PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1923692

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1923692

Nutraceutical Excipients Market by Source (Organic Chemicals, Inorganic Chemicals), Functionality (Binders, Fillers & Diluents, Disintegrants, Coating Agents), End Product, Formulation, Functionality Application and Region - Global Forecast to 2030

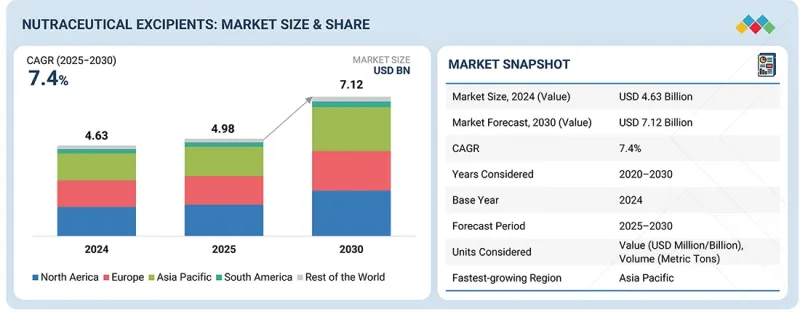

The nutraceutical excipients market is estimated to be valued at USD 4.98 billion in 2025 and is projected to reach USD 7.12 billion by 2030, growing at a CAGR of 7.4% during the forecast period. The nutraceutical excipients market is projected to witness steady expansion through 2030, driven by the surging demand for high-quality, clean-label, and science-backed dietary supplements across global consumer groups. As brands innovate with advanced dosage forms-including gummies, softgels, controlled-release tablets, and functional beverages-there is a growing need for excipients that enhance stability, bioavailability, taste, and overall product performance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD), Volume (Metric Tons) |

| Segments | Source, End Product, Functionality, Functionality Application, Formulation, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, RoW |

Rising health consciousness, coupled with the shift toward plant-based, natural, and allergen-free ingredients, is accelerating the adoption of novel excipients sourced from botanical and sustainable materials. Technological advancements such as plant-based capsule systems, multifunctional excipient blends, and improved solubility enhancers, supported by strong regulatory frameworks in regions like Europe and North America, are further propelling market growth. With increasing investments in R&D, formulation innovation, and manufacturing modernization, the nutraceutical excipients industry is emerging as a key enabler of high-performance and consumer-centric supplement development within the broader health and nutrition landscape.

"The dry formulation segment is estimated to witness a significant share during the forecast period."

The dry nutraceutical excipients segment continues to dominate the market as manufacturers increasingly adopt powder-based ingredients for enhanced stability, extended shelf life, and ease of processing in tablets, capsules, and sachets. Dry excipients such as microcrystalline cellulose (MCC), lactose monohydrate, maltodextrin, prebiotic fibers, and silicon dioxide remain widely used for their superior flowability, compressibility, and bulking properties. Growing demand for clean-label and plant-derived nutraceuticals has also accelerated the use of bio-based dry excipients, including organic rice flour, acacia gum, and natural starch derivatives. Recent industry examples include Roquette's launch of LYCOAT NG starch excipient for nutraceutical films in 2024, DFE Pharma's expansion of its dry powder excipients portfolio for dietary supplements, and BASF's introduction of dry-coated solutions to improve tablet performance. These innovations are strengthening the role of dry excipients as essential functional ingredients supporting formulation efficiency and high-quality nutraceutical product development.

"The taste masking functionality segment is the fastest to maintain robust growth."

Taste masking has become the fastest-growing functionality in the nutraceutical excipients market as brands increasingly incorporate bitter plant extracts, minerals, amino acids, and next-generation bioactives into consumer-friendly formats. With rising demand for gummies, chewables, effervescent, and orally disintegrating powders, manufacturers now rely on excipients that can effectively reduce bitterness, metallic notes, and strong herbal flavors. This shift has accelerated the use of cyclodextrins for inclusion complexation, lipid-based carriers to block taste receptor interaction, and modified starches for microencapsulation. New developments are reinforcing this momentum, such as Ingredion's 2024 clean-label encapsulation starches for flavor modulation, Ashland's recent Klucel HPC grades optimized for taste-masked chewables, and Kerry's release of Enmask(TM) natural flavor-modulating systems for active-rich supplements. As consumer expectations for pleasant-tasting nutraceuticals rise-especially in pediatric, sports nutrition, and women's health products-taste masking is rapidly becoming a critical performance driver, solidifying its position as the fastest-expanding application area in nutraceutical excipients.

"Europe is estimated to account for a significant share of the nutraceutical excipients market."

Europe holds a significant share in the nutraceutical excipients market, driven by the strong presence of leading global players and a steady rise in innovative product launches across the region. Countries such as Germany, France, the UK, and Switzerland serve as key hubs for pharmaceutical and nutraceutical manufacturing, supported by advanced R&D capabilities and strict quality standards that encourage the development of next-generation excipients. Major companies like Roquette, BASF, Kerry, and IMCD continue to expand their portfolios, with recent launches such as Roquette's LYCAGEL(R) Flex softgel capsule shell system introduced at Vitafoods Europe 2024, reinforcing the region's leadership in plant-based and functional excipient solutions. These innovations cater to Europe's rapidly growing demand for vegan, clean-label, and high-performance nutraceutical formulations. The combination of well-established excipient manufacturers, continuous technological advancements, and a strong regulatory framework firmly positions Europe as a dominant and fast-evolving market for nutraceutical excipients.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the nutraceutical excipients market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World (Middle East and Africa) - 10%

Prominent companies in the market include International Flavors & Fragrances Inc. (US), Kerry Group plc (Ireland), Ingredion (US), Sensient Technologies Corporation (US), Associated British Foods plc (UK), BASF SE (Germany), Roquette Freres (France), MEGGLE GmbH & Co. KG (Germany), Cargill, Incorporated (US), Ashland (US), IMCD (Netherlands), Hilmar Cheese Company, Inc. (US), SEPPIC (US), and Azelis Group (Luxembourg).

Research Coverage

This research report categorizes the nutraceutical excipients market by source (organic chemicals, inorganic chemicals, others), functionality (disintegrants, colorants, lubricants & glidants, preservatives, emulsifying agents, other functionalities), end product (proteins & amino acids, omega-3 fatty acids, vitamins, minerals, prebiotics, probiotics, other end products), form (dry, liquid), functionality application (taste masking, stabilizers, modified release, solubility & bioavailability enhancers, other functionality applications), and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the nutraceutical excipients market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, and agreements. The study includes new product & service launches, mergers & acquisitions, and recent developments associated with the nutraceutical excipients market. This report also includes a competitive analysis of emerging startups in the nutraceutical excipients market ecosystem.

Reasons to Buy this Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall nutraceutical excipients and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

1. In-depth Segmentation across Type, Source, and Application: This study presents a detailed breakdown of the nutraceutical excipients market, categorizing it source (organic chemicals, inorganic chemicals, others), functionality (Disintegrants, Colorants, Lubricants & Glidants, Preservatives, Emulsifying Agents, Other Functionalities), end product (Proteins & Amino Acids, Omega-3 Fatty Acids, Vitamins, Minerals, Prebiotics, Probiotics, Other End Products). The analysis also covers key functional roles such as taste masking agents, stabilizers, solubilizers, and release-modifying excipients. This holistic segmentation enables stakeholders to identify high-growth formulation areas, enhance product development strategies, and align offerings with evolving nutraceutical manufacturing needs.

2. Region-specific Insights with Focus on Emerging Markets: The report offers an in-depth regional and country-level assessment, highlighting expanding opportunities across high-growth regions such as the Asia Pacific, South America, and the Middle East. It examines regulatory frameworks, clean-label norms, and consumer shifts toward plant-based, vegan, and natural supplements, driving excipient adoption. Additionally, it outlines government support for nutraceutical manufacturing, investments in advanced processing technologies, and rising local production capabilities-providing valuable guidance for companies seeking to scale, partner locally, or strengthen regional presence.

3. Competitive Intelligence and Innovation Landscape: Detailed competitive profiles of leading players-including Roquette, Kerry Group, BASF, Ingredion, and DSM-are provided, covering their strategic initiatives, technological advancements, and expansion plans. The report tracks major market developments such as product launches, facility expansions, mergers and acquisitions, and R&D activities. These insights equip stakeholders to benchmark competition, understand innovation trajectories, and capitalize on emerging formulation technologies shaping the nutraceutical excipients market.

4. Demand Forecasts Backed by Data-driven Methodologies: Market size projections and growth estimates through 2030 are based on validated top-down and bottom-up analytical approaches, supplemented by industry expert inputs and verified trade data. The forecasts deliver reliable insights into demand patterns, excipient consumption trends across dosage forms, and long-term market opportunities, helping stakeholders strategize investments and strengthen future-ready portfolios.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NUTRACEUTICAL EXCIPIENTS MARKET

- 3.2 NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE AND REGION

- 3.3 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION

- 3.4 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION

- 3.5 NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE

- 3.6 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION

- 3.7 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT

- 3.8 NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increased focus on preventive care to encourage investments in products/solutions

- 4.2.1.2 Advancements in nanotechnology equipped with new features relating to nutraceutical excipients

- 4.2.1.3 Rising investments in clean-label and natural excipients driven by regulatory pressure and shifting consumer health preferences

- 4.2.1.4 Mandates on food fortification by government organizations

- 4.2.2 RESTRAINTS

- 4.2.2.1 Decrease in returns on R&D investments and high costs of clinical trials and registration

- 4.2.2.2 Stringent regulatory expectations for excipient safety, purity, and compliance, adding complexity to product approvals

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Multi-functionalities of excipients aiding in saving costs and processing time

- 4.2.3.2 Rising awareness of micronutrient deficiencies

- 4.2.3.3 Growing popularity of gummy supplements

- 4.2.4 CHALLENGES

- 4.2.4.1 Consumer skepticism associated with nutraceutical products due to rural and semi-urban consumers' perception of dietary supplements as pharmaceutical drugs

- 4.2.4.2 Ensuring compatibility with high-potency actives

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.2.2 BARGAINING POWER OF SUPPLIERS

- 5.2.3 BARGAINING POWER OF BUYERS

- 5.2.4 THREAT OF SUBSTITUTES

- 5.2.5 THREAT OF NEW ENTRANTS

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 GLOBAL POPULATION WITNESSING HIGH PREVALENCE OF OBESITY

- 5.3.2 AGING POPULATION BECOMING MORE AWARE OF BENEFITS OF NUTRACEUTICALS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 SOURCING OF RAW MATERIALS

- 5.5.2 MANUFACTURING

- 5.5.3 DISTRIBUTION, MARKETING, AND SALES

- 5.6 ECOSYSTEM/MARKET MAP

- 5.6.1 UPSTREAM

- 5.6.1.1 Excipient manufacturers

- 5.6.1.2 Technology providers

- 5.6.2 DOWNSTREAM

- 5.6.2.1 Regulatory bodies

- 5.6.2.2 Nutraceutical manufacturers

- 5.6.1 UPSTREAM

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE AVERAGE SELLING PRICE, BY SOURCE

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8 TRADE ANALYSIS

- 5.8.1 TRADE ANALYSIS OF HS CODE 210690

- 5.8.1.1 Export trends of nutraceutical excipient under HS Code 210690

- 5.8.1.2 Import trends of nutraceutical excipients under HS Code 210690

- 5.8.2 TRADE ANALYSIS OF HS CODE 300490

- 5.8.2.1 Export trends of nutraceutical excipients under HS Code 300490

- 5.8.2.2 Import trends of nutraceutical excipients under HS Code 300490

- 5.8.3 TRADE ANALYSIS OF HS CODE 293090

- 5.8.3.1 Export trends of nutraceutical excipient under HS Code 293090

- 5.8.3.2 Import trends of nutraceutical excipients under HS Code 293090

- 5.8.4 TRADE ANALYSIS OF HS CODE 382200

- 5.8.4.1 Export trends of nutraceutical excipient under HS Code 382200

- 5.8.4.2 Import trends of nutraceutical excipient under HS Code 382200

- 5.8.1 TRADE ANALYSIS OF HS CODE 210690

- 5.9 KEY CONFERENCES & EVENTS

- 5.10 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 BENEO'S GALENIQ(R) MULTIFUNCTIONAL FILLER-BINDER FOR CLEAN-LABEL TABLETS (CPHI 2025)

- 5.12.2 ROQUETTE READILYCOAT(R) LOW-TEMPERATURE COATING SYSTEM (2025)

- 5.12.3 EVONIK - LIPID-BASED CARRIER FOR OMEGA-3 CAPSULES (APRIL 2024)

- 5.13 IMPACT OF 2025 US TARIFF - NUTRACEUTICAL EXCIPIENTS MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 KEY TARIFF RATES

- 5.13.3 PRICE IMPACT ANALYSIS

- 5.13.4 IMPACT ON COUNTRY/REGION

- 5.13.5 IMPACT ON END-USE INDUSTRY

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 INTRODUCTION

- 6.2 KEY EMERGING TECHNOLOGIES

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.5.1 LIST OF MAJOR PATENTS

- 6.6 FUTURE APPLICATIONS

- 6.7 IMPACT OF AI/GEN AI ON NUTRACEUTICAL EXCIPIENTS MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES IN NUTRACEUTICAL EXCIPIENT PROCESSING

- 6.7.3 CASE STUDIES OF AI IMPLEMENTATION IN NUTRACEUTICAL EXCIPIENTS MARKET

- 6.7.3.1 AI-driven Ingredient Discovery & Formulation Optimization

- 6.7.3.2 AI-Enabled Evidence Review and Product Rationalization (2025)

- 6.7.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN NUTRACEUTICAL EXCIPIENTS MARKET

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.2 REGIONAL REGULATIONS AND COMPLIANCE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2.2 INDUSTRY STANDARDS

- 7.2.2.1 Organizations/Regulations governing nutraceutical excipients market

- 7.2.2.2 North America

- 7.2.2.2.1 Canada

- 7.2.2.2.2 US

- 7.2.2.2.3 Mexico

- 7.2.2.3 European Union (EU)

- 7.2.2.4 Asia Pacific

- 7.2.2.4.1 Japan

- 7.2.2.4.2 China

- 7.2.2.4.3 India

- 7.2.2.4.4 Australia & New Zealand

- 7.2.2.5 Rest of the World (RoW)

- 7.2.2.5.1 Brazil

- 7.2.2.6 Probiotics

- 7.2.2.6.1 Introduction

- 7.2.2.6.2 National/International bodies for safety standards and regulations

- 7.2.2.6.3 Codex Alimentarius Commission (CAC)

- 7.2.2.6.4 North America: regulatory environment analysis

- 7.2.2.6.4.1 US

- 7.2.2.6.4.2 Canada

- 7.2.2.6.5 Asia Pacific: Regulatory environment analysis

- 7.2.2.6.5.1 Japan

- 7.2.2.6.5.2 India

- 7.2.2.6.6 South America: Regulatory Environment Analysis

- 7.2.2.6.6.1 Brazil

- 7.2.2.7 Prebiotics

- 7.2.2.7.1 Introduction

- 7.2.2.7.2 Asia Pacific

- 7.2.2.7.2.1 Japan

- 7.2.2.7.2.2 Australia & New Zealand

- 7.2.2.7.2.3 South Korea

- 7.2.2.7.2.4 India

- 7.2.2.7.3 North America

- 7.2.2.7.3.1 US

- 7.2.2.7.3.2 Canada

- 7.2.2.7.4 European Union

- 7.3 SUSTAINABILITY INITIATIVES

- 7.3.1 ADOPTION OF PLANT-BASED AND UPCYCLED RAW MATERIALS

- 7.3.2 IMPLEMENTATION OF ENERGY-EFFICIENT PROCESSING TECHNOLOGIES

- 7.4 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.5 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.6 MARKET PROFITABILITY

9 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT

- 9.1 INTRODUCTION

- 9.2 PROBIOTICS

- 9.2.1 GROWING STABILITY REQUIREMENTS OF PROBIOTIC INGREDIENTS TO DRIVE MARKET

- 9.3 PREBIOTICS

- 9.3.1 INCREASING FORMULATION NEEDS FOR STABLE PREBIOTIC INGREDIENTS TO DRIVE MARKET

- 9.4 PROTEINS & AMINO ACIDS

- 9.4.1 GROWING FORMULATION REQUIREMENTS FOR STABLE PROTEIN AND AMINO ACID INGREDIENTS TO DRIVE MARKET

- 9.5 VITAMINS

- 9.5.1 PREVALENCE OF VITAMIN DEFICIENCIES AMONG CONSUMERS TO DRIVE MARKET GROWTH FOR NUTRACEUTICAL EXCIPIENTS

- 9.6 MINERALS

- 9.6.1 BENEFITS OFFERED FOR OPTIMAL FUNCTIONING OF BRAIN AND HEART TO DRIVE GROWTH OF NUTRACEUTICAL EXCIPIENTS MARKET

- 9.7 OMEGA-3 FATTY ACIDS

- 9.7.1 INCREASE IN HEART DISEASES TO DRIVE DEMAND FOR OMEGA-3 FATTY ACID SUPPLEMENTS

- 9.8 OTHER END PRODUCTS

10 NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE

- 10.1 INTRODUCTION

- 10.2 ORGANIC CHEMICALS

- 10.2.1 OLEOCHEMICALS

- 10.2.1.1 Fatty alcohols

- 10.2.1.1.1 Need for enhancing texture and creaminess likely to propel demand

- 10.2.1.2 Mineral stearates

- 10.2.1.2.1 Mineral stearates to reduce friction and avoid equipment clogging during manufacturing of nutraceuticals

- 10.2.1.3 Glycerin

- 10.2.1.3.1 Glycerin to help improve smoothness and lubrication process

- 10.2.1.4 Other oleochemicals

- 10.2.1.1 Fatty alcohols

- 10.2.2 CARBOHYDRATES

- 10.2.2.1 Sugars

- 10.2.2.1.1 Actual sugars

- 10.2.2.1.1.1 Rising diabetic population to fuel need for low-glycemic index alternatives like xylitol and isomaltulose

- 10.2.2.1.2 Sugar alcohols

- 10.2.2.1.2.1 Various advantageous and unique properties of sugar alcohols to make them an attractive option

- 10.2.2.1.3 Artificial sweeteners

- 10.2.2.1.3.1 Emerging trends in utilization of natural sweeteners in nutraceutical products to drive demand

- 10.2.2.1.1 Actual sugars

- 10.2.2.2 Cellulose

- 10.2.2.2.1 Microcrystalline cellulose

- 10.2.2.2.1.1 Rising nutraceutical trend to bolster microcrystalline cellulose demand for superior tablet integrity

- 10.2.2.2.2 Cellulose ethers

- 10.2.2.2.2.1 Cellulose ethers help streamline nutraceutical rheology

- 10.2.2.2.3 CMC & croscarmellose sodium

- 10.2.2.2.3.1 Enhanced mouthfeel and fast-acting properties to help propel market growth

- 10.2.2.2.4 Cellulose esters

- 10.2.2.2.4.1 Rising demand for cellulose esters to provide a technical edge in nutraceuticals

- 10.2.2.2.1 Microcrystalline cellulose

- 10.2.2.3 Starch

- 10.2.2.3.1 Modified starch

- 10.2.2.3.1.1 Technical advancements to fuel modified starch demand in nutraceutical excipient industry

- 10.2.2.3.2 Dried starch

- 10.2.2.3.2.1 Capabilities such as disintegration enhancement and bulking effects to drive market

- 10.2.2.3.3 Converted starch

- 10.2.2.3.3.1 Properties such as increased solubility to boost nutrient absorption

- 10.2.2.3.1 Modified starch

- 10.2.2.1 Sugars

- 10.2.3 PETROCHEMICALS

- 10.2.3.1 Glycols

- 10.2.3.1.1 Humectant & solvent properties to drive demand

- 10.2.3.2 Povidones

- 10.2.3.2.1 Film-forming function to provide controlled release of active ingredients

- 10.2.3.3 Mineral hydrocarbons

- 10.2.3.3.1 Properties such as antifoaming and lubrication to help in nutraceutical manufacturing

- 10.2.3.4 Acrylic polymers

- 10.2.3.4.1 Diverse functions of acrylic polymers in nutraceuticals to propel growth

- 10.2.3.5 Other petrochemical excipients

- 10.2.3.1 Glycols

- 10.2.4 PROTEINS

- 10.2.4.1 Expanding utilization of proteins as carriers for microparticles and nanoparticles to propel market growth

- 10.2.5 OTHER ORGANIC CHEMICALS

- 10.2.1 OLEOCHEMICALS

- 10.3 INORGANIC CHEMICALS

- 10.3.1 CALCIUM PHOSPHATE

- 10.3.1.1 Nutraceutical production to be optimized by utilizing GMO-free calcium phosphates as GRAS excipients

- 10.3.2 METAL OXIDES

- 10.3.2.1 Metal oxides to help meet rising demand for iron-enriched nutraceuticals

- 10.3.3 HALITES

- 10.3.3.1 Halites to ensure taste improvement and salting-out techniques

- 10.3.4 CALCIUM CARBONATE

- 10.3.4.1 Focus on R&D of calcium carbonate to help launch new products

- 10.3.5 CALCIUM SULFATE

- 10.3.5.1 Improved flowability to drive demand for calcium sulfate

- 10.3.6 OTHER INORGANIC CHEMICALS

- 10.3.1 CALCIUM PHOSPHATE

- 10.4 OTHER CHEMICALS

11 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION

- 11.1 INTRODUCTION

- 11.2 TASTE MASKING

- 11.2.1 CREATING DIFFERENTIATION IS KEY IN THIS COMPETITIVE MARKET

- 11.3 STABILIZERS

- 11.3.1 MAINTAINING DESIRABLE PROPERTIES UNTIL CONSUMPTION TO DRIVE DEMAND FOR STABILIZERS

- 11.4 MODIFIED RELEASE

- 11.4.1 NEED FOR SLOWER AND STEADIER RELEASE OF COMPOUNDS TO PROPEL GROWTH OF MODIFIED-RELEASE APPLICATIONS IN NUTRACEUTICAL EXCIPIENTS MARKET

- 11.5 SOLUBILITY & BIOAVAILABILITY ENHANCEMENT

- 11.5.1 CHALLENGES RELATED TO POOR SOLUBILITY AND LIMITED ABSORPTION OF BIOACTIVE COMPOUNDS TO DRIVE DEMAND

- 11.6 OTHER FUNCTIONALITY APPLICATIONS

12 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION

- 12.1 INTRODUCTION

- 12.2 DRY

- 12.2.1 TABLETS

- 12.2.1.1 Easy-to-carry and portable nature makes them attractive option

- 12.2.2 CAPSULES

- 12.2.2.1 Quick-dissolving capsule shells for targeted absorption are ideal for nutraceuticals designed to act in specific areas of digestive tract

- 12.2.1 TABLETS

- 12.3 LIQUID

- 12.3.1 POTENTIAL GROWTH OPPORTUNITIES FOR LIQUID NUTRACEUTICAL EXCIPIENTS DUE TO INNOVATIONS IN FORMULATIONS TO DRIVE GROWTH

- 12.4 OTHER FORMULATIONS

13 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

- 13.1 INTRODUCTION

- 13.2 BINDERS

- 13.2.1 INCREASED ACCEPTANCE AND USE OF BINDING AGENTS IN PRODUCTS TO DRIVE GROWTH OF NUTRACEUTICAL EXCIPIENTS MARKET

- 13.3 FILLERS & DILUENTS

- 13.3.1 USE OF ACTIVE INGREDIENTS IN NUTRACEUTICAL PRODUCTS TO ENCOURAGE USE OF FILLERS AND DILUENTS AS EXCIPIENTS

- 13.4 DISINTEGRANTS

- 13.4.1 HIGH CONSUMPTION OF DIETARY SUPPLEMENTS IN FORM OF ORAL DOSAGES OR TABLETS TO DRIVE GROWTH OF DISINTEGRANTS SEGMENT

- 13.5 COATING AGENTS

- 13.5.1 PROTECTION FROM MOISTURE AND BACTERIA TO DRIVE DEMAND

- 13.6 FLAVORING AGENTS & SWEETENERS

- 13.6.1 INCREASE IN NEED FOR MASKING STRONG AND UNAPPEALING FLAVORS TO DRIVE GROWTH OF SEGMENT

- 13.7 PRESERVATIVES

- 13.7.1 INHIBITION OF MICROBIAL GROWTH AND MAINTAINING PRODUCT QUALITY AND SAFETY TO DRIVE DEMAND FOR PRESERVATIVES

- 13.8 LUBRICANTS & GLIDANTS

- 13.8.1 INCREASE IN NEED FOR REDUCING FRICTION AND KEEPING FORMULATION INTACT DURING PRODUCTION PROCESS TO DRIVE GROWTH OF SEGMENT

- 13.9 SUSPENDING & VISCOSITY AGENTS

- 13.9.1 PREVENTING SETTLING TO HELP MAINTAIN HOMOGENEITY AND STABILITY OF PRODUCT

- 13.10 COLORANTS

- 13.10.1 NEED FOR VISUAL APPEAL AND PRODUCT DIFFERENTIATION TO FUEL DEMAND FOR COLORANTS

- 13.11 EMULSIFYING AGENTS

- 13.11.1 NEED FOR REDUCING SURFACE TENSION BETWEEN DIFFERENT COMPONENTS TO DRIVE DEMAND FOR EMULSIFYING AGENTS

- 13.12 OTHER FUNCTIONALITIES

14 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 High concentration of key players, various nutrition awareness programs, and increase in preventive healthcare trends in US

- 14.2.2 CANADA

- 14.2.2.1 Demand for quality and cost-competition: Two key factors for manufacturers to consider in Canada

- 14.2.3 MEXICO

- 14.2.3.1 Increase in foreign direct investments and rise in awareness regarding healthier lifestyles associated with dietary supplements

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Demand for nutraceutical excipients is likely to increase to serve health-conscious consumers

- 14.3.2 FRANCE

- 14.3.2.1 Innovations in product formulations to cater to increased consumer demands

- 14.3.3 UK

- 14.3.3.1 Growth of functional/fortified food & beverage industry in UK to drive demand for nutraceutical excipients

- 14.3.4 ITALY

- 14.3.4.1 Growing trend of online OTC and food supplement purchases in Italy

- 14.3.5 SPAIN

- 14.3.5.1 Excipient manufacturers expand Iberian operations to support tablets and capsules marketed across Spain

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Rise in preference for nutraceutical products and innovations in dietary supplement formulations and fortified food products

- 14.4.2 JAPAN

- 14.4.2.1 Manufacturers should think beyond pills & innovation to tap this growing market in Japan

- 14.4.3 INDIA

- 14.4.3.1 Government policies and importance of nutraceuticals in daily life

- 14.4.4 SOUTH KOREA

- 14.4.4.1 Rapid growth of supplements industry in South Korea

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Growth in awareness regarding the benefits of functional foods and rise in aging population in Brazil

- 14.5.2 ARGENTINA

- 14.5.2.1 Country's focus on prevention healthcare system to be positive sign for nutraceutical excipients market

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD (ROW)

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Rise in obesity and other health-related concerns in Middle East

- 14.6.2 AFRICA

- 14.6.2.1 Intra-African trade policies and investments by global nutraceutical players

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2020-2024

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.5.1 KERRY GROUP PLC (IRELAND)

- 15.5.2 INGREDION (US)

- 15.5.3 BASF (GERMANY)

- 15.5.4 ASSOCIATED BRITISH FOODS PLC (UK)

- 15.5.5 SENSIENT TECHNOLOGIES CORPORATION (US)

- 15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.6.5.1 Company footprint

- 15.6.5.2 Region footprint

- 15.6.5.3 Source footprint

- 15.6.5.4 Functionality footprint

- 15.6.5.5 Functionality application footprint

- 15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- 15.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.7.5.1 Detailed list of key startups/SMEs

- 15.7.5.2 Competitive benchmarking of key startups/SMEs

- 15.8 COMPANY VALUATION AND FINANCIAL METRICS

- 15.8.1 COMPANY VALUATION

- 15.8.2 EV/EBITDA

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 KERRY GROUP PLC

- 16.1.1.1 Business overview

- 16.1.1.2 Product/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 INGREDION

- 16.1.2.1 Business overview

- 16.1.2.2 Product/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 BASF SE

- 16.1.3.1 Business overview

- 16.1.3.2 Product/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 ASSOCIATED BRITISH FOODS PLC

- 16.1.4.1 Business overview

- 16.1.4.2 Product/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 SENSIENT TECHNOLOGIES CORPORATION

- 16.1.5.1 Business overview

- 16.1.5.2 Product/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 CARGILL, INCORPORATED

- 16.1.6.1 Business overview

- 16.1.6.2 Product/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Expansions

- 16.1.6.4 MnM view

- 16.1.6.4.1 Right to win

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 AZELIS

- 16.1.7.1 Business overview

- 16.1.7.2 Product/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.7.3.2 Expansions

- 16.1.7.4 MnM view

- 16.1.7.4.1 Right to win

- 16.1.7.4.2 Strategic choices

- 16.1.7.4.3 Weaknesses and competitive threats

- 16.1.8 ASHLAND

- 16.1.8.1 Business overview

- 16.1.8.2 Product/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.3.2 Other developments

- 16.1.8.4 MnM view

- 16.1.8.4.1 Right to win

- 16.1.8.4.2 Strategic choices

- 16.1.8.4.3 Weaknesses and competitive threats

- 16.1.9 MEGGLE HOLDING SE

- 16.1.9.1 Business overview

- 16.1.9.2 Product/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.4 MnM view

- 16.1.9.4.1 Right to win

- 16.1.9.4.2 Strategic choices

- 16.1.9.4.3 Weaknesses and competitive threats

- 16.1.10 ROQUETTE FRERES

- 16.1.10.1 Business overview

- 16.1.10.2 Product/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.10.3.3 Expansions

- 16.1.10.4 MnM view

- 16.1.10.4.1 Right to win

- 16.1.10.4.2 Strategic choices

- 16.1.10.4.3 Weaknesses and competitive threats

- 16.1.11 COLORCON, INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Product/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.11.3.2 Deals

- 16.1.11.3.3 Expansions

- 16.1.11.3.4 Other developments

- 16.1.11.4 MnM view

- 16.1.11.4.1 Right to win

- 16.1.11.4.2 Strategic choices

- 16.1.11.4.3 Weaknesses and competitive threats

- 16.1.12 ALSIANO A/S

- 16.1.12.1 Business overview

- 16.1.12.2 Product/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.12.4 MnM view

- 16.1.12.4.1 Right to win

- 16.1.12.4.2 Strategic choices

- 16.1.12.4.3 Weaknesses and competitive threats

- 16.1.13 JIGS CHEMICAL

- 16.1.13.1 Business overview

- 16.1.13.2 Product/Solutions/Services offered

- 16.1.13.3 MnM view

- 16.1.13.3.1 Right to win

- 16.1.13.3.2 Strategic choices

- 16.1.13.3.3 Weaknesses and competitive threats

- 16.1.14 IMCD

- 16.1.14.1 Business overview

- 16.1.14.2 Product/Solutions/Services offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Deals

- 16.1.14.3.2 Expansions

- 16.1.14.4 MnM view

- 16.1.14.4.1 Right to win

- 16.1.14.4.2 Strategic choices

- 16.1.14.4.3 Weaknesses and competitive threats

- 16.1.15 HILMAR CHEESE COMPANY, INC.

- 16.1.15.1 Business overview

- 16.1.15.2 Product/Solutions/Services offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Expansions

- 16.1.15.4 MnM view

- 16.1.15.4.1 Right to win

- 16.1.15.4.2 Strategic choices

- 16.1.15.4.3 Weaknesses and competitive threats

- 16.1.16 OMYA

- 16.1.16.1 Business overview

- 16.1.16.2 Product/Solutions/Services offered

- 16.1.16.3 Recent developments

- 16.1.16.3.1 Deals

- 16.1.16.4 MnM view

- 16.1.17 BIOGRUND

- 16.1.17.1 Business overview

- 16.1.17.2 Product/Solutions/Services offered

- 16.1.17.3 Recent developments

- 16.1.17.3.1 Deals

- 16.1.17.3.2 Expansions

- 16.1.17.4 MnM view

- 16.1.18 JRS PHARMA

- 16.1.18.1 Business overview

- 16.1.18.2 Product/Solutions/Services offered

- 16.1.18.3 Recent developments

- 16.1.18.3.1 Product launches

- 16.1.18.3.2 Expansions

- 16.1.18.4 MnM view

- 16.1.19 INNOPHOS

- 16.1.19.1 Business overview

- 16.1.19.2 Product/Solutions/Services offered

- 16.1.19.3 Recent developments

- 16.1.19.3.1 Expansions

- 16.1.19.4 MnM view

- 16.1.20 NOVO EXCIPIENTS PVT. LTD.

- 16.1.20.1 Business overview

- 16.1.20.2 Products offered

- 16.1.20.3 MnM view

- 16.1.21 PANCHAMRUT CHEMICALS

- 16.1.22 GATTEFOSSE

- 16.1.23 FUJI CHEMICAL INDUSTRIES CO., LTD.

- 16.1.24 SUDEEP PHARMA LIMITED

- 16.1.25 SORSE TECHNOLOGIES

- 16.1.1 KERRY GROUP PLC

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 Key primary participants

- 17.1.2.2.1 Nutraceutical excipients companies

- 17.1.2.3 Breakdown of primary interviews

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 BOTTOM-UP APPROACH

- 17.2.2 TOP-DOWN APPROACH

- 17.2.3 TOP-DOWN APPROACH

- 17.3 DATA TRIANGULATION

- 17.4 FACTOR ANALYSIS

- 17.5 RESEARCH ASSUMPTIONS

- 17.6 RESEARCH LIMITATIONS

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 RELATED REPORTS

- 18.4 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2020-2024

- TABLE 3 GLOBAL PREVALENCE OF ANEMIA, 2024-2025

- TABLE 4 UNMET NEEDS AND WHITE SPACES IN NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 5 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 7 NUTRACEUTICAL EXCIPIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 NUTRACEUTICAL EXCIPIENTS MARKET: ECOSYSTEM

- TABLE 9 INDICATIVE AVERAGE SELLING PRICE (ASP) OF NUTRACEUTICAL EXCIPIENTS BY KEY PLAYERS, 2024 (USD/MT)

- TABLE 10 INDICATIVE PRICING ANALYSIS FOR NUTRACEUTICAL EXCIPIENTS, BY SOURCE, 2023-2024 (USD/KG)

- TABLE 11 AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2024 (USD/KG)

- TABLE 12 NUTRACEUTICAL EXCIPIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 14 EXPECTED IMPACT LEVEL ON TARGET PRODUCTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFF IMPACT

- TABLE 15 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: NUTRACEUTICAL EXCIPIENT

- TABLE 16 TECHNOLOGY/PRODUCT MAP FOR NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 17 LIST OF MAJOR PATENTS ABOUT NUTRACEUTICAL EXCIPIENTS MARKET, 2021-2024

- TABLE 18 NUTRACEUTICAL EXCIPIENTS MARKET: FUTURE APPLICATIONS

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 DEFINITIONS & REGULATIONS FOR NUTRACEUTICAL EXCIPIENTS WORLDWIDE

- TABLE 25 DEFINITIONS & REGULATIONS FOR NUTRACEUTICALS WORLDWIDE

- TABLE 26 SCHEDULE - XI OF FOOD SAFETY AND STANDARDS REGULATIONS, 2015, FOR LIST OF APPROVED PREBIOTIC EXCIPIENTS

- TABLE 27 LIST OF ACCEPTED DIETARY FIBERS BY CANADIAN REGULATORY AUTHORITIES & THEIR SOURCES

- TABLE 28 KEY INDUSTRY STANDARDS FOR NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR NUTRACEUTICAL EXCIPIENT SOURCE

- TABLE 30 KEY BUYING CRITERIA FOR NUTRACEUTICAL EXCIPIENT END PRODUCT

- TABLE 31 NUTRACEUTICAL EXCIPIENTS MARKET, BY MATERIAL, 2020-2024 (USD MILLION)

- TABLE 32 NUTRACEUTICAL EXCIPIENTS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 33 NUTRACEUTICAL EXCIPIENTS MARKET IN PROBIOTICS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 NUTRACEUTICAL EXCIPIENTS MARKET IN PROBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 NUTRACEUTICAL EXCIPIENTS MARKET IN PREBIOTICS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 NUTRACEUTICAL EXCIPIENTS MARKET IN PREBIOTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 NUTRACEUTICAL EXCIPIENTS MARKET IN PROTEINS & AMINO ACIDS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 NUTRACEUTICAL EXCIPIENTS MARKET IN PROTEINS & AMINO ACIDS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 LIST OF NUTRIENTS AND THEIR RELEVANCE

- TABLE 40 NUTRACEUTICAL EXCIPIENTS MARKET IN VITAMINS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 NUTRACEUTICAL EXCIPIENTS MARKET IN VITAMINS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 NUTRACEUTICAL EXCIPIENTS MARKET IN MINERALS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 NUTRACEUTICAL EXCIPIENTS MARKET IN MINERALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 NUTRACEUTICAL EXCIPIENTS MARKET IN OMEGA-3 FATTY ACIDS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 NUTRACEUTICAL EXCIPIENTS MARKET IN OMEGA-3 FATTY ACIDS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 NUTRACEUTICAL EXCIPIENTS MARKET IN OTHER END PRODUCTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 NUTRACEUTICAL EXCIPIENTS MARKET IN OTHER END PRODUCTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 49 NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 50 ORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 ORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 ORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 53 ORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 OLEOCHEMICAL NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 55 OLEOCHEMICAL NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 56 CARBOHYDRATE-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 57 CARBOHYDRATE-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 58 SUGAR-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 59 SUGAR-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 60 CELLULOSE-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 61 CELLULOSE-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 62 STARCH-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 63 STARCH-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 64 PETROCHEMICAL NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 65 PETROCHEMICAL NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 66 INORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 INORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 INORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2020-2024 (USD MILLION)

- TABLE 69 INORGANIC NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 70 OTHER CHEMICAL-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 OTHER CHEMICAL-BASED NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 73 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 NUTRACEUTICAL EXCIPIENTS MARKET FOR TASTE MASKING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 NUTRACEUTICAL EXCIPIENTS MARKET FOR TASTE MASKING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 NUTRACEUTICAL EXCIPIENTS MARKET FOR STABILIZERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 NUTRACEUTICAL EXCIPIENTS MARKET FOR STABILIZERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 NUTRACEUTICAL EXCIPIENTS MARKET FOR MODIFIED RELEASE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 NUTRACEUTICAL EXCIPIENTS MARKET FOR MODIFIED RELEASE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 NUTRACEUTICAL EXCIPIENTS MARKET FOR SOLUBILITY & BIOAVAILABILITY ENHANCEMENT, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 NUTRACEUTICAL EXCIPIENTS MARKET FOR SOLUBILITY & BIOAVAILABILITY ENHANCEMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 NUTRACEUTICAL EXCIPIENTS MARKET FOR OTHER FUNCTIONALITY APPLICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 NUTRACEUTICAL EXCIPIENTS MARKET FOR OTHER FUNCTIONALITY APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 85 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 86 DRY NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 DRY NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 DRY NUTRACEUTICAL EXCIPIENTS MARKET, BY DRY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 89 DRY NUTRACEUTICAL EXCIPIENTS MARKET, BY DRY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 90 LIQUID NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 LIQUID NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 OTHER NUTRACEUTICAL EXCIPIENT FORMULATIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 OTHER NUTRACEUTICAL EXCIPIENT FORMULATIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 95 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 96 NUTRACEUTICAL EXCIPIENTS MARKET IN BINDERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 NUTRACEUTICAL EXCIPIENTS MARKET IN BINDERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 NUTRACEUTICAL EXCIPIENTS MARKET IN FILLERS & DILUENTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 NUTRACEUTICAL EXCIPIENTS MARKET IN FILLERS & DILUENTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 NUTRACEUTICAL EXCIPIENTS MARKET IN DISINTEGRANTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 NUTRACEUTICAL EXCIPIENTS MARKET IN DISINTEGRANTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 NUTRACEUTICAL EXCIPIENTS MARKET IN COATING AGENTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 NUTRACEUTICAL EXCIPIENTS MARKET IN COATING AGENTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 NUTRACEUTICAL EXCIPIENTS MARKET IN FLAVORING AGENTS & SWEETENERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 NUTRACEUTICAL EXCIPIENTS MARKET IN FLAVORING AGENTS & SWEETENERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 NUTRACEUTICAL EXCIPIENTS MARKET IN PRESERVATIVES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 107 NUTRACEUTICAL EXCIPIENTS MARKET IN PRESERVATIVES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 NUTRACEUTICAL EXCIPIENTS MARKET IN LUBRICANTS & GLIDANTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 109 NUTRACEUTICAL EXCIPIENTS MARKET IN LUBRICANTS & GLIDANTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 NUTRACEUTICAL EXCIPIENTS MARKET IN SUSPENDING & VISCOSITY AGENTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 111 NUTRACEUTICAL EXCIPIENTS MARKET IN SUSPENDING & VISCOSITY AGENTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 NUTRACEUTICAL EXCIPIENTS MARKET IN COLORANTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 113 NUTRACEUTICAL EXCIPIENTS MARKET IN COLORANTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 NUTRACEUTICAL EXCIPIENTS MARKET IN EMULSIFYING AGENTS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 115 NUTRACEUTICAL EXCIPIENTS MARKET IN EMULSIFYING AGENTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 NUTRACEUTICAL EXCIPIENTS MARKET IN OTHER FUNCTIONALITIES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 117 NUTRACEUTICAL EXCIPIENTS MARKET IN OTHER FUNCTIONALITIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 119 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 121 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 122 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2020-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 US: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 135 US: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 136 CANADA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 137 CANADA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 138 MEXICO: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 139 MEXICO: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 141 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 143 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 145 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 146 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 147 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 148 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2020-2024 (USD MILLION)

- TABLE 149 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2025-2030 (USD MILLION)

- TABLE 150 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 151 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 152 GERMANY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 153 GERMANY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 154 FRANCE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 155 FRANCE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 156 UK: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 157 UK: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 158 ITALY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 159 ITALY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 160 SPAIN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 161 SPAIN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 163 REST OF EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2020-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2025-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 176 CHINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 177 CHINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 178 JAPAN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 179 JAPAN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 180 INDIA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 181 INDIA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 182 SOUTH KOREA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 183 SOUTH KOREA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 189 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 191 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2020-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 197 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 198 BRAZIL: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 199 BRAZIL: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 200 ARGENTINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 201 ARGENTINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 202 REST OF SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 203 REST OF SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 204 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 205 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 206 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 207 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 208 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 209 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 210 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2020-2024 (USD MILLION)

- TABLE 211 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2025-2030 (USD MILLION)

- TABLE 212 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2020-2024 (USD MILLION)

- TABLE 213 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2025-2030 (USD MILLION)

- TABLE 214 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 215 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 217 MIDDLE EAST: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 218 AFRICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2020-2024 (USD MILLION)

- TABLE 219 AFRICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025-2030 (USD MILLION)

- TABLE 220 COMPETITIVE STRATEGIES ADOPTED BY KEY PLAYERS IN NUTRACEUTICAL EXCIPIENTS MARKET, 2020-2024

- TABLE 221 NUTRACEUTICAL EXCIPIENTS MARKET: DEGREE OF COMPETITION

- TABLE 222 NUTRACEUTICAL EXCIPIENTS MARKET: REGION FOOTPRINT

- TABLE 223 NUTRACEUTICAL EXCIPIENTS MARKET: SOURCE FOOTPRINT

- TABLE 224 NUTRACEUTICAL EXCIPIENTS MARKET: FUNCTIONALITY FOOTPRINT

- TABLE 225 NUTRACEUTICAL EXCIPIENTS MARKET: FUNCTIONALITY APPLICATION FOOTPRINT

- TABLE 226 NUTRACEUTICAL EXCIPIENTS MARKET: KEY STARTUPS/SMES

- TABLE 227 NUTRACEUTICAL EXCIPIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 228 NUTRACEUTICAL EXCIPIENTS MARKET: PRODUCT LAUNCHES, 2020-NOVEMBER 2025

- TABLE 229 NUTRACEUTICAL EXCIPIENTS MARKET: DEALS, 2020-NOVEMBER 2025

- TABLE 230 NUTRACEUTICAL EXCIPIENTS MARKET: EXPANSIONS, 2020-NOVEMBER 2025

- TABLE 231 NUTRACEUTICAL EXCIPIENTS MARKET: OTHER DEVELOPMENTS, 2020-NOVEMBER 2025

- TABLE 232 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 233 KERRY GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 KERRY GROUP PLC: DEALS

- TABLE 235 KERRY GROUP PLC: EXPANSION

- TABLE 236 INGREDION: BUSINESS OVERVIEW

- TABLE 237 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 INGREDION: DEALS

- TABLE 239 BASF SE: BUSINESS OVERVIEW

- TABLE 240 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 BASF SE: DEALS

- TABLE 242 BASF SE: OTHER DEVELOPMENTS

- TABLE 243 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- TABLE 244 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 ASSOCIATED BRITISH FOODS PLC: PRODUCT LAUNCHES

- TABLE 246 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 247 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 SENSIENT TECHNOLOGIES CORPORATION: DEALS

- TABLE 249 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 250 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 CARGILL, INCORPORATED: EXPANSIONS

- TABLE 252 AZELIS: BUSINESS OVERVIEW

- TABLE 253 AZELIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 AZELIS: DEALS

- TABLE 255 AZELIS: EXPANSIONS

- TABLE 256 ASHLAND: BUSINESS OVERVIEW

- TABLE 257 ASHLAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 ASHLAND: PRODUCT LAUNCHES

- TABLE 259 ASHLAND: OTHER DEVELOPMENTS

- TABLE 260 MEGGLE HOLDING SE: BUSINESS OVERVIEW

- TABLE 261 MEGGLE HOLDING SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 MEGGLE HOLDING SE: PRODUCT LAUNCHES

- TABLE 263 ROQUETTE FRERES: BUSINESS OVERVIEW

- TABLE 264 ROQUETTE FRERES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ROQUETTE FRERES: PRODUCT LAUNCHES

- TABLE 266 ROQUETTE FRERES: DEALS

- TABLE 267 ROQUETTE FRERES: EXPANSIONS

- TABLE 268 COLORCON, INC.: BUSINESS OVERVIEW

- TABLE 269 COLORCON, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 COLORCON, INC.: PRODUCT LAUNCHES

- TABLE 271 COLORCON, INC.: DEALS

- TABLE 272 COLORCON, INC.: EXPANSIONS

- TABLE 273 COLORCON, INC.: OTHER DEVELOPMENTS

- TABLE 274 ALSIANO A/S: BUSINESS OVERVIEW

- TABLE 275 ALSIANO A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 ALSIANO A/S: DEALS

- TABLE 277 JIGS CHEMICAL: BUSINESS OVERVIEW

- TABLE 278 JIGS CHEMICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 IMCD: BUSINESS OVERVIEW

- TABLE 280 IMCD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 IMCD: DEALS

- TABLE 282 IMCD: EXPANSIONS

- TABLE 283 HILMAR CHEESE COMPANY, INC.: BUSINESS OVERVIEW

- TABLE 284 HILMAR CHEESE COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 HILMAR CHEESE COMPANY, INC.: EXPANSIONS

- TABLE 286 OMYA: BUSINESS OVERVIEW

- TABLE 287 OMYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 OMYA: DEALS

- TABLE 289 BIOGRUND: BUSINESS OVERVIEW

- TABLE 290 BIOGRUND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 BIOGRUND: DEALS

- TABLE 292 BIOGRUND: EXPANSIONS

- TABLE 293 JRS PHARMA: BUSINESS OVERVIEW

- TABLE 294 JRS PHARMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 JRS PHARMA: PRODUCT LAUNCHES

- TABLE 296 JRS PHARMA: EXPANSIONS

- TABLE 297 INNOPHOS: BUSINESS OVERVIEW

- TABLE 298 INNOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 INNOPHOS: EXPANSIONS

- TABLE 300 NOVO EXCIPIENTS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 301 NOVO EXCIPIENTS PVT. LTD.: PRODUCTS OFFERED

- TABLE 302 PANCHAMRUT CHEMICALS: COMPANY OVERVIEW

- TABLE 303 GATTEFOSSE: COMPANY OVERVIEW

- TABLE 304 FUJI CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 305 SUDEEP PHARMA LIMITED: COMPANY OVERVIEW

- TABLE 306 SORSE TECHNOLOGIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 NUTRACEUTICAL EXCIPIENTS MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 4 GLOBAL NUTRACEUTICAL EXCIPIENTS MARKET, 2021-2030 (USD MILLION)

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN NUTRACEUTICAL EXCIPIENTS MARKET, 2020-2025

- FIGURE 6 DISRUPTIVE TRENDS IMPACTING GROWTH OF NUTRACEUTICAL EXCIPIENTS MARKET DURING FORECAST PERIOD

- FIGURE 7 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN NUTRACEUTICAL EXCIPIENTS MARKET, 2025-2030

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 INCREASING DEMAND FOR HIGH-QUALITY EXCIPIENTS ENABLING EFFECTIVE TABLET AND CAPSULE NUTRACEUTICAL FORMULATIONS

- FIGURE 10 ORGANIC CHEMICALS SEGMENT AND NORTH AMERICA ACCOUNTED FOR LARGEST SEGMENTAL SHARES IN 2024

- FIGURE 11 NORTH AMERICA DOMINATED NUTRACEUTICAL EXCIPIENTS MARKET IN 2024

- FIGURE 12 DRY SEGMENT DOMINATED NUTRACEUTICAL EXCIPIENTS MARKET IN 2024

- FIGURE 13 ORGANIC CHEMICALS SEGMENT DOMINATED NUTRACEUTICAL EXCIPIENTS MARKET IN 2024

- FIGURE 14 MODIFIED RELEASE SEGMENTS DOMINATED NUTRACEUTICAL EXCIPIENTS MARKET IN 2024

- FIGURE 15 PROBIOTICS SEGMENT DOMINATED NUTRACEUTICAL EXCIPIENTS MARKET IN 2024

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 NUTRACEUTICAL EXCIPIENTS MARKET DYNAMICS

- FIGURE 18 NUMBER OF AMERICANS WITH CHRONIC CONDITIONS, 1995-2030 (MILLION)

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS: NUTRACEUTICAL EXCIPIENTS MARKET

- FIGURE 20 US: POPULATION AGED 65 AND OLDER, 2000-2060 (MILLION)

- FIGURE 21 KEY MARKET DRIVERS SHAPING INNOVATION, ADOPTION, AND GROWTH DYNAMICS ACROSS GLOBAL NUTRACEUTICAL EXCIPIENT INDUSTRY IN RESPONSE TO EVOLVING FORMULATION DEMANDS

- FIGURE 22 NUTRACEUTICAL EXCIPIENTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 NUTRACEUTICAL EXCIPIENTS MARKET: ECOSYSTEM

- FIGURE 24 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024 (USD/KG)

- FIGURE 25 EXPORT VALUE OF NUTRACEUTICAL EXCIPIENTS UNDER HS CODE 210690 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 26 IMPORT VALUE OF NUTRACEUTICAL EXCIPIENTS UNDER HS CODE 210690 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 27 EXPORT VALUE OF NUTRACEUTICAL EXCIPIENTS UNDER HS CODE 300490 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 28 IMPORT VALUE OF NUTRACEUTICAL EXCIPIENTS UNDER HS CODE 300490 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 29 EXPORT VALUE OF NUTRACEUTICAL EXCIPIENTS UNDER HS CODE 293090 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 30 IMPORT VALUE OF NUTRACEUTICAL EXCIPIENTS UNDER HS CODE 293090 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 31 EXPORT VALUE OF NUTRACEUTICAL EXCIPIENTS UNDER HS CODE 382200 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 32 IMPORT VALUE OF NUTRACEUTICAL EXCIPIENT UNDER HS CODE 382200 FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO, 2020-2025 (USD MILLION)

- FIGURE 35 NUMBER OF PATENTS GRANTED FOR NUTRACEUTICAL EXCIPIENTS MARKET, 2014-2024

- FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED FOR NUTRACEUTICAL EXCIPIENTS MARKET, 2014-2024

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR NUTRACEUTICAL EXCIPIENT TYPE

- FIGURE 38 KEY BUYING CRITERIA FOR NUTRACEUTICAL EXCIPIENT END PRODUCT

- FIGURE 39 PROTEIN & AMINO ACIDS TO LEAD DURING FORECAST PERIOD

- FIGURE 40 NUTRACEUTICAL EXCIPIENTS MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 41 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2025 VS. 2030

- FIGURE 42 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 43 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2025 VS. 2030 (USD MILLION)

- FIGURE 44 ITALY, CHINA, INDIA, AND SOUTH KOREA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 47 NUTRACEUTICAL EXCIPIENTS MARKET: REVENUE ANALYSIS FOR FIVE KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 48 SHARE OF LEADING COMPANIES IN NUTRACEUTICAL EXCIPIENTS MARKET, 2024

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 NUTRACEUTICAL EXCIPIENTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 NUTRACEUTICAL EXCIPIENTS MARKET: COMPANY FOOTPRINT

- FIGURE 52 NUTRACEUTICAL EXCIPIENTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 53 COMPANY VALUATION OF KEY NUTRACEUTICAL EXCIPIENTS MANUFACTURERS

- FIGURE 54 EV/EBITDA OF KEY COMPANIES

- FIGURE 55 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 56 INGREDION: COMPANY SNAPSHOT

- FIGURE 57 BASF SE: COMPANY SNAPSHOT

- FIGURE 58 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- FIGURE 59 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 61 AZELIS: COMPANY SNAPSHOT

- FIGURE 62 ASHLAND: COMPANY SNAPSHOT

- FIGURE 63 ROQUETTE FRERES: COMPANY SNAPSHOT

- FIGURE 64 IMCD: COMPANY SNAPSHOT

- FIGURE 65 NUTRACEUTICAL EXCIPIENTS MARKET: RESEARCH DESIGN

- FIGURE 66 KEY DATA FROM PRIMARY SOURCES

- FIGURE 67 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 68 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 69 BRIEF OF BOTTOM-UP APPROACH

- FIGURE 70 NUTRACEUTICAL EXCIPIENTS MARKET: BOTTOM-UP APPROACH

- FIGURE 71 NUTRACEUTICAL EXCIPIENTS MARKET: TOP-DOWN APPROACH

- FIGURE 72 BRIEF OF TOP-DOWN APPROACH

- FIGURE 73 DATA TRIANGULATION

- FIGURE 74 FACTOR ANALYSIS

- FIGURE 75 RESEARCH ASSUMPTIONS

- FIGURE 76 RESEARCH LIMITATIONS