PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883068

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883068

Aircraft Heat Exchanger Market by Design, Application, Medium, Platform, Material, Architecture, Point of Sale and Region - Global Forecast to 2030

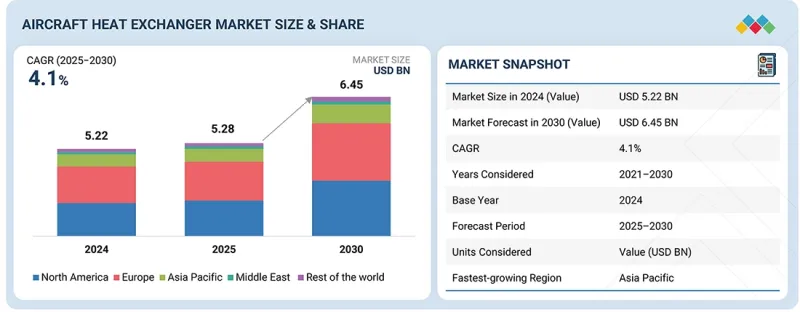

The aircraft heat exchanger market is projected to reach USD 6.45 billion by 2030, growing from USD 5.28 billion in 2025, at a CAGR of 4.1% during the forecast period. Market growth is primarily driven by the increasing production of modern, fuel-efficient aircraft, rising MRO activities, and continuous fleet modernization initiatives across the commercial and military aviation sectors. As aircraft systems become more integrated and thermally complex, manufacturers are increasingly investing in compact, high-performance heat exchangers to enhance operational efficiency, ensure component reliability, and comply with stringent emission standards.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Design, Application, Medium, Platform, Material, Architecture and Region |

| Regions covered | North America, Europe, APAC, RoW |

Moreover, advancements in lightweight materials, additive manufacturing, and optimized fin-core geometries are enabling superior heat transfer performance while reducing overall system weight.

"By application, the engine systems segment is projected to grow at the highest CAGR during the forecast period."

The engine systems segment is projected to grow at the highest CAGR during the forecast period due to the essential role of engine systems in maintaining optimal thermal balance and operational efficiency in high-temperature environments. Modern turbofan and turboprop engines generate substantial heat loads that must be effectively managed to prevent thermal stress and maintain fuel efficiency. As leading OEMs, such as GE Aerospace, Rolls-Royce plc, and Pratt & Whitney, develop next-generation propulsion systems with higher pressure ratios and tighter thermal margins, the adoption of advanced heat exchangers-particularly plate-fin and microchannel designs-continues to accelerate.

Additionally, the engine systems segment experiences consistent aftermarket demand, as oil, fuel, and bleed air cooling systems require regular maintenance and replacement during overhaul cycles. This recurring demand is reinforced by the global shift toward sustainable aviation, where minimizing heat-related inefficiencies directly supports reduced fuel consumption and lower emissions. Consequently, engine system heat exchangers remain central to improving aircraft performance, durability, and environmental compliance across all major aviation platforms.

"By point of sale, the OEM segment is projected to grow at a higher CAGR than the aftermarket segment during the forecast period."

The OEM segment is projected to record higher growth than the aftermarket segment during the forecast period, driven by strong aircraft production rates and substantial order backlogs from major manufacturers, including Airbus, Boeing, Embraer, and COMAC. Each newly produced aircraft integrates multiple heat exchangers across various systems, including engines, environmental control, and avionics cooling, resulting in consistent demand from OEM assembly lines. Additionally, the continuous development of next-generation aircraft platforms with advanced propulsion and hybrid-electric configurations is accelerating the need for more compact, lightweight, and efficient thermal management systems. Another significant factor driving growth is the increasing integration of additive manufacturing and high-performance materials during aircraft assembly, which enables improved thermal efficiency, reduced system weight, and enhanced design flexibility. OEMs are prioritizing heat exchangers that ensure seamless integration with advanced composite structures and new propulsion technologies. Unlike aftermarket replacements, OEMs demand benefits from multi-year production contracts and long-term supply partnerships, where key suppliers are embedded in aircraft programs for extended lifecycles.

"Asia Pacific is projected to grow at the highest rate during the forecast period."

Asia Pacific is projected to register the highest growth rate in the aircraft heat exchanger market through 2030, supported by rapid fleet expansion, strong economic growth, and increasing investments in domestic aerospace manufacturing. Countries such as China, India, and Japan are leading regional growth through large-scale commercial aircraft acquisitions and indigenous aircraft development programs. Rising air passenger traffic and the growing presence of regional airlines are also fueling the growth of the region.

On the defense side, regional modernization programs in India, South Korea, and Japan are boosting procurement of advanced fighter aircraft, transport planes, and UAVs equipped with high-efficiency thermal management systems. Furthermore, emerging nations such as Indonesia, Malaysia, and the Philippines are expanding their MRO infrastructure, thereby strengthening aftermarket opportunities for heat exchanger replacement and maintenance. Combined, these factors are positioning Asia Pacific as the fastest-growing market, driven by sustained OEM output, growing defense procurement, and increased focus on fleet efficiency across both commercial and military aviation sectors.

The breakdown of profiles for primary participants in the aircraft heat exchanger market is provided below:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East - 10% Rest of the World (RoW) - 5%

Research Coverage:

This market study covers the aircraft heat exchanger market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall aircraft heat exchanger market. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and will provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Drivers (Growing fleet sizes and aircraft renewals, tightening fuel efficiency and CO2 requirements, rising avionics and electrical power density), Restraints (Weight pressure drop trade-offs, supply chain constraints in specialty materials and furnace capacity), Opportunities (Expansion of additive manufacturing for exchanger cores, adoption of sensorized units and predictive maintenance), Challenges (Detection of internal effects, integration with tight high-load spaces)

- Market Penetration: Comprehensive information on aircraft heat exchangers offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the aircraft heat exchanger market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the aircraft heat exchanger market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the aircraft h/at exchanger market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT HEAT EXCHANGER MARKET

- 4.2 AIRCRAFT HEAT EXCHANGER MARKET, BY ARCHITECTURE

- 4.3 AIRCRAFT HEAT EXCHANGER MARKET, BY DESIGN

- 4.4 AIRCRAFT HEAT EXCHANGER MARKET, BY MATERIAL

- 4.5 AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding fleet sizes and ongoing aircraft renewals

- 5.2.1.2 Focus on reducing fuel consumption and emissions

- 5.2.1.3 Increasing complexity of modern aircraft systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Trade-off between weight reduction and pressure-drop performance

- 5.2.2.2 Supply chain constraints in specialty materials and furnace capacity

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of additive manufacturing for exchanger cores

- 5.2.3.2 Adoption of on-demand connectivity services

- 5.2.4 CHALLENGES

- 5.2.4.1 Detection of internal defects in complex cores

- 5.2.4.2 Integration within tight, high-load spaces

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 INDICATIVE PRICING ANALYSIS FOR OEMS, BY PLATFORM AND APPLICATION

- 5.3.2 INDICATIVE PRICING ANALYSIS FOR AFTERMARKET, BY PLATFORM AND APPLICATION

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 MANUFACTURERS

- 5.5.2 SERVICE PROVIDERS

- 5.5.3 END USERS

- 5.6 TECHNOLOGY ROADMAP

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF DATA

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 REGULATORY FRAMEWORK

- 5.9 TRADE DATA

- 5.9.1 IMPORT SCENARIO (HS CODE 841950)

- 5.9.2 EXPORT SCENARIO (HS CODE 841950)

- 5.10 USE CASE ANALYSIS

- 5.10.1 AKG GROUP'S HEAT EXCHANGER FOR ELECTRIC AVIATION SYSTEMS

- 5.10.2 CONFLUX TECHNOLOGIES' THERMAL MANAGEMENT FOR EVTOL BATTERY COOLING

- 5.10.3 BOYD CORPORATIONS' CRYOGENIC LOOP HEAT PIPE FOR LUNAR SEISMIC INSTRUMENTS

- 5.10.4 THERMOVAC AEROSPACE'S HEAT EXCHANGER REPLACEMENT

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS

- 5.13 INVESTMENT AND FUNDING SCENARIO

- 5.14 BUSINESS MODELS

- 5.15 MACROECONOMIC OUTLOOK

- 5.15.1 NORTH AMERICA

- 5.15.2 EUROPE

- 5.15.3 ASIA PACIFIC

- 5.15.4 MIDDLE EAST

- 5.15.5 LATIN AMERICA

- 5.15.6 AFRICA

- 5.16 IMPACT OF AI

- 5.16.1 ADOPTION OF AI IN AVIATION BY TOP COUNTRIES

- 5.16.2 ADOPTION OF AI IN AIRCRAFT HEAT EXCHANGER MARKET

- 5.17 PATENT ANALYSIS

- 5.18 TECHNOLOGY ANALYSIS

- 5.18.1 KEY TECHNOLOGIES

- 5.18.1.1 Plate-fin heat exchangers

- 5.18.1.2 Advanced materials and precision brazing

- 5.18.1.3 Anti-fouling and anti-icing surfaces

- 5.18.2 COMPLEMENTARY TECHNOLOGIES

- 5.18.2.1 Environmental control systems and air cycle machines

- 5.18.2.2 Thermal sensors and health monitoring

- 5.18.3 ADJACENT TECHNOLOGIES

- 5.18.3.1 Power electronics and battery systems

- 5.18.1 KEY TECHNOLOGIES

- 5.19 IMPACT OF MEGATRENDS

- 5.19.1 DECARBONIZATION OF FLEET AND OPERATIONS

- 5.19.2 ELECTRIFICATION AND HYBRID ELECTRIC PROPULSION

- 5.19.3 EXPANSION OF EVTOL AND URBAN AIR MOBILITY

6 AIRCRAFT HEAT EXCHANGER MARKET, BY POINT OF SALE

- 6.1 INTRODUCTION

- 6.2 OEM

- 6.2.1 NEED FOR ADVANCED THERMAL MANAGEMENT SOLUTIONS

- 6.3 AFTERMARKET

- 6.3.1 RECURRING DEMAND FOR COMPONENT REFURBISHMENT AND REPLACEMENT

7 AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- 7.2 COMMERCIAL AVIATION

- 7.2.1 STRATEGIC SHIFTS DUE TO DEMAND RECOVERY AND FLEET MODERNIZATION

- 7.2.2 NARROW-BODY AIRCRAFT

- 7.2.3 WIDE-BODY AIRCRAFT

- 7.2.4 REGIONAL TRANSPORT AIRCRAFT

- 7.2.5 HELICOPTER

- 7.3 BUSINESS & GENERAL AVIATION

- 7.3.1 ELEVATED DEMAND FOR FLEXIBLE, POINT-TO-POINT TRAVEL

- 7.3.2 BUSINESS JET

- 7.3.3 LIGHT AIRCRAFT

- 7.4 MILITARY AVIATION

- 7.4.1 EMPHASIS ON STRENGTHENING MULTI-DOMAIN OPERATIONAL READINESS

- 7.4.2 FIGHTER AIRCRAFT

- 7.4.3 TRANSPORT AIRCRAFT

- 7.4.4 SPECIAL MISSION AIRCRAFT

- 7.4.5 MILITARY HELICOPTER

- 7.5 ADVANCED AIR MOBILITY

- 7.5.1 SHIFT TOWARD INTEGRATED URBAN AND REGIONAL AIR SOLUTIONS

- 7.5.2 AIR TAXI

- 7.5.3 AIR SHUTTLE & AIR METRO

- 7.5.4 GOVERNMENT & LAW ENFORCEMENT

- 7.5.5 PERSONAL AIR VEHICLE

- 7.5.6 CARGO AIR VEHICLE

- 7.5.7 AIR AMBULANCE & MEDICAL EMERGENCY VEHICLE

- 7.6 UAV

- 7.6.1 ADVANCEMENTS IN AUTONOMY, SENSOR INTEGRATION, AND DATA ANALYTICS

- 7.6.2 CONSUMER UAV

- 7.6.3 COMMERCIAL UAV

- 7.6.4 GOVERNMENT & LAW ENFORCEMENT UAV

- 7.6.5 MILITARY UAV

8 AIRCRAFT HEAT EXCHANGER MARKET, BY DESIGN

- 8.1 INTRODUCTION

- 8.2 PLATE FIN

- 8.2.1 CONTINUOUS INNOVATIONS IN FIN GEOMETRY

- 8.2.2 PLAIN FIN

- 8.2.3 WAVY FIN

- 8.2.4 LOUVERED FIN

- 8.2.5 SERRATED FIN

- 8.3 TUBE FIN

- 8.3.1 FOCUS ON ACHIEVING SUPERIOR THERMAL PERFORMANCE AND COMPACT DESIGN

- 8.3.2 ROUND TUBE

- 8.3.3 FLAT TUBE/MICROCHANNEL

- 8.3.4 SERPENTINE COIL

9 AIRCRAFT HEAT EXCHANGER MARKET, BY MEDIUM

- 9.1 INTRODUCTION

- 9.2 AIR-TO-AIR

- 9.2.1 INDIRECT COOLING FOR HIGH-TEMPERATURE ENGINE AND CABIN FLOWS

- 9.3 AIR-TO-LIQUID

- 9.3.1 MULTI-FLUID INTERFACE FOR ENHANCED POWER SYSTEM COOLING

- 9.4 LIQUID-TO-AIR

- 9.4.1 ACTIVE COOLANT CIRCULATION FOR HIGH HEAT REJECTION RATES

- 9.5 LIQUID-TO-LIQUID

- 9.5.1 CLOSED LOOP COOLING FOR MISSION-CRITICAL THERMAL STABILITY

10 AIRCRAFT HEAT EXCHANGER MARKET, BY MATERIAL

- 10.1 INTRODUCTION

- 10.2 ALUMINUM

- 10.2.1 SUSTAINED DEMAND FOR EFFICIENCY AND WEIGHT OPTIMIZATION

- 10.3 STAINLESS STEEL

- 10.3.1 INCREASED PREFERENCE DUE TO DURABILITY AND HIGH-TEMPERATURE PERFORMANCE

- 10.4 NICKEL ALLOY

- 10.4.1 SIGNIFICANT TRACTION IN HIGH-TEMPERATURE AND CORROSIVE ENVIRONMENTS

- 10.5 TITANIUM

- 10.5.1 HEIGHTENED USE DUE TO EXCELLENT STRENGTH-TO-WEIGHT RATIO AND CORROSION RESISTANCE

11 AIRCRAFT HEAT EXCHANGER MARKET, BY ARCHITECTURE

- 11.1 INTRODUCTION

- 11.2 ELECTRIC

- 11.2.1 RISE IN ELECTRIFICATION AND ENERGY-EFFICIENT THERMAL MANAGEMENT

- 11.3 NON-ELECTRIC

- 11.3.1 PROVEN RELIABILITY AND BROAD APPLICATION VERSATILITY

12 AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 ENVIRONMENTAL COOLING SYSTEM

- 12.2.1 IMPROVED COOLING DENSITY AND HEAT FLUX CAPACITY WITH INNOVATIONS IN MICROCHANNEL GEOMETRIES

- 12.3 ENGINE SYSTEM

- 12.3.1 SIGNIFICANT IMPACT ON ENGINE PERFORMANCE, MAINTENANCE INTERVALS, AND FUEL ECONOMY

- 12.4 BLEED AIR SYSTEM

- 12.4.1 NEED FOR EFFICIENT THERMAL AND PRESSURE MANAGEMENT

- 12.5 AVIONICS/ELECTRONIC POD COOLING

- 12.5.1 RAPID INTEGRATION OF HIGH-POWER ELECTRONICS IN ELECTRIC AND HYBRID AIRCRAFT

- 12.6 HYDRAULIC COOLING

- 12.6.1 RELIABLE OPERATIONS WITH ADOPTION OF LIGHTWEIGHT ALLOYS AND ADDITIVE MANUFACTURING

13 AIRCRAFT HEAT EXCHANGER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 PESTLE ANALYSIS

- 13.2.2 US

- 13.2.2.1 Government support for aerospace innovation and defense modernization to drive market

- 13.2.3 CANADA

- 13.2.3.1 Favorable government policies and emphasis on sustainable aviation to drive market

- 13.3 EUROPE

- 13.3.1 PESTLE ANALYSIS

- 13.3.2 UK

- 13.3.2.1 Advanced aerospace manufacturing base to drive market

- 13.3.3 GERMANY

- 13.3.3.1 Engineering expertise and EU-funded programs to drive market

- 13.3.4 FRANCE

- 13.3.4.1 National aerospace leadership and sustainability goals to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Strong integration within European Union programs to drive market

- 13.3.6 ITALY

- 13.3.6.1 Focus on civil and military aerospace programs to drive market

- 13.4 ASIA PACIFIC

- 13.4.1 PESTLE ANALYSIS

- 13.4.2 CHINA

- 13.4.2.1 Indigenous aircraft programs and defense expansion to drive market

- 13.4.3 INDIA

- 13.4.3.1 Government initiatives and local manufacturing to drive market

- 13.4.4 JAPAN

- 13.4.4.1 Advanced engineering and aerospace expertise to drive market

- 13.4.5 AUSTRALIA

- 13.4.5.1 Defense procurement and aerospace partnerships to drive market

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Indigenous aerospace programs and cutting-edge manufacturing capabilities to drive market

- 13.5 MIDDLE EAST

- 13.5.1 PESTLE ANALYSIS

- 13.5.2 GCC

- 13.5.2.1 UAE

- 13.5.2.1.1 Aerospace diversification and fleet modernization to drive market

- 13.5.2.2 Saudi Arabia

- 13.5.2.2.1 Vision 2030 initiatives and defense procurement to drive market

- 13.5.2.1 UAE

- 13.5.3 ISRAEL

- 13.5.3.1 Advanced UAV programs and defense innovation to drive market

- 13.5.4 TURKEY

- 13.5.4.1 Indigenous fighter programs and industrial growth to drive demand

- 13.6 LATIN AMERICA

- 13.6.1 PESTLE ANALYSIS

- 13.6.2 BRAZIL

- 13.6.2.1 Government support for aerospace innovation to drive market

- 13.6.3 MEXICO

- 13.6.3.1 Integration into global supply chains to drive market

- 13.7 AFRICA

- 13.7.1 PESTLE ANALYSIS

- 13.7.2 SOUTH AFRICA

- 13.7.2.1 Established aerospace industry and defense procurement programs to drive market

- 13.7.3 NIGERIA

- 13.7.3.1 Increased airline activity and diverse defense needs to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 REVENUE ANALYSIS, 2021-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Application footprint

- 14.5.5.4 Platform footprint

- 14.5.5.5 Material footprint

- 14.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING

- 14.6.5.1 List of start-ups/SMEs

- 14.6.5.2 Competitive benchmarking of start-ups/SMEs

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 OTHERS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 RTX

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Right to win

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses and competitive threats

- 15.1.3 SAFRAN

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Right to win

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses and competitive threats

- 15.1.4 LIEBHERR GROUP

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 PARKER HANNIFIN CORPORATION

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 AMETEK, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.7 BOYD CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.8 CONFLUX TECHNOLOGY

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.9 TAT TECHNOLOGIES LTD.

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Others

- 15.1.10 SUMITOMO PRECISION PRODUCTS CO., LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.11 JAMCO CORPORATION

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.12 UNISON INDUSTRIES, LLC

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.13 WALL COLMONOY CORPORATION

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Others

- 15.1.14 TRIUMPH GROUP

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.15 THERMOVAC AEROSPACE

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.16 RANGSONS AEROSPACE PRIVATE LIMITED

- 15.1.16.1 Business overview

- 15.1.16.2 Products offered

- 15.1.17 EATON

- 15.1.17.1 Business overview

- 15.1.17.2 Products offered

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.2 OTHER PLAYERS

- 15.2.1 ADDUP SAS

- 15.2.2 SINTAVIA, LLC

- 15.2.3 INTERGALACTIC

- 15.2.4 MORPHEUS DESIGNS

- 15.2.5 PARFUSE CORPORATION

- 15.2.6 SIGNIA AEROSPACE

- 15.2.7 AIRMARK COMPONENTS

- 15.2.8 AKG GROUP

- 15.2.9 AVIATION TECHNICAL SERVICES

- 15.2.10 VITESSE SYSTEMS

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 INDICATIVE OEM PRICING, BY PLATFORM AND APPLICATION (USD/UNIT)

- TABLE 3 INDICATIVE AFTERMARKET PRICING, BY PLATFORM AND APPLICATION (USD/UNIT)

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 TARIFF DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, 2024

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA AND AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 COUNTRY-SPECIFIC REGULATORY FRAMEWORK

- TABLE 12 IMPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY POINT OF SALE (%)

- TABLE 15 KEY BUYING CRITERIA, BY PLATFORM

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 BUSINESS MODELS IN AIRCRAFT HEAT EXCHANGER MARKET

- TABLE 18 PATENT ANALYSIS

- TABLE 19 AIRCRAFT HEAT EXCHANGER MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 20 AIRCRAFT HEAT EXCHANGER MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 21 AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 22 AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 23 AIRCRAFT HEAT EXCHANGER MARKET, BY DESIGN, 2021-2024 (USD MILLION)

- TABLE 24 AIRCRAFT HEAT EXCHANGER MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 25 AIRCRAFT HEAT EXCHANGER MARKET, BY MEDIUM, 2021-2024 (USD MILLION)

- TABLE 26 AIRCRAFT HEAT EXCHANGER MARKET, BY MEDIUM, 2025-2030 (USD MILLION)

- TABLE 27 AIRCRAFT HEAT EXCHANGER MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 28 AIRCRAFT HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 29 AIRCRAFT HEAT EXCHANGER MARKET, BY ARCHITECTURE, 2021-2024 (USD MILLION)

- TABLE 30 AIRCRAFT HEAT EXCHANGER MARKET, BY ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 31 AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 32 AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 AIRCRAFT HEAT EXCHANGER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 AIRCRAFT HEAT EXCHANGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 36 NORTH AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 38 NORTH AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 41 US: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 US: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 US: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 44 US: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 45 CANADA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 CANADA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 CANADA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 48 CANADA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 49 EUROPE: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 EUROPE: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 EUROPE: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 52 EUROPE: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 EUROPE: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 54 EUROPE: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 55 UK: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 56 UK: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 UK: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 58 UK: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 59 GERMANY: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 60 GERMANY: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 GERMANY: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 62 GERMANY: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 63 FRANCE: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 64 FRANCE: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 FRANCE: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 66 FRANCE: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 67 SPAIN: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 68 SPAIN: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 SPAIN: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 70 SPAIN: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 71 ITALY: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 ITALY: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 ITALY: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 74 ITALY: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 ASIA PACIFIC: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 ASIA PACIFIC: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 81 CHINA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 82 CHINA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 CHINA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 84 CHINA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 85 INDIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 INDIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 INDIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 88 INDIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 89 JAPAN: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 JAPAN: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 JAPAN: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 92 JAPAN: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 93 AUSTRALIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 94 AUSTRALIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 AUSTRALIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 96 AUSTRALIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 97 SOUTH KOREA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 SOUTH KOREA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 SOUTH KOREA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 100 SOUTH KOREA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 101 MIDDLE EAST: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 MIDDLE EAST: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 MIDDLE EAST: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 MIDDLE EAST: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 MIDDLE EAST: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 106 MIDDLE EAST: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 107 UAE: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 108 UAE: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 UAE: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 110 UAE: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 111 SAUDI ARABIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 112 SAUDI ARABIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 SAUDI ARABIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 114 SAUDI ARABIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 115 ISRAEL: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 116 ISRAEL: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 ISRAEL: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 118 ISRAEL: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 119 TURKEY: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 TURKEY: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 TURKEY: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 122 TURKEY: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 123 LATIN AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 LATIN AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 LATIN AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 126 LATIN AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 LATIN AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 128 LATIN AMERICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 129 BRAZIL: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 BRAZIL: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 BRAZIL: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 132 BRAZIL: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 133 MEXICO: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 MEXICO: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 MEXICO: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 136 MEXICO: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 137 AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 142 AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 143 SOUTH AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 SOUTH AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 146 SOUTH AFRICA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 147 NIGERIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 NIGERIA: AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 NIGERIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 150 NIGERIA: AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 151 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 152 AIRCRAFT HEAT EXCHANGER MARKET: DEGREE OF COMPETITION

- TABLE 153 REGION FOOTPRINT

- TABLE 154 APPLICATION FOOTPRINT

- TABLE 155 PLATFORM FOOTPRINT

- TABLE 156 MATERIAL FOOTPRINT

- TABLE 157 LIST OF START-UPS/SMES

- TABLE 158 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 159 AIRCRAFT HEAT EXCHANGER MARKET: DEALS, 2021-2025

- TABLE 160 AIRCRAFT HEAT EXCHANGER MARKET: OTHERS, 2021-2025

- TABLE 161 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 162 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 163 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 164 RTX: COMPANY OVERVIEW

- TABLE 165 RTX: PRODUCTS OFFERED

- TABLE 166 SAFRAN: COMPANY OVERVIEW

- TABLE 167 SAFRAN: PRODUCTS OFFERED

- TABLE 168 LIEBHERR GROUP: COMPANY OVERVIEW

- TABLE 169 LIEBHERR GROUP: PRODUCTS OFFERED

- TABLE 170 LIEBHERR GROUP: DEALS

- TABLE 171 PARKER HANNIFIN CORPORATION: COMPANY OVERVIEW

- TABLE 172 PARKER HANNIFIN CORPORATION: PRODUCTS OFFERED

- TABLE 173 PARKER HANNIFIN CORPORATION: DEALS

- TABLE 174 AMETEK, INC.: COMPANY OVERVIEW

- TABLE 175 AMETEK, INC.: PRODUCTS OFFERED

- TABLE 176 BOYD CORPORATION: COMPANY OVERVIEW

- TABLE 177 BOYD CORPORATION: PRODUCTS OFFERED

- TABLE 178 CONFLUX TECHNOLOGY: COMPANY OVERVIEW

- TABLE 179 CONFLUX TECHNOLOGY: PRODUCTS OFFERED

- TABLE 180 TAT TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 181 TAT TECHNOLOGIES LTD.: PRODUCTS OFFERED

- TABLE 182 TAT TECHNOLOGIES LTD.: OTHERS

- TABLE 183 SUMITOMO PRECISION PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 184 SUMITOMO PRECISION PRODUCTS CO., LTD.: PRODUCTS OFFERED

- TABLE 185 JAMCO CORPORATION: COMPANY OVERVIEW

- TABLE 186 JAMCO CORPORATION: PRODUCTS OFFERED

- TABLE 187 UNISON INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 188 UNISON INDUSTRIES, LLC: PRODUCTS OFFERED

- TABLE 189 WALL COLMONOY CORPORATION: COMPANY OVERVIEW

- TABLE 190 WALL COLMONOY CORPORATION: PRODUCTS OFFERED

- TABLE 191 WALL COLMONOY CORPORATION: OTHERS

- TABLE 192 TRIUMPH GROUP: COMPANY OVERVIEW

- TABLE 193 TRIUMPH GROUP: PRODUCTS OFFERED

- TABLE 194 THERMOVAC AEROSPACE: COMPANY OVERVIEW

- TABLE 195 THERMOVAC AEROSPACE: PRODUCTS OFFERED

- TABLE 196 RANGSONS AEROSPACE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 197 RANGSONS AEROSPACE PRIVATE LIMITED: PRODUCTS OFFERED

- TABLE 198 EATON: COMPANY OVERVIEW

- TABLE 199 EATON: PRODUCTS OFFERED

- TABLE 200 ADDUP SAS: COMPANY OVERVIEW

- TABLE 201 SINTAVIA, LLC: COMPANY OVERVIEW

- TABLE 202 INTERGALACTIC: COMPANY OVERVIEW

- TABLE 203 MORPHEUS DESIGNS: COMPANY OVERVIEW

- TABLE 204 PARFUSE CORPORATION: COMPANY OVERVIEW

- TABLE 205 SIGNIA AEROSPACE: COMPANY OVERVIEW

- TABLE 206 AIRMARK COMPONENTS: COMPANY OVERVIEW

- TABLE 207 AKG GROUP: COMPANY OVERVIEW

- TABLE 208 AVIATION TECHNICAL SERVICES: COMPANY OVERVIEW

- TABLE 209 VITESSE SYSTEMS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AIRCRAFT HEAT EXCHANGER MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 HYDRAULIC COOLING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 8 LIQUID-TO-LIQUID TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 TITANIUM TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 OEM TO GROW FASTER THAN AFTERMARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO REGISTER RAPID GROWTH DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FOR LIGHTWEIGHT THERMAL MANAGEMENT SOLUTIONS TO DRIVE MARKET

- FIGURE 13 NON-ELECTRIC SEGMENT TO BE DOMINANT IN 2025

- FIGURE 14 PLATE FIN TO BE LARGER THAN TUBE FIN DURING FORECAST PERIOD

- FIGURE 15 ALUMINUM TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 16 COMMERCIAL AVIATION TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 17 AIRCRAFT HEAT EXCHANGER MARKET DYNAMICS

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 TECHNOLOGY ROADMAP

- FIGURE 21 EVOLUTION OF AIRCRAFT HEAT EXCHANGER TECHNOLOGIES

- FIGURE 22 EMERGING TECHNOLOGY TRENDS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 IMPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 25 EXPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY POINT OF SALE

- FIGURE 27 KEY BUYING CRITERIA, BY PLATFORM

- FIGURE 28 PE/VC TRENDS, 2019-2024

- FIGURE 29 YOY FUNDING TRENDS ACROSS CIVIL AND MILITARY AIRCRAFT, 2019-2024

- FIGURE 30 YOY FUNDING TRENDS ACROSS UAV AND AAM PLATFORMS, 2019-2024

- FIGURE 31 BUSINESS MODELS IN AIRCRAFT HEAT EXCHANGER MARKET

- FIGURE 32 ADOPTION OF AI IN AVIATION

- FIGURE 33 ADOPTION OF AI IN AVIATION BY TOP COUNTRIES

- FIGURE 34 IMPACT OF AI ON AIRCRAFT HEAT EXCHANGER MARKET

- FIGURE 35 PATENT ANALYSIS

- FIGURE 36 AIRCRAFT HEAT EXCHANGER MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- FIGURE 37 AIRCRAFT HEAT EXCHANGER MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- FIGURE 38 AIRCRAFT HEAT EXCHANGER MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- FIGURE 39 AIRCRAFT HEAT EXCHANGER MARKET, BY MEDIUM, 2025-2030 (USD MILLION)

- FIGURE 40 AIRCRAFT HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- FIGURE 41 AIRCRAFT HEAT EXCHANGER MARKET, BY ARCHITECTURE, 2025-2030 (USD MILLION)

- FIGURE 42 AIRCRAFT HEAT EXCHANGER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- FIGURE 43 AIRCRAFT HEAT EXCHANGER MARKET, BY REGION, 2025-2030

- FIGURE 44 NORTH AMERICA: AIRCRAFT HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 45 EUROPE: AIRCRAFT HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: AIRCRAFT HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 47 MIDDLE EAST: AIRCRAFT HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 48 LATIN AMERICA: AIRCRAFT HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 49 AFRICA: AIRCRAFT HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 52 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 COMPANY FOOTPRINT

- FIGURE 54 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 55 YEAR-TO-DATE PRICE TOTAL RETURN

- FIGURE 56 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 57 BRAND/PRODUCT COMPARISON

- FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 59 RTX: COMPANY SNAPSHOT

- FIGURE 60 SAFRAN: COMPANY SNAPSHOT

- FIGURE 61 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 AMTEK, INC.: COMPANY SNAPSHOT

- FIGURE 63 TAT TECHNOLOGIES LTD.: COMPANY SNAPSHOT

- FIGURE 64 JAMCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 TRIUMPH GROUP: COMPANY SNAPSHOT

- FIGURE 66 EATON: COMPANY SNAPSHOT