloud offerings is set to rise fastest, expanding at 19.2% CAGR through 2030 as regulators issue clarifications that encrypted data may reside in approved jurisdictions.

Cloud providers offer elastic compute for back-testing millions of scenarios overnight, an ability that on-premise grids struggle to replicate without oversizing. Hybrid models gain traction because they keep personally identifiable information in local data centres while diverting de-identified trade records to cloud clusters for heavy analytics. Successful pilots in Singapore and Canada demonstrate that such architectures pass regulatory inspection when encryption keys remain client-controlled.

Trade Surveillance Systems Market is Segmented by Component (Solutions and Services), Deployment Mode (On-Premise and Cloud), Trading Type (Equities, Fixed Income, and More), End-User (Sell-Side Institutions, Buy-Side Institutions, and More), Organisation Size (Tier-1 Global Banks, Tier-2 and Mid-Sized Firms, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific records the fastest regional CAGR of 18.1%, moving from follower to front-runner in supervisory technology. Monetary Authority of Singapore pilots AI-based AML-CFT models that feed into trade-surveillance controls, creating reference implementations that other regulators monitor closely. Hong Kong mandates surveillance coverage for licensed virtual-asset operators, lifting spending among exchanges and prime brokers.

North America remains the largest contributor with a 34.16% share, driven by CAT and planned short-sale flags that take effect mid-2025. The United States benefits from vendor proximity to major equity and options venues, while Canada accelerates investment as cross-listing volumes climb.

Europe holds a mature adopter profile where MiFID II and EMIR already embed strict transaction reporting. Upcoming MiFIR 3 changes introduce digital-token identifiers that widen the regulatory perimeter. Continental banks upgrade systems to reconcile trade identifiers across business lines, and UK firms run parallel processes to manage post-Brexit divergence.

- NICE Ltd. (Actimize)

- Nasdaq Inc. (SMARTS)

- BAE Systems Digital Intelligence

- Fidelity National Information Services Inc. (FIS)

- Software AG

- Eventus Systems Inc.

- ACA Group

- TradingHub Group Ltd.

- eflow Ltd.

- B-next Group GmbH

- Solidus Labs Inc.

- Aquis Technologies Ltd.

- Trillium Management LLC

- SIA S.p.A.

- IBM Watson Financial RegTech

- S&P Global Market Intelligence (KYC/Surveillance)

- VoxSmart Ltd.

- OneMarketData LLC

- SteelEye Ltd.

- CranSoft (Scila AB)

- KX Systems (First Derivatives plc)

- ShieldFC Ltd.

- IPC Systems Inc. (Connexus)

- Trapets AB

- Corvil Analytics by Pico

- Digital Reasoning Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of global multi-asset electronic trading venues

- 4.2.2 Mandatory consolidated audit trail (CAT) and other post-trade transparency mandates

- 4.2.3 AI/ML-powered anomaly detection reduces false positives and compliance costs

- 4.2.4 Cloud-native SaaS delivery lowering total cost of ownership

- 4.2.5 Growing adoption of crypto and digital-asset trading by regulated institutions

- 4.2.6 Tokenisation of real-world assets creating new surveillance blind spots

- 4.3 Market Restraints

- 4.3.1 High integration complexity with legacy front-, middle- and back-office systems

- 4.3.2 Shortage of trade-surveillance data-science talent

- 4.3.3 Fragmented global rule sets leading to costly rule-mapping

- 4.3.4 Rising privacy regulations limiting holistic surveillance data pooling

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Trading Type

- 5.3.1 Equities

- 5.3.2 Fixed Income

- 5.3.3 Derivatives

- 5.3.4 Foreign Exchange

- 5.3.5 Commodities

- 5.3.6 Digital Assets

- 5.4 By End-user

- 5.4.1 Sell-Side Institutions

- 5.4.2 Buy-Side Institutions

- 5.4.3 Market Venues and Exchanges

- 5.4.4 Regulators and SROs

- 5.5 By Organisation Size

- 5.5.1 Tier-1 Global Banks

- 5.5.2 Tier-2 and Mid-Sized Firms

- 5.5.3 Small FIs and Broker-Dealers

- 5.5.4 FinTech and Crypto Exchanges

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Singapore

- 5.6.4.7 Malaysia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NICE Ltd. (Actimize)

- 6.4.2 Nasdaq Inc. (SMARTS)

- 6.4.3 BAE Systems Digital Intelligence

- 6.4.4 Fidelity National Information Services Inc. (FIS)

- 6.4.5 Software AG

- 6.4.6 Eventus Systems Inc.

- 6.4.7 ACA Group

- 6.4.8 TradingHub Group Ltd.

- 6.4.9 eflow Ltd.

- 6.4.10 B-next Group GmbH

- 6.4.11 Solidus Labs Inc.

- 6.4.12 Aquis Technologies Ltd.

- 6.4.13 Trillium Management LLC

- 6.4.14 SIA S.p.A.

- 6.4.15 IBM Watson Financial RegTech

- 6.4.16 S&P Global Market Intelligence (KYC/Surveillance)

- 6.4.17 VoxSmart Ltd.

- 6.4.18 OneMarketData LLC

- 6.4.19 SteelEye Ltd.

- 6.4.20 CranSoft (Scila AB)

- 6.4.21 KX Systems (First Derivatives plc)

- 6.4.22 ShieldFC Ltd.

- 6.4.23 IPC Systems Inc. (Connexus)

- 6.4.24 Trapets AB

- 6.4.25 Corvil Analytics by Pico

- 6.4.26 Digital Reasoning Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment