PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1819097

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1819097

Rapid Food Safety Testing Market by Target Tested, Food Tested, Technology, End User, and Region - Global Forecast to 2030

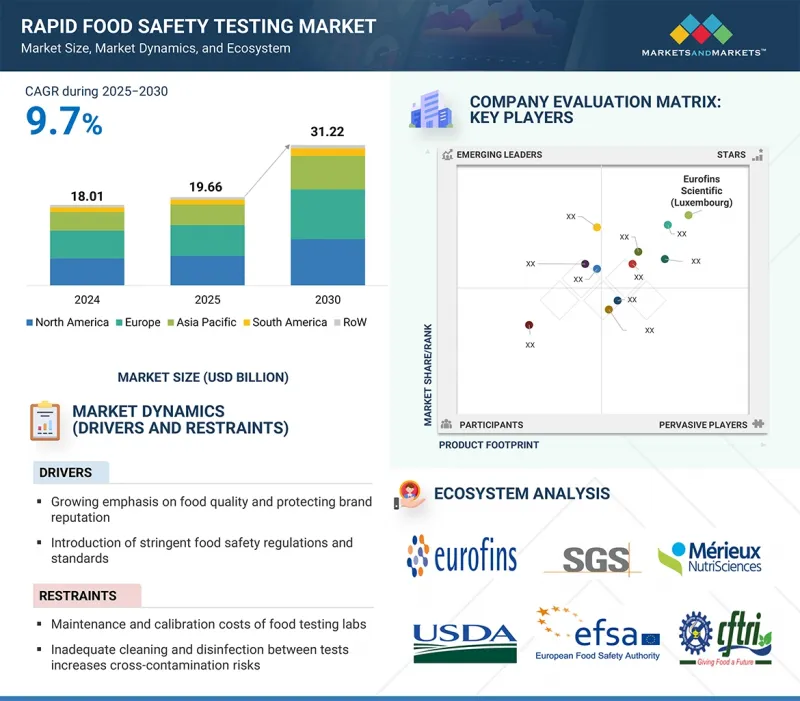

The global market for rapid food safety testing is estimated to be valued at USD 19.66 billion in 2025 and is projected to reach USD 31.22 billion by 2030, at a CAGR of 9.7% during the forecast period. The rising demand for convenience and packaged food products is a major driver of the rapid food safety testing market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Units) |

| Segments | By Target Tested, Food Tested, Technology, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Packaged foods, such as ready-to-eat meals, frozen products, dairy, meat, and snacks, undergo extensive processing and longer supply chains, increasing the risk of contamination by pathogens, allergens, or chemical residues. Consumers are highly conscious of food safety, pushing manufacturers to adopt rapid testing methods like PCR, ELISA, and chromatography to ensure product safety before reaching shelves. For example, Nestle and PepsiCo rely on rapid microbial and allergen testing to meet strict global food safety standards. Similarly, Tyson Foods uses rapid pathogen detection for meat products, ensuring compliance and consumer trust. This demand boosts the adoption of rapid testing technologies worldwide.

"Immunoassay-based testing segment is expected to hold the third-largest share by technology of the rapid food safety testing market."

Immunoassay-based testing is a rapid food safety testing method that uses antigen-antibody reactions to detect contaminants, pathogens, toxins, or allergens in food. Its main types include Enzyme-Linked Immunosorbent Assay (ELISA), Lateral Flow Assay (LFA), and Radioimmunoassay (RIA). In the rapid food safety testing market, it enables quick, cost-effective, and highly sensitive detection. It is widely applied to dairy, meat, seafood, grains, nuts, and processed foods. Immunoassays target pathogens like Salmonella, Listeria, E. coli, allergens (peanuts, gluten, soy), toxins, and mycotoxins. Their versatility and speed make them critical for ensuring compliance with safety standards and protecting consumer health.

"The meat, poultry & seafood segment holds a significant share in the food tested segment of the rapid food safety testing market."

Meat, poultry, and seafood are animal-derived food products consumed globally for their high protein and nutrient content. Meat includes beef, pork, and lamb; poultry covers chicken, turkey, and duck; seafoods comprise fish, shellfish, and crustaceans. These foods are highly perishable and prone to contamination by pathogens (Salmonella, Listeria, E. coli), toxins, and allergens. Rapid food safety testing technologies such as PCR-based testing, immunoassays (ELISA, LFA), chromatography, spectrometry, and convenience-based tests are widely used in meat, poultry & seafood testing. With rising global demand for protein-rich diets and processed meat products, consumption is increasing, creating significant opportunities for rapid food safety testing to ensure safety, compliance, and consumer protection.

Asia Pacific holds the third-largest share in the global rapid food safety testing market.

The Asia Pacific rapid food safety testing market is expanding rapidly, driven by growing concerns over foodborne illnesses, rising consumption of packaged and processed foods, and stricter regulatory standards. Countries such as China, India, Japan, and Australia are witnessing increasing demand for advanced testing methods like PCR, immunoassays, and chromatography to ensure food safety. The growing middle-class population and urbanization further boost demand for safe and high-quality food. A recent development occurred in 2025 when SGS launched its new next-generation rapid microbiological testing platform in Singapore, enhancing detection speed and accuracy. Key regulatory bodies include Food Safety and Standards Authority of India (FSSAI) (India), National Medical Products Administration (NMPA) (China), Ministry of Health, Labour and Welfare (MHLW) (Japan), and Food Standards Australia New Zealand (FSANZ) (Australia-New Zealand), ensuring compliance, safety, and consumer protection.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the rapid food safety testing market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), Merieux NutriSciences (US), TUV SUD (Germany), AsureQuality (New Zealand), Neogen Corporation (US), QIAGEN (Netherlands), TUV NORD GROUP (Germany), Microbac Laboratories (US), Hill Labs (New Zealand), FoodChain ID (US), Romer Labs Division Holding (Austria), and Promega Corporation (US).

Other players include Certified Group (US), Symbio Labs (Australia), AGROLAB (Germany), OMIC USA Inc. (US), AccreditedTestLabs (US), Campden BRI (UK), Mitra S.K. Private Limited (India), Element Material Technology (UK), Daane Labs (US), and Cotecna (Switzerland).

Research Coverage:

This research report categorizes the rapid food safety testing market by target tested (pathogens, GMOs, pesticides, mycotoxins, allergens, heavy metals, other targets tested), food tested (meat, poultry & seafood, dairy products, processed foods, fruits & vegetables, cereals & grains, other food tested), technology (convenience-based testing, PCR-based testing, immunoassay-based testing, chromatography & spectrometry, and other technologies), end user (food manufacturers, food service & catering companies, retail & supermarkets, other end users), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the rapid food safety testing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, service launches, mergers and acquisitions, and recent developments associated with the rapid food safety testing market. Competitive analysis of upcoming startups in the rapid food safety testing market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall rapid food safety testing and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Growing emphasis on food quality and protecting brand reputation), restraints (Maintenance and calibration costs of food testing labs), opportunities (Integration of AI and machine learning for predictive food safety analytics), and challenges (High cost associated with the procurement of food safety testing equipment).

- Service Launch/Innovation: Detailed insights on research & development activities and service launches in the rapid food safety testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the rapid food safety testing market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the rapid food safety testing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), Merieux NutriSciences (US), and other players in the rapid food safety testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 RAPID FOOD SAFETY TESTING MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 MARKET BREAKUP AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAPID FOOD SAFETY TESTING MARKET

- 4.2 RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY

- 4.3 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED AND COUNTRY

- 4.4 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED

- 4.5 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED

- 4.6 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL ECONOMIC OUTLOOK: RISING FOODBORNE DISEASE CASES DRIVE MARKET

- 5.2.2 GLOBAL ECONOMIC OUTLOOK: RISING TRADE OPPORTUNITIES

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing emphasis on food quality and protecting brand reputation

- 5.3.1.2 Introduction of stringent food safety regulations and standards

- 5.3.1.3 Rise in food recalls

- 5.3.1.4 Increase in demand for convenience and packaged food products

- 5.3.2 RESTRAINTS

- 5.3.2.1 Maintenance and calibration costs of food testing labs

- 5.3.2.2 Inadequate cleaning and disinfection between tests increase cross-contamination risks

- 5.3.2.3 Lack of coordination between market stakeholders and improper enforcement of regulatory laws and supporting infrastructure

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Integration of AI and ML for predictive food safety analytics

- 5.3.3.2 Government-funded programs to modernize food safety infrastructure

- 5.3.3.3 Increasing focus on importance of food safety

- 5.3.4 CHALLENGES

- 5.3.4.1 High costs associated with procurement of food safety testing equipment

- 5.3.4.2 Rapid tests frequently experience delays in availability for newly identified pathogens

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI ON FOOD SAFETY TESTING MARKET

- 5.4.1 USE OF GEN AI IN FOOD SAFETY TESTING MARKET

- 5.4.2 CASE STUDY ANALYSIS

- 5.4.2.1 AI-enabled food plants to conduct rapid, real-time contaminant testing directly on-site

- 5.4.2.2 TAAG Xpert Assistant, a web-based AI-driven platform, reduces contamination detection time

- 5.4.3 IMPACT ON RAPID FOOD SAFETY TESTING MARKET

- 5.4.4 ADJACENT ECOSYSTEMS WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFFS-RAPID FOOD SAFETY TESTING MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 DISRUPTION IN FOOD SAFETY TESTING INDUSTRY

- 6.2.4 PRICE IMPACT ANALYSIS

- 6.2.5 IMPACT ON COUNTRY/REGION

- 6.2.5.1 US

- 6.2.5.2 Europe

- 6.2.5.3 Asia Pacific

- 6.2.6 IMPACT ON END-USE INDUSTRIES

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 SOURCING

- 6.3.3 DATA ANALYSIS & INTERPRETATION

- 6.3.4 CONSULTATION & ADVISORY SERVICE

- 6.3.5 COLLABORATION & NETWORKING

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 3822)

- 6.4.2 EXPORT SCENARIO (HS CODE 3822)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 PCR

- 6.5.1.2 Immunoassay

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Sample preparation

- 6.5.2.2 Data processing and analytics

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Food processing automation & control

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 North America

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 DRIVING TRUST THROUGH SPEED AND ACCURACY: SGS'S JOURNEY TO CII FOOD SAFETY RECOGNITION

- 6.14.2 EUROFINS ELEVATES FRUIT SAFETY: RAPID AND RELIABLE PATULIN TESTING

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED

- 7.1 INTRODUCTION

- 7.2 PATHOGENS

- 7.2.1 RISING FOOD SAFETY CONCERNS AND DEMAND FOR ACCURATE PATHOGEN DETECTION TO DRIVE MARKET

- 7.2.2 E. COLI

- 7.2.3 SALMONELLA

- 7.2.4 CAMPYLOBACTER

- 7.2.5 LISTERIA

- 7.2.6 OTHER PATHOGENS

- 7.3 GMOS

- 7.3.1 ENSURING FOOD SAFETY AND COMPLIANCE WITH RAPID GMO TESTING TO DRIVE MARKET

- 7.4 PESTICIDES

- 7.4.1 ENSURING COMPLIANCE AND SAFETY THROUGH ADVANCED PESTICIDE TESTING TO DRIVE MARKET

- 7.5 MYCOTOXINS

- 7.5.1 ENHANCING FOOD SAFETY THROUGH RAPID MYCOTOXIN DETECTION TO DRIVE MARKET

- 7.6 ALLERGENS

- 7.6.1 SAFEGUARDING FOOD PRODUCTS FROM HIDDEN ALLERGENS TO DRIVE MARKET

- 7.7 HEAVY METALS

- 7.7.1 CONCERNS OVER RISING HEAVY METAL CONTAMINATION AND INCREASED REGULATORY ENFORCEMENT TO DRIVE DEMAND FOR FOOD HEAVY METALS TESTING

- 7.8 OTHER TARGETS TESTED

8 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED

- 8.1 INTRODUCTION

- 8.2 MEAT, POULTRY, AND SEAFOOD

- 8.2.1 ADVANCED PATHOGEN AND CONTAMINANT DETECTION IN MEAT, POULTRY, AND SEAFOOD TO DRIVE MARKET

- 8.3 DAIRY PRODUCTS

- 8.3.1 STRINGENT REGULATIONS, TECHNOLOGICAL ADVANCEMENTS, AND RISING DAIRY SAFETY CONCERNS TO BOOST MARKET GROWTH

- 8.4 PROCESSED FOODS

- 8.4.1 EXPANDING PROCESSED FOOD CONSUMPTION AND TECHNOLOGICAL ADVANCEMENTS IN RAPID FOOD SAFETY TESTING TO DRIVE MARKET

- 8.5 FRUITS & VEGETABLES

- 8.5.1 STRINGENT SAFETY TESTING OF FRUITS & VEGETABLES AGAINST PESTICIDES AND CONTAMINANTS TO DRIVE MARKET

- 8.6 CEREALS & GRAINS

- 8.6.1 KEY ROLE OF LEADING FOOD TESTING COMPANIES IN ENSURING CEREAL & GRAIN SAFETY TO DRIVE MARKET

- 8.7 OTHER FOODS TESTED

9 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 CONVENIENCE-BASED TESTING

- 9.2.1 EXPANDING USER-FRIENDLY RAPID FOOD SAFETY TESTING TECHNOLOGIES TO DRIVE MARKET

- 9.3 PCR-BASED TESTING

- 9.3.1 OPTIMIZING FOOD SAFETY MONITORING ACROSS DIVERSE FOOD TYPES TO DRIVE MARKET

- 9.4 IMMUNOASSAY-BASED TESTING

- 9.4.1 IMMUNOASSAY-BASED RAPID FOOD SAFETY TESTING TO WITNESS GROWTH AS DEMAND RISES FOR QUICK AND ACCURATE FOOD HAZARD DETECTION

- 9.5 CHROMATOGRAPHY & SPECTROMETRY

- 9.5.1 CUTTING-EDGE CHROMATOGRAPHY & SPECTROMETRY SOLUTIONS TO DRIVE MARKET

- 9.6 OTHER TECHNOLOGIES

10 END USERS OF RAPID FOOD SAFETY TESTING SOLUTIONS

- 10.1 INTRODUCTION

- 10.2 FOOD MANUFACTURERS

- 10.3 FOOD SERVICE & CATERING COMPANIES

- 10.4 RETAIL & SUPERMARKETS

- 10.5 OTHER END USERS

11 RAPID FOOD SAFETY TESTING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Rising concern over USDA food recalls linked to contamination to drive market

- 11.2.2 CANADA

- 11.2.2.1 Stringent export regulations on food safety to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Rising incidences of foodborne diseases to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Enforcing stringent EU food safety norms to drive market

- 11.3.2 UK

- 11.3.2.1 Growing public health concerns from food poisoning incidences to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Rising consumption of dairy products to drive market

- 11.3.4 ITALY

- 11.3.4.1 Increasing trade resulting in growing requirement for food safety testing to drive market

- 11.3.5 POLAND

- 11.3.5.1 Stringent food safety regulations to drive market

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Stringent government regulations and policies to strengthen growth prospects

- 11.4.2 INDIA

- 11.4.2.1 Adoption of advanced technologies and analytical instruments in food laboratories to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Push for global standards to boost rapid food safety testing adoption

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Rising investments from global companies to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Need to ensure food safety and protect public health and growing concern about dangers of foodborne illnesses to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Strengthening public health protection and ensuring food supply chain safety to drive market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Growing dependence on food imports to drive market

- 11.6.2 AFRICA

- 11.6.2.1 Increasing foodborne-related cases to spur demand for rapid food safety testing

- 11.6.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Regional footprint

- 12.5.5.3 Target tested footprint

- 12.5.5.4 Food tested footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 12.6.5.1 Detailed list of key start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/SERVICE COMPARATIVE ANALYSIS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 SERVICE LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EUROFINS SCIENTIFIC

- 13.1.1.1 Business overview

- 13.1.1.2 Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- 13.1.2.1 Business overview

- 13.1.2.2 Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Expansions

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 ALS

- 13.1.3.1 Business overview

- 13.1.3.2 Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Service launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 INTERTEK GROUP PLC

- 13.1.4.1 Business overview

- 13.1.4.2 Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Expansions

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 MERIEUX NUTRISCIENCES CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 TUV SUD

- 13.1.6.1 Business overview

- 13.1.6.2 Services offered

- 13.1.6.3 MnM view

- 13.1.7 ASUREQUALITY

- 13.1.7.1 Business overview

- 13.1.7.2 Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.7.3.2 Deals

- 13.1.7.4 MnM view

- 13.1.8 TENTAMUS

- 13.1.8.1 Business overview

- 13.1.8.2 Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Service launches

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.9 ALFA CHEMISTRY

- 13.1.9.1 Business overview

- 13.1.9.2 Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Service launches

- 13.1.9.4 MnM view

- 13.1.10 TUV NORD GROUP

- 13.1.10.1 Business overview

- 13.1.10.2 Services offered

- 13.1.10.3 MnM view

- 13.1.11 MICROBAC LABORATORIES

- 13.1.11.1 Business overview

- 13.1.11.2 Services offered

- 13.1.11.3 MnM view

- 13.1.12 HILL LABS

- 13.1.12.1 Business overview

- 13.1.12.2 Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Expansions

- 13.1.12.4 MnM view

- 13.1.13 FOODCHAIN ID

- 13.1.13.1 Business overview

- 13.1.13.2 Services offered

- 13.1.13.3 MnM view

- 13.1.14 ROMER LABS DIVISION HOLDING

- 13.1.14.1 Business overview

- 13.1.14.2 Services offered

- 13.1.14.3 MnM view

- 13.1.15 AGQ LABS

- 13.1.15.1 Business overview

- 13.1.15.2 Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Expansions

- 13.1.15.3.2 Deals

- 13.1.15.4 MnM view

- 13.1.1 EUROFINS SCIENTIFIC

- 13.2 OTHER PLAYERS

- 13.2.1 CERTIFIED GROUP

- 13.2.1.1 Business overview

- 13.2.1.2 Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Expansions

- 13.2.1.4 MnM view

- 13.2.2 SYMBIO LABS

- 13.2.2.1 Business overview

- 13.2.2.2 Services offered

- 13.2.2.3 MnM view

- 13.2.3 AGROLAB

- 13.2.3.1 Business overview

- 13.2.3.2 Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.3.2 Expansions

- 13.2.3.4 MnM view

- 13.2.4 OMIC USA INC.

- 13.2.4.1 Business overview

- 13.2.4.2 Services offered

- 13.2.4.3 MnM view

- 13.2.5 FARE LABS

- 13.2.5.1 Business overview

- 13.2.5.2 Services offered

- 13.2.5.3 MnM view

- 13.2.6 CAMPDEN BRI

- 13.2.7 MITRA S.K. PRIVATE LIMITED

- 13.2.8 ELEMENT MATERIALS TECHNOLOGY

- 13.2.9 AMLAB SERVICES PTE. LTD.

- 13.2.10 COTECNA

- 13.2.1 CERTIFIED GROUP

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 FOOD SAFETY TESTING MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 FOOD PATHOGEN TESTING MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 2 RAPID FOOD SAFETY TESTING MARKET SHARE SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 3 FOODBORNE OUTBREAKS IN US, 2021-2023

- TABLE 4 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 5 EXPECTED IMPACT LEVEL ON TARGET TESTING MATERIALS WITH RELEVANT HS CODES DUE TO 2025 US TARIFF IMPACT

- TABLE 6 EXPECTED 2025 US TARIFFS' IMPACT ON END-USE INDUSTRIES: RAPID FOOD SAFETY TESTING MARKET

- TABLE 7 IMPORT SCENARIO FOR HS CODE 3822-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (TON)

- TABLE 8 EXPORT SCENARIO OF HS CODE-3822-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (TON)

- TABLE 9 AVERAGE SELLING PRICE OF RAPID FOOD SAFETY TESTING, BY KEY PLAYER, 2024 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE TREND OF RAPID FOOD SAFETY TESTING, BY REGION, 2021-2024 (USD/KG)

- TABLE 11 ROLES OF PLAYERS IN RAPID FOOD SAFETY TESTING MARKET ECOSYSTEM

- TABLE 12 LIST OF MAJOR PATENTS PERTAINING TO RAPID FOOD SAFETY TESTING MARKET, 2018-2025

- TABLE 13 RAPID FOOD SAFETY TESTING MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 IMPACT OF PORTER'S FIVE FORCES ON RAPID FOOD SAFETY TESTING MARKET

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP-THREE TARGET TESTED TYPES

- TABLE 21 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS FOR TOP-THREE TARGET TESTED TYPES

- TABLE 22 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 23 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 24 PATHOGENS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 PATHOGENS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 PATHOGENS: RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2021-2024 (USD MILLION)

- TABLE 27 PATHOGENS: RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2025-2030 (USD MILLION)

- TABLE 28 E. COLI: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 E. COLI: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 SALMONELLA: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 SALMONELLA: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 CAMPYLOBACTER: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 CAMPYLOBACTER: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 LISTERIA: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 LISTERIA: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 OTHER PATHOGENS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 OTHER PATHOGENS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 GMOS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 GMOS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 PESTICIDES: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 PESTICIDES: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 MYCOTOXINS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 MYCOTOXINS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 ALLERGENS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 ALLERGENS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 HEAVY METALS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 HEAVY METALS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 OTHER TARGETS TESTED: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 OTHER TARGETS TESTED: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2021-2024 (USD MILLION)

- TABLE 51 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025-2030 (USD MILLION)

- TABLE 52 MEAT, POULTRY, AND SEAFOOD: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 MEAT, POULTRY, AND SEAFOOD: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 DAIRY PRODUCTS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 DAIRY PRODUCTS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 PROCESSED FOODS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 PROCESSED FOODS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 FRUITS & VEGETABLES: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 FRUITS & VEGETABLES: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 CEREALS & GRAINS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 CEREALS & GRAINS: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 OTHER FOODS TESTED: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 OTHER FOODS TESTED: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 65 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 66 CONVENIENCE-BASED TESTING: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 CONVENIENCE-BASED TESTING: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 PCR-BASED TESTING: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 PCR-BASED TESTING: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 IMMUNOASSAY-BASED TESTING: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 IMMUNOASSAY-BASED TESTING: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 CHROMATOGRAPHY & SPECTROMETRY: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 CHROMATOGRAPHY & SPECTROMETRY: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 OTHER TECHNOLOGIES: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 OTHER TECHNOLOGIES: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 79 RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 80 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2021-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 90 US: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 91 US: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 92 CANADA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 93 CANADA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 94 MEXICO: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 95 MEXICO: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2021-2024 (USD MILLION)

- TABLE 101 EUROPE: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2021-2024 (USD MILLION)

- TABLE 103 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 105 EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 106 GERMANY: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 107 GERMANY: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 108 UK: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 109 UK: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 110 FRANCE: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 111 FRANCE: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 112 ITALY: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 113 ITALY: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 114 POLAND: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 115 POLAND: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 116 REST OF EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 117 REST OF EUROPE: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2021-2024 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2021-2024 (USD MILLION)

- TABLE 125 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 128 CHINA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 129 CHINA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 130 INDIA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 131 INDIA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 132 JAPAN: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 133 JAPAN: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 134 AUSTRALIA AND NEW ZEALAND: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 135 AUSTRALIA AND NEW ZEALAND: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 141 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 142 SOUTH AMERICA: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2021-2024 (USD MILLION)

- TABLE 143 SOUTH AMERICA: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2025-2030 (USD MILLION)

- TABLE 144 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2021-2024 (USD MILLION)

- TABLE 145 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 147 SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 148 BRAZIL: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 149 BRAZIL: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 150 ARGENTINA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 151 ARGENTINA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 154 ROW: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 155 ROW: RAPID FOOD SAFETY TESTING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 156 ROW: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 157 ROW: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 158 ROW: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2021-2024 (USD MILLION)

- TABLE 159 ROW: PATHOGEN RAPID FOOD SAFETY TESTING MARKET, BY SUBSEGMENT, 2025-2030 (USD MILLION)

- TABLE 160 ROW: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2021-2024 (USD MILLION)

- TABLE 161 ROW: RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025-2030 (USD MILLION)

- TABLE 162 ROW: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 163 ROW: RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 166 AFRICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2021-2024 (USD MILLION)

- TABLE 167 AFRICA: RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025-2030 (USD MILLION)

- TABLE 168 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN RAPID FOOD SAFETY TESTING MARKET, JANUARY 2021-AUGUST 2025

- TABLE 169 RAPID FOOD SAFETY TESTING MARKET: DEGREE OF COMPETITION

- TABLE 170 RAPID FOOD SAFETY TESTING MARKET: REGIONAL FOOTPRINT

- TABLE 171 RAPID FOOD SAFETY TESTING MARKET: TARGET TESTED FOOTPRINT

- TABLE 172 RAPID FOOD SAFETY TESTING MARKET: FOOD TESTED FOOTPRINT

- TABLE 173 RAPID FOOD SAFETY TESTING MARKET: KEY START-UPS/SMES

- TABLE 174 RAPID FOOD SAFETY TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, 2024

- TABLE 175 RAPID FOOD SAFETY TESTING MARKET: SERVICE LAUNCHES, JANUARY 2021-AUGUST 2025

- TABLE 176 RAPID FOOD SAFETY TESTING MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 177 RAPID FOOD SAFETY TESTING MARKET: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 178 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 179 EUROFINS SCIENTIFIC: SERVICES OFFERED

- TABLE 180 EUROFINS SCIENTIFIC: DEALS

- TABLE 181 SGS SOCIETE GENERALE DE SURVEILLANCE SA: COMPANY OVERVIEW

- TABLE 182 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: SERVICES OFFERED

- TABLE 183 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: EXPANSIONS

- TABLE 184 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: DEALS

- TABLE 185 ALS: COMPANY OVERVIEW

- TABLE 186 ALS: SERVICES OFFERED

- TABLE 187 ALS: SERVICE LAUNCHES

- TABLE 188 ALS: DEALS

- TABLE 189 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 190 INTERTEK GROUP PLC: SERVICES OFFERED

- TABLE 191 INTERTEK GROUP PLC: EXPANSIONS

- TABLE 192 INTERTEK GROUP PLC: DEALS

- TABLE 193 MERIEUX NUTRISCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 194 MERIEUX NUTRISCIENCES CORPORATION: SERVICES OFFERED

- TABLE 195 MERIEUX NUTRISCIENCES CORPORATION: DEALS

- TABLE 196 TUV SUD: COMPANY OVERVIEW

- TABLE 197 TUV SUD: SERVICES OFFERED

- TABLE 198 ASUREQUALITY: COMPANY OVERVIEW

- TABLE 199 ASUREQUALITY: SERVICES OFFERED

- TABLE 200 ASUREQUALITY: EXPANSIONS

- TABLE 201 ASUREQUALITY: DEALS

- TABLE 202 TENTAMUS: COMPANY OVERVIEW

- TABLE 203 TENTAMUS: SERVICES OFFERED

- TABLE 204 TENTAMUS: SERVICE LAUNCHES

- TABLE 205 TENTAMUS: EXPANSIONS

- TABLE 206 ALFA CHEMISTRY: COMPANY OVERVIEW

- TABLE 207 ALFA CHEMISTRY: SERVICES OFFERED

- TABLE 208 ALFA CHEMISTRY: SERVICE LAUNCHES

- TABLE 209 TUV NORD GROUP: COMPANY OVERVIEW

- TABLE 210 TUV NORD GROUP: SERVICES OFFERED

- TABLE 211 MICROBAC LABORATORIES: COMPANY OVERVIEW

- TABLE 212 MICROBAC LABORATORIES: SERVICES OFFERED

- TABLE 213 HILL LABS: COMPANY OVERVIEW

- TABLE 214 HILL LABS: SERVICES OFFERED

- TABLE 215 HILL LABS: EXPANSIONS

- TABLE 216 FOODCHAIN ID: COMPANY OVERVIEW

- TABLE 217 FOODCHAIN ID: SERVICES OFFERED

- TABLE 218 ROMER LABS DIVISION HOLDING: COMPANY OVERVIEW

- TABLE 219 ROMER LABS DIVISION HOLDING: SERVICES OFFERED

- TABLE 220 AGQ LABS: COMPANY OVERVIEW

- TABLE 221 AGQ LABS: SERVICES OFFERED

- TABLE 222 AGQ LABS: EXPANSIONS

- TABLE 223 AGQ LABS: DEALS

- TABLE 224 CERTIFIED GROUP: COMPANY OVERVIEW

- TABLE 225 CERTIFIED GROUP: SERVICES OFFERED

- TABLE 226 CERTIFIED GROUP: EXPANSIONS

- TABLE 227 SYMBIO LABS: COMPANY OVERVIEW

- TABLE 228 SYMBIO LABS: SERVICES OFFERED

- TABLE 229 AGROLAB: COMPANY OVERVIEW

- TABLE 230 AGROLAB: SERVICES OFFERED

- TABLE 231 AGROLAB: DEALS

- TABLE 232 AGROLAB: EXPANSIONS

- TABLE 233 OMIC USA INC.: COMPANY OVERVIEW

- TABLE 234 OMIC USA INC.: SERVICES OFFERED

- TABLE 235 FARE LABS: COMPANY OVERVIEW

- TABLE 236 FARE LABS: SERVICES OFFERED

- TABLE 237 ADJACENT MARKETS

- TABLE 238 FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2017-2021 (USD MILLION)

- TABLE 239 FOOD SAFETY TESTING MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 240 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 241 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 RAPID FOOD SAFETY TESTING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 5 RAPID FOOD SAFETY TESTING MARKET: BOTTOM-UP APPROACH

- FIGURE 6 RAPID FOOD SAFETY TESTING MARKET: DATA TRIANGULATION

- FIGURE 7 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025 VS. 2030

- FIGURE 8 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025 VS. 2030

- FIGURE 9 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025 VS. 2030

- FIGURE 10 RAPID FOOD SAFETY TESTING MARKET SHARE (2024) AND CAGR (2025-2030), BY REGION

- FIGURE 11 GROWING EMPHASIS ON FOOD QUALITY AND PROTECTING BRAND REPUTATION CREATE OPPORTUNITIES IN MARKET

- FIGURE 12 US TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 GERMANY AND DAIRY PRODUCTS ACCOUNTED FOR SIGNIFICANT SHARES IN EUROPE IN 2024

- FIGURE 14 PATHOGENS SEGMENT TO LEAD MARKET, BY TARGET TESTED, DURING FORECAST PERIOD

- FIGURE 15 PROCESSED FOOD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 PCR-BASED TESTING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 EU AGRI-FOOD EXPORTS, 2023-2024

- FIGURE 18 TRADE OF FOOD PREPARATIONS, 2020-2024

- FIGURE 19 RAPID FOOD SAFETY TESTING MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 FOOD RECALL CASES, 2020-2025

- FIGURE 21 MAJOR REASONS FOR FOOD RECALLS, 2023

- FIGURE 22 GLOBAL TRADE OF MEAT PRODUCTS, 2023-2024

- FIGURE 23 ADOPTION OF GEN AI IN FOOD SAFETY TESTING MARKET

- FIGURE 24 RAPID FOOD SAFETY TESTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 IMPORT DATA OF HS CODE 3822-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (TON)

- FIGURE 26 EXPORT DATA OF HS CODE 3822-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (TON)

- FIGURE 27 AVERAGE SELLING PRICE OF RAPID FOOD SAFETY TESTING, BY KEY PLAYER, 2024 (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF RAPID FOOD SAFETY TESTING, BY REGION, 2021-2024 (USD/KG)

- FIGURE 29 KEY PLAYERS IN RAPID FOOD SAFETY TESTING ECOSYSTEM

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING BUYERS IN RAPID FOOD SAFETY TESTING MARKET

- FIGURE 31 NUMBER OF PATENTS GRANTED FOR RAPID FOOD SAFETY TESTING, 2017-2025

- FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR RAPID FOOD SAFETY TESTING SERVICES, 2024

- FIGURE 33 RAPID FOOD SAFETY TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP-THREE TARGET TESTED TYPES

- FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS FOR TOP-THREE TARGET TESTED TYPES

- FIGURE 36 RAPID FOOD SAFETY TESTING MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 RAPID FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 RAPID FOOD SAFETY TESTING MARKET, BY FOOD TESTED, 2025 VS. 2030 (USD MILLION)

- FIGURE 39 RAPID FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 40 CHINA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 41 EUROPE: RAPID FOOD SAFETY TESTING MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: RAPID FOOD SAFETY TESTING MARKET SNAPSHOT

- FIGURE 43 ANNUAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020-2024

- FIGURE 44 RAPID FOOD SAFETY TESTING MARKET SHARE ANALYSIS, 2024

- FIGURE 45 RAPID FOOD SAFETY TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 RAPID FOOD SAFETY TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 47 RAPID FOOD SAFETY TESTING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 COMPANY VALUATION OF KEY VENDORS, 2025

- FIGURE 49 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 50 RAPID FOOD SAFETY TESTING MARKET: BRAND/SERVICE COMPARISON

- FIGURE 51 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 52 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: COMPANY SNAPSHOT

- FIGURE 53 ALS: COMPANY SNAPSHOT

- FIGURE 54 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 55 TUV SUD: COMPANY SNAPSHOT

- FIGURE 56 ASUREQUALITY: COMPANY SNAPSHOT

- FIGURE 57 TUV NORD GROUP: COMPANY SNAPSHOT