PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1840080

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1840080

Electric Vehicle Market by Vehicle Type, Propulsion, Vehicle Connectivity, Component, End Use, P-EV market, H-EV market and Region - Global Forecast 2035

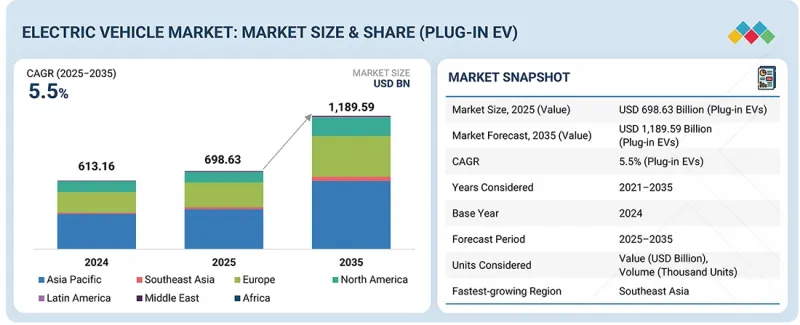

The plug-in electric vehicle market is predicted to grow from USD 698.63 billion in 2025 to USD 1,189.59 billion in 2035, at a CAGR of 5.5%. The hybrid electric vehicle market (HEV+MHEV) is set to grow from USD 446.87 billion in 2025 to USD 667.75 billion in 2035, at a CAGR of 4.1%. The electric vehicle market is set for steady growth, driven by rising demand for battery-powered mobility across passenger and commercial segments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Volume (Thousand Units) and Value (USD Billion) |

| Segments | Vehicle Type, Propulsion, EV Architecture, Vehicle Top Speed, Vehicle Drive Type, Vehicle Body Type, Configuration Type, Topology, Vehicle Connectivity, Propulsion & Component, End Use, and Region |

| Regions covered | Asia Pacific, Southeast Asia, Europe, North America, Latin America, the Middle East, and Africa |

Key factors include improvements in battery energy density, faster charging capabilities, and enhanced vehicle safety and performance. Government policies, such as Europe's 2035 zero-emission targets and supportive regulations in countries like Germany and Norway, are accelerating adoption despite subsidies in China and the US being phased out. Expansion of charging infrastructure and investments in powertrain efficiency enable longer ranges and lower ownership costs. Consumer interest in EVs is fostering OEM focus on integrating advanced technologies such as improved thermal management systems and software-driven energy optimization, ensuring vehicles are safer, more efficient, and user-friendly. Continuous innovation in vehicle design, software integration, and energy management supports sustained growth in the EV market throughout the forecast period.

"Front-wheel drive type is expected to have the largest growth in the electric vehicle market during the forecast period."

The front-wheel drive (FWD) segment is expected to witness the largest growth in the electric vehicle market over the forecast period, driven by its cost efficiency, practicality, and suitability for urban and high-traffic conditions. FWD systems are simpler and cheaper to produce than RWD or AWD configurations, translating into more affordable EV options for budget-conscious consumers. The lower drivetrain weight improves energy efficiency and range, while the weight distribution over the front axle provides better traction in rainy or snowy conditions, making FWD vehicles appealing in diverse climates. Leading FWD EV models such as Nissan Leaf, Hyundai Kona Electric, Toyota bZ4X, and mini EVs like GW Black Cat, GW White Cat, and GW Good Cat have demonstrated strong market acceptance due to their practicality and cost-effectiveness. Manufacturers have also leveraged FWD architectures by converting existing ICE platforms to EVs, accelerating early adoption. Recent launches, including Hyundai's Kona Electric FWD variant in Thailand in February 2025 with a 450 km range, further reinforce the segment's growth potential. While RWD and AWD continue to see demand in performance and premium models, FWD is expected to dominate due to affordability, efficiency, and suitability for everyday urban mobility.

"400V architecture is expected to hold the largest share in the electric vehicle market during the forecast period."

The 400V electric architecture is expected to hold the largest share in the electric vehicle market over the forecast period, driven by its widespread adoption, cost efficiency, and compatibility with existing charging infrastructure. Most early and mid-range EVs utilize 400V systems due to their balance of performance, moderate charging speeds, and lower production costs compared with higher-voltage architectures. The voltage in these systems ranges between 300V and 500V, depending on factors such as state of charge, temperature, and battery age, offering flexibility while maintaining efficiency. Leading global EV models powered by 400V architecture include Hyundai Kona Electric, Kia Niro EV, Volkswagen ID.4, BMW i4, Mercedes EQE, Kia EV6, Tesla Model 3, and mass-market launches such as Tata Motors' planned 400V EVs on its acti.ev platform. Another example is the Kia EV4, unveiled at Kia's 2025 EV Day, built on the 400V E-GMP platform with battery options offering up to 630 km range and fast 400V charging capabilities. Nissan launched the new LEAF based on a 400V architecture in September 2025. The mature supply chain, high-volume component availability, and lower purchase prices make 400V systems attractive for both OEMs and consumers. While 800V architectures are emerging for high-performance, fast-charging EVs, the combination of cost advantages, established production processes, and broad compatibility ensures that 400V systems will continue to dominate the EV market during the forecast period.

"Europe set to witness a significant growth in the electric vehicle market during the forecast period."

Europe is set to witness notable growth in the electric vehicle market over the forecast period, driven by regulatory mandates, strong OEM commitments, and expanding consumer adoption. Policies such as the EU 2035 zero-emission target for new cars and vans, coupled with stricter CO2 reduction standards for 2030, are accelerating the shift toward fully electric passenger cars and plug-in hybrids. Leading European automakers, including Volkswagen, BMW, Mercedes-Benz, Volvo, and Stellantis, are investing heavily in EV production, software integration, and dedicated charging infrastructure, while introducing models like the VW ID.4, BMW iX, and Mercedes EQC to meet rising consumer demand. The growing adoption of plug-in hybrids supports continued demand for dual powertrain systems, while battery electric vehicles are driving expansion in high-capacity battery packs, thermal management systems, and inverter cooling solutions. In the first half of 2025, BEV registrations in Europe surged 34% year-over-year, reaching 15.6% of market share, with PHEVs accounting for 8.4% of sales. Germany, Belgium, and the Netherlands led this growth, supported by increased charging infrastructure and consumer incentives. At the IAA Mobility auto show in Munich, Chinese luxury automaker Hongqi unveiled the EHS5, a compact electric SUV with a 550 km range and fast charging capability (10% to 80% in 20 minutes), targeting urban and suburban drivers. Europe's strong automotive manufacturing base, combined with investments in localized component production and charging networks, is ensuring supply chain resilience and competitiveness. Regulatory pressure, OEM electrification roadmaps, hybrid adoption, and consumer demand are positioning Europe for sustained growth in the electric vehicle market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 42%, Tier II - 35%, and Tier III - 23%

- By Designation: Directors - 36%, Managers - 43%, and Others - 21%

- By Region: Asia Pacific - 17%, Southeast Asia - 11%, Europe - 28%, North America - 31%, Latin America - 8%, Middle East - 3%, and Africa - 2%

The electric vehicle market is dominated by major players, including BYD Company Ltd. (China), Tesla (US), Zhejiang Geely Holding Group (China), Volkswagen Group (Germany), and General Motors (US). These companies are expanding their portfolios to strengthen their electric vehicle market position.

Research Coverage

The report covers the electric vehicle market in terms of vehicle type (passenger cars and commercial vehicles), propulsion (battery electric vehicle, fuel cell electric vehicle, plug-in hybrid electric vehicle, hybrid electric vehicle, and mild hybrid electric vehicle), by EV architecture (400V and 800V), vehicle top speed (<125 mph and >125 mph), vehicle drive type (front-wheel drive, rear-wheel drive, and all wheel drive), vehicle body type (SUV/MPV, sedan, and hatchback), configuration type (series, parallel, and series-parallel), topology (P0, P1, P2, P3, and P4), vehicle connectivity (V2G, V2H/V2B, and V2L), propulsion & component (BEV components, PHEV components, FCEV components, HEV components, and MHEV components), end use (private and commercial fleets), and region. It covers the competitive landscape and company profiles of the significant electric vehicle market players.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the electric vehicle market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the electric vehicle market.

- The report will help market leaders/new entrants with information on various trends in the electric vehicle market based on propulsion, vehicle type, drive type, EV architecture, body type, region, and other parameters.

The report provides insight into the following pointers:

- Analysis of key drivers (policy support for EV adoption, Reduced operating and maintenance costs, Next generation battery innovations, zero tailpipe and vehicle lifecycle emissions, declining costs of EV batteries), restraints (high initial purchase price, capital-intensive charging infrastructure deployment, battery durability and lifecycle management, geopolitical instability and supply chain disruptions), opportunities (accelerated investment in charging infrastructure, innovation in wireless and on-the-move charging, fleet electrification and commercial deployment, expansion of Charging-as-a-Service (CaaS) business model, integration of bidirectional charging and smart parking), and challenges (extended charging duration constraints, fragmented charging standards and infrastructure)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the electric vehicle market

- Market Development: Comprehensive information about lucrative markets - the report analyses the electric vehicle market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electric vehicle market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like BYD Company Ltd. (China), Tesla (US), Zhejiang Geely Holding Group (China), Volkswagen Group (Germany), and General Motors (US), among others, in the electric vehicle market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.2.2 Primary interviews from demand and supply sides

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PLUG-IN ELECTRIC VEHICLE MARKET

- 4.2 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

- 4.3 ELECTRIC VEHICLE MARKET, BY PROPULSION

- 4.4 PLUG-IN ELECTRIC VEHICLE MARKET, BY TOP SPEED

- 4.5 PLUG-IN ELECTRIC VEHICLE MARKET, BY DRIVE TYPE

- 4.6 PLUG-IN ELECTRIC VEHICLE MARKET, BY ELECTRIC ARCHITECTURE

- 4.7 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE BODY TYPE

- 4.8 HYBRID ELECTRIC VEHICLE MARKET, BY CONFIGURATION TYPE

- 4.9 PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Policy support for electric vehicle adoption

- 5.2.1.2 Reduced operating and maintenance costs

- 5.2.1.3 Next-generation battery innovations

- 5.2.1.4 Zero tailpipe and vehicle lifecycle emissions

- 5.2.1.5 Declining costs of EV batteries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial purchase price

- 5.2.2.2 Capital-intensive charging infrastructure deployment

- 5.2.2.3 Battery durability and lifecycle management

- 5.2.2.4 Geopolitical instability and supply chain disruptions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Accelerated investment in charging infrastructure

- 5.2.3.2 Innovation in wireless and on-the-move charging

- 5.2.3.3 Fleet electrification and commercial deployment

- 5.2.3.4 Expansion of Charging-as-a-Service (CaaS) business model

- 5.2.3.5 Integration of bidirectional charging and smart parking

- 5.2.4 CHALLENGES

- 5.2.4.1 Extended charging duration constraints

- 5.2.4.2 Fragmented charging standards and infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 REGULATORY LANDSCAPE

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1.2 ELECTRIC VEHICLE INCENTIVES, BY KEY COUNTRIES

- 6.1.2.1 Netherlands

- 6.1.2.2 Germany

- 6.1.2.3 France

- 6.1.2.4 UK

- 6.1.2.5 China

- 6.1.2.6 US

- 6.1.2.7 Austria

- 6.1.3 INDUSTRY STANDARDS

- 6.2 SUSTAINABILITY INITIATIVES

- 6.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ELECTRIC VEHICLES

- 6.2.1.1 Carbon impact reduction

- 6.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ELECTRIC VEHICLES

- 6.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 KEY EMERGING TECHNOLOGIES

- 6.4.1.1 Introduction

- 6.4.1.2 SiC/GaN for power electronics

- 6.4.1.3 Sodium-ion batteries

- 6.4.1.4 E-axles and integrated drive units

- 6.4.1.5 V2X charging

- 6.4.1.6 V2L

- 6.4.1.7 Solid-state batteries

- 6.4.2 COMPLEMENTARY TECHNOLOGIES

- 6.4.2.1 Battery recycling and 2nd life batteries

- 6.4.2.2 Internet of Things in electric vehicles

- 6.4.2.3 Lightweight materials for electric vehicles

- 6.4.3 ADJACENT TECHNOLOGIES

- 6.4.3.1 Smart grids and microgrids

- 6.4.3.2 Energy storage systems (ESS) for grid balancing

- 6.4.1 KEY EMERGING TECHNOLOGIES

- 6.5 TECHNOLOGY/PRODUCT ROADMAP

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.3 DOCUMENT TYPE

- 6.6.4 INSIGHTS

- 6.6.5 LEGAL STATUS OF PATENTS

- 6.6.6 JURISDICTION ANALYSIS

- 6.6.7 TOP APPLICANTS

- 6.6.8 LIST OF PATENTS

- 6.7 FUTURE APPLICATIONS

- 6.8 IMPACT OF AI/GEN AI ON ELECTRIC VEHICLE MARKET

- 6.8.1 TOP IN-VEHICLE USE CASES AND MARKET POTENTIAL

- 6.8.2 TOP MANUFACTURING USE CASES AND MARKET POTENTIAL

- 6.8.3 BEST PRACTICES IN ELECTRIC VEHICLE DEVELOPMENT

- 6.8.4 CASE STUDIES OF AI IMPLEMENTATION IN ELECTRIC VEHICLE MARKET

- 6.8.5 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.8.6 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ELECTRIC VEHICLE MARKET

- 6.9 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.9.1 RIVIAN: AI FOR PREDICTIVE MAINTENANCE

- 6.9.2 BMW GROUP: GEN AI IN PURCHASING AND DIGITAL EXPERIENCE

- 6.9.3 VOLKSWAGEN GROUP: GEN AI AND CONNECTED VEHICLE ECOSYSTEMS

- 6.10 DECISION-MAKING PROCESS FOR INVESTMENT IN EV MARKET

- 6.11 KEY STAKEHOLDERS IN BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 6.13 ECOSYSTEM ANALYSIS

- 6.13.1 ELECTRIC VEHICLE CHARGING PROVIDERS

- 6.13.2 ENERGY UTILITY COMPANIES

- 6.13.3 SOFTWARE PROVIDERS

- 6.13.4 BATTERY MANUFACTURERS

- 6.13.5 COMPONENT MANUFACTURERS

- 6.13.6 OEMS

- 6.13.7 END USERS

- 6.13.7.1 Mobility service providers

- 6.13.7.2 EV fleet operators

- 6.14 SUPPLY CHAIN ANALYSIS

- 6.15 PRICING ANALYSIS

- 6.15.1 INDICATIVE SELLING PRICE, BY KEY BATTERY ELECTRIC VEHICLE MODELS, 2024

- 6.15.2 AVERAGE SELLING PRICE TREND OF ELECTRIC PROPULSION, 2022-2024

- 6.15.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.17 INVESTMENT AND FUNDING SCENARIO

- 6.18 FUNDING BY USE CASE APPLICATION

- 6.19 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.20 TRADE ANALYSIS

- 6.20.1 IMPORT SCENARIO (HS CODE 870380)

- 6.20.2 EXPORT SCENARIO (HS CODE 870380)

- 6.21 CASE STUDY ANALYSIS

- 6.21.1 ELECTRIC VEHICLE FLEETS FOR PUBLIC SECTOR IN VERMONT, US

- 6.21.2 FRITO-LAY LOGISTICS FLEET ELECTRIFICATION

- 6.21.3 NAIROBI'S ELECTRIC TAXI FLEET

- 6.21.4 NOPIARIDE DC FAST CHARGING HUBS IN KENYA

- 6.22 EXISTING AND UPCOMING ELECTRIC VEHICLE MODELS, 2024-2026

- 6.23 TOTAL COST OF OWNERSHIP

- 6.24 BILL OF MATERIALS ANALYSIS

- 6.25 OEM ELECTROMOBILITY PROGRESS

- 6.25.1 OEM TARGETS AND INVESTMENTS

- 6.25.2 REGIONAL PLUG-IN ELECTRIC VEHICLE OEM ANALYSIS

- 6.25.2.1 Asia Pacific

- 6.25.2.2 Southeast Asia

- 6.25.2.3 Europe

- 6.25.2.4 Latin America

- 6.25.2.5 North America

7 ELECTRIC VEHICLE MARKET, BY PROPULSION

- 7.1 INTRODUCTION

- 7.2 BEST-SELLING ELECTRIC VEHICLE MODELS, 2024

- 7.3 BATTERY ELECTRIC VEHICLE (BEV)

- 7.3.1 SHIFT TO ZERO TAILPIPE EMISSION TRANSPORT & GOVERNMENT SUPPORT TO DRIVE MARKET

- 7.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 7.4.1 OEM PLANS TO REDUCE INVESTMENTS TO H2 VEHICLES AND RECENT H2 REFUELING STATION SHUTDOWNS TO REDUCE DEMAND

- 7.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 7.5.1 REDUCED FUEL CONSUMPTION AND EMISSIONS TO DRIVE MARKET

- 7.6 HYBRID ELECTRIC VEHICLE (HEV)

- 7.6.1 INCREASED VEHICLE MILEAGE WITH DUAL PROPULSION TO DRIVE MARKET

- 7.7 MILD HYBRID ELECTRIC VEHICLE (MHEV)

- 7.7.1 LOW-COST ELECTRIFICATION OPTION TO DRIVE MARKET

- 7.8 PRIMARY INSIGHTS

8 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 BEST-SELLING ELECTRIC PASSENGER CARS, 2024

- 8.3 PASSENGER CAR

- 8.3.1 SUPPORTIVE GOVERNMENT REGULATIONS AND SUBSIDIES TO DRIVE MARKET

- 8.4 COMMERCIAL VEHICLE

- 8.4.1 GROWING FLEET ELECTRIFICATION TO DRIVE MARKET

- 8.5 KEY PRIMARY INSIGHTS

9 ELECTRIC VEHICLE MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 BATTERY CELLS AND PACKS

- 9.3 ON-BOARD CHARGERS

- 9.4 MOTORS

- 9.5 POWER CONTROL UNITS

- 9.6 BATTERY MANAGEMENT SYSTEMS

- 9.7 FUEL CELL STACKS

- 9.8 FUEL PROCESSORS

- 9.9 POWER CONDITIONERS

- 9.10 AIR COMPRESSORS

- 9.11 HUMIDIFIERS

10 ELECTRIC VEHICLE MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 OPERATIONAL DATA

- 10.3 PRIVATE

- 10.4 COMMERCIAL FLEET

11 ELECTRIC VEHICLE MARKET, BY VEHICLE CONNECTIVITY

- 11.1 INTRODUCTION

- 11.2 VEHICLE-TO-BUILDING (V2B)/VEHICLE TO INFRASTRUCTURE (V2I)

- 11.3 VEHICLE-TO-GRID (V2G)

- 11.4 VEHICLE-TO-VEHICLE (V2V)

12 HYBRID ELECTRIC VEHICLE MARKET, BY CONFIGURATION TYPE

- 12.1 INTRODUCTION

- 12.2 SERIES

- 12.2.1 RISING DEMAND FOR LOW-EMISSION URBAN TRANSPORT AND DELIVERY FLEETS TO DRIVE MARKET

- 12.3 PARALLEL

- 12.3.1 LOWER PRODUCTION COSTS AND HIGH EFFICIENCY DURING HIGHWAY CRUISING TO DRIVE MARKET

- 12.4 SERIES-PARALLEL

- 12.4.1 FLEXIBLE OPERATION THAT SWITCHES POWER MODES TO OPTIMIZE FUEL SAVINGS AND PERFORMANCE TO DRIVE MARKET

- 12.5 PRIMARY INSIGHTS

13 MILD HYBRID ELECTRIC VEHICLE MARKET, BY TOPOLOGY

- 13.1 INTRODUCTION

- 13.2 P0-BELT INTEGRATION

- 13.3 P1 - BETWEEN ENGINE AND TRANSMISSION

- 13.4 P2 - TRANSMISSION-SIDE INTEGRATION (BELT-CONNECTED)

- 13.5 P3 - TRANSMISSION-SIDE INTEGRATION (SHAFT-CONNECTED)

- 13.6 P4 - REAR AXLE INTEGRATION

14 PLUG-IN ELECTRIC VEHICLE MARKET, BY ELECTRIC ARCHITECTURE

- 14.1 INTRODUCTION

- 14.2 VEHICLE MODELS, BY ELECTRIC ARCHITECTURE

- 14.3 400V

- 14.3.1 COST-EFFECTIVENESS OF 400V ARCHITECTURE TO DRIVE MARKET

- 14.4 800V

- 14.4.1 RISING DEMAND FOR 350+ KW RAPID CHARGING TO DRIVE MARKET IN LUXURY ELECTRIC VEHICLE SEGMENT

- 14.5 PRIMARY INSIGHTS

15 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE BODY TYPE

- 15.1 INTRODUCTION

- 15.2 SUV/MPV

- 15.2.1 CONSUMER DEMAND FOR SPACIOUS, VERSATILE VEHICLES WITH LARGE CARGO AREA TO DRIVE MARKET

- 15.3 SEDAN

- 15.3.1 BALANCE OF EFFICIENCY, COMFORT, AND PERFORMANCE FOR URBAN AND LONG-DISTANCE COMMUTING TO DRIVE DEMAND

- 15.4 HATCHBACK

- 15.4.1 AFFORDABILITY, COMPACT SIZE, AND HIGH ENERGY EFFICIENCY TO DRIVE MARKET

- 15.5 PRIMARY INSIGHTS

16 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE

- 16.1 INTRODUCTION

- 16.2 POPULAR ELECTRIC VEHICLE MODELS, BY DRIVE TYPE

- 16.3 FRONT-WHEEL DRIVE (FWD)

- 16.3.1 LOWER PRODUCTION AND MAINTENANCE COSTS TO DRIVE MARKET

- 16.4 REAR-WHEEL DRIVE (RWD)

- 16.4.1 ENHANCED WEIGHT DISTRIBUTION IMPROVES VEHICLE BALANCE, ATTRACTING PERFORMANCE-FOCUSED CONSUMERS

- 16.5 ALL WHEEL DRIVE (AWD)

- 16.5.1 MULTI-MOTOR CONFIGURATIONS ENABLING RAPID ACCELERATION AND HIGH-SPEED CAPABILITIES TO DRIVE MARKET

- 16.6 PRIMARY INSIGHTS

17 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE TOP SPEED

- 17.1 INTRODUCTION

- 17.2 ACCELERATION AND TOP SPEED BENCHMARKING OF KEY EV MODELS

- 17.3 <110 MPH

- 17.3.1 URBAN COMMUTING AND INCREASED USE OF ELECTRIC VEHICLES IN DELIVERY FLEETS TO DRIVE MARKET

- 17.4 >110 MPH

- 17.4.1 RISING DEMAND FOR LUXURY AND HIGH-PERFORMANCE ELECTRIC VEHICLES TO DRIVE MARKET

- 17.5 PRIMARY INSIGHTS

18 ELECTRIC VEHICLE MARKET, BY REGION

- 18.1 INTRODUCTION

- 18.2 ASIA PACIFIC

- 18.2.1 MACROECONOMIC OUTLOOK

- 18.2.2 CHINA

- 18.2.2.1 Dominant domestic EV supply chain to drive market

- 18.2.3 INDIA

- 18.2.3.1 Domestic OEM push for EV innovation and localized manufacturing to drive market

- 18.2.4 JAPAN

- 18.2.4.1 Growing preference for dual-propulsion vehicles to drive market

- 18.2.5 SOUTH KOREA

- 18.2.5.1 Government incentives and OEM EV targets to drive market

- 18.3 SOUTHEAST ASIA

- 18.3.1 MACROECONOMIC OUTLOOK

- 18.3.2 THAILAND

- 18.3.2.1 Government plans for 30% EVs by 2030 and growing presence of Chinese budget EVs to drive market

- 18.3.3 INDONESIA

- 18.3.3.1 Government support for domestic EV manufacturing to drive demand

- 18.3.4 MALAYSIA

- 18.3.4.1 National Green Technology Policy to drive market

- 18.3.5 VIETNAM

- 18.3.5.1 Strong government support and growing demand for Vinfast to drive market

- 18.3.6 SINGAPORE

- 18.3.6.1 Surge in electric fleets to drive market

- 18.3.7 PHILIPPINES

- 18.3.7.1 Urbanization and financing trends to drive market

- 18.3.8 AUSTRALIA

- 18.3.8.1 Government support and setting of charging stations to drive demand

- 18.4 NORTH AMERICA

- 18.4.1 MACROECONOMIC OUTLOOK

- 18.4.2 US

- 18.4.2.1 Support for local manufacturing of EVs to drive market

- 18.4.3 CANADA

- 18.4.3.1 Government support for clean transportation and zero tailpipe emissions to drive market

- 18.4.4 MEXICO

- 18.4.4.1 Growing setup of Chinese EVs to drive market

- 18.5 EUROPE

- 18.5.1 MACROECONOMIC OUTLOOK

- 18.5.2 GERMANY

- 18.5.2.1 Strong domestic OEM investment in vehicle electrification to drive market

- 18.5.3 FRANCE

- 18.5.3.1 Government subsidies and strong domestic OEM EV offerings to drive market

- 18.5.4 NETHERLANDS

- 18.5.4.1 Government incentives and presence of dense supporting infrastructure to drive market

- 18.5.5 NORWAY

- 18.5.5.1 High rate of EV adoption and government policy leadership to drive market

- 18.5.6 SWEDEN

- 18.5.6.1 Strong government focus for sustainability, tax benefits, and business incentives to drive market

- 18.5.7 UK

- 18.5.7.1 ZEV mandates and growing rate of fleet electrification to drive market

- 18.5.8 DENMARK

- 18.5.8.1 Tax breaks on EV registrations and substantial investments in public and private charging infrastructure to drive market

- 18.5.9 AUSTRIA

- 18.5.9.1 Significant private investment in charging infrastructure and strong government subsidies to drive market

- 18.5.10 SWITZERLAND

- 18.5.10.1 High environmental awareness and expanding government incentives to drive market

- 18.5.11 SPAIN

- 18.5.11.1 Government incentives and strong infrastructure investments to drive market

- 18.5.12 RUSSIA

- 18.5.12.1 Chinese OEM influx to drive market

- 18.5.13 ITALY

- 18.5.13.1 Government support through incentives and presence of diverse plug-in and hybrid electric vehicle models to drive market

- 18.6 MIDDLE EAST

- 18.6.1 MACROECONOMIC OUTLOOK

- 18.6.2 UAE

- 18.6.2.1 Policy incentives and growing EV support infrastructure to drive market

- 18.6.3 SAUDI ARABIA

- 18.6.3.1 Government targets and support for localized manufacturing to drive market

- 18.6.4 ISRAEL

- 18.6.4.1 Strong incentives and rapid new-tech adoption to drive market

- 18.7 LATIN AMERICA

- 18.7.1 MACROECONOMIC OUTLOOK

- 18.7.2 BRAZIL

- 18.7.2.1 Government support for Chinese EV manufacturer setup to drive market

- 18.7.3 COLOMBIA

- 18.7.3.1 Increased focus on fleet electrification to drive demand

- 18.7.4 CHILE

- 18.7.4.1 Government support for infrastructure development to drive market

- 18.7.5 URUGUAY

- 18.7.5.1 Aggressive subsidies and supportive policies to drive market

- 18.7.6 COSTA RICA

- 18.7.6.1 Government support for EV adoption to drive market

- 18.8 AFRICA

- 18.8.1 MACROECONOMIC OUTLOOK

- 18.8.2 MOROCCO

- 18.8.2.1 Strong tax breaks and focus on domestic EV manufacturing to drive market

- 18.8.3 EGYPT

- 18.8.3.1 Rising urbanization and increase in localized EV assembly to drive market

- 18.8.4 SOUTH AFRICA

- 18.8.4.1 Government incentives and domestic automotive sector transition to drive market

19 COMPETITIVE LANDSCAPE

- 19.1 INTRODUCTION

- 19.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-JULY 2025

- 19.3 MARKET SHARE ANALYSIS, 2024

- 19.3.1 PLUG-IN ELECTRIC VEHICLE MARKET SHARE ANALYSIS, 2024

- 19.3.2 HYBRID ELECTRIC AND MILD HYBRID VEHICLE MARKET SHARE ANALYSIS, 2024

- 19.3.3 REGIONAL-LEVEL ELECTRIC VEHICLE MARKET SHARE ANALYSIS

- 19.3.3.1 Asia Pacific

- 19.3.3.2 Southeast Asia

- 19.3.3.3 Europe

- 19.3.3.4 North America

- 19.3.3.5 Latin America

- 19.4 REVENUE ANALYSIS, 2020-2024

- 19.5 COMPANY VALUATION AND FINANCIAL METRICS

- 19.6 BRAND/PRODUCT COMPARISON

- 19.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 19.7.1 STARS

- 19.7.2 EMERGING LEADERS

- 19.7.3 PERVASIVE PLAYERS

- 19.7.4 PARTICIPANTS

- 19.7.5 COMPANY FOOTPRINT

- 19.7.5.1 Company footprint

- 19.7.5.2 Region footprint

- 19.7.5.3 Top speed footprint

- 19.7.5.4 Vehicle drive type footprint

- 19.7.5.5 Propulsion footprint

- 19.7.5.6 Vehicle body type footprint

- 19.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 19.8.1 PROGRESSIVE COMPANIES

- 19.8.2 RESPONSIVE COMPANIES

- 19.8.3 DYNAMIC COMPANIES

- 19.8.4 STARTING BLOCKS

- 19.8.5 COMPETITIVE BENCHMARKING

- 19.8.5.1 List of startups/SMEs

- 19.8.5.2 Competitive benchmarking of startups/SMEs

- 19.9 COMPETITIVE SCENARIO

- 19.9.1 PRODUCT LAUNCHES

- 19.9.2 DEALS

- 19.9.3 EXPANSIONS

- 19.9.4 OTHER DEVELOPMENTS

20 COMPANY PROFILES

- 20.1 KEY PLAYERS

- 20.1.1 BYD COMPANY LTD.

- 20.1.1.1 Business overview

- 20.1.1.2 Products/Solutions offered

- 20.1.1.3 Recent developments

- 20.1.1.3.1 Product launches/developments

- 20.1.1.3.2 Deals

- 20.1.1.3.3 Expansions

- 20.1.1.3.4 Other developments

- 20.1.1.4 MnM view

- 20.1.1.4.1 Right to win

- 20.1.1.4.2 Strategic choices

- 20.1.1.4.3 Weaknesses and competitive threats

- 20.1.2 TESLA

- 20.1.2.1 Business overview

- 20.1.2.2 Products/Solutions offered

- 20.1.2.3 Recent developments

- 20.1.2.3.1 Product launches/developments/upgrades

- 20.1.2.3.2 Deals

- 20.1.2.3.3 Expansions

- 20.1.2.3.4 Other developments

- 20.1.2.4 MnM view

- 20.1.2.4.1 Right to win

- 20.1.2.4.2 Strategic choices

- 20.1.2.4.3 Weaknesses and competitive threats

- 20.1.3 ZHEJIANG GEELY HOLDING GROUP

- 20.1.3.1 Business overview

- 20.1.3.2 Products/Solutions offered

- 20.1.3.3 Recent developments

- 20.1.3.3.1 Product launches/developments

- 20.1.3.3.2 Deals

- 20.1.3.3.3 Expansions

- 20.1.3.3.4 Other developments

- 20.1.3.4 MnM view

- 20.1.3.4.1 Right to win

- 20.1.3.4.2 Strategic choices

- 20.1.3.4.3 Weaknesses and competitive threats

- 20.1.4 VOLKSWAGEN GROUP

- 20.1.4.1 Business overview

- 20.1.4.2 Products/Solutions offered

- 20.1.4.3 Recent developments

- 20.1.4.3.1 Product launches/developments

- 20.1.4.3.2 Deals

- 20.1.4.3.3 Expansions

- 20.1.4.3.4 Other developments

- 20.1.4.4 MnM view

- 20.1.4.4.1 Right to win

- 20.1.4.4.2 Strategic choices

- 20.1.4.4.3 Weaknesses and competitive threats

- 20.1.5 GENERAL MOTORS

- 20.1.5.1 Business overview

- 20.1.5.2 Products/Solutions offered

- 20.1.5.3 Recent developments

- 20.1.5.3.1 Product launches

- 20.1.5.3.2 Deals

- 20.1.5.3.3 Expansions

- 20.1.5.3.4 Other developments

- 20.1.5.4 MnM view

- 20.1.5.4.1 Right to win

- 20.1.5.4.2 Strategic choices

- 20.1.5.4.3 Weaknesses and competitive threats

- 20.1.6 CHANGAN

- 20.1.6.1 Business overview

- 20.1.6.2 Products/Solutions offered

- 20.1.6.3 Recent developments

- 20.1.6.3.1 Product launches

- 20.1.6.3.2 Deals

- 20.1.6.3.3 Expansions

- 20.1.7 BMW GROUP

- 20.1.7.1 Business overview

- 20.1.7.2 Products/Solutions offered

- 20.1.7.3 Recent developments

- 20.1.7.3.1 Product launches/upgrades

- 20.1.7.3.2 Expansions

- 20.1.7.3.3 Other developments

- 20.1.8 LI AUTO INC.

- 20.1.8.1 Business overview

- 20.1.8.2 Products/Solutions offered

- 20.1.8.3 Recent developments

- 20.1.8.3.1 Product launches

- 20.1.8.3.2 Deals

- 20.1.9 HYUNDAI MOTOR GROUP

- 20.1.9.1 Business overview

- 20.1.9.2 Products/Solutions offered

- 20.1.9.3 Recent developments

- 20.1.9.3.1 Product launches

- 20.1.9.3.2 Deals

- 20.1.9.3.3 Expansions

- 20.1.9.3.4 Other developments

- 20.1.10 GAC GROUP

- 20.1.10.1 Business overview

- 20.1.10.2 Products/Solutions offered

- 20.1.10.3 Recent developments

- 20.1.10.3.1 Product launches/developments

- 20.1.10.3.2 Deals

- 20.1.10.3.3 Expansions

- 20.1.10.3.4 Other developments

- 20.1.11 STELLANTIS NV

- 20.1.11.1 Business overview

- 20.1.11.2 Products/Solutions offered

- 20.1.11.3 Recent developments

- 20.1.11.3.1 Product launches/developments

- 20.1.11.3.2 Deals

- 20.1.11.3.3 Expansions

- 20.1.11.3.4 Other developments

- 20.1.12 GREAT WALL MOTOR

- 20.1.12.1 Business overview

- 20.1.12.2 Products/Solutions offered

- 20.1.12.3 Recent developments

- 20.1.12.3.1 Product launches/developments

- 20.1.12.3.2 Deals

- 20.1.12.3.3 Expansions

- 20.1.12.3.4 Other developments

- 20.1.1 BYD COMPANY LTD.

- 20.2 OTHER KEY PLAYERS

- 20.2.1 TOYOTA MOTOR CORPORATION

- 20.2.2 RENAULT-NISSAN-MITSUBISHI

- 20.2.3 HONDA MOTOR CO., LTD.

- 20.2.4 MERCEDES-BENZ GROUP AG

- 20.2.5 FORD MOTOR COMPANY

- 20.2.6 CHERY

- 20.2.7 LEAPMOTOR INTERNATIONAL B.V.

- 20.2.8 SAIC MOTOR CORPORATION LIMITED

- 20.2.9 NIO

- 20.2.10 XIAOMI

- 20.2.11 RIVIAN

- 20.2.12 LUCID

- 20.2.13 DONGFENG MOTOR CORPORATION

- 20.2.14 FAW TRUCKS CO., LTD.

- 20.2.15 XPENG INC.

- 20.2.16 KG MOBILITY CORP.

- 20.2.17 NETA

- 20.2.18 MAZDA MOTOR CORPORATION

- 20.2.19 SUBARU CORPORATION

- 20.2.20 BAIC GROUP CO., LTD.

- 20.2.21 TATA MOTORS LIMITED

- 20.2.22 XIAOMI AUTO

21 RECOMMENDATIONS BY MARKETSANDMARKETS

- 21.1 SOUTHEAST ASIA TO OFFER LUCRATIVE OPPORTUNITIES

- 21.2 BATTERY ELECTRIC VEHICLES TO HOLD DOMINANT MARKET SHARE

- 21.3 800V ELECTRIC ARCHITECTURE TO ACCELERATE ADOPTION

- 21.4 EMERGING BUSINESS MODELS: BATTERY-AS-A-SERVICE AND CHARGING-AS-A-SERVICE

- 21.5 CONCLUSION

22 APPENDIX

- 22.1 DISCUSSION GUIDE

- 22.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 22.3 CUSTOMIZATION OPTIONS

- 22.3.1 ELECTRIC VEHICLE MARKET, BY BODY TYPE AT COUNTRY LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 22.3.2 PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5)

- 22.3.3 PROFILING OF ADDITIONAL COUNTRIES (UP TO 3)

- 22.4 RELATED REPORTS

- 22.5 AUTHOR DETAILS

List of Tables

- TABLE 1 ELECTRIC VEHICLE MARKET DEFINITION, BY PROPULSION

- TABLE 2 ELECTRIC VEHICLE MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 PLUG-IN ELECTRIC VEHICLE MARKET DEFINITION, BY VEHICLE DRIVE TYPE

- TABLE 4 PLUG-IN ELECTRIC VEHICLE MARKET DEFINITION, BY VEHICLE TOP SPEED

- TABLE 5 ELECTRIC VEHICLE MARKET DEFINITION, BY VEHICLE CONNECTIVITY

- TABLE 6 ELECTRIC VEHICLE MARKET DEFINITION, BY COMPONENT

- TABLE 7 PLUG-IN ELECTRIC VEHICLE MARKET DEFINITION, BY BODY TYPE

- TABLE 8 ELECTRIC VEHICLE MARKET DEFINITION, BY END USE

- TABLE 9 PLUG-IN ELECTRIC VEHICLE MARKET DEFINITION, BY ELECTRIC ARCHITECTURE

- TABLE 10 HYBRID ELECTRIC VEHICLE MARKET DEFINITION, BY CONFIGURATION TYPE

- TABLE 11 MILD HYBRID ELECTRIC VEHICLE MARKET DEFINITION, BY TOPOLOGY

- TABLE 12 ELECTRIC VEHICLE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 13 CURRENCY EXCHANGE RATES, 2019-2024

- TABLE 14 COMPARISON TABLE OF CHARGING COSTS, BY COUNTRY

- TABLE 15 INNOVATION IN BATTERIES BY KEY MANUFACTURERS

- TABLE 16 NUMBER OF CHARGE POINT OPERATORS FOR ELECTRIC CARS, BY COUNTRY, 2024

- TABLE 17 LIST OF ELECTRIC VEHICLES WITH AVERAGE RANGE

- TABLE 18 CHARGING POINT OPERATORS

- TABLE 19 ELECTRIC FLEET COMMITMENTS BY LEADING COMPANIES

- TABLE 20 ELECTRIC VEHICLE MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 NETHERLANDS: ELECTRIC VEHICLE INCENTIVES

- TABLE 25 NETHERLANDS: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 26 GERMANY: ELECTRIC VEHICLE INCENTIVES

- TABLE 27 GERMANY: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 28 FRANCE: ELECTRIC VEHICLE INCENTIVES

- TABLE 29 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 30 UK: ELECTRIC VEHICLE INCENTIVES

- TABLE 31 UK: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 32 CHINA: ELECTRIC VEHICLE INCENTIVES

- TABLE 33 CHINA: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 34 US: ELECTRIC VEHICLE INCENTIVES

- TABLE 35 US: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- TABLE 36 AUSTRIA: ELECTRIC VEHICLE INCENTIVES

- TABLE 37 GLOBAL INDUSTRY STANDARDS IN ELECTRIC VEHICLE MARKET

- TABLE 38 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN ELECTRIC VEHICLE MARKET

- TABLE 39 COMPANY ANNOUNCEMENTS FOR SODIUM-ION BATTERY ROADMAP

- TABLE 40 OEM TIE-UPS FOR INTEGRATED E-AXLE DEPLOYMENT

- TABLE 41 LIST OF ELECTRIC VEHICLES WITH V2L

- TABLE 42 RECENT DEVELOPMENTS IN SOLID-STATE BATTERIES

- TABLE 43 OEM PLANS FOR BATTERY CIRCULARITY

- TABLE 44 ELECTRIC VEHICLE MARKET: TOTAL NUMBER OF PATENTS, JANUARY 2015-DECEMBER 2024

- TABLE 45 IMPORTANT PATENT REGISTRATIONS RELATED TO ELECTRIC VEHICLE MARKET

- TABLE 46 COMMERCIALIZATION PLANS AND VALUE PROPOSITION FOR KEY ELECTRIC VEHICLE TECHNOLOGIES

- TABLE 47 TOP USE CASES AND MARKET POTENTIAL

- TABLE 48 TOP MANUFACTURING USE CASES AND MARKET POTENTIAL

- TABLE 49 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 50 ELECTRIC VEHICLE MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 51 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 52 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VEHICLE TYPES (%)

- TABLE 53 KEY BUYING CRITERIA FOR ELECTRIC VEHICLE, BY VEHICLE TYPE

- TABLE 54 ELECTRIC VEHICLE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 55 ELECTRIC VEHICLE MARKET: INDICATIVE SELLING PRICE, BY KEY BATTERY ELECTRIC VEHICLE MODELS, 2024

- TABLE 56 AVERAGE SELLING PRICE, BY PROPULSION, 2022-2024 (USD)

- TABLE 57 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 58 ELECTRIC VEHICLE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 59 IMPORT DATA FOR HS CODE 870380, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 60 EXPORT DATA FOR HS CODE 870380, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 61 EXISTING AND UPCOMING ELECTRIC VEHICLE MODELS, 2024-2026

- TABLE 62 ANNUAL ELECTRIC COST VS. ANNUAL GAS COST (2024)

- TABLE 63 ELECTRIC VEHICLE MARKET: OEM TARGETS AND INVESTMENTS

- TABLE 64 ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 65 ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 66 ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (USD BILLION)

- TABLE 67 ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (USD BILLION)

- TABLE 68 BEST-SELLING ELECTRIC VEHICLES IN 2024 (UNITS)

- TABLE 69 BATTERY ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 70 BATTERY ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 71 BATTERY ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 72 BATTERY ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 73 FUEL CELL ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 74 FUEL CELL ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 75 FUEL CELL ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 76 FUEL CELL ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 77 PLUG-IN HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 78 PLUG-IN HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 79 PLUG-IN HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 80 PLUG-IN HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 81 HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 82 HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 83 HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 84 HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 85 MILD HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 86 MILD HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 87 MILD HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 88 MILD HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 89 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 90 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 91 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2021-2024 (USD BILLION)

- TABLE 92 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2025-2035 (USD BILLION)

- TABLE 93 BEST-SELLING ELECTRIC PASSENGER CAR SALES, BY MODEL, 2024

- TABLE 94 ELECTRIC PASSENGER CAR MODELS, 2024-2027

- TABLE 95 UPCOMING ELECTRIC COMMERCIAL VEHICLES, 2024-2026

- TABLE 96 ELECTRIC PASSENGER CAR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 97 ELECTRIC PASSENGER CAR MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 98 ELECTRIC PASSENGER CAR MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 99 ELECTRIC PASSENGER CAR MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 100 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 101 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 102 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 103 ELECTRIC COMMERCIAL VEHICLE MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 104 BATTERY CELL AND PACK SUPPLIER DATA

- TABLE 105 ON-BOARD CHARGER SUPPLIER DATA

- TABLE 106 MOTOR SUPPLIER DATA

- TABLE 107 DC-DC CONVERTER SUPPLIER DATA

- TABLE 108 INVERTER SUPPLIER DATA

- TABLE 109 BATTERY MANAGEMENT SYSTEM SUPPLIER DATA

- TABLE 110 ELECTRIC VEHICLE FLEET TARGETS WORLDWIDE

- TABLE 111 ELECTRIC VEHICLES IN USE FOR COMMERCIAL FLEETS

- TABLE 112 COMMERCIAL FLEET SEGMENTS BY KEY COMPANIES

- TABLE 113 HYBRID ELECTRIC VEHICLE MARKET, BY CONFIGURATION TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 114 HYBRID ELECTRIC VEHICLE MARKET, BY CONFIGURATION TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 115 SERIES: HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 116 SERIES: HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 117 PARALLEL: HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 118 PARALLEL: HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 119 SERIES-PARALLEL: HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 120 SERIES-PARALLEL: HYBRID ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 121 DIFFERENCE BETWEEN 400V AND 800V ELECTRIC ARCHITECTURES

- TABLE 122 ELECTRIC VEHICLE MARKET, BY ELECTRIC ARCHITECTURE, 2021-2024 (THOUSAND UNITS)

- TABLE 123 ELECTRIC VEHICLE MARKET, BY ELECTRIC ARCHITECTURE, 2025-2035 (THOUSAND UNITS)

- TABLE 124 VEHICLE MODELS, BY ELECTRIC ARCHITECTURE 400V-800V (UNITS)

- TABLE 125 400V: ELECTRIC ARCHITECTURE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 126 400V: ELECTRIC ARCHITECTURE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 127 VEHICLE MODELS, BY ELECTRIC ARCHITECTURE FOR 800V, 2024

- TABLE 128 800V: ELECTRIC ARCHITECTURE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 129 800V: ELECTRIC ARCHITECTURE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 130 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE BODY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 131 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE BODY TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 132 SUV/MPV: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 133 SUV/MPV: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 134 SEDAN: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 135 SEDAN: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 136 HATCHBACK: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 137 HATCHBACK: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 138 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 139 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 140 POPULAR ELECTRIC VEHICLES WORLDWIDE, BY DRIVE TYPE (UNITS)

- TABLE 141 FRONT-WHEEL DRIVE: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 142 FRONT-WHEEL DRIVE: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 143 REAR-WHEEL DRIVE: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 144 REAR-WHEEL DRIVE: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 145 ALL WHEEL DRIVE: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 146 ALL WHEEL DRIVE: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 147 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE TOP SPEED, 2021-2024 (THOUSAND UNITS)

- TABLE 148 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE TOP SPEED, 2025-2035 (THOUSAND UNITS)

- TABLE 149 FASTEST ELECTRIC CARS

- TABLE 150 <110 MPH: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 151 <110 MPH: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 152 >110 MPH: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 153 >110 MPH: PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 154 ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 155 ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 156 ELECTRIC VEHICLE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 157 ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035 (USD BILLION)

- TABLE 158 ASIA PACIFIC: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 159 ASIA PACIFIC: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 160 BEST-SELLING ELECTRIC VEHICLES IN CHINA, 2024

- TABLE 161 CHINA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 162 CHINA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 163 INDIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 164 INDIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 165 JAPAN: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 166 JAPAN: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 167 SOUTH KOREA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 168 SOUTH KOREA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 169 SOUTHEAST ASIA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 170 SOUTHEAST ASIA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 171 THAILAND: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 172 THAILAND: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 173 INDONESIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 174 INDONESIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 175 MALAYSIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 MALAYSIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 177 VIETNAM: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 178 VIETNAM: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 179 SINGAPORE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 180 SINGAPORE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 181 PHILIPPINES: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 182 PHILIPPINES: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 183 AUSTRALIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 184 AUSTRALIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 185 NORTH AMERICA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 186 NORTH AMERICA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 187 BEST-SELLING ELECTRIC VEHICLES IN US, 2024

- TABLE 188 US: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 189 US: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 190 CANADA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 191 CANADA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 192 MEXICO: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 193 MEXICO: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 194 EUROPE: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 195 EUROPE: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 196 GERMANY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 197 GERMANY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 198 FRANCE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 199 FRANCE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 200 NETHERLANDS: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 201 NETHERLANDS: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 202 NORWAY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 203 NORWAY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 204 SWEDEN: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 205 SWEDEN: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 206 UK: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 207 UK: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 208 DENMARK: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 209 DENMARK: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 210 AUSTRIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 211 AUSTRIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 212 SWITZERLAND: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 213 SWITZERLAND: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 214 SPAIN: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 215 SPAIN: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 216 RUSSIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 217 RUSSIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 218 ITALY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 219 ITALY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 220 MIDDLE EAST: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 221 MIDDLE EAST: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 222 UAE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 223 UAE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 224 SAUDI ARABIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 225 SAUDI ARABIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 226 ISRAEL: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 227 ISRAEL: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 228 LATIN AMERICA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 229 LATIN AMERICA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 230 BRAZIL: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 231 BRAZIL: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 232 COLOMBIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 233 COLOMBIA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 234 CHILE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 235 CHILE: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 236 URUGUAY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 237 URUGUAY: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 238 COSTA RICA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 239 COSTA RICA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 240 AFRICA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 241 AFRICA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 242 MOROCCO: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 243 MOROCCO: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 244 EGYPT: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 245 EGYPT: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 246 SOUTH AFRICA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 247 SOUTH AFRICA: ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035 (THOUSAND UNITS)

- TABLE 248 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 249 ELECTRIC VEHICLE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 250 ELECTRIC VEHICLE MARKET: REGION FOOTPRINT

- TABLE 251 ELECTRIC VEHICLE MARKET: VEHICLE TOP SPEED FOOTPRINT

- TABLE 252 ELECTRIC VEHICLE MARKET: VEHICLE DRIVE TYPE FOOTPRINT

- TABLE 253 ELECTRIC VEHICLE MARKET: PROPULSION FOOTPRINT

- TABLE 254 ELECTRIC VEHICLE MARKET: VEHICLE BODY TYPE FOOTPRINT

- TABLE 255 ELECTRIC VEHICLE MARKET: LIST OF STARTUPS/SMES

- TABLE 256 ELECTRIC VEHICLE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, (1/2)

- TABLE 257 ELECTRIC VEHICLE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, (2/2)

- TABLE 258 ELECTRIC VEHICLE MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 259 ELECTRIC VEHICLE MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 260 ELECTRIC VEHICLE MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 261 ELECTRIC VEHICLE MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JULY 2025

- TABLE 262 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 263 BYD COMPANY LTD.: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 264 BYD COMPANY LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 265 BYD COMPANY LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 266 BYD COMPANY LTD.: DEALS

- TABLE 267 BYD COMPANY LTD.: EXPANSIONS

- TABLE 268 BYD COMPANY LTD.: OTHER DEVELOPMENTS

- TABLE 269 TESLA: COMPANY OVERVIEW

- TABLE 270 TESLA: INSTALLED ANNUAL VEHICLE CAPACITY, BY MODEL

- TABLE 271 TESLA: PRODUCTION AND DELIVERY OF VEHICLES, 2024

- TABLE 272 TESLA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 273 TESLA: PRODUCT LAUNCHES/DEVELOPMENTS/UPGRADES

- TABLE 274 TESLA: DEALS

- TABLE 275 TESLA: EXPANSIONS

- TABLE 276 TESLA: OTHER DEVELOPMENTS

- TABLE 277 ZHEJIANG GEELY HOLDING GROUP: COMPANY OVERVIEW

- TABLE 278 ZHEJIANG GEELY HOLDING GROUP: VOLVO CAR SALES, 2024 (UNITS)

- TABLE 279 ZHEJIANG GEELY HOLDING GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 280 ZHEJIANG GEELY HOLDING GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 281 ZHEJIANG GEELY HOLDING GROUP: DEALS

- TABLE 282 ZHEJIANG GEELY HOLDING GROUP: EXPANSIONS

- TABLE 283 ZHEJIANG GEELY HOLDING GROUP: OTHER DEVELOPMENTS

- TABLE 284 VOLKSWAGEN GROUP: COMPANY OVERVIEW

- TABLE 285 VOLKSWAGEN GROUP: BATTERY ELECTRIC VEHICLE DELIVERIES, 2024

- TABLE 286 VOLKSWAGEN GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 287 VOLKSWAGEN GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 288 VOLKSWAGEN GROUP: DEALS

- TABLE 289 VOLKSWAGEN GROUP: EXPANSIONS

- TABLE 290 VOLKSWAGEN GROUP: OTHER DEVELOPMENTS

- TABLE 291 GENERAL MOTORS: COMPANY OVERVIEW

- TABLE 292 GENERAL MOTORS: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 293 GENERAL MOTORS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 294 GENERAL MOTORS: PRODUCT LAUNCHES

- TABLE 295 GENERAL MOTORS: DEALS

- TABLE 296 GENERAL MOTORS: EXPANSIONS

- TABLE 297 GENERAL MOTORS: OTHER DEVELOPMENTS

- TABLE 298 CHANGAN: COMPANY OVERVIEW

- TABLE 299 CHANGAN: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 300 CHANGAN: PRODUCTS/SOLUTIONS OFFERED

- TABLE 301 CHANGAN: PRODUCT LAUNCHES

- TABLE 302 CHANGAN: DEALS

- TABLE 303 CHANGAN: EXPANSIONS

- TABLE 304 BMW GROUP: COMPANY OVERVIEW

- TABLE 305 BMW GROUP: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 306 BMW GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 307 BMW GROUP: PRODUCT LAUNCHES/UPGRADES

- TABLE 308 BMW GROUP: EXPANSIONS

- TABLE 309 BMW GROUP: OTHER DEVELOPMENTS

- TABLE 310 LI AUTO INC.: COMPANY OVERVIEW

- TABLE 311 LI AUTO INC.: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 312 LI AUTO INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 313 LI AUTO INC.: PRODUCT LAUNCHES

- TABLE 314 LI AUTO INC.: DEALS

- TABLE 315 HYUNDAI MOTOR GROUP: COMPANY OVERVIEW

- TABLE 316 HYUNDAI MOTOR GROUP: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 317 HYUNDAI MOTOR GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 318 HYUNDAI MOTOR GROUP: PRODUCT LAUNCHES

- TABLE 319 HYUNDAI MOTOR GROUP: DEALS

- TABLE 320 HYUNDAI MOTOR GROUP: EXPANSIONS

- TABLE 321 HYUNDAI MOTOR GROUP: OTHER DEVELOPMENTS

- TABLE 322 GAC GROUP: COMPANY OVERVIEW

- TABLE 323 GAC GROUP: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 324 GAC GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 325 GAC GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 326 GAC GROUP: DEALS

- TABLE 327 GAC GROUP: EXPANSIONS

- TABLE 328 GAC GROUP: OTHER DEVELOPMENTS

- TABLE 329 STELLANTIS NV: COMPANY OVERVIEW

- TABLE 330 STELLANTIS NV: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 331 STELLANTIS NV: PRODUCTS/SOLUTIONS OFFERED

- TABLE 332 STELLANTIS NV: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 333 STELLANTIS NV: DEALS

- TABLE 334 STELLANTIS NV: EXPANSIONS

- TABLE 335 STELLANTIS NV: OTHER DEVELOPMENTS

- TABLE 336 GREAT WALL MOTOR: COMPANY OVERVIEW

- TABLE 337 GREAT WALL MOTOR: TOTAL VOLUME OF PRODUCTION AND SALE OF VEHICLES, 2024 (UNITS)

- TABLE 338 GREAT WALL MOTOR: PRODUCTS/SOLUTIONS OFFERED

- TABLE 339 GREAT WALL MOTOR: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 340 GREAT WALL MOTOR: DEALS

- TABLE 341 GREAT WALL MOTOR: EXPANSIONS

- TABLE 342 GREAT WALL MOTOR: OTHER DEVELOPMENTS

- TABLE 343 TOYOTA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 344 RENAULT-NISSAN-MITSUBISHI: COMPANY OVERVIEW

- TABLE 345 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 346 MERCEDES-BENZ GROUP AG: COMPANY OVERVIEW

- TABLE 347 FORD MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 348 CHERY: COMPANY OVERVIEW

- TABLE 349 LEAPMOTOR INTERNATIONAL B.V.: COMPANY OVERVIEW

- TABLE 350 SAIC MOTOR CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 351 NIO: COMPANY OVERVIEW

- TABLE 352 XIAOMI: COMPANY OVERVIEW

- TABLE 353 RIVIAN: COMPANY OVERVIEW

- TABLE 354 LUCID: COMPANY OVERVIEW

- TABLE 355 DONGFENG MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 356 FAW TRUCKS CO., LTD.: COMPANY OVERVIEW

- TABLE 357 XPENG INC.: COMPANY OVERVIEW

- TABLE 358 KG MOBILITY CORP.: COMPANY OVERVIEW

- TABLE 359 NETA: COMPANY OVERVIEW

- TABLE 360 MAZDA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 361 SUBARU CORPORATION: COMPANY OVERVIEW

- TABLE 362 BAIC GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 363 TATA MOTORS LIMITED: COMPANY OVERVIEW

- TABLE 364 XIAOMI AUTO: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ELECTRIC VEHICLE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 PRIMARY INSIGHTS

- FIGURE 5 MARKET SIZE ESTIMATION: HYPOTHESIS BUILDING

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 10 DEMAND AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 11 ELECTRIC VEHICLE MARKET OUTLOOK

- FIGURE 12 PLUG-IN ELECTRIC VEHICLE MARKET, BY REGION, 2025-2035

- FIGURE 13 ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025-2035

- FIGURE 14 KEY PLAYERS IN ELECTRIC VEHICLE MARKET

- FIGURE 15 ADVANCEMENTS IN BATTERY TECHNOLOGIES TO DRIVE MARKET

- FIGURE 16 PASSENGER CAR SEGMENT TO SECURE LEADING POSITION IN 2035

- FIGURE 17 BEV TO HOLD LARGEST MARKET SHARE IN 2035

- FIGURE 18 >110 MPH TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 19 FWD TO SECURE LEADING POSITION IN 2035

- FIGURE 20 400V ELECTRIC ARCHITECTURE TO DOMINATE MARKET IN 2035

- FIGURE 21 SUV/MPV TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 22 PARALLEL CONFIGURATION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 23 ASIA PACIFIC TO SURPASS OTHER REGIONAL MARKETS IN 2025

- FIGURE 24 ELECTRIC VEHICLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 ELECTRIFICATION TARGETS BY COUNTRIES, 2025-2050

- FIGURE 26 EMISSIONS OF ELECTRIC VEHICLES AND GASOLINE VEHICLES

- FIGURE 27 PRICE TREND OF ELECTRIC VEHICLE BATTERIES, 2020-2030 (USD PER KWH)

- FIGURE 28 PURCHASE COST FOR ELECTRIC AND ICE VEHICLES, BY KEY MODELS

- FIGURE 29 FUEL STATION AVERAGE PRICE COMPARISON

- FIGURE 30 CHINA'S CONTRIBUTION IN PRODUCTION AND PROCESSING OF CRITICAL MINERALS, 2023

- FIGURE 31 GLOBAL COBALT RESERVES, 2024

- FIGURE 32 GLOBAL LITHIUM RESERVES, 2024

- FIGURE 33 OPERATION OF WIRELESS CHARGING TECHNOLOGY

- FIGURE 34 ELECTRIC VEHICLE CHARGING TIME

- FIGURE 35 ELECTRIC VEHICLE CHARGERS USED WORLDWIDE

- FIGURE 36 SIC SUPPLY CHAIN FOR ELECTRIC VEHICLES

- FIGURE 37 HOW V2G CHARGING WORKS

- FIGURE 38 ELECTRIC VEHICLES WITH V2L

- FIGURE 39 SOLID-STATE BATTERY ROADMAP, 2035+

- FIGURE 40 BATTERY MANAGEMENT AND MONITORING SYSTEM

- FIGURE 41 BATTERY MANAGEMENT AND MONITORING SYSTEM OF ELECTRIC VEHICLE ARCHITECTURE

- FIGURE 42 TECHNOLOGY ADOPTION TIMELINE FOR ELECTRIC VEHICLE MARKET

- FIGURE 43 PATENT ANALYSIS, BY DOCUMENT TYPE, JANUARY 2015-DECEMBER 2024

- FIGURE 44 PATENT PUBLICATION TRENDS, 2015-2024

- FIGURE 45 ELECTRIC VEHICLE MARKET: LEGAL STATUS OF PATENTS, JANUARY 2015-DECEMBER 2024

- FIGURE 46 JURISDICTION OF US REGISTERED HIGHEST PERCENTAGE OF PATENTS, 2015-2024

- FIGURE 47 TOP PATENT APPLICANTS, JANUARY 2015-DECEMBER 2024

- FIGURE 48 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 VEHICLE TYPES

- FIGURE 49 KEY BUYING CRITERIA FOR ELECTRIC VEHICLE, BY VEHICLE TYPE

- FIGURE 50 ELECTRIC VEHICLE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 51 ELECTRIC VEHICLE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 52 AVERAGE SELLING PRICE, BY PROPULSION, 2022-2024

- FIGURE 53 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- FIGURE 54 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 55 INVESTMENT AND FUNDING SCENARIO, 2020-2025 (USD BILLION)

- FIGURE 56 IMPORT DATA FOR HS CODE 870380, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 57 EXPORT DATA FOR HS CODE 870380, BY COUNTRY, 2021-2024 (USD BILLION)

- FIGURE 58 US: TOTAL COST OF OWNERSHIP BREAKDOWN (5 YEARS)

- FIGURE 59 BILL OF MATERIALS FOR ICE AND ELECTRIC VEHICLES, 2025 VS. 2035

- FIGURE 60 TOP-SELLING ELECTRIC VEHICLES WORLDWIDE, 2024 (UNITS)

- FIGURE 61 ASIA PACIFIC: TOP-SELLING ELECTRIC VEHICLES, 2024 (UNITS)

- FIGURE 62 ASIA PACIFIC: KEY PRICE POINT OF ELECTRIC VEHICLES

- FIGURE 63 SOUTHEAST ASIA: TOP-SELLING ELECTRIC VEHICLES, 2024 (UNITS)

- FIGURE 64 SOUTHEAST ASIA: KEY PRICE POINT OF ELECTRIC VEHICLES

- FIGURE 65 EUROPE: TOP-SELLING ELECTRIC VEHICLES, 2024 (UNITS)

- FIGURE 66 EUROPE: KEY PRICE POINT OF ELECTRIC VEHICLES

- FIGURE 67 LATIN AMERICA: TOP-SELLING ELECTRIC VEHICLES, 2024 (UNITS)

- FIGURE 68 LATIN AMERICA: KEY PRICE POINT OF ELECTRIC VEHICLES

- FIGURE 69 NORTH AMERICA: TOP-SELLING ELECTRIC VEHICLES, 2024 (UNITS)

- FIGURE 70 NORTH AMERICA: KEY PRICE POINT OF ELECTRIC VEHICLES

- FIGURE 71 ELECTRIC VEHICLE COMPARISON, BY PROPULSION

- FIGURE 72 ELECTRIC VEHICLE MARKET, BY PROPULSION, 2025 VS. 2035 (USD BILLION)

- FIGURE 73 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2025 VS. 2035 (USD BILLION)

- FIGURE 74 SIGNIFICANCE OF V2X IN ELECTRIC VEHICLE MARKET

- FIGURE 75 V2X COMMUNICATION

- FIGURE 76 ELECTRIC VEHICLE MARKET: FACTORS IMPACTING V2X

- FIGURE 77 COMPARISON OF HYBRID ELECTRIC CONFIGURATION TYPES

- FIGURE 78 HYBRID ELECTRIC VEHICLE MARKET, BY CONFIGURATION TYPE, 2025 VS. 2035 (THOUSAND UNITS)

- FIGURE 79 CO2 EMISSION REDUCTION POTENTIAL ACROSS DIFFERENT TOPOLOGIES

- FIGURE 80 HYBRID FUNCTIONS SUPPORTED BY DIFFERENT TOPOLOGIES

- FIGURE 81 COMPARISON OF CO2 REDUCTION IN WLTC AND NEDC FOR DIFFERENT TOPOLOGIES

- FIGURE 82 ELECTRIC VEHICLE MARKET, BY ELECTRIC ARCHITECTURE, 2025 VS. 2035 (THOUSAND UNITS)

- FIGURE 83 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE BODY TYPE, 2025 VS. 2035 (THOUSAND UNITS)

- FIGURE 84 COMPARISON OF ELECTRIC VEHICLE DRIVE TYPES

- FIGURE 85 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2025 VS. 2035 (THOUSAND UNITS)

- FIGURE 86 PLUG-IN ELECTRIC VEHICLE MARKET, BY VEHICLE TOP SPEED, 2025 VS. 2035 (THOUSAND UNITS)

- FIGURE 87 KEY TRANSPORT POLICIES AND TARGETS BY COUNTRIES

- FIGURE 88 ELECTRIC VEHICLE MARKET, BY REGION, 2025 VS. 2035 (USD BILLION)

- FIGURE 89 ASIA PACIFIC: ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 90 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 91 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 92 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 93 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 94 ELECTRIC VEHICLE MOBILITY LANDSCAPE IN CHINA

- FIGURE 95 SOUTHEAST ASIA: ELECTRIC VEHICLE MARKET, BY COUNTRY, 2025 VS. 2035 (THOUSAND UNITS)

- FIGURE 96 SOUTHEAST ASIA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 97 SOUTHEAST ASIA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 98 SOUTHEAST ASIA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 99 SOUTHEAST ASIA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 100 NORTH AMERICA: ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 101 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 102 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 103 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 104 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 105 BEST-SELLING ELECTRIC VEHICLE MODELS IN EUROPE, 2024 (BEV AND PHEV)

- FIGURE 106 EUROPE: ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 107 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 108 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 109 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2025

- FIGURE 110 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 111 GERMANY: ELECTRIC VEHICLE ROADMAP

- FIGURE 112 UK: ELECTRIC VEHICLE ROADMAP

- FIGURE 113 MIDDLE EAST: ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 114 MIDDLE EAST: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 115 MIDDLE EAST: GDP PER CAPITA, 2024-2026

- FIGURE 116 MIDDLE EAST: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 117 MIDDLE EAST: MANUFACTURING INDUSTRY VALUE (AS PART OF GDP), 2024

- FIGURE 118 LATIN AMERICA: ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 119 LATIN AMERICA: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 120 LATIN AMERICA: GDP PER CAPITA, 2024-2026

- FIGURE 121 LATIN AMERICA: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 122 LATIN AMERICA: MANUFACTURING INDUSTRY VALUE (AS PART OF GDP), 2024

- FIGURE 123 AFRICA: ELECTRIC VEHICLE MARKET SNAPSHOT

- FIGURE 124 AFRICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 125 AFRICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 126 AFRICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 127 AFRICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 128 MARKET SHARE ANALYSIS OF KEY PLUG-IN ELECTRIC VEHICLE MANUFACTURERS, 2024

- FIGURE 129 MARKET SHARE ANALYSIS OF KEY PLAYERS IN HYBRID ELECTRIC VEHICLE MARKET, 2024

- FIGURE 130 ASIA PACIFIC: MARKET SHARE ANALYSIS OF KEY PLAYERS IN ELECTRIC VEHICLE MARKET, 2024

- FIGURE 131 SOUTHEAST ASIA: MARKET SHARE ANALYSIS OF KEY PLAYERS IN ELECTRIC VEHICLE MARKET, 2024

- FIGURE 132 EUROPE: MARKET SHARE ANALYSIS OF KEY PLAYERS IN ELECTRIC VEHICLE MARKET, 2024

- FIGURE 133 NORTH AMERICA: MARKET SHARE ANALYSIS OF KEY PLAYERS IN ELECTRIC VEHICLE MARKET, 2024

- FIGURE 134 LATIN AMERICA: MARKET SHARE ANALYSIS OF KEY PLAYERS IN ELECTRIC VEHICLE MARKET, 2024

- FIGURE 135 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 136 COMPANY VALUATION IN ELECTRIC VEHICLE MARKET, 2025

- FIGURE 137 FINANCIAL METRICS (EV/EBITDA) IN ELECTRIC VEHICLE MARKET, 2025

- FIGURE 138 BRAND/PRODUCT COMPARISON IN ELECTRIC VEHICLE MARKET

- FIGURE 139 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 140 ELECTRIC VEHICLE MARKET: COMPANY FOOTPRINT

- FIGURE 141 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 142 BYD COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 143 TESLA: COMPANY SNAPSHOT

- FIGURE 144 ZHEJIANG GEELY HOLDING GROUP: COMPANY SNAPSHOT

- FIGURE 145 ZHEJIANG GEELY HOLDING GROUP: BRANDS

- FIGURE 146 ZHEJIANG GEELY HOLDING GROUP: PRODUCT LINE-UP OF VOLVO

- FIGURE 147 VOLKSWAGEN GROUP: COMPANY SNAPSHOT

- FIGURE 148 VOLKSWAGEN GROUP: REPORTING STRUCTURE

- FIGURE 149 VOLKSWAGEN GROUP: BUSINESS LANDSCAPE, 2024

- FIGURE 150 VOLKSWAGEN GROUP: EXPANSION IN KEY REGIONS, 2024

- FIGURE 151 GENERAL MOTORS: COMPANY SNAPSHOT

- FIGURE 152 CHANGAN: COMPANY SNAPSHOT

- FIGURE 153 BMW GROUP: COMPANY SNAPSHOT

- FIGURE 154 BMW GROUP: ELECTRIC VEHICLE PLANS

- FIGURE 155 LI AUTO INC.: COMPANY SNAPSHOT

- FIGURE 156 HYUNDAI MOTOR GROUP: COMPANY SNAPSHOT

- FIGURE 157 GAC GROUP: COMPANY SNAPSHOT

- FIGURE 158 STELLANTIS NV: COMPANY SNAPSHOT

- FIGURE 159 STELLANTIS NV: ELECTRIFICATION PLANS

- FIGURE 160 GREAT WALL MOTOR: COMPANY SNAPSHOT

- FIGURE 161 GREAT WALL MOTOR: GLOBAL R&D NETWORK