PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1893731

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1893731

SUV Market By Type (Mini, Compact, Mid- & Full-Size, MPV), Propulsion (Diesel, Gasoline, Electric), Class (B, C, D, E), Seating Capacity (5-seater,>5-seater), EV Type (BEV, PHEV, FCEV), and Region - Forecast to 2032

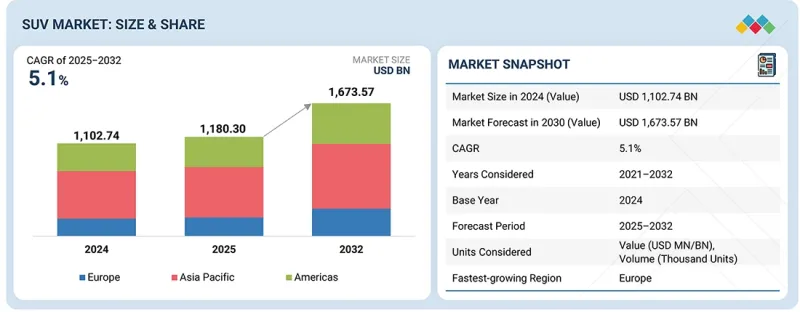

The SUV market is expected to grow from USD 1,180.30 billion in 2025 to USD 1,673.57 billion in 2032, registering a CAGR of 5.1%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Segments | Type, Seating Capacity, Propulsion, Class, Electric & Hybrid Vehicle Type |

| Regions covered | Asia Pacific, Europe, Americas |

In the US and Europe, SUV demand is increasingly driven by advanced chassis architectures, where OEMs are integrating adaptive air suspensions, active roll control, and terrain-calibrated torque management systems to enhance both on-road dynamics and off-road articulation. Premium SUV growth is supported by the shift to zonal E/E architectures, enabling real-time damping control, predictive ADAS functions, and improved NVH isolation through active noise cancellation. Electrification is accelerating due to consumer demand for high-performance e-SUVs, pushing OEMs toward 800V platforms, high-density NMC battery packs, and multi-motor e-axles that deliver higher towing capacity and thermal robustness, critical performance differentiators in the Western market.

In China, India, and Japan, the momentum for compact and mid-size SUVs is being shaped by modular skateboard and multi-energy platforms that enable OEMs to package hybrid, turbo-petrol, and BEV powertrains without requiring redesign of the vehicle architecture. The shift toward 1.0-1.5L turbocharged GDI engines, strong-hybrid systems with e-CVTs, and localized battery modules has made SUVs more efficient and cost-competitive than sedans. Chinese and Indian manufacturers are also deploying lightweight multilink rear suspensions, high-strength steel cages, and compact e-drive units to improve handling and crash safety while maintaining aggressive pricing.

"The 5-seater segment is expected to hold a larger market share during the forecast period."

Mini, compact, and select mid-size SUVs in Asia Pacific and Europe continue to gain traction due to their optimized 2-row configurations, which balance urban maneuverability with enhanced cabin ergonomics. In Asia Pacific, increased disposable income and rapid urban expansion are pushing young buyers toward SUVs that integrate advanced infotainment domains, ADAS Level 1-2 features, and high-efficiency turbo-hybrid powertrains, delivering premium functionality without the pricing burden of larger segments. Automakers are also leveraging localized modular platforms (e.g., CMP, TNGA-B, BMA) to engineer roomier 5-seater layouts and maximize interior volume despite compact exterior footprints, directly appealing to dense-city use cases.

In Europe, the surge in premium 5-seater mid-size SUVs is driven by the demand for vehicles that combine long-distance comfort, upgraded multilink rear suspensions, and enhanced cargo capacity while remaining compliant with stringent EU emissions and safety norms. European OEMs, such as Volkswagen, BMW, Mercedes-Benz, Skoda, and Audi, are expanding their portfolios with models featuring 48V mild-hybrid integration, advanced chassis domain control units, and high-strength, lightweight structures to improve both efficiency and dynamic capability. These engineering advancements, combined with consumer preferences for spacious yet city-suitable vehicles, are reinforcing the growth of the 5-seater SUV segment.

"Class D is expected to be the largest segment during the forecast period."

Class D continues to dominate global SUV demand, as India, China, and Thailand shift toward larger, multi-row vehicles built on scalable architectures like MQB, TNGA-K, SPA, and CLAR, which enable higher wheelbases and improved cabin packaging. These models increasingly feature electrified AWD (e-axles), 2.0-3.0L turbocharged powertrains, and multilink rear suspensions, providing superior tractability and high-speed stability compared to smaller classes. Rising consumer preference for 3-row flexibility, higher towing capacity, and long-distance ride comfort continues to make Class-D SUVs attractive in both ICE and hybrid categories. Premium OEMs, including BMW, Mercedes-Benz, Lexus, Land Rover, and Cadillac, are upgrading this segment with 48V systems, advanced ADAS L2+/L3 preparation, and lightweight aluminum subframes, further driving market growth. As emerging markets upscale and infrastructure improves, Class-D SUVs are becoming the default choice for families seeking larger footprint vehicles with premium mechanical and software capabilities.

The Americas is expected to be the second-largest market during the forecast period."

The Americas remain the second-largest SUV market, driven by strong demand for premium D- and E-segment SUVs equipped with high-output turbo/V6 engines, electrified AWD systems, and advanced ADAS L2+ suites. In the US, luxury OEMs now generate 70-80% of their premium volumes from SUVs, supported by consumer preference for high ground clearance, tow ratings above 3,500-5,000 lbs, multi-terrain drive modes, and long-wheelbase comfort. The shift toward hybrid and extended-range SUV architectures is accelerating as CAFE and EPA standards tighten, pushing Ford, GM, and Stellantis to expand battery-electric body-on-frame platforms. Full-size and three-row SUVs remain dominant due to their superior cabin space and payload/towing capability, making them the preferred choice across the US and Canada. Mexico contributes to strong growth in compact and mid-size SUVs, driven by cost-sensitive buyers and the expansion of local manufacturing by Asian OEMs. The competitive landscape is intensifying as Tesla, Hyundai-Kia, BMW, and Toyota scale up regional production of electric and hybrid SUVs, reshaping the powertrain mix and supply chain localization.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Automotive OEMs - 90%, Tier 1 - 10%

- By Designation: C-level - 35%, Director Level - 55%, Others - 10%

- By Region: North America - 20%, Europe - 45%, Asia Pacific - 30%, Rest of the World - 5%

The SUV market is dominated by established players, such as Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motor Co., Ltd. (Japan), General Motors (US), Ford Motor Company (US), and Stellantis (Netherlands).

Research Coverage:

The study segments the SUV market and forecasts the market size based on type (mini, compact, mid-size, full-size, MPV/MUV), seating capacity (5-seater, >5-seater), propulsion (diesel, gasoline, electric), class (B, C, D, E), electric & hybrid vehicle type (BEV, PHEV, FCEV), and region (Asia Pacific, Europe, Americas).

Key Benefits of Purchasing this Report

The study provides a comprehensive competitive analysis of key market players, including their company profiles, key insights into product and business offerings, recent developments, and primary market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall SUV market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, enabling stakeholders to stay informed about market dynamics.

The report provides insights into the following points:

- Analysis of key drivers (demand for premium vehicles with advanced features and consumer inclination toward compact and mid-size SUVs), restraints (high cost of SUVs), opportunities (trend of electrification), and challenges (Adherence to fuel economy and emission limits and range limitations of electric SUVs) influencing the growth of the SUV market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the SUV market

- Market Development: Comprehensive information about lucrative markets; the report analyzes the SUV across various regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the SUV market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), Honda Motor (Japan), General Motors (US), Ford Motor Company (US), and Stellantis (Netherlands)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN SUV MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

- 2.6 SUV PRODUCTION VS. SALES OUTLOOK

- 2.7 SUV PRODUCTION VS. TOTAL CAR PRODUCTION OUTLOOK

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUV MARKET

- 3.2 SUV MARKET, BY TYPE

- 3.3 SUV MARKET, BY SEATING CAPACITY

- 3.4 SUV MARKET, BY CLASS

- 3.5 SUV MARKET, BY PROPULSION

- 3.6 ELECTRIC SUV MARKET, BY TYPE

- 3.7 SUV MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Surge in demand for premium vehicles with advanced features

- 4.2.1.2 Consumer inclination toward compact and mid-size SUVs

- 4.2.1.3 Launch of new EV models by major OEMs

- 4.2.2 RESTRAINTS

- 4.2.2.1 High cost of SUVs

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Trend of electrification

- 4.2.4 CHALLENGES

- 4.2.4.1 Adherence to fuel economy and emission limits

- 4.2.4.2 Range limitations of electric SUVs

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 SUPPLIERS

5 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 5.1 KEY TECHNOLOGIES

- 5.1.1 800V ELECTRIFIED POWERTRAIN SYSTEMS

- 5.1.2 ADAS AND AUTONOMOUS DRIVING SUITES

- 5.2 COMPLEMENTARY TECHNOLOGIES

- 5.2.1 AR-BASED HEAD-UP DISPLAYS

- 5.2.2 PACKAGED FUEL CELL POWER MODULES

- 5.3 TECHNOLOGY ROADMAP

- 5.3.1 SHORT-TERM ROADMAP

- 5.3.2 MID-TERM ROADMAP

- 5.3.3 LONG-TERM ROADMAP

- 5.4 PATENT ANALYSIS

- 5.5 FUTURE APPLICATIONS

- 5.6 IMPACT OF AI/GEN AI

- 5.6.1 TOP USE CASES AND MARKET POTENTIAL

- 5.6.2 BEST PRACTICES

- 5.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 5.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.6.5 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 5.6.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 5.6.6.1 Ford Motor Company: AI for adaptive vehicle diagnostics and predictive maintenance

- 5.6.6.2 Mercedes-Benz Group: Gen AI for personalized in-cabin experience and design optimization

- 5.6.6.3 Hyundai Motor Company: AI for energy management and off-road performance optimization

6 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 6.1 DECISION-MAKING PROCESS

- 6.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 6.4 UNMET NEEDS FROM END-USE INDUSTRIES

- 6.5 MARKET PROFITABILITY

- 6.5.1 REVENUE POTENTIAL

- 6.5.2 COST DYNAMICS

- 6.5.3 MARGIN OPPORTUNITIES BY APPLICATION

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 INDUSTRY TRENDS

- 8.1 MACROECONOMIC INDICATORS

- 8.1.1 INTRODUCTION

- 8.1.2 GDP TRENDS AND FORECAST

- 8.1.3 TRENDS IN SUV INDUSTRY

- 8.2 ECOSYSTEM ANALYSIS

- 8.2.1 OEMS

- 8.2.2 COMPONENT MANUFACTURERS

- 8.2.3 SOFTWARE PROVIDERS

- 8.2.4 SUV CHARGING PROVIDERS

- 8.2.5 BATTERY MANUFACTURERS

- 8.2.6 END USERS

- 8.3 SUPPLY CHAIN ANALYSIS

- 8.4 PRICING ANALYSIS

- 8.4.1 AVERAGE SELLING PRICE OF SUVS OFFERED BY KEY PLAYERS, 2024

- 8.4.2 AVERAGE SELLING PRICE OF ICE SUVS, BY REGION, 2024

- 8.4.3 AVERAGE SELLING PRICE OF ELECTRIC SUVS, BY REGION, 2024

- 8.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 8.6 INVESTMENT AND FUNDING SCENARIO

- 8.7 FUNDING, BY APPLICATION

- 8.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 8.9 TRADE ANALYSIS

- 8.9.1 IMPORT SCENARIO (HS CODE 870380)

- 8.9.2 EXPORT SCENARIO (HS CODE 870380)

- 8.10 CASE STUDY ANALYSIS

- 8.10.1 ELECTRIFIED SUV MANUFACTURING EXPANSION

- 8.10.2 PREMIUM ELECTRIC SUV PORTFOLIO REVAMP

- 8.10.3 STRATEGIC INVESTMENTS FOR MARKET DIVERSIFICATION

- 8.11 EXISTING AND UPCOMING SUV MODELS

- 8.12 TOTAL COST OF OWNERSHIP

- 8.13 ICE VS. EV PRICE COMPARISON

- 8.14 BILL OF MATERIALS

- 8.15 GLOBAL SUV L**H ANALYSIS

- 8.16 GLOBAL ELECTRIC SUV L**H ANALYSIS

- 8.17 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES, 2018-2023

- 8.18 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES, 2024-2030

- 8.19 SUV PENETRATION IN TOTAL PASSENGER CAR SALES, 2018-2030

- 8.20 GLOBAL SUV SALES, BY TYPE, 2023-2030

- 8.21 GLOBAL SUV SALES, BY PROPULSION, 2023-2030

- 8.22 GLOBAL SUV SALES, BY REGION, 2018-2030

- 8.23 SUV L**H ANALYSIS, BY REGION

- 8.23.1 NORTH AMERICA

- 8.23.2 EUROPE

- 8.23.3 ASIA PACIFIC

- 8.24 GLOBAL AVERAGE BATTERY COST ANALYSIS

- 8.25 ELECTRIC SUV BATTERY CAPACITY VS. RANGE ANALYSIS

- 8.26 ELECTRIC SUV PRICING VS. RANGE ANALYSIS

- 8.27 FUEL CELLS IN SUV

- 8.28 SUV PLATFORMS

- 8.28.1 CURRENT SUV PLATFORMS

- 8.28.2 FUTURE OF SUV PLATFORMS

- 8.29 SUV MANUFACTURING PLANTS BY OEM AND LOCATION

- 8.30 SUV L**H ANALYSIS, BY OEM

- 8.30.1 TOYOTA GROUP

- 8.30.2 VOLKSWAGEN GROUP

- 8.30.3 HYUNDAI MOTOR COMPANY

9 SUV MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 MINI

- 9.2.1 LOWER OWNERSHIP COST TO DRIVE MARKET

- 9.3 COMPACT

- 9.3.1 INCREASED CONSUMER PREFERENCE DUE TO POWERTRAIN VARIANTS AND AFFORDABILITY TO DRIVE MARKET

- 9.4 MID-SIZE

- 9.4.1 BETTER FUNCTIONALITY AND PRACTICAL FEATURES TO DRIVE MARKET

- 9.5 FULL-SIZE

- 9.5.1 LARGER CABIN AREA AND SUPERIOR ENGINE PERFORMANCE TO DRIVE MARKET

- 9.6 MPV/MUV

- 9.6.1 PREFERENCE FOR COMPACT AND MID-SIZE SUVS TO IMPEDE MARKET

- 9.7 PRIMARY INSIGHTS

10 SUV MARKET, BY CLASS

- 10.1 INTRODUCTION

- 10.2 CLASS B

- 10.2.1 ONGOING ENGINEERING UPGRADES TO DRIVE MARKET

- 10.3 CLASS C

- 10.3.1 LONG-WHEELBASE PACKAGING AND ADVANCED SAFETY ELECTRONICS TO DRIVE MARKET

- 10.4 CLASS D

- 10.4.1 IMPROVED CONVENIENCE WITH OFF-ROADING CAPABILITIES TO DRIVE MARKET

- 10.5 CLASS E

- 10.5.1 HIGHER ACCEPTANCE OF LUXURY VEHICLES IN NORTH AMERICA TO DRIVE MARKET

- 10.6 PRIMARY INSIGHTS

11 SUV MARKET, BY SEATING CAPACITY

- 11.1 INTRODUCTION

- 11.2 5-SEATER

- 11.2.1 HIGH DEMAND FOR COMPACT SUVS IN EMERGING COUNTRIES TO DRIVE MARKET

- 11.3 >5-SEATER

- 11.3.1 INCLINATION FOR FULL-SIZE SUVS TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 SUV MARKET, BY PROPULSION

- 12.1 INTRODUCTION

- 12.2 GASOLINE

- 12.2.1 PUSH FOR CLEANER FUEL WITH ENHANCED PERFORMANCE TO DRIVE MARKET

- 12.3 DIESEL

- 12.3.1 GLOBAL ADOPTION OF EURO 6/VI, BS-VI PHASE II, CHINA 6B, AND US TIER 3 STANDARDS TO IMPEDE MARKET

- 12.4 ELECTRIC

- 12.4.1 STRINGENT EMISSION NORMS AND HIGHER FUEL EFFICIENCY TO DRIVE MARKET

- 12.5 PRIMARY INSIGHTS

13 ELECTRIC SUV MARKET, BY TYPE

- 13.1 INTRODUCTION

- 13.2 BEV

- 13.2.1 DEVELOPMENT OF HIGH-RANGE BATTERIES AND FAST CHARGING INFRASTRUCTURE TO DRIVE MARKET

- 13.3 PHEV

- 13.3.1 ELEVATED DEMAND FOR FLEXIBLE POWERTRAINS TO DRIVE MARKET

- 13.4 FCEV

- 13.4.1 SUBSTANTIAL INVESTMENTS IN NEWER MODELS TO DRIVE MARKET

- 13.5 PRIMARY INSIGHTS

14 SUV SALES, BY TYPE

- 14.1 INTRODUCTION

- 14.2 COMPACT

- 14.2.1 ASIA PACIFIC

- 14.2.2 EUROPE

- 14.2.3 AMERICAS

- 14.3 MID-SIZE

- 14.3.1 ASIA PACIFIC

- 14.3.2 EUROPE

- 14.3.3 AMERICAS

- 14.4 FULL-SIZE

- 14.4.1 ASIA PACIFIC

- 14.4.2 EUROPE

- 14.4.3 AMERICAS

15 SUV MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 CHINA

- 15.2.1.1 Strong demand for compact and mid-size SUVs to drive market

- 15.2.2 INDIA

- 15.2.2.1 Recent launches and feature updates to drive market

- 15.2.3 JAPAN

- 15.2.3.1 Consumer preference for advanced features with improved cabin comfort to drive market

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Rapid shift toward hybrid and electric SUVs to drive market

- 15.2.5 INDONESIA

- 15.2.5.1 Preference for family-oriented vehicles to drive market

- 15.2.6 REST OF ASIA PACIFIC

- 15.2.1 CHINA

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 High demand for premium cars to drive market

- 15.3.2 FRANCE

- 15.3.2.1 Shift toward hybrid and fully electric SUVs due to regulatory pressures to drive market

- 15.3.3 ITALY

- 15.3.3.1 Rise of electrification and urban-friendly designs to drive market

- 15.3.4 SPAIN

- 15.3.4.1 Strong consumer demand to drive market

- 15.3.5 UK

- 15.3.5.1 High per capita income and robust economic conditions to drive market

- 15.3.6 CZECH REPUBLIC

- 15.3.6.1 Strong supplier networks and favorable production ecosystem to drive market

- 15.3.7 SLOVAKIA

- 15.3.7.1 Significant presence of OEMs to drive market

- 15.3.8 RUSSIA

- 15.3.8.1 Growing consumer interest in hybrid and fully electric SUVs to drive market

- 15.3.9 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 AMERICAS

- 15.4.1 US

- 15.4.1.1 High demand for powerful vehicles for off-roading to drive market

- 15.4.2 CANADA

- 15.4.2.1 Regulatory push toward sustainability to drive market

- 15.4.3 MEXICO

- 15.4.3.1 Rise in domestic purchasing power and proximity to US to drive market

- 15.4.4 BRAZIL

- 15.4.4.1 Competitive manufacturing costs and availability of skilled labor to drive market

- 15.4.1 US

- 15.5 PRIMARY INSIGHTS

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Propulsion footprint

- 16.7.5.4 Application footprint

- 16.7.5.5 Type footprint

- 16.8 COMPETITIVE SCENARIO

- 16.8.1 PRODUCT LAUNCHES

- 16.8.2 DEALS

- 16.8.3 EXPANSIONS

- 16.8.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 TOYOTA MOTOR CORPORATION

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.3.4 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HONDA MOTOR CO., LTD.

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Expansions

- 17.1.2.3.4 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 HYUNDAI MOTOR COMPANY

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 GENERAL MOTORS

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Expansions

- 17.1.4.3.4 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 STELLANTIS N.V.

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Expansions

- 17.1.5.3.4 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 VOLKSWAGEN GROUP

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Expansions

- 17.1.6.3.4 Other developments

- 17.1.6.4 MnM view

- 17.1.6.4.1 Key strengths

- 17.1.6.4.2 Strategic choices

- 17.1.6.4.3 Weaknesses and competitive threats

- 17.1.7 FORD MOTOR COMPANY

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.7.3.2 Other developments

- 17.1.8 MERCEDES-BENZ

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Other developments

- 17.1.9 BMW GROUP

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Expansions

- 17.1.9.3.3 Other developments

- 17.1.10 NISSAN MOTORS

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Deals

- 17.1.1 TOYOTA MOTOR CORPORATION

- 17.2 OTHER PLAYERS

- 17.2.1 RENAULT GROUP

- 17.2.2 SUZUKI MOTOR CORPORATION

- 17.2.3 SUBARU CORPORATION

- 17.2.4 TATA MOTORS

- 17.2.5 MITSUBISHI MOTORS CORPORATION

- 17.2.6 MAHINDRA & MAHINDRA LIMITED

- 17.2.7 VOLVO CAR CORPORATION

- 17.2.8 TESLA, INC.

