PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1881229

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1881229

Power Conditioning Unit Market by Type (Active, Passive), Phase (Single, Three), End User (Industrial & Manufacturing, Commercial, Utilities, Transportation, Residential, Healthcare), Power Rating, and Region - Global Forecast to 2030

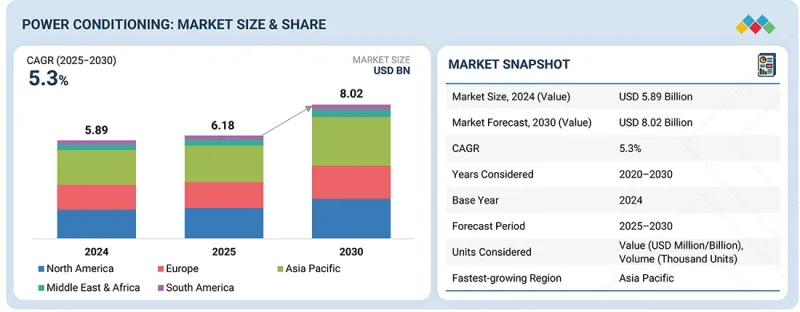

The global power conditioning unit market is projected to reach USD 8.02 billion by 2030 from USD 6.18 billion in 2025, registering a CAGR of 5.3%. The power conditioning unit market is on a growth trajectory driven by the increasing need for stable, high-quality power across industrial, commercial, and residential applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value, Volume (Thousand Units) |

| Segments | Type, Phase, Power rating, End User (Industry & Manufacturing Facilities, Commercial, Utilities, Transportation, Residential, Heal |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and South America |

The rapid expansion of renewable energy integration, electric vehicle infrastructure, and data centers is boosting demand for advanced power conditioning systems to ensure an uninterrupted and clean power supply. Supportive government initiatives promoting energy efficiency, coupled with stricter power quality regulations, are further accelerating market adoption. Technological advancements in voltage regulation, harmonic filtration, and digital monitoring enhance system reliability and performance, while partnerships between equipment manufacturers, utilities, and industrial operators foster large-scale deployments and long-term service opportunities.

"By phase, the single-phase segment accounted for the second largest market share in 2024."

By phase, the single-phase segment accounted for the second-largest market share in 2024. These systems are primarily used in residential buildings, small offices, retail outlets, and light commercial facilities where the power demand is relatively lower compared to industrial applications. The growing adoption of electronic appliances, home automation systems, and small-scale renewable installations has fueled demand for single-phase conditioners to ensure voltage stability and equipment protection. Additionally, their compact design, ease of installation, and cost-effectiveness make them ideal for decentralized and small-load power applications, sustaining their steady demand across emerging economies.

"By type, the passive segment accounted for the largest market in 2024."

By type, the passive power conditioner segment accounted for the second-largest market share in 2024. Passive power conditioners are widely used in applications where basic voltage regulation, noise filtering, and surge protection are required without active electronic components. Their simple design, high reliability, and low maintenance needs make them a preferred choice for small-scale and cost-sensitive installations across residential, commercial, and light industrial sectors. Growing demand for affordable power quality solutions, particularly in developing regions with unstable grid conditions, continues to support the adoption of passive power conditioners in the global market. The rising integration of passive units in consumer electronics and office equipment enhances their utility in safeguarding sensitive devices. Increasing focus on cost optimization and energy-efficient infrastructure also contributes to the steady market growth of this segment.

"Asia Pacific accounted for the largest region in 2024."

Asia Pacific held the largest share in the power conditioning unit market in 2024, driven by rapid industrialization, urbanization, and the expansion of manufacturing and commercial infrastructure across countries such as China, India, Japan, and South Korea. The growing demand for reliable and high-quality power in sectors like electronics, automotive, and data centers has significantly boosted the adoption of power conditioning systems. Increasing investments in renewable energy integration and smart grid infrastructure further strengthen market growth in the region. Government initiatives promoting energy efficiency and stable power supply are encouraging the deployment of advanced conditioning technologies. Additionally, the strong presence of local manufacturers offering cost-effective solutions enhances market accessibility. The region's ongoing digital transformation and growth in power-sensitive industries continue to create robust opportunities for power conditioning unit suppliers.

In-depth interviews were conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 57%, Tier 2 - 29%, and Tier 3 - 14%

By Designation: C-Level Executives - 35%, Directors - 20%, and Others - 45%

By Region: North America - 20%, Europe - 15%, Asia Pacific - 30%, Middle East & Africa - 25%, and South America - 10%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million. Others include sales managers, engineers, and regional managers.

ABB (Switzerland), Eaton (Ireland), Schneider Electric (France), Mitsubishi Electric Power Products Inc. (US), Emerson Electric Co. (US), Delta Electronics, Inc. (Taiwan), Power Systems & Controls, Inc. (US), Trystar (US), AMETEK Inc. (US), Fuji Electric Co., Ltd. (Japan), Rockwell Automation (US), NXT Power, LLC (US), Quality Transformer & Electronics, Inc. (US), Servomax Limited (India), Farmax Technologies Pvt. Ltd. (India), STACO ENERGY PRODUCTS CO. (US), LS ELECTRIC (South Korea), ASHLEY EDISON INTERNATIONAL LTD (UK), Singadia UK Limited (UK), SPECTRUMSTAB INDIA PVT. LTD. (India), Acumentrics (US), Statcon Electronics India Limited (India), Elinex Power Solutions B.V. (Netherlands), MEIDENSHA CORPORATION (Japan), and NISSIN ELECTRIC Co., Ltd. (Japan) are some of the key players in the power conditioning unit market. The study includes an in-depth competitive analysis of these key players in the market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report defines, describes, and forecasts the power conditioning unit market type (active power conditioner, passive power conditioner), phase (single phase, three phase), power rating (<=10 kVA, 10-50 kVA, 50-150 kVA, >150 kVA), end user (industry & manufacturing facility, commercial, utilities, transportation, residential, healthcare), and region (North America, Europe, Asia Pacific, Middle East & Africa and South America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the power conditioning unit market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, expansion, Joint ventures, collaborations, and acquisitions; and recent developments associated with the market. This report covers the competitive analysis of upcoming startups in the power conditioning unit market ecosystem.

Key Benefits of Buying the Report

- The report includes the analysis of key drivers (rising adoption of renewable and distributed energy growth is boosting demand for efficient power conditioning, burgeoning semiconductor industry is driving demand for advanced power conditioning solutions), restraints (integration challenges with existing infrastructure restrain the adoption of new power conditioners, competition from alternative solutions), opportunities (rising data center demand and IoT growth drive the need for reliable, high-availability power conditioning systems, increasing demand for clean and stable power in critical infrastructure such as healthcare, IT, and defense is creating new growth revenues) and challenges (high costs of power conditioners may limit adoption among small and medium-sized businesses, Compliance and Regulatory Standards Influence market adoption).

- Product Development/Innovation: Power conditioning unit market players are actively developing advanced technologies to enhance power quality, reliability, and efficiency across diverse applications. In design and components, innovations such as high-frequency transformers, silicon carbide (SiC) and gallium nitride (GaN) semiconductors, and advanced harmonic filters are improving response times and energy efficiency. Manufacturers also integrate digital monitoring systems, IoT connectivity, and AI-based analytics to enable predictive maintenance and real-time performance optimization. In renewable and grid-connected systems, next-generation power conditioners are being engineered to handle voltage fluctuations, harmonics, and intermittent loads more effectively. Furthermore, modular and scalable architectures are gaining traction, allowing flexible deployment across industrial, commercial, and residential sectors while reducing overall lifecycle costs.

- Market Development: In March 2024, Schneider Electric invested USD 140 million to expand its US manufacturing capabilities, focusing on critical infrastructure and data center solutions. The investment includes USD 85 million to transform a 500,000-square-foot facility in Mt. Juliet, Tennessee, and upgrade operations in Smyrna, Tennessee, producing custom electrical switch gear, medium-voltage power distribution products, and power conditioning equipment.

- Market Diversification: The report offers a comprehensive analysis of the strategies employed by power conditioners solutions provider players to facilitate market diversification. It outlines innovative products and operating models, as well as new partnership frameworks across various regions, underpinned by technology-driven business lines. The findings emphasize opportunities for expansion beyond traditional operations, identifying geographical areas and customer segments that are currently served but remain underserved and are suitable for strategic entry.

- Competitive Assessment: The report provides in-depth assessment of market shares, growth strategies, and service offerings of leading players such as ABB (Switzerland), Eaton (Ireland), Schneider Electric (France), Mitsubishi Electric Power Products Inc. (US), Emerson Electric Co. (US), Delta Electronics, Inc. (Taiwan), Power Systems & Controls, Inc. (US), Trystar (US), AMETEK Inc. (US), Fuji Electric Co., Ltd. (Japan), Rockwell Automation (US), NXT Power, LLC (US), Quality Transformer & Electronics, Inc. (US), and Servomax Limited (India), among others, in the power conditioning unit market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING POWER CONDITIONING UNIT MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POWER CONDITIONING UNIT MARKET

- 3.2 POWER CONDITIONING UNIT MARKET, BY REGION

- 3.3 POWER CONDITIONING UNIT MARKET, BY POWER RATING

- 3.4 POWER CONDITIONING UNIT MARKET, BY PHASE

- 3.5 POWER CONDITIONING UNIT MARKET, BY TYPE

- 3.6 POWER CONDITIONING UNIT MARKET, BY END USER

- 3.7 POWER CONDITIONING UNIT MARKET, BY TYPE AND REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Expansion of renewable and distributed energy systems

- 4.2.1.2 Booming semiconductor industry

- 4.2.2 RESTRAINTS

- 4.2.2.1 Limited demand from SMEs due to budget constraints

- 4.2.2.2 Availability of substitute technologies

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising demand for data centers and IoT devices

- 4.2.3.2 Escalating need for clean and stable power supply in healthcare, IT, and defense infrastructure

- 4.2.4 CHALLENGES

- 4.2.4.1 Complexities associated with reengineering legacy systems for future-ready power infrastructure

- 4.2.4.2 Hidden cost of compliance and inconsistent regulatory standards

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS: CUSTOMER REQUIREMENTS IN POWER CONDITIONING UNIT MARKET

- 4.3.2 WHITE SPACES: MARKET-DRIVEN OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL UTILITIES INDUSTRY

- 5.2.4 TRENDS IN GLOBAL TRANSPORTATION INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL ANALYSIS

- 5.3.2 FINAL PRODUCT ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING RANGE OF POWER CONDITIONING UNITS, BY POWER RATING, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF POWER CONDITIONING UNITS, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 8535)

- 5.6.2 EXPORT SCENARIO (HS CODE 8535)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 DATA CENTER ACHIEVES COST SAVINGS AND MINIMIZES DOWNTIME THROUGH ADVANCED POWER CONDITIONING SOLUTIONS

- 5.10.2 MANUFACTURING FACILITY ENHANCES PRODUCTION EFFICIENCY BY DEPLOYING INTELLIGENT POWER CONDITIONERS

- 5.10.3 SOLAR POWER PLANT ENHANCES SOLAR UTILIZATION BY INTEGRATING ADVANCED POWER CONDITIONERS INTO GRID-TIED INVERTERS

- 5.11 IMPACT OF 2025 US TARIFF - POWER CONDITIONING UNIT MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END USERS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ACTIVE HARMONIC FILTERS

- 6.1.2 STATIC VAR COMPENSATORS AND STATIC SYNCHRONOUS COMPENSATORS

- 6.1.3 IOT-INTEGRATED SMART UPS SYSTEMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ENERGY STORAGE SYSTEMS

- 6.2.2 SMART GRID AND ADVANCED METERING

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 PATENT ACTIVITY INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 LIST OF KEY PATENTS HELD BY QUALCOMM INC

- 6.4.9 LIST OF KEY PATENTS HELD BY SAMSUNG ELECTRONICS CO LTD

- 6.5 FUTURE APPLICATIONS

- 6.5.1 SMART GRIDS: NEXT-GENERATION GRID STABILITY AND VOLTAGE OPTIMIZATION

- 6.5.2 DATA CENTERS: ENERGY-EFFICIENT AND LOW-HARMONIC POWER INFRASTRUCTURE

- 6.5.3 ELECTRIC VEHICLE CHARGING SYSTEMS: FAST-CHARGING RELIABILITY AND POWER QUALITY ENHANCEMENT

- 6.5.4 RENEWABLE ENERGY INTEGRATION: GRID-CONNECTED SOLAR AND WIND POWER OPTIMIZATION

- 6.5.5 INDUSTRIAL AUTOMATION: PRECISION POWER CONDITIONING FOR ROBOTICS AND PROCESS CONTROL

- 6.6 IMPACT OF AI/GEN AI ON POWER CONDITIONING UNIT MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY OEMS IN POWER CONDITIONING UNIT MARKET

- 6.6.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN POWER CONDITIONING UNIT MARKET

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI-INTEGRATED POWER CONDITIONERS

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 ABB: PREDICTIVE MAINTENANCE, SMART UPS, AND GRID OPTIMIZATION

- 6.7.2 SCHNEIDER ELECTRIC: ECOSTRUXURE POWER MONITORING AND AUTOMATION

- 6.7.3 EATON: UPS AND INDUSTRIAL POWER SYSTEMS

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 USE OF POWER CONDITIONERS TO REDUCE CARBON IMPACT AND ENHANCE GRID STABILITY

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS OF VARIOUS END USERS

- 8.6 MARKET PROFITABILITY

- 8.6.1 REVENUE POTENTIAL

- 8.6.2 COST DYNAMICS

- 8.6.3 MARGIN OPPORTUNITIES, BY END USER

9 POWER CONDITIONING UNIT MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 ACTIVE

- 9.2.1 GROWING ADOPTION OF AUTOMATION AND DIGITAL EQUIPMENT IN MANUFACTURING TO DRIVE MARKET

- 9.3 PASSIVE

- 9.3.1 FOCUS ON IMPROVING ELECTRICAL EQUIPMENT EFFICIENCY AND LOWERING PENALTIES FOR POOR POWER FACTOR TO PROPEL MARKET

10 POWER CONDITIONING UNIT MARKET, BY PHASE

- 10.1 INTRODUCTION

- 10.2 SINGLE-PHASE

- 10.2.1 AFFORDABILITY, EASE OF INSTALLATION, AND COMPATIBILITY WITH DISTRIBUTED ENERGY RESOURCES TO BOOST DEMAND

- 10.3 THREE-PHASE

- 10.3.1 POTENTIAL TO MANAGE HEAVY ELECTRICAL LOADS AND ENHANCE PRODUCTIVITY TO SPUR DEMAND

11 POWER CONDITIONING UNIT MARKET, BY POWER RATING

- 11.1 INTRODUCTION

- 11.2 <=10 KVA

- 11.2.1 RISING DEMAND FOR HOME AUTOMATION SYSTEMS, POS TERMINALS, AND COMPACT MEDICAL DEVICES TO PROPEL MARKET

- 11.3 >10-50 KVA

- 11.3.1 FOCUS ON PREVENTING OPERATIONAL DOWNTIME OR EQUIPMENT MALFUNCTION TO SURGE ADOPTION

- 11.4 >50-150 KVA

- 11.4.1 ELEVATING DEMAND FOR INDUSTRIAL ROBOTICS AND MRI IMAGING SYSTEMS TO FUEL SEGMENTAL GROWTH

- 11.5 >150 KVA

- 11.5.1 ESCALATING DEMAND FROM HYPERSCALE DATA CENTERS AND ENERGY-INTENSIVE MANUFACTURING PLANTS TO FOSTER MARKET GROWTH

12 POWER CONDITIONING UNIT MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 INDUSTRIAL & MANUFACTURING

- 12.2.1 NEED TO ENSURE OPERATIONAL STABILITY AND PROTECT SENSITIVE EQUIPMENT TO ACCELERATE DEMAND

- 12.3 COMMERCIAL

- 12.3.1 GROWING SMART BUILDING INITIATIVES AND ELECTRIC VEHICLE CHARGING INFRASTRUCTURE TO CREATE OPPORTUNITIES

- 12.4 UTILITIES

- 12.4.1 FOCUS ON BUILDING FLEXIBLE AND RELIABLE POWER DISTRIBUTION NETWORK TO FUEL SEGMENTAL GROWTH

- 12.5 TRANSPORTATION

- 12.5.1 RISING ADOPTION OF SMART TRANSPORTATION SYSTEMS TO SUPPORT MARKET GROWTH

- 12.6 RESIDENTIAL

- 12.6.1 INCREASING USE OF HVAC SYSTEMS, ENTERTAINMENT DEVICES, AND PERSONAL COMPUTING EQUIPMENT TO DRIVE MARKET

- 12.7 HEALTHCARE

- 12.7.1 GROWING ADOPTION OF ADVANCED IMAGING, DIAGNOSTIC, AND LIFE-SUPPORT TECHNOLOGIES TO SPUR DEMAND

13 POWER CONDITIONING UNIT MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Rapid electrification and increasing demand from compute-intensive facilities to support market growth

- 13.2.2 CANADA

- 13.2.2.1 Rising funding for grid modernization to enhance distribution assets and energy storage capacity to propel market

- 13.2.3 MEXICO

- 13.2.3.1 Increasing stress on power infrastructure due to high energy demand to spike demand

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Strong base of heavy-duty industries to boost demand

- 13.3.2 UK

- 13.3.2.1 Substantial investment in new energy sources to spur demand

- 13.3.3 FRANCE

- 13.3.3.1 Strong commitment to clean energy transition to foster market growth

- 13.3.4 ITALY

- 13.3.4.1 Rapid transition toward resilient and sustainable power ecosystem to fuel market growth

- 13.3.5 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Significant focus on data center capacity expansion to accelerate demand

- 13.4.2 JAPAN

- 13.4.2.1 Growing adoption of automation in electronics and automotive industries to create growth opportunities

- 13.4.3 INDIA

- 13.4.3.1 Greater emphasis on expanding power capacity through renewable energy sources to drive market

- 13.4.4 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Industrial modernization and fast-growing data center ecosystem to facilitate market growth

- 13.5.1.2 UAE

- 13.5.1.2.1 Digital transformation through clean and reliable energy infrastructure to contribute to market growth

- 13.5.1.3 Qatar

- 13.5.1.3.1 Transition toward diversified energy mix to escalate demand

- 13.5.1.4 Rest of GCC

- 13.5.1.1 Saudi Arabia

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Persistent issue of load shedding and voltage fluctuations to escalate PCU demand

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC

- 13.6 SOUTH AMERICA

- 13.6.1 BRAZIL

- 13.6.1.1 Strategic focus on hydro and renewable sources to generate electricity to contribute to market growth

- 13.6.2 ARGENTINA

- 13.6.2.1 Rapid expansion of data center capacity to favor market growth

- 13.6.3 VENEZUELA

- 13.6.3.1 Pressing need to fix intermittent outage and aging infrastructure issues to elevate adoption

- 13.6.4 REST OF SOUTH AMERICA

- 13.6.1 BRAZIL

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, AUGUST 2021-SEPTEMBER 2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.6.1 EATON

- 14.6.2 SCHNEIDER ELECTRIC

- 14.6.3 FUJI ELECTRIC CO., LTD.

- 14.6.4 EMERSON ELECTRIC CO.

- 14.6.5 AMETEK INC.

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Type footprint

- 14.7.5.4 Phase footprint

- 14.7.5.5 Power rating footprint

- 14.7.5.6 End user footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 EMERSON ELECTRIC CO.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Key strengths

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses and competitive threats

- 15.1.2 AMETEK INC.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Key strengths

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses and competitive threats

- 15.1.3 EATON

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 SCHNEIDER ELECTRIC

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.3.2 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 FUJI ELECTRIC CO., LTD.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses and competitive threats

- 15.1.6 ABB

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Other developments

- 15.1.8 ROCKWELL AUTOMATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 DELTA ELECTRONICS, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 LS ELECTRIC

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Developments

- 15.1.11 POWER SYSTEMS & CONTROLS, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 TRYSTAR

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.13 NXT POWER, LLC

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 ASHLEY EDISON INTERNATIONAL LTD

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 QUALITY TRANSFORMER & ELECTRONICS, INC.

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.1 EMERSON ELECTRIC CO.

- 15.2 OTHER PLAYERS

- 15.2.1 SERVOMAX LIMITED

- 15.2.2 FARMAX TECHNOLOGIES PVT.LTD

- 15.2.3 STACO ENERGY PRODUCTS CO.

- 15.2.4 SINALDA UK LIMITED

- 15.2.5 ACUMENTRICS

- 15.2.6 ELINEX POWER SOLUTIONS B.V.

- 15.2.7 MEIDENSHA CORPORATION

- 15.2.8 SPECTRUMSTAB INDIA PVT.LTD.

- 15.2.9 STATCON ELECTRONICS INDIA LIMITED

- 15.2.10 NISSIN ELECTRIC CO., LTD.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.2 SECONDARY DATA

- 16.2.1 LIST OF KEY SECONDARY SOURCES

- 16.2.2 KEY DATA FROM SECONDARY SOURCES

- 16.3 PRIMARY DATA

- 16.3.1 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- 16.3.2 KEY DATA FROM PRIMARY SOURCES

- 16.3.3 KEY INDUSTRY INSIGHTS

- 16.3.4 BREAKDOWN OF PRIMARIES

- 16.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 16.5 MARKET SIZE ESTIMATION

- 16.5.1 BOTTOM-UP APPROACH

- 16.5.2 TOP-DOWN APPROACH

- 16.6 MARKET SIZE ESTIMATION

- 16.6.1 DEMAND-SIDE ANALYSIS

- 16.6.1.1 Demand-side assumptions

- 16.6.1.2 Demand-side calculations

- 16.6.2 SUPPLY-SIDE ANALYSIS

- 16.6.2.1 Supply-side assumptions

- 16.6.2.2 Supply-side calculations

- 16.6.1 DEMAND-SIDE ANALYSIS

- 16.7 MARKET FORECAST APPROACH

- 16.7.1 SUPPLY SIDE

- 16.7.2 DEMAND SIDE

- 16.8 GROWTH PROJECTION

- 16.9 RESEARCH LIMITATIONS

- 16.10 RISK ANALYSIS

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

List of Tables

- TABLE 1 POWER CONDITIONING UNIT MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 POWER CONDITIONING UNIT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 GDP OF KEY COUNTRIES, 2021-2029

- TABLE 4 GLOBAL VEHICLE PRODUCTION TREND, 2022-2023

- TABLE 5 ROLES OF COMPANIES IN POWER CONDITIONING UNIT ECOSYSTEM

- TABLE 6 INDICATIVE PRICING RANGE OF POWER CONDITIONING UNITS, BY POWER RATING, 2024 (USD THOUSAND)

