PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1881228

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1881228

Medium Frequency Magnetics Market by Type, Converter Type, Power Output, Voltage, Application (Power Conversion Systems, Renewable & Energy Systems, Electronics & Industrial Equipment, Specialized Systems), and Region - Global Forecast to 2030

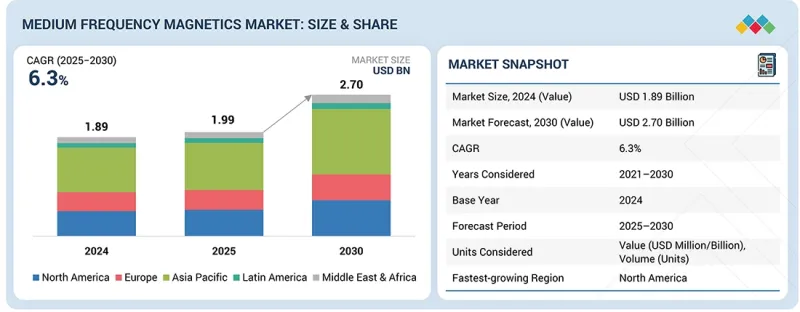

The medium frequency magnetics market was valued at USD 1.99 billion in 2025 and is projected to reach USD 2.70 billion by 2030, registering a CAGR of 6.3% during the forecast period. The increasing demand for compact, lightweight, and energy-efficient magnetics for renewable energy systems, EV charging infrastructure, and advanced power electronics is driving market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Units) |

| Segments | Type, Power Output, Voltage, Converter Type, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Moreover, the growing shift toward high-frequency power conversion in industries such as aerospace, automotive, and industrial automation, coupled with advancements in core materials and magnetic design, is further fueling adoption. Supportive government initiatives promoting clean energy technologies and the expansion of smart grid infrastructure are expected to create significant growth opportunities for manufacturers in this market.

"The solid-state transformers (SSTs) segment is projected to grow at the highest CAGR between 2025 and 2030."

Solid-state transformers (SSTs) are projected to grow at the fastest CAGR between 2025 and 2030 because they offer substantial advantages over conventional transformers in terms of efficiency, flexibility, and integration with renewable energy and smart grid systems. SSTs leverage power semiconductor-based conversion, enabling seamless bi-directional energy flow, compact size, weight reduction, improved voltage control, and compatibility with DC systems such as EV fast charging and microgrids. The rising need for digitalized grid management, distributed energy, and electrification across transport and industrial sectors is driving greater adoption of SSTs, especially as utilities and infrastructure providers seek high-performance grid-interactive solutions to meet modern reliability, flexibility, and sustainability targets.

"The transformer type is projected to be the largest share from 2025 to 2030."

The transformer segment is expected to hold the largest share of the medium frequency magnetics market from 2025 to 2030, primarily due to its widespread application across renewable energy systems, electric vehicles, industrial automation, and power conversion equipment. Medium frequency transformers are essential for isolating circuits, managing voltage levels, and enhancing energy efficiency in compact and high-power-density systems. Their ability to operate at higher frequencies enables reduced size and weight compared to traditional transformers, making them ideal for emerging technologies such as solid-state transformers, EV chargers, and renewable inverters. The rising adoption of distributed energy resources, coupled with the increasing demand for efficient power management and conversion in both industrial and utility applications, further drives the growth of this segment during the forecast period.

"The medium (10-500 kW) power output segment is projected to grow at the fastest CAGR between 2025 and 2030."

The medium (10-500 kW) power output segment is projected to grow at the fastest CAGR between 2025 and 2030, driven by its broad applicability across renewable energy systems, electric vehicle charging infrastructure, industrial automation, and aerospace and defense applications. Medium power magnetics provide an optimal balance between efficiency, size, and power density, making them suitable for grid-connected converters, medium-scale solar and wind inverters, and energy storage systems. The ongoing electrification of transport and the rapid growth of distributed generation systems are further boosting demand for medium power components that enable efficient energy transfer and conversion. Additionally, advancements in materials and magnetic design technologies are enhancing thermal performance and reliability, accelerating the adoption of medium frequency magnetics in this power range.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

By Designation: C-level Executives - 25%, Directors - 35%, and Others - 40%

By Region: North America - 10%, Europe - 15%, Asia Pacific - 60%, the Middle East & Africa - 10%, and Latin America - 5%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

BLOCK Transformatoren-Elektronik GmbH (Germany), Jackson Transformer Company (US), Cefem Groupe (France), Standex Electronics (US), Vishay Intertechnology, Inc. (US), CTM Magnetics (US), Triad Magnetics (US), West Coast Magnetics (US), Eaton Corporation plc (Ireland), RoMan Manufacturing (US), AFP Transformer (US), CorePower Magnetics (US), Sumida Corporation (Japan), discoverIE Group plc (UK) are some key players in the medium frequency magnetics market.

The study includes an in-depth competitive analysis of these key players in the medium frequency magnetics market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage

The report defines, describes, and forecasts the medium frequency magnetics market by type, converter type, power output, medium voltage, and application. The report's scope includes comprehensive qualitative and quantitative analyses of key market dynamics, drivers, restraints, challenges, and opportunities, along with detailed insights into the competitive landscape, market estimates in terms of value (USD million) for 2020-2030, and strategic developments such as product launches, technological innovations, partnerships, mergers, and acquisitions shaping the medium frequency magnetics industry.

Key Benefits of Buying the Report

- Analysis of key drivers [mandatory grid modernization and resilience requirements, accelerated integration of distributed and renewable energy resources (DERs)], restraints (high manufacturing cost and technical complexity of advanced components, critical vulnerabilities in global supply chains for magnetic materials), opportunities [development of advanced soft magnetic materials for medium-to-high frequency applications, expansion into high-voltage/high-power dc microgrids and distribution systems (MVDC)], and challenges [need for standardization and interoperability protocols, managing extreme thermal stresses in high-density design) influencing the growth of the medium frequency magnetics market.

- Product Development/Innovation: Advancements in medium frequency transformers and inductors enabling higher efficiency and power density across renewable, automotive, and industrial sectors. Manufacturers are focusing on developing magnetic components compatible with next-generation wide-bandgap semiconductors (SiC, GaN) that support faster switching frequencies, reduced losses, and smaller form factors. Companies are also investing in advanced materials like nanocrystalline and amorphous cores to improve energy transfer efficiency and minimize thermal losses.

- Market Development: The increasing penetration of renewable energy systems and EV charging stations is driving the demand for medium frequency magnetics used in power conversion and conditioning applications. Governments across North America, Europe, and Asia Pacific are promoting clean energy initiatives and supporting the development of high-efficiency power electronics. The ongoing transition toward electrification in transportation, grid modernization, and distributed energy systems is fostering market expansion for medium frequency magnetic components.

- Market Diversification: Companies such as BLOCK Transformatoren-Elektronik GmbH (Germany), Jackson Transformer Company (US), Cefem Groupe (France), Standex Electronics (US), and Vishay Intertechnology, Inc. (US) are diversifying their product portfolios with customized, application-specific magnetic solutions tailored for renewable, EV, and industrial power conversion needs. Innovations include compact modular magnetics for DC-DC converters, EV inverters, and high-power-density power supplies.

- Competitive Assessment: The report provides an in-depth assessment of market shares, growth strategies, and technological advancements of leading players such as BLOCK Transformatoren-Elektronik GmbH (Germany), Jackson Transformer Company (US), Cefem Groupe (France), Standex Electronics (US), Vishay Intertechnology, Inc. (US), CTM Magnetics (US), Triad Magnetics (US), West Coast Magnetics (US), Eaton Corporation plc (Ireland), RoMan Manufacturing (US), AFP Transformer (US), CorePower Magnetics (US), Sumida Corporation (Japan), discoverIE Group plc (UK), and SFO Technologies (India) in the medium frequency magnetics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING MEDIUM FREQUENCY MAGNETIC MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THE MEDIUM FREQUENCY MAGNETICS MARKET

- 3.2 MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION

- 3.3 MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE

- 3.4 MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE

- 3.5 MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER OUTPUT

- 3.6 MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE

- 3.7 MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION

- 3.8 MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE AND REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Focus on grid modernization

- 4.2.1.2 Global surge in clean energy

- 4.2.1.3 Shift toward compact and high-efficiency power systems

- 4.2.2 RESTRAINTS

- 4.2.2.1 High production costs

- 4.2.2.2 Difficulties in securing consistent supply at stable prices

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Advancements in soft magnetic materials

- 4.2.3.2 Transition from conventional AC systems to DC-based networks

- 4.2.4 CHALLENGES

- 4.2.4.1 Absence of globally aligned standards

- 4.2.4.2 Managing heat dissipation while maintaining magnetic efficiency

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN MEDIUM FREQUENCY MAGNETICS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 MEDIUM FREQUENCY TRANSFORMER MARKET: INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.1.2 THREAT OF NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 THREATS OF SUBSTITUTES

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL CONSUMER ELECTRONICS INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF MEDIUM FREQUENCY MAGNETICS, BY POWER OUTPUT, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF MEDIUM FREQUENCY MAGNETICS, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 8504)

- 5.6.2 EXPORT SCENARIO (HS CODE 8504)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 MEDIUM FREQUENCY DESIGN BOOSTS POWER DENSITY, EFFICIENCY, AND OPERATIONAL PORTABILITY

- 5.10.2 MAGNETIC ALLOY INNOVATION DRIVES SMALLER AND MORE STABLE INDUCTORS FOR POWER ELECTRONICS

- 5.10.3 INTEGRATED COMPONENTS SUPPORT ADVANCED INVERTER TOPOLOGIES AND SMART CONTROLLERS

- 5.10.4 UNIVERSITY OF WOLLONGONG DEVELOPS UNIFIED THREE-PHASE MAGNETIC LINK TO BOOST SST EFFICIENCY AND SCALABILITY

- 5.11 IMPACT OF 2025 US TARIFF ON MEDIUM FREQUENCY MAGNETICS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON TYPES OF MEDIUM FREQUENCY MAGNETICS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ADVANCED MAGNETIC CORE MATERIALS (FERRITE, NANOCRYSTALLINE, AMORPHOUS)

- 6.1.2 PLANAR MAGNETICS DESIGN

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 WIDE-BANDGAP (WBG) SEMICONDUCTOR TECHNOLOGY - SIC & GAN DEVICES

- 6.2.2 THERMAL MANAGEMENT SYSTEMS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 INDUCTION HEATING SYSTEMS

- 6.3.2 WIRELESS POWER TRANSFER (WPT)

- 6.4 PATENT ANALYSIS

- 6.4.1 TOP APPLICANTS

- 6.4.2 LIST OF KEY PATENTS, 2002-2019

- 6.5 FUTURE APPLICATIONS

- 6.5.1 SOLID-STATE TRANSFORMERS (SSTS) / SMART DISTRIBUTION GRIDS

- 6.5.2 HIGH-POWER EV CHARGING (WIRED DC FAST CHARGING, BIDIRECTIONAL CHARGERS, AND WIRELESS EV CHARGING)

- 6.5.3 DATA-CENTER & TELECOM POWER CONVERSION (MODULAR DC-DC, ON-BOARD CHARGERS, AND PLANAR MAGNETICS)

- 6.5.4 UTILITY & GRID-SCALE RENEWABLE + ENERGY-STORAGE CONVERTERS

- 6.6 IMPACT OF AI/GEN AI ON MEDIUM FREQUENCY MAGNETICS MARKET

- 6.6.1 BEST PRACTICES IN MEDIUM FREQUENCY MAGNETICS PROCESSING

- 6.6.2 CASE STUDIES OF AI IMPLEMENTATION IN MEDIUM FREQUENCY MAGNETICS MARKET

- 6.6.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN MEDIUM FREQUENCY MAGNETICS MARKET

- 6.6.5 VACUUMSCHMELZE (VAC) -VITROPERM CORES

- 6.6.6 HITACHI METALS (PROTERIAL LTD.) - METGLAS AMORPHOUS ALLOYS

- 6.6.7 SYRMA SGS (INDIA)-HIGH-FREQUENCY MAGNETICS FOR EV CHARGING INFRASTRUCTURE

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF MEDIUM FREQUENCY MAGNETICS

- 7.2.1.1 Carbon impact reduction

- 7.2.1.2 Eco-applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF MEDIUM FREQUENCY MAGNETICS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS APPLICATIONS

- 8.5 MARKET PROFITIBILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE

- 9.1 INTRODUCTION

- 9.2 AC-AC CONVERTERS

- 9.2.1 GROWING NEED FOR ENERGY-EFFICIENT MOTORS TO FUEL MARKET GROWTH

- 9.3 DC-DC CONVERTERS

- 9.3.1 RISE OF ELECTRIFIED TRANSPORT AND DISTRIBUTED ENERGY SYSTEMS TO DRIVE MARKET

- 9.4 RENEWABLE ENERGY INVERTERS (DC-AC-DC TOPOLOGIES)

- 9.4.1 TRANSITION TOWARD SUSTAINABLE POWER GENERATION TO FUEL MARKET GROWTH

- 9.5 SOLID-STATE TRANSFORMERS (SSTS)

