PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1830050

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1830050

Yellow Phosphorus & Derivatives Market by Derivative (Thermal Phosphoric Acid, Phosphorus Trichloride, Phosphorous Pentoxide, Red Phosphorus), End Use (Agriculture, Chemicals, Pharmaceutical, Lithium-ion Batteries), Region - Global Forecast to 2030

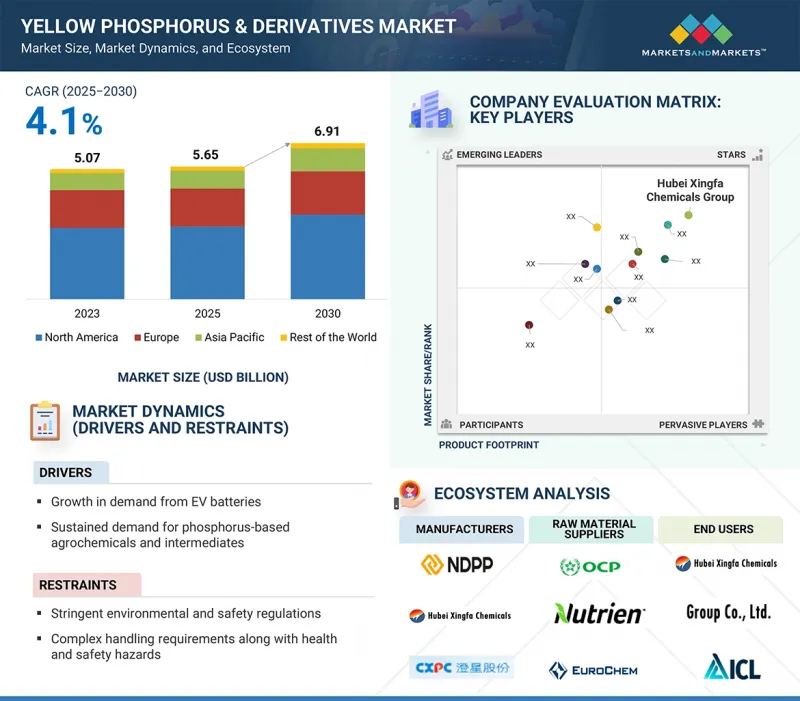

The global yellow phosphorus & derivatives market is projected to grow from USD 5.65 billion in 2025 to USD 6.91 billion by 2030, at a CAGR of 4.1% during the forecast period. Yellow phosphorus is a vital industrial chemical whose utility depends not only on its derivatives but also on the forms in which it is supplied-solid, liquid, and slurry. Solid yellow phosphorus is primarily favored for long-term storage and safe transport, while the liquid form is used where precise dosing into continuous chemical processes is required.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Derivative, Form, End-use, and Application |

| Regions covered | North America, Asia Pacific, Europe, and Rest of the World |

Slurry form, on the other hand, provides flexibility for blending in industrial applications, making it suitable for specialized production lines. These forms feed into several downstream uses, with the food and beverage sector standing out for its reliance on thermal phosphoric acid as an acidity regulator and preservative, particularly in beverages and processed foods. In pharmaceuticals, phosphorus compounds are integral to drug synthesis and nutritional formulations, further highlighting its critical role in health-related industries. The combination of adaptable supply forms and specialized applications makes yellow phosphorus indispensable in value-added sectors. The market is being driven by rising global demand for processed foods and expanding pharmaceutical production.

Phosphorus trichloride segment, by derivative, is estimated to account for the second largest share during the forecast period

Phosphorus trichloride, by derivative, is expected to account for the second largest share of the yellow phosphorus & derivatives market during the forecast period, due to its wide use as a crucial intermediate across several industries. Produced directly from yellow phosphorus, it is indispensable in the manufacture of organophosphorus compounds, which form the backbone of many agrochemicals such as herbicides, insecticides, and fungicides. With the rising need to improve agricultural efficiency and protect crops to meet growing food demand, the consumption of phosphorus trichloride in crop protection chemicals continues to increase. In addition, it is used in the production of plasticizers, surfactants, and flame retardants, ensuring its relevance in the chemicals and materials industry. Its applications also extend to pharmaceuticals, where it is employed in synthesizing active ingredients, adding further value to its demand. These wide-ranging applications, spanning both bulk and specialty uses, drive its strong market position. Overall, the growth of the yellow phosphorus & derivatives market is being driven by the combined pull of agriculture, specialty chemicals, and pharmaceuticals, with phosphorus trichloride playing a central role in linking these sectors and sustaining steady consumption.

Based on end-use, chemicals segment is estimated to account for the second largest share during the forecast period

The chemicals segment, by end-use, is expected to account for the second largest share of the yellow phosphorus & derivatives market during the forecast period, supported by its broad industrial relevance and diverse downstream applications. Yellow phosphorus derivatives such as phosphorus trichloride, phosphorus sulfides, and phosphorous pentoxide are essential building blocks in the production of a wide range of specialty and industrial chemicals. These intermediates are widely used in the manufacture of surfactants, plasticizers, lubricants, catalysts, and water treatment chemicals, linking yellow phosphorus to several vital industrial supply chains. The demand from the chemicals sector is further reinforced by the growth of specialty applications, including flame retardants, which are gaining traction as safer alternatives to halogen-based products, and intermediates for pharmaceuticals and advanced materials. This broad spectrum of uses ensures stable and expanding consumption, making chemicals one of the most important end-use segments after agriculture. Overall, the growth of the yellow phosphorus & derivatives market is being driven by both the need for fertilizers in agriculture and the rising importance of phosphorus-derived intermediates in industrial chemicals, with the chemicals sector playing a critical role in diversifying and strengthening long-term demand.

North America region is projected to account for the second-largest share during the forecast period

North America is expected to account for the second largest share of the yellow phosphorus & derivatives market during the forecast period, driven by its strong industrial base and diversified end-use demand. The region is a key consumer of phosphorus derivatives such as thermal phosphoric acid, phosphorus trichloride, and phosphorous pentoxide, which are widely utilized across agriculture, chemicals, pharmaceuticals, and food & beverage industries. In agriculture, phosphorus-based fertilizers remain vital for supporting high crop yields, while in the chemical sector, phosphorus compounds serve as intermediates in the production of specialty chemicals, flame retardants, and water treatment agents. The pharmaceutical and food & beverage industries also contribute significantly, with thermal phosphoric acid used in drug formulations and as an acidulant in processed foods and beverages. Furthermore, the growing interest in advanced energy storage technologies in the US and Canada is fostering additional demand for phosphorus-based materials in lithium-ion batteries. These diverse applications make North America a critical contributor to overall market stability and growth, with its robust regulatory frameworks and technological advancements further reinforcing consumption. Overall, the region's reliance on both traditional and emerging applications is a key driver for the expansion of the yellow phosphorus & derivatives market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, and Rest of the World - 10%

Hubei Xingfa Chemicals Group Co., Ltd. (China), Kazphosphate LLP (Kazakhstan), Sichuan Chuantou Chemical Industry Group Co., Ltd. (China), Bayer AG (Germany), and JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD. (China) are some of the major players operating in the yellow phosphorus & derivatives market. The key players have adopted acquisitions and agreements strategies to increase their market share business revenue.

Research Coverage:

The report defines, segments, and projects the yellow phosphorus & derivatives market based on derivative, form, end-use, application, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles yellow phosphorus manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as acquisitions, agreements, joint ventures, and expansions.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the yellow phosphorus & derivatives market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (growth in demand from EV batteries, sustained demand for phosphorus-based agrochemicals and intermediates, and rising industrialization and demand for yellow phosphorus derivatives in various applications), restraints (stringent environmental and safety regulations, and complex handling requirement along with health and safety hazards), opportunities (growth in demand for flame retardants, and rising demand in the food & beverage sector), and challenges (supply chain reliability due to geopolitical uncertainty, and price volatility) influencing the growth of the yellow phosphorus & derivatives market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the yellow phosphorus & derivatives market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the yellow phosphorus & derivatives market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the yellow phosphorus & derivatives market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Hubei Xingfa Chemicals Group Co., Ltd. (China), Kazphosphate LLP (Kazakhstan), Sichuan Chuantou Chemical Industry Group Co., Ltd. (China), Bayer AG (Germany), and JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD. (China), and others in the yellow phosphorus & derivatives market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants (demand and supply sides)

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Calculations for supply-side analysis

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN YELLOW PHOSPHORUS & DERIVATIVES MARKET

- 4.2 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION

- 4.3 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY DERIVATIVE

- 4.4 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE

- 4.5 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in demand from EV battery industry

- 5.2.1.2 Constant demand for phosphorus-based agrochemicals and intermediates

- 5.2.1.3 Rising industrialization and demand for yellow phosphorus derivatives in various applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental and safety regulations regarding hazardous materials

- 5.2.2.2 Complex handling requirements and health and safety risks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for flame retardants and plastic additives

- 5.2.3.2 Rising demand in food & beverage industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain reliability due to geopolitical uncertainties

- 5.2.4.2 Volatility in raw material prices

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.1.1 GDP

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 THREAT OF NEW ENTRANTS

- 6.4.2 THREAT OF SUBSTITUTES

- 6.4.3 BARGAINING POWER OF SUPPLIERS

- 6.4.4 BARGAINING POWER OF BUYERS

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.6.2 AVERAGE SELLING PRICE TREND OF YELLOW PHOSPHORUS OFFERED BY KEY PLAYERS, BY END USE, 2024

- 6.7 TARIFF ANALYSIS AND REGULATORY LANDSCAPE

- 6.7.1 TARIFF ANALYSIS

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Submerged arc furnace (SAF) technology

- 6.10.2 ADJACENT TECHNOLOGIES

- 6.10.2.1 Phosphate rock beneficiation

- 6.10.1 KEY TECHNOLOGIES

- 6.11 TRADE ANALYSIS

- 6.11.1 IMPORT SCENARIO (HS CODE 281213)

- 6.11.2 EXPORT SCENARIO (HS CODE 281213)

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.13 IMPACT OF GENERATIVE AI/AI ON YELLOW PHOSPHORUS & DERIVATIVES MARKET

- 6.13.1 INTRODUCTION

- 6.13.1.1 Enhanced Routine Operations and Product Quality

- 6.13.1.2 Greater Energy and Resource Efficiency

- 6.13.1.3 Platform Scalability and Innovation

- 6.13.1.4 Reliability and market trust

- 6.13.1 INTRODUCTION

- 6.14 IMPACT OF 2025 TARIFFS ON YELLOW PHOSPHORUS & DERIVATIVES MARKET

- 6.14.1 KEY TARIFF RATES IMPACTING MARKET

- 6.14.2 PRICE IMPACT ANALYSIS

- 6.14.3 IMPACT ON KEY REGIONS/COUNTRIES

- 6.14.3.1 US

- 6.14.3.2 Europe

- 6.14.3.3 Asia Pacific

- 6.14.4 IMPACT ON END USE SEGMENTS

- 6.14.4.1 Agriculture

- 6.14.4.2 Chemicals

- 6.14.4.3 Food & beverages

- 6.14.4.4 Pharmaceuticals

- 6.14.4.5 Lithium-ion batteries

7 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FERTILIZERS

- 7.2.1 RISING DEPENDENCE ON PHOSPHATE-BASED FERTILIZERS TO ENHANCE SOIL FERTILITY AND CROP YIELDS TO DRIVE DEMAND

- 7.3 PESTICIDES

- 7.3.1 GROWING USE OF YELLOW PHOSPHORUS IN AGROCHEMICALS FOR EFFECTIVE CROP PROTECTION TO PROPEL MARKET

- 7.4 FLAME RETARDANTS

- 7.4.1 INCREASING DEMAND FOR YELLOW PHOSPHORUS-BASED FLAME RETARDANTS IN CONSTRUCTION, ELECTRONICS, AND CONSUMER GOODS INDUSTRIES TO FUEL MARKET GROWTH

- 7.5 ANIMAL FEED ADDITIVES

- 7.5.1 RISING USE OF YELLOW PHOSPHORUS-BASED ADDITIVES IN LIVESTOCK NUTRITION TO BOOST PRODUCTIVITY TO FUEL MARKET GROWTH

