PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1924863

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1924863

Metamaterial Market by Product (Antenna, Reconfigurable Intelligent Surfaces, Lenses & Optical Modules, Sensors & Beam Steering, Anti-Reflective Films), Wave Steering, Electromagnetic, Terahertz, Application, and Region - Global Forecast to 2032

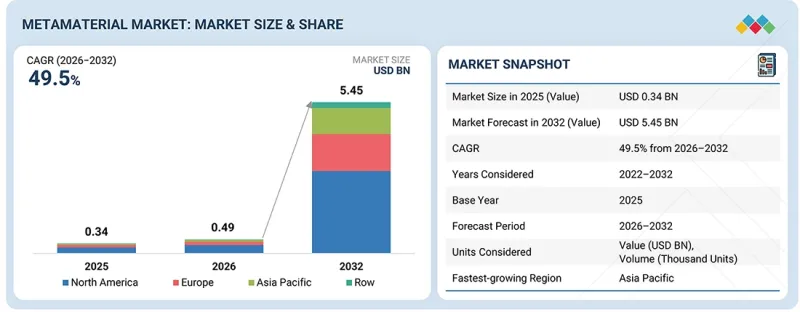

The global metamaterial market is projected to reach USD 5.45 billion by 2032, growing from USD 0.49 billion in 2026 at a CAGR of 49.5% during the forecast period. Market growth is fueled by rising demand for enhanced signal performance, miniaturization, and functional integration across the aerospace & defense, telecommunications, automotive, and consumer electronics industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2026-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

The increasing focus on high-frequency communications, satellite connectivity, radar systems, and autonomous platforms is further accelerating the adoption of metamaterial-based antennas, sensors, and beam steering solutions. Additionally, advancements in computational design, nanofabrication, and digitally controlled reconfigurable surfaces are enabling more efficient, tunable, and scalable metamaterial implementations. Growing investments in 5G and future wireless networks, space technologies, and advanced sensing infrastructure are further expanding commercialization opportunities, positioning metamaterials as a key enabler of next-generation electronic and photonic systems.

"The other end users segment is projected to grow at the highest CAGR during the forecast period."

By end user, the other end users segment is projected to achieve the highest CAGR during the forecast period. This growth is supported by increasing adoption of metamaterial-based solutions in smart infrastructure, industrial automation, and energy systems to improve signal control, structural monitoring, and electromagnetic interference management. Metamaterials are being integrated into industrial sensors, wireless communication modules, and shielding components to enhance performance, reliability, and operational efficiency in complex environments. Additionally, rising investments in smart cities, intelligent transportation systems, and digitally connected industrial facilities are accelerating deployment. Advancements in scalable manufacturing and system-level integration are further enabling adoption across large-scale infrastructure and industrial use cases, positioning this segment as a key growth contributor over the forecast period.

"The electromagnetic segment is projected to achieve a higher CAGR than the other types segment during the forecast period."

The electromagnetic segment is projected to grow at a higher CAGR than the other types segment during the forecast period. This growth is driven by increasing demand for advanced control of electromagnetic waves across high-frequency communication, radar, and sensing applications. Strong adoption in satellite communications, 5G and future wireless networks, automotive radar, and defense systems is accelerating deployment. These materials enable compact antenna designs, enhanced beam steering, reduced interference, and improved signal efficiency, addressing performance limitations of conventional materials. Additionally, advancements in reconfigurable and tunable electromagnetic metamaterials are expanding use cases across dynamic and software-defined systems. As industries increasingly prioritize miniaturization, performance optimization, and system-level integration, electromagnetic metamaterials are emerging as a key growth driver in the overall market.

"Asia Pacific is projected to register the highest growth in the metamaterial market between 2026 and 2030."

The Asia Pacific region is witnessing strong growth in the metamaterial market, driven by rapid digital transformation, expanding telecommunications infrastructure, and rising investments in defense modernization and semiconductor manufacturing. Countries such as China, Japan, South Korea, and India are leading adoption through large-scale deployment of 5G networks, satellite programs, automotive electronics, and advanced sensing technologies. The region's focus on smart infrastructure, autonomous mobility, and high-frequency electronics is accelerating demand for metamaterial-based antennas, radar components, and optical modules. Additionally, cost-effective manufacturing capabilities, strong electronics supply chains, and supportive government initiatives for advanced materials and next-generation connectivity are positioning Asia Pacific as one of the fastest-growing regions in the global metamaterial market.

Extensive primary interviews were conducted with key industry experts in the metamaterial market space to determine and verify the market size for various segments and subsegments gathered through secondary research.

The breakdown of primary participants for the report is shown below.

- By Company Type: Tier 1 - 20%, Tier 2 - 45%, Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 25%, Others - 40%

- By Region: Asia Pacific - 45%, Europe - 25%, North America - 20%, RoW - 10%

The metamaterial market is dominated by a few globally established players, such as Kymeta Corporation (US), PIVOTAL COMMWARE (US), Echodyne Corp. (US), Lumotive (US), and Radi-Cool, Inc. (US). The study includes an in-depth competitive analysis of these key players in the metamaterial market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the metamaterial market by type (Electromagnetic, other types), application (RF, optical, other applications), product [Antennas, radar, and reconfigurable intelligent surfaces (RIS); lenses & optical modules; sensors and beam steering modules; anti-reflective films; other products], end user (Aerospace & defense, automotive, telecommunication, consumer electronics, robotics, photovoltaics, healthcare, other end users)

The report discusses the market drivers, restraints, opportunities, and challenges, and provides a detailed view of the market across North America, Europe, Asia Pacific, and the Rest of the World. It includes a supply chain analysis of the key players and their competitive analysis in the metamaterial market ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Rising personnel and asset protection in the industrial sector, mandatory safety standards for equipment and machinery), restraints (Growing demand for enhanced wireless communication systems, advancements in optical metamaterials), opportunities (Expansion of renewable energy sector, advancements in thermal metamaterials), challenges (Scaling up production of metamaterials for mass markets, limited availability of resources)

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product launches in the metamaterial market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the metamaterial market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players, such as Kymeta Corporation (US), PIVOTAL COMMWARE (US), Echodyne Corp. (US), Lumotive (US), and Radi-Cool, Inc. (US), in the metamaterial market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METAMATERIAL MARKET

- 3.2 TYPE: METAMATERIAL MARKET (USD MILLION)

- 3.3 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET, BY REGION

- 3.4 APPLICATION: METAMATERIAL MARKET

- 3.5 METAMATERIAL MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growing demand for enhanced wireless communication systems

- 4.2.1.2 Advancements in optical metamaterials

- 4.2.1.3 Advancements in next-generation aerospace and defense technologies

- 4.2.2 RESTRAINTS

- 4.2.2.1 High production costs

- 4.2.2.2 Complex manufacturing processes

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expansion of renewable energy sector

- 4.2.3.2 Advancements in thermal metamaterials

- 4.2.3.3 Integration of nanotechnology with metamaterials

- 4.2.4 CHALLENGES

- 4.2.4.1 Scaling up production of metamaterials for mass markets

- 4.2.4.2 Limited availability of resources

- 4.2.4.3 Stringent regulatory hurdles

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.2.4 TRENDS IN CONSUMER ELECTRONICS INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF METAMATERIALS PROVIDED BY KEY PLAYERS, BY PRODUCT TYPE

- 5.5.2 AVERAGE SELLING PRICE TREND OF METAMATERIAL-BASED LENSES, BY REGION, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE OF METAMATERIAL-BASED LENSES, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 852910)

- 5.6.2 EXPORT SCENARIO (HS CODE 852910)

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 KYMETA ENABLES MOBILE SATELLITE CONNECTIVITY USING METAMATERIAL ANTENNAS

- 5.10.2 ECHODYNE ENABLES LOW-SWAP RADAR USING METAMATERIAL ELECTRONIC SCANNING ARRAYS

- 5.10.3 ALCAN SYSTEMS ADDRESSES MMWAVE 5G ROLLOUT CHALLENGES WITH LIQUID CRYSTAL SMART ANTENNAS

- 5.10.4 METALENZ ENABLES COMPACT OPTICAL SYSTEMS USING METASURFACE LENSES

- 5.10.5 PIVOTAL COMMUNICATIONS TRANSFORMS MMWAVE DEPLOYMENT WITH PIVOTAL TURNKEY

- 5.10.6 UNIVERSITY OF EXETER AND VIRGINIA TECH COLLABORATE TO HARNESS ACOUSTIC METAMATERIALS FOR ENHANCED NOISE CONTROL

- 5.11 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 REGULATORY LANDSCAPE

- 6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2 INDUSTRY STANDARDS

7 STRATEGIC DISRUPTION, PATENT, DIGITAL, AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 METASURFACES

- 7.1.2 PHOTONIC CRYSTALS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 ADVANCED NANOFABRICATION AND LITHOGRAPHY

- 7.2.2 AI-DRIVEN DESIGN AND SIMULATION

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.4 PATENT ANALYSIS

- 7.5 IMPACT OF AI/GEN AI ON METAMATERIAL MARKET

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

9 FUNCTIONALITIES OF METAMATERIALS

- 9.1 INTRODUCTION

- 9.2 WAVE STEERING

- 9.3 WAVE ABSORPTION

- 9.4 WAVE AMPLIFICATION

- 9.5 CLOAKING

- 9.6 ENERGY FOCUSING

- 9.7 FREQUENCY FILTERING

- 9.8 BEAM SHAPING

- 9.9 MULTI-FUNCTIONAL BEHAVIOR

10 FORM FACTORS OF METAMATERIALS

- 10.1 INTRODUCTION

- 10.2 THIN FILMS

- 10.3 BULK MATERIALS

11 FREQUENCY BAND OF METAMATERIAL

- 11.1 INTRODUCTION

- 11.2 TERAHERTZ

- 11.3 PHOTONIC (NEAR IR)

- 11.4 TUNABLE

- 11.5 PLASMONIC

12 STRUCTURAL DIMENSIONS OF METAMATERIALS

- 12.1 INTRODUCTION

- 12.2 2D METASURFACES

- 12.3 3D BULK METAMATERIALS

- 12.4 MULTI-LAYER ARCHITECTURES

- 12.5 GRADIENT INDEX METAMATERIALS

13 METAMATERIAL MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 RF

- 13.2.1 EXPANSION OF 5G, SATELLITE CONNECTIVITY, AND ADVANCED RADAR SYSTEMS TO DRIVE DOMINANCE

- 13.3 OPTICAL

- 13.3.1 GROWING ADOPTION OF COMPACT HIGH-PERFORMANCE IMAGING AND PHOTONIC SYSTEMS ACCELERATING OPTICAL METAMATERIALS USAGE

- 13.4 OTHER APPLICATIONS

14 METAMATERIAL MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.2 CONSUMER ELECTRONICS

- 14.2.1 ADVANCEMENTS TO ENHANCE PERFORMANCE AND ENERGY EFFICIENCY TO BOOST MARKET GROWTH

- 14.2.1.1 Smartphones

- 14.2.1.2 Laptops & tablets

- 14.2.1.3 Head-mounted displays

- 14.2.1 ADVANCEMENTS TO ENHANCE PERFORMANCE AND ENERGY EFFICIENCY TO BOOST MARKET GROWTH

- 14.3 AUTOMOTIVE

- 14.3.1 GROWTH OF AUTONOMOUS, CONNECTED, AND ELECTRIFIED VEHICLES TO FUEL METAMATERIAL ADOPTION

- 14.4 AEROSPACE & DEFENSE

- 14.4.1 INCREASING FOCUS ON STEALTH, ADVANCED SENSING, AND LIGHTWEIGHT PLATFORMS TO BOOST GROWTH

- 14.5 PHOTOVOLTAICS

- 14.5.1 INCREASING EMPHASIS ON SOLAR EFFICIENCY AND ADVANCED LIGHT MANAGEMENT TO FUEL ADOPTION

- 14.6 ROBOTICS

- 14.6.1 EXPANSION OF INTELLIGENT AUTOMATION AND PRECISION ROBOTICS TO DRIVE METAMATERIALS INTEGRATION IN ROBOTIC SYSTEMS

- 14.7 HEALTHCARE

- 14.7.1 HIGH DEMAND FOR ADVANCED IMAGING, DIAGNOSTICS, AND MINIATURIZED MEDICAL DEVICES TO DRIVE ADOPTION

- 14.8 TELECOMMUNICATION

- 14.8.1 RISING DEMAND FOR HIGH-CAPACITY DATA TRANSMISSION TO FUEL MARKET GROWTH

- 14.9 OTHER END USERS

- 14.9.1 GROWING DEMAND FOR ENERGY EFFICIENCY AND NOISE REDUCTION SOLUTIONS TO FUEL GROWTH

15 METAMATERIAL MARKET, BY PRODUCT

- 15.1 INTRODUCTION

- 15.2 ANTENNAS, RADAR, AND RECONFIGURABLE INTELLIGENT SURFACES (RIS)

- 15.2.1 DEMAND FOR ADVANCED WIRELESS CONNECTIVITY AND SMART RADIO ENVIRONMENTS TO DRIVE ADOPTION

- 15.2.2 ACTIVE

- 15.2.3 PASSIVE

- 15.2.4 HYBRID

- 15.3 LENSES & OPTICAL MODULES

- 15.3.1 DEMAND FOR COMPACT, HIGH-RESOLUTION IMAGING AND ADVANCED OPTICAL PERFORMANCE TO DRIVE GROWTH

- 15.4 SENSORS & BEAM STEERING MODULES

- 15.4.1 INCREASING DEMAND IN TELECOMMUNICATIONS TO BOOST MARKET GROWTH

- 15.5 ANTI-REFLECTIVE FILMS

- 15.5.1 ENHANCED OPTICAL EFFICIENCY AND ENERGY SAVINGS TO DRIVE GROWTH

- 15.6 OTHER PRODUCTS

- 15.6.1 RISING DEMAND FOR ADVANCED EMI SHIELDING AND WIRELESS POWER SOLUTIONS TO PROPEL MARKET GROWTH

- 15.6.1.1 Absorbers

- 15.6.1.2 Cloaking devices

- 15.6.1.3 Light and sound filters

- 15.6.1.4 Isolator and circulators

- 15.6.1.5 RF filters

- 15.6.1.6 Transmission lines

- 15.6.1.7 Wireless charging solutions

- 15.6.1 RISING DEMAND FOR ADVANCED EMI SHIELDING AND WIRELESS POWER SOLUTIONS TO PROPEL MARKET GROWTH

16 METAMATERIAL MARKET, BY TYPE

- 16.1 INTRODUCTION

- 16.2 ELECTROMAGNETIC

- 16.2.1 RISING DEMAND FOR 5G, ADVANCED RADAR, AND HIGH-RESOLUTION IMAGING TO DRIVE GROWTH

- 16.2.2 DOUBLE NEGATIVE

- 16.2.3 SINGLE NEGATIVE

- 16.2.4 ELECTRONIC BANDGAP

- 16.2.5 DOUBLE POSITIVE

- 16.2.6 BI-ISOTROPIC

- 16.2.7 CHIRAL

- 16.2.8 FREQUENCY SELECTIVE SURFACE-BASED

- 16.3 OTHER TYPES

- 16.3.1 THERMAL

- 16.3.1.1 Growing demand for advanced thermal control and energy efficiency to drive adoption

- 16.3.2 ELASTIC

- 16.3.2.1 Rising need for vibration control and structural resilience to fuel growth

- 16.3.3 ACOUSTIC

- 16.3.3.1 Increasing focus on noise reduction and advanced sound control to accelerate adoption

- 16.3.1 THERMAL

17 METAMATERIAL MARKET, BY REGION

- 17.1 INTRODUCTION

- 17.2 NORTH AMERICA

- 17.2.1 US

- 17.2.1.1 Defense modernization, advanced wireless infrastructure, and optical innovation driving metamaterials leadership

- 17.2.2 CANADA

- 17.2.2.1 Emphasis on advanced sensing, aerospace research, and wireless innovation to support metamaterials adoption

- 17.2.3 MEXICO

- 17.2.3.1 Electronics manufacturing growth and automotive integration to support gradual metamaterials adoption

- 17.2.1 US

- 17.3 EUROPE

- 17.3.1 GERMANY

- 17.3.1.1 Automotive innovation, industrial digitization, and radar systems to drive metamaterials adoption

- 17.3.2 UK

- 17.3.2.1 Defense research and wireless innovation support metamaterials commercialization

- 17.3.3 FRANCE

- 17.3.3.1 Aerospace leadership and smart connectivity initiatives driving metamaterials adoption

- 17.3.4 ITALY

- 17.3.4.1 Research-driven adoption in aerospace and photonics to support niche market growth

- 17.3.5 REST OF EUROPE

- 17.3.1 GERMANY

- 17.4 ASIA PACIFIC

- 17.4.1 CHINA

- 17.4.1.1 Large-scale 5g deployment and advanced manufacturing to drive market growth

- 17.4.2 JAPAN

- 17.4.2.1 Photonics leadership and precision electronics to drive metamaterials innovation

- 17.4.3 INDIA

- 17.4.3.1 Defense modernization and wireless research to support emerging metamaterials market

- 17.4.4 TAIWAN

- 17.4.4.1 Semiconductor and electronics manufacturing ecosystem enables metamaterials integration

- 17.4.5 SOUTH KOREA

- 17.4.5.1 Next-generation wireless and consumer electronics to drive metamaterials adoption

- 17.4.6 REST OF ASIA PACIFIC

- 17.4.1 CHINA

- 17.5 REST OF THE WORLD

- 17.5.1 MIDDLE EAST

- 17.5.1.1 Defense modernization, satellite communications, and advanced surveillance systems to drive adoption

- 17.5.2 AFRICA

- 17.5.2.1 Selective defense and security applications to support early-stage metamaterials adoption

- 17.5.3 SOUTH AMERICA

- 17.5.3.1 Telecommunications expansion, defense modernization, and infrastructure upgrades to drive market

- 17.5.1 MIDDLE EAST

18 COMPETITIVE LANDSCAPE

- 18.1 OVERVIEW

- 18.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 18.3 MARKET SHARE ANALYSIS, 2025

- 18.4 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 18.5 BRAND COMPARISON

- 18.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 18.6.1 STARS

- 18.6.2 EMERGING LEADERS

- 18.6.3 PERVASIVE PLAYERS

- 18.6.4 PARTICIPANTS

- 18.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 18.6.5.1 Company footprint

- 18.6.5.2 Region footprint

- 18.6.5.3 Application footprint

- 18.6.5.4 End user footprint

- 18.6.5.5 Product footprint

- 18.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 18.7.1 PROGRESSIVE COMPANIES

- 18.7.2 RESPONSIVE COMPANIES

- 18.7.3 DYNAMIC COMPANIES

- 18.7.4 STARTING BLOCKS

- 18.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 18.7.5.1 Detailed list of startups/SMEs

- 18.7.5.2 Competitive benchmarking of startups/SMEs

- 18.8 COMPETITIVE SCENARIO

- 18.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 18.8.2 DEALS

19 COMPANY PROFILES

- 19.1 KEY PLAYERS

- 19.1.1 KYMETA CORPORATION

- 19.1.1.1 Business overview

- 19.1.1.2 Products/Solutions/Services offered

- 19.1.1.3 Recent developments

- 19.1.1.3.1 Product launches

- 19.1.1.3.2 Deals

- 19.1.1.3.3 Other developments

- 19.1.1.4 MnM view

- 19.1.1.4.1 Right to win

- 19.1.1.4.2 Strategic choices

- 19.1.1.4.3 Weaknesses and competitive threats

- 19.1.2 PIVOTAL COMMWARE

- 19.1.2.1 Business overview

- 19.1.2.2 Products/Solutions/Services offered

- 19.1.2.3 Recent developments

- 19.1.2.3.1 Product launches

- 19.1.2.3.2 Deals

- 19.1.2.3.3 Other developments

- 19.1.2.4 MnM view

- 19.1.2.4.1 Right to win

- 19.1.2.4.2 Strategic choices

- 19.1.2.4.3 Weaknesses and competitive threats

- 19.1.3 ECHODYNE CORP.

- 19.1.3.1 Business overview

- 19.1.3.2 Products/Solutions/Services offered

- 19.1.3.3 Recent developments

- 19.1.3.3.1 Product launches

- 19.1.3.3.2 Deals

- 19.1.3.4 MnM view

- 19.1.3.4.1 Right to win

- 19.1.3.4.2 Strategic choices

- 19.1.3.4.3 Weaknesses and competitive threats

- 19.1.4 ALCAN SYSTEMS GMBH I.L.

- 19.1.4.1 Business overview

- 19.1.4.2 Products/Solutions/Services offered

- 19.1.4.3 Recent developments

- 19.1.4.3.1 Product launches

- 19.1.4.3.2 Deals

- 19.1.4.4 MnM view

- 19.1.4.4.1 Right to win

- 19.1.4.4.2 Strategic choices

- 19.1.4.4.3 Weaknesses and competitive threats

- 19.1.5 METALENZ, INC.

- 19.1.5.1 Business overview

- 19.1.5.2 Products/Solutions/Services offered

- 19.1.5.3 Recent developments

- 19.1.5.3.1 Product launches

- 19.1.5.3.2 Deals

- 19.1.5.4 MnM view

- 19.1.5.4.1 Right to win

- 19.1.5.4.2 Strategic choices

- 19.1.5.4.3 Weaknesses and competitive threats

- 19.1.6 GREENERWAVE

- 19.1.6.1 Business overview

- 19.1.6.2 Products/Solutions/Services offered

- 19.1.6.3 Recent developments

- 19.1.6.3.1 Product launches

- 19.1.6.3.2 Deals

- 19.1.7 EDGEHOG

- 19.1.7.1 Business overview

- 19.1.7.2 Products/Solutions/Services offered

- 19.1.8 METAMAGNETICS INC.

- 19.1.8.1 Business overview

- 19.1.8.2 Products/Solutions/Services offered

- 19.1.8.3 Recent developments

- 19.1.8.3.1 Product launches

- 19.1.8.3.2 Other developments

- 19.1.9 FRACTAL ANTENNA SYSTEMS, INC.

- 19.1.9.1 Business overview

- 19.1.9.2 Products/Solutions/Services offered

- 19.1.9.3 Recent developments

- 19.1.9.3.1 Expansions

- 19.1.10 LUMOTIVE

- 19.1.10.1 Business overview

- 19.1.10.2 Products/Solutions/Services offered

- 19.1.10.3 Recent developments

- 19.1.10.3.1 Product launches

- 19.1.10.3.2 Deals

- 19.1.11 TERAVIEW LIMITED

- 19.1.11.1 Business overview

- 19.1.11.2 Products/Solutions/Services offered

- 19.1.11.3 Recent developments

- 19.1.11.3.1 Product launches

- 19.1.1 KYMETA CORPORATION

- 19.2 OTHER PLAYERS

- 19.2.1 2PI INC.

- 19.2.2 MOXTEK, INC.

- 19.2.3 PLASMONICS INC.

- 19.2.4 SINTEC OPTRONICS PTE LTD.

- 19.2.5 PHONONIC VIBES S.R.L.

- 19.2.6 PHOEBUS OPTOELECTRONICS LLC

- 19.2.7 APPLIED METAMATERIALS

- 19.2.8 AMG

- 19.2.9 RADI-COOL SDN BHD

- 19.2.10 METABOARDS

- 19.2.11 JEM ENGINEERING

- 19.2.12 METASONIXX

- 19.2.13 THORLABS, INC.

- 19.2.14 HUAWEI TECHNOLOGIES CO., LTD.

- 19.2.15 NIL TECHNOLOGY

- 19.2.16 ZTE CORPORATION

- 19.2.17 METASHIELD LLC

20 RESEARCH METHODOLOGY

- 20.1 INTRODUCTION

- 20.2 RESEARCH DATA

- 20.2.1 SECONDARY DATA

- 20.2.1.1 List of major secondary sources

- 20.2.1.2 Key data from secondary sources

- 20.2.2 PRIMARY DATA

- 20.2.2.1 List of primary interview participants

- 20.2.2.2 Breakdown of primaries

- 20.2.2.3 Key data from primary sources

- 20.2.2.4 Key industry insights

- 20.2.1 SECONDARY DATA

- 20.3 FACTOR ANALYSIS

- 20.3.1 SUPPLY-SIDE ANALYSIS

- 20.3.2 DEMAND-SIDE ANALYSIS

- 20.4 MARKET SIZE ESTIMATION METHODOLOGY

- 20.4.1 BOTTOM-UP APPROACH

- 20.4.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 20.4.2 TOP-DOWN APPROACH

- 20.4.2.1 Approach to arrive at market size using top-down approach (supply side)

- 20.4.1 BOTTOM-UP APPROACH

- 20.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 20.6 RESEARCH ASSUMPTIONS

- 20.7 RESEARCH LIMITATIONS

- 20.8 RISK ANALYSIS

21 APPENDIX

- 21.1 INSIGHTS FROM INDUSTRY EXPERTS

- 21.2 DISCUSSION GUIDE

- 21.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 21.4 CUSTOMIZATION OPTIONS

- 21.5 RELATED REPORTS

- 21.6 AUTHOR DETAILS

List of Tables

- TABLE 1 METAMATERIAL MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 3 MARKET DYNAMICS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES: METAMATERIAL MARKET

- TABLE 5 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 6 ROLE OF COMPANIES IN METAMATERIAL ECOSYSTEM

- TABLE 7 PRICING RANGE OF METAMATERIAL PROVIDED BY KEY PLAYERS (USD), BY PRODUCT TYPE

- TABLE 8 AVERAGE SELLING PRICE TREND OF METAMATERIAL-BASED LENSES, BY REGION, 2021-2024 (USD)

- TABLE 9 IMPORT DATA FOR HS CODE 852910-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 852910-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 KEY CONFERENCES AND EVENTS, 2026

- TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 STANDARDS: METAMATERIALS

- TABLE 18 METAMATERIAL MARKET: TECHNOLOGY ROADMAP

- TABLE 19 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATION

- TABLE 21 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 22 UNMET NEEDS IN METAMATERIAL MARKET, BY APPLICATION

- TABLE 23 METAMATERIAL MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 24 METAMATERIAL MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 25 RF: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 26 RF: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 27 RF: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 28 RF: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 29 OPTICAL: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 30 OPTICAL: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 31 OPTICAL: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 32 OPTICAL: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 33 OTHER APPLICATIONS: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 34 OTHER APPLICATIONS: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 35 METAMATERIAL MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 36 METAMATERIAL MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 37 METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 38 METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 39 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (THOUSAND UNITS)

- TABLE 40 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (THOUSAND UNITS)

- TABLE 41 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 42 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 43 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 44 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 45 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 46 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 47 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 48 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 49 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR ROW, BY REGION, 2022-2025 (USD THOUSAND)

- TABLE 50 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET FOR ROW, BY REGION, 2026-2032 (USD THOUSAND)

- TABLE 51 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 52 ANTENNA, RADAR, AND RIS: METAMATERIAL MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 53 LENSES & OPTICAL MODULES: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 54 LENSES & OPTICAL MODULES: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 55 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 56 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 57 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 58 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 59 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 60 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 61 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR ROW, BY REGION, 2022-2025 (USD THOUSAND)

- TABLE 62 LENSES & OPTICAL MODULES: METAMATERIAL MARKET FOR ROW, BY REGION, 2026-2032 (USD THOUSAND)

- TABLE 63 LENSES & OPTICAL MODULES: METAMATERIAL MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 64 LENSES & OPTICAL MODULES: METAMATERIAL MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 65 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 66 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 67 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 68 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 69 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 70 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 71 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 72 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 73 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR ROW, BY REGION, 2022-2025 (USD THOUSAND)

- TABLE 74 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET FOR ROW, BY REGION, 2026-2032 (USD THOUSAND)

- TABLE 75 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 76 SENSORS & BEAM STEERING MODULES: METAMATERIAL MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 77 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 78 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 79 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 80 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 81 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 82 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 83 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 84 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 85 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR ROW, BY REGION, 2022-2025 (USD THOUSAND)

- TABLE 86 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET FOR ROW, BY REGION, 2026-2032 (USD THOUSAND)

- TABLE 87 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 88 ANTI-REFLECTIVE FILMS: METAMATERIAL MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 89 OTHER PRODUCTS: METAMATERIAL MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 90 OTHER PRODUCTS: METAMATERIAL MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 91 OTHER PRODUCTS: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 92 OTHER PRODUCTS: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 93 OTHER PRODUCTS: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 94 OTHER PRODUCTS: METAMATERIAL MARKET FOR NORTH AMERICA, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 95 OTHER PRODUCTS: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 96 OTHER PRODUCTS: METAMATERIAL MARKET FOR EUROPE, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 97 OTHER PRODUCTS: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022-2025 (USD THOUSAND)

- TABLE 98 OTHER PRODUCTS: METAMATERIAL MARKET FOR ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD THOUSAND)

- TABLE 99 OTHER PRODUCTS: METAMATERIAL MARKET FOR ROW, BY REGION, 2022-2025 (USD THOUSAND)

- TABLE 100 OTHER PRODUCTS: METAMATERIAL MARKET FOR ROW, BY REGION, 2026-2032 (USD THOUSAND)

- TABLE 101 OTHER PRODUCTS: METAMATERIAL MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 102 OTHER PRODUCTS: METAMATERIAL MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 103 METAMATERIAL MARKET, BY TYPE, 2022-2025 (USD MILLION)

- TABLE 104 METAMATERIAL MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 105 ELECTROMAGNETIC: METAMATERIAL MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 106 ELECTROMAGNETIC: METAMATERIAL MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 107 ELECTROMAGNETIC: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 108 ELECTROMAGNETIC: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 109 ELECTROMAGNETIC: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 110 ELECTROMAGNETIC: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 111 OTHER METAMATERIAL MARKET, BY TYPE, 2022-2025 (USD MILLION)

- TABLE 112 OTHER METAMATERIAL MARKET, BY TYPE, 2026-2032 (USD MILLION)

- TABLE 113 METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 114 METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 115 NORTH AMERICA: METAMATERIAL MARKET, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 116 NORTH AMERICA: METAMATERIAL MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 117 NORTH AMERICA: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 118 NORTH AMERICA: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 119 NORTH AMERICA: METAMATERIAL MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 120 NORTH AMERICA: METAMATERIAL MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 121 US: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 122 US: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 123 CANADA: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 124 CANADA: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 125 MEXICO: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 126 MEXICO: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 127 EUROPE: METAMATERIAL MARKET, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 128 EUROPE: METAMATERIAL MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 129 EUROPE: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 130 EUROPE: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 131 EUROPE: METAMATERIAL MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 132 EUROPE: METAMATERIAL MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 133 GERMANY: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 134 GERMANY: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 135 UK: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 136 UK: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 137 FRANCE: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 138 FRANCE: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 139 ITALY: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 140 ITALY: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 141 REST OF EUROPE: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 142 REST OF EUROPE: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 143 ASIA PACIFIC: METAMATERIAL MARKET, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 144 ASIA PACIFIC: METAMATERIAL MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 145 ASIA PACIFIC: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD MILLION)

- TABLE 146 ASIA PACIFIC: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD MILLION)

- TABLE 147 ASIA PACIFIC: METAMATERIAL MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 148 ASIA PACIFIC: METAMATERIAL MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 149 CHINA: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 150 CHINA: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 151 JAPAN: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 152 JAPAN: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 153 INDIA: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 154 INDIA: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 155 TAIWAN: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 156 TAIWAN: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 157 SOUTH KOREA: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 158 SOUTH KOREA: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 159 REST OF ASIA PACIFIC: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 160 REST OF ASIA PACIFIC: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 161 ROW: METAMATERIAL MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 162 ROW: METAMATERIAL MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 163 ROW: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 164 ROW: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 165 ROW: METAMATERIAL MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 166 ROW: METAMATERIAL MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 167 MIDDLE EAST: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 168 MIDDLE EAST: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 169 AFRICA: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 170 AFRICA: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 171 SOUTH AMERICA: METAMATERIAL MARKET, BY PRODUCT, 2022-2025 (USD THOUSAND)

- TABLE 172 SOUTH AMERICA: METAMATERIAL MARKET, BY PRODUCT, 2026-2032 (USD THOUSAND)

- TABLE 173 METAMATERIAL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 174 METAMATERIAL MARKET: DEGREE OF COMPETITION, 2024

- TABLE 175 METAMATERIAL MARKET: REGION FOOTPRINT

- TABLE 176 METAMATERIAL MARKET: APPLICATION FOOTPRINT

- TABLE 177 METAMATERIAL MARKET: END USER FOOTPRINT

- TABLE 178 METAMATERIAL MARKET: PRODUCT FOOTPRINT

- TABLE 179 METAMATERIAL MARKET: LIST OF STARTUPS/SMES

- TABLE 180 METAMATERIAL MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 181 METAMATERIAL MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-NOVEMBER 2025

- TABLE 182 METAMATERIAL MARKET: DEALS, JANUARY 2021-NOVEMBER 2025

- TABLE 183 KYMETA CORPORATION: COMPANY OVERVIEW

- TABLE 184 KYMETA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 KYMETA CORPORATION: PRODUCT LAUNCHES

- TABLE 186 KYMETA CORPORATION: DEALS

- TABLE 187 KYMETA CORPORATION: OTHER DEVELOPMENTS

- TABLE 188 PIVOTAL COMMWARE: COMPANY OVERVIEW

- TABLE 189 PIVOTAL COMMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 PIVOTAL COMMWARE: PRODUCT LAUNCHES

- TABLE 191 PIVOTAL COMMWARE: DEALS

- TABLE 192 PIVOTAL COMMWARE: OTHER DEVELOPMENTS

- TABLE 193 ECHODYNE CORP.: COMPANY OVERVIEW

- TABLE 194 ECHODYNE CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ECHODYNE CORP.: PRODUCT LAUNCHES

- TABLE 196 ECHODYNE CORP.: DEALS

- TABLE 197 ALCAN SYSTEMS GMBH I.L.: COMPANY OVERVIEW

- TABLE 198 ALCAN SYSTEMS GMBH I.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ALCAN SYSTEMS GMBH I.L.: PRODUCT LAUNCHES

- TABLE 200 ALCAN SYSTEMS GMBH I.L.: DEALS

- TABLE 201 METALENZ, INC.: COMPANY OVERVIEW

- TABLE 202 METALENZ, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 METALENZ, INC.: PRODUCT LAUNCHES

- TABLE 204 METALENZ, INC.: DEALS

- TABLE 205 GREENERWAVE: COMPANY OVERVIEW

- TABLE 206 GREENERWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 GREENERWAVE: PRODUCT LAUNCHES

- TABLE 208 GREENERWAVE: DEALS

- TABLE 209 EDGEHOG: COMPANY OVERVIEW

- TABLE 210 EDGEHOG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 METAMAGNETICS INC.: COMPANY OVERVIEW

- TABLE 212 METAMAGNETICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 METAMAGNETICS INC.: PRODUCT LAUNCHES

- TABLE 214 METAMAGNETICS INC.: OTHER DEVELOPMENTS

- TABLE 215 FRACTAL ANTENNA SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 216 FRACTAL ANTENNA SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 FRACTAL ANTENNA SYSTEMS, INC.: EXPANSIONS

- TABLE 218 LUMOTIVE: COMPANY OVERVIEW

- TABLE 219 LUMOTIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 LUMOTIVE: PRODUCT LAUNCHES

- TABLE 221 LUMOTIVE: DEALS

- TABLE 222 TERAVIEW LIMITED: COMPANY OVERVIEW

- TABLE 223 TERAVIEW LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 TERAVIEW LIMITED: PRODUCT LAUNCHES

- TABLE 225 2PI INC.: COMPANY OVERVIEW

- TABLE 226 MOXTEK, INC.: COMPANY OVERVIEW

- TABLE 227 PLASMONICS INC.: COMPANY OVERVIEW

- TABLE 228 SINTEC OPTRONICS PTE LTD.: COMPANY OVERVIEW

- TABLE 229 PHONONIC VIBES S.R.L.: COMPANY OVERVIEW

- TABLE 230 PHOEBUS OPTOELECTRONICS LLC: COMPANY OVERVIEW

- TABLE 231 APPLIED METAMATERIALS: COMPANY OVERVIEW

- TABLE 232 AMG: COMPANY OVERVIEW

- TABLE 233 RADI-COOL SDN BHD: COMPANY OVERVIEW

- TABLE 234 METABOARDS: COMPANY OVERVIEW

- TABLE 235 JEM ENGINEERING: COMPANY OVERVIEW

- TABLE 236 METASONIXX: COMPANY OVERVIEW

- TABLE 237 THORLABS, INC.: COMPANY OVERVIEW

- TABLE 238 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 239 NIL TECHNOLOGY: COMPANY OVERVIEW

- TABLE 240 ZTE CORPORATION: COMPANY OVERVIEW

- TABLE 241 METASHIELD LLC: COMPANY OVERVIEW

- TABLE 242 LIST OF MAJOR SECONDARY SOURCES

- TABLE 243 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 244 METAMATERIAL MARKET: RESEARCH ASSUMPTIONS

- TABLE 245 METAMATERIAL MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 METAMATERIAL MARKET SEGMENTATION

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 4 GLOBAL METAMATERIAL MARKET, 2026-2032

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN METAMATERIAL MARKET (2021-2025)

- FIGURE 6 DISRUPTIVE TRENDS IMPACTING GROWTH OF METAMATERIAL MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN METAMATERIAL MARKET, 2025

- FIGURE 8 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 RISING DEMAND FOR HIGH-PERFORMANCE METAMATERIAL-ENABLED SOLUTIONS ACROSS TELECOM, DEFENSE, AND ELECTRONICS TO DRIVE METAMATERIAL MARKET

- FIGURE 10 ELECTROMAGNETIC SEGMENT TO DOMINATE IN 2032

- FIGURE 11 NORTH AMERICAN ANTENNA, RADAR & RIS MARKET TO DOMINATE IN 2032

- FIGURE 12 OPTICAL SEGMENT TO ACCOUNTED FOR LARGEST SHARE IN 2032

- FIGURE 13 TAIWAN TO EXHIBIT HIGHEST CAGR IN METAMATERIAL MARKET DURING FORECAST PERIOD

- FIGURE 14 METAMATERIAL MARKET DYNAMICS

- FIGURE 15 GLOBAL 5G MOBILE SUBSCRIPTIONS, 2021-2030 (MILLION UNITS)

- FIGURE 16 IMPACT ANALYSIS OF DRIVERS ON METAMATERIAL MARKET

- FIGURE 17 IMPACT ANALYSIS OF RESTRAINTS ON METAMATERIAL MARKET

- FIGURE 18 IMPACT ANALYSIS OF OPPORTUNITIES ON METAMATERIAL MARKET

- FIGURE 19 IMPACT ANALYSIS OF CHALLENGES ON METAMATERIAL MARKET

- FIGURE 20 METAMATERIAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 METAMATERIAL ECOSYSTEM

- FIGURE 23 AVERAGE SELLING PRICE TREND OF METAMATERIAL-BASED LENSES, BY REGION, 2021-2024 (USD)

- FIGURE 24 IMPORT SCENARIO FOR HS CODE 852910-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 25 EXPORT SCENARIO FOR HS CODE 852910-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 26 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2020-2025

- FIGURE 28 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 29 METAMATERIAL MARKET DECISION-MAKING FACTORS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 32 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 33 RF APPLICATIONS TO DOMINATE METAMATERIAL MARKET IN 2026

- FIGURE 34 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET IN 2026

- FIGURE 35 ANTENNA, RADAR, AND RIS TO DOMINATE MARKET IN 2026

- FIGURE 36 ELECTROMAGNETIC TYPE TO CAPTURE LARGEST MARKET IN 2032

- FIGURE 37 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: METAMATERIAL MARKET SNAPSHOT

- FIGURE 39 EUROPE: METAMATERIAL MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: METAMATERIAL MARKET SNAPSHOT

- FIGURE 41 ROW: METAMATERIAL MARKET SNAPSHOT

- FIGURE 42 METAMATERIAL MARKET SHARE ANALYSIS, 2025

- FIGURE 43 COMPANY VALUATION, 2025

- FIGURE 44 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 45 BRAND COMPARISON

- FIGURE 46 METAMATERIAL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 47 METAMATERIAL MARKET: COMPANY FOOTPRINT

- FIGURE 48 METAMATERIAL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 49 METAMATERIAL MARKET: RESEARCH DESIGN

- FIGURE 50 METAMATERIAL MARKET: RESEARCH APPROACH

- FIGURE 51 KEY DATA FROM SECONDARY SOURCES

- FIGURE 52 BREAKDOWN OF PRIMARIES

- FIGURE 53 KEY DATA FROM PRIMARY SOURCES

- FIGURE 54 KEY INDUSTRY INSIGHTS

- FIGURE 55 REVENUE GENERATED FROM SALES OF METAMATERIALS

- FIGURE 56 METAMATERIAL MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 57 METAMATERIAL MARKET: BOTTOM-UP APPROACH

- FIGURE 58 METAMATERIAL MARKET: TOP-DOWN APPROACH

- FIGURE 59 METAMATERIAL MARKET: DATA TRIANGULATION