- TABLE 7 AVERAGE SELLING PRICE TREND OF POWER CONDITIONING UNITS, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 8 LEADING IMPORTERS OF HS CODE 8535-COMPLIANT PRODUCTS, 2020-2024 (USD THOUSAND)

- TABLE 9 LEADING EXPORTERS OF HS CODE 8535-COMPLIANT PRODUCTS, 2020-2024 (USD THOUSAND)

- TABLE 10 POWER CONDITIONING UNIT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 EXPECTED CHANGE IN PRICES AND IMPACT ON END USERS DUE TO TARIFFS

- TABLE 13 POWER CONDITIONING UNIT MARKET: TOTAL NUMBER OF PATENTS, JANUARY 2015-DECEMBER 2024

- TABLE 14 TOP USE CASES AND MARKET POTENTIAL

- TABLE 15 BEST PRACTICES IMPLEMENTED BY KEY COMPANIES

- TABLE 16 POWER CONDITIONING UNIT MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION IN POWER CONDITIONERS

- TABLE 17 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 GLOBAL INDUSTRY STANDARDS IN POWER CONDITIONING UNIT MARKET

- TABLE 24 CERTIFICATIONS AND ECO-STANDARDS IN POWER CONDITIONING UNIT MARKET

- TABLE 25 IMPACT OF DECISION AUTHORITIES ON BUYING PROCESS, BY END USER (%)

- TABLE 26 MAJOR FACTORS INFLUENCING PURCHASING DECISIONS OF END USERS

- TABLE 27 UNFULFILLED DEMAND FROM END USERS FOR POWER CONDITIONING UNITS

- TABLE 28 POWER CONDITIONING UNIT MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 29 POWER CONDITIONING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 ACTIVE: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 ACTIVE: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 PASSIVE: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 PASSIVE: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 POWER CONDITIONG UNIT MARKET, BY PHASE, 2020-2024 (USD MILLION)

- TABLE 35 POWER CONDITIONING UNIT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 36 SINGLE-PHASE: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 SINGLE-PHASE: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 THREE-PHASE: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 THREE-PHASE: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 41 POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 42 POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2020-2024 (THOUSAND UNITS)

- TABLE 43 POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2025-2030 (THOUSAND UNITS)

- TABLE 44 <=10 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 <=10 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 >10-50 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 >10-50 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 >50-150 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 >50-150 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 >150 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 >150 KVA: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 53 POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 54 INDUSTRIAL & MANUFACTURING: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 INDUSTRIAL & MANUFACTURING: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 COMMERCIAL: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 COMMERCIAL: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 UTILITIES: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 UTILITIES: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 TRANSPORTATION: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 TRANSPORTATION: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 RESIDENTIAL: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 RESIDENTIAL: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 HEALTHCARE: POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 HEALTHCARE: POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 POWER CONDITIONING UNIT MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 69 POWER CONDITIONING UNIT MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 70 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY PHASE, 2020-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 US: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 81 US: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 82 CANADA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 83 CANADA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 84 MEXICO: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 85 MEXICO: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: POWER CONDITIONING UNIT MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 87 EUROPE: POWER CONDITIONING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: POWER CONDITIONING UNIT MARKET, BY PHASE, 2020-2024 (USD MILLION)

- TABLE 89 EUROPE: POWER CONDITIONING UNIT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 91 EUROPE: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 93 EUROPE: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 95 EUROPE: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 GERMANY: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 97 GERMANY: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 98 UK: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 99 UK: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 100 FRANCE: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 101 FRANCE: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 ITALY: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 103 ITALY: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 105 REST OF EUROPE: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY PHASE, 2020-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 CHINA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 117 CHINA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 118 JAPAN: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 119 JAPAN: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 120 INDIA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 121 INDIA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY PHASE, 2020-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 GCC: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 135 GCC: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 GCC: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 137 GCC: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH AFRICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 139 SOUTH AFRICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 142 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 143 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY PHASE, 2020-2024 (USD MILLION)

- TABLE 145 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 146 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2020-2024 (USD MILLION)

- TABLE 147 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 148 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 149 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 150 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 151 SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 BRAZIL: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 153 BRAZIL: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 154 ARGENTINA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 155 ARGENTINA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 156 VENEZUELA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 157 VENEZUELA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 158 REST OF SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 159 REST OF SOUTH AMERICA: POWER CONDITIONING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 160 COMPETITIVE STRATEGIES ADOPTED BY MARKET PLAYERS, AUGUST 2021-SEPTEMBER 2025

- TABLE 161 POWER CONDITIONING UNIT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 162 POWER CONDITIONING UNIT MARKET: REGION FOOTPRINT

- TABLE 163 POWER CONDITIONING UNIT MARKET: TYPE FOOTPRINT

- TABLE 164 POWER CONDITIONING UNIT MARKET: PHASE FOOTPRINT

- TABLE 165 POWER CONDITIONING UNIT MARKET: POWER RATING FOOTPRINT

- TABLE 166 POWER CONDITIONING UNIT MARKET: END USER FOOTPRINT

- TABLE 167 POWER CONDITIONING UNIT MARKET: DETAILED LIST OF KEYS STARTUPS/SMES

- TABLE 168 POWER CONDITIONING UNIT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 169 POWER CONDITIONING UNIT MARKET: DEALS, AUGUST 2021-SEPTEMBER 2025

- TABLE 170 POWER CONDITIONING UNIT MARKET: EXPANSIONS, AUGUST 2021-SEPTEMBER 2025

- TABLE 171 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 172 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 AMETEK INC.: COMPANY OVERVIEW

- TABLE 174 AMETEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 EATON: COMPANY OVERVIEW

- TABLE 176 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 EATON: DEALS

- TABLE 178 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 179 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 SCHNEIDER ELECTRIC: DEALS

- TABLE 181 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 182 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 183 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 ABB: COMPANY OVERVIEW

- TABLE 185 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ABB: DEALS

- TABLE 187 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 188 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 189 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: DEALS

- TABLE 190 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: OTHER DEVELOPMENTS

- TABLE 191 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 192 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 194 DELTA ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 DELTA ELECTRONICS, INC.: DEALS

- TABLE 196 LS ELECTRIC: COMPANY OVERVIEW

- TABLE 197 LS ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 LS ELECTRIC: DEVELOPMENTS

- TABLE 199 POWER SYSTEMS & CONTROLS, INC.: COMPANY OVERVIEW

- TABLE 200 POWER SYSTEMS & CONTROLS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 TRYSTAR: COMPANY OVERVIEW

- TABLE 202 TRYSTAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 TRYSTAR: DEALS

- TABLE 204 NXT POWER, LLC: COMPANY OVERVIEW

- TABLE 205 NXT POWER, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ASHLEY EDISON INTERNATIONAL LTD: COMPANY OVERVIEW

- TABLE 207 ASHLEY EDISON INTERNATIONAL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 QUALITY TRANSFORMER & ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 209 QUALITY TRANSFORMER & ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 210 SERVOMAX LIMITED: BUSINESS OVERVIEW

- TABLE 211 FARMAX TECHNOLOGIES PVT.LTD: BUSINESS OVERVIEW

- TABLE 212 STACO ENERGY PRODUCTS CO.: BUSINESS OVERVIEW

- TABLE 213 SINALDA UK LIMITED: BUSINESS OVERVIEW

- TABLE 214 ACUMENTRICS: BUSINESS OVERVIEW

- TABLE 215 ELINEX POWER SOLUTIONS B.V.: BUSINESS OVERVIEW

- TABLE 216 MEIDENSHA CORPORATION: BUSINESS OVERVIEW

- TABLE 217 SPECTRUMSTAB INDIA PVT.LTD.: BUSINESS OVERVIEW

- TABLE 218 STATCON ELECTRONICS INDIA LIMITED: BUSINESS OVERVIEW

- TABLE 219 NISSIN ELECTRIC CO., LTD.: BUSINESS OVERVIEW

- TABLE 220 LIST OF KEY SECONDARY SOURCES

- TABLE 221 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 222 POWER CONDITIONING UNIT MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SPLIT

- FIGURE 2 DURATION COVERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 GLOBAL POWER CONDITIONING UNIT MARKET, 2021-2030

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN POWER CONDITIONING UNIT MARKET, 2020-2025

- FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF POWER CONDITIONING UNIT MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN POWER CONDITIONING UNIT MARKET, 2025-2030

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN POWER CONDITIONING UNIT MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 9 RAPID DATA CENTER EXPANSION AND ELECTRIFICATION OF COMMERCIAL BUILDINGS TO CREATE GROWTH OPPORTUNITIES BETWEEN 2025 AND 2030

- FIGURE 10 ASIA PACIFIC TO DEPICT HIGHEST CAGR IN POWER CONDITIONING UNIT MARKET DURING FORECAST PERIOD

- FIGURE 11 <=10 KVA SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 THREE-PHASE POWER CONDITIONING UNITS TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN 2030

- FIGURE 13 PASSIVE POWER CONDITIONERS TO ACCOUNT FOR PROMINENT MARKET SHARE IN 2030

- FIGURE 14 INDUSTRIAL & MANUFACTURING SEGMENT TO LEAD POWER CONDITIONING UNIT MARKET IN 2030

- FIGURE 15 PASSIVE POWER CONDITIONERS AND ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 16 POWER CONDITIONING UNIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GLOBAL INSTALLED RENEWABLE ENERGY CAPACITY, BY TECHNOLOGY, 2021-2024

- FIGURE 18 POWER CONDITIONING UNIT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 POWER CONDITIONING UNIT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 KEY PARTICIPANTS IN POWER CONDITIONING UNIT ECOSYSTEM

- FIGURE 21 POWER CONDITIONING UNIT ECOSYSTEM ANALYSIS

- FIGURE 22 REGION-WISE AVERAGE SELLING PRICE TREND OF POWER CONDITIONING UNITS, 2021-2024

- FIGURE 23 IMPORT SCENARIO FOR HS CODE 8535-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 24 EXPORT SCENARIO FOR HS CODE 8535-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 POWER CONDITIONING UNIT MARKET: INVESTMENT AND FUNDING SCENARIO OF MAJOR PLAYERS, 2024

- FIGURE 27 PATENT ANALYSIS, BY DOCUMENT TYPE, JANUARY 2015-DECEMBER 2024

- FIGURE 28 PATENT PUBLICATION TRENDS, 2015-2024

- FIGURE 29 POWER CONDITIONING UNIT MARKET: LEGAL STATUS OF PATENTS, JANUARY 2014-JULY 2024

- FIGURE 30 US ACCOUNTED FOR PROMINENT SHARE OF PATENT ACTIVITY DURING 2014-2024

- FIGURE 31 TOP PATENT APPLICANTS, JANUARY 2014-DECEMBER 2024

- FIGURE 32 FUTURE APPLICATIONS

- FIGURE 33 FACTORS CONSIDERED WHILE PURCHASING POWER CONDITIONERS

- FIGURE 34 INFLUENCE OF DECISION AUTHORITIES ON BUYING PROCESS, BY END USER

- FIGURE 35 KEY BUYING CRITERIA, BY END USER

- FIGURE 36 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 37 PASSIVE SEGMENT HELD LARGEST SHARE OF POWER CONDITIONING UNIT MARKET IN 2024

- FIGURE 38 POWER CONDITIONING UNIT MARKET, BY PHASE, 2024

- FIGURE 39 <=10 KVA SEGMENT HELD LARGEST SHARE OF POWER CONDITIONING UNIT MARKET IN 2024

- FIGURE 40 POWER CONDITIONING UNIT MARKET, BY END USER, 2024

- FIGURE 41 ASIA PACIFIC TO RECORD HIGHEST CAGR IN POWER CONDITIONING UNIT MARKET DURING FORECAST PERIOD

- FIGURE 42 POWER CONDITIONING UNIT MARKET SHARE, BY REGION, 2024

- FIGURE 43 NORTH AMERICA: POWER CONDITIONING UNIT MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: POWER CONDITIONING UNIT MARKET SNAPSHOT

- FIGURE 45 POWER CONDITIONING UNIT MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 46 POWER CONDITIONING UNIT MARKET SHARE ANALYSIS, 2024

- FIGURE 47 POWER CONDITIONING UNIT MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 48 COMPANY VALUATION

- FIGURE 49 POWER CONDITIONING UNIT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 50 POWER CONDITIONING UNIT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 POWER CONDITIONING UNIT MARKET: COMPANY FOOTPRINT

- FIGURE 52 POWER CONDITIONING UNIT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 54 AMETEK INC.: COMPANY SNAPSHOT

- FIGURE 55 EATON: COMPANY SNAPSHOT

- FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 57 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 ABB: COMPANY SNAPSHOT

- FIGURE 59 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 60 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 61 LS ELECTRIC: COMPANY SNAPSHOT

- FIGURE 62 POWER CONDITIONING UNIT MARKET: RESEARCH DESIGN

- FIGURE 63 DATA SOURCED FROM SECONDARY LITERATURE

- FIGURE 64 DATA SOURCED FROM INDUSTRY EXPERTS

- FIGURE 65 INSIGHTS FROM SUBJECT-MATTER EXPERTS

- FIGURE 66 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 67 POWER CONDITIONING UNIT MARKET: DATA TRIANGULATION

- FIGURE 68 POWER CONDITIONING UNIT MARKET: BOTTOM-UP APPROACH

- FIGURE 69 POWER CONDITIONING UNIT MARKET: TOP-DOWN APPROACH

- FIGURE 70 POWER CONDITIONING UNIT MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 71 SUPPLY CHAIN PARTICIPANTS

- FIGURE 72 POWER CONDITIONING UNIT MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 73 INDUSTRY CONCENTRATION, 2024

- FIGURE 74 POWER CONDITIONING UNIT MARKET: RESEARCH LIMITATIONS