PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928850

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928850

Electronic Hydrofluoric Acid Market by Grade, Type, Application, & Region - Global Forecast to 2030

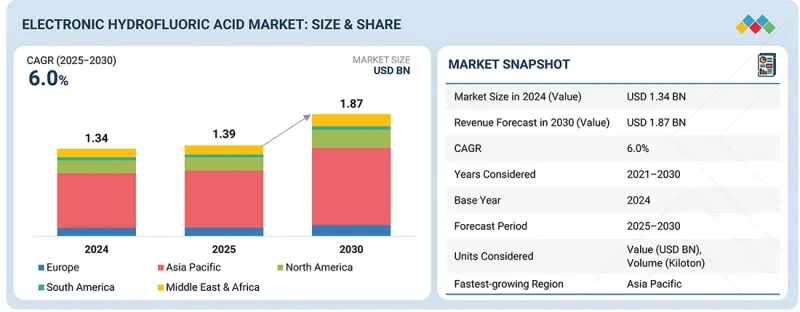

The electronic hydrofluoric acid market size is projected to grow from USD 1.39 billion in 2025 to USD 1.87 billion by 2030, registering a CAGR of 6.0%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Grade, Type, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The growth of this market is driven by the sustained expansion of the semiconductor, electronics, and photovoltaic industries, which are the primary consumers of high-purity hydrofluoric acid. Growth is stable rather than rapid because semiconductor capacity expansions are controlled and based on planned fab schedules, ensuring predictable demand for hydrofluoric acid.

The ongoing shift toward smaller technology nodes (7 nm, 5 nm, and below) and high-precision wet-etching processes further reinforces the need for ultra-high-purity hydrofluoric acid. At the same time, supply-side constraints, including limited fluorspar availability, export regulations in China, and strict purification standards, maintain market balance and prevent volatility. Overall, electronic hydrofluoric acid consumption closely follows fab expansion cycles, capital investment approvals, and long-term supply agreements, resulting in steady, year-on-year market growth.

"UP-SSS is the largest grade segment of the electronic hydrofluoric acid market in terms of value."

The UP-SSS grade segment is the largest and fastest-growing segment of the electronic hydrofluoric acid market. UP-SSS grade acid is uniquely capable of meeting the ultra-stringent purity requirements of leading-edge semiconductor manufacturing, including 3 nm logic nodes, next-generation DRAM, and high-stack 3D NAND architectures. At these advanced technology nodes, even trace-level metallic contamination can result in critical defects, yield loss, or long-term reliability issues, making UP-SSS essential for the numerous hydrofluoric acid-based etching and cleaning steps in both logic and memory fabrication. Major semiconductor manufacturers, including TSMC, Samsung, Intel, SK hynix, and Micron, have standardized the use of UP-SSS in all critical wet processes, driving strong and consistent demand. Although the consumption per wafer is relatively low, UP-SSS commands a significant price premium over lower-grade hydrofluoric acid, and its adoption continues to grow in tandem with the increasing share of cutting-edge wafers in global production.

"Fluorite-based is the fastest-growing type segment of the electronic hydrofluoric acid market in terms of value."

Fluorite-based electronic hydrofluoric acid is experiencing faster growth than hydrofluoric acid sourced from fluorosilicic acid because fluorite (CaF2) is the only feedstock that can reliably achieve the ultra-high purity standards demanded by advanced semiconductor manufacturing. Using natural fluorspar as a starting material allows precise control over metallic contaminants, particulates, and silicates, making it suitable for cutting-edge logic chips, DRAM, and 3D NAND fabrication, where even ppt- or sub-ppt-level impurities can impact yield and device reliability. In contrast, hydrofluoric acid obtained from fluorosilicic acid, a by-product of phosphate fertilizer production, has higher inherent contamination levels, including metals, phosphates, and silica, making it costly and technically challenging to purify to electronic standards. This restricts its use primarily to industrial, metallurgical, and lower-end electronic applications. The growing complexity of semiconductor processes, including the shift toward 2 nm-class nodes, EUV lithography, and intensive wet-cleaning sequences, has further amplified the need for ultra-pure hydrofluoric acid, which can be consistently supplied only through fluorite-based production. Coupled with global investments in fluorspar mining and hydrofluoric acid manufacturing capacity, particularly in China, Mexico, and South Africa, this has strengthened the supply reliability of fluorite-based hydrofluoric acid, while FSA-based hydrofluoric acid remains dependent on variable fertilizer production cycles. Consequently, demand for fluorite-based electronic hydrofluoric acid continues to outpace FSA-based hydrofluoric acid, reflecting its critical role in advanced semiconductor fabrication and superior market growth potential.

"Semiconductor wafers are the fastest-growing application segment of the electronic hydrofluoric acid market in terms of value."

Semiconductor wafers represent the fastest-growing application segment for the electronic hydrofluoric acid market due to the rapid expansion of advanced semiconductor manufacturing and node miniaturization. Electronic hydrofluoric acid is indispensable in wafer fabrication for critical processes such as native oxide removal, surface cleaning, and silicon dioxide etching at multiple stages of device production. The transition toward smaller process nodes, 3D architectures such as FinFETs and gate-all-around transistors, and increased layer stacking in memory devices significantly raise the frequency and purity requirements of wet etching and cleaning steps. Additionally, strong investments in fabs, particularly in the Asia Pacific, further accelerate demand for ultra-high-purity electronic hydrofluoric acid in wafer processing.

"Asia Pacific is the fastest-growing electronic hydrofluoric acid market in terms of value."

The Asia Pacific is the fastest-growing electronic hydrofluoric acid market, driven by strong industrial expansion and supportive policy frameworks. The region hosts a concentration of emerging and established semiconductor fabs, flat-panel display plants, and solar PV manufacturing facilities, which are scaling up to meet growing global demand for electronics, renewable energy, and high-performance chips. Governments across the region are offering incentives for local semiconductor production, renewable energy adoption, and advanced manufacturing, which encourages investment in new fabrication lines and advanced wafer technologies. The Asia Pacific region benefits from a well-integrated chemical supply chain, including local fluorspar mining and hydrofluoric acid production, which reduces its dependency on imports and improves process reliability. Rapid urbanization, growing adoption of consumer electronics, and increasing focus on research and development in materials and process innovation further drive demand for high-purity hydrofluoric acid, positioning the region as the leading growth engine in the market.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the electronic hydrofluoric acid market. Information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers - 15%, Directors - 20%, and Others - 65%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East & Africa - 10%, and South America - 5%.

The electronic hydrofluoric acid market comprises Honeywell International Inc. (US), Solvay (Belgium), LANXESS (Germany), Stella Chemifa Corporation (Japan), DONGYUE GROUP (China), Soulbrain Co., Ltd. (South Korea), JUHUA Technology Inc. (China), Gulf Flour (UAE), Formosa Daikin Advanced Chemicals Co., Ltd. (Japan), and MORITA CHEMICAL INDUSTRIES CO., LTD (Japan). The study includes an in-depth competitive analysis of key players in the electronic hydrofluoric acid market, featuring their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for electronic hydrofluoric acid on the basis of type, grade, application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for electronic hydrofluoric acid.

Key benefits of buying this report

This research report is focused on various levels of analysis, industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the electronic hydrofluoric acid market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers (Surging semiconductor and advanced electronics demand), restraints (Hydrofluoric acid's extreme corrosivity and health risk raise OSHA/EPA compliance, emergency response, and insurance costs for producers and logistics providers), opportunities (Fabs prefer shorter lead times and lower transport risk; small modular hydrofluoric acid purification units located near semiconductor clusters (US, Europe, India, & Southeast Asia) can win premium contracts), and challenges (Demonstrating sub-ppb metal levels, trace organic control, and consistent batch-to-batch purity need advanced analytics, cleanroom packaging, and certified traceability).

- Market Penetration: Comprehensive information on the electronic hydrofluoric acid market offered by top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, partnerships, agreements, joint ventures, collaborations, announcements, awards, and expansions in the market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the electronic hydrofluoric acid market across regions.

- Market Capacity: Production capacities of companies producing electronic hydrofluoric acid are provided wherever available, with upcoming capacities for the electronic hydrofluoric acid market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the electronic hydrofluoric acid market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRONIC HYDROFLUORIC ACID MARKET

- 3.2 ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE AND REGION

- 3.3 ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE

- 3.4 ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION

- 3.5 ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising global semiconductor wafer fabrication capacity

- 4.2.1.2 Expansion of AI, 5G, EV, and high-performance computing applications

- 4.2.1.3 Growing adoption of 300 mm wafers and higher wafer throughput

- 4.2.2 RESTRAINTS

- 4.2.2.1 High production and purification costs associated with ultra-high-purity requirements

- 4.2.2.2 Growing adoption of alternative processes such as vapor HF and dry plasma etching

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing adoption of advanced device architectures such as FinFETs and gate-all-around (GAA) transistors

- 4.2.3.2 Growth of compound semiconductors (SiC, GaN) and MEMS devices

- 4.2.4 CHALLENGES

- 4.2.4.1 Maintaining consistent ppt-ppb level impurity control across large production volumes

- 4.2.4.2 Meeting stringent environmental, safety, and compliance standards without disrupting fab operations

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN ELECTRONIC HYDROFLUORIC ACID MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL ELECTRONICS INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF ELECTRONIC HYDROFLUORIC ACID, BY TYPE, 2024

- 5.5.2 AVERAGE SELLING PRICE OF ELECTRONIC HYDROFLUORIC ACID OF KEY PLAYERS, BY TYPE, 2024

- 5.5.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 281111)

- 5.8.2 IMPORT SCENARIO (HS CODE 281111)

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ULTRA-HIGH-PURITY EHF ENABLING YIELD IMPROVEMENT IN ADVANCED LOGIC SEMICONDUCTORS

- 5.10.2 BUFFERED ELECTRONIC HYDROFLUORIC ACID INNOVATION FOR HIGH-ASPECT-RATIO 3D NAND MEMORY APPLICATIONS

- 5.10.3 APPLICATION-SPECIFIC ELECTRONIC HYDROFLUORIC ACID DEVELOPMENT FOR SIC AND GAN POWER SEMICONDUCTORS

- 5.11 IMPACT OF 2025 US TARIFF - ELECTRONIC HYDROFLUORIC ACID MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 North America

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ULTRA HIGH PURITY HYDROFLUORIC ACID PRODUCTION AND ADVANCED PURIFICATION TECHNIQUES

- 6.1.2 DILUTE HYDROFLUORIC ACID AND CONTROLLED ETCHING SYSTEMS

- 6.1.3 CIRCULAR HYDROFLUORIC ACID MANAGEMENT AND CLOSED-LOOP RECYCLING

- 6.1.4 VAPOR PHASE AND DRY ETCHING ALTERNATIVES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ADVANCED HYDROFLUORIC ACID HANDLING MATERIALS AND EQUIPMENT

- 6.2.2 METAL-ASSISTED AND ENHANCED ETCHING METHODS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 HISTORICAL FOUNDATION AND CURRENT STATE

- 6.3.2 ULTRA-HIGH PURITY ADVANCEMENT (UP-SS AND UP-SSS GRADES)

- 6.3.3 ADVANCED PURIFICATION AND PROCESS CONTROL TECHNOLOGIES

- 6.3.4 CONTAMINATION-FREE PACKAGING AND DELIVERY SYSTEMS

- 6.3.5 LOCALIZATION AND FAB-ADJACENT MANUFACTURING TECHNOLOGIES

- 6.3.6 SUSTAINABILITY, SAFETY, AND REGULATORY-DRIVEN INNOVATION

- 6.4 PATENT ANALYSIS

- 6.4.1 METHODOLOGY

- 6.4.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.4.3 PATENT PUBLICATION TRENDS

- 6.4.4 INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 LIST OF MAJOR PATENTS

- 6.5 FUTURE APPLICATIONS

- 6.5.1 AI-DRIVEN AUTONOMOUS CHEMICAL DELIVERY & PURIFICATION SYSTEMS

- 6.5.2 ASEPTIC/ULTRA-LOW-OXYGEN HERMETIC PURIFICATION & DELIVERY SYSTEMS

- 6.5.3 RESOURCE-RECOVERY & REGENERATION SYSTEMS FOR WASTE VALORISATION & CIRCULAR CHEMICAL PLANTS

- 6.6 IMPACT OF AI/GEN AI ON ELECTRONIC HYDROFLUORIC ACID MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN ELECTRONIC HYDROFLUORIC ACID MANUFACTURING

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ELECTRONIC HYDROFLUORIC ACID MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ELECTRONIC HYDROFLUORIC ACID MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 SOLVAY: ULTRA-HIGH-PURITY ELECTRONIC HYDROFLUORIC ACID FOR ADVANCED SEMICONDUCTOR MANUFACTURING

- 6.7.2 STELLA CHEMIFA CORPORATION: PROCESS-INTEGRATED ELECTRONIC HYDROFLUORIC ACID SOLUTIONS FOR LOGIC, MEMORY, AND DISPLAY FABS

- 6.7.3 HONEYWELL INTERNATIONAL INC.: DIGITALLY ENABLED, HIGH-PURITY ELECTRONIC CHEMICALS FOR RESILIENT SEMICONDUCTOR SUPPLY CHAINS

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 REGULATIONS RELATED TO ELECTRONIC HYDROFLUORIC ACID

- 7.1.3 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ELECTRONIC HYDROFLUORIC ACID

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN ELECTRONICS AND SEMICONDUCTOR INDUSTRY

- 8.5 MARKET PROFITIBILITY

- 8.5.1 PREMIUM PRICING DRIVEN BY ULTRA-HIGH PURITY REQUIREMENTS

- 8.5.2 HIGH SWITCHING COSTS AND LONG-TERM CUSTOMER LOCK-IN

- 8.5.3 ECONOMIES OF SCALE AND CAPITAL INTENSITY ADVANTAGES

- 8.5.4 STRONG DEMAND VISIBILITY FROM SEMICONDUCTOR CAPACITY EXPANSION

- 8.5.5 VALUE-ADDED SERVICES AND MARGIN EXPANSION OPPORTUNITIES

9 ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE

- 9.1 INTRODUCTION

- 9.2 EL GRADE

- 9.2.1 COST-EFFICIENT PROCESSING IN ESTABLISHED SEMICONDUCTOR AND ELECTRONIC APPLICATIONS TO DRIVE DEMAND

- 9.3 UP GRADE

- 9.3.1 GROWING SEMICONDUCTOR FABRICATION AND PROCESS UPGRADES FUELING CONSUMPTION

- 9.4 UP-S

- 9.4.1 MINIATURIZATION AND COMPLEX DEVICE ARCHITECTURES PROPEL MARKET GROWTH

- 9.5 UP-SS

- 9.5.1 GROWTH IN ADVANCED LOGIC, MEMORY, AND DISPLAY TECHNOLOGIES TO DRIVE CONSUMPTION

- 9.6 UP-SSS

- 9.6.1 DEMAND IN NEXT-GENERATION 3D SEMICONDUCTOR AND FLEXIBLE DISPLAYS TO DRIVE MARKET

10 ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 FLUORITE-BASED

- 10.2.1 EFFICIENT PRODUCTION AND CHEMICAL STABILITY FUELING FLUORITE-BASED HF APPLICATIONS IN ELECTRONICS

- 10.3 FLUOROSILICIC ACID-BASED

- 10.3.1 LOWER RAW MATERIAL DEPENDENCY AND RELIABLE CHEMISTRY TO PROPEL DEMAND

11 ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 SEMICONDUCTOR WAFERS

- 11.2.1 NEED FOR ULTRA-PRECISE OXIDE ETCHING AND SURFACE CLEANING TO DRIVE DEMAND

- 11.3 SOLAR CELLS

- 11.3.1 PHOTOVOLTAIC MANUFACTURING EXPANSION DRIVING STABLE MARKET GROWTH

- 11.4 FLAT PANEL DISPLAYS

- 11.4.1 TECHNOLOGY ADVANCEMENTS IN DISPLAYS TO FUEL DEMAND

- 11.5 LEDS & COMPOUND SEMICONDUCTORS

- 11.5.1 CONSISTENT DEMAND FROM ENERGY-EFFICIENT LIGHTING TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 11.6 ELECTRONIC COMPONENTS

- 11.6.1 STABLE DEMAND OF ELECTRONIC COMPONENTS ACROSS BROAD ELECTRONICS MANUFACTURING TO DRIVE MARKET

- 11.7 OPTICAL FIBERS

- 11.7.1 EXPANSION OF FTTH NETWORKS, DATA CENTER INTERCONNECTS, AND 5G BACKHAUL INFRASTRUCTURE TO DRIVE MARKET

- 11.8 MEMS

- 11.8.1 RAPID GROWTH IN ADOPTION OF SENSORS BOOSTING MARKET GROWTH

12 ELECTRONIC HYDROFLUORIC ACID MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Strategic national investments in semiconductors, solar cells, and display manufacturing to drive market

- 12.2.2 JAPAN

- 12.2.2.1 Advanced-node semiconductor revival and global leadership in electronic materials to drive market

- 12.2.3 INDIA

- 12.2.3.1 Policy-led expansion of electronics, solar manufacturing, and semiconductor infrastructure fueling demand

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Large-scale memory and advanced logic fabrication backed by strong government incentives underpin market growth

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 CHIPS Act incentives and large-scale fab expansions to fuel strong demand

- 12.3.2 CANADA

- 12.3.2.1 Strong specialty chemical production and robust supply-chain integration supporting market growth

- 12.3.3 MEXICO

- 12.3.3.1 Integration into North American electronics manufacturing and growing component assembly ecosystems fueling demand

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Automotive electrification and EU-backed semiconductor manufacturing expansion driving market growth

- 12.4.2 ITALY

- 12.4.2.1 Industrial digitization and participation in EU semiconductor programs fueling demand

- 12.4.3 FRANCE

- 12.4.3.1 State-backed semiconductor expansion and high-technology exports driving demand

- 12.4.4 SPAIN

- 12.4.4.1 Renewable energy manufacturing and national semiconductor initiatives supporting market growth

- 12.4.5 UK

- 12.4.5.1 Strong focus on semiconductor R&D and compound semiconductor manufacturing driving consumption

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 UAE

- 12.5.1.1.1 Advanced manufacturing and digital transformation strategies catalyzing market growth

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Vision 2030 industrialization and digital infrastructure expansion fueling demand

- 12.5.1.3 Rest of GCC Countries

- 12.5.1.1 UAE

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Industrial policy and expanding electronics/ICT sectors driving demand for electronic hydrofluoric acid

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Digital transformation and 5G infrastructure deployment supporting market growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Electronics and renewable energy expansion driving market growth

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN (2021-2025)

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2021-2025

- 13.5 PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS (2024)

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Type footprint

- 13.6.5.4 Grade footprint

- 13.6.5.5 Application footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, (2024)

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.7.6 VALUATION AND FINANCIAL METRICS OF KEY ELECTRONIC HYDROFLUORIC ACID VENDORS

- 13.8 COMPETITIVE SCENARIO AND TRENDS

- 13.8.1 PRODUCT LAUNCHES

- 13.8.2 DEALS

- 13.8.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 STELLA CHEMIFA CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 LANXESS

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 SOLVAY

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 MORITA CHEMICAL INDUSTRIES CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Expansions

- 14.1.4.3.2 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 FORMOSA DAIKIN ADVANCED CHEMICALS CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 DONGYUE GROUP

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 MnM view

- 14.1.6.3.1 Right to win

- 14.1.6.3.2 Strategic choices

- 14.1.6.3.3 Weaknesses and competitive threats

- 14.1.7 HONEYWELL INTERNATIONAL INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 MnM view

- 14.1.7.4.1 Right to win

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses and competitive threats

- 14.1.8 NAVIN FLUORINE INTERNATIONAL LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Right to win

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 BASF

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 MnM view

- 14.1.9.3.1 Right to win

- 14.1.9.3.2 Strategic choices

- 14.1.9.3.3 Weaknesses and competitive threats

- 14.1.10 GULF FLUOR

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.10.3.1 Right to win

- 14.1.10.3.2 Strategic choices

- 14.1.10.3.3 Weaknesses and competitive threats

- 14.1.1 STELLA CHEMIFA CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 ZHEJIANG YONGHE REFRIGERANT CO., LTD.

- 14.2.2 HALOPOLYMER OJSC

- 14.2.3 SINOCHEM LANTIAN CO., LTD.

- 14.2.4 FUJIAN YONGJING TECHNOLOGY CO., LTD.

- 14.2.5 LIAONING EAST SHINE CHEMICAL TECHNOLOGY CO., LTD.

- 14.2.6 LUOYANG FENGRUI FLUORINE INDUSTRY CO., LTD.

- 14.2.7 ZHEJIANG SANMEI CHEMICAL INCORPORATED COMPANY

- 14.2.8 TANFAC INDUSTRIES LTD.

- 14.2.9 DERIVADOS DEL FLUOR SAU

- 14.2.10 ULBA METALLURGICAL PLANT JSC

- 14.2.11 FUBAO GROUP

- 14.2.12 FOOSUNG CO., LTD.

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Key primary interview participants

- 15.1.2.3 Breakdown of primary interviews

- 15.1.2.4 Key industry insights

- 15.1.1 SECONDARY DATA

- 15.2 MARKET SIZE ESTIMATION

- 15.2.1 BOTTOM-UP APPROACH

- 15.2.2 TOP-DOWN APPROACH

- 15.3 BASE NUMBER CALCULATION

- 15.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 15.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 15.4 MARKET FORECAST APPROACH

- 15.4.1 SUPPLY SIDE

- 15.4.2 DEMAND SIDE

- 15.5 DATA TRIANGULATION

- 15.6 FACTOR ANALYSIS

- 15.7 RESEARCH ASSUMPTIONS

- 15.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 ELECTRONIC HYDROFLUORIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2021-2029

- TABLE 3 AVERAGE SELLING PRICE OF ELECTRONIC HYDROFLUORIC ACID, BY TYPE, 2024 (USD/TON)

- TABLE 4 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE, 2024 (USD/TON)

- TABLE 5 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/TON)

- TABLE 6 ELECTRONIC HYDROFLUORIC ACID MARKET: ROLES OF COMPANIES IN ECOSYSTEM

- TABLE 7 EXPORT DATA FOR HS CODE 281111-COMPLIANT PRODUCTS (IN KGS)

- TABLE 8 IMPORT DATA FOR HS CODE 281111-COMPLIANT PRODUCTS (IN KGS)

- TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 10 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 11 ELECTRONIC HYDROFLUORIC ACID: TOTAL NUMBER OF PATENTS

- TABLE 12 ELECTRONIC HYDROFLUORIC ACID MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 13 ELECTRONIC HYDROFLUORIC ACID: LIST OF MAJOR PATENTS, 2015-2024

- TABLE 14 TOP USE CASES AND MARKET POTENTIAL

- TABLE 15 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 16 ELECTRONIC HYDROFLUORIC ACID MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 17 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 GLOBAL INDUSTRY STANDARDS IN ELECTRONIC HYDROFLUORIC ACID MARKET

- TABLE 24 CERTIFICATIONS, LABELING, ECO-STANDARDS IN ELECTRONIC HYDROFLUORIC ACID MARKET

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 26 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 27 UNMET NEEDS OF ELECTRONIC HYDROFLUORIC ACID IN SEMICONDUCTOR INDUSTRY

- TABLE 28 ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 29 ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 30 ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 31 ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 32 ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 35 ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 36 ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 37 ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 38 ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 39 ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 40 ELECTRONIC HYDROFLUORIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 ELECTRONIC HYDROFLUORIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 ELECTRONIC HYDROFLUORIC ACID MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 43 ELECTRONIC HYDROFLUORIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 44 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 47 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 48 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 49 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 51 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 52 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025- 2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 55 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 56 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 57 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 59 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 60 CHINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 61 CHINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 62 CHINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 63 CHINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 64 JAPAN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 65 JAPAN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 JAPAN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 67 JAPAN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 68 INDIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 INDIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 INDIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 71 INDIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 72 SOUTH KOREA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 73 SOUTH KOREA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 SOUTH KOREA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 75 SOUTH KOREA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 76 REST OF ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 79 REST OF ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 80 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 83 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 84 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 87 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 88 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 91 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 92 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 95 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 96 US: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 US: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 US: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 99 US: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 100 CANADA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 CANADA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 CANADA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 103 CANADA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 104 MEXICO: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 MEXICO: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 MEXICO: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 107 MEXICO: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 108 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 111 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 112 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 115 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 116 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 119 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 120 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 121 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 123 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 124 GERMANY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 GERMANY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 GERMANY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 127 GERMANY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 128 ITALY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 ITALY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 ITALY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 131 ITALY: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 132 FRANCE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 FRANCE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 FRANCE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 135 FRANCE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 136 SPAIN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 SPAIN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 SPAIN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 139 SPAIN: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 140 UK: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 UK: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 UK: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 143 UK: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 144 REST OF EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 REST OF EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 147 REST OF EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 148 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 152 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 164 UAE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 165 UAE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 UAE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 167 UAE: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 168 SAUDI ARABIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 SAUDI ARABIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 SAUDI ARABIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 171 SAUDI ARABIA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 172 REST OF GCC COUNTRIES: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 173 REST OF GCC COUNTRIES: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 REST OF GCC COUNTRIES: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 175 REST OF GCC COUNTRIES: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 176 SOUTH AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 177 SOUTH AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 SOUTH AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 179 SOUTH AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 184 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 187 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 188 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 189 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 191 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 192 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 195 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 196 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 199 SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 200 BRAZIL: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 201 BRAZIL: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 BRAZIL: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 203 BRAZIL: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 204 ARGENTINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 205 ARGENTINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 206 ARGENTINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 207 ARGENTINA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 208 REST OF SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 209 REST OF SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 210 REST OF SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 211 REST OF SOUTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 212 OVERVIEW OF STRATEGIES ADOPTED BY KEY ELECTRONIC HYDROFLUORIC ACID MANUFACTURERS

- TABLE 213 ELECTRONIC HYDROFLUORIC ACID: DEGREE OF COMPETITION

- TABLE 214 ELECTRONIC HYDROFLUORIC ACID: REGION FOOTPRINT

- TABLE 215 ELECTRONIC HYDROFLUORIC ACID: TYPE FOOTPRINT

- TABLE 216 ELECTRONIC HYDROFLUORIC ACID: GRADE FOOTPRINT

- TABLE 217 ELECTRONIC HYDROFLUORIC ACID: APPLICATION FOOTPRINT

- TABLE 218 ELECTRONIC HYDROFLUORIC ACID: KEY STARTUPS/SMES

- TABLE 219 ELECTRONIC HYDROFLUORIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 220 ELECTRONIC HYDROFLUORIC ACID: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2025

- TABLE 221 ELECTRONIC HYDROFLUORIC ACID: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 222 ELECTRONIC HYDROFLUORIC ACID: EXPANSIONS, JANUARY 2021-DECEMBER 2025

- TABLE 223 STELLA CHEMIFA CORPORATION: COMPANY OVERVIEW

- TABLE 224 STELLA CHEMIFA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 STELLA CHEMIFA CORPORATION: PRODUCT LAUNCHES

- TABLE 226 STELLA CHEMIFA CORPORATION: DEALS

- TABLE 227 LANXESS: COMPANY OVERVIEW

- TABLE 228 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 SOLVAY: COMPANY OVERVIEW

- TABLE 230 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SOLVAY: EXPANSIONS

- TABLE 232 MORITA CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 233 MORITA CHEMICAL INDUSTRIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 MORITA CHEMICAL INDUSTRIES CO., LTD.: EXPANSIONS

- TABLE 235 MORITA CHEMICAL INDUSTRIES CO., LTD.: OTHER DEVELOPMENTS

- TABLE 236 FORMOSA DAIKIN ADVANCED CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 237 FORMOSA DAIKIN ADVANCED CHEMICALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 DONGYUE GROUP LIMITED: COMPANY OVERVIEW

- TABLE 239 DONGYUE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 241 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 243 NAVIN FLUORINE INTERNATIONAL LIMITED.: COMPANY OVERVIEW

- TABLE 244 NAVIN FLUORINE INTERNATIONAL LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 NAVIN FLUORINE INTERNATIONAL LIMITED: EXPANSIONS

- TABLE 246 BASF: COMPANY OVERVIEW

- TABLE 247 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 GULF FLUOR: COMPANY OVERVIEW

- TABLE 249 GULF FLUOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 ZHEJIANG YONGHE REFRIGERANT CO., LTD.: COMPANY OVERVIEW

- TABLE 251 HALOPOLYMER: COMPANY OVERVIEW

- TABLE 252 SINOCHEM LANTIAN CO., LTD.: COMPANY OVERVIEW

- TABLE 253 FUJIAN YONGJING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 254 LIAONING EAST SHINE CHEMICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 255 LUOYANG FENGRUI FLUORINE INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 256 ZHEJIANG SANMEI CHEMICAL INCORPORATED COMPANY: COMPANY OVERVIEW

- TABLE 257 TANFAC INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 258 DERIVADOS DEL FLUOR SAU: COMPANY OVERVIEW

- TABLE 259 ULBA METALLURGICAL PLANT JSC: COMPANY OVERVIEW

- TABLE 260 FUBAO GROUP: COMPANY OVERVIEW

- TABLE 261 FOOSUNG CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ELECTRONIC HYDROFLUORIC ACID MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL ELECTRONIC HYDROFLUORIC ACID MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ELECTRONIC HYDROFLUORIC ACID MARKET (2021-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF ELECTRONIC HYDROFLUORIC ACID MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN ELECTRONIC HYDROFLUORIC ACID MARKET, 2025

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 NEED FOR ULTRA-HIGH-PURITY ETCHING AND CLEANING PROCESSES IN EXPANDING SEMICONDUCTOR MANUFACTURING TO DRIVE MARKET

- FIGURE 9 FLUORITE-BASED ELECTRONIC HYDROFLUORIC ACID ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 UP-SS GRADE SEGMENT ACCOUNTED FOR LARGEST SHARE OF ELECTRONIC HYDROFLUORIC ACID MARKET IN 2024

- FIGURE 11 SEMICONDUCTOR WAFERS SEGMENT DOMINATED ELECTRONIC HYDROFLUORIC ACID MARKET IN 2024

- FIGURE 12 SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ELECTRONIC HYDROFLUORIC ACID MARKET

- FIGURE 14 ELECTRONIC HYDROFLUORIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 ELECTRONIC HYDROFLUORIC ACID MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 16 ELECTRONIC HYDROFLUORIC ACID MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE, 2024 (USD/TON)

- FIGURE 18 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/TON)

- FIGURE 19 KEY PARTICIPANTS IN ELECTRONIC HYDROFLUORIC ACID ECOSYSTEM

- FIGURE 20 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 21 EXPORT DATA OF HS CODE 281111-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024

- FIGURE 22 IMPORT DATA OF HS CODE 281111-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024

- FIGURE 23 NUMBER OF PATENTS GRANTED (2015-2024)

- FIGURE 24 ELECTRONIC HYDROFLUORIC ACID: LEGAL STATUS OF PATENTS

- FIGURE 25 PATENT ANALYSIS FOR ELECTRONIC HYDROFLUORIC ACID, BY JURISDICTION, 2015-2024

- FIGURE 26 TOP 7 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 27 FUTURE APPLICATIONS OF AI IN ELECTRONIC HYDROFLUORIC ACID MARKET

- FIGURE 28 ELECTRONIC HYDROFLUORIC ACID MARKET DECISION-MAKING FACTORS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 30 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 31 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 32 UP-SS TO LEAD ELECTRONIC HYDROFLUORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 33 FLUORITE-BASED TO LEAD ELECTRONIC HYDROFLUORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 34 SEMICONDUCTOR WAFERS TO LEAD ELECTRONIC HYDROFLUORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 35 SOUTH KOREA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC: ELECTRONIC HYDROFLUORIC ACID MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: ELECTRONIC HYDROFLUORIC ACID MARKET SNAPSHOT

- FIGURE 38 EUROPE: ELECTRONIC HYDROFLUORIC ACID MARKET SNAPSHOT

- FIGURE 39 ELECTRONIC HYDROFLUORIC ACID MARKET: SHARE OF KEY PLAYERS (2024)

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2025

- FIGURE 41 PRODUCT COMPARATIVE ANALYSIS, BY SEGMENT

- FIGURE 42 ELECTRONIC HYDROFLUORIC ACID: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 ELECTRONIC HYDROFLUORIC ACID: COMPANY FOOTPRINT

- FIGURE 44 ELECTRONIC HYDROFLUORIC ACID: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 47 STELLA CHEMIFA CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 LANXESS: COMPANY SNAPSHOT

- FIGURE 49 SOLVAY: COMPANY SNAPSHOT

- FIGURE 50 DONGYUE GROUP: COMPANY SNAPSHOT

- FIGURE 51 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 52 NAVIN FLUORINE INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- FIGURE 53 BASF: COMPANY SNAPSHOT

- FIGURE 54 ELECTRONIC HYDROFLUORIC ACID MARKET: RESEARCH DESIGN

- FIGURE 55 ELECTRONIC HYDROFLUORIC ACID MARKET: BOTTOM-UP APPROACH

- FIGURE 56 ELECTRONIC HYDROFLUORIC ACID MARKET: TOP-DOWN APPROACH

- FIGURE 57 ELECTRONIC HYDROFLUORIC ACID MARKET: DATA TRIANGULATION