- 9.5.1 INCREASING DEPLOYMENT IN EVS AND RENEWABLE MICROGRIDS TO SUPPORT MARKET GROWTH

10 MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER OUTPUT

- 10.1 INTRODUCTION

- 10.2 LOW

- 10.2.1 CONVERGENCE OF ELECTRONICS MINIATURIZATION AND RENEWABLE MICRO-SYSTEMS TO OFFER GROWTH OPPORTUNITIES

- 10.3 MEDIUM

- 10.3.1 ADVANCEMENTS IN POWDERED IRON AND AMORPHOUS MAGNETIC MATERIALS TO FOSTER MARKET GROWTH

- 10.4 HIGH

- 10.4.1 EMERGENCE OF MMC ARCHITECTURES AND DIGITAL CONTROL INTEGRATION TO FUEL MARKET GROWTH

11 MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 TRANSFORMERS

- 11.2.1 RISING DEMAND FOR EV FAST CHARGERS AND HIGH-EFFICIENCY POWER SUPPLIES TO DRIVE MARKET

- 11.3 INDUCTORS

- 11.3.1 SHIFT TOWARD SURFACE-MOUNT AND PLANAR INDUCTORS TO OFFER GROWTH OPPORTUNITIES

- 11.4 REACTORS

- 11.4.1 GROWING APPLICATIONS IN ENERGY STORAGE SYSTEMS AND PLASMA GENERATION TO FOSTER MARET GROWTH

- 11.5 OTHER TYPES

12 MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 POWER CONVERSION SYSTEMS

- 12.2.1 INCREASING ADOPTION OF ELECTRIC MOBILITY TO DRIVE MARKET

- 12.2.2 POWER SUPPLIES

- 12.2.3 BATTERY CHARGING SYSTEMS

- 12.2.4 UPS SYSTEMS

- 12.2.5 DC-DC CONVERTERS

- 12.2.6 PERSONAL ELECTRONICS POWER MODULES (ADAPTERS, CHARGERS, WIRELESS CHARGING)

- 12.3 RENEWABLE & ENERGY SYSTEMS

- 12.3.1 EXPANSION OF SOLAR, WIND, AND HYBRID POWER GENERATION TO BOOST DEMAND

- 12.3.2 ALTERNATIVE ENERGY INVERTERS

- 12.3.3 PLASMA GENERATION

- 12.4 ELECTRONICS & INDUSTRIAL EQUIPMENT

- 12.4.1 TRANSITION TOWARD INDUSTRY 4.0 AND SMART MANUFACTURING TO SUPPORT MARKET GROWTH

- 12.4.2 LED LIGHTING

- 12.4.3 WELDING / LASER EQUIPMENT

- 12.4.4 MOTOR DRIVES / VARIABLE FREQUENCY DRIVES (VFDS)

- 12.5 SPECIALIZED SYSTEMS

- 12.5.1 GROWING IMPORTANCE OF MINITURIZATION TO OFFER GROWTH OPPORTUNITIES

- 12.5.2 MEDICAL EQUIPMENT

- 12.5.3 AEROSPACE & AVIONICS SYSTEMS

- 12.5.4 MARINE & RAILWAY AUXILIARY POWER

- 12.5.5 OTHER SPECIALIZED SYSTEMS

13 MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Emphasis on industrial automation and smart manufacturing to fuel market growth

- 13.2.2 JAPAN

- 13.2.2.1 Expansion of solar photovoltaics, offshore wind, and energy storage systems to support market growth

- 13.2.3 INDIA

- 13.2.3.1 Transition to clean energy and industrial modernization to drive market

- 13.2.4 AUSTRALIA

- 13.2.4.1 Shift toward high-renewable share electricity system to foster market growth

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 Ongoing grid modernization to offer growth opportunities

- 13.3.2 CANADA

- 13.3.2.1 Expansion of EV infrastructure to boost demand

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 Transition to electrified systems across automotive, industrial, and energy sectors to foster market growth

- 13.4.2 FRANCE

- 13.4.2.1 Accelerating electrification and industrial modernization to fuel market growth

- 13.4.3 UK

- 13.4.3.1 Government-led initiatives to advance electrification and decarbonization to support market growth

- 13.4.4 ITALY

- 13.4.4.1 Focus on increasing renewable energy capacity to foster market growth

- 13.4.5 SPAIN

- 13.4.5.1 Growing adoption of EVs to boost demand

- 13.4.6 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 LATIN AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Adoption of advanced power electronics for automation and electrification to drive market

- 13.5.2 ARGENTINA

- 13.5.2.1 Growing emphasis on localized manufacturing to fuel market growth

- 13.5.3 MEXICO

- 13.5.3.1 Increasing adoption of electric mobility solutions to drive market

- 13.5.4 REST OF LATIN AMERICA

- 13.5.1 BRAZIL

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 GCC

- 13.6.1.1 Saudi Arabia

- 13.6.1.1.1 Shift toward energy-efficient and high-temperature SiC/GaN semiconductor-based designs to support market growth

- 13.6.1.2 UAE

- 13.6.1.2.1 Focus on advanced energy systems and renewable power initiatives to drive market

- 13.6.1.3 Rest of GCC

- 13.6.1.1 Saudi Arabia

- 13.6.2 SOUTH AFRICA

- 13.6.2.1 Focus on integrating renewable energy and upgrading power infrastructure to fuel market growth

- 13.6.3 REST OF MIDDLE EAST & AFRICA

- 13.6.1 GCC

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 14.6 PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Region footprint

- 14.7.5.2 Voltage footprint

- 14.7.5.3 Power output footprint

- 14.7.5.4 Type footprint

- 14.7.5.5 Application footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 BLOCK TRANSFORMATOREN-ELEKTRONIK GMBH

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 JACKSON TRANSFORMER COMPANY

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Key strengths/Right to win

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses/Competitive threats

- 15.1.3 CEFEM GROUPE

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 AQ GROUP

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 STANDEX ELECTRONICS, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 DISCOVERIE GROUP PLC

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 VISHAY INTERTECHNOLOGY

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Expansions

- 15.1.8 CTM MAGNETICS

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 TRIAD MAGNETICS

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 WEST COAST MAGNETICS

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 EATON

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.12 ROMAN MANUFACTURING

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 AFP TRANSFORMERS CORP.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 COREPOWER MAGNETICS

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches

- 15.1.15 SUMIDA CORPORATION

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.1 BLOCK TRANSFORMATOREN-ELEKTRONIK GMBH

- 15.2 OTHER PLAYERS

- 15.2.1 MPS INDUSTRIES, INC.

- 15.2.2 MECH-TRONICS

- 15.2.3 CUSTOM MAGNETICS, INC.

- 15.2.4 PICO ELECTRONICS

- 15.2.5 TIANJIN ROSEN TECHNOLOGY CO., LTD.

- 15.2.6 TCT

- 15.2.7 SFO TECHNOLOGIES

- 15.2.8 MARQUE MAGNETICS

- 15.2.9 BH ELECTRONICS

- 15.2.10 HITACHI ENERGY LTD

- 15.2.11 DATSONS ELECTRONICS PVT. LTD.

- 15.2.12 GCI TECHNOLOGIES

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.2 SECONDARY DATA

- 16.2.1 LIST OF KEY SECONDARY SOURCES

- 16.2.2 KEY DATA FROM SECONDARY SOURCES

- 16.3 PRIMARY DATA

- 16.3.1 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- 16.3.2 KEY DATA FROM PRIMARY SOURCES

- 16.3.3 KEY INDUSTRY INSIGHTS

- 16.3.4 BREAKDOWN OF PRIMARIES

- 16.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 16.5 MARKET SIZE ESTIMATION

- 16.5.1 BOTTOM-UP APPROACH

- 16.5.2 TOP-DOWN APPROACH

- 16.6 BASE NUMBER CALCULATION

- 16.6.1 DEMAND-SIDE ANALYSIS

- 16.6.1.1 Demand-side assumptions

- 16.6.1.2 Demand-side calculations

- 16.6.2 SUPPLY-SIDE ANALYSIS

- 16.6.2.1 Supply-side assumptions

- 16.6.2.2 Supply-side calculations

- 16.6.1 DEMAND-SIDE ANALYSIS

- 16.7 FORECAST

- 16.8 FACTOR ANALYSIS

- 16.9 RESEARCH ASSUMPTIONS

- 16.10 RESEARCH LIMITATIONS

- 16.11 RISK ANALYSIS

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MEDIUM FREQUENCY MAGNETICS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MEDIUM FREQUENCY MAGNETICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 4 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY, 2022-2023

- TABLE 5 MEDIUM FREQUENCY MAGNETICS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 PRICING RANGE OF MEDIUM FREQUENCY MAGNETICS, BY POWER OUTPUT, 2024, (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE TREND OF MEDIUM FREQUENCY MAGNETICS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 8 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 MEDIUM FREQUENCY MAGNETICS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 13 MEDIUM FREQUENCY MAGNETICS MARKET: TOTAL NUMBER OF PATENTS, 2014-2024

- TABLE 14 TOP USE CASES AND MARKET POTENTIAL

- TABLE 15 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 16 MEDIUM FREQUENCY MAGNETICS MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 17 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 GLOBAL STANDARDS IN MEDIUM FREQUENCY MAGNETICS MARKET

- TABLE 23 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN MEDIUM FREQUENCY MAGNETICS MARKET

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 25 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 26 MEDIUM FREQUENCY MAGNETICS MARKET: UNMET NEEDS IN KEY APPLICATIONS

- TABLE 27 MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2020-2024 (USD MILLION)

- TABLE 28 MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2025-2030 (USD MILLION)

- TABLE 29 AC-AC CONVERTER: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 AC-AC CONVERTER: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 DC-DC CONVERTER: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 DC-DC CONVERTER: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 RENEWABLE ENERGY INVERTERS (DC-AC-DC TOPOLOGIES): MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 RENEWABLE ENERGY INVERTERS (DC-AC-DC TOPOLOGIES): MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 SOLID-STATE TRANSFORMERS (SSTS): MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 SOLID-STATE TRANSFORMERS (SSTS): MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER OUTPUT, 2020-2024 (USD MILLION)

- TABLE 38 MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER OUTPUT, 2025-2030 (USD MILLION)

- TABLE 39 LOW: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 LOW: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 MEDIUM: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 MEDIUM: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 HIGH: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 HIGH : MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 46 MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 TRANSFORMERS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 TRANSFORMERS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 INDUCTORS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 INDUCTORS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 REACTORS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 REACTORS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 OTHER TYPES: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 OTHER TYPES: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 56 MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 57 POWER CONVERSION SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 58 POWER CONVERSION SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 59 POWER CONVERSION SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 POWER CONVERSION SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 RENEWABLE & ENERGY SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 62 RENEWABLE & ENERGY SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 63 RENEWABLE & ENERGY SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 RENEWABLE & ENERGY SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 ELECTRONICS & INDUSTRIAL EQUIPMENT: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 66 ELECTRONICS & INDUSTRIAL EQUIPMENT: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 67 ELECTRONICS & INDUSTRIAL EQUIPMENT: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 ELECTRONICS & INDUSTRIAL EQUIPMENT: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 SPECIALIZED SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 70 SPECIALIZED SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 71 SPECIALIZED SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 SPECIALIZED SYSTEMS: MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2020-2024 (UNITS)

- TABLE 76 MEDIUM FREQUENCY MAGNETICS MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 77 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 78 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2020-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2020-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 CHINA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 90 CHINA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 JAPAN: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 92 JAPAN: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 INDIA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 94 INDIA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 AUSTRALIA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 96 AUSTRALIA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2020-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2020-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 US: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 112 US: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 CANADA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 114 CANADA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 116 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2020-2024 (USD MILLION)

- TABLE 118 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2020-2024 (USD MILLION)

- TABLE 122 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 124 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 126 EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 GERMANY: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 128 GERMANY: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 FRANCE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 130 FRANCE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 UK: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 132 UK: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 134 ITALY: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 SPAIN: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 136 SPAIN: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 REST OF EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 138 REST OF EUROPE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 140 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2020-2024 (USD MILLION)

- TABLE 142 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2025-2030 (USD MILLION)

- TABLE 143 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 144 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2020-2024 (USD MILLION)

- TABLE 146 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 148 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 150 LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 BRAZIL: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 152 BRAZIL: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 ARGENTINA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 154 ARGENTINA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 MEXICO: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 156 MEXICO: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 REST OF LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 158 REST OF LATIN AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2020-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2020-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 170 GCC: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 GCC: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 SAUDI ARABIA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 174 SAUDI ARABIA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 UAE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 176 UAE: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 REST OF GCC: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 178 REST OF GCC: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 SOUTH AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 180 SOUTH AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 183 MEDIUM FREQUENCY MAGNETICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 184 MEDIUM FREQUENCY MAGNETICS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 185 MEDIUM FREQUENCY MAGNETICS MARKET: REGION FOOTPRINT

- TABLE 186 MEDIUM FREQUENCY MAGNETICS MARKET: VOLTAGE FOOTPRINT

- TABLE 187 MEDIUM FREQUENCY MAGNETICS MARKET: POWER OUTPUT FOOTPRINT

- TABLE 188 MEDIUM FREQUENCY MAGNETICS MARKET: TYPE FOOTPRINT

- TABLE 189 MEDIUM FREQUENCY MAGNETICS MARKET: APPLICATION FOOTPRINT

- TABLE 190 MEDIUM FREQUENCY MAGNETICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 191 MEDIUM FREQUENCY MAGNETICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 192 MEDIUM FREQUENCY MAGNETICS MARKET: DEALS, JANUARY 2021- SEPTEMBER 2025

- TABLE 193 MEDIUM FMEDREQUENCY MAGNETICS MARKET: EXPANSIONS, JANUARY 2021-SEPTEMBER 2025

- TABLE 194 BLOCK TRANSFORMATOREN-ELEKTRONIK GMBH: COMPANY OVERVIEW

- TABLE 195 BLOCK TRANSFORMATOREN-ELEKTRONIK GMBH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 196 BLOCK TRANSFORMATOREN-ELEKTRONIK GMBH: EXPANSIONS

- TABLE 197 JACKSON TRANSFORMER COMPANY: COMPANY OVERVIEW

- TABLE 198 JACKSON TRANSFORMER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 CEFEM GROUPE: COMPANY OVERVIEW

- TABLE 200 CEFEM GROUPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 CEFEM GROUPE: EXPANSIONS

- TABLE 202 AQ GROUP: COMPANY OVERVIEW

- TABLE 203 AQ GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 AQ GROUP: DEALS

- TABLE 205 STANDEX ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 206 STANDEX ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 STANDEX ELECTRONICS, INC.: DEALS

- TABLE 208 DISCOVERIE GROUP PLC: COMPANY OVERVIEW

- TABLE 209 DISCOVERIE GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 DISCOVERIE GROUP PLC: DEALS

- TABLE 211 VISHAY INTERTECHNOLOGY: COMPANY OVERVIEW

- TABLE 212 VISHAY INTERTECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 VISHAY INTERTECHNOLOGY: PRODUCT LAUNCHES

- TABLE 214 VISHAY INTERTECHNOLOGY: EXPANSIONS

- TABLE 215 CTM MAGNETICS: COMPANY OVERVIEW

- TABLE 216 CTM MAGNETICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 TRIAD MAGNETICS: COMPANY OVERVIEW

- TABLE 218 TRIAD MAGNETICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 WEST COAST MAGNETICS: COMPANY OVERVIEW

- TABLE 220 WEST COAST MAGNETICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 EATON: COMPANY OVERVIEW

- TABLE 222 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 EATON: DEALS

- TABLE 224 ROMAN MANUFACTURING: COMPANY OVERVIEW

- TABLE 225 ROMAN MANUFACTURING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 AFP TRANSFORMERS CORP.: COMPANY OVERVIEW

- TABLE 227 AFP TRANSFORMERS CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 COREPOWER MAGNETICS: COMPANY OVERVIEW

- TABLE 229 COREPOWER MAGNETICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 COREPOWER MAGNETICS: PRODUCT LAUNCHES

- TABLE 231 SUMIDA CORPORATION: COMPANY OVERVIEW

- TABLE 232 SUMIDA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 MPS INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 234 MECH-TRONICS: COMPANY OVERVIEW

- TABLE 235 CUSTOM MAGNETICS, INC.: COMPANY OVERVIEW

- TABLE 236 PICO ELECTRONICS: COMPANY OVERVIEW

- TABLE 237 TIANJIN ROSEN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 238 TCT: COMPANY OVERVIEW

- TABLE 239 SFO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 240 MARQUE MAGNETICS: COMPANY OVERVIEW

- TABLE 241 BH ELECTRONICS: COMPANY OVERVIEW

- TABLE 242 HITACHI ENERGY LTD: COMPANY OVERVIEW

- TABLE 243 DATSONS ELECTRONICS PVT. LTD.: COMPANY OVERVIEW

- TABLE 244 GCI TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 245 LIST OF KEY SECONDARY SOURCES

- TABLE 246 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 247 KEY DATA FROM PRIMARY SOURCES

- TABLE 248 MEDIUM FREQUENCY MAGNETICS MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 MEDIUM FREQUENCY MAGNETICS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL MEDIUM FREQUENCY MAGNETICS MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN MEDIUM FREQUENCY MAGNETICS MARKET, 2020-2025

- FIGURE 5 DISRUPTIONS SHAPING MEDIUM FREQUENCY MAGNETICS MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN MEDIUM FREQUENCY MAGNETICS MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 RISING DEMAND FOR EFFICIENT POWER CONVERSION SYSTEMS TO DRIVE MARKET

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MEDIUM FREQUENCY MAGNETICS MARKET DURING FORECAST PERIOD

- FIGURE 10 TRANSFORMERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 11 RENEWABLE ENERGY INVERTERS SEGMENT TO CAPTURE LARGEST MARKET SHARE

- FIGURE 12 MEDIUM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 13 LOW VOLTAGE TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 14 POWER CONVERSION SYSTEMS TO DOMINATE MARKET IN 2030

- FIGURE 15 LOW VOLTAGE AND ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARES OF MEDIUM FREQUENCY MAGNETICS MARKET IN 2025

- FIGURE 16 MEDIUM FREQUENCY MAGNETICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 TOTAL ELECTRICITY GENERATION, BY REGION, 2010-2050

- FIGURE 18 MEDIUM FREQUENCY MAGNETICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 MEDIUM FREQUENCY MAGNETICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 MEDIUM FREQUENCY MAGNETICS ECOSYSTEM

- FIGURE 21 MEDIUM FREQUENCY MAGNETICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF MEDIUM FREQUENCY MAGNETICS, BY REGION, 2021-2024

- FIGURE 23 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 24 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 MEDIUM FREQUENCY MAGNETICS MARKET: INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 27 PATENT ANALYSIS, BY DOCUMENT TYPE, 2014-2024

- FIGURE 28 PATENT PUBLICATION TRENDS, 2014-2024

- FIGURE 29 TOP PATENT APPLICANTS, 2014-2024

- FIGURE 30 FUTURE APPLICATIONS OF MEDIUM FREQUENCY MAGNETICS

- FIGURE 31 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- FIGURE 32 MEDIUM FREQUENCY MAGNETICS MARKET: DECISION-MAKING FACTORS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 34 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 35 ADOPTION BARRIERS AND INTERNAL CHALLENGES IN MEDIUM FREQUENCY MAGNETICS MARKET

- FIGURE 36 MEDIUM FREQUENCY MAGNETICS MARKET, BY CONVERTER TYPE, 2024

- FIGURE 37 MEDIUM FREQUENCY MAGNETICS MARKET, BY POWER OUTPUT, 2024

- FIGURE 38 MEDIUM FREQUENCY MAGNETICS MARKET, BY TYPE, 2024

- FIGURE 39 MEDIUM FREQUENCY MAGNETICS MARKET, BY APPLICATION, 2024

- FIGURE 40 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 41 MEDIUM FREQUENCY MAGNETICS MARKET SHARE, BY REGION, 2024

- FIGURE 42 ASIA PACIFIC: MEDIUM FREQUENCY MAGNETICS MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: MEDIUM FREQUENCY MAGNETICS MARKET SNAPSHOT

- FIGURE 44 MARKET SHARE ANALYSIS OF COMPANIES OFFERING MEDIUM FREQUENCY MAGNETICS, 2024

- FIGURE 45 MEDIUM FREQUENCY MAGNETICS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 46 COMPANY VALUATION, 2025

- FIGURE 47 FINANCIAL METRICS, 2024

- FIGURE 48 PRODUCT COMPARISON

- FIGURE 49 MEDIUM FREQUENCY MAGNETICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 MEDIUM FREQUENCY MAGNETICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 MEDIUM FREQUENCY MAGNETICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 AQ GROUP: COMPANY SNAPSHOT

- FIGURE 53 STANDEX ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 54 DISCOVERIE GROUP PLC: COMPANY SNAPSHOT

- FIGURE 55 VISHAY INTERTECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 56 EATON: COMPANY SNAPSHOT

- FIGURE 57 SUMIDA CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 MEDIUM FREQUENCY MAGNETICS MARKET: RESEARCH DESIGN

- FIGURE 59 KEY DATA FROM SECONDARY SOURCES

- FIGURE 60 KEY INDUSTRY INSIGHTS

- FIGURE 61 BREAKDOWN OF PRIMARIES

- FIGURE 62 DATA TRIANGULATION

- FIGURE 63 BOTTOM-UP APPROACH

- FIGURE 64 TOP-DOWN APPROACH

- FIGURE 65 DEMAND-SIDE ANALYSIS

- FIGURE 66 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF MEDIUM FREQUENCY MAGNETICS

- FIGURE 67 MEDIUM FREQUENCY MAGNETICS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 68 INDUSTRY CONCENTRATION, 2024

- FIGURE 69 MEDIUM FREQUENCY MAGNETICS MARKET: RESEARCH LIMITATIONS