PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1863600

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1863600

Automotive Semiconductor Market By Component, Vehicle Type (Light Commercial Vehicle, Heavy Commercial Vehicle ), Propulusion Type (Internal Combustion Engine, Electric), Application, Material and Region - Global Forecast to 2030

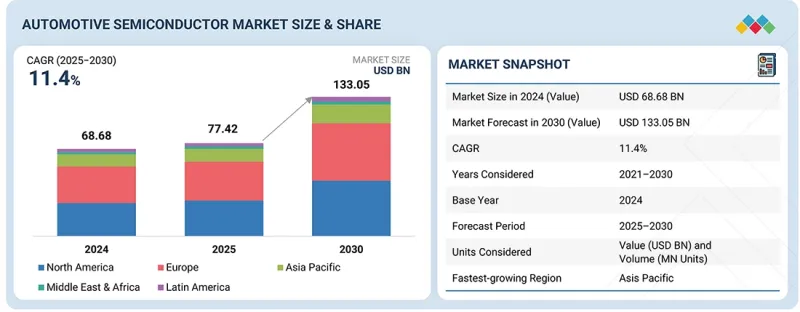

The automotive semiconductor market is projected to grow from USD 77.42 billion in 2025 to USD 133.05 billion by 2030, at a CAGR of 11.4% between 2025 and 2030. Driven by the accelerating transition toward vehicle electrification, the rising integration of advanced driver-assistance systems (ADAS), and the surge in connected and software-defined vehicles, the market continues to expand rapidly.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Vehicle Type, Material, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Increasing semiconductor content per vehicle and advancements in silicon carbide (SiC) and gallium nitride (GaN) technologies enhance energy efficiency, safety, and performance. Expanding EV production, adoption of autonomous features, and government initiatives promoting sustainable mobility further stimulate market growth. However, supply chain disruptions and high production costs remain key challenges, emphasizing the need for collaboration, localization, and innovation to sustain long-term competitiveness.

"By propulsion type, the electric segment is likely to register the highest CAGR between 2025 and 2030."

The electric segment is projected to record the highest CAGR in the automotive semiconductor market during the forecast period, driven by the accelerating global transition toward clean mobility and stringent emission regulations. EVs rely heavily on semiconductors for efficient power conversion, battery management, and energy optimization across propulsion and control systems. Power devices based on silicon carbide (SiC) and gallium nitride (GaN) materials are increasingly adopted for superior switching efficiency, thermal performance, and compact design, supporting higher driving ranges and faster charging. Advanced sensors, microcontrollers, and communication chips further enhance safety, connectivity, and real-time control within electric powertrains. The growing deployment of ADAS, vehicle-to-everything (V2X) communication, and intelligent thermal management systems expands semiconductor content per EV. Additionally, government incentives, infrastructure investments, and the scaling of gigafactories across Asia Pacific, Europe, and North America are strengthening the EV semiconductor supply chain. As automakers invest in software-defined and autonomous EV architectures, semiconductor innovations will remain central to achieving worldwide sustainable, efficient, high-performance electric mobility.

"Based on application, the powertrain segment is projected to account for the largest market share in 2030."

The powertrain segment is projected to hold the largest share of the automotive semiconductor market in 2030, driven by the accelerating shift toward vehicle electrification and the integration of advanced control technologies. Market growth is primarily supported by the rising deployment of semiconductors in engine management systems, transmission control units, battery management systems (BMS), and electric drive modules, enabling improved efficiency, reduced emissions, and enhanced performance. With the increasing adoption of electric and hybrid vehicles, demand for power semiconductors-silicon carbide (SiC) and gallium nitride (GaN) devices-surges due to their ability to support higher voltage operations, faster switching, and superior thermal performance. Additionally, automakers emphasize smart powertrain architectures integrating real-time monitoring, predictive maintenance, and energy optimization features, further increasing semiconductor content per vehicle. The expansion of 800 V vehicle platforms and the move toward modular power electronics also contribute to the growing use of semiconductor solutions in inverters, onboard chargers, and DC-DC converters. As a result, the powertrain segment remains a critical revenue driver, with semiconductor suppliers investing heavily in material innovation, system miniaturization, and high-efficiency designs to meet OEMs' evolving electrification and sustainability requirements.

"Europe is projected to exhibit the second-highest CAGR from 2025 to 2030."

During the forecast period, Europe is expected to register the second-highest CAGR in the automotive semiconductor market, driven by strong advancements in electric mobility, vehicle safety technologies, and digital transformation across the automotive sector. The region hosts leading automakers and Tier-1 suppliers, accelerating the adoption of semiconductors for electrification, ADAS, and connectivity applications. Increasing production of electric and hybrid vehicles, supported by stringent carbon dioxide (CO2) emission regulations and the European Green Deal, boosts the demand for power semiconductors, sensors, and microcontrollers. Countries such as Germany, France, and the Netherlands are leading in innovation, supported by government funding for EV infrastructure, autonomous driving trials, and semiconductor R&D. Moreover, collaborations between chipmakers and automotive OEMs foster localized supply chains and next-generation E/E architectures. These factors collectively position the region as a major hub for technological innovation and sustainable growth in the global automotive semiconductor landscape.

The break-up of the profile of primary participants in the automotive semiconductor market-

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation: C-Level Executives - 40%, Directors - 30%, Others - 30%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, RoW - 10%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the automotive semiconductor market with a significant global presence include Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), Texas Instruments Incorporated (US), and Renesas Electronics Corporation (Japan).

Research Coverage

The report segments the automotive semiconductor market and forecasts its size by component, vehicle type, propulsion type, application, and region. It also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall automotive semiconductor market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (rising vehicle electrification to curb emissions, rapid advances in ADAS and autonomous driving technologies, evolution of connected and software-defined vehicle ecosystem), restraints (high development and qualification costs, supply chain and capacity constraints), opportunities (localization and development of semiconductor ecosystem, rising development of ai-driven domain controllers and edge computing solutions, mounting demand for fast-charging and vehicle-to-grid infrastructure), and challenges (issues in scaling wide-bandgap semiconductor production for automotive applications, challenges in meeting rigorous standards related to automotive systems, complexities associated with semiconductor integration)

- Product development/innovation: Detailed insights on upcoming technologies, research & development activities, and strategies, such as new product launches, collaborations, partnerships, expansions, and acquisitions, in the automotive semiconductor market

- Market development: Comprehensive information about lucrative markets-the report analyses the automotive semiconductor market across varied regions

- Market diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the automotive semiconductor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), Texas Instruments Incorporated (US), Renesas Electronics Corporation (Japan), Semiconductor Components Industries, LLC (US), Robert Bosch GmbH (Germany), Qualcomm Technologies, Inc. (US), Analog Devices, Inc. (US), and Microchip Technology Inc. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE SEMICONDUCTOR MARKET

- 4.2 AUTOMOTIVE SEMICONDUCTOR MARKET, BY COMPONENT

- 4.3 AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE

- 4.4 AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE

- 4.5 AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION

- 4.6 AUTOMOTIVE SEMICONDUCTOR MARKET, BY MATERIAL

- 4.7 AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION

- 4.8 AUTOMOTIVE SEMICONDUCTOR MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising vehicle electrification to curb emissions

- 5.2.1.2 Rapid advances in ADAS and autonomous driving technologies

- 5.2.1.3 Evolution of connected and software-defined vehicle ecosystem

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development and qualification costs

- 5.2.2.2 Supply chain and capacity constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Localization and development of semiconductor ecosystem

- 5.2.3.2 Rising development of AI-driven domain controllers and edge computing solutions

- 5.2.3.3 Mounting demand for fast-charging and vehicle-to-grid infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues in scaling wide-bandgap semiconductor production for automotive applications

- 5.2.4.2 Challenges in meeting rigorous standards related to automotive systems

- 5.2.4.3 Complexities associated with semiconductor integration

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 System-on-chip (SoC) platforms

- 5.7.1.2 Power semiconductor devices

- 5.7.1.3 Automotive sensors

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Advanced semiconductor packaging

- 5.7.2.2 Automotive Ethernet and high-speed connectivity standards

- 5.7.2.3 Functional safety and security frameworks

- 5.7.2.4 In-vehicle AI accelerators and domain controllers

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Software-defined vehicles (SDVs) and centralized E/E architectures

- 5.7.3.2 Vehicle-to-Everything (V2X) communication

- 5.7.3.3 Digital twins and over-the-air (OTA) update ecosystems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF MEMORY, BY KEY PLAYER, 2021-2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF MEMORY, BY REGION, 2021-2024

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MOBILEYE IMPROVES AUTOMOTIVE SAFETY USING STMICROELECTRONICS' SEMICONDUCTORS

- 5.11.2 FLEX LEVERAGES STMICROELECTRONICS' SEMICONDUCTORS TO SUPPORT AUTOMOTIVE INNOVATION

- 5.11.3 GIGABYTE PILOT SERVES AS AUTONOMOUS-DRIVING CONTROL UNIT FOR TAIWAN'S FIRST SELF-DRIVING BUS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 8542)

- 5.12.2 EXPORT SCENARIO (HS CODE 8542)

- 5.13 PATENT ANALYSIS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON AUTOMOTIVE SEMICONDUCTOR MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 USE CASES OF AI/GEN AI IN AUTOMOTIVE SEMICONDUCTOR MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON AUTOMOTIVE SEMICONDUCTOR MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 PRICE IMPACT ANALYSIS

- 5.17.3 KEY TARIFF RATES

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 AUTOMOTIVE SEMICONDUCTOR MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 PROCESSORS

- 6.2.1 GROWING POPULARITY OF SOFTWARE-DEFINED VEHICLES AND ZONAL ARCHITECTURES TO FUEL SEGMENTAL GROWTH

- 6.2.2 MICROPROCESSOR UNITS (MPUS)

- 6.2.3 MICROCONTROLLER UNITS (MCUS)

- 6.2.4 DIGITAL SIGNAL PROCESSORS (DSPS)

- 6.2.5 GRAPHIC PROCESSING UNITS (GPUS)

- 6.3 ANALOG ICS

- 6.3.1 RISING INTEGRATION OF MULTIPLE SENSORS IN ADAS, LIDAR, RADAR, AND CAMERA SYSTEMS TO AUGMENT SEGMENTAL GROWTH

- 6.3.2 AMPLIFIERS

- 6.3.3 INTERFACES

- 6.3.4 CONVERTERS

- 6.3.5 COMPARATORS

- 6.3.6 ASICS/ASSPS

- 6.3.7 LOGIC ICS

- 6.3.8 INFOTAINMENT/TELEMATICS/CONNECTIVITY DEVICES

- 6.4 DISCRETE POWER DEVICES

- 6.4.1 ACCELERATING ADOPTION OF HIGH-VOLTAGE EV ARCHITECTURES TO BOLSTER SEGMENTAL GROWTH

- 6.4.2 SMALL-SIGNAL TRANSISTORS

- 6.4.3 POWER TRANSISTORS

- 6.4.4 THYRISTORS

- 6.4.5 RECTIFIERS AND DIODES

- 6.5 SENSORS

- 6.5.1 INCREASING VEHICLE ELECTRIFICATION AND ADAS INTEGRATION TO ACCELERATE SEGMENTAL GROWTH

- 6.5.2 IMAGE SENSORS

- 6.5.3 CMOS IMAGE SENSORS

- 6.5.4 CHARGE-COUPLED DEVICE (CCD) SENSORS

- 6.5.5 PRESSURE SENSORS

- 6.5.6 INERTIAL SENSORS

- 6.5.7 ACCELEROMETERS

- 6.5.8 GYROSCOPES

- 6.5.9 TEMPERATURE SENSORS

- 6.5.10 RADARS

- 6.6 MEMORY

- 6.6.1 SHIFT TOWARD SOFTWARE-DEFINED VEHICLES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.6.2 DYNAMIC RANDOM-ACCESS MEMORY (DRAM)

- 6.6.3 STATIC RANDOM-ACCESS MEMORY (SRAM)

- 6.7 OTHER COMPONENTS

7 AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- 7.2 PASSENGER CARS

- 7.2.1 RAPID TRANSITION TOWARD SOFTWARE-DEFINED ARCHITECTURES TO BOOST SEGMENTAL GROWTH

- 7.2.2 HATCHBACKS

- 7.2.3 SEDANS

- 7.2.4 SUVS/CROSSOVERS

- 7.3 LIGHT COMMERCIAL VEHICLES (LCVS)

- 7.3.1 RISING NEED FOR PREDICTIVE MAINTENANCE, OPERATIONAL EFFICIENCY, AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 7.3.2 VANS

- 7.3.3 PICKUPS

- 7.4 HEAVY COMMERCIAL VEHICLES (HCVS)

- 7.4.1 STRONG FOCUS ON ELECTRIFICATION AND HYBRIDIZATION TO ACCELERATE SEGMENTAL GROWTH

- 7.4.2 TRUCKS

- 7.4.3 BUSES

8 AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE

- 8.1 INTRODUCTION

- 8.2 INTERNAL COMBUSTION ENGINE (ICE)

- 8.2.1 RISING INTEGRATION OF ADVANCED SEMICONDUCTORS TO ENABLE NEXT-GENERATION MOBILITY TO FUEL SEGMENTAL GROWTH

- 8.2.2 GASOLINE

- 8.2.3 DIESEL

- 8.2.4 OTHER INTERNAL COMBUSTION ENGINES

- 8.3 ELECTRIC

- 8.3.1 STRONG FOCUS ON REACHING SUSTAINABILITY GOALS TO ACCELERATE SEGMENTAL GROWTH

- 8.3.2 HYBRID ELECTRIC VEHICLES (HEVS)

- 8.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

- 8.3.4 BATTERY ELECTRIC VEHICLES (BEVS)

9 AUTOMOTIVE SEMICONDUCTOR MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 SILICON (SI)

- 9.2.1 RELIABILITY, SCALABILITY, AND COST-EFFICIENCY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.3 SILICON CARBIDE (SIC)

- 9.3.1 ABILITY TO DELIVER HIGH ENERGY EFFICIENCY, VOLTAGE ENDURANCE, AND SWITCHING PERFORMANCE TO FUEL SEGMENTAL GROWTH

- 9.4 GALLIUM NITRIDE (GAN)

- 9.4.1 EVOLUTION OF COMPACT AND HIGH-EFFICIENCY POWER ELECTRONICS TO BOLSTER SEGMENTAL GROWTH

- 9.5 OTHER MATERIALS

10 AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 POWERTRAIN

- 10.2.1 GROWING EMPHASIS ON VEHICLE ELECTRIFICATION AND PERFORMANCE OPTIMIZATION TO FOSTER SEGMENTAL GROWTH

- 10.2.2 ENGINE CONTROLS

- 10.2.3 HEV/EV MOTORS

- 10.2.4 TRANSMISSION CONTROLS

- 10.3 SAFETY

- 10.3.1 HIGH-SPEED SENSOR INTEGRATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.3.2 AIRBAGS

- 10.3.3 ELECTRONIC STABILITY CONTROLS

- 10.3.4 TIRE PRESSURE MONITORING SYSTEMS

- 10.4 BODY ELECTRONICS

- 10.4.1 RISING FOCUS ON SMART, CONNECTED, AND PERSONALIZED VEHICLE EXPERIENCES TO BOOST SEGMENTAL GROWTH

- 10.4.2 BODY CONTROL MODULES

- 10.4.3 SEAT ELECTRONICS

- 10.4.4 DOORS

- 10.4.5 MIRROR & WINDOW CONTROLS

- 10.4.6 HVAC SYSTEMS

- 10.5 CHASSIS

- 10.5.1 MOUNTING ADOPTION OF INTELLIGENCE-DRIVEN SYSTEMS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.5.2 BRAKING

- 10.5.3 STEERING

- 10.5.4 TRACTION CONTROL

- 10.5.5 VEHICLE DYNAMICS MANAGEMENT

- 10.6 TELEMATICS & INFOTAINMENT

- 10.6.1 INCREASING DEMAND FOR SEAMLESS IN-VEHICLE, DIGITAL EXPERIENCES TO EXPEDITE SEGMENTAL GROWTH

- 10.6.2 DASHBOARDS

- 10.6.3 NAVIGATION SYSTEMS

- 10.6.4 CONNECTIVITY DEVICES

- 10.6.5 AUDIO-VIDEO SYSTEMS

- 10.7 ADAS & AUTONOMOUS DRIVING

- 10.7.1 RISING NEED FOR ENHANCED SAFETY, OPERATIONAL EFFICIENCY, AND INTELLIGENT MOBILITY TO SUPPORT MARKET GROWTH

- 10.7.2 ADAPTIVE CRUISE CONTROL (ACC)

- 10.7.3 LANE DEPARTURE WARNING (LDW)

- 10.7.4 LANE KEEP ASSIST (LKA)

- 10.7.5 BLIND SPOT DETECTION (BSD)

- 10.7.6 AUTOMATIC EMERGENCY BRAKING (AEB)

- 10.7.7 TRAFFIC SIGN RECOGNITION (TSR)

- 10.7.8 PARKING ASSISTANCE (PA)

- 10.7.9 NIGHT VISION

- 10.7.10 DRIVER MONITORING SYSTEMS (DMS)

- 10.7.11 FULLY AUTONOMOUS DRIVING SYSTEMS (FADS)

11 AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Rising passenger and commercial vehicle production, electrification, and ADAS deployment to drive market

- 11.2.3 CANADA

- 11.2.3.1 Government incentives for electric vehicles to accelerate market growth

- 11.2.4 MEXICO

- 11.2.4.1 Mounting adoption of connected vehicles and rise in EV assembly to boost market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Implementation of stringent safety and emission regulations to augment market growth

- 11.3.3 UK

- 11.3.3.1 Strong focus on electrification and connected mobility to fuel market growth

- 11.3.4 FRANCE

- 11.3.4.1 Escalating production of passenger and commercial vehicles to support market growth

- 11.3.5 ITALY

- 11.3.5.1 OEM investments in connected mobility solutions to expedite market growth

- 11.3.6 SPAIN

- 11.3.6.1 Mounting demand for enhanced automobile safety systems to boost market growth

- 11.3.7 POLAND

- 11.3.7.1 Rising deployment of intelligent sensor systems in automobiles to foster market growth

- 11.3.8 NETHERLANDS

- 11.3.8.1 Rapid expansion of electric vehicle hubs to contribute to market growth

- 11.3.9 NORDICS

- 11.3.9.1 Increasing adoption of advanced safety and connectivity systems to drive market

- 11.3.10 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rising adoption of EVs and HEVs to accelerate market growth

- 11.4.3 INDIA

- 11.4.3.1 Growing consumer awareness about vehicle safety and connectivity to fuel market growth

- 11.4.4 JAPAN

- 11.4.4.1 Increasing investment in low-emission vehicles to augment market growth

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Mounting consumer demand for intelligent mobility to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Rising development of advanced sensors and power modules for EV fleets to drive market

- 11.4.7 TAIWAN

- 11.4.7.1 Rising adoption of advanced ADAS solutions to facilitate market growth

- 11.4.8 SOUTHEAST ASIA

- 11.4.8.1 Accelerating adoption of connected and telematics-enabled vehicles to drive market

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Increasing vehicle production and electrification to foster market growth

- 11.5.3 AFRICA

- 11.5.3.1 South Africa

- 11.5.3.1.1 Rising demand for advanced vehicle safety and connectivity features to accelerate market growth

- 11.5.3.2 Other African countries

- 11.5.3.1 South Africa

- 11.5.4 MIDDLE EAST

- 11.5.4.1 Bahrain

- 11.5.4.1.1 Rising implementation of fleet modernization initiatives to bolster market growth

- 11.5.4.2 Kuwait

- 11.5.4.2.1 Increasing fleet electrification programs to contribute to market growth

- 11.5.4.3 Oman

- 11.5.4.3.1 Government incentives for electrified vehicles to expedite market growth

- 11.5.4.4 Qatar

- 11.5.4.4.1 Rising enforcement of electrification mandates and fleet digitalization to augment market growth

- 11.5.4.5 Saudi Arabia

- 11.5.4.5.1 Rapid modernization of commercial fleets to accelerate market growth

- 11.5.4.6 UAE

- 11.5.4.6.1 Incentives supporting EV adoption to contribute to market growth

- 11.5.4.7 Rest of Middle East

- 11.5.4.1 Bahrain

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Component footprint

- 12.7.5.4 Vehicle type footprint

- 12.7.5.5 Propulsion type footprint

- 12.7.5.6 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 INFINEON TECHNOLOGIES AG

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches

- 13.2.1.3.2 Deals

- 13.2.1.3.3 Expansions

- 13.2.1.3.4 Other developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths/Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses/Competitive threats

- 13.2.2 NXP SEMICONDUCTORS

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches

- 13.2.2.3.2 Deals

- 13.2.2.3.3 Other developments

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths/Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses/Competitive threats

- 13.2.3 STMICROELECTRONICS

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths/Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses/Competitive threats

- 13.2.4 TEXAS INSTRUMENTS INCORPORATED

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Expansions

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths/Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses/Competitive threats

- 13.2.5 RENESAS ELECTRONICS CORPORATION

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.3.2 Expansions

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths/Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses/Competitive threats

- 13.2.6 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.7 ROBERT BOSCH GMBH

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches

- 13.2.7.3.2 Deals

- 13.2.7.3.3 Expansions

- 13.2.8 QUALCOMM TECHNOLOGIES, INC.

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.9 ANALOG DEVICES, INC.

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.9.3.2 Other developments

- 13.2.1 INFINEON TECHNOLOGIES AG

- 13.3 OTHER PLAYERS

- 13.3.1 TE CONNECTIVITY

- 13.3.2 ROHM CO., LTD.

- 13.3.3 APTIV

- 13.3.4 CTS CORPORATION

- 13.3.5 AUTOLIV

- 13.3.6 ZF FRIEDRICHSHAFEN AG

- 13.3.7 QUANERGY SOLUTIONS, INC.

- 13.3.8 TOSHIBA CORPORATION

- 13.3.9 MAGNA INTERNATIONAL INC.

- 13.3.10 MELEXIS

- 13.3.11 AMPHENOL CORPORATION

- 13.3.12 VALEO

- 13.3.13 CONTINENTAL AG

- 13.3.14 BROADCOM

- 13.3.15 ELMOS SEMICONDUCTOR SE

- 13.3.16 VISHAY INTERTECHNOLOGY, INC.

- 13.3.17 NUVOTON TECHNOLOGY CORPORATION

- 13.3.18 XILINX

- 13.3.19 BORGWARNER INC.

- 13.3.20 DENSO CORPORATION

- 13.3.21 SENSATA TECHNOLOGIES, INC.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 AUTOMOTIVE SEMICONDUCTOR MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 DATA CAPTURED FROM PRIMARY SOURCES

- TABLE 5 AUTOMOTIVE SEMICONDUCTOR MARKET: RESEARCH ASSUMPTIONS

- TABLE 6 AUTOMOTIVE SEMICONDUCTOR MARKET: RISK ANALYSIS

- TABLE 7 ROLE OF COMPANIES IN AUTOMOTIVE SEMICONDUCTOR ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE TREND OF MEMORY OFFERED BY KEY PLAYERS, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF MEMORY, BY REGION, 2021-2024 (USD)

- TABLE 10 IMPACT OF PORTER'S FIVE FORCES

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 12 BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 13 IMPORT DATA FOR HS CODE 8542-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 8542-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 LIST OF MAJOR PATENTS, 2021-2025

- TABLE 16 MFN TARIFFS FOR HS CODE 8542-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 AUTOMOTIVE SEMICONDUCTOR MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 24 AUTOMOTIVE SEMICONDUCTOR MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 25 AUTOMOTIVE SEMICONDUCTOR MARKET, BY COMPONENT, 2021-2024 (MILLION UNITS)

- TABLE 26 AUTOMOTIVE SEMICONDUCTOR MARKET, BY COMPONENT, 2025-2030 (MILLION UNITS)

- TABLE 27 AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 28 AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 29 PASSENGER CARS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 PASSENGER CARS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 PASSENGER CARS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 32 PASSENGER CARS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 33 LIGHT COMMERCIAL VEHICLES (LCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 34 LIGHT COMMERCIAL VEHICLES (LCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 35 LIGHT COMMERCIAL VEHICLES (LCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 36 LIGHT COMMERCIAL VEHICLES (LCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 37 HEAVY COMMERCIAL VEHICLES (HCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 38 HEAVY COMMERCIAL VEHICLES (HCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 39 HEAVY COMMERCIAL VEHICLES (HCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 40 HEAVY COMMERCIAL VEHICLES (HCVS): AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 41 AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 42 AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 43 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 44 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 45 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN ASIA PACIFIC, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 52 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN ASIA PACIFIC, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 53 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 INTERNAL COMBUSTION ENGINE (ICE): AUTOMOTIVE SEMICONDUCTOR MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 60 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 61 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN ASIA PACIFIC, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 68 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN ASIA PACIFIC, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 69 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 ELECTRIC: AUTOMOTIVE SEMICONDUCTOR MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 AUTOMOTIVE SEMICONDUCTOR MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 76 AUTOMOTIVE SEMICONDUCTOR MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 77 AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 AUTOMOTIVE SEMICONDUCTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 POWERTRAIN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 80 POWERTRAIN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 81 SAFETY: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 82 SAFETY: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 83 BODY ELECTRONICS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 84 BODY ELECTRONICS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 85 CHASSIS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 86 CHASSIS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 87 TELEMATICS & INFOTAINMENT: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 88 TELEMATICS & INFOTAINMENT: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 89 ADAS & AUTONOMOUS DRIVING: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 90 ADAS & AUTONOMOUS DRIVING: AUTOMOTIVE SEMICONDUCTOR MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 91 AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 97 US: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 98 US: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 99 CANADA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 100 CANADA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 101 MEXICO: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 102 MEXICO: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 107 GERMANY: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 108 GERMANY: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 109 UK: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 110 UK: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 111 FRANCE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 112 FRANCE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 113 ITALY: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 114 ITALY: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 115 SPAIN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 116 SPAIN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 117 POLAND: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 118 POLAND: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 119 NETHERLANDS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 120 NETHERLANDS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 121 NORDICS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 122 NORDICS: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 124 REST OF EUROPE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY GEOGRAPHY, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY GEOGRAPHY, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 129 CHINA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 130 CHINA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 131 INDIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 132 INDIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 133 JAPAN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 134 JAPAN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 135 SOUTH KOREA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 136 SOUTH KOREA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 137 AUSTRALIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 138 AUSTRALIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 139 TAIWAN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 140 TAIWAN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 141 SOUTHEAST ASIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 142 SOUTHEAST ASIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 145 ROW: AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 ROW: AUTOMOTIVE SEMICONDUCTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 ROW: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 148 ROW: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH AMERICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 151 AFRICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 AFRICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 AFRICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 154 AFRICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 155 SOUTH AFRICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 156 SOUTH AFRICA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 157 OTHER AFRICAN COUNTRIES: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 158 OTHER AFRICAN COUNTRIES: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST: AUTOMOTIVE SEMICONDUCTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 163 BAHRAIN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 164 BAHRAIN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 165 KUWAIT: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 166 KUWAIT: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 167 OMAN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 168 OMAN: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 169 QATAR: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 170 QATAR: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 171 SAUDI ARABIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 172 SAUDI ARABIA: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 173 UAE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 174 UAE: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2021-2024 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST: AUTOMOTIVE SEMICONDUCTOR MARKET, BY PROPULSION TYPE, 2025-2030 (USD MILLION)

- TABLE 177 AUTOMOTIVE SEMICONDUCTOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-SEPTEMBER 2025

- TABLE 178 AUTOMOTIVE SEMICONDUCTOR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 179 AUTOMOTIVE SEMICONDUCTOR MARKET: REGION FOOTPRINT

- TABLE 180 AUTOMOTIVE SEMICONDUCTOR MARKET: COMPONENT FOOTPRINT

- TABLE 181 AUTOMOTIVE SEMICONDUCTOR MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 182 AUTOMOTIVE SEMICONDUCTOR MARKET: PROPULSION TYPE FOOTPRINT

- TABLE 183 AUTOMOTIVE SEMICONDUCTOR MARKET: APPLICATION FOOTPRINT

- TABLE 184 AUTOMOTIVE SEMICONDUCTOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 AUTOMOTIVE SEMICONDUCTOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 AUTOMOTIVE SEMICONDUCTOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-SEPTEMBER 2025

- TABLE 187 AUTOMOTIVE SEMICONDUCTOR MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 188 AUTOMOTIVE SEMICONDUCTOR MARKET: EXPANSIONS, JANUARY 2021-SEPTEMBER 2025

- TABLE 189 AUTOMOTIVE SEMICONDUCTOR MARKET: OTHER DEVELOPMENTS, JANUARY 2021-SEPTEMBER 2025

- TABLE 190 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 191 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 193 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 194 INFINEON TECHNOLOGIES AG: EXPANSIONS

- TABLE 195 INFINEON TECHNOLOGIES AG: OTHER DEVELOPMENTS

- TABLE 196 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 197 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 199 NXP SEMICONDUCTORS: DEALS

- TABLE 200 NXP SEMICONDUCTORS: OTHER DEVELOPMENTS

- TABLE 201 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 202 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 204 STMICROELECTRONICS: DEALS

- TABLE 205 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 206 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 207 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 208 TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS

- TABLE 209 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 210 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 211 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 212 RENESAS ELECTRONICS CORPORATION: EXPANSIONS

- TABLE 213 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 214 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 216 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 218 ROBERT BOSCH GMBH: DEALS

- TABLE 219 ROBERT BOSCH GMBH: EXPANSIONS

- TABLE 220 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 221 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 223 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 ANALOG DEVICES, INC.: DEALS

- TABLE 225 ANALOG DEVICES, INC.: OTHER DEVELOPMENTS

- TABLE 226 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 227 ROHM CO., LTD.: COMPANY OVERVIEW

- TABLE 228 APTIV: COMPANY OVERVIEW

- TABLE 229 CTS CORPORATION: COMPANY OVERVIEW

- TABLE 230 AUTOLIV: COMPANY OVERVIEW

- TABLE 231 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 232 QUANERGY SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 233 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 234 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 235 MELEXIS: COMPANY OVERVIEW

- TABLE 236 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 237 VALEO: COMPANY OVERVIEW

- TABLE 238 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 239 BROADCOM: COMPANY OVERVIEW

- TABLE 240 ELMOS SEMICONDUCTOR SE: COMPANY OVERVIEW

- TABLE 241 VISHAY INTERTECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 242 NUVOTON TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 243 XILINX: COMPANY OVERVIEW

- TABLE 244 BORGWARNER INC.: COMPANY OVERVIEW

- TABLE 245 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 246 SENSATA TECHNOLOGIES, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE SEMICONDUCTOR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AUTOMOTIVE SEMICONDUCTOR MARKET: DURATION COVERED

- FIGURE 3 AUTOMOTIVE SEMICONDUCTOR MARKET: RESEARCH DESIGN

- FIGURE 4 AUTOMOTIVE SEMICONDUCTOR MARKET: RESEARCH APPROACH

- FIGURE 5 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 8 AUTOMOTIVE SEMICONDUCTOR MARKET: BOTTOM-UP APPROACH

- FIGURE 9 AUTOMOTIVE SEMICONDUCTOR MARKET: TOP-DOWN APPROACH

- FIGURE 10 AUTOMOTIVE SEMICONDUCTOR MARKET: DATA TRIANGULATION

- FIGURE 11 AUTOMOTIVE SEMICONDUCTOR MARKET SIZE, 2021-2030

- FIGURE 12 ANALOG ICS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 13 PASSENGER CARS TO BE FASTEST-GROWING VEHICLE TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 14 INTERNAL COMBUSTION ENGINE (ICE) SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 15 ADAS & AUTONOMOUS DRIVING SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 16 SILICON (SI) SEGMENT TO DOMINATE AUTOMOTIVE SEMICONDUCTOR MARKET BETWEEN 2025 AND 2030

- FIGURE 17 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 RISING ADOPTION OF CONNECTED AND AUTONOMOUS VEHICLES TO CONTRIBUTE TO AUTOMOTIVE SEMICONDUCTOR MARKET GROWTH

- FIGURE 19 ANALOG ICS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 20 PASSENGER CARS SEGMENT TO DOMINATE AUTOMOTIVE SEMICONDUCTOR MARKET FROM 2025 TO 2030

- FIGURE 21 INTERNAL COMBUSTION ENGINE (ICE) SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2025

- FIGURE 22 POWERTRAIN APPLICATION TO ACCOUNT FOR LARGEST SHARE OF AUTOMOTIVE SEMICONDUCTOR MARKET IN 2030

- FIGURE 23 GALLIUM NITRIDE (GAN) SEGMENT TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 24 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL AUTOMOTIVE SEMICONDUCTOR MARKET BETWEEN 2025 AND 2030

- FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 IMPACT ANALYSIS: DRIVERS

- FIGURE 28 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 29 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 30 IMPACT ANALYSIS: CHALLENGES

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 AUTOMOTIVE SEMICONDUCTOR ECOSYSTEM

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 34 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 35 AVERAGE SELLING PRICE TREND OF MEMORY OFFERED BY KEY PLAYERS, 2021-2024

- FIGURE 36 AVERAGE SELLING PRICE TREND OF MEMORY IN DIFFERENT REGIONS, 2021-2024

- FIGURE 37 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 40 IMPORT DATA FOR HS CODE 8542-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 41 EXPORT DATA FOR HS CODE 8542-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 42 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 43 USE CASES AND IMPACT OF AI/GEN AI ON AUTOMOTIVE SEMICONDUCTOR MARKET

- FIGURE 44 SENSORS SEGMENT TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 45 PASSENGER CARS SEGMENT TO BE FASTEST-GROWING DURING FORECAST PERIOD

- FIGURE 46 INTERNAL COMBUSTION ENGINE (ICE) SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 47 SILICON (SI) SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 48 ADAS & AUTONOMOUS DRIVING SEGMENT TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 49 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN AUTOMOTIVE SEMICONDUCTOR MARKET FROM 2025 TO 2030

- FIGURE 50 NORTH AMERICA: AUTOMOTIVE SEMICONDUCTOR MARKET SNAPSHOT

- FIGURE 51 EUROPE: AUTOMOTIVE SEMICONDUCTOR MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: AUTOMOTIVE SEMICONDUCTOR MARKET SNAPSHOT

- FIGURE 53 MARKET SHARE ANALYSIS OF COMPANIES OFFERING AUTOMOTIVE SEMICONDUCTORS, 2024

- FIGURE 54 AUTOMOTIVE SEMICONDUCTOR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 55 COMPANY VALUATION

- FIGURE 56 FINANCIAL METRICS

- FIGURE 57 BRAND/PRODUCT COMPARISON

- FIGURE 58 AUTOMOTIVE SEMICONDUCTOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 59 AUTOMOTIVE SEMICONDUCTOR MARKET: COMPANY FOOTPRINT

- FIGURE 60 AUTOMOTIVE SEMICONDUCTORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 61 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 62 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 63 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 64 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 65 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

- FIGURE 67 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 68 ANALOG DEVICES, INC.: COMPANY SNAPSHOT