PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1829988

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1829988

Industrial Gases Market by Type (Oxygen, Nitrogen, Hydrogen, Carbon Dioxide, Acetylene, Inert Gases), End-use Industry (Chemical, Electronics, Food & Beverage, Healthcare, Manufacturing, Metallurgy, Refining), and Region - Global Forecast to 2030

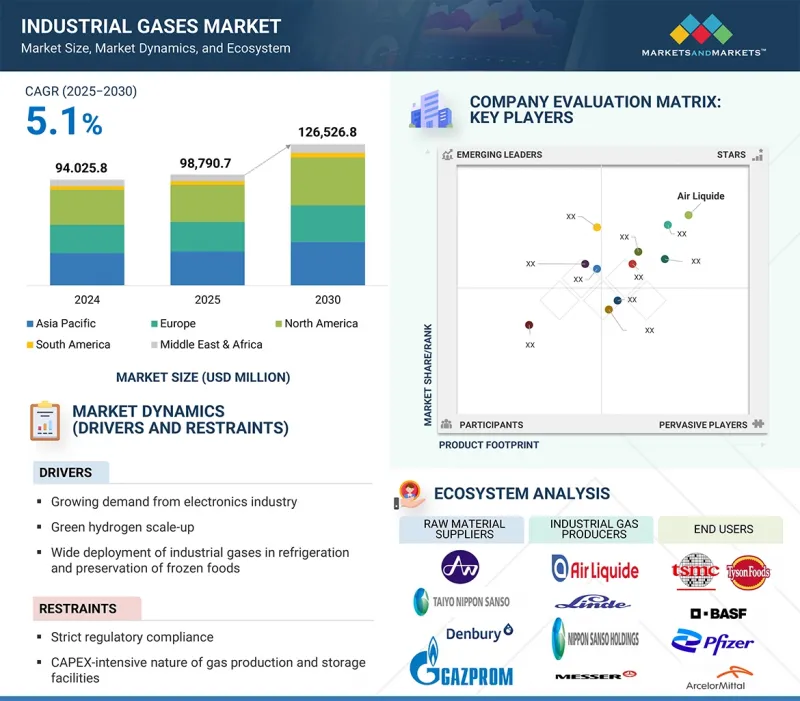

The industrial gases market was valued at USD 94.025.8 million in 2024 and is projected to reach USD 126,526.8 million by 2030, growing at a CAGR of 5.1% during the forecast period. Rapid industrialization, technological advances, and increasing demand for high-purity gases in chemical, healthcare, food & beverage, metallurgy, refining, and electronics industries drive the market. The healthcare sector's growth is fueled by the need for medical-grade oxygen for a rising aging population, respiratory illnesses, and other health requirements.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

Chemical and refining industries rely on gases to produce, process, synthesize, and purify chemicals. Transitioning to clean energy sources, including hydrogen, and the adoption of carbon capture technologies are creating more industrial development opportunities. In food & beverages, gases are used for preservation, carbonation, and packaging. The rise in environmental regulations and incentives for low emissions naturally boosts demand for industrial gases, indicating the industry will experience steady growth.

By type, nitrogen segment to account for second-largest market share during forecast period

Nitrogen is expected to hold the second-largest share of the industrial gases market during the forecast period due to its versatile uses in many applications. Nitrogen is an inert gas used for blanketing, purging, and pressurizing systems to prevent oxidation, contamination, or hazardous reactions. In the chemical and petrochemical industries, nitrogen is vital for ensuring safety and maintaining product integrity during manufacturing and storage. The food and beverage industry uses nitrogen in modified atmosphere packaging (MAP) to extend the shelf life of products while ensuring freshness and quality during transportation. Ultra-high purity nitrogen is essential in manufacturing electronic devices, providing controlled environments during the production of semiconductor devices and circuit boards. The metallurgy and metal fabrication industries also frequently use nitrogen during heat treatment processes and as a safeguard against oxidation during production. Its non-reactive, versatile, and cost-effective combination makes it well-suited as an input in industrial production. Nitrogen is poised for continued growth as manufacturing, food processing, and high-tech industries expand, making it a significant contributor to the overall growth of the industrial gases market.