- 17.2.9 MAZDA MOTOR CORPORATION

- 17.2.10 BYD COMPANY LTD.

- 17.2.11 ISUZU MOTORS LIMITED

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 List of secondary sources to estimate vehicle production

- 18.1.1.2 List of secondary sources to estimate market size

- 18.1.1.3 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviewees from demand and supply sides

- 18.1.2.2 Breakdown of primary interviews

- 18.1.2.3 List of primary participants

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 DATA TRIANGULATION

- 18.4 FACTOR ANALYSIS

- 18.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 18.6 RESEARCH LIMITATIONS

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 SUV MARKET, BY CLASS, AT COUNTRY LEVEL

- 19.4.1.1 Class B

- 19.4.1.2 Class C

- 19.4.1.3 Class D

- 19.4.1.4 Class E

- 19.4.2 ELECTRIC SUV MARKET, AT COUNTRY LEVEL

- 19.4.1 SUV MARKET, BY CLASS, AT COUNTRY LEVEL

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, BY COUNTRY, 2019-2024

- TABLE 2 PROMINENT COMPACT SUV MODELS, 2025

- TABLE 3 FULL-SIZE SUV PRICES, 2025

- TABLE 4 TOP ELECTRIC SUV MODEL SALES AND PRICES, 2024

- TABLE 5 LAUNCHED AND UPCOMING ELECTRIC SUV MODELS, 2023-2025

- TABLE 6 STRATEGIC MOVES BY TIER-1/2/3 SUPPLIERS

- TABLE 7 AUTONOMOUS SUVS AND THEIR FEATURES

- TABLE 8 HEAD-UP DISPLAYS IN SUVS

- TABLE 9 PATENT ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SUVS (%)

- TABLE 11 KEY BUYING CRITERIA FOR SUVS

- TABLE 12 UNMET NEEDS FROM END-USE INDUSTRIES

- TABLE 13 AMERICAS: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ELECTRIC SUV-SPECIFIC STANDARDS

- TABLE 17 STRUCTURAL AND MECHANICAL ENGINEERING STANDARDS

- TABLE 18 EMISSIONS, FUEL EFFICIENCY, AND POWERTRAIN STANDARDS

- TABLE 19 SAFETY AND REGULATORY STANDARDS

- TABLE 20 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2030

- TABLE 21 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 22 AVERAGE SELLING PRICE OF SUVS OFFERED BY KEY PLAYERS, 2024 (USD/UNIT)

- TABLE 23 AVERAGE SELLING PRICE OF ICE SUVS, BY REGION, 2024 (USD/UNIT)

- TABLE 24 AVERAGE SELLING PRICE OF ELECTRIC SUVS, BY REGION, 2024 (USD/UNIT)

- TABLE 25 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 26 IMPORT DATA FOR HS CODE 870380-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 27 EXPORT DATA FOR HS CODE 870380-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 28 EXISTING AND UPCOMING SUV MODELS, 2024-2026

- TABLE 29 ANNUAL GAS COST VS. ANNUAL ELECTRIC COST, 2024

- TABLE 30 SUV MANUFACTURING PLANTS BY OEM AND LOCATION

- TABLE 31 SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 32 SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 33 SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 34 SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 35 MINI SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 36 MINI SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 37 MINI SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 38 MINI SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 39 COMPACT SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 40 COMPACT SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 41 COMPACT SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 42 COMPACT SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 43 MID-SIZE SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 44 MID-SIZE SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 45 MID-SIZE SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 46 MID-SIZE SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 47 FULL-SIZE SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 48 FULL-SIZE SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 49 FULL-SIZE SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 50 FULL-SIZE SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 51 MPV/MUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 52 MPV/MUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 53 MPV/MUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 54 MPV/MUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 55 SUV MARKET, BY CLASS, 2021-2024 (USD BILLION)

- TABLE 56 SUV MARKET, BY CLASS, 2025-2032 (USD BILLION)

- TABLE 57 SUV MARKET, BY CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 58 SUV MARKET, BY CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 59 CLASS B SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 60 CLASS B SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 61 CLASS B SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 62 CLASS B SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 63 CLASS C SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 64 CLASS C SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 65 CLASS C SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 66 CLASS C SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 67 CLASS D SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 68 CLASS D SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 69 CLASS D SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 70 CLASS D SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 71 CLASS E SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 72 CLASS E SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 73 CLASS E SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 74 CLASS E SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 75 SUV MARKET, BY SEATING CAPACITY, 2021-2024 (USD BILLION)

- TABLE 76 SUV MARKET, BY SEATING CAPACITY, 2025-2032 (USD BILLION)

- TABLE 77 SUV MARKET, BY SEATING CAPACITY, 2021-2024 (THOUSAND UNITS)

- TABLE 78 SUV MARKET, BY SEATING CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 79 5-SEATER SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 80 5-SEATER SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 81 5-SEATER SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 82 5-SEATER SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 83 >5-SEATER SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 84 >5-SEATER SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 85 >5-SEATER SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 86 >5-SEATER SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 87 SUV MARKET, BY PROPULSION, 2021-2024 (USD BILLION)

- TABLE 88 SUV MARKET, BY PROPULSION, 2025-2032 (USD BILLION)

- TABLE 89 SUV MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 90 SUV MARKET, BY PROPULSION, 2025-2032 (THOUSAND UNITS)

- TABLE 91 GASOLINE SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 92 GASOLINE SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 93 GASOLINE SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 94 GASOLINE SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 95 DIESEL SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 96 DIESEL SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 97 DIESEL SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 98 DIESEL SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 99 ELECTRIC SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 100 ELECTRIC SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 101 ELECTRIC SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 102 ELECTRIC SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 103 ELECTRIC SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 104 ELECTRIC SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 105 ELECTRIC SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 106 ELECTRIC SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 107 BEV SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 108 BEV SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 109 BEV SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 110 BEV SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 111 PHEV SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 112 PHEV SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 113 PHEV SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 114 PHEV SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 115 FCEV SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 116 FCEV SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 117 FCEV SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 118 FCEV SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 119 GLOBAL SUV SALES, BY TYPE, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 120 ASIA PACIFIC: COMPACT SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 121 EUROPE: COMPACT SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 122 AMERICAS: COMPACT SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 123 ASIA PACIFIC: MID-SIZE SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 124 EUROPE: MID-SIZE SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 125 AMERICAS: MID-SIZE SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 126 ASIA PACIFIC: FULL-SIZE SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 127 EUROPE: FULL-SIZE SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 128 AMERICAS: FULL-SIZE SUV SALES, BY COUNTRY, 2023 VS. 2024 (THOUSAND UNITS)

- TABLE 129 SUV MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 130 SUV MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 131 SUV MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 132 SUV MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 133 ASIA PACIFIC: SUV MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 134 ASIA PACIFIC: SUV MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 135 ASIA PACIFIC: SUV MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 136 ASIA PACIFIC: SUV MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 137 CHINA: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 138 CHINA: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 139 CHINA: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 140 CHINA: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 141 INDIA: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 142 INDIA: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 143 INDIA: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 144 INDIA: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 145 JAPAN: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 146 JAPAN: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 147 JAPAN: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 148 JAPAN: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 149 SOUTH KOREA: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 150 SOUTH KOREA: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 151 SOUTH KOREA: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 152 SOUTH KOREA: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 153 INDONESIA: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 154 INDONESIA: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 155 INDONESIA: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 156 INDONESIA: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 157 REST OF ASIA PACIFIC: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 158 REST OF ASIA PACIFIC: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 159 REST OF ASIA PACIFIC: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 160 REST OF ASIA PACIFIC: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 161 EUROPE: SUV MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 162 EUROPE: SUV MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 163 EUROPE: SUV MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 164 EUROPE: SUV MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 165 GERMANY: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 166 GERMANY: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 167 GERMANY: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 168 GERMANY: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 169 FRANCE: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 170 FRANCE: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 171 FRANCE: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 172 FRANCE: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 173 ITALY: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 174 ITALY: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 175 ITALY: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 176 ITALY: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 177 SPAIN: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 178 SPAIN: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 179 SPAIN: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 180 SPAIN: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 181 UK: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 182 UK: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 183 UK: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 184 UK: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 185 CZECH REPUBLIC: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 186 CZECH REPUBLIC: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 187 CZECH REPUBLIC: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 188 CZECH REPUBLIC: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 189 SLOVAKIA: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 190 SLOVAKIA: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 191 SLOVAKIA: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 192 SLOVAKIA: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 193 RUSSIA: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 194 RUSSIA: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 195 RUSSIA: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 196 RUSSIA: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 197 REST OF EUROPE: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 198 REST OF EUROPE: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 199 REST OF EUROPE: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 200 REST OF EUROPE: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 201 AMERICAS: SUV MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 202 AMERICAS: SUV MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 203 AMERICAS: SUV MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 204 AMERICAS: SUV MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 205 US: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 206 US: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 207 US: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 208 US: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 209 CANADA: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 210 CANADA: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 211 CANADA: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 212 CANADA: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 213 MEXICO: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 214 MEXICO: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 215 MEXICO: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 216 MEXICO: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 217 BRAZIL: SUV MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 218 BRAZIL: SUV MARKET, BY TYPE, 2025-2032 (USD BILLION)

- TABLE 219 BRAZIL: SUV MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 220 BRAZIL: SUV MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 221 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- TABLE 222 SUV MARKET: DEGREE OF COMPETITION, 2024

- TABLE 223 REGION FOOTPRINT

- TABLE 224 PROPULSION FOOTPRINT

- TABLE 225 APPLICATION FOOTPRINT

- TABLE 226 TYPE FOOTPRINT

- TABLE 227 SUV MARKET: PRODUCT LAUNCHES, 2023-2025

- TABLE 228 SUV MARKET: DEALS, 2023-2025

- TABLE 229 SUV MARKET: EXPANSIONS, 2023-2025

- TABLE 230 SUV MARKET: OTHER DEVELOPMENTS, 2023-2025

- TABLE 231 TOYOTA MOTOR CORPORATION: KEY BRANDS

- TABLE 232 TOYOTA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 233 TOYOTA MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 234 TOYOTA MOTOR CORPORATION: PRODUCT LAUNCHES

- TABLE 235 TOYOTA MOTOR CORPORATION: DEALS

- TABLE 236 TOYOTA MOTOR CORPORATION: EXPANSIONS

- TABLE 237 TOYOTA MOTOR CORPORATION: OTHER DEVELOPMENTS

- TABLE 238 HONDA MOTOR CO., LTD.: KEY BRANDS

- TABLE 239 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 240 HONDA MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 241 HONDA MOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 242 HONDA MOTOR CO., LTD.: DEALS

- TABLE 243 HONDA MOTOR CO., LTD.: EXPANSIONS

- TABLE 244 HONDA MOTOR CO., LTD.: OTHER DEVELOPMENTS

- TABLE 245 HYUNDAI MOTOR COMPANY: KEY BRANDS

- TABLE 246 HYUNDAI MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 247 HYUNDAI MOTOR COMPANY: PRODUCTS OFFERED

- TABLE 248 HYUNDAI MOTOR COMPANY: PRODUCT LAUNCHES

- TABLE 249 HYUNDAI MOTOR COMPANY: DEALS

- TABLE 250 HYUNDAI MOTOR COMPANY: OTHER DEVELOPMENTS

- TABLE 251 GENERAL MOTORS: KEY BRANDS

- TABLE 252 GENERAL MOTORS: COMPANY OVERVIEW

- TABLE 253 GENERAL MOTORS: PRODUCTS OFFERED

- TABLE 254 GENERAL MOTORS: PRODUCT LAUNCHES

- TABLE 255 GENERAL MOTORS: DEALS

- TABLE 256 GENERAL MOTORS: EXPANSIONS

- TABLE 257 GENERAL MOTORS: OTHER DEVELOPMENTS

- TABLE 258 STELLANTIS N.V.: KEY BRANDS

- TABLE 259 STELLANTIS N.V.: COMPANY OVERVIEW

- TABLE 260 STELLANTIS N.V.: PRODUCTS OFFERED

- TABLE 261 STELLANTIS N.V.: PRODUCT LAUNCHES

- TABLE 262 STELLANTIS N.V.: DEALS

- TABLE 263 STELLANTIS N.V.: EXPANSIONS

- TABLE 264 STELLANTIS N.V.: OTHER DEVELOPMENTS

- TABLE 265 VOLKSWAGEN GROUP: KEY BRANDS

- TABLE 266 VOLKSWAGEN GROUP: COMPANY OVERVIEW

- TABLE 267 VOLKSWAGEN GROUP: PRODUCTS OFFERED

- TABLE 268 VOLKSWAGEN GROUP: PRODUCT LAUNCHES

- TABLE 269 VOLKSWAGEN GROUP: DEALS

- TABLE 270 VOLKSWAGEN GROUP: EXPANSIONS

- TABLE 271 VOLKSWAGEN GROUP: OTHER DEVELOPMENTS

- TABLE 272 FORD MOTOR COMPANY: KEY BRANDS

- TABLE 273 FORD MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 274 FORD MOTOR COMPANY: PRODUCTS OFFERED

- TABLE 275 FORD MOTOR COMPANY: DEALS

- TABLE 276 FORD MOTOR COMPANY: OTHER DEVELOPMENTS

- TABLE 277 MERCEDES-BENZ: KEY BRANDS

- TABLE 278 MERCEDES-BENZ: COMPANY OVERVIEW

- TABLE 279 MERCEDES-BENZ: PRODUCTS OFFERED

- TABLE 280 MERCEDES-BENZ: PRODUCT LAUNCHES

- TABLE 281 MERCEDES-BENZ: OTHER DEVELOPMENTS

- TABLE 282 BMW GROUP: KEY BRANDS

- TABLE 283 BMW GROUP: COMPANY OVERVIEW

- TABLE 284 BMW GROUP: PRODUCTS OFFERED

- TABLE 285 BMW GROUP: PRODUCT LAUNCHES

- TABLE 286 BMW GROUP: EXPANSIONS

- TABLE 287 BMW GROUP: OTHER DEVELOPMENTS

- TABLE 288 NISSAN MOTORS: COMPANY OVERVIEW

- TABLE 289 NISSAN MOTORS: PRODUCTS OFFERED

- TABLE 290 NISSAN MOTORS: PRODUCT LAUNCHES

- TABLE 291 NISSAN MOTORS: DEALS

- TABLE 292 RENAULT GROUP: COMPANY OVERVIEW

- TABLE 293 SUZUKI MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 294 SUBARU CORPORATION: COMPANY OVERVIEW

- TABLE 295 TATA MOTORS: COMPANY OVERVIEW

- TABLE 296 MITSUBISHI MOTORS CORPORATION: COMPANY OVERVIEW

- TABLE 297 MAHINDRA & MAHINDRA LIMITED: COMPANY OVERVIEW

- TABLE 298 VOLVO CAR CORPORATION: COMPANY OVERVIEW

- TABLE 299 TESLA, INC.: COMPANY OVERVIEW

- TABLE 300 MAZDA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 301 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 302 ISUZU MOTORS LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SUV MARKET SEGMENTATION

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL SUV MARKET, 2021-2032

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN SUV MARKET, 2023-2025

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF SUV MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN SUV MARKET, 2025-2032

- FIGURE 7 ASIA PACIFIC TO DOMINATE SUV MARKET DURING FORECAST PERIOD

- FIGURE 8 SUV PRODUCTION VS. SALES, 2024 (THOUSAND UNITS)

- FIGURE 9 SUV PRODUCTION VS. TOTAL CAR PRODUCTION, 2021-2032 (THOUSAND UNITS)

- FIGURE 10 CONSUMER INCLINATION TOWARD UPRIGHT DRIVING EXPERIENCE TO DRIVE MARKET

- FIGURE 11 MID-SIZE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 5-SEATER TO HOLD HIGHER SHARE THAN >5-SEATER DURING FORECAST PERIOD

- FIGURE 13 CLASS D TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 14 GASOLINE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 15 PHEV TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 EUROPE TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 SUV MARKET DYNAMICS

- FIGURE 18 LUXURY SUV PRODUCTION (D AND E SEGMENTS), 2019-2024 (UNITS)

- FIGURE 19 PATENT ANALYSIS

- FIGURE 20 FUTURE APPLICATIONS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SUVS

- FIGURE 22 KEY BUYING CRITERIA FOR SUVS

- FIGURE 23 ECOSYSTEM ANALYSIS

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020-2025 (USD BILLION)

- FIGURE 27 IMPORT DATA FOR HS CODE 870380-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 28 EXPORT DATA FOR HS CODE 870380-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 29 TOTAL COST OF OWNERSHIP OF ICE VS. ELECTRIC SUVS

- FIGURE 30 ICE VS. EV COST COMPARISON

- FIGURE 31 BILL OF MATERIALS FOR ICE VS. ELECTRIC SUVS, 2025 VS. 2030

- FIGURE 32 SUV L**H GLOBAL ANALYSIS, 2024

- FIGURE 33 ELECTRIC SUV L**H GLOBAL ANALYSIS, 2024

- FIGURE 34 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES, 2018-2023

- FIGURE 35 SUV VS. TOTAL PASSENGER VEHICLE VOLUME SALES, 2024-2030

- FIGURE 36 SUV PENETRATION IN TOTAL PASSENGER CAR SALES, 2018-2030

- FIGURE 37 GLOBAL SUV SALES, BY TYPE, 2023-2030

- FIGURE 38 GLOBAL SUV SALES, BY PROPULSION, 2023-2030

- FIGURE 39 GLOBAL SUV SALES, BY REGION, 2018-2022

- FIGURE 40 GLOBAL SUV SALES, BY REGION, 2023-2030

- FIGURE 41 NORTH AMERICA: SUV L**H ANALYSIS

- FIGURE 42 EUROPE: SUV L**H ANALYSIS

- FIGURE 43 ASIA PACIFIC: SUV L**H ANALYSIS

- FIGURE 44 GLOBAL AVERAGE BATTERY COST (USD/KWH)

- FIGURE 45 AUXILIARY COST VS. CELL COST (%)

- FIGURE 46 EV BATTERY COST IN SUVS

- FIGURE 47 ELECTRIC SUV BATTERY CAPACITY VS. RANGE ANALYSIS

- FIGURE 48 ELECTRIC SUV PRICING VS. RANGE ANALYSIS

- FIGURE 49 SUV MANUFACTURING PLANTS

- FIGURE 50 TOYOTA GROUP: SUV L**H ANALYSIS

- FIGURE 51 VOLKSWAGEN GROUP: SUV L**H ANALYSIS

- FIGURE 52 HYUNDAI GROUP: SUV L**H ANALYSIS

- FIGURE 53 SUV MARKET, BY TYPE, 2025 VS. 2032 (USD BILLION)

- FIGURE 54 SUV MARKET, BY CLASS, 2025 VS. 2032 (USD BILLION)

- FIGURE 55 SUV MARKET, BY SEATING CAPACITY, 2025 VS. 2032 (USD BILLION)

- FIGURE 56 SUV MARKET, BY PROPULSION, 2025 VS. 2032 (USD BILLION)

- FIGURE 57 ELECTRIC SUV MARKET, BY TYPE, 2025 VS. 2032 (USD BILLION)

- FIGURE 58 GLOBAL SUV SALES, BY TYPE, 2023 VS. 2024 (THOUSAND UNITS)

- FIGURE 59 SUV MARKET, BY REGION, 2025 VS. 2032 (USD BILLION)

- FIGURE 60 ASIA PACIFIC: SUV MARKET SNAPSHOT

- FIGURE 61 EUROPE: SUV MARKET SNAPSHOT

- FIGURE 62 AMERICAS: SUV MARKET SNAPSHOT

- FIGURE 63 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 64 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 65 COMPANY VALUATION (USD BILLION)

- FIGURE 66 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 67 BRAND/PRODUCT COMPARISON

- FIGURE 68 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 69 COMPANY FOOTPRINT

- FIGURE 70 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 HONDA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 72 HYUNDAI MOTOR COMPANY: COMPANY SNAPSHOT

- FIGURE 73 GENERAL MOTORS: COMPANY SNAPSHOT

- FIGURE 74 STELLANTIS N.V.: COMPANY SNAPSHOT

- FIGURE 75 VOLKSWAGEN GROUP: COMPANY SNAPSHOT

- FIGURE 76 FORD MOTOR COMPANY: COMPANY SNAPSHOT

- FIGURE 77 MERCEDES-BENZ: COMPANY SNAPSHOT

- FIGURE 78 BMW GROUP: COMPANY SNAPSHOT

- FIGURE 79 NISSAN MOTORS: COMPANY SNAPSHOT

- FIGURE 80 RESEARCH DESIGN

- FIGURE 81 RESEARCH DESIGN MODEL

- FIGURE 82 MARKET ESTIMATION METHODOLOGY

- FIGURE 83 BOTTOM-UP APPROACH (TYPE AND REGION)

- FIGURE 84 TOP-DOWN APPROACH (CLASS)

- FIGURE 85 DATA TRIANGULATION

- FIGURE 86 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 87 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS