PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928858

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928858

AI Inspection Market by Service Type (Testing, Inspection, Certification), Technology (Computer Vision, ML, NLP), Service Delivery Mode, Application, Sourcing Type (In-house, Outsourced), End-use Industry, and Region - Global Forecast to 2032

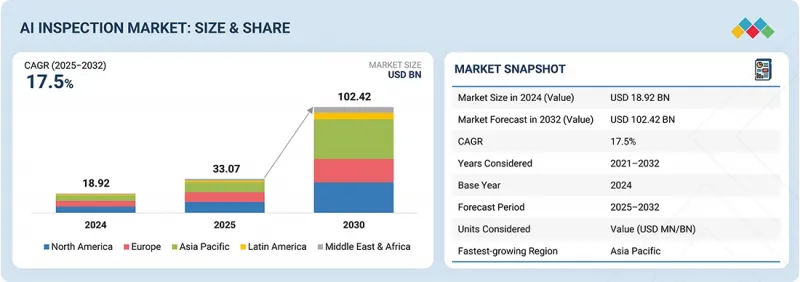

The global AI inspection market is expected to grow from USD 33.07 billion in 2025 to USD 102.42 billion by 2032, at a CAGR of 17.5% during the forecast period. Growth is driven by stricter regulatory scrutiny, higher audit-readiness expectations, and the shift from manual checks to AI-enabled testing, inspection, and certification.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Service Type, Technology, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Computer vision and ML analytics are improving defect detection and risk prioritization, while NLP is automating documentation and evidence workflows. Remote and hybrid delivery models are scaling faster as enterprises seek wider coverage and quicker verification cycles across multi-site operations and supply chains.

"AI-powered Certification Services Are Growing the Fastest as Audit Readiness and Trust Requirements Intensify Across Industries"

AI-powered certification services are projected to grow at the highest CAGR in the AI inspection market as enterprises face rising scrutiny on compliance outcomes and need faster, more consistent certification decisions supported by audit-ready digital evidence. Growth is being fueled by expanding ESG verification requirements, tighter product and process regulations, and increasing reliance on standardized documentation that can be traced back to inspection data and validated workflows. Certification is also accelerating as remote and hybrid delivery models mature, enabling scalable audits and faster turnaround without compromising traceability and governance. If demand continues to shift toward continuous assurance rather than periodic checks, AI-powered inspection services are expected to remain the next-fastest growth area, supported by multi-site rollout needs and the push to reduce manual dependency while improving repeatability.

"In-house Sourcing to lead the AI Inspection Market in 2025 as Enterprises Prioritize Control, Data Security, and Workflow Integration."

In-house sourcing is estimated to hold the largest share of the AI inspection market in 2025, as many enterprises prefer to retain direct control over quality and compliance-critical workflows while building confidence in AI outputs and governance. This approach is particularly common where inspection data is sensitive, processes are tightly coupled with production KPIs, and results must integrate seamlessly into internal QMS, risk, and reporting systems. In-house adoption also reflects the need to standardize models, thresholds, and exception handling across multi-site operations before expanding external reliance. At the same time, outsourced sourcing remains the higher-growth avenue as companies scale deployments and seek accredited expertise, faster rollouts, and managed remote and hybrid delivery for distributed assets and supplier networks, making it the next key opportunity area within the sourcing segment.

"India Is the Fastest-Growing Country in the AI Inspection Market During the Forecast Period"

India is projected to be the fastest-growing country in the AI inspection market over the forecast period as enterprises accelerate the shift from manual assurance to AI-enabled testing, inspection, and certification across expanding industrial and infrastructure activity. Rapid growth in manufacturing ecosystems, increasing export orientation, and tighter customer expectations for traceability and audit-ready documentation are pushing adoption of computer vision and ML-led quality and process assurance across multi-site operations. Rising focus on compliance, safety, and supplier transparency is also strengthening demand for AI-supported certification and ESG verification programs. In parallel, remote and hybrid delivery models are gaining traction to improve coverage across distributed plants, assets, and supplier networks while reducing inspection cycle time and dependence on scarce skilled manpower.

Breakdown of Primaries

Various executives from key organizations operating in the AI inspection market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 30%, Directors - 40%, and Others - 30%

- By Region: Asia Pacific - 30%, North America - 30%, Europe - 25%, and Rest of the World - 15%

SGS SA (Switzerland), Bureau Veritas (France), DEKRA (Germany), TUV SUD (Germany), TUV RHEINLAND (Germany), Intertek Group plc (UK), DNV (Norway), Applus+ (Spain), Eurofins Scientific (Luxembourg), UL LLC (US), TUV NORD (Germany), TUV NORD Group (Germany), Element Materials Technology (UK), ALS Limited (Australia), Kiwa (Netherlands), SOCOTEC (France), RINA S.p.A (Italy), MISTRAS Group (US), Acuren (US), Lloyd's Register (UK), LRQA (UK), TEAM, Inc. (US), ROSEN Group (Switzerland), NDT Global (Ireland), OIMA (China), and BSI Group (UK) are some of the key players in the AI inspection market. The study includes an in-depth competitive analysis of these key players in the AI inspection market, covering their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the AI Inspection market and forecasts its service type, technology, applications, service delivery mode, sourcing type, end-use industry, and regions. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across five main regions-North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa. The report includes a supply chain analysis of the key players and their competitive analysis of the AI inspection ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising regulatory complexity and compliance intensity across industries; Pressure to reduce inspection turnaround time and operational costs), restraints (High upfront investment and long validation cycles within accredited TIC frameworks; Integration complexity with legacy inspection processes and client-specific compliance requirements), opportunities (Monetization of inspection data and compliance intelligence services; Expansion into underserved mid-market and SME compliance segments), and challenges (Shortage of qualified personnel for AI-governed inspection and regulatory interpretation; Ensuring regulatory trust, explainability, and cross-border acceptance of inspection outcomes) influencing the growth of the AI Inspection market

- Solution/Service Development/Innovation: Detailed insights into upcoming components, technologies, research, and development activities in the AI Inspection market

- Market Development: Comprehensive information about lucrative markets-the report analyses the AI Inspection market across varied regions

- Market Diversification: Exhaustive information about new AI-powered TIC services in untapped geographies, recent developments, and investments in the AI Inspection market

- Competitive Assessment: In-depth assessment of market shares and growth strategies, and offerings of leading players, such as SGS SA (Switzerland), Bureau Veritas (France), DEKRA (Germany), TUV SUD (Germany), TUV RHEINLAND (Germany), Intertek Group plc (UK), DNV (Norway), Applus+ (Spain), Eurofins Scientific (Luxembourg), and UL LLC (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS & KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AI INSPECTION MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI INSPECTION MARKET

- 3.2 AI INSPECTION MARKET, BY SERVICE DELIVERY MODE

- 3.3 AI INSPECTION MARKET, BY APPLICATION

- 3.4 AI INSPECTION MARKET, BY MANUFACTURING END-USE INDUSTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising regulatory complexity and compliance intensity across industries

- 4.2.1.2 Pressure to reduce inspection turnaround time and operational costs

- 4.2.1.3 Growth of remote inspection and digital audit models

- 4.2.1.4 Increasing focus on safety, asset integrity, and lifecycle risk management

- 4.2.1.5 Digital transformation of TIC service delivery models

- 4.2.2 RESTRAINTS

- 4.2.2.1 High upfront investment and long validation cycles within accredited TIC frameworks

- 4.2.2.2 Integration complexity with legacy inspection processes and client-specific compliance requirements

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Monetization of inspection data and compliance intelligence services

- 4.2.3.2 Expansion into underserved mid-market and SME compliance segments

- 4.2.3.3 Development of sector-specific and regulation-specific assurance offerings

- 4.2.4 CHALLENGES

- 4.2.4.1 Shortage of qualified personnel for AI-governed inspection and regulatory interpretation

- 4.2.4.2 Ensuring regulatory trust, explainability, and cross-border acceptance of inspection outcomes

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS & WHITE SPACES

- 4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS & FORECAST

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.2.4 TRENDS IN HEALTHCARE & LIFE SCIENCE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 KEY CONFERENCES & EVENTS, 2026-2027

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: AI-ENABLED REMOTE INSPECTION AND DIGITAL ASSURANCE IN ENERGY INFRASTRUCTURE

- 5.7.2 CASE STUDY 2: AI-POWERED DRONE AND IMAGE-BASED INSPECTION FOR SOLAR ASSETS

- 5.7.3 CASE STUDY 3: AI-ENHANCED QUALITY AND COMPLIANCE INSPECTION IN CONSUMER GOODS MANUFACTURING

- 5.8 IMPACT OF 2025 US TARIFFS ON AI INSPECTION MARKET

- 5.8.1 INTRODUCTION

- 5.8.2 KEY TARIFF RATES

- 5.8.3 PRICE IMPACT ANALYSIS

- 5.8.4 IMPACT ON COUNTRIES/REGIONS

- 5.8.4.1 US

- 5.8.4.2 Europe

- 5.8.4.3 Asia Pacific

- 5.8.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 COMPUTER VISION

- 6.1.2 MACHINE LEARNING (ML) & ANALYTICS

- 6.1.3 NATURAL LANGUAGE PROCESSING (NLP)

- 6.1.4 DIGITAL TWIN & SIMULATION SERVICES

- 6.1.5 GENERATIVE AI & LARGE LANGUAGE MODELS (LLMS)

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 EDGE AI & EDGE COMPUTING

- 6.2.2 CLOUD COMPUTING & DATA PLATFORMS

- 6.2.3 EXPLAINABLE AI (XAI) & MODEL GOVERNANCE

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.5.1 KEY FUTURE APPLICATIONS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS & COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS & BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

9 AI INSPECTION MARKET, BY SERVICE TYPE

- 9.1 INTRODUCTION

- 9.2 AI-POWERED TESTING SERVICES

- 9.2.1 THROUGHPUT AND COMPLIANCE-AT-SCALE TO DRIVE AI-POWERED TESTING TRANSFORMATION

- 9.2.2 SOFTWARE & SYSTEMS TESTING

- 9.2.3 HARDWARE & PHYSICAL TESTING

- 9.3 AI-POWERED INSPECTION SERVICES

- 9.3.1 RISK-BASED INTEGRITY AND ZERO-DEFECT EXPECTATIONS TO ACCELERATE AI-POWERED INSPECTION ADOPTION

- 9.3.2 VISUAL INSPECTION & QUALITY CONTROL (QC)

- 9.3.3 ASSET & INFRASTRUCTURE INSPECTION

- 9.4 AI-POWERED CERTIFICATION SERVICES

- 9.4.1 AUDITABLE COMPLIANCE AND TRUST-BY-DESIGN TO ACCELERATE AI-POWERED CERTIFICATION ADOPTION

- 9.4.2 COMPLIANCE & REGULATORY VALIDATION

- 9.4.3 AI MODEL & ALGORITHM CERTIFICATION

- 9.4.4 AUTOMATED REPORTING & DOCUMENTATION

- 9.5 OTHER SERVICE TYPES

- 9.5.1 AUDITING & ASSESSMENT

- 9.5.2 TRAINING & BUSINESS ASSURANCE

10 AI INSPECTION MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 COMPUTER VISION

- 10.2.1 STANDARDIZED VISUAL EVIDENCE AND SCALABLE DEFECT DETECTION TO BOOST MARKET GROWTH

- 10.3 MACHINE LEARNING (ML) & ANALYTICS

- 10.3.1 RISK-BASED DECISIONING AND PREDICTIVE INSIGHT AT SCALE TO DRIVE DEMAND

- 10.3.2 PREDICTIVE & PRESCRIPTIVE ANALYTICS

- 10.3.3 UNSUPERVISED LEARNING (ANOMALY DETECTION)

- 10.3.4 SUPERVISED LEARNING-BASED CLASSIFICATION

- 10.4 NATURAL LANGUAGE PROCESSING (NLP)

- 10.4.1 DOCUMENTATION-INTENSIVE COMPLIANCE AND EVIDENCE TRACEABILITY AT SCALE TO SUPPORT GROWTH

- 10.5 OTHER TECHNOLOGIES

- 10.5.1 DIGITAL TWIN & SIMULATION SERVICES

- 10.5.2 GENERATIVE AI & LARGE LANGUAGE MODELS (LLMS)

11 AI INSPECTION MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 QUALITY & PROCESS ASSURANCE

- 11.2.1 DEFECT PREVENTION AND PROCESS STABILITY AT SCALE

- 11.3 REGULATORY & COMPLIANCE MANAGEMENT

- 11.3.1 EVIDENCE TRACEABILITY AND CONSISTENT INTERPRETATION ACROSS JURISDICTIONS TO BOOST MARKET GROWTH

- 11.4 ASSET INTEGRITY MANAGEMENT

- 11.4.1 RISK-BASED ASSET RELIABILITY AND LIFECYCLE ASSURANCE TO SUPPORT GROWTH

- 11.5 CYBERSECURITY & DATA ASSURANCE

- 11.5.1 DIGITAL TRUST, SYSTEM RESILIENCE, AND DATA INTEGRITY ASSURANCE

- 11.6 SUSTAINABILITY & ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) AUDITING

- 11.6.1 TRANSPARENCY, TRACEABILITY, AND SCALABLE ESG ASSURANCE TO BOOST DEMAND

- 11.7 OTHER APPLICATIONS

- 11.7.1 SAFETY & RISK ANALYTICS

- 11.7.2 R&D AND T&D SUPPORT SERVICES

12 AI INSPECTION MARKET, BY SERVICE DELIVERY MODE

- 12.1 INTRODUCTION

- 12.2 ON-SITE

- 12.2.1 PHYSICAL ACCESS, SAFETY MANDATES, AND REGULATORY PRESENCE TO SUSTAIN ON-SITE AI-ENABLED DELIVERY

- 12.2.2 FIELD INSPECTION SERVICES

- 12.2.3 IN-FACILITY TESTING SERVICES

- 12.2.4 ON-LOCATION CERTIFICATION SERVICES

- 12.2.5 EMBEDDED QUALITY ASSURANCE SERVICES

- 12.3 REMOTE

- 12.3.1 SCALABILITY, SPEED, AND CENTRALIZED EXPERTISE TO DRIVE DEMAND FOR REMOTE AI-ENABLED DELIVERY

- 12.3.2 CLOUD-BASED ANALYSIS SERVICES

- 12.3.3 REMOTE MONITORING SERVICES

- 12.3.4 VIRTUAL INSPECTION SERVICES

- 12.3.5 DIGITAL AUDIT SERVICES

- 12.3.6 ONLINE CERTIFICATION SERVICES

- 12.4 HYBRID

- 12.4.1 REGULATORY ACCEPTANCE AND OPERATIONAL EFFICIENCY TO DRIVE ADOPTION OF HYBRID AI-ENABLED DELIVERY

- 12.4.2 COMBINED ON-SITE & REMOTE SERVICES

- 12.4.3 BLENDED INSPECTION MODELS

- 12.4.4 FLEXIBLE SERVICE DELIVERY

- 12.4.5 MULTI-LOCATION COORDINATION SERVICES

13 AI INSPECTION MARKET, BY SOURCING TYPE

- 13.1 INTRODUCTION

- 13.2 IN-HOUSE

- 13.2.1 CONTROL, DATA OWNERSHIP, AND DEEP INTEGRATION WITH OPERATIONS TO BOOST MARKET GROWTH

- 13.3 OUTSOURCED

- 13.3.1 ACCESS TO SPECIALIZED EXPERTISE AND SCALABLE AI-ENABLED DELIVERY TO SUPPORT GROWTH

14 AI INSPECTION MARKET, BY END-USE INDUSTRY

- 14.1 INTRODUCTION

- 14.2 MANUFACTURING

- 14.2.1 AUTOMOTIVE

- 14.2.1.1 High-throughput production and zero-defect expectations to drive AI inspection adoption

- 14.2.2 ELECTRONICS & SEMICONDUCTORS

- 14.2.2.1 Miniaturization, yield sensitivity, and precision-driven inspection requirements to support growth

- 14.2.3 AEROSPACE & DEFENSE

- 14.2.3.1 Safety-critical certification and traceability-driven inspection demand to drive market growth

- 14.2.4 HEAVY MACHINERY & INDUSTRIAL

- 14.2.4.1 Asset reliability and lifecycle quality assurance in complex equipment to drive demand

- 14.2.5 HEALTHCARE & LIFE SCIENCES

- 14.2.5.1 Patient safety, regulatory rigor, and validation-driven assurance requirements to contribute to growth

- 14.2.1 AUTOMOTIVE

- 14.3 ENERGY & UTILITIES

- 14.3.1 OIL & GAS

- 14.3.1.1 Asset integrity, safety assurance, and regulatory compliance across value chain to boost growth

- 14.3.2 POWER GENERATION & RENEWABLES

- 14.3.2.1 Grid reliability, asset availability, and transition-driven inspection demand to drive growth

- 14.3.1 OIL & GAS

- 14.4 CONSUMER GOODS & RETAIL

- 14.4.1 PRODUCT SAFETY, BRAND PROTECTION, AND SUPPLY CHAIN TRACEABILITY TO POSITIVELY IMPACT MARKET GROWTH

- 14.5 AGRICULTURE & FOOD

- 14.5.1 FOOD SAFETY, QUALITY CONSISTENCY, AND REGULATORY TRACEABILITY TO FUEL GROWTH

- 14.6 IT & TELECOMMUNICATIONS

- 14.6.1 SOFTWARE DEVELOPMENT & IT SERVICES

- 14.6.1.1 Continuous delivery, system reliability, and compliance-ready assurance to boost demand

- 14.6.2 TELECOMMUNICATION INFRASTRUCTURE

- 14.6.2.1 Network reliability, uptime assurance, and regulatory compliance at scale to propel market growth

- 14.6.1 SOFTWARE DEVELOPMENT & IT SERVICES

- 14.7 CONSTRUCTION & INFRASTRUCTURE

- 14.7.1 STRUCTURAL SAFETY, PROJECT COMPLIANCE, AND LIFECYCLE ASSURANCE TO DRIVE ADOPTION OF AI INSPECTION SOLUTIONS

- 14.8 TRANSPORTATION & LOGISTICS

- 14.8.1 SUPPLY CHAIN & WAREHOUSE OPERATIONS

- 14.8.1.1 Operational visibility, safety compliance, and throughput optimization to fuel growth

- 14.8.2 AEROSPACE, MARITIME, AND RAIL ASSETS

- 14.8.2.1 Safety-critical asset integrity and regulatory-driven inspection requirements to drive market

- 14.8.1 SUPPLY CHAIN & WAREHOUSE OPERATIONS

- 14.9 OTHER VERTICALS

15 AI INSPECTION MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 CHINA

- 15.2.1.1 Large-scale manufacturing, export compliance, and industrial digitalization to drive market growth

- 15.2.2 JAPAN

- 15.2.2.1 Precision manufacturing, quality discipline, and advanced automation to support growth

- 15.2.3 INDIA

- 15.2.3.1 Industrial expansion, export alignment, and digital quality adoption to fuel market

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Technology-intensive manufacturing and export-driven quality control to propel market

- 15.2.5 AUSTRALIA

- 15.2.5.1 Regulatory rigor, asset integrity, and infrastructure assurance to boost market

- 15.2.6 THAILAND

- 15.2.6.1 Manufacturing hub expansion and export-oriented quality assurance to drive market

- 15.2.7 VIETNAM

- 15.2.7.1 Rapid industrialization and global supply chain integration to support growth

- 15.2.8 MALAYSIA

- 15.2.8.1 Electronics manufacturing and standards-driven inspection adoption

- 15.2.9 INDONESIA

- 15.2.9.1 Infrastructure development and industrial base expansion to propel growth

- 15.2.10 SINGAPORE

- 15.2.10.1 Regional TIC hub and advanced digital assurance adoption to propel market

- 15.2.11 REST OF ASIA PACIFIC

- 15.2.1 CHINA

- 15.3 NORTH AMERICA

- 15.3.1 US

- 15.3.1.1 Regulatory intensity, technology leadership, and enterprise-scale adoption to drive market growth

- 15.3.2 CANADA

- 15.3.2.1 Resource-driven industries and compliance-focused inspection to fuel growth

- 15.3.1 US

- 15.4 EUROPE

- 15.4.1 GERMANY

- 15.4.1.1 Industrial engineering leadership and standards-centric assurance to drive market growth

- 15.4.2 FRANCE

- 15.4.2.1 Aerospace strength, industrial regulation, and compliance modernization to support market

- 15.4.3 UK

- 15.4.3.1 Regulatory transition, infrastructure assurance, and digital inspection adoption to propel market

- 15.4.4 ITALY

- 15.4.4.1 Manufacturing diversity and quality-driven compliance to support growth

- 15.4.5 SPAIN

- 15.4.5.1 Industrial modernization and infrastructure-linked inspection demand to aid growth

- 15.4.6 NETHERLANDS

- 15.4.6.1 Logistics hub, advanced manufacturing, and digital compliance to drive market

- 15.4.7 NORDICS

- 15.4.7.1 Sustainability leadership and asset-centric inspection to contribute to market growth

- 15.4.8 REST OF EUROPE

- 15.4.1 GERMANY

- 15.5 LATIN AMERICA

- 15.5.1 BRAZIL

- 15.5.1.1 Industrial scale, energy assets, and regulatory modernization to drive market

- 15.5.2 ARGENTINA

- 15.5.2.1 Energy development and industrial compliance needs to fuel growth

- 15.5.3 MEXICO

- 15.5.3.1 Manufacturing integration and export-driven inspection demand to drive growth

- 15.5.4 REST OF LATIN AMERICA

- 15.5.1 BRAZIL

- 15.6 MIDDLE EAST & AFRICA

- 15.6.1 GCC COUNTRIES

- 15.6.1.1 Saudi Arabia

- 15.6.1.1.1 Energy dominance, mega-projects, and asset integrity at scale to drive market growth

- 15.6.1.2 UAE

- 15.6.1.2.1 Infrastructure modernization, regulatory excellence, and digital assurance to fuel growth

- 15.6.1.3 Rest of GCC Countries

- 15.6.1.1 Saudi Arabia

- 15.6.2 SOUTH AFRICA

- 15.6.2.1 Mining, energy assets, and compliance-led inspection demand to support market

- 15.6.3 REST OF MIDDLE EAST & AFRICA

- 15.6.1 GCC COUNTRIES

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 COMPANY VALUATION & FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Service type footprint

- 16.7.5.4 Technology footprint

- 16.7.5.5 Application footprint

- 16.7.5.6 End-use industry footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 SOLUTION/SERVICE LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 INTRODUCTION

- 17.2 KEY AI-POWERED TIC SERVICE PROVIDERS

- 17.2.1 SGS SA

- 17.2.1.1 Business overview

- 17.2.1.2 Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Solution/Service launches

- 17.2.1.3.2 Deals

- 17.2.1.3.3 Other developments

- 17.2.1.4 MnM view

- 17.2.1.4.1 Key strengths/Right to win

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses/Competitive threats

- 17.2.2 BUREAU VERITAS

- 17.2.2.1 Business overview

- 17.2.2.2 Solutions/Services offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Solution/Service launches

- 17.2.2.3.2 Deals

- 17.2.2.3.3 Expansions

- 17.2.2.4 MnM view

- 17.2.2.4.1 Key strengths/Right to win

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses/Competitive threats

- 17.2.3 TUV RHEINLAND

- 17.2.3.1 Business overview

- 17.2.3.2 Solutions/Services offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Solution/Service launches

- 17.2.3.3.2 Deals

- 17.2.3.3.3 Expansions

- 17.2.3.3.4 Other developments

- 17.2.3.4 MnM view

- 17.2.3.4.1 Key strengths/Right to win

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses/Competitive threats

- 17.2.4 TUV SUD

- 17.2.4.1 Business overview

- 17.2.4.2 Solutions/Services offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Solution/Service launches

- 17.2.4.3.2 Deals

- 17.2.4.3.3 Expansions

- 17.2.4.3.4 Other developments

- 17.2.4.4 MnM view

- 17.2.4.4.1 Key strengths/Right to win

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses/Competitive threats

- 17.2.5 DEKRA

- 17.2.5.1 Business overview

- 17.2.5.2 Solutions/Services offered

- 17.2.5.3 Recent developments

- 17.2.5.3.1 Solution/Service launches

- 17.2.5.3.2 Deals

- 17.2.5.3.3 Expansions

- 17.2.5.3.4 Other developments

- 17.2.5.4 MnM view

- 17.2.5.5 Key strengths/Right to win

- 17.2.5.6 Strategic choices

- 17.2.5.7 Weaknesses/Competitive threats

- 17.2.6 INTERTEK GROUP PLC

- 17.2.6.1 Business overview

- 17.2.6.2 Solutions/Services offered

- 17.2.6.3 Recent developments

- 17.2.6.3.1 Solution/Service launches

- 17.2.6.3.2 Deals

- 17.2.6.3.3 Expansions

- 17.2.6.3.4 Other developments

- 17.2.7 DNV

- 17.2.7.1 Business overview

- 17.2.7.2 Solutions/Services offered

- 17.2.7.3 Recent developments

- 17.2.7.3.1 Solution/Service launches

- 17.2.7.3.2 Deals

- 17.2.7.3.3 Expansions

- 17.2.7.3.4 Other developments

- 17.2.8 APPLUS+

- 17.2.8.1 Business overview

- 17.2.8.2 Recent developments

- 17.2.8.2.1 Solution/Service launches

- 17.2.8.2.2 Deals

- 17.2.8.2.3 Expansions

- 17.2.8.2.4 Other developments

- 17.2.9 EUROFINS SCIENTIFIC

- 17.2.9.1 Business overview

- 17.2.9.2 Solutions/Services offered

- 17.2.9.3 Recent developments

- 17.2.9.3.1 Solution/Service launches

- 17.2.9.3.2 Deals

- 17.2.9.3.3 Expansions

- 17.2.9.3.4 Other developments

- 17.2.10 UL LLC

- 17.2.10.1 Business overview

- 17.2.10.2 Solutions/Services offered

- 17.2.10.3 Recent developments

- 17.2.10.3.1 Solution/Service launches

- 17.2.10.3.2 Deals

- 17.2.10.3.3 Expansions

- 17.2.10.3.4 Other developments

- 17.2.1 SGS SA

- 17.3 OTHER AI-POWERED TIC SERVICE PROVIDERS

- 17.3.1 TUV NORD GROUP

- 17.3.2 ELEMENT MATERIALS TECHNOLOGY

- 17.3.3 ALS LIMITED

- 17.3.4 KIWA

- 17.3.5 SOCOTEC

- 17.3.6 RINA

- 17.3.7 MISTRAS GROUP

- 17.3.8 ACUREN

- 17.3.9 LLOYD'S REGISTER

- 17.3.10 LRQA

- 17.3.11 TEAM, INC.

- 17.3.12 ROSEN GROUP

- 17.3.13 NDT GLOBAL

- 17.3.14 QIMA

- 17.3.15 BSI GROUP

- 17.4 AI TECHNOLOGY & INFRASTRUCTURE ENABLERS

- 17.4.1 IBM

- 17.4.2 GOOGLE LLC

- 17.4.3 MICROSOFT AZURE

- 17.4.4 AMAZON WEB SERVICES

- 17.4.5 CREDO AI

- 17.4.6 HOLISTIC AI

- 17.4.7 LANDINGAI

- 17.4.8 NVIDIA

- 17.4.9 COGNEX

- 17.4.10 SUPER.AI

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY RESEARCH

- 18.1.1.1 Major secondary sources

- 18.1.1.2 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviews with experts

- 18.1.2.2 Key data from primary sources

- 18.1.2.3 Key industry insights

- 18.1.2.4 Breakdown of primary interviews

- 18.1.3 SECONDARY & PRIMARY RESEARCH

- 18.1.1 SECONDARY RESEARCH

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.1.1 Approach to estimate market size using bottom-up approach

- 18.2.2 TOP-DOWN APPROACH

- 18.2.2.1 Approach to estimate market size using top-down approach

- 18.2.1 BOTTOM-UP APPROACH

- 18.3 DATA TRIANGULATION

- 18.4 RESEARCH ASSUMPTIONS

- 18.5 RISK ASSESSMENT

- 18.6 RESEARCH LIMITATIONS

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 STRATEGIC MOVES BY TIER 1, TIER 2, AND TIER 3 PLAYERS: COMPETITIVE STRATEGY MATRIX

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES

- TABLE 3 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 4 ROLE OF COMPANIES IN AI INSPECTION ECOSYSTEM

- TABLE 5 LIST OF KEY CONFERENCES & EVENTS, 2026-2027

- TABLE 6 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 7 AI INSPECTION MARKET: TECHNOLOGY ROADMAP

- TABLE 8 LIST OF MAJOR PATENTS, 2020-2024

- TABLE 9 AI INSPECTION MARKET: REGULATIONS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANISATIONS

- TABLE 15 STANDARDS: AI INSPECTION/AI-POWERED TIC SERVICES

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 17 KEY BUYING CRITERIA FOR END USERS

- TABLE 18 UNMET NEEDS IN AI INSPECTION MARKET BY END-USE INDUSTRY

- TABLE 19 AI INSPECTION MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 20 AI INSPECTION MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 21 AI-POWERED TESTING SERVICES: AI INSPECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 22 AI-POWERED TESTING SERVICES: AI INSPECTION MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 23 AI-POWERED INSPECTION SERVICES: AI INSPECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 24 AI-POWERED INSPECTION SERVICES: AI INSPECTION MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 25 AI-POWERED CERTIFICATION SERVICES: AI INSPECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 26 AI-POWERED CERTIFICATION SERVICES: AI INSPECTION MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 27 OTHER SERVICE TYPES: AI INSPECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 28 OTHER SERVICE TYPES: AI INSPECTION MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 29 AI INSPECTION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 30 AI INSPECTION MARKET, BY TECHNOLOGY, 2025-2032 (USD MILLION)

- TABLE 31 COMPUTER VISION: AI INSPECTION MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 32 COMPUTER VISION: AI INSPECTION MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 33 MACHINE LEARNING (ML) & ANALYTICS: AI INSPECTION MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 34 MACHINE LEARNING (ML) & ANALYTICS: AI INSPECTION MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 35 MACHINE LEARNING (ML) & ANALYTICS: AI INSPECTION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 36 MACHINE LEARNING (ML) & ANALYTICS: AI INSPECTION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 37 NATURAL LANGUAGE PROCESSING (NLP): AI INSPECTION MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 38 NATURAL LANGUAGE PROCESSING (NLP): AI INSPECTION MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 39 OTHER TECHNOLOGIES: AI INSPECTION MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 40 OTHER TECHNOLOGIES: AI INSPECTION MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 41 AI INSPECTION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 AI INSPECTION MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 43 AI INSPECTION MARKET, BY SERVICE DELIVERY MODE, 2021-2024 (USD MILLION)

- TABLE 44 AI INSPECTION MARKET, BY SERVICE DELIVERY MODE, 2025-2032 (USD MILLION)

- TABLE 45 AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 46 AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 47 AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 48 AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 49 MANUFACTURING: AI INSPECTION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 MANUFACTURING: AI INSPECTION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 51 ENERGY & UTILITIES: AI INSPECTION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 52 ENERGY & UTILITIES: AI INSPECTION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 53 IT & TELECOMMUNICATIONS: AI INSPECTION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 54 IT & TELECOMMUNICATIONS: AI INSPECTION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 55 TRANSPORTATION & LOGISTICS: AI INSPECTION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 56 TRANSPORTATION & LOGISTICS: AI INSPECTION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 57 AI INSPECTION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 AI INSPECTION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 ASIA PACIFIC: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 61 ASIA PACIFIC: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 62 ASIA PACIFIC: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 63 ASIA PACIFIC: AI INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: AI INSPECTION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 65 CHINA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 66 CHINA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 67 CHINA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 68 CHINA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 69 JAPAN: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 70 JAPAN: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 71 JAPAN: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 72 JAPAN: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 73 INDIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 74 INDIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 75 INDIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 76 INDIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 77 SOUTH KOREA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 78 SOUTH KOREA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 79 SOUTH KOREA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 80 SOUTH KOREA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 81 AUSTRALIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 82 AUSTRALIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 83 AUSTRALIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 84 AUSTRALIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 85 THAILAND: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 86 THAILAND: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 87 THAILAND: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 88 THAILAND: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 89 VIETNAM: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 90 VIETNAM: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 91 VIETNAM: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 92 VIETNAM: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 93 MALAYSIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 94 MALAYSIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 95 MALAYSIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 96 MALAYSIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 97 INDONESIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 98 INDONESIA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 99 INDONESIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 100 INDONESIA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 101 SINGAPORE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 SINGAPORE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 103 SINGAPORE: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 104 SINGAPORE: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 109 NORTH AMERICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 111 NORTH AMERICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 113 NORTH AMERICA: AI INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: AI INSPECTION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 115 US: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 US: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 117 US: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 118 US: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 119 CANADA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 CANADA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 121 CANADA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 122 CANADA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 123 EUROPE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 125 EUROPE: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 127 EUROPE: AI INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: AI INSPECTION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 129 GERMANY: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 131 GERMANY: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 132 GERMANY: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 133 FRANCE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 FRANCE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 135 FRANCE: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 136 FRANCE: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 137 UK: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 UK: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 139 UK: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 140 UK: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 141 ITALY: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 ITALY: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 143 ITALY: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 144 ITALY: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 145 SPAIN: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 SPAIN: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 147 SPAIN: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 148 SPAIN: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 149 NETHERLANDS: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 NETHERLANDS: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 151 NETHERLANDS: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 152 NETHERLANDS: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 153 NORDICS: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 NORDICS: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 155 NORDICS: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 156 NORDICS: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 157 REST OF EUROPE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 REST OF EUROPE: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 159 REST OF EUROPE: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 160 REST OF EUROPE: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 161 LATIN AMERICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 LATIN AMERICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 163 LATIN AMERICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 164 LATIN AMERICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 165 LATIN AMERICA: AI INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 LATIN AMERICA: AI INSPECTION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 167 BRAZIL: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 BRAZIL: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 169 BRAZIL: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 170 BRAZIL: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 171 ARGENTINA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 ARGENTINA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 173 ARGENTINA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 174 ARGENTINA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 175 MEXICO: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 176 MEXICO: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 177 MEXICO: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 178 MEXICO: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 181 REST OF LATIN AMERICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 182 REST OF LATIN AMERICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 189 GCC COUNTRIES: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 190 GCC COUNTRIES: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 191 GCC COUNTRIES: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 192 GCC COUNTRIES: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 193 GCC COUNTRIES: AI INSPECTION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 194 GCC COUNTRIES: AI INSPECTION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 195 SOUTH AFRICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 196 SOUTH AFRICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 197 SOUTH AFRICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 198 SOUTH AFRICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2021-2024 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: AI INSPECTION MARKET, BY SOURCING TYPE, 2025-2032 (USD MILLION)

- TABLE 203 AI INSPECTION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 204 AI INSPECTION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 205 AI INSPECTION MARKET: REGION FOOTPRINT

- TABLE 206 AI INSPECTION MARKET: SERVICE TYPE FOOTPRINT

- TABLE 207 AI INSPECTION MARKET: TECHNOLOGY FOOTPRINT

- TABLE 208 AI INSPECTION MARKET: APPLICATION FOOTPRINT

- TABLE 209 AI INSPECTION MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 210 AI INSPECTION MARKET: KEY STARTUPS/SMES

- TABLE 211 AI INSPECTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 212 AI INSPECTION MARKET: SOLUTION/SERVICE LAUNCHES, JANUARY 2021-DECEMBER 2025

- TABLE 213 AI INSPECTION MARKET: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 214 AI INSPECTION MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2025

- TABLE 215 AI INSPECTION MARKET: OTHER DEVELOPMENTS, JANUARY 2021-DECEMBER 2025

- TABLE 216 SGS SA: COMPANY OVERVIEW

- TABLE 217 SGS SA: SOLUTIONS/SERVICES OFFERED

- TABLE 218 SGS SA: SOLUTION/SERVICE LAUNCHES

- TABLE 219 SGS SA: DEALS

- TABLE 220 SGS SA: OTHER DEVELOPMENTS

- TABLE 221 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 222 BUREAU VERITAS: SOLUTIONS/SERVICES OFFERED

- TABLE 223 BUREAU VERITAS: SOLUTION/SERVICE LAUNCHES

- TABLE 224 BUREAU VERITAS: DEALS

- TABLE 225 BUREAU VERITAS: EXPANSIONS

- TABLE 226 TUV RHEINLAND: COMPANY OVERVIEW

- TABLE 227 TUV RHEINLAND: SOLUTIONS/SERVICES OFFERED

- TABLE 228 TUV RHEINLAND: SOLUTION/SERVICE LAUNCHES

- TABLE 229 TUV RHEINLAND: DEALS

- TABLE 230 TUV RHEINLAND: EXPANSIONS

- TABLE 231 TUV RHEINLAND: OTHER DEVELOPMENTS

- TABLE 232 TUV SUD: COMPANY OVERVIEW

- TABLE 233 TUV SUD: SOLUTIONS/SERVICES OFFERED

- TABLE 234 TUV SUD: SOLUTION/SERVICE LAUNCHES

- TABLE 235 TUV SUD: DEALS

- TABLE 236 TUV SUD: EXPANSIONS

- TABLE 237 TUV SUD: OTHER DEVELOPMENTS

- TABLE 238 DEKRA: COMPANY OVERVIEW

- TABLE 239 DEKRA: SOLUTIONS/SERVICES OFFERED

- TABLE 240 DEKRA: SOLUTION/SERVICE LAUNCHES

- TABLE 241 DEKRA: DEALS

- TABLE 242 DEKRA: EXPANSIONS

- TABLE 243 DEKRA: OTHER DEVELOPMENTS

- TABLE 244 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 245 INTERTEK GROUP PLC: SOLUTIONS/SERVICES OFFERED

- TABLE 246 INTERTEK GROUP PLC: SOLUTION/SERVICE LAUNCHES

- TABLE 247 INTERTEK GROUP PLC: DEALS

- TABLE 248 INTERTEK GROUP PLC: EXPANSIONS

- TABLE 249 INTERTEK GROUP PLC: OTHER DEVELOPMENTS

- TABLE 250 DNV: COMPANY OVERVIEW

- TABLE 251 DNV: SOLUTIONS/SERVICES OFFERED

- TABLE 252 DNV: SOLUTION/SERVICE LAUNCHES

- TABLE 253 DNV: DEALS

- TABLE 254 DNV: EXPANSIONS

- TABLE 255 DNV: OTHER DEVELOPMENTS

- TABLE 256 APPLUS+: COMPANY OVERVIEW

- TABLE 257 APPLUS+: SOLUTIONS/SERVICES OFFERED

- TABLE 258 APPLUS+: SOLUTION/SERVICE LAUNCHES

- TABLE 259 APPLUS+: DEALS

- TABLE 260 APPLUS+: EXPANSIONS

- TABLE 261 APPLUS+: OTHER DEVELOPMENTS

- TABLE 262 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 263 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 EUROFINS SCIENTIFIC: SOLUTION/SERVICE LAUNCHES

- TABLE 265 EUROFINS SCIENTIFIC: DEALS

- TABLE 266 EUROFINS SCIENTIFIC: EXPANSIONS

- TABLE 267 EUROFINS SCIENTIFIC: OTHER DEVELOPMENTS

- TABLE 268 UL LLC: COMPANY OVERVIEW

- TABLE 269 UL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 UL LLC: SOLUTION/SERVICE LAUNCHES

- TABLE 271 UL LLC: DEALS

- TABLE 272 UL LLC: EXPANSIONS

- TABLE 273 UL LLC: OTHER DEVELOPMENTS

- TABLE 274 RISK FACTOR ANALYSIS

List of Figures

- FIGURE 1 AI INSPECTION MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL AI INSPECTION MARKET, 2021-2032

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AI INSPECTION MARKET, 2023-2025

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF AI INSPECTION MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS IN AI INSPECTION MARKET, 2025-2030

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AI INSPECTION MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 8 INCREASING RELIANCE ON AI-BASED QUALITY AND COMPLIANCE SOLUTIONS TO DRIVE AI INSPECTION MARKET

- FIGURE 9 ON-SITE SERVICE DELIVERY MODE TO DOMINATE MARKET IN 2025 AND 2032

- FIGURE 10 QUALITY & PROCESS ASSURANCE SEGMENT TO DOMINATE MARKET IN 2025 AND 2032

- FIGURE 11 AUTOMOTIVE MANUFACTURING INDUSTRY ACCOUNTED FOR LARGEST SHARE OF AI INSPECTION MARKET IN 2025

- FIGURE 12 AI INSPECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 IMPACT ANALYSIS OF DRIVERS IN AI INSPECTION MARKET

- FIGURE 14 IMPACT ANALYSIS OF RESTRAINTS IN AI INSPECTION MARKET

- FIGURE 15 IMPACT ANALYSIS OF OPPORTUNITIES IN AI INSPECTION MARKET

- FIGURE 16 IMPACT ANALYSIS OF CHALLENGES IN AI INSPECTION MARKET

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 AI INSPECTION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 19 AI INSPECTION MARKET ECOSYSTEM

- FIGURE 20 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 22 AI INSPECTION MARKET: DECISION-MAKING FACTORS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- FIGURE 25 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 26 AI-POWERED CERTIFICATION SERVICES ARE EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 27 NATURAL LANGUAGE PROCESSING (NLP) TECHNOLOGY TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 28 PREDICTIVE & PRESCRIPTIVE ANALYTICS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 29 SUSTAINABILITY & ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) AUDITING SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 30 REMOTE SERVICES TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 31 OUTSOURCED SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 32 HEALTHCARE & LIFE SCIENCES APPLICATION SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 33 AEROSPACE & DEFENSE APPLICATIONS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 34 POWER GENERATION & RENEWABLES APPLICATION TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 35 SOFTWARE DEVELOPMENT & IT APPLICATION SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 36 SUPPLY CHAIN & WAREHOUSE OPERATIONS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 37 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE BY 2032

- FIGURE 39 ASIA PACIFIC: AI INSPECTION MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: AI INSPECTION MARKET SNAPSHOT

- FIGURE 41 EUROPE: AI INSPECTION MARKET SNAPSHOT

- FIGURE 42 LATIN AMERICA: AI INSPECTION MARKET SNAPSHOT

- FIGURE 43 MIDDLE EAST & AFRICA: AI INSPECTION MARKET SNAPSHOT

- FIGURE 44 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN AI INSPECTION MARKET, 2020-2024

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS IN AI INSPECTION MARKET, 2024

- FIGURE 46 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 47 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 AI INSPECTION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 AI INSPECTION MARKET: COMPANY FOOTPRINT

- FIGURE 51 AI INSPECTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 SGS SA: COMPANY SNAPSHOT

- FIGURE 53 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 54 TUV RHEINLAND: COMPANY SNAPSHOT

- FIGURE 55 TUV SUD: COMPANY SNAPSHOT

- FIGURE 56 DEKRA: COMPANY SNAPSHOT

- FIGURE 57 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 58 DNV: COMPANY SNAPSHOT

- FIGURE 59 APPLUS+: COMPANY SNAPSHOT

- FIGURE 60 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 61 UL LLC: COMPANY SNAPSHOT

- FIGURE 62 AI INSPECTION MARKET: RESEARCH DESIGN

- FIGURE 63 APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY AI-POWERED TIC SERVICE PROVIDERS

- FIGURE 64 APPROACH 2 (DEMAND SIDE): BOTTOM-UP ESTIMATION BASED ON REGION

- FIGURE 65 BOTTOM-UP APPROACH

- FIGURE 66 TOP-DOWN APPROACH

- FIGURE 67 DATA TRIANGULATION