PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1944726

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1944726

Drug Screening Market by Offering (On-site Testing, Rapid Testing, Analytical ), Sample, Drug, End User - Global Forecast to 2030

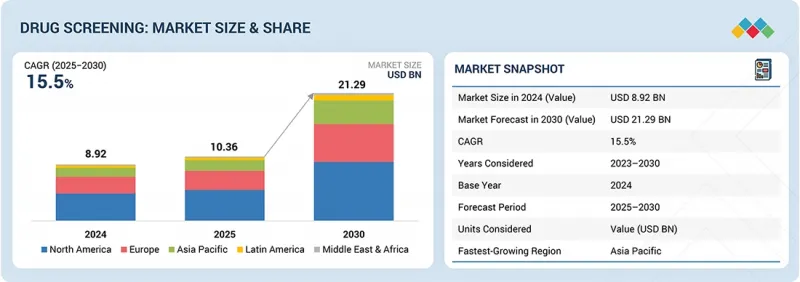

The global drug screening market is projected to reach USD 21.29 billion by 2030 from USD 10.36 billion in 2025, at a CAGR of 15.5%. The drug screening market is being driven by expanding government mandates and risk-based testing across safety-sensitive sectors such as transportation, construction, and manufacturing. This growth is underpinned by rising global substance use. Around 316 million people worldwide used drugs in 2023, a rate increasing faster than population growth, heightening impairment risks in workplaces and on public roads. Drug-related impairment is a critical contributor to road traffic injuries (RTIs), which cause approximately 1.3 million deaths annually, with 93% occurring in low- and middle-income countries, reinforcing the need for roadside and post-incident drug testing programs globally.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Offering, Sample Type, Drug Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

In the US, post-accident workplace drug positivity reached 10.4% in 2023, with marijuana positivity rising to a 25-year high of 7.5%, illustrating similar risk patterns in mature markets and accelerating adoption of random and post-incident testing. As a result, employers and regulators are prioritizing fast, legally defensible screening and confirmatory solutions, while hospitals increasingly rely on high-throughput LC-MS definitive toxicology testing to support critical clinical decisions. At the same time, broader acceptance of oral fluid, saliva, and hair testing is reshaping testing protocols by enabling more accurate detection of recent drug use with lower tampering risk, compelling organizations to upgrade conventional drug screening technologies in response to rising impairment rates and stricter accreditation standards.

"By offering, services segment to account for largest market share"

Based on offering, the services segment, which includes laboratory testing services and onsite testing services, is anticipated to fuel the drug screening market over the forecast period, as organizations continue to adopt comprehensive and managed testing services. Laboratory testing services assist in dealing with a large number of tests, confirmatory tests, and regulatory requirements, whereas onsite testing services facilitate rapid testing at the point of need. The rising trend of compliance-driven, random, and multi-panel testing programs, as well as the increasing use of alternative specimen types such as oral fluid and hair, is driving the demand for specialized service providers. This is also evident in the operational trends, which highlight that, according to the 2023 Quest Diagnostics Drug Testing Index, incidents of workforce test cheating jumped sharply, indicating the growing complexity and need for expert management and confirmatory services. In addition, workplace trends in 2025 highlight that scalability, regulatory compliance, and integrated reporting are key drivers for organizations outsourcing drug testing, rather than managing testing programs in-house. As testing volumes and expenses increase, organizations are increasingly adopting scalable, compliant, and service-oriented drug screening solutions, which support robust growth in the services market. In December 2022, Omega Laboratories launched the Urine Drugs of Abuse Testing Services in its state-of-the-art laboratory in Ontario, Canada. The laboratory offered urine drug testing from January 3, 2023, to complement its molecular testing.

"By end user, drug testing laboratories accounted for largest share of drug screening market in 2024."

The global drug screening market is fueled by the growing prevalence of illicit drug use, occupational health and safety concerns, and changing medical and legal needs. Globally, it is estimated that 9% of the adult population between 15 and 64 years of age uses illicit drugs every year, with cannabis, opioids, and stimulants being the most prevalent, while drug-related deaths contribute to approximately 0.6 million deaths annually, emphasizing a substantial public health problem. In Europe, cannabis use is a problem for 8.4 % of adults, and drug-related deaths continue to increase, largely due to opioids and polysubstance use. These factors are fueling increasing post-incident, random, and routine drug screening in the workplace in safety-sensitive industries worldwide. The increasing use of non-invasive specimen types, such as oral fluid and hair, as well as the expansion of roadside and law enforcement drug testing, is improving the detection of recent drug use and preventing sample tampering.

"APAC to witness the highest growth rate during the forecast period"

The increasing prevalence of substance use and the structural need for outsourced laboratory testing are driving the market in Asia Pacific. In Australia, the 2022-2023 National Drug Strategy Household Survey estimates that 1.8 million people smoke daily, 2.5 million people have used cannabis in the past 12 months, 1.0 million people have used cocaine, and 6.6 million people engage in risky alcohol consumption, reflecting the continued demand for clinical toxicology and substance monitoring services in healthcare and occupational settings. Moreover, illicit substance use, including cocaine and e-cigarettes, is rising among young adults and women, expanding the tested population beyond the traditional high-risk group. In India, the numbers are even more substantial. National survey data show that 14.6% of the population (approximately 160 million people) are current alcohol users, 31 million people use cannabis, and over 20 million people use opioids, with nearly 6 million people in need of treatment services. Furthermore, 11.8 million people misuse sedatives, and an estimated 850,000 people inject drugs, representing a continued need for laboratory-based toxicology testing in hospitals, rehabilitation facilities, and public health settings.

The breakdown of primary participants is as given below:

- By Company Type - Tier 1: 60%, Tier 2: 30%, and Tier 3: 10%

- By Designation - C-level: 30%, Director-level: 50%, and Others: 20%

- By Region - North America: 45%, Europe: 20%, Asia Pacific: 25%, Rest of the world: 10%.

Labcorp (US), Quest Diagnostics Incorporated (US), and Abbott (US) are some of the key players in the drug screening market.

- The study includes an in-depth competitive analysis of these key players in the drug screening market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the drug screening market by offering (products & services), sample type (urine samples, breath samples, oral fluid samples, hair samples, other samples), drug type (cannabis, alcohol, cocaine, opioids, amphetamine and methamphetamine, other drugs) end user (drug testing laboratories, workplaces, criminal justice systems and law enforcement agencies, hospitals, drug treatment centers, individual users, pain management centers, schools and colleges, other end users), and region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the drug screening market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers & acquisitions, and recent developments associated with the drug screening market. Competitive analysis of upcoming startups in the drug screening market ecosystem is covered in this report.

Reasons to buy this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the drug screening market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing consumption of illicit drugs and alcohol, Enforcement of stringent laws mandating drug and alcohol testing, Increasing number of regulatory approvals for drug screening products and services) restraints (Ban on alcohol consumption in Islamic countries, Prohibition on workplace drug testing) opportunities (Popularity of oral fluid testing, Introduction of fingerprint-based drug testing at workplaces, High growth opportunities in emerging economies) challenges (Accuracy and specificity concerns in breathalyzers, False positive and negative results in drug screening) influencing the growth of the drug screening market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the drug screening market

- Market Development: Comprehensive information about lucrative markets; the report analyses the drug screening market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the drug screening market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like LabCorp (US), Quest Diagnostics Incorporated (US), Abbott (US), OraSure Technologies Inc. (US), Alfa Scientific Designs Inc. (US), Thermo Fisher Scientific Inc. (US), and Dragerwerk AG & Co. KGaA (Germany), among others, in the drug screening market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS & KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN DRUG SCREENING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 DRUG SCREENING MARKET OVERVIEW

- 3.2 DRUG SCREENING MARKET, BY OFFERING & REGION

- 3.3 DRUG SCREENING MARKET: GEOGRAPHIC SNAPSHOT

- 3.4 DRUG SCREENING MARKET: DEVELOPED VS. EMERGING ECONOMIES

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growing consumption of illicit drugs and alcohol

- 4.2.1.2 Enforcement of stringent laws mandating drug and alcohol testing

- 4.2.1.3 Increasing number of regulatory approvals for drug screening products & services

- 4.2.2 RESTRAINTS

- 4.2.2.1 Ban on alcohol consumption in Islamic countries

- 4.2.2.2 Prohibition on workplace drug testing

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Popularity of oral fluid testing

- 4.2.3.2 Introduction of fingerprint-based drug testing in workplaces

- 4.2.3.3 High growth opportunities in emerging economies

- 4.2.4 CHALLENGES

- 4.2.4.1 Accuracy and specificity concerns in breathalyzers

- 4.2.4.2 False positive and negative results in drug screening

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS & WHITE SPACES

- 4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF SUBSTITUTES

- 5.1.4 THREAT OF NEW ENTRANTS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS & FORECAST

- 5.2.3 TRENDS IN GLOBAL HEALTHCARE IT INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING OF DRUG SCREENING PRODUCTS & SERVICES, BY TYPE (2024)

- 5.5.2 INDICATIVE PRICING OF DRUG SCREENING PRODUCTS & SERVICES, BY REGION (2024)

- 5.6 KEY CONFERENCES & EVENTS, 2026-2027

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.10 IMPACT OF 2025 US TARIFFS ON DRUG SCREENING MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON END-USE INDUSTRIES

- 5.10.5.1 Drug testing laboratories

- 5.10.5.2 Workplaces

- 5.10.5.3 Criminal justice systems & law enforcement agencies

- 5.10.5.4 Hospitals

- 5.10.5.5 Drug treatment centers

- 5.10.5.6 Individual users

- 5.10.5.7 Pain management centers

- 5.10.5.8 Schools & colleges

- 5.10.5.9 Other end users

6 STRATEGIC DISRUPTIONS THROUGH TECHNOLOGY, PATENTS, AND DIGITAL & AI ADOPTION

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 LC-MS/MS & GC-MS-BASED CONFIRMATORY TESTING TECHNOLOGIES

- 6.1.2 AI-DRIVEN RESULT INTERPRETATION & QUALITY ASSURANCE TECHNOLOGIES

- 6.1.3 LABORATORY AUTOMATION & ROBOTICS TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MOBILE HEALTH (MHEALTH) & REMOTE COLLECTION TECHNOLOGIES

- 6.2.2 ANALYTICS & POPULATION-LEVEL DRUG USE SURVEILLANCE TOOLS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 FORENSIC CASE MANAGEMENT SYSTEMS

- 6.3.2 WORKFORCE BACKGROUND SCREENING/VERIFICATION SYSTEMS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.5.1 PATENT PUBLICATION TRENDS FOR DRUG SCREENING MARKET

- 6.5.2 INSIGHTS: JURISDICTION & TOP APPLICANT ANALYSIS

- 6.6 FUTURE APPLICATIONS

- 6.6.1 AI-ENABLED INTELLIGENT SCREENING AND RESULT INTERPRETATION

- 6.6.2 CONTINUOUS AND PREDICTIVE DRUG MONITORING APPLICATIONS

- 6.6.3 DECENTRALIZED, AT-HOME, AND POINT-OF-CARE SCREENING EXPANSION

- 6.6.4 INTEGRATED COMPLIANCE, FORENSIC, AND PUBLIC HEALTH INTELLIGENCE PLATFORMS

- 6.6.5 PERSONALIZED AND THERAPEUTIC DRUG SCREENING APPLICATIONS

- 6.7 IMPACT OF AI/GEN AI ON DRUG SCREENING MARKET

- 6.7.1 INTRODUCTION

- 6.7.2 MARKET POTENTIAL OF AI/GEN AI IN DRUG SCREENING MARKET

- 6.7.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- 6.7.3.1 AI-driven transformation of preclinical toxicology screening at PathAI

- 6.7.4 IMPACT OF AI/GEN AI ON INTERCONNECTED & ADJACENT ECOSYSTEMS

- 6.7.4.1 Laboratory & toxicology operations

- 6.7.4.2 Laboratory information systems (LIS) & compliance infrastructure

- 6.7.4.3 Clinical care, workplace safety, and monitoring programs

- 6.7.5 USER READINESS AND IMPACT ASSESSMENT

- 6.7.5.1 User readiness

- 6.7.5.1.1 User A: Clinical, reference, and toxicology laboratories

- 6.7.5.1.2 User B: Healthcare providers, employers, and forensic agencies

- 6.7.5.2 Impact assessment

- 6.7.5.2.1 User A: Clinical, reference, and toxicology laboratories

- 6.7.5.2.1.1 Implementation

- 6.7.5.2.1.2 Impact

- 6.7.5.2.2 User B: Healthcare providers, employers, and forensic agencies

- 6.7.5.2.2.1 Implementation

- 6.7.5.2.2.2 Impact

- 6.7.5.2.1 User A: Clinical, reference, and toxicology laboratories

- 6.7.5.1 User readiness

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 INTRODUCTION

- 7.2 DECISION-MAKING PROCESS

- 7.3 BUYER STAKEHOLDERS & BUYING EVALUATION CRITERIA

- 7.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.3.2 BUYING CRITERIA

- 7.4 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 7.5.1 UNMET NEEDS

- 7.5.2 END-USER EXPECTATIONS

- 7.6 MARKET PROFITABILITY

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS & COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATORY FRAMEWORK

- 8.1.2.1 North America

- 8.1.2.2 Europe

- 8.1.2.3 Asia Pacific

- 8.1.2.4 Latin America

- 8.1.2.5 Middle East & Africa

- 8.1.3 INDUSTRY STANDARDS

9 DRUG SCREENING MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 SERVICES

- 9.2.1 WORKFORCE DECENTRALIZATION, PANEL COMPLEXITY, AND LITIGATION-READY TESTING TO DRIVE SUSTAINED MARKET GROWTH

- 9.2.2 LABORATORY TESTING SERVICES

- 9.2.2.1 Ability to ensure analytical rigor and compliance with regulatory standards to drive demand

- 9.2.3 ON-SITE TESTING SERVICES

- 9.2.3.1 Ability to deliver rapid, point-of-care screening solutions to drive market growth

- 9.3 PRODUCTS

- 9.3.1 ANALYTICAL INSTRUMENTS MARKET, BY TYPE

- 9.3.1.1 Breathalyzers

- 9.3.1.1.1 Fuel-cell breathalyzers

- 9.3.1.1.1.1 Extremely high accuracy, sensitivity, and reliability to drive demand for fuel-cell breathalyzers

- 9.3.1.1.2 Semiconductor breathalyzers

- 9.3.1.1.2.1 Lower prices of semiconductor breathalyzers to drive adoption

- 9.3.1.1.3 Other breathalyzers

- 9.3.1.1.1 Fuel-cell breathalyzers

- 9.3.1.2 Immunoassay analyzers

- 9.3.1.2.1 Growing adoption of high-throughput immunoassay platforms to power modern toxicology

- 9.3.1.3 Chromatography instruments

- 9.3.1.3.1 Advantages such as precise, high-sensitivity analysis in forensic, clinical, and regulatory laboratories to fuel growth

- 9.3.1.1 Breathalyzers

- 9.3.2 ANALYTICAL INSTRUMENTS MARKET, BY MODALITY

- 9.3.2.1 Handheld breathalyzers

- 9.3.2.1.1 Critical role in delivering fast, accurate, and portable alcohol screening to support market growth

- 9.3.2.2 Benchtop breathalyzers

- 9.3.2.2.1 Growing use of benchtop breathalyzers for drug detection analysis to drive growth

- 9.3.2.1 Handheld breathalyzers

- 9.3.3 RAPID TESTING DEVICES

- 9.3.3.1 Urine testing devices

- 9.3.3.1.1 Drug testing cups

- 9.3.3.1.1.1 Reduced contact with urine sample to drive demand

- 9.3.3.1.2 Dip cards

- 9.3.3.1.2.1 Ability to provide qualitative results within minutes to propel market

- 9.3.3.1.3 Drug testing cassettes

- 9.3.3.1.3.1 Lower cost alternatives to drug testing cups and dip cards to boost adoption

- 9.3.3.1.1 Drug testing cups

- 9.3.3.2 Oral fluid testing devices

- 9.3.3.2.1 Rapid, non-invasive detection of recent drug use across workplace, clinical, and law enforcement settings to fuel growth

- 9.3.3.1 Urine testing devices

- 9.3.4 CONSUMABLES

- 9.3.4.1 Assay kits

- 9.3.4.1.1 Rapid, cost-effective, and high-throughput screening across drug testing applications to drive market

- 9.3.4.2 Sample collection devices

- 9.3.4.2.1 Reliable, tamper-resistant, and versatile drug testing across settings to support growth

- 9.3.4.3 Calibrators & controls

- 9.3.4.3.1 Ability to verify accuracy, precision, and reliability of screening and confirmatory test results to drive growth

- 9.3.4.4 Other consumables

- 9.3.4.1 Assay kits

- 9.3.1 ANALYTICAL INSTRUMENTS MARKET, BY TYPE

10 DRUG SCREENING MARKET, BY SAMPLE TYPE

- 10.1 INTRODUCTION

- 10.2 URINE SAMPLES

- 10.2.1 RECENT ADVANCES TO STRENGTHEN ACCURACY AND RELIABILITY IN URINE DRUG TESTING

- 10.3 BREATH SAMPLES

- 10.3.1 BREATH ALCOHOL TESTS TO REGISTER WIDE USAGE IN WORKPLACE TESTING AND LAW ENFORCEMENT APPLICATIONS

- 10.4 ORAL FLUID SAMPLES

- 10.4.1 NON-INVASIVE SAMPLE COLLECTION AND LOW CHANCE OF ADULTERATION TO SUPPORT USAGE OF ORAL FLUID SAMPLES

- 10.5 HAIR SAMPLES

- 10.5.1 ABILITY OF HAIR SAMPLES TO PROVIDE INSIGHTS INTO LONG-TERM DRUG USE TO BOOST MARKET

- 10.6 OTHER SAMPLES

11 DRUG SCREENING MARKET, BY DRUG TYPE

- 11.1 INTRODUCTION

- 11.2 CANNABIS

- 11.2.1 GROWING CANNABIS USE AND REGULATORY COMPLEXITY TO DRIVE SUSTAINED DEMAND FOR DRUG SCREENING SOLUTIONS

- 11.3 ALCOHOL

- 11.3.1 REGULATORY ENFORCEMENT AND TECHNOLOGY INNOVATION TO STRENGTHEN ALCOHOL SCREENING ADOPTION

- 11.4 COCAINE

- 11.4.1 SHIFT TOWARD RAPID, DEFENSIBLE DETECTION TO POSITION COCAINE AS PRIORITY DRUG IN MODERN SCREENING PANELS

- 11.5 OPIOIDS

- 11.5.1 EXPANDED OPIOID PANELS AND ADVANCED CONFIRMATORY TECHNOLOGIES TO REINFORCE OPIOID SCREENING AS HIGH PRIORITY

- 11.6 AMPHETAMINES & METHAMPHETAMINES

- 11.6.1 ADVANCED ANALYTICS AND DIFFERENTIATION TESTING TO REDEFINE AMPHETAMINE & METHAMPHETAMINE DETECTION

- 11.7 OTHER DRUGS

12 DRUG SCREENING MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 DRUG TESTING LABORATORIES

- 12.2.1 ADVANCED ANALYTICS, AUTOMATION, AND EXPANDING FORENSIC AND CLINICAL DEMAND TO DRIVE MARKET GROWTH

- 12.3 WORKPLACES

- 12.3.1 RISING NUMBER OF DRUG ABUSE CASES TO INCREASE WORKPLACE TESTING

- 12.4 CRIMINAL JUSTICE SYSTEMS & LAW ENFORCEMENT AGENCIES

- 12.4.1 HIGH SUBSTANCE-USE PREVALENCE AND DUI RISKS TO DRIVE MANDATORY DRUG & ALCOHOL TESTING

- 12.5 HOSPITALS

- 12.5.1 RISING EMERGENCY ADMISSIONS, OPIOID OVERDOSES, AND PATIENT SAFETY MANDATES TO DRIVE STRONG DEMAND

- 12.6 DRUG TREATMENT CENTERS

- 12.6.1 RISING ADOPTION OF MEDICATION-ASSISTED TREATMENT, RELAPSE MONITORING, AND FENTANYL DETECTION TO DRIVE DEMAND

- 12.7 INDIVIDUAL USERS

- 12.7.1 GROWING SELF-MONITORING, HOME TESTING, AND RECOVERY ACCOUNTABILITY TO EXPANDING INDIVIDUAL USE OF SCREENING

- 12.8 PAIN MANAGEMENT CENTERS

- 12.8.1 OPIOID PRESCRIBING OVERSIGHT AND PATIENT SAFETY MANDATES TO DRIVE INCREASED DRUG SCREENING

- 12.9 SCHOOLS & COLLEGES

- 12.9.1 MODERN TESTING AND AWARENESS PROGRAMS TO STRENGTHEN DRUG ABUSE PREVENTION IN SCHOOLS & COLLEGES

- 12.10 OTHER END USERS

13 DRUG SCREENING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Regulatory enforcement and substance use prevalence drive drug screening market in US

- 13.2.3 CANADA

- 13.2.3.1 Public health surveillance, consumption trends, and enforcement & technological advancements to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Strengthening drug screening adoption through public health policy and technological modernization to support market growth

- 13.3.3 FRANCE

- 13.3.3.1 Regulatory enforcement, transport safety, and forensic modernization to shape drug screening market

- 13.3.4 UK

- 13.3.4.1 Community-embedded testing, criminal justice demand, and real-time drug surveillance to shape UK drug screening market

- 13.3.5 ITALY

- 13.3.5.1 Strengthening drug screening market through roadside enforcement and analytical innovation & institutional capacity

- 13.3.6 SPAIN

- 13.3.6.1 Expanding drug screening adoption through road safety programs to drive market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Synthetic drug control and pharmaceutical innovation to drive drug screening market growth

- 13.4.3 JAPAN

- 13.4.3.1 Japan's aging population and advanced digital infrastructure to drive rapid adoption

- 13.4.4 INDIA

- 13.4.4.1 Alcohol dominance, opioid misuse, and India's role as global pharmaceutical hub to drive drug screening market growth

- 13.4.5 AUSTRALIA

- 13.4.5.1 Harm-reduction policy, workplace safety regulation, and roadside testing to drive drug screening market

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Zero-tolerance drug policy, mandatory military service, and forensic-grade testing to shape drug screening market

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 13.5.2 BRAZIL

- 13.5.2.1 Brazil's drug screening market to expand amid road safety mandates, substance-use burden, and regulatory enforcement

- 13.5.3 MEXICO

- 13.5.3.1 Mexico's drug screening market shaped by methamphetamine prevalence, cross-border labor dynamics, and public safety enforcement

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 13.6.2 GCC COUNTRIES

- 13.6.2.1 Saudi Arabia

- 13.6.2.1.1 Public safety, diagnostic modernization, and evolving consumption patterns to boost market

- 13.6.2.2 UAE

- 13.6.2.2.1 Integrated safety enforcement, workplace testing, and diagnostic modernization to expand market in UAE

- 13.6.2.3 Rest of GCC Countries

- 13.6.2.1 Saudi Arabia

- 13.6.3 SOUTH AFRICA

- 13.6.3.1 Rising substance use, workplace risk management, and advanced screening capabilities to fuel market growth

- 13.6.4 REST OF MIDDLE EAST & AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DRUG SCREENING MARKET

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 BRAND COMPARISON

- 14.6 COMPANY VALUATION & FINANCIAL METRICS

- 14.6.1 FINANCIAL METRICS

- 14.6.2 COMPANY VALUATION

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Offering footprint

- 14.7.5.4 Sample type footprint

- 14.7.5.5 Drug type footprint

- 14.7.5.6 End-user footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 14.9.2 DEALS

- 14.9.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 LABCORP

- 15.1.1.1 Business overview

- 15.1.1.2 Products & services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 QUEST DIAGNOSTICS INCORPORATED

- 15.1.2.1 Business overview

- 15.1.2.2 Products & services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product & service launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 ABBOTT

- 15.1.3.1 Business overview

- 15.1.3.2 Products & services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses & competitive threats

- 15.1.4 ORASURE TECHNOLOGIES INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products & services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 ALFA SCIENTIFIC DESIGNS INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products & services offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses & competitive threats

- 15.1.6 THERMO FISHER SCIENTIFIC INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products & services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product developments

- 15.1.6.3.2 Deals

- 15.1.7 DRAGERWERK AG & CO. KGAA

- 15.1.7.1 Business overview

- 15.1.7.2 Products & services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.8 LIFELOC TECHNOLOGIES, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products & services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Other developments

- 15.1.9 MPD INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products & services offered

- 15.1.10 OMEGA LABORATORIES, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products & services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Service launches

- 15.1.10.3.2 Deals

- 15.1.10.3.3 Other developments

- 15.1.11 PREMIER BIOTECH, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products & services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.12 PSYCHEMEDICS CORPORATION

- 15.1.12.1 Business overview

- 15.1.12.2 Products & services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches & enhancements

- 15.1.12.3.2 Other developments

- 15.1.13 F. HOFFMANN-LA ROCHE LTD.

- 15.1.13.1 Business overview

- 15.1.13.2 Products & services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.14 SHIMADZU CORPORATION

- 15.1.14.1 Business overview

- 15.1.14.2 Products & services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches

- 15.1.14.3.2 Deals

- 15.1.15 SIEMENS HEALTHINEERS AG

- 15.1.15.1 Business overview

- 15.1.15.2 Products & services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.15.3.2 Deals

- 15.1.16 BIO-RAD LABORATORIES, INC.

- 15.1.16.1 Business overview

- 15.1.16.2 Products & services offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Product enhancements

- 15.1.16.3.2 Deals

- 15.1.1 LABCORP

- 15.2 OTHER PLAYERS

- 15.2.1 CAREHEALTH AMERICA CORP.

- 15.2.2 ACCUSOURCEHR, INC.

- 15.2.3 CORDANT HEALTH SOLUTIONS

- 15.2.4 ADVACARE PHARMA

- 15.2.5 ACM GLOBAL LABORATORIES

- 15.2.6 MILLENNIUM HEALTH

- 15.2.7 CLINICAL REFERENCE LABORATORY, INC.

- 15.2.8 INTOXIMETERS

- 15.2.9 INTOXALOCK

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH APPROACH

- 16.1.1 SECONDARY RESEARCH

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY RESEARCH

- 16.1.2.1 Primary sources

- 16.1.2.2 Key data from primary sources

- 16.1.2.3 Breakdown of primaries

- 16.1.2.4 Insights from primary experts

- 16.1.1 SECONDARY RESEARCH

- 16.2 RESEARCH METHODOLOGY DESIGN

- 16.3 MARKET SIZE ESTIMATION

- 16.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 16.5 MARKET SHARE ESTIMATION

- 16.6 STUDY ASSUMPTIONS

- 16.7 RESEARCH LIMITATIONS

- 16.7.1 METHODOLOGY-RELATED LIMITATIONS

- 16.8 RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 KEY PRODUCT & SERVICE LAUNCHES FOR DRUG & ALCOHOL TESTING, 2022-2025

- TABLE 3 REGULATORY AUTHORITIES FOR DRUG & ALCOHOL TESTING PRODUCTS & SERVICES

- TABLE 4 DRUG SCREENING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 DRUG SCREENING MARKET: ROLE IN ECOSYSTEM

- TABLE 6 INDICATIVE PRICING OF DRUG SCREENING PRODUCTS & SERVICES, BY TYPE, 2024 (USD)

- TABLE 7 INDICATIVE PRICING OF DRUG SCREENING PRODUCTS & SERVICES, BY REGION, 2024 (USD)

- TABLE 8 DRUG SCREENING MARKET: KEY CONFERENCES & EVENTS, 2026-2027

- TABLE 9 CASE 1: COMPREHENSIVE ORAL FLUID DUID TESTING PROGRAM

- TABLE 10 CASE 2: HIGH-THROUGHPUT GC-MS DRUG SCREENING IN FORENSIC URINE TESTING

- TABLE 11 CASE 3: ORAL FLUID DRUG TESTING IMPLEMENTATION IN A DRUG COURT PROGRAM

- TABLE 12 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR DRUG SCREENING MARKET

- TABLE 14 DRUG SCREENING MARKET: LIST OF PATENTS/PATENT APPLICATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END USERS (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 17 UNMET NEEDS IN DRUG SCREENING MARKET

- TABLE 18 END-USER EXPECTATIONS IN DRUG SCREENING MARKET

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 REGULATORY SCENARIO OF NORTH AMERICA

- TABLE 25 REGULATORY SCENARIO OF EUROPE

- TABLE 26 REGULATORY SCENARIO OF ASIA PACIFIC

- TABLE 27 REGULATORY SCENARIO OF LATIN AMERICA

- TABLE 28 REGULATORY SCENARIO OF MIDDLE EAST & AFRICA

- TABLE 29 DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 30 DRUG SCREENING SERVICES MARKET: MAJOR PLAYERS & OFFERINGS

- TABLE 31 DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 32 DRUG SCREENING SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 DRUG SCREENING MARKET FOR LABORATORY TESTING SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 DRUG SCREENING MARKET FOR ON-SITE TESTING SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 DRUG SCREENING PRODUCTS MARKET: MAJOR PLAYERS & OFFERINGS

- TABLE 36 DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 37 DRUG SCREENING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 41 DRUG SCREENING MARKET FOR BREATHALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 DRUG SCREENING MARKET FOR FUEL-CELL BREATHALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 DRUG SCREENING MARKET FOR SEMICONDUCTOR BREATHALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 DRUG SCREENING MARKET FOR OTHER BREATHALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 DRUG SCREENING MARKET FOR IMMUNOASSAY ANALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 DRUG SCREENING MARKET FOR CHROMATOGRAPHY INSTRUMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 48 DRUG SCREENING MARKET FOR HANDHELD BREATHALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 DRUG SCREENING MARKET FOR BENCHTOP BREATHALYZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 51 DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 BLOOD SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 53 DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 DRUG SCREENING MARKET FOR DRUG TESTING CUPS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 DRUG SCREENING MARKET FOR DIP CARDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 DRUG SCREENING MARKET FOR DRUG TESTING CASSETTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 DRUG SCREENING MARKET FOR ORAL FLUID TESTING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 59 DRUG SCREENING MARKET FOR CONSUMABLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 DRUG SCREENING MARKET FOR ASSAY KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 DRUG SCREENING MARKET FOR SAMPLE COLLECTION DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 DRUG SCREENING MARKET FOR CALIBRATORS & CONTROLS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 DRUG SCREENING MARKET FOR OTHER CONSUMABLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 65 DRUG SCREENING MARKET FOR URINE SAMPLES: MAJOR PLAYERS & OFFERINGS

- TABLE 66 DRUG SCREENING MARKET FOR URINE SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 DRUG SCREENING MARKET FOR BREATH SAMPLES: MAJOR PLAYERS & OFFERINGS

- TABLE 68 DRUG SCREENING MARKET FOR BREATH SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 DRUG SCREENING MARKET FOR ORAL FLUID SAMPLES: MAJOR PLAYERS & OFFERINGS

- TABLE 70 DRUG SCREENING MARKET FOR ORAL FLUID SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 DRUG SCREENING MARKET FOR HAIR SAMPLES: MAJOR PLAYERS & OFFERINGS

- TABLE 72 DRUG SCREENING MARKET FOR HAIR SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 DRUG SCREENING MARKET FOR OTHER SAMPLES: MAJOR PLAYERS & OFFERINGS

- TABLE 74 DRUG SCREENING MARKET FOR OTHER SAMPLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 76 DRUG SCREENING MARKET FOR CANNABIS: MAJOR PLAYERS & OFFERINGS

- TABLE 77 DRUG SCREENING MARKET FOR CANNABIS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 DRUG SCREENING MARKET FOR ALCOHOL: MAJOR PLAYERS & OFFERINGS

- TABLE 79 DRUG SCREENING MARKET FOR ALCOHOL, BY REGION, 2023-2030 (USD MILLION)