By end-use industry, metallurgy segment to account for second-largest market share during forecast period

The metallurgy segment is projected to hold the second-largest market share during the forecast period. This is mainly because gases are utilized in the manufacturing, processing, and production of metals. Oxygen is commonly found in both blast furnaces and basic oxygen furnaces (BOF), which enhance combustion and produce higher-quality steel. Noble gases like argon and nitrogen are used to shield molten metal during casting and welding because they minimize oxidation. For non-ferrous metals, industrial gases used in smelting, refining, and heat treatment help achieve desired metallurgical properties and product uniformity. The increased demand for high-quality engineered steel and alloys by the construction, automotive, aerospace, and heavy machinery industries positively influences gas consumption, as these materials offer greater durability and improved performance. Significant advancements also improve energy efficiency and reduce emissions in energy-intensive steelmaking processes-such as oxygen-enriched transparent combustion and gas-based reduction technologies-thus increasing reliance on industrial gases.

North America to account for largest market share during forecast period

North America is expected to hold the largest industrial gas market share due to its high industrial base and diverse end-use requirements during the forecast period. The region has sectors such as chemical, healthcare, metallurgy, refining, and food and beverage industries that demand large quantities of industrial gases like oxygen, nitrogen, hydrogen, and carbon dioxide for their production processes. The United States' healthcare sector is a leading indicator, with growing demand for medical-grade gases driven by increasing investments in healthcare facilities and more cases requiring respiratory care that uses medical gases. Gases are also extensively used in chemical and petrochemical processing and refining, especially in the Gulf Coast region. Additionally, North America is a key player in clean energy initiatives, including developing a hydrogen economy and implementing carbon capture, utilization, and storage (CCUS) technologies, which present further growth opportunities. Thanks to its extensive distribution networks, advanced cryogenic technology, and significant investments in eco-friendly manufacturing, North America is poised to maintain its dominance in the market, gaining a first-mover advantage in the global industrial gases industry during the forecast period.

- By Company Type: Tier 1: 40%, Tier 2: 25%, Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, Others: 35%

- By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, Middle East & Africa: 5%, and South America: 5%

Companies Covered:

Air Liquide (France), Linde PLC (UK), Air Products and Chemicals, Inc. (US), Messer SE & Co. KGaA (Germany), NIPPON SANSO HOLDINGS CORPORATION (Japan), BASF SE (Germany), Bhoruka Specialty Gases Pvt Ltd (India), Ellenbarrie Industrial Gases Limited (India), Iwatani Corporation (Japan), and AIR WATER INC (Japan) are some key players in the industrial gases market.

Research Coverage

The market study examines the industrial gases market across various segments. It aims to estimate the market size and growth potential in different segments based on type, end-use industry, and region. The study also features an in-depth competitive analysis of key market players, including their company profiles, product and business offering insights, recent developments, and key growth strategies to enhance their market position.

Key Benefits of Buying Report

The report is designed to help market leaders and new entrants approximate the revenue figures of the overall industrial gases market, along with its segments and sub-segments. It aims to assist stakeholders in understanding the competitive landscape, gaining insights to strengthen their business positions, and developing effective go-to-market strategies. Additionally, the report seeks to provide stakeholders with a pulse on the market by offering information on key drivers, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Growing demand from electronics industry and Green hydrogen scale-up), restraints (Strict regulatory compliance and CapEx-Heavy nature of gas production and storage facilities), opportunities (Advanced semiconductor manufacturing expansion), and challenges (Hazardous material handling and Safety regulations and geopolitical disruptions in critical supply regions) influencing the growth of the industrial gases market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the industrial gases market

- Market Development: Comprehensive information about profitable markets - the report analyses the industrial gases market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial gases market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as Air Liquide (France), Linde PLC (UK), Air Products and Chemicals, Inc. (US), Messer SE & Co. KGaA (Germany), NIPPON SANSO HOLDINGS CORPORATION (Japan), BASF SE (Germany), Bhoruka Specialty Gases Pvt Ltd (India), Ellenbarrie Industrial Gases Limited (India), Gruppo SIAD (Italy), Iwatani Corporation (Japan), AIR WATER INC (Japan), AirPower Technologies Limited (China) and others in the industrial gases market. The report also helps stakeholders understand the pulse of the industrial gases market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL GASES MARKET

- 4.2 INDUSTRIAL GASES MARKET, BY TYPE

- 4.3 INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY

- 4.4 ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY TYPE AND COUNTRY

- 4.5 INDUSTRIAL GASES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Growing demand from electronics industry

- 5.1.1.2 Green hydrogen scale-up

- 5.1.1.3 Wide deployment of industrial gases in refrigeration and preservation of frozen foods

- 5.1.2 RESTRAINTS

- 5.1.2.1 Strict regulatory compliance

- 5.1.2.2 CapEx-heavy nature of gas production and storage facilities

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Advanced semiconductor manufacturing expansion

- 5.1.3.2 Medical gas expansion in emerging healthcare markets

- 5.1.3.3 Agri-food cold chain and modified atmosphere packaging

- 5.1.3.4 Specialty gas demand in renewable energy component manufacturing

- 5.1.4 CHALLENGES

- 5.1.4.1 Hazardous material handling and safety regulations

- 5.1.4.2 Geopolitical disruptions in critical supply regions

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Air Separation Units (ASUs)

- 6.5.1.2 Pressure swing adsorption (PSA)

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Cryogenic Storage & Distribution Systems

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Carbon Capture, Utilization & Storage (CCUS)

- 6.5.3.2 Fuel Cell Technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON INDUSTRIAL GASES MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 APPROACH

- 6.7.3 TOP APPLICANTS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT DATA FOR HS CODE 2804

- 6.8.2 EXPORT DATA FOR HS CODE 2804

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY FRAMEWORK

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 LINDE PARTNERED TO ENHANCE PLASTICS COMPOUNDING WITH PRECISE GAS-ASSISTED PROCESSING CONTROLS

- 6.13.2 AIR LIQUIDE IMPLEMENTED CO2 RECYCLING IN LITHIUM CARBONATE PURIFICATION TO CUT FRESH CO2 USE

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.14.3 INFRASTRUCTURE DEVELOPMENT AND URBANIZATION

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFFS-INDUSTRIAL GASES MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRIES/REGIONS

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON END-USE INDUSTRIES

- 6.16.5.1 Chemicals

- 6.16.5.2 Electronics

- 6.16.5.3 Food & Beverages

- 6.16.5.4 Healthcare

- 6.16.5.5 Manufacturing

- 6.16.5.6 Metallurgy

- 6.16.5.7 Refining

7 INDUSTRIAL GASES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 OXYGEN

- 7.2.1 OXYGEN STRENGTHENS INDUSTRIAL EFFICIENCY ACROSS METALLURGY, CHEMICALS, HEALTHCARE, AND REFINING SECTORS

- 7.3 NITROGEN

- 7.3.1 NITROGEN ENSURES QUALITY AND SAFETY ACROSS CHEMICALS, ELECTRONICS, FOOD, AND MANUFACTURING INDUSTRIES

- 7.4 CARBON DIOXIDE

- 7.4.1 CARBON DIOXIDE SUPPORTS KEY APPLICATIONS IN CHEMICALS, FOOD, HEALTHCARE, AND MANUFACTURING INDUSTRIES

- 7.5 HYDROGEN

- 7.5.1 HYDROGEN POWERS CRITICAL PROCESSES IN CHEMICALS, REFINING, METALLURGY, AND EMERGING ENERGY APPLICATIONS

- 7.6 ACETYLENE

- 7.6.1 ACETYLENE DELIVERS HIGH-TEMPERATURE PRECISION FOR MANUFACTURING, METALLURGY, AND SPECIALIZED INDUSTRIAL APPLICATIONS

- 7.7 INERT GASES

- 7.7.1 INERT GASES ENABLE PRECISION, STABILITY, AND SAFETY IN ADVANCED INDUSTRIAL APPLICATIONS

- 7.8 OTHER GASES

8 INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 CHEMICALS

- 8.2.1 INDUSTRIAL GASES DRIVE EFFICIENCY, SAFETY, AND INNOVATION IN CHEMICAL INDUSTRY

- 8.3 ELECTRONICS

- 8.3.1 INDUSTRIAL GASES ENSURE PRECISION, PURITY, AND INNOVATION IN ADVANCED ELECTRONICS MANUFACTURING

- 8.4 FOOD & BEVERAGES

- 8.4.1 INDUSTRIAL GASES ENHANCE QUALITY, SAFETY, AND SHELF LIFE IN FOOD AND BEVERAGES

- 8.5 HEALTHCARE

- 8.5.1 INDUSTRIAL GASES SUPPORT CRITICAL THERAPIES, DIAGNOSTICS, AND INNOVATIONS IN HEALTHCARE SERVICES

- 8.6 MANUFACTURING

- 8.6.1 INDUSTRIAL GASES ENHANCE EFFICIENCY, PRECISION, AND QUALITY ACROSS DIVERSE MANUFACTURING PROCESSES

- 8.7 METALLURGY

- 8.7.1 INDUSTRIAL GASES OPTIMIZE QUALITY, AND INNOVATION IN MODERN METALLURGICAL PROCESSES

- 8.8 REFINING

- 8.8.1 INDUSTRIAL GASES DRIVE PROCESS OPTIMIZATION, PRODUCT QUALITY, AND DECARBONIZATION IN REFINING OPERATIONS

- 8.9 OTHER END-USE INDUSTRIES

9 INDUSTRIAL GASES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Expanding manufacturing, chemical, and export activities set to drive market

- 9.2.2 CANADA

- 9.2.2.1 Manufacturing, energy, and chemical sector growth to push growth

- 9.2.3 MEXICO

- 9.2.3.1 Chemical, electronics, energy, and food sector expansion to drive market

- 9.2.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 CHINA

- 9.3.1.1 Robust growth in chemicals, manufacturing, food, and metals to propel demand

- 9.3.2 JAPAN

- 9.3.2.1 Growing chemical and pharmaceutical industry to support demand

- 9.3.3 INDIA

- 9.3.3.1 Expanding manufacturing, chemicals, food processing, and refining capacity to propel demand

- 9.3.4 SOUTH KOREA

- 9.3.4.1 High-tech manufacturing and export growth to drive market

- 9.3.5 OCEANIA

- 9.3.5.1 Manufacturing, chemical, and refining sector expansion in Australia, and New Zealand to propel growth

- 9.3.6 REST OF ASIA PACIFIC

- 9.3.1 CHINA

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Expanding manufacturing and energy-intensive industries in Germany set to drive demand

- 9.4.2 UK

- 9.4.2.1 Diverse high-value manufacturing and innovation investments to support market growth

- 9.4.3 FRANCE

- 9.4.3.1 Expanding chemical, steel, and energy sectors set to propel demand

- 9.4.4 ITALY

- 9.4.4.1 Expanding manufacturing and export sectors boost industrial gas consumption

- 9.4.5 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Broad-based growth across chemicals, food, and electronics to propel demand

- 9.5.2 ARGENTINA

- 9.5.2.1 Expanding manufacturing, chemical, and energy industries to propel demand

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Expanding industrial base and chemical export diversification to propel demand

- 9.6.1.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.2.1 UAE's energy expansion and diversified non-oil growth to drive market

- 9.6.3 REST OF GCC COUNTRIES

- 9.6.4 SOUTH AFRICA

- 9.6.4.1 Manufacturing and energy sector expansion to support growth

- 9.6.5 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5.1 COMPANY VALUATION

- 10.6 FINANCIAL METRICS

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.8.1 STARS

- 10.8.2 EMERGING LEADERS

- 10.8.3 PERVASIVE PLAYERS

- 10.8.4 PARTICIPANTS

- 10.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.8.5.1 Company footprint

- 10.8.5.2 Region footprint

- 10.8.5.3 Type footprint

- 10.8.5.4 End-use industry footprint

- 10.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- 10.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.9.6 DETAILED LIST OF KEY STARTUPS/SMES

- 10.9.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 DEALS

- 10.10.2 EXPANSIONS

- 10.10.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 AIR LIQUIDE

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 LINDE PLC

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 AIR PRODUCTS AND CHEMICALS, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 MESSER SE & CO. KGAA

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 NIPPON SANSO HOLDINGS CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.3.2 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 BASF SE

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.6.4 MnM view

- 11.1.7 BHORUKA SPECIALTY GASES PVT. LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.4 MnM view

- 11.1.8 ELLENBARRIE INDUSTRIAL GASES LIMITED

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Expansions

- 11.1.8.4 MnM view

- 11.1.9 GRUPPO SIAD

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.9.4 MnM view

- 11.1.10 IWATANI CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.3.2 Expansions

- 11.1.10.4 MnM view

- 11.1.11 AIR WATER INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.3.2 Expansions

- 11.1.11.4 MnM view

- 11.1.12 AIRPOWER TECHNOLOGIES LIMITED

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.12.3.2 Expansions

- 11.1.12.4 MnM view

- 11.1.1 AIR LIQUIDE

- 11.2 OTHER PLAYERS

- 11.2.1 SOL GROUP

- 11.2.2 SAPIO GROUP

- 11.2.3 SOUTHERN GAS LIMITED

- 11.2.4 GOYAL MG GASES PVT. LTD.

- 11.2.5 GULF CRYO

- 11.2.6 CONCORDE-CORODEX GROUP

- 11.2.7 AMERICAN WELDING & GAS

- 11.2.8 HOLSTON GASE

- 11.2.9 AXCEL GASES

- 11.2.10 PT SAMATOR INDO GAS TBK

- 11.2.11 INOX-AIR PRODUCTS INC.

- 11.2.12 STEELMAN GASES PVT. LTD.

- 11.2.13 ALCHEMIE GASES & CHEMICALS PVT. LTD.

- 11.2.14 WESTFALEN AG

- 11.2.15 TYCZKA AIR GASES

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.2.1 INDUSTRIAL NITROGEN MARKET

- 12.2.1.1 Market definition

- 12.2.1 INDUSTRIAL NITROGEN MARKET

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF INDUSTRIAL GASES, BY KEY PLAYER, 2024 (USD/UNIT)

- TABLE 2 AVERAGE SELLING PRICE TREND OF OXYGEN, BY REGION, 2024-2030 (USD/UNIT)

- TABLE 3 AVERAGE SELLING PRICE TREND OF NITROGEN, BY REGION, 2024-2030 (USD/UNIT)

- TABLE 4 AVERAGE SELLING PRICE TREND OF CARBON DIOXIDE, BY REGION, 2024-2030 (USD/UNIT)

- TABLE 5 ROLE OF COMPANIES IN INDUSTRIAL GASES MARKET ECOSYSTEM

- TABLE 6 INDUSTRIAL GASES MARKET: INDICATIVE LIST OF PATENTS

- TABLE 7 IMPORT DATA RELATED TO HS CODE 2804, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA RELATED TO HS CODE 2804, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 INDUSTRIAL GASES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 KEY REGULATIONS AND STANDARDS FOR INDUSTRIAL GASES

- TABLE 16 INDUSTRIAL GASES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 18 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 19 MESSER DROVE ENHANCED OIL RECOVERY USING CO2 INJECTION TO BOOST FIELD OUTPUT

- TABLE 20 GLOBAL GDP GROWTH PROJECTIONS, 2021-2028 (USD TRILLION)

- TABLE 21 US: KEY TARIFF RATES ON INDUSTRIAL GASES IMPORTS, 2025

- TABLE 22 INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 23 INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 24 COMPARATIVE PROPERTIES & INDUSTRY INSIGHTS OF MAJOR INDUSTRIAL GASES

- TABLE 25 INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 26 INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 27 INDUSTRIAL GASES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 28 INDUSTRIAL GASES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: INDUSTRIAL GASES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 30 NORTH AMERICA: INDUSTRIAL GASES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 31 NORTH AMERICA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 32 NORTH AMERICA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 34 NORTH AMERICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 35 US: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 36 US: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 37 US: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 38 US: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 39 CANADA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 40 CANADA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 41 CANADA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 42 CANADA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 43 MEXICO: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 44 MEXICO: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 45 MEXICO: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 46 MEXICO: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 48 ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 50 ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 52 ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 53 CHINA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 54 CHINA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 55 CHINA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 56 CHINA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 57 JAPAN: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 58 JAPAN: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 59 JAPAN: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 60 JAPAN: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 61 INDIA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 62 INDIA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 63 INDIA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 64 INDIA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 65 SOUTH KOREA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 66 SOUTH KOREA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 67 SOUTH KOREA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 68 SOUTH KOREA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 69 OCEANIA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 70 OCEANIA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 71 OCEANIA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 72 OCEANIA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 77 EUROPE: INDUSTRIAL GASES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 78 EUROPE: INDUSTRIAL GASES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 79 EUROPE: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 80 EUROPE: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 81 EUROPE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 82 EUROPE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 83 GERMANY: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 84 GERMANY: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 85 GERMANY: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 86 GERMANY: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 87 UK: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 88 UK: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 89 UK: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 90 UK: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 91 FRANCE: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 92 FRANCE: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 93 FRANCE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 94 FRANCE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 95 ITALY: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 96 ITALY: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 97 ITALY: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 98 ITALY: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 100 REST OF EUROPE: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 101 REST OF EUROPE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 102 REST OF EUROPE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 103 SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 104 SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 105 SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 106 SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 107 SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 108 SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 109 BRAZIL: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 110 BRAZIL: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 111 BRAZIL: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 112 BRAZIL: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 113 ARGENTINA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 114 ARGENTINA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 115 ARGENTINA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 116 ARGENTINA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 117 REST OF SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 118 REST OF SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 119 REST OF SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 120 REST OF SOUTH AMERICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 127 GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 128 GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 129 GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 130 GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 131 SAUDI ARABIA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 132 SAUDI ARABIA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 133 SAUDI ARABIA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 134 SAUDI ARABIA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 135 UAE: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 136 UAE: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 137 UAE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 138 UAE: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 139 REST OF GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 140 REST OF GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 141 REST OF GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 142 REST OF GCC COUNTRIES: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 143 SOUTH AFRICA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 144 SOUTH AFRICA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 145 SOUTH AFRICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 146 SOUTH AFRICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 151 INDUSTRIAL GASES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2021 AND JULY 2025

- TABLE 152 INDUSTRIAL GASES MARKET: DEGREE OF COMPETITION

- TABLE 153 INDUSTRIAL GASES MARKET: REGION FOOTPRINT

- TABLE 154 INDUSTRIAL GASES MARKET: TYPE FOOTPRINT

- TABLE 155 INDUSTRIAL GASES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 156 INDUSTRIAL GASES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 157 INDUSTRIAL GASES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION AND TYPE)

- TABLE 158 INDUSTRIAL GASES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (END-USE INDUSTRY)

- TABLE 159 INDUSTRIAL GASES MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 160 INDUSTRIAL GASES MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 161 INDUSTRIAL GASES MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 162 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 163 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 AIR LIQUIDE: DEALS, JANUARY 2021-JULY 2025

- TABLE 165 AIR LIQUIDE: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 166 AIR LIQUIDE: OTHER DEVELOPMENTS, JANUARY 2021- JULY 2025

- TABLE 167 LINDE PLC: COMPANY OVERVIEW

- TABLE 168 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 LINDE PLC: DEALS, JANUARY 2021-JULY 2025

- TABLE 170 LINDE PLC: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 171 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 172 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 173 AIR PRODUCTS AND CHEMICALS, INC.: DEALS, JANUARY 2021-JULY 2025

- TABLE 174 AIR PRODUCTS AND CHEMICALS, INC.: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 175 MESSER SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 176 MESSER SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 MESSER SE & CO. KGAA: DEALS, JANUARY 2021-JULY 2025

- TABLE 178 MESSER SE & CO. KGAA: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 179 NIPPON SANSO HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 180 NIPPON SANSO HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 NIPPON SANSO HOLDINGS CORPORATION: DEALS, JANUARY 2021-JULY 2025

- TABLE 182 NIPPON SANSO HOLDINGS CORPORATION: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 183 BASF SE: COMPANY OVERVIEW

- TABLE 184 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 BASF SE: DEALS, JANUARY 2021-JULY 2025

- TABLE 186 BASF SE: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 187 BHORUKA SPECIALTY GASES PVT. LTD.: COMPANY OVERVIEW

- TABLE 188 BHORUKA SPECIALTY GASES PVT. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 189 BHORUKA SPECIALTY GASES PVT. LTD.: DEALS, JANUARY 2021-JULY 2025

- TABLE 190 ELLENBARRIE INDUSTRIAL GASES LIMITED: COMPANY OVERVIEW

- TABLE 191 ELLENBARRIE INDUSTRIAL GASES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 ELLENBARRIE INDUSTRIAL GASES LIMITED: DEALS, JANUARY 2021-JULY 2025

- TABLE 193 ELLENBARRIE INDUSTRIAL GASES LIMITED: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 194 GRUPPO SIAD: COMPANY OVERVIEW

- TABLE 195 GRUPPO SIAD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 GRUPPO SIAD: DEALS, JANUARY 2021-JULY 2025

- TABLE 197 GRUPPO SIAD: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 198 IWATANI CORPORATION: COMPANY OVERVIEW

- TABLE 199 IWATANI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 IWATANI CORPORATION: DEALS, JANUARY 2021-JULY 2025

- TABLE 201 IWATANI CORPORATION: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 202 AIR WATER INC.: COMPANY OVERVIEW

- TABLE 203 AIR WATER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 AIR WATER INC: DEALS, JANUARY 2021-JULY 2025

- TABLE 205 AIR WATER INC: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 206 AIRPOWER TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 207 AIRPOWER TECHNOLOGIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 AIRPOWER TECHNOLOGIES LIMITED: DEALS, JANUARY 2021-JULY 2025

- TABLE 209 AIRPOWER TECHNOLOGIES LIMITED: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 210 SOL GROUP: COMPANY OVERVIEW

- TABLE 211 SAPIO GROUP: COMPANY OVERVIEW

- TABLE 212 SOUTHERN GAS LIMITED: COMPANY OVERVIEW

- TABLE 213 GOYAL MG GASES PVT. LTD.: COMPANY OVERVIEW

- TABLE 214 GULF CRYO: COMPANY OVERVIEW

- TABLE 215 CONCORDE-CORODEX GROUP: COMPANY OVERVIEW

- TABLE 216 AMERICAN WELDING & GAS: COMPANY OVERVIEW

- TABLE 217 HOLSTON GASES: COMPANY OVERVIEW

- TABLE 218 AXCEL GASES: COMPANY OVERVIEW

- TABLE 219 PT SAMATOR INDO GAS TBK: COMPANY OVERVIEW

- TABLE 220 INOX-AIR PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 221 STEELMAN GASES PVT. LTD.: COMPANY OVERVIEW

- TABLE 222 ALCHEMIE GASES & CHEMICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 223 WESTFALEN AG: COMPANY OVERVIEW

- TABLE 224 TYCZKA AIR GASES: COMPANY OVERVIEW

- TABLE 225 INDUSTRIAL NITROGEN MARKET, BY REGION, 2015-2022 (USD BILLION)

- TABLE 226 INDUSTRIAL NITROGEN MARKET, BY REGION, 2015-2022 (BILLION CUBIC FEET)

List of Figures

- FIGURE 1 INDUSTRIAL GASES MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 APPROACH 1: END-USE INDUSTRY CONSUMPTION PATTERS

- FIGURE 5 APPROACH 2: COMPANY-SPECIFIC CONSUMPTION PATTERNS

- FIGURE 6 INDUSTRIAL GASES MARKET: DATA TRIANGULATION

- FIGURE 7 OXYGEN SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 CHEMICAL END-USE INDUSTRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN INDUSTRIAL GASES MARKET DURING FORECAST PERIOD

- FIGURE 11 OXYGEN HELD LARGEST MARKET SHARE IN 2024

- FIGURE 12 ELECTRONICS AND FOOD & BEVERAGES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 OXYGEN ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2024

- FIGURE 14 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 GLOBAL HYDROGEN PRODUCTION CAPACITY, 2013-2023 (THOUSAND TONNES)

- FIGURE 17 INDUSTRIAL GASES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 18 AVERAGE SELLING PRICE TREND OF INDUSTRIAL GASES, BY KEY PLAYER, 2024 (USD/UNIT)

- FIGURE 19 AVERAGE SELLING PRICE TREND OF OXYGEN, BY REGION, 2024-2030 (USD/UNIT)

- FIGURE 20 AVERAGE SELLING PRICE TREND OF NITROGEN, BY REGION, 2024-2030 (USD/UNIT)

- FIGURE 21 AVERAGE SELLING PRICE TREND OF CARBON DIOXIDE, BY REGION, 2024-2030 (USD/UNIT)

- FIGURE 22 INDUSTRIAL GASES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 INDUSTRIAL GASES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 LIST OF MAJOR PATENTS FOR INDUSTRIAL GASES MARKET, 2014-2024

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED FOR INDUSTRIAL GASES MARKET, 2014-2024

- FIGURE 26 IMPORT DATA RELATED TO HS CODE 2804, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 EXPORT DATA RELATED TO HS CODE 2804, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 INDUSTRIAL GASES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 31 GLOBAL CONSTRUCTION INDUSTRY, ANNUAL % GROWTH, 2018-2024

- FIGURE 32 INDUSTRIAL GASES MARKET: INVESTOR DEALS AND FUNDING TRENDS, 2020-2024 (USD MILLION)

- FIGURE 33 INDUSTRIAL GASES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 34 INDUSTRIAL GASES MARKET, BY END-USE INDUSTRY, 2025 VS. 2030 (USD MILLION)

- FIGURE 35 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR INDUSTRIAL GASES DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: INDUSTRIAL GASES MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: INDUSTRIAL GASES MARKET SNAPSHOT

- FIGURE 38 INDUSTRIAL GASES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 39 INDUSTRIAL GASES MARKET SHARE ANALYSIS, 2024

- FIGURE 40 COMPANY VALUATION (USD MILLION), 2024

- FIGURE 41 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 42 YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 43 INDUSTRIAL GASES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 INDUSTRIAL GASES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 INDUSTRIAL GASES MARKET: COMPANY FOOTPRINT

- FIGURE 46 INDUSTRIAL GASES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 AIR LIQUIDE: COMPANY SNAPSHOT (2024)

- FIGURE 48 LINDE PLC: COMPANY SNAPSHOT (2024)

- FIGURE 49 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 50 MESSER SE & CO. KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 51 NIPPON SANSO HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 52 BASF SE: COMPANY SNAPSHOT (2024)

- FIGURE 53 ELLENBARRIE INDUSTRIAL GASES LIMITED: COMPANY SNAPSHOT (2024)

- FIGURE 54 IWATANI CORPORATION (2024): COMPANY SNAPSHOT (2024)

- FIGURE 55 AIR WATER INC. (2024): COMPANY SNAPSHOT (2024)