- 7.6 OTHER APPLICATIONS

8 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY DERIVATIVE

- 8.1 INTRODUCTION

- 8.2 THERMAL PHOSPHORIC ACID

- 8.2.1 GROWING NEED FOR HIGH-PURITY ACIDS IN FOOD, HEALTHCARE, AND SPECIALTY CHEMICAL APPLICATIONS TO DRIVE MARKET

- 8.3 PHOSPHORUS TRICHLORIDE

- 8.3.1 RISING USE IN AGROCHEMICALS, FLAME RETARDANTS, AND PHARMACEUTICAL INTERMEDIATES TO FUEL MARKET GROWTH

- 8.4 PHOSPHORUS PENTOXIDE

- 8.4.1 INCREASING RELIANCE ON PHOSPHORUS PENTOXIDE IN AGRICULTURE AND PHARMACEUTICAL INDUSTRIES TO FUEL MARKET GROWTH

- 8.5 PHOSPHORUS SULFIDES

- 8.5.1 VITAL ROLE OF PHOSPHORUS SULFIDES IN FLAME RETARDANTS AND INDUSTRIAL CHEMICALS TO FUEL MARKET GROWTH

- 8.6 RED PHOSPHORUS

- 8.6.1 RISING DEMAND FOR FLAME RETARDANTS TO DRIVE MARKET

- 8.7 OTHER DERIVATIVES

9 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY FORM

- 9.1 INTRODUCTION

- 9.2 SOLID

- 9.2.1 RISING USE OF SOLID YELLOW PHOSPHORUS IN FERTILIZERS, PESTICIDES, AND FLAME RETARDANTS TO DRIVE MARKET

- 9.3 LIQUID

- 9.3.1 INCREASING APPLICATIONS OF LIQUID YELLOW PHOSPHORUS IN CHEMICAL PROCESSING TO FUEL MARKET GROWTH

- 9.4 SLURRY

- 9.4.1 GROWING USE OF SLURRY YELLOW PHOSPHORUS IN FERTILIZERS, PESTICIDES, AND CHEMICAL FORMULATIONS TO PROPEL MARKET

10 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 AGRICULTURE

- 10.2.1 INCREASING DEMAND FOR FERTILIZERS AND PESTICIDES TO ENHANCE CROP PRODUCTIVITY AND ENSURE FOOD SECURITY TO ACCELERATE MARKET GROWTH

- 10.3 CHEMICALS

- 10.3.1 RISING USE OF YELLOW PHOSPHORUS-BASED INTERMEDIATES IN SPECIALTY AND INDUSTRIAL CHEMICALS TO FUEL MARKET GROWTH

- 10.4 FOOD & BEVERAGES

- 10.4.1 INCREASING USE OF HIGH-PURITY THERMAL PHOSPHORIC ACID IN PROCESSED FOODS AND BEVERAGES TO ENSURE SAFETY, STABILITY, AND QUALITY TO FUEL MARKET GROWTH

- 10.5 PHARMACEUTICALS

- 10.5.1 GROWING PHARMACEUTICAL APPLICATIONS REQUIRING HIGH-PURITY PHOSPHORUS DERIVATIVES TO PROPEL MARKET

- 10.6 LITHIUM-ION BATTERIES

- 10.6.1 INCREASING USE OF YELLOW PHOSPHORUS-BASED COMPOUNDS IN CATHODE MATERIALS FOR ELECTRIC VEHICLES (EVS) AND ENERGY STORAGE TO DRIVE MARKET

- 10.7 OTHER END USES

11 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Control over lithium resources and expansion of lithium-ion battery manufacturing to drive market

- 11.2.2 JAPAN

- 11.2.2.1 High demand from chemicals, pharmaceuticals, flame retardants, lithium-ion batteries, and other applications to drive market

- 11.2.3 INDIA

- 11.2.3.1 Expanding agriculture industry to propel market

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Booming high-tech industries (battery and chemicals) to drive market

- 11.2.5 VIETNAM

- 11.2.5.1 Growing agriculture and food processing industries to boost market

- 11.2.6 MALAYSIA

- 11.2.6.1 Rising demand from chemical and food processing industries to propel market

- 11.2.7 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Critical role of yellow phosphorus in sustaining large-scale agriculture applications to fuel demand

- 11.3.2 CANADA

- 11.3.2.1 Increasing reliance on yellow phosphorus in fertilizer production to drive market

- 11.3.3 MEXICO

- 11.3.3.1 Rising agricultural activities and growth of food processing and chemical industries to fuel market growth

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 CZECH REPUBLIC

- 11.4.1.1 Rising demand for fertilizers, pesticides, and specialty chemicals supported by strong industrial base to drive market

- 11.4.2 GERMANY

- 11.4.2.1 Strong chemical industry and continued use of phosphorus fertilizers in modern agriculture to boost market

- 11.4.3 ITALY

- 11.4.3.1 High reliance on yellow phosphorus-derived fertilizers and rising applications in food processing industry to propel market

- 11.4.4 POLAND

- 11.4.4.1 High use of yellow phosphorus derivatives in chemical industry to drive market

- 11.4.5 FRANCE

- 11.4.5.1 Extensive agricultural diversity, high crop output, and growing food industry applications to fuel market growth

- 11.4.6 SWITZERLAND

- 11.4.6.1 Growing demand in pharmaceutical and food & beverage industry to drive market

- 11.4.7 REST OF EUROPE

- 11.4.1 CZECH REPUBLIC

- 11.5 ROW

- 11.5.1 MIDDLE EAST & AFRICA

- 11.5.1.1 Rising demand in agricultural and industrial sectors to drive market

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Growing use in phosphate fertilizers to improve crop quality to propel market

- 11.5.1 MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.3.1 REVENUE ANALYSIS OF TOP 5 PLAYERS

- 12.4 MARKET SHARE ANALYSIS

- 12.4.1 HUBEI XINGFA CHEMICALS GROUP CO., LTD. (CHINA)

- 12.4.2 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD. (CHINA)

- 12.4.3 NDFZ LLP (KAZAKHSTAN)

- 12.4.4 SICHUAN CHUANTOU CHEMICAL INDUSTRY GROUP CO., LTD. (CHINA)

- 12.4.5 BAYER AG (GERMANY)

- 12.5 BRAND/PRODUCT COMPARISON

- 12.5.1 YELLOW PHOSPHORUS

- 12.5.2 YELLOW PHOSPHORUS

- 12.5.3 YELLOW PHOSPHORUS

- 12.5.4 YELLOW PHOSPHORUS (P4)

- 12.5.5 TECHNICAL YELLOW PHOSPHORUS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Derivative footprint

- 12.6.5.4 End use footprint

- 12.6.5.5 Application footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 DEALS

- 12.9 COMPANY VALUATION AND FINANCIAL METRICS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 HUBEI XINGFA CHEMICALS GROUP CO., LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Key strengths/Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses/Competitive threats

- 13.1.2 NDFZ LLP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses/Competitive threats

- 13.1.3 BAYER AG

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses/Competitive threats

- 13.1.4 SICHUAN CHUANTOU CHEMICAL INDUSTRY GROUP CO., LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 VIET NAM APATITE - PHOSPHORUS JOINT STOCK COMPANY

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 YUNNAN MILE PHOSPHORUS ELECTRICITY CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 YUNTIANHUA CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 GUIZHOU QIANNENG TIANHE PHOSPHORUS INDUSTRY CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 VIETNAM PHOSPHORUS JSC

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 YUNNAN CHENGJIANG HUAYE PHOSPHORUS CHEMICALS CO., LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 YUNPHOS

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 CHENGDU WINTRUE HOLDING CO., LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.1 HUBEI XINGFA CHEMICALS GROUP CO., LTD.

- 13.2 OTHER PLAYERS

- 13.2.1 YIBIN TIANYUAN GROUP CO., LTD.

- 13.2.2 GUIZHOU SINO-PHOS CHEMICAL CO., LTD.

- 13.2.3 MIANYANG QIMINGXING PHOSPHORUS CHEMICAL CO., LTD.

- 13.2.4 CHONGQING CHUANDONG CHEMICAL (GROUP) CO., LTD.

14 ADJACENT AND RELATED MARKET

- 14.1 INTRODUCTION

- 14.1.1 LIMITATIONS

- 14.1.2 INTERCONNECTED MARKET

- 14.2 PHOSPHATE MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.3 PHOSPHATE MARKET, BY TYPE OF RESOURCE

- 14.3 SEDIMENTARY MARINE DEPOSITS

- 14.3.1 INCREASING FOCUS ON SUSTAINABILITY TO DRIVE DEMAND

- 14.4 IGNEOUS AND WEATHERED

- 14.4.1 HIGH PURITY OF PHOSPHATE IN IGNEOUS AND WEATHERED RESOURCE TYPES TO BOOST MARKET GROWTH

- 14.5 BIOGENIC

- 14.5.1 GROWING NEED TO INCREASE AGRICULTURAL PRODUCTIVITY TO FUEL DEMAND

- 14.6 OTHER TYPES OF RESOURCES

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

List of Tables

- TABLE 1 YELLOW PHOSPHORUS & DERIVATIVES MARKET: SNAPSHOT 2025 VS. 2030

- TABLE 2 LIST OF OEM ANNOUNCEMENTS ON ELECTRIC CARS AS OF JULY 2021

- TABLE 3 ELECTRIC CAR SALES, BY KEY COUNTRY, 2020-2023 (MILLION UNITS)

- TABLE 4 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 6 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 7 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 AND 2023 (USD BILLION)

- TABLE 8 ROLES OF COMPANIES IN YELLOW PHOSPHORUS & DERIVATIVES ECOSYSTEM

- TABLE 9 YELLOW PHOSPHORUS & DERIVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

- TABLE 11 KEY BUYING CRITERIA, BY END USE

- TABLE 12 AVERAGE SELLING PRICE TREND OF YELLOW PHOSPHORUS, BY REGION, 2022-2024 (USD/TON)

- TABLE 13 AVERAGE SELLING PRICE TREND OF YELLOW PHOSPHORUS OFFERED BY KEY PLAYERS, BY END USE, 2024 (USD/TON)

- TABLE 14 TARIFF ANALYSIS RELATED TO HS CODE 281213-COMPLIANT PRODUCTS, 2025

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 YELLOW PHOSPHORUS & DERIVATIVES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 YELLOW PHOSPHORUS & DERIVATIVES MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 20 IMPORT DATA FOR HS CODE 281213-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 21 EXPORT DATA FOR HS CODE 281213-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 22 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY DERIVATIVE, 2020-2023 (USD MILLION)

- TABLE 23 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY DERIVATIVE, 2024-2030 (USD MILLION)

- TABLE 24 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY DERIVATIVE, 2020-2023 (KILOTON)

- TABLE 25 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY DERIVATIVE, 2024-2030 (KILOTON)

- TABLE 26 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 27 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 28 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 29 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 30 AGRICULTURE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 31 AGRICULTURE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 32 CHEMICALS: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 33 CHEMICALS: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 34 FOOD & BEVERAGES: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 35 FOOD & BEVERAGES: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 36 PHARMACEUTICALS: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 37 PHARMACEUTICALS: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 38 LITHIUM-ION BATTERIES: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 39 LITHIUM-ION BATTERIES: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 40 OTHER END USES: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 41 OTHER END USES: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 42 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 44 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 45 YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 46 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 47 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 49 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 50 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 51 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 53 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 54 CHINA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 55 CHINA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 56 CHINA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 57 CHINA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 58 JAPAN: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 59 JAPAN: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 60 JAPAN: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 61 JAPAN: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 62 INDIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 63 INDIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 64 INDIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 65 INDIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 66 SOUTH KOREA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 67 SOUTH KOREA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 68 SOUTH KOREA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 69 SOUTH KOREA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 70 VIETNAM: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 71 VIETNAM: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 72 VIETNAM: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 73 VIETNAM: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 74 MALAYSIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 75 MALAYSIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 76 MALAYSIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 77 MALAYSIA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 78 REST OF ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 82 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 85 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 86 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 87 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 89 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 90 US: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 91 US: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 92 US: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 93 US: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 94 CANADA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 95 CANADA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 96 CANADA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 97 CANADA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 98 MEXICO: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 99 MEXICO: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 100 MEXICO: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 101 MEXICO: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 102 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 103 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 104 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 105 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 106 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 107 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 108 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 109 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 110 CZECH REPUBLIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 111 CZECH REPUBLIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 112 CZECH REPUBLIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 113 CZECH REPUBLIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 114 GERMANY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 115 GERMANY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 116 GERMANY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 117 GERMANY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 118 ITALY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 119 ITALY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 120 ITALY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 121 ITALY: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 122 POLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 123 POLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 124 POLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 125 POLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 126 FRANCE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 127 FRANCE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 128 FRANCE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 129 FRANCE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 130 SWITZERLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 131 SWITZERLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 132 SWITZERLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 133 SWITZERLAND: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 134 REST OF EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 135 REST OF EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 136 REST OF EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 137 REST OF EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 138 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 139 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 140 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 141 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 142 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 143 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 144 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 145 ROW: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 150 SOUTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (USD MILLION)

- TABLE 151 SOUTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (USD MILLION)

- TABLE 152 SOUTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2020-2023 (KILOTON)

- TABLE 153 SOUTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET, BY END USE, 2024-2030 (KILOTON)

- TABLE 154 YELLOW PHOSPHORUS & DERIVATIVES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 155 YELLOW PHOSPHORUS & DERIVATIVES MARKET: DEGREE OF COMPETITION, 2023

- TABLE 156 YELLOW PHOSPHORUS & DERIVATIVES MARKET: REGION FOOTPRINT (14 COMPANIES)

- TABLE 157 YELLOW PHOSPHORUS & DERIVATIVES MARKET: DERIVATIVE FOOTPRINT (14 COMPANIES)

- TABLE 158 YELLOW PHOSPHORUS & DERIVATIVES MARKET: END USE FOOTPRINT (14 COMPANIES)

- TABLE 159 YELLOW PHOSPHORUS & DERIVATIVES MARKET: APPLICATION FOOTPRINT (14 COMPANIES)

- TABLE 160 YELLOW PHOSPHORUS & DERIVATIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 161 YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 162 YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 163 YELLOW PHOSPHORUS & DERIVATIVES MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 164 HUBEI XINGFA CHEMICALS GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 165 HUBEI XINGFA CHEMICALS GROUP CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 166 NDFZ LLP: COMPANY OVERVIEW

- TABLE 167 NDFZ LLP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 BAYER AG: COMPANY OVERVIEW

- TABLE 169 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 SICHUAN CHUANTOU CHEMICAL INDUSTRY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 171 SICHUAN CHUANTOU CHEMICAL INDUSTRY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 173 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY: COMPANY OVERVIEW

- TABLE 175 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY: DEALS

- TABLE 177 VIET NAM APATITE - PHOSPHORUS JOINT STOCK COMPANY: COMPANY OVERVIEW

- TABLE 178 VIET NAM APATITE - PHOSPHORUS JOINT STOCK COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 YUNNAN MILE PHOSPHORUS ELECTRICITY CO., LTD.: COMPANY OVERVIEW

- TABLE 180 YUNNAN MILE PHOSPHORUS ELECTRICITY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 YUNTIANHUA CO., LTD.: COMPANY OVERVIEW

- TABLE 182 YUNTIANHUA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 GUIZHOU QIANNENG TIANHE PHOSPHORUS INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 184 GUIZHOU QIANNENG TIANHE PHOSPHORUS INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 VIETNAM PHOSPHORUS JSC: COMPANY OVERVIEW

- TABLE 186 VIETNAM PHOSPHORUS JSC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 YUNNAN CHENGJIANG HUAYE PHOSPHORUS CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 188 YUNNAN CHENGJIANG HUAYE PHOSPHORUS CHEMICALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 YUNPHOS: COMPANY OVERVIEW

- TABLE 190 YUNPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 CHENGDU WINTRUE HOLDING CO., LTD.: COMPANY OVERVIEW

- TABLE 192 CHENGDU WINTRUE HOLDING CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 193 YIBIN TIANYUAN GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 194 GUIZHOU SINO-PHOS CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 195 MIANYANG QIMINGXING PHOSPHORUS CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 196 CHONGQING CHUANDONG CHEMICAL (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 197 PHOSPHATE MARKET, BY TYPE OF RESOURCE, 2018-2023 (USD MILLION)

- TABLE 198 PHOSPHATE MARKET, BY TYPE OF RESOURCE, 2024-2029 (USD MILLION)

- TABLE 199 PHOSPHATE MARKET, BY TYPE OF RESOURCE, 2018-2023 (KILOTON)

- TABLE 200 PHOSPHATE MARKET, BY TYPE OF RESOURCE, 2024-2029 (KILOTON)

- TABLE 201 SEDIMENTARY MARINE DEPOSITS: PHOSPHATE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 202 SEDIMENTARY MARINE DEPOSITS: PHOSPHATE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 203 SEDIMENTARY MARINE DEPOSITS: PHOSPHATE MARKET, BY REGION, 2018-2023 (KILOTON)

- TABLE 204 SEDIMENTARY MARINE DEPOSITS: PHOSPHATE MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 205 IGNEOUS AND WEATHERED: PHOSPHATE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 206 IGNEOUS AND WEATHERED: PHOSPHATE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 207 IGNEOUS AND WEATHERED: PHOSPHATE MARKET, BY REGION, 2018-2023 (KILOTON)

- TABLE 208 IGNEOUS AND WEATHERED: PHOSPHATE MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 209 BIOGENIC: PHOSPHATE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 210 BIOGENIC: PHOSPHATE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 211 BIOGENIC: PHOSPHATE MARKET, BY REGION, 2018-2023 (KILOTON)

- TABLE 212 BIOGENIC: PHOSPHATE MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 213 OTHER TYPES OF RESOURCES: PHOSPHATE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 214 OTHER TYPES OF RESOURCES: PHOSPHATE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 215 OTHER TYPES OF RESOURCES: PHOSPHATE MARKET, BY REGION, 2018-2023 (KILOTON)

- TABLE 216 OTHER TYPES OF RESOURCES: PHOSPHATE MARKET, BY REGION, 2024-2029 (KILOTON)

List of Figures

- FIGURE 1 YELLOW PHOSPHORUS & DERIVATIVES MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YELLOW PHOSPHORUS & DERIVATIVES MARKET: RESEARCH DESIGN

- FIGURE 3 YELLOW PHOSPHORUS & DERIVATIVES MARKET: BOTTOM-UP APPROACH

- FIGURE 4 YELLOW PHOSPHORUS & DERIVATIVES MARKET: TOP-DOWN APPROACH

- FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF YELLOW PHOSPHORUS & DERIVATIVES MARKET (1/2)

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF YELLOW PHOSPHORUS & DERIVATIVES MARKET (2/2)

- FIGURE 7 YELLOW PHOSPHORUS & DERIVATIVES MARKET: DATA TRIANGULATION

- FIGURE 8 THERMAL PHOSPHORIC ACID SEGMENT TO HOLD MAJOR MARKET SHARE IN 2030

- FIGURE 9 LITHIUM-ION BATTERIES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 GROWTH IN DEMAND FOR FLAME RETARDANTS AND RISING DEMAND IN FOOD & BEVERAGE INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 12 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 RED PHOSPHORUS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 LITHIUM-ION BATTERIES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 YELLOW PHOSPHORUS & DERIVATIVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GLOBAL COMBINED SALES OF BATTERY ELECTRIC VEHICLES AND PLUG-IN HYBRIDS, 2020-2023 (MILLION UNITS)

- FIGURE 18 GLOBAL PRODUCTION DATA OF DIAMMONIUM PHOSPHATE, 2021-2023 (KILOTON)

- FIGURE 19 GLOBAL PRODUCTION DATA OF CEREAL, 2021 & 2023 (TON)

- FIGURE 20 PRICE OF ROCK PHOSPHATE, 2021-2024 (USD/TON)

- FIGURE 21 YELLOW PHOSPHORUS & DERIVATIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 YELLOW PHOSPHORUS & DERIVATIVES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 YELLOW PHOSPHORUS & DERIVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 25 KEY BUYING CRITERIA, BY END USE

- FIGURE 26 AVERAGE SELLING PRICE TREND OF YELLOW PHOSPHORUS, BY REGION, 2022-2024 (USD/TON)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF YELLOW PHOSPHORUS OFFERED BY KEY PLAYERS, BY END USE, 2024 (USD/TON)

- FIGURE 28 LIST OF MAJOR PATENTS RELATED TO YELLOW PHOSPHORUS & DERIVATIVES, 2014-2024

- FIGURE 29 IMPORT DATA RELATED TO HS CODE 281213-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA RELATED TO HS CODE 281213-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 31 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 32 THERMAL PHOSPHORIC ACID SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 33 AGRICULTURE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 34 ASIA PACIFIC TO LEAD YELLOW PHOSPHORUS & DERIVATIVES MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: YELLOW PHOSPHORUS & DERIVATIVES MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: YELLOW PHOSPHORUS & DERIVATIVES MARKET SNAPSHOT

- FIGURE 37 EUROPE: YELLOW PHOSPHORUS & DERIVATIVES MARKET SNAPSHOT

- FIGURE 38 YELLOW PHOSPHORUS & DERIVATIVES MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 39 YELLOW PHOSPHORUS & DERIVATIVES MARKET SHARE ANALYSIS, 2024

- FIGURE 40 YELLOW PHOSPHORUS & DERIVATIVES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMPANY FOOTPRINT (14 COMPANIES)

- FIGURE 43 YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 YELLOW PHOSPHORUS & DERIVATIVES MARKET: EV/EBITDA

- FIGURE 45 YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMPANY VALUATION (USD BILLION)

- FIGURE 46 YELLOW PHOSPHORUS & DERIVATIVES MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 47 HUBEI XINGFA CHEMICALS GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 48 BAYER AG: COMPANY SNAPSHOT

- FIGURE 49 JIANGSU CHENGXING PHOSPH- CHEMICALS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 DUC GIANG CHEMICALS GROUP JOINT STOCK COMPANY: COMPANY SNAPSHOT

- FIGURE 51 YUNTIANHUA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 CHENGDU WINTRUE HOLDING CO., LTD.: COMPANY SNAPSHOT