PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1927585

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1927585

Base Oil Market by Group, Application, and Region - Global Forecast to 2030

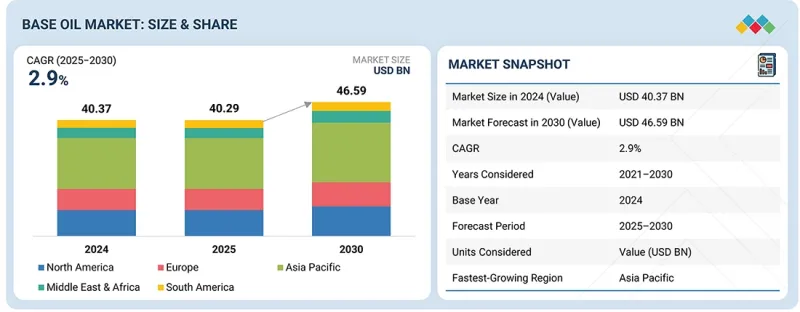

The base oil market is projected to grow from USD 40.29 billion in 2025 to USD 46.59 billion by 2030, at a CAGR of 2.9% during the forecast period. The market is primarily influenced by the increasing demand for lubricants across several sectors, including automotive, industrial, marine, and power generation. This has been further supported by rising vehicle ownership, industrial expansion, and infrastructure development, especially in the case of emerging economies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, Application, Group, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

The need for high-quality lubrication oils in vehicles and the strict need for adherence to strict emission limits also drives growth. Additionally, the base oil market is providing tremendous growth opportunities for oil manufacturers with the increasing production of premium cars, especially in Asia Pacific. This is further driving the demand for premium and synthetic oils and advanced refining technologies like hydrocracking and gas-to-liquids (GTL). Moreover, long-term growth opportunities offered by the market to manufacturers, because of upcoming base oil applications in the electric vehicle fluids sector, metalworking, and specialty industrial lubricants areas, are further driving the growth of the market.

"By group, the Group III segment is projected to grow at the highest rate, in terms of value, during the forecast period."

The Group III segment is projected to achieve the highest growth rate during the forecast period. This growth is mainly attributed to the rising quality of synthetic lubricants. Group III base oils are more costly because of their excellent viscosity index, very low sulfur content, and fine thermal and oxidative stability. These qualities make them the best fit for accomplishing very tough fuel economy and emission standards. Additionally, the rising adoption of modern engine technologies, oil drain intervals extension, and the popularity of high-performance automotive and industrial lubricants are further driving the growth of this segment. Moreover, advanced hydrocracking and isodewaxing capacity investments, especially in the Asia Pacific and the Middle East, are further driving the growth of the segment.

"By application, the automotive oil segment is projected to be the fastest-growing segment during the forecast period."

The automotive oil segment is projected to grow at the highest rate during the forecast period. This growth is owing to the rising global vehicle production and a gradually increasing vehicle parc. Other factors include rising demand for engine oils, transmission fluids, and gear oils, especially in passenger cars and commercial vehicles. Additionally, the need for stringent emission regulations and fuel efficiency standards is driving the transition to high-performance lubricants based on better-quality Group II, Group III, and synthetic base oils is being driven by the more. Moreover, the use of advanced engine technologies that include turbocharged, hybrid, and next-generation vehicles, along with the preference for longer oil drain intervals, is further contributing to the growth of the automotive oil segment quite vigorously.

"Asia Pacific is projected to grow at the highest rate during the forecast period."

Asia Pacific is projected to witness the fastest growth during the forecast period. This growth is mainly due to factors like rapid industrialization, urbanization, and a significant increase in the production of automobiles in countries like China, India, and Southeast Asia. The trend of increasing vehicle ownership, along with the need for highly efficient lubricants, is pushing the usage of higher-value Group II and Group III base oils. Besides, stricter emission rules, more refining capabilities, and continuous investments in state-of-the-art hydrocracking and isodewaxing technologies are all contributing to the upscale of base oils. Additionally, constant demand for base oils from the industrial, construction, and transport sectors is further spurring the growth of the base oil market in Asia Pacific.

Break-up of Primary Participants:

- By Company Type: Tier 1 - 45%, Tier 2 - 22%, and Tier 3 - 33%

- By Designation: C-Level Executives - 50%, Directors - 10%, and Others - 40%

- By Region: North America - 17%, Asia Pacific - 17%, Europe - 33%, Middle East & Africa - 25%, and South America - 8%

Leading players operating in the base oil market include Exxon Mobil Corporation (US), Saudi Arabian Oil Co. (Saudi Arabia), SK Enmove (South Korea), China Petrochemical Corporation (China), PetroChina Company Limited (China), and others. These key players are significant contributors to the base oil market. These players have adopted various strategies, including agreements, joint ventures, and expansions, to increase their market share and business revenue.

Research Coverage:

The report defines market segments and projects the size of the base oil market based on type, group, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as expansions, partnerships, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help market leaders/new entrants by providing them with the closest approximations of revenue numbers for the base oil market and its segments. This report is also expected to help stakeholders gain a deeper understanding of the market's competitive landscape, acquire valuable insights to enhance their business positions, and develop effective go-to-market strategies. It will also enable stakeholders to understand the market's pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of drivers (Rising demand for high-performance lubricants, rapid industrialization in Asia Pacific and emerging economies), restraints (Volatility in crude oil prices, declining demand for Group I base oil), opportunities (Growth in renewable and bio-based base oils, expansion of re-refining and closed-loop recycling infrastructure for used lubricants), and challenges (EV penetration reducing long-term lubricant consumption) influencing the growth of the base oil market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the base oil market

- Market Development: Comprehensive information about lucrative markets across regions

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the base oil market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players, including Chevron Corporation (US), Exxon Mobil Corporation (US), S-Oil Corporation (South Korea), Motiva Enterprises LLC (US), SK Enmove (South Korea), Saudi Arabian Oil Co. (Saudi Arabia), ENEOS (Japan), Shandong Qingyuan Group Co., Ltd. (China), Hindustan Petroleum Corporation Limited (India), Shell (UK), Avista Oil Deutschland GmbH (Germany), Nynas AB (Sweden), Repsol (Spain), Ergon, Inc. (US), Calumet, Inc. (US), China Petrochemical Corporation (China), ADNOC (UAE), Phillips 66 Company (US), PETRONAS Lubricants International (Malaysia), ORLEN (Poland), GS Caltex Corporation (South Korea), H&R Group (Germany), PetroChina Company Limited (China), PT Pertamina (Persero), FUCHS (Germany), and Baker Hughes Company (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BASE OIL MARKET

- 3.2 BASE OIL MARKET, BY GROUP AND REGION

- 3.3 BASE OIL MARKET, BY APPLICATION

- 3.4 BASE OIL MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand for high-performance lubricants

- 4.2.1.2 Rapid industrialization in Asia Pacific

- 4.2.2 RESTRAINTS

- 4.2.2.1 Declining demand for Group I base oil

- 4.2.2.2 Volatile crude oil prices

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expansion of re-refining and closed-loop recycling infrastructure

- 4.2.3.2 Growth in renewable and bio-based base oils

- 4.2.4 CHALLENGES

- 4.2.4.1 Electric vehicle penetration reducing long-term lubricant consumption

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN BASE OIL MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL BASE OIL INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & DEVELOPMENT

- 5.3.2 RAW MATERIAL

- 5.3.3 MANUFACTURING

- 5.3.4 DISTRIBUTION

- 5.3.5 END-USE INDUSTRIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF BASE OIL, BY REGION, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF BASE OIL, BY KEY PLAYERS, 2024

- 5.6 TRADE DATA

- 5.6.1 IMPORT SCENARIO (HS CODE 2709)

- 5.6.2 EXPORT SCENARIO (HS CODE 2709)

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 SHELL CASE STUDY: EGYPTIAN IRON AND STEEL COMPANY

- 5.10.1.1 Shell Lubricant Solutions collaborated with Egyptian Iron and Steel Company to deliver significant savings

- 5.10.2 NYNAS CASE STUDY: CARL BECHEM INDIA

- 5.10.2.1 Optimizing food-grade lubricant performance with Nynas' base oils

- 5.10.3 EXXONMOBIL CASE STUDY: DALIAN HILUBO LUBRICATING OIL COMPANY

- 5.10.3.1 Dalian Hilubo Lubricating Oil Company used ExxonMobil's formulation expertise and mPAO base stocks to succeed in China's wind industry

- 5.10.1 SHELL CASE STUDY: EGYPTIAN IRON AND STEEL COMPANY

- 5.11 IMPACT OF US 2025 TARIFFS ON BASE OIL MARKET

- 5.11.1 KEY TARIFF RATES IMPACTING MARKET

- 5.11.2 PRICE IMPACT ANALYSIS

- 5.11.3 IMPACT ON KEY COUNTRIES/REGIONS

- 5.11.3.1 US

- 5.11.3.2 Europe

- 5.11.3.3 Asia Pacific

- 5.11.4 IMPACT ON END-USE INDUSTRIES

- 5.11.4.1 Automotive

- 5.11.4.2 Industrial machinery and manufacturing

- 5.11.4.3 Marine

- 5.11.4.4 Aviation

- 5.11.4.5 Metalworking and process

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 SEPARATION PROCESS

- 6.1.1.1 Solvent Extraction

- 6.1.1.2 Dewaxing

- 6.1.1.3 Hydrofinishing

- 6.1.1 SEPARATION PROCESS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 CONVERSION PROCESS

- 6.2.1.1 Hydrocracking

- 6.2.1.2 Hydroisomerization

- 6.2.1.3 Hydrotreating

- 6.2.1 CONVERSION PROCESS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | PROCESS OPTIMIZATION & ENVIRONMENTAL COMPLIANCE

- 6.3.2 MID-TERM (2027-2030) | INNOVATION & SUSTAINABLE TRANSFORMATION

- 6.3.3 LONG-TERM (2030-2035+) | CIRCULARITY, DECARBONIZATION, AND NEW APPLICATIONS

- 6.4 PATENT ANALYSIS

- 6.4.1 METHODOLOGY

- 6.5 FUTURE APPLICATIONS

- 6.5.1 SMART & CONNECTED MACHINERY LUBRICANTS: AI-ENABLED PREDICTIVE MAINTENANCE

- 6.5.2 BIO-BASED & CARBON-NEUTRAL BASE OILS: SUSTAINABLE FEEDSTOCK TRANSITION

- 6.5.3 HIGH-PERFORMANCE ELECTRIC VEHICLE FLUIDS: ADVANCED COOLING & LUBRICATION FOR ELECTRIC MOBILITY

- 6.5.4 PRECISION MANUFACTURING & ROBOTICS LUBRICANTS: ULTRA-CLEAN, HIGH-PERFORMANCE OILS

- 6.5.5 CIRCULAR RE-REFINING SYSTEMS: CLOSED-LOOP SUSTAINABILITY IN LUBRICANTS

- 6.6 IMPACT OF GENERATIVE AI ON BASE OIL MARKET

- 6.6.1 INTRODUCTION

- 6.6.1.1 Operational efficiency and cost structure optimization

- 6.6.1.1.1 Refinery and base oil production optimization

- 6.6.1.1.2 Predictive maintenance and asset management

- 6.6.1.1.3 Supply chain, logistics, and demand forecasting

- 6.6.1.2 Digital simulation and scenario planning

- 6.6.1.3 Innovation in formulation and product development

- 6.6.1.4 Market analytics, pricing intelligence, and commercial strategy

- 6.6.1.5 Challenges and adoption barriers

- 6.6.1.1 Operational efficiency and cost structure optimization

- 6.6.1 INTRODUCTION

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF BASE OIL

- 7.2.1.1 Carbon impact reduction

- 7.2.1.2 Eco-applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF BASE OIL

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 BASE OIL MARKET, BY GROUP

- 9.1 INTRODUCTION

- 9.2 GROUP I

- 9.2.1 HIGH SULFUR CONTENT TO AFFECT DEMAND

- 9.3 GROUP II

- 9.3.1 RISING DEMAND FOR CLEANER AND COST-EFFICIENT LUBRICANTS TO DRIVE DEMAND

- 9.4 GROUP III

- 9.4.1 SHIFT TOWARD FUEL-EFFICIENT AND LOW-VISCOSITY LUBRICANTS TO DRIVE DEMAND

- 9.5 GROUP IV

- 9.5.1 HIGH VISCOSITY INDEX AND EXTREME TEMPERATURE PERFORMANCE TO DRIVE DEMAND

- 9.6 GROUP V

- 9.6.1 INCREASING USE OF SPECIALTY AND BIO-BASED FORMULATIONS TO DRIVE DEMAND

10 BASE OIL MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE OIL

- 10.2.1 INCREASING PRODUCTION OF VEHICLES IN EMERGING ECONOMIES TO DRIVE DEMAND

- 10.3 INDUSTRIAL OIL

- 10.3.1 GROWING ELECTRICITY GENERATION CAPACITY TO DRIVE DEMAND FOR TURBINE AND TRANSFORMER OILS

- 10.4 METALWORKING FLUID

- 10.4.1 GROWING METAL & MINING INDUSTRY TO DRIVE DEMAND

- 10.5 HYDRAULIC OIL

- 10.5.1 RAPID URBANIZATION AND LARGE-SCALE INFRASTRUCTURE PROJECTS ACROSS REGIONS TO DRIVE DEMAND

- 10.6 GREASE

- 10.6.1 APPLICATIONS WHERE LONG SERVICE LIFE, RESISTANCE TO WASHOUT, AND PROTECTION UNDER HIGH LOADS ARE CRITICAL TO DRIVE DEMAND

- 10.7 OTHERS

11 BASE OIL MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 MINERAL OIL

- 11.3 SYNTHETIC OIL

- 11.4 BIO-BASED OIL

12 BASE OIL MARKET, BY SALES CHANNEL

- 12.1 INTRODUCTION

- 12.2 OEM

- 12.3 AFTERMARKET

13 RE-REFINED BASE OIL MARKET

- 13.1 INTRODUCTION

- 13.2 TECHNOLOGY FOR RE-REFINED BASE OIL

- 13.3 ANALYSIS

- 13.3.1 GLOBAL

- 13.3.2 NORTH AMERICA

- 13.3.3 EUROPE

14 BASE OIL MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 CHINA

- 14.2.1.1 Strong automobile production, expanding industrial base, and large-scale infrastructure development to drive growth

- 14.2.2 JAPAN

- 14.2.2.1 Growing demand from automotive sector to drive growth

- 14.2.3 INDIA

- 14.2.3.1 Growth in steel production, metal fabrication, and heavy engineering to drive growth

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Investments in high-value manufacturing and export-oriented industries to drive growth

- 14.2.5 INDONESIA

- 14.2.5.1 Growth in mining, construction, and metal processing industries to fuel demand

- 14.2.6 THAILAND

- 14.2.6.1 Export-oriented manufacturing base to drive growth

- 14.2.7 REST OF ASIA PACIFIC

- 14.2.1 CHINA

- 14.3 EUROPE

- 14.3.1 RUSSIA

- 14.3.1.1 Resilient demand and integrated refining strength to drive market

- 14.3.2 GERMANY

- 14.3.2.1 Advanced refining, sustainability focus, and industrial strength to drive market

- 14.3.3 FRANCE

- 14.3.3.1 Regulatory alignment, industrial demand, and quality shift to boost market

- 14.3.4 ITALY

- 14.3.4.1 Industrial demand, import dependence, and sustainability trends to drive market

- 14.3.5 UK

- 14.3.5.1 Well-established lubricant blending and distribution network to drive market

- 14.3.6 SPAIN

- 14.3.6.1 Growth of lubricant consumption to drive market

- 14.3.7 REST OF EUROPE

- 14.3.1 RUSSIA

- 14.4 NORTH AMERICA

- 14.4.1 US

- 14.4.1.1 Strong demand from automotive and industrial lubricant applications to propel demand

- 14.4.2 CANADA

- 14.4.2.1 Expansion of manufacturing and industrial sectors to drive market

- 14.4.3 MEXICO

- 14.4.3.1 Expanding manufacturing activity to drive demand

- 14.4.1 US

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.5.1.1 Saudi Arabia

- 14.5.1.1.1 Focus on higher-performance and synthetic lubricants to drive growth

- 14.5.1.2 Rest of GCC

- 14.5.1.1 Saudi Arabia

- 14.5.2 TURKEY

- 14.5.2.1 Growth in construction, logistics, and energy-related activities to drive demand

- 14.5.3 IRAN

- 14.5.3.1 Growing activity across oil & gas, construction, and mining industries to drive demand

- 14.5.4 REST OF MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.6 SOUTH AMERICA

- 14.6.1 BRAZIL

- 14.6.1.1 Import-driven supply and automotive sector growth to drive market

- 14.6.2 COLOMBIA

- 14.6.2.1 Growth in industrial applications, including hydraulic fluids, metalworking oils, to drive demand

- 14.6.3 ARGENTINA

- 14.6.3.1 Growth of automotive and industrial activity and upgrades in lubricant quality to drive market

- 14.6.4 REST OF SOUTH AMERICA

- 14.6.1 BRAZIL

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS, 2024

- 15.3.1 KEY PLAYERS' REVENUE ANALYSIS

- 15.4 MARKET RANKING AND MARKET SHARE ANALYSIS, 2024

- 15.4.1 RANKING OF KEY MARKET PLAYERS

- 15.4.2 MARKET SHARE ANALYSIS

- 15.5 BRAND/PRODUCT COMPARISON

- 15.5.1 CHEVRON CORPORATION

- 15.5.2 EXXONMOBIL

- 15.5.3 SAUDI ARABIAN OIL CO. (SAUDI ARAMCO)

- 15.5.4 CHINA PETROCHEMICAL CORPORATION (SINOPEC)

- 15.5.5 PETROCHINA COMPANY LIMITED

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.8 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.8.1 COMPANY FOOTPRINT

- 15.8.2 REGION FOOTPRINT

- 15.8.3 TYPE FOOTPRINT

- 15.8.4 GROUP FOOTPRINT

- 15.8.5 APPLICATION FOOTPRINT

- 15.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.9.1 PROGRESSIVE COMPANIES

- 15.9.2 RESPONSIVE COMPANIES

- 15.9.3 DYNAMIC COMPANIES

- 15.9.4 STARTING BLOCKS

- 15.10 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.10.1 LIST OF KEY STARTUPS/SMES

- 15.10.2 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 15.11 COMPETITIVE SCENARIO

- 15.11.1 DEALS

16 COMPANY PROFILES

- 16.1 MAJOR PLAYERS

- 16.1.1 CHEVRON CORPORATION

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 EXXONMOBIL

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 S-OIL CORPORATION

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 MnM view

- 16.1.3.3.1 Right to win

- 16.1.3.3.2 Strategic choices

- 16.1.3.3.3 Weaknesses and competitive threats

- 16.1.4 MOTIVA ENTERPRISES LLC

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 MnM view

- 16.1.4.3.1 Right to win

- 16.1.4.3.2 Strategic choices

- 16.1.4.3.3 Weaknesses and competitive threats

- 16.1.5 SK ENMOVE

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 MnM view

- 16.1.5.3.1 Right to win

- 16.1.5.3.2 Strategic choices

- 16.1.5.3.3 Weaknesses and competitive threats

- 16.1.6 SAUDI ARABIAN OIL CO.

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.7 ENEOS

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.8 SHANDONG QINGYUAN GROUP CO., LTD.

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.9 HINDUSTAN PETROLEUM CORPORATION LIMITED

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.10 SHELL

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.11 AVISTA OIL DEUTSCHLAND GMBH

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.12 NYNAS AB

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.13 REPSOL

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.14 ERGON, INC.

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Deals

- 16.1.15 CALUMET, INC.

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.16 CHINA PETROCHEMICAL CORPORATION/SINOPEC GROUP

- 16.1.16.1 Business overview

- 16.1.16.2 Products offered

- 16.1.17 ADNOC

- 16.1.17.1 Business overview

- 16.1.17.2 Products offered

- 16.1.18 PHILLIPS 66 COMPANY

- 16.1.18.1 Business overview

- 16.1.18.2 Products offered

- 16.1.19 PETRONAS LUBRICANTS INTERNATIONAL

- 16.1.19.1 Business overview

- 16.1.19.2 Products offered

- 16.1.20 ORLEN

- 16.1.20.1 Business overview

- 16.1.20.2 Products offered

- 16.1.21 GS CALTEX CORPORATION

- 16.1.21.1 Business overview

- 16.1.21.2 Products offered

- 16.1.22 H&R GROUP

- 16.1.22.1 Business overview

- 16.1.22.2 Products offered

- 16.1.23 PETROCHINA COMPANY LIMITED

- 16.1.23.1 Business overview

- 16.1.23.2 Products offered

- 16.1.24 PT PERTAMINA (PERSERO)

- 16.1.24.1 Business overview

- 16.1.24.2 Products offered

- 16.1.25 FUCHS

- 16.1.25.1 Business overview

- 16.1.25.2 Products offered

- 16.1.26 BAKER HUGHES COMPANY

- 16.1.26.1 Business overview

- 16.1.26.2 Products offered

- 16.1.1 CHEVRON CORPORATION

- 16.2 OTHER PLAYERS

- 16.2.1 FORMOSA PETROCHEMICAL CORPORATION

- 16.2.2 HF SINCLAIR CORPORATION

- 16.2.3 PBF ENERGY

- 16.2.4 ROSNEFT

- 16.2.5 TUPRAS

- 16.2.6 CROSS OIL

- 16.2.7 ENILIVE S.P.A.

- 16.2.8 HAINAN HANDI SUNSHINE PETROCHEMICAL CO., LTD.

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 List of key secondary sources

- 17.1.1.2 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 List of primary interview participants (demand and supply sides)

- 17.1.2.3 Key industry insights

- 17.1.2.4 Breakdown of interviews with experts

- 17.1.1 SECONDARY DATA

- 17.2 DEMAND-SIDE ANALYSIS

- 17.3 MARKET SIZE ESTIMATION

- 17.3.1 BOTTOM-UP APPROACH

- 17.3.2 TOP-DOWN APPROACH

- 17.3.3 SUPPLY-SIDE ANALYSIS OF BASE OIL MARKET

- 17.3.3.1 Calculations for supply-side analysis

- 17.4 GROWTH FORECAST

- 17.5 DATA TRIANGULATION

- 17.6 FACTOR ANALYSIS

- 17.7 RESEARCH ASSUMPTIONS

- 17.8 RESEARCH LIMITATIONS

- 17.9 RISK ASSESSMENT

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

List of Tables

- TABLE 1 BASE OIL MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRIES, 2022-2024 (%)

- TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRIES, 2022-2024 (%)

- TABLE 4 INFLATION RATE, AVERAGE CONSUMER PRICES, BY KEY COUNTRIES, 2022-2024 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 VS. 2023 (USD BILLION)

- TABLE 6 BASE OIL MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 AVERAGE SELLING PRICE OF BASE OIL, BY REGION, 2022-2024 (USD/TON)

- TABLE 8 AVERAGE SELLING PRICE OF BASE OIL, BY KEY PLAYERS, 2024 (USD/TON)

- TABLE 9 IMPORT DATA FOR HS CODE 2709 PETROLEUM OILS AND OILS OBTAINED FROM BITUMINOUS MINERALS, CRUDE, BY KEY COUNTRIES, 2021-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 2709 PETROLEUM OILS AND OILS OBTAINED FROM BITUMINOUS MINERALS, CRUDE, BY KEY COUNTRIES, 2021-2024 (USD THOUSAND)

- TABLE 11 BASE OIL MARKET: KEY CONFERENCES AND EVENTS, 2026

- TABLE 12 BASE OIL MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 GLOBAL STANDARDS IN BASE OIL MARKET

- TABLE 17 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN BASE OIL MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 19 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 20 BASE OIL MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES

- TABLE 21 BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 22 BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 23 BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 24 BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 25 GROUP I: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 26 GROUP I: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 27 GROUP I: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 GROUP I: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 GROUP II: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 30 GROUP II: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 31 GROUP II: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 GROUP II: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 GROUP III: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 34 GROUP III: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 35 GROUP III: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 GROUP III: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 GROUP IV: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 38 GROUP IV: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 39 GROUP IV: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 GROUP IV: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 GROUP V: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 42 GROUP V: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 43 GROUP V: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 GROUP V: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 46 BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 47 BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 48 BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 AUTOMOTIVE OIL: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 50 AUTOMOTIVE OIL: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 51 AUTOMOTIVE OIL: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 AUTOMOTIVE OIL: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 INDUSTRIAL OIL: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 54 INDUSTRIAL OIL: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 55 INDUSTRIAL OIL: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 INDUSTRIAL OIL: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 METALWORKING FLUID: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 58 METALWORKING FLUID: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 59 METALWORKING FLUID: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 METALWORKING FLUID: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 HYDRAULIC OIL: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 62 HYDRAULIC OIL: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 63 HYDRAULIC OIL: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 HYDRAULIC OIL: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 GREASE: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 66 GREASE: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 67 GREASE: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 GREASE: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 OTHERS: BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 70 OTHERS: BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 71 OTHERS: BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OTHERS: BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 BASE OIL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 74 BASE OIL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 75 BASE OIL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 BASE OIL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 78 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 79 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 82 ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 83 ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 86 ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 87 ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 88 ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 CHINA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 90 CHINA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 91 CHINA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 92 CHINA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 93 CHINA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 94 CHINA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 95 CHINA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 96 CHINA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 JAPAN: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 98 JAPAN: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 99 JAPAN: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 100 JAPAN: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 101 JAPAN: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 102 JAPAN: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 103 JAPAN: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 JAPAN: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 INDIA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 106 INDIA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 107 INDIA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 108 INDIA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 109 INDIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 110 INDIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 111 INDIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 112 INDIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 SOUTH KOREA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 114 SOUTH KOREA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 115 SOUTH KOREA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 116 SOUTH KOREA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 117 SOUTH KOREA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 118 SOUTH KOREA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 119 SOUTH KOREA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 SOUTH KOREA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 INDONESIA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 122 INDONESIA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 123 INDONESIA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 124 INDONESIA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 125 INDONESIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 126 INDONESIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 127 INDONESIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 INDONESIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 THAILAND: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 130 THAILAND: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 131 THAILAND: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 132 THAILAND: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 133 THAILAND: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 134 THAILAND: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 135 THAILAND: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 THAILAND: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 138 REST OF ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 139 REST OF ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 142 REST OF ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 143 REST OF ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: BASE OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 146 EUROPE: BASE OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 147 EUROPE: BASE OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 EUROPE: BASE OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 EUROPE: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 150 EUROPE: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 151 EUROPE: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 152 EUROPE: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 153 EUROPE: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 154 EUROPE: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 155 EUROPE: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 EUROPE: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 RUSSIA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 158 RUSSIA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 159 RUSSIA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 160 RUSSIA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 161 RUSSIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 162 RUSSIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 163 RUSSIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 164 RUSSIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 GERMANY: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 166 GERMANY: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 167 GERMANY: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 168 GERMANY: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 169 GERMANY: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 170 GERMANY: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 171 GERMANY: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 172 GERMANY: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 FRANCE: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 174 FRANCE: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 175 FRANCE: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 176 FRANCE: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 177 FRANCE: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 178 FRANCE: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 179 FRANCE: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 180 FRANCE: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 ITALY: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 182 ITALY: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 183 ITALY: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 184 ITALY: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 185 ITALY: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 186 ITALY: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 187 ITALY: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 188 ITALY: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 UK: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 190 UK: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 191 UK: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 192 UK: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 193 UK: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 194 UK: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 195 UK: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 196 UK: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 SPAIN: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 198 SPAIN: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 199 SPAIN: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 200 SPAIN: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 201 SPAIN: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 202 SPAIN: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 203 SPAIN: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 204 SPAIN: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 REST OF EUROPE: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 206 REST OF EUROPE: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 207 REST OF EUROPE: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 208 REST OF EUROPE: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 209 REST OF EUROPE: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 210 REST OF EUROPE: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 211 REST OF EUROPE: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 212 REST OF EUROPE: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 213 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 214 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 215 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 216 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 217 NORTH AMERICA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 218 NORTH AMERICA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 219 NORTH AMERICA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 220 NORTH AMERICA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 221 NORTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 222 NORTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 223 NORTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 224 NORTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 225 US: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 226 US: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 227 US: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 228 US: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 229 US: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 230 US: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 231 US: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 232 US: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 CANADA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 234 CANADA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 235 CANADA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 236 CANADA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 237 CANADA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 238 CANADA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 239 CANADA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 240 CANADA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 241 MEXICO: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 242 MEXICO: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 243 MEXICO: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 244 MEXICO: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 245 MEXICO: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 246 MEXICO: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 247 MEXICO: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 248 MEXICO: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 250 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 251 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 254 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 255 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 258 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 259 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 261 SAUDI ARABIA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 262 SAUDI ARABIA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 263 SAUDI ARABIA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 264 SAUDI ARABIA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 265 SAUDI ARABIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 266 SAUDI ARABIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 267 SAUDI ARABIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 268 SAUDI ARABIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 269 REST OF GCC: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 270 REST OF GCC: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 271 REST OF GCC: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 272 REST OF GCC: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 273 REST OF GCC: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 274 REST OF GCC: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 275 REST OF GCC: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 276 REST OF GCC: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 277 TURKEY: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 278 TURKEY: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 279 TURKEY: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 280 TURKEY: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 281 TURKEY: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 282 TURKEY: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 283 TURKEY: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 284 TURKEY: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 285 IRAN: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 286 IRAN: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 287 IRAN: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 288 IRAN: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 289 IRAN: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 290 IRAN: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 291 IRAN: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 292 IRAN: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 297 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 298 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 299 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 300 REST OF MIDDLE EAST & AFRICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 301 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 302 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 303 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 304 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 305 SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 306 SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 307 SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 308 SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 309 SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 310 SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 311 SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 312 SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 313 BRAZIL: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 314 BRAZIL: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 315 BRAZIL: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 316 BRAZIL: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 317 BRAZIL: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 318 BRAZIL: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 319 BRAZIL: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 320 BRAZIL: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 321 COLOMBIA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 322 COLOMBIA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 323 COLOMBIA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 324 COLOMBIA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 325 COLOMBIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 326 COLOMBIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 327 COLOMBIA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 328 COLOMBIA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 329 ARGENTINA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 330 ARGENTINA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 331 ARGENTINA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 332 ARGENTINA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 333 ARGENTINA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 334 ARGENTINA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 335 ARGENTINA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 336 ARGENTINA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 337 REST OF SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2021-2024 (KILOTON)

- TABLE 338 REST OF SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2025-2030 (KILOTON)

- TABLE 339 REST OF SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2021-2024 (USD MILLION)

- TABLE 340 REST OF SOUTH AMERICA: BASE OIL MARKET, BY GROUP, 2025-2030 (USD MILLION)

- TABLE 341 REST OF SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 342 REST OF SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 343 REST OF SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 344 REST OF SOUTH AMERICA: BASE OIL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 345 BASE OIL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 346 BASE OIL MARKET: DEGREE OF COMPETITION, 2024

- TABLE 347 BASE OIL MARKET: REGION FOOTPRINT

- TABLE 348 BASE OIL MARKET: TYPE FOOTPRINT

- TABLE 349 BASE OIL MARKET: GROUP FOOTPRINT

- TABLE 350 BASE OIL MARKET: APPLICATION FOOTPRINT

- TABLE 351 BASE OIL MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 352 BASE OIL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 353 BASE OIL MARKET: DEALS, JANUARY 2020-DECEMBER 2025

- TABLE 354 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 355 CHEVRON CORPORATION: PRODUCTS OFFERED

- TABLE 356 CHEVRON CORPORATION: DEALS

- TABLE 357 EXXONMOBIL: COMPANY OVERVIEW

- TABLE 358 EXXONMOBIL: PRODUCTS OFFERED

- TABLE 359 EXXONMOBIL: DEALS

- TABLE 360 S-OIL CORPORATION: COMPANY OVERVIEW

- TABLE 361 S-OIL CORPORATION: PRODUCTS OFFERED

- TABLE 362 MOTIVA ENTERPRISES LLC: COMPANY OVERVIEW

- TABLE 363 MOTIVA ENTERPRISES LLC: PRODUCTS OFFERED

- TABLE 364 SK ENMOVE: COMPANY OVERVIEW

- TABLE 365 SK ENMOVE: PRODUCTS OFFERED

- TABLE 366 SAUDI ARABIAN OIL CO.: COMPANY OVERVIEW

- TABLE 367 SAUDI ARABIAN OIL CO.: PRODUCTS OFFERED

- TABLE 368 SAUDI ARABIAN OIL CO.: DEALS

- TABLE 369 ENEOS: COMPANY OVERVIEW

- TABLE 370 ENEOS: PRODUCTS OFFERED

- TABLE 371 SHANDONG QINGYUAN GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 372 SHANDONG QINGYUAN GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 373 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 374 HINDUSTAN PETROLEUM CORPORATION LIMITED: PRODUCTS OFFERED

- TABLE 375 SHELL: COMPANY OVERVIEW

- TABLE 376 SHELL: PRODUCTS OFFERED

- TABLE 377 AVISTA OIL DEUTSCHLAND GMBH: COMPANY OVERVIEW

- TABLE 378 AVISTA OIL DEUTSCHLAND GMBH: PRODUCTS OFFERED

- TABLE 379 NYNAS AB: COMPANY OVERVIEW

- TABLE 380 NYNAS AB: PRODUCTS OFFERED

- TABLE 381 REPSOL: COMPANY OVERVIEW

- TABLE 382 REPSOL: PRODUCTS OFFERED

- TABLE 383 ERGON, INC.: COMPANY OVERVIEW

- TABLE 384 ERGON, INC.: PRODUCTS OFFERED

- TABLE 385 ERGON, INC.: DEALS

- TABLE 386 CALUMET, INC.: COMPANY OVERVIEW

- TABLE 387 CALUMET, INC.: PRODUCTS OFFERED

- TABLE 388 CHINA PETROCHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 389 CHINA PETROCHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 390 ADNOC: COMPANY OVERVIEW

- TABLE 391 ADNOC: PRODUCTS OFFERED

- TABLE 392 PHILLIPS 66 COMPANY: COMPANY OVERVIEW

- TABLE 393 PHILLIPS 66 COMPANY: PRODUCTS OFFERED

- TABLE 394 PETRONAS LUBRICANTS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 395 PETRONAS LUBRICANTS INTERNATIONAL: PRODUCTS OFFERED

- TABLE 396 ORLEN: COMPANY OVERVIEW

- TABLE 397 ORLEN: PRODUCTS OFFERED

- TABLE 398 GS CALTEX CORPORATION: COMPANY OVERVIEW

- TABLE 399 GS CALTEX CORPORATION: PRODUCTS OFFERED

- TABLE 400 H&R GROUP: COMPANY OVERVIEW

- TABLE 401 H&R GROUP: PRODUCTS OFFERED

- TABLE 402 PETROCHINA COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 403 PETROCHINA COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 404 PT PERTAMINA (PERSERO): COMPANY OVERVIEW

- TABLE 405 PT PERTAMINA (PERSERO): PRODUCTS OFFERED

- TABLE 406 FUCHS: COMPANY OVERVIEW

- TABLE 407 FUCHS: PRODUCTS OFFERED

- TABLE 408 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 409 BAKER HUGHES COMPANY: PRODUCTS OFFERED

- TABLE 410 FORMOSA PETROCHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 411 HF SINCLAIR CORPORATION: COMPANY OVERVIEW

- TABLE 412 PBF ENERGY: COMPANY OVERVIEW

- TABLE 413 ROSNEFT: COMPANY OVERVIEW

- TABLE 414 TUPRAS: COMPANY OVERVIEW

- TABLE 415 CROSS OIL: COMPANY OVERVIEW

- TABLE 416 ENILIVE S.P.A.: COMPANY OVERVIEW

- TABLE 417 HAINAN HANDI SUNSHINE PETROCHEMICAL CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BASE OIL MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL BASE OIL MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN BASE OIL MARKET (2020-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF BASE OIL MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN BASE OIL MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 HIGH DEMAND IN AUTOMOTIVE OIL APPLICATION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 9 GROUP II AND ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARES IN 2024

- FIGURE 10 AUTOMOTIVE OIL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 MEXICO TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 BASE OIL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 CRUDE OIL FIRST PURCHASE PRICES, 2011-2024

- FIGURE 14 BASE OIL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 BASE OIL MARKET: VALUE CHAIN ANALYSIS

- FIGURE 16 BASE OIL MARKET: ECOSYSTEM MAPPING

- FIGURE 17 AVERAGE SELLING PRICE TREND OF BASE OIL, BY REGION, 2022-2024 (USD/TON)

- FIGURE 18 AVERAGE SELLING PRICE TREND OF BASE OIL, BY KEY PLAYERS, 2024 (USD/TON)

- FIGURE 19 IMPORT SCENARIO FOR HS CODE 2709 PETROLEUM OILS AND OILS OBTAINED FROM BITUMINOUS MINERALS, CRUDE, BY KEY COUNTRIES, 2021-2024

- FIGURE 20 EXPORT SCENARIO FOR HS CODE 2709 PETROLEUM OILS AND OILS OBTAINED FROM BITUMINOUS MINERALS, CRUDE, BY KEY COUNTRIES, 2021-2024

- FIGURE 21 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 22 BASE OIL MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2025

- FIGURE 23 LIST OF MAJOR PATENTS RELATED TO BASE OIL, 2014-2024

- FIGURE 24 FUTURE APPLICATIONS OF BASE OIL

- FIGURE 25 BASE OIL MARKET: DECISION-MAKING FACTORS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 27 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 28 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 29 GROUP II BASE OILS TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 30 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 31 ASIA PACIFIC REGION TO LEAD BASE OIL MARKET IN 2030

- FIGURE 32 ASIA PACIFIC: BASE OIL MARKET SNAPSHOT

- FIGURE 33 EUROPE: BASE OIL MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: BASE OIL MARKET SNAPSHOT

- FIGURE 35 BASE OIL MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 36 RANKING OF KEY PLAYERS IN BASE OIL MARKET, 2024

- FIGURE 37 BASE OIL MARKET SHARE ANALYSIS, 2024

- FIGURE 38 BASE OIL MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 BASE OIL MARKET: EV/EBITDA

- FIGURE 40 BASE OIL MARKET: EV/REVENUE

- FIGURE 41 BASE OIL MARKET: YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 42 BASE OIL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 BASE OIL MARKET: COMPANY FOOTPRINT

- FIGURE 44 BASE OIL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 EXXONMOBIL: COMPANY SNAPSHOT

- FIGURE 47 S-OIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 SK ENMOVE: COMPANY SNAPSHOT

- FIGURE 49 SAUDI ARABIAN OIL CO.: COMPANY SNAPSHOT

- FIGURE 50 ENEOS: COMPANY SNAPSHOT

- FIGURE 51 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 52 SHELL: COMPANY SNAPSHOT

- FIGURE 53 NYNAS AB: COMPANY SNAPSHOT

- FIGURE 54 REPSOL: COMPANY SNAPSHOT

- FIGURE 55 CALUMET, INC.: COMPANY SNAPSHOT

- FIGURE 56 CHINA PETROCHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 ADNOC: COMPANY SNAPSHOT

- FIGURE 58 PHILLIPS 66 COMPANY: COMPANY SNAPSHOT

- FIGURE 59 PETRONAS LUBRICANTS INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 60 ORLEN: COMPANY SNAPSHOT

- FIGURE 61 GS CALTEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 H&R GROUP: COMPANY SNAPSHOT

- FIGURE 63 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 64 PT PERTAMINA (PERSERO): COMPANY SNAPSHOT

- FIGURE 65 FUCHS: COMPANY SNAPSHOT

- FIGURE 66 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 67 BASE OIL MARKET: RESEARCH DESIGN

- FIGURE 68 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR BASE OILS

- FIGURE 69 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 70 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 71 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF BASE OIL MARKET

- FIGURE 72 BASE OIL MARKET: DATA TRIANGULATION