PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906974

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906974

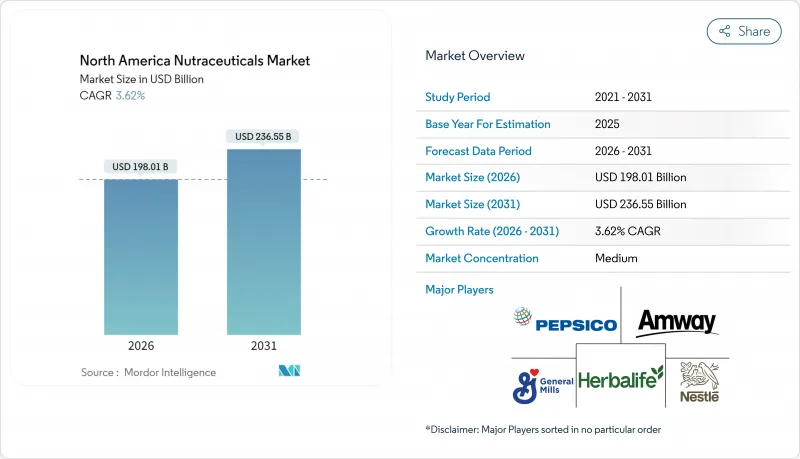

North America Nutraceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America nutraceuticals market was valued at USD 191.09 billion in 2025 and estimated to grow from USD 198.01 billion in 2026 to reach USD 236.55 billion by 2031, at a CAGR of 3.62% during the forecast period (2026-2031).

The market's expansion is fundamentally supported by demographic shifts toward longer life expectancy, the increasing prevalence of lifestyle-related health conditions, and a growing consumer emphasis on preventive healthcare through the consumption of functional foods, beverages, and dietary supplements. In response to regulatory changes, manufacturers are actively reformulating their product portfolios to align with the U.S. Food and Drug Administration's updated "healthy" definition, scheduled for implementation in 2028. The digital transformation of retail through e-commerce platforms has revolutionized how consumers discover and regularly purchase products, while artificial intelligence technologies enable more sophisticated product recommendations based on individual health needs. The industry faces supply chain complexities due to trade tariffs affecting ingredients sourced from Canada, Mexico, and China, prompting companies to establish strategic regional partnerships with local ingredient suppliers to ensure supply stability. The market maintains a dynamic competitive environment where multinational food corporations, established pharmaceutical companies, and emerging digital-first brands compete by leveraging their unique strengths in operational scale, product innovation, and distribution strategies to capture market share.

North America Nutraceuticals Market Trends and Insights

Increasing Consumer Health Awareness Regarding Diet and Lifestyle

Health consciousness among consumers has evolved significantly toward preventive healthcare, with a substantial majority of global consumers actively managing their wellbeing, according to Kerry's research. This transformation has strengthened the demand for scientifically validated ingredients, as consumers increasingly prioritize ingredient quality over taste, fundamentally changing how companies approach product development. The movement reaches across different age demographics, with younger consumers actively pursuing functional benefits, particularly for beauty enhancement and cognitive performance improvement. A considerable portion of consumers specifically seeks nutrition products that support skin health. Products supported by clinical validation command higher market prices, as consumers demonstrate clear preferences for items validated through peer-reviewed research. The widespread adoption of wearable health devices has intensified this trend, generating increased demand for nutrition products that address specific health indicators and measurements.

Growing Aging Population with Rising Health Needs

North America's aging population continues to fuel demand for targeted nutritional solutions, with a significant portion of middle-aged and older adults regularly consuming dietary supplements. This demographic transformation influences product development in healthy aging supplements, expanding from basic multivitamins to formulations that address specific conditions like sarcopenia, cognitive decline, and metabolic health. The market has adapted through improved delivery systems and enhanced bioavailability to address age-related absorption challenges. While multivitamins remain the primary supplement category, new segments such as collagen peptides for glucose management reflect the shift toward condition-specific products. The integration of supplements into healthcare practices, supported by clinical evidence, has established a professional distribution channel with premium pricing.

Stringent Regulatory Requirements for Labeling, Safety, and Health Claims

The Food and Drug Administration's implementation of new food labeling requirements introduces significant regulatory changes, with the revised "healthy" definition taking effect in February 2028, requiring manufacturers to reformulate many products. The proposed front-of-package nutrition labeling regulations add further requirements, including mandatory "Nutrition Info boxes" that must indicate "Low," "Med," or "High" levels of saturated fat, sodium, and added sugars. For cross-border manufacturers, Health Canada's regulatory updates create additional requirements, though the new framework for food compositional standards provides some operational flexibility. While the Food and Drug Administration's uniform compliance date of January 1, 2028, for labeling regulations published between 2025-2026 allows coordinated implementation, it concentrates compliance costs within a limited period . State-specific regulations further complicate compliance, as exemplified by West Virginia's ban on synthetic dyes and Virginia's restrictions on artificial additives in school meals, resulting in varied requirements that increase operational demands and costs.

Other drivers and restraints analyzed in the detailed report include:

- Popularity of Plant-Based and Vegan Diets Driving Demand for Botanical Ingredients

- Rising Fitness and Sports Nutrition Trends

- Tariffs and Import Restrictions on Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The functional foods segment maintains its market dominance with a substantial 43.68% share in 2025. This leadership position reflects an important consumer behavior pattern where individuals increasingly prefer obtaining their nutritional benefits through regular food products rather than taking separate supplements. The integration of health-enhancing ingredients into familiar food formats has particularly resonated with health-conscious consumers who seek seamless nutrition in their daily diets.

Meanwhile, the functional beverages category demonstrates remarkable market dynamics with a projected growth rate of 4.58% CAGR through 2031. This growth is primarily attributed to the increasing consumer demand for convenient, on-the-go nutrition solutions. In the functional foods space, fortified cereals and bakery products continue to perform well, while enhanced dairy alternatives capture the expanding plant-based market through strategic addition of proteins and probiotics. The beverage segment's acceleration is further supported by continuous product innovations and targeted health positioning, particularly evident in energy drinks, sports drinks, and fortified juices that deliver specific nutritional benefits beyond basic hydration requirements.

The North America Nutraceutical Market Report is Segmented by Product Type (Functional Food, Functional Beverage, and Dietary Supplements), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, and More), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PepsiCo Inc.

- General Mills Inc.

- Nestle S.A.

- Herbalife International of America, Inc.

- Amway Corp.

- Kellanova

- The Nature's Bounty Co.

- Pfizer Inc.

- Abbott Laboratories

- Red Bull GmbH

- GNC Holdings LLC

- Jamieson Wellness Inc.

- NOW Health Group, Inc.

- Church & Dwight Co., Inc. (Vitafusion)

- Nature's Way Brands, LLC

- Pharmavite LLC

- Glanbia plc

- Danone S.A.

- DSM-Firmenich

- BASF SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing consumer health awareness regarding diet and lifestyle

- 4.2.2 Growing aging population with rising health needs

- 4.2.3 Popularity of plant-based and vegan diets driving demand for botanical ingredients

- 4.2.4 Development of allergen-free, trans fat-free, and sugar substitute products

- 4.2.5 Rising fitness and sports nutrition trends

- 4.2.6 Personalized nutrition solutions and customized supplements

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory requirements for labeling, safety, and health claims

- 4.3.2 High product development and R&D costs for innovation and formulations

- 4.3.3 Tariffs and import restrictions on ingredients

- 4.3.4 Counterfeit and low-quality products impacting brand integrity

- 4.4 Technology Outlook

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Functional Food

- 5.1.1.1 Cereals

- 5.1.1.2 Bakery and Confectionery

- 5.1.1.3 Dairy

- 5.1.1.4 Snacks

- 5.1.1.5 Other Functional Foods

- 5.1.2 Functional Beverage

- 5.1.2.1 Energy Drinks

- 5.1.2.2 Sports Drinks

- 5.1.2.3 Fortified Juice

- 5.1.2.4 Dairy and Dairy-Alternative Beverages

- 5.1.2.5 Other Functional Beverages

- 5.1.3 Dietary Supplements

- 5.1.3.1 Vitamins and Minerals

- 5.1.3.2 Botanicals

- 5.1.3.3 Enzymes

- 5.1.3.4 Fatty Acids

- 5.1.3.5 Proteins

- 5.1.3.6 Other Dietary Supplements

- 5.1.1 Functional Food

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets and Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Retail

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 General Mills Inc.

- 6.4.3 Nestle S.A.

- 6.4.4 Herbalife International of America, Inc.

- 6.4.5 Amway Corp.

- 6.4.6 Kellanova

- 6.4.7 The Nature's Bounty Co.

- 6.4.8 Pfizer Inc.

- 6.4.9 Abbott Laboratories

- 6.4.10 Red Bull GmbH

- 6.4.11 GNC Holdings LLC

- 6.4.12 Jamieson Wellness Inc.

- 6.4.13 NOW Health Group, Inc.

- 6.4.14 Church & Dwight Co., Inc. (Vitafusion)

- 6.4.15 Nature's Way Brands, LLC

- 6.4.16 Pharmavite LLC

- 6.4.17 Glanbia plc

- 6.4.18 Danone S.A.

- 6.4.19 DSM-Firmenich

- 6.4.20 BASF SE

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK