PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1877349

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1877349

Blood Glucose Monitor Market by Product Type, Application, Test site, End User - Global Forecast to 2030

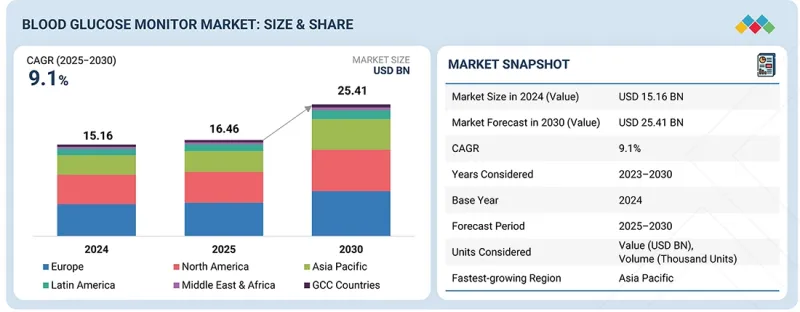

The global blood glucose monitor market is projected to reach 25.4 billion in 2030 from USD 16.5 billion in 2025, at a CAGR of 9.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product type, Application, Test Site, End User, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, the Middle East & Africa, and GCC Countries |

The market for blood glucose monitors is expected to grow strongly, driven by demographic, clinical, and technological factors. The rising global prevalence of diabetes, coupled with an expanding geriatric population and increasing awareness of self-monitoring, continues to fuel demand for blood glucose monitoring devices.

Technological advancements, including continuous glucose monitoring (CGM), integration with smartphones and wearables, and AI-based data analytics, have significantly improved accuracy, convenience, and patient engagement, thereby accelerating adoption. Furthermore, supportive government initiatives, improved healthcare infrastructure, and expanding access to home-based monitoring solutions are contributing to market growth. These trends are expected to sustain robust momentum across both developed and emerging economies in the coming years.

Based on product type, the self-monitoring blood glucose systems segment accounted for the largest share in the blood glucose monitor market in 2024.

Based on product type, the global blood glucose monitor market is divided into four main segments: self-monitoring blood glucose systems, continuous glucose monitoring systems, professional point-of-care devices, and non-invasive products. Among these, self-monitoring blood glucose (SMBG) systems have gained the highest adoption due to their optimal balance between accuracy, comfort, and convenience for patients, particularly those managing their condition at home. These devices offer quick and reliable glucose readings with minimal discomfort, encouraging consistent self-monitoring practices. Additionally, advancements such as micro-needle lancets, smaller sample requirements, and improved test strip designs have enhanced their usability. Their compatibility with connected health ecosystems-including smartphone apps, cloud-based data tracking, and telehealth integration-further drives patient engagement and improves healthcare provider oversight. Growing patient preference for affordable, easy-to-use monitoring tools, combined with rising awareness of proactive diabetes management, continues to reinforce the dominance of the SMBG segment across both developed and developing markets.

Based on application, the diabetes management segment is expected to grow at the highest CAGR during the forecast period in the blood glucose monitor market.

The global blood glucose monitor market is segmented by application into three categories: diabetes management, health & wellness monitoring, and other applications. Among these, the diabetes management segment is projected to witness the fastest growth during the forecast period, driven by the rising prevalence of type 1 and type 2 diabetes and the growing need for continuous and precise glucose tracking. The increasing adoption of continuous glucose monitoring (CGM) systems, which offer real-time insights, has enabled improved insulin dosing, dietary management, and lifestyle optimization. The integration of monitoring devices with digital health platforms, mobile applications, and cloud-based analytics enables remote consultations, automated alerts, and seamless data sharing with healthcare professionals, thereby supporting personalized diabetes care. Moreover, the growing emphasis on preventive healthcare, early disease detection, and supportive reimbursement programs is encouraging the adoption of regular monitoring. The availability of compact, user-friendly, and connected home monitoring devices empowers patients to independently manage their glucose levels, ensuring better compliance and reducing the risk of severe complications. Additionally, the rising consumer focus on health optimization and metabolic wellness is expanding the use of glucose monitors beyond traditional diabetes management, further amplifying market growth.

North America is expected to register the highest share of the blood glucose monitor market during the forecast period.

The global blood glucose monitor market is divided into six main regions: North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries.

North America accounted for the largest share of the global blood glucose monitor market, driven by its advanced healthcare infrastructure, high diabetes prevalence, and strong adoption of digital health technologies. The region benefits from the widespread availability of continuous glucose monitoring (CGM) systems, favorable reimbursement frameworks, and increased awareness of diabetes management and preventive care. Moreover, the strong presence of leading market players, continuous product innovation, and strategic collaborations between healthcare providers and technology companies further reinforce North America's leadership position. Rising healthcare expenditure, growing geriatric population, and the rapid integration of connected and AI-enabled glucose monitoring devices continue to support sustained market growth across the region.

A breakdown of the primary participants (supply side) for the blood glucose monitor market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), Middle East & Africa (2%), GCC Countries (3%)

Prominent players in the blood glucose monitor market include Abbott Laboratories (US), Dexcom, Inc. (US), Medtronic (Ireland), B.Braun SE (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Ascensia Diabetes Care Holdings AG (Switzerland), Senseonics (US), Nipro (Japan), Medical Technology and Devices S.p.A. (Italy), Terumo Corporation (Japan), i-SENS, Inc. (South Korea), Sinocare (China), Nemaura Medical Inc. (UK), ACON Laboratories, Inc. (US), LifeScan IP Holdings, LLC (US), Ultrahuman Healthcare Pvt Ltd. (India), LifePlus (US), Prodigy Diabetes Care, LLC (US), A. Menarini Diagnostics S.r.l (Italy), Beurer GmbH (Germany), Oura Health Oy (Finland), SD Biosensor, INC (South Korea), Agatsa (India), Rossmax International Ltd (US), and Medisana Gmbh (Germany).

Research Coverage

The report provides an analysis of the blood glucose monitor market, focusing on estimating the market size and potential for future growth across various segments, including products, applications, test sites, regions, and end users. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product & service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report provides valuable insights for market leaders and new entrants in the blood glucose monitor industry, offering approximate revenue figures for the overall market and its subsegments. It assists stakeholders in understanding the competitive landscape, enabling them to better position their businesses and develop effective go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, enabling stakeholders to assess the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (Increasing prevalence of diabetes, Growing elderly population and increasing life expectancy, Rise in R&D investments and launch of technologically advanced products, wellness & preventive use of CGMs beyond diabetes), restraints (High cost and socioeconomic disparities in access to blood glucose sensors, Short sensor lifespan and frequent replacements), opportunities (Integration with digital health platforms and smart devices, Expansion of coverage and reimbursement policies for CGMs) and challenges (Regulatory compliance challenges for non-invasive glucose monitoring technologies, Data overload & alarm fatigue).

- Market Penetration: It provides detailed information on the product portfolios offered by major players in the global blood glucose monitor market. The report covers various segments, including product type, application, test site, end user, and region.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global blood glucose monitor market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product type, application, test site, end user, and region.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global blood glucose monitor market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global blood glucose monitor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Objectives of primary research

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH (BASED ON UTILIZATION RATE AND ADOPTION PATTERN)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH LIMITATIONS

- 2.4.1 SCOPE-RELATED LIMITATIONS

- 2.4.2 METHODOLOGY-RELATED LIMITATIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BLOOD GLUCOSE MONITOR MARKET OVERVIEW

- 4.2 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE AND COUNTRY (2024)

- 4.3 BLOOD GLUCOSE MONITOR MARKET: GEOGRAPHICAL MIX

- 4.4 BLOOD GLUCOSE MONITOR MARKET: REGIONAL MIX (2025-2030)

- 4.5 BLOOD GLUCOSE MONITOR MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of diabetes

- 5.2.1.2 Growing elderly population and increasing life expectancy

- 5.2.1.3 Rise in R&D investments and launch of technologically advanced products

- 5.2.1.4 Wellness & preventive use of CGMs beyond diabetes

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and socioeconomic disparities in access to blood glucose sensors

- 5.2.2.2 Short sensor lifespan and frequent replacements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration with digital health platforms and smart devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory and compliance challenges for non-invasive glucose monitoring technologies

- 5.2.4.2 Data overload & alarm fatigue

- 5.2.4.3 Financial burden and coverage gaps

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS & WHITE SPACES

- 5.3.1 UNMET NEEDS IN BLOOD GLUCOSE MONITOR MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 INTENSITY OF COMPETITIVE RIVALRY

- 6.1.3 BARGAINING POWER OF BUYERS

- 6.1.4 BARGAINING POWER OF SUPPLIERS

- 6.1.5 THREAT OF SUBSTITUTES

- 6.2 MACROECONOMIC OUTLOOK

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN DIABETES CARE INDUSTRY

- 6.2.4 TRENDS IN GLOBAL INSULIN DELIVERY SYSTEMS INDUSTRY

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.5.1 ROLE IN ECOSYSTEM

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF BLOOD GLUCOSE MONITORS, BY PRODUCT, 2024

- 6.6.2 AVERAGE SELLING PRICE TREND OF SELF-MONITORING BLOOD GLUCOSE SYSTEMS, BY REGION, 2022-2024

- 6.6.3 PRODUCT PURCHASE CYCLE, BY PRODUCT SEGMENT

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT DATA FOR HS CODE 9027, 2020-2024

- 6.7.2 EXPORT DATA FOR HS CODE 9027, 2020-2024

- 6.8 KEY CONFERENCES & EVENTS, 2025-2026

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.10 INVESTMENT & FUNDING SCENARIO

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CASE STUDY 1: LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSOR

- 6.11.2 CASE STUDY 2: ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- 6.11.3 CASE STUDY 3: IMPROVING GLYCEMIC CONTROL WITH DEXCOM G6 CGM SYSTEM

- 6.12 IMPACT OF 2025 US TARIFFS ON BLOOD GLUCOSE MONITOR MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTIONS THROUGH TECHNOLOGY, PATENTS, AND DIGITAL AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 BATTERY AND ENERGY HARVESTING INNOVATIONS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.3.2 MID TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.3.3 LONG TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.4 PATENT ANALYSIS

- 7.4.1 PATENT PUBLICATION TRENDS FOR BLOOD GLUCOSE MONITOR MARKET

- 7.4.2 TOP APPLICANTS (COMPANIES) OF BLOOD GLUCOSE MONITOR PATENTS

- 7.4.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN BLOOD GLUCOSE MONITOR MARKET

- 7.4.4 LIST OF MAJOR PATENTS

- 7.5 PIPELINE ANALYSIS

- 7.6 IMPACT OF AI/GEN AI ON BLOOD GLUCOSE MONITOR MARKET

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 TOP CASE STUDIES OF AI IMPLEMENTATION IN BLOOD GLUCOSE MONITOR MARKET

- 7.6.3 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 7.6.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN BLOOD GLUCOSE MONITOR MARKET

- 7.7 SUCCESS STORIES & REAL-WORLD APPLICATIONS

- 7.7.1 ABBOTT: FREESTYLE LIBRE 3-MINIATURIZED SENSOR WITH REAL-TIME CONNECTIVITY

- 7.7.2 DEXCOM: G7 SENSOR-ADVANCED ALGORITHM FOR ACCURATE AND FAST GLUCOSE READINGS

- 7.7.3 SENSEONICS: EVERSENSE E3-LONG-TERM IMPLANTABLE CGM WITH SMART ALERTS

8 TREATMENT & REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS & COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATORY STANDARDS

- 8.1.2.1 North America

- 8.1.2.1.1 US

- 8.1.2.1.2 Canada

- 8.1.2.2 Europe

- 8.1.2.3 Asia Pacific

- 8.1.2.3.1 China

- 8.1.2.3.2 Japan

- 8.1.2.3.3 India

- 8.1.2.4 Latin America

- 8.1.2.4.1 Brazil

- 8.1.2.4.2 Mexico

- 8.1.2.5 Middle East

- 8.1.2.6 Africa

- 8.1.2.1 North America

- 8.2 EPIDEMIOLOGY OF DIABETES, BY KEY COUNTRY

- 8.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- 8.3.1 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN BLOOD GLUCOSE MONITOR MARKET

- 8.4 TREATMENT AND REGULATORY LANDSCAPE

- 8.4.1 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 KEY BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS OF END USERS

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

10 BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE

- 10.1 INTRODUCTION

- 10.2 SELF-MONITORING BLOOD GLUCOSE SYSTEMS

- 10.2.1 GLUCOMETERS

- 10.2.1.1 Regulatory reinforcement and digital integration to drive advancements in market

- 10.2.2 TESTING STRIPS

- 10.2.2.1 Shift toward non-invasive methods for blood glucose monitoring to restrain market growth

- 10.2.3 LANCETS & LANCING DEVICES

- 10.2.3.1 Rising focus on reducing chances of infection to increase popularity of safety lancets

- 10.2.1 GLUCOMETERS

- 10.3 CONTINUOUS GLUCOSE MONITORING SYSTEMS

- 10.3.1 SENSORS

- 10.3.1.1 Technological advancements and expanding use in diabetes management to boost market growth

- 10.3.2 IMPLANTS

- 10.3.2.1 Rising demand for long-duration sensors offering extended lifespan and reduced replacement frequency to drive growth

- 10.3.3 TRANSMITTERS & RECEIVERS

- 10.3.3.1 Integration with smart monitoring systems and interoperable diabetes management platforms to fuel growth

- 10.3.1 SENSORS

- 10.4 PROFESSIONAL POINT-OF-CARE DEVICES

- 10.4.1 ADVANCING PATIENT CARE THROUGH DECENTRALIZED POINT-OF-CARE GLUCOSE MONITORING TO BOOST MARKET

- 10.5 NON-INVASIVE PRODUCTS

- 10.5.1 RISING PATIENT PREFERENCE FOR PAINLESS TECHNOLOGY TO FOSTER DEVELOPMENT AND ADOPTION IN FUTURE

11 BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE

- 11.1 INTRODUCTION

- 11.2 FINGERTIP

- 11.2.1 HIGH ACCURACY ASSOCIATED WITH FINGERTIP TESTING TO SUPPORT MARKET GROWTH

- 11.3 UPPER ARM

- 11.3.1 RISE OF CONTINUOUS AND MINIMALLY INVASIVE MONITORING TECHNOLOGIES TO BOOST DEMAND FOR UPPER ARM TESTING

- 11.4 OTHER TEST SITES

12 BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 DIABETES MANAGEMENT

- 12.2.1 TYPE 1 DIABETES

- 12.2.1.1 Intensive management needs associated with type 1 diabetes to boost adoption

- 12.2.2 TYPE 2 DIABETES

- 12.2.2.1 High prevalence of type 2 diabetes to drive market demand

- 12.2.1 TYPE 1 DIABETES

- 12.3 HEALTH & WELLNESS MONITORING

- 12.3.1 EMERGING ROLE OF HEALTH & WELLNESS MONITORING FOR BLOOD GLUCOSE MONITORS TO DRIVE MARKET GROWTH

- 12.4 OTHER APPLICATIONS

13 BLOOD GLUCOSE MONITOR MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 SELF/HOME CARE

- 13.2.1 CONVENIENT, COST-EFFECTIVE, AND FREQUENT MONITORING ASSOCIATED WITH HOME CARE SETTINGS TO DRIVE MARKET

- 13.3 HOSPITALS & CLINICS

- 13.3.1 STRATEGIC ADOPTION OF BLOOD GLUCOSE SENSORS IN HOSPITALS & CLINICS TO DRIVE MARKET VALIDATION AND GROWTH

- 13.4 OTHER END USERS

14 BLOOD GLUCOSE MONITOR MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 US to account for largest share of North American blood glucose monitor market

- 14.2.3 CANADA

- 14.2.3.1 Rising government support to boost blood glucose monitor market in Canada

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Germany to dominate European blood glucose monitor market

- 14.3.3 UK

- 14.3.3.1 Government support and research funding to drive blood glucose monitor market growth in UK

- 14.3.4 FRANCE

- 14.3.4.1 High insurance coverage and increasing affordability to support market growth

- 14.3.5 ITALY

- 14.3.5.1 Increasing government spending to drive market growth in Italy

- 14.3.6 SPAIN

- 14.3.6.1 High diabetes prevalence to drive market growth in Spain

- 14.3.7 REST OF EUROPE (ROE)

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 China to dominate Asia Pacific blood glucose monitor market

- 14.4.3 JAPAN

- 14.4.3.1 Rising aging population and high number of diabetes cases to drive market growth in Japan

- 14.4.4 INDIA

- 14.4.4.1 Rising diabetes cases and affordable local manufacturing to fuel insulin device demand in India

- 14.4.5 AUSTRALIA

- 14.4.5.1 Government subsidies to drive market

- 14.4.6 SOUTH KOREA

- 14.4.6.1 Rising diabetes cases across country to boost market

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 LATIN AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 14.5.2 BRAZIL

- 14.5.2.1 Brazil to account for largest share of Latin American blood glucose monitor market

- 14.5.3 MEXICO

- 14.5.3.1 Rising diabetes prevalence to drive market growth

- 14.5.4 REST OF LATIN AMERICA

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 INTERNATIONAL AID PROGRAMS AND GOVERNMENT-LED INITIATIVES FOR NON-COMMUNICABLE DISEASE MANAGEMENT TO FOSTER GROWTH

- 14.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 14.7 GCC COUNTRIES

- 14.7.1 RISING DIABETES PREVALENCE TO DRIVE MARKET IN GCC COUNTRIES

- 14.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN BLOOD GLUCOSE MONITOR MARKET

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.5.5.1 Company footprint

- 15.5.5.2 Region footprint

- 15.5.5.3 Product type footprint

- 15.5.5.4 Test site footprint

- 15.5.5.5 Application footprint

- 15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.6.5.1 Detailed list of key startups/SMEs

- 15.6.5.2 Competitive benchmarking of key startups/SMEs

- 15.7 COMPANY VALUATION & FINANCIAL METRICS

- 15.7.1 FINANCIAL METRICS

- 15.7.2 COMPANY VALUATION

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 R&D EXPENDITURE OF KEY PLAYERS

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES & APPROVALS

- 15.10.2 DEALS

- 15.10.3 EXPANSIONS

- 15.10.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 ABBOTT LABORATORIES

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches & approvals

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.3.4 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses & competitive threats

- 16.1.2 DEXCOM, INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches & approvals

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 MEDTRONIC

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product approvals

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.3.4 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses & competitive threats

- 16.1.4 SINOCARE

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product approvals

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses & competitive threats

- 16.1.5 ROCHE DIABETES CARE

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches & approvals

- 16.1.5.3.2 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses & competitive threats

- 16.1.6 B. BRAUN SE

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.7 I-SENS, INC.

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product approvals

- 16.1.7.3.2 Deals

- 16.1.8 SENSEONICS

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches & approvals

- 16.1.8.3.2 Deals

- 16.1.8.3.3 Other developments

- 16.1.9 ASCENSIA DIABETES CARE HOLDINGS AG

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.10 NIPRO

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Expansions

- 16.1.11 NEMAURA MEDICAL INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Other developments

- 16.1.12 MEDICAL TECHNOLOGY AND DEVICES S.P.A.

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Deals

- 16.1.13 TERUMO CORPORATION

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Deals

- 16.1.13.3.2 Expansions

- 16.1.13.3.3 Other developments

- 16.1.14 LIFESCAN IP HOLDINGS, LLC

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Deals

- 16.1.1 ABBOTT LABORATORIES

- 16.2 OTHER PLAYERS

- 16.2.1 ACON LABORATORIES, INC.

- 16.2.2 LIFEPLUS

- 16.2.3 PRODIGY DIABETES CARE, LLC

- 16.2.4 ULTRAHUMAN HEALTHCARE PVT. LTD.

- 16.2.5 BEURER GMBH

- 16.2.6 OURA HEALTH OY

- 16.2.7 SD BIOSENSOR, INC.

- 16.2.8 A. MENARINI DIAGNOSTICS S.R.L

- 16.2.9 MEDISANA GMBH

- 16.2.10 AGATSA

- 16.2.11 ROSSMAX INTERNATIONAL LTD.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: BLOOD GLUCOSE MONITOR MARKET

- TABLE 3 BLOOD GLUCOSE MONITOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 5 BLOOD GLUCOSE MONITOR MARKET: ROLE IN ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF BLOOD GLUCOSE MONITORS, BY PRODUCT, 2024

- TABLE 7 AVERAGE SELLING PRICE TREND OF SELF-MONITORING BLOOD GLUCOSE SYSTEMS, BY REGION, 2022-2024

- TABLE 8 IMPORT DATA FOR HS CODE 9027, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 9027, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 BLOOD GLUCOSE MONITOR MARKET: LIST OF KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 11 CASE STUDY 1: LONG-TERM GLUCOSE MONITORING FOR SENSITIVE SKIN PATIENTS USING SENSEONICS' EVERSENSE E3 IMPLANTABLE SENSOR

- TABLE 12 CASE STUDY 2: ENHANCING PATIENT ADHERENCE AND GLYCEMIC CONTROL USING ABBOTT'S FREESTYLE LIBRE 2 CGM

- TABLE 13 CASE STUDY 3: MPROVING GLYCEMIC CONTROL WITH DEXCOM G6 CGM SYSTEM

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR BLOOD GLUCOSE MONITOR PRODUCTS

- TABLE 16 BLOOD GLUCOSE MONITOR MARKET: LIST OF MAJOR PATENTS

- TABLE 17 UPCOMING AND PIPELINE PRODUCTS IN GLOBAL BLOOD GLUCOSE MONITOR MARKET

- TABLE 18 TOP USE CASES AND MARKET POTENTIAL

- TABLE 19 BLOOD GLUCOSE MONITOR MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 20 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 DIABETES PREVALENCE, BY KEY COUNTRY

- TABLE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 29 ADOPTION BARRIERS & INTERNAL CHALLENGES

- TABLE 30 BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 31 COMPANIES OFFERING SELF-MONITORING BLOOD GLUCOSE (SMBG) SYSTEMS

- TABLE 32 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 33 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET FOR GLUCOMETERS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 35 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET FOR GLUCOMETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET FOR TESTING STRIPS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET FOR LANCETS & LANCING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 COMPANIES OFFERING CONTINUOUS GLUCOSE MONITORING (CGM) SYSTEMS

- TABLE 39 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET FOR SENSORS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 42 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET FOR SENSORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET FOR IMPLANTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET FOR TRANSMITTERS & RECEIVERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 COMPANIES OFFERING PROFESSIONAL POINT-OF-CARE DEVICES

- TABLE 46 PROFESSIONAL POINT-OF-CARE DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 COMPANIES OFFERING NON-INVASIVE PRODUCTS

- TABLE 48 NON-INVASIVE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 50 BLOOD GLUCOSE MONITOR MARKET FOR FINGERTIP TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 BLOOD GLUCOSE MONITOR MARKET FOR UPPER ARM TESTING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 BLOOD GLUCOSE MONITOR MARKET FOR OTHER TEST SITES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 54 BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 55 BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 BLOOD GLUCOSE MONITOR MARKET FOR TYPE 1 DIABETES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 BLOOD GLUCOSE MONITOR MARKET FOR TYPE 2 DIABETES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 BLOOD GLUCOSE MONITOR MARKET FOR HEALTH & WELLNESS MONITORING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 BLOOD GLUCOSE MONITOR MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 61 BLOOD GLUCOSE MONITOR MARKET FOR SELF/HOME CARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 BLOOD GLUCOSE MONITOR MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 BLOOD GLUCOSE MONITOR MARKET FOR OTHER END USER, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 BLOOD GLUCOSE MONITOR MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 73 US: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 74 US: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 US: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 US: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 77 US: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 78 US: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 US: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 CANADA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 CANADA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 84 CANADA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 CANADA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 CANADA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 96 GERMANY: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 99 GERMANY: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 100 GERMANY: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 GERMANY: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 102 UK: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 103 UK: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 UK: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 UK: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 106 UK: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 107 UK: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 UK: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 109 FRANCE: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 110 FRANCE: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 FRANCE: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 FRANCE: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 113 FRANCE: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 114 FRANCE: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 FRANCE: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 116 ITALY: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 117 ITALY: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 ITALY: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 ITALY: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 120 ITALY: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 ITALY: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 ITALY: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 SPAIN: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 124 SPAIN: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 SPAIN: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 SPAIN: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 127 SPAIN: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 128 SPAIN: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 SPAIN: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 REST OF EUROPE: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 REST OF EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 134 REST OF EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 REST OF EUROPE: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 145 CHINA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 146 CHINA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 CHINA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 CHINA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 149 CHINA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 150 CHINA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 CHINA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 JAPAN: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 153 JAPAN: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 JAPAN: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 JAPAN: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 156 JAPAN: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 157 JAPAN: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 JAPAN: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 159 INDIA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 160 INDIA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 INDIA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 INDIA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 163 INDIA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 164 INDIA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 INDIA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 166 AUSTRALIA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 167 AUSTRALIA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 AUSTRALIA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 AUSTRALIA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 170 AUSTRALIA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 171 AUSTRALIA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 AUSTRALIA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 173 SOUTH KOREA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 174 SOUTH KOREA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 SOUTH KOREA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 SOUTH KOREA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 177 SOUTH KOREA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 178 SOUTH KOREA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 SOUTH KOREA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 REST OF ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 187 LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 192 LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 193 LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 195 BRAZIL: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 196 BRAZIL: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 BRAZIL: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 BRAZIL: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 199 BRAZIL: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 200 BRAZIL: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 BRAZIL: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 202 MEXICO: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 203 MEXICO: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 MEXICO: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 MEXICO: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 206 MEXICO: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 207 MEXICO: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 MEXICO: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 209 REST OF LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 210 REST OF LATIN AMERICA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 REST OF LATIN AMERICA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 REST OF LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 213 REST OF LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 214 REST OF LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 223 GCC COUNTRIES: BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 224 GCC COUNTRIES: SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 GCC COUNTRIES: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 GCC COUNTRIES: BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2023-2030 (USD MILLION)

- TABLE 227 GCC COUNTRIES: BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: BLOOD GLUCOSE MONITOR MARKET FOR DIABETES MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 GCC COUNTRIES: BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 230 STRATEGIES ADOPTED BY KEY PLAYERS IN BLOOD GLUCOSE MONITOR MARKET, JANUARY 2022-SEPTEMBER 2025

- TABLE 231 BLOOD GLUCOSE MONITOR MARKET: DEGREE OF COMPETITION

- TABLE 232 BLOOD GLUCOSE MONITOR MARKET: REGION FOOTPRINT

- TABLE 233 BLOOD GLUCOSE MONITOR MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 234 BLOOD GLUCOSE MONITOR MARKET: TEST SITE FOOTPRINT

- TABLE 235 BLOOD GLUCOSE MONITOR MARKET: APPLICATION FOOTPRINT

- TABLE 236 BLOOD GLUCOSE MONITOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 237 BLOOD GLUCOSE MONITOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 238 BLOOD GLUCOSE MONITOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 239 BLOOD GLUCOSE MONITOR MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 240 BLOOD GLUCOSE MONITOR MARKET: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 241 BLOOD GLUCOSE MONITOR MARKET: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 242 BLOOD GLUCOSE MONITOR MARKET: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 243 ABBOTT LABORATORIES: COMPANY OVERVIEW

- TABLE 244 ABBOTT LABORATORIES: PRODUCTS OFFERED

- TABLE 245 ABBOTT LABORATORIES: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 246 ABBOTT LABORATORIES: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 247 ABBOTT LABORATORIES: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 248 ABBOTT LABORATORIES: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 249 DEXCOM, INC.: COMPANY OVERVIEW

- TABLE 250 DEXCOM, INC.: PRODUCTS OFFERED

- TABLE 251 DEXCOM, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 252 DEXCOM, INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 253 MEDTRONIC: COMPANY OVERVIEW

- TABLE 254 MEDTRONIC: PRODUCTS OFFERED

- TABLE 255 MEDTRONIC: PRODUCT APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 256 MEDTRONIC: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 257 MEDTRONIC: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 258 MEDTRONIC: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 259 SINOCARE: COMPANY OVERVIEW

- TABLE 260 SINOCARE: PRODUCTS OFFERED

- TABLE 261 SINOCARE: PRODUCT APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 262 SINOCARE: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 263 SINOCARE: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 264 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 265 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS OFFERED

- TABLE 266 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS LAUNCHES & APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 267 F. HOFFMANN-LA ROCHE LTD.: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 268 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 269 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 270 I-SENS, INC.: COMPANY OVERVIEW

- TABLE 271 I-SENS, INC.: PRODUCTS OFFERED

- TABLE 272 I-SENS, INC.: PRODUCT APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 273 I-SENS, INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 274 SENSEONICS: COMPANY OVERVIEW

- TABLE 275 SENSEONICS: PRODUCTS OFFERED

- TABLE 276 SENSEONICS: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 277 SENSEONICS: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 278 SENSEONICS: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 279 ASCENSIA DIABETES CARE HOLDINGS AG: COMPANY OVERVIEW

- TABLE 280 ASCENSIA DIABETES CARE HOLDINGS AG: PRODUCTS OFFERED

- TABLE 281 ASCENSIA DIABETES CARE HOLDINGS AG: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 282 ASCENSIA DIABETES CARE HOLDINGS AG: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 283 NIPRO: COMPANY OVERVIEW

- TABLE 284 NIPRO: PRODUCTS OFFERED

- TABLE 285 NIPRO: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 286 NEMAURA MEDICAL INC.: COMPANY OVERVIEW

- TABLE 287 NEMAURA MEDICAL INC.: PRODUCTS OFFERED

- TABLE 288 NEMAURA MEDICAL INC.: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 289 MEDICAL TECHNOLOGY AND DEVICES S.P.A.: COMPANY OVERVIEW

- TABLE 290 MEDICAL TECHNOLOGY AND DEVICES S.P.A.: PRODUCTS OFFERED

- TABLE 291 MEDICAL TECHNOLOGY AND DEVICES S.P.A.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 292 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 293 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 294 TERUMO CORPORATION: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 295 TERUMO CORPORATION: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 296 TERUMO CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 297 LIFESCAN IP HOLDINGS, LLC: COMPANY OVERVIEW

- TABLE 298 LIFESCAN IP HOLDINGS, LLC: PRODUCTS OFFERED

- TABLE 299 LIFESCAN IP HOLDINGS, LLC: DEALS, JANUARY 2022-SEPTEMBER 2025

List of Figures

- FIGURE 1 BLOOD GLUCOSE MONITOR MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 BLOOD GLUCOSE MONITOR MARKET: RESEARCH DESIGN

- FIGURE 4 BLOOD GLUCOSE MONITOR MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BLOOD GLUCOSE MONITOR MARKET: KEY PRIMARY SOURCES (DEMAND AND SUPPLY SIDE)

- FIGURE 6 BLOOD GLUCOSE MONITOR MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 BLOOD GLUCOSE MONITOR MARKET SIZE ESTIMATION

- FIGURE 10 REVENUE SHARE ANALYSIS ILLUSTRATION: MEDTRONIC PLC

- FIGURE 11 BLOOD GLUCOSE MONITOR MARKET: REVENUE ANALYSIS OF TOP 5 COMPANIES (2024)

- FIGURE 12 BLOOD GLUCOSE MONITOR MARKET: EPIDEMIC MODEL ANALYSIS

- FIGURE 13 BLOOD GLUCOSE MONITOR MARKET: TOP-DOWN APPROACH

- FIGURE 14 BLOOD GLUCOSE MONITORMARKET: CAGR PROJECTIONS (SUPPLY SIDE) (2024)

- FIGURE 15 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF BLOOD GLUCOSE MONITOR MARKET (2025-2030)

- FIGURE 16 BLOOD GLUCOSE MONITOR MARKET: DATA TRIANGULATION

- FIGURE 17 BLOOD GLUCOSE MONITOR MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 BLOOD GLUCOSE MONITOR MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 BLOOD GLUCOSE MONITOR MARKET, BY TEST SITE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 BLOOD GLUCOSE MONITOR MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 GEOGRAPHICAL SNAPSHOT OF BLOOD GLUCOSE MONITOR MARKET

- FIGURE 22 INCREASING TECHNOLOGICAL ADVANCEMENTS IN BLOOD GLUCOSE MONITOR MARKET TO DRIVE GROWTH

- FIGURE 23 CHINA ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2024

- FIGURE 24 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD (2025-2030)

- FIGURE 26 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 27 BLOOD GLUCOSE MONITOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 HEALTHCARE EXPENDITURE AS PERCENTAGE OF GDP FOR 1995, 2005, 2014, AND 2024

- FIGURE 29 BLOOD GLUCOSE MONITOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 BLOOD GLUCOSE MONITOR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 BLOOD GLUCOSE MONITOR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 32 BLOOD GLUCOSE MONITOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 33 BLOOD GLUCOSE MONITOR MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 34 BLOOD GLUCOSE MONITOR MARKET: FUNDING AND NUMBER OF DEALS, 2021-2024

- FIGURE 35 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR BLOOD GLUCOSE MONITORS (JANUARY 2015-APRIL 2025)

- FIGURE 36 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR BLOOD GLUCOSE MONITOR PATENTS, 2015-2025

- FIGURE 37 KEY FEATURES OF AI/GENERATIVE AI IN BLOOD GLUCOSE MONITOR MARKET

- FIGURE 38 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 40 BLOOD GLUCOSE MONITOR MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 41 NORTH AMERICA: BLOOD GLUCOSE MONITOR MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: BLOOD GLUCOSE MONITOR MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN BLOOD GLUCOSE MONITOR MARKET, 2020-2024

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BLOOD GLUCOSE MONITOR MARKET (2024)

- FIGURE 45 BLOOD GLUCOSE MONITOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 BLOOD GLUCOSE MONITOR MARKET: COMPANY FOOTPRINT

- FIGURE 47 BLOOD GLUCOSE MONITOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 BLOOD GLUCOSE MONITOR MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 51 R&D EXPENDITURE OF KEY PLAYERS IN BLOOD GLUCOSE MONITOR MARKET, 2022-2024

- FIGURE 52 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2024)

- FIGURE 53 DEXCOM, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 54 MEDTRONIC: COMPANY SNAPSHOT (2024)

- FIGURE 55 SINOCARE: COMPANY SNAPSHOT (2024)

- FIGURE 56 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 57 B. BRAUN SE: COMPANY SNAPSHOT (2024)

- FIGURE 58 I-SENS, INC: COMPANY SNAPSHOT (2024)

- FIGURE 59 SENSEONICS: COMPANY SNAPSHOT (2024)

- FIGURE 60 NIPRO: COMPANY SNAPSHOT (2024)

- FIGURE 61 TERUMO CORPORATION: COMPANY SNAPSHOT (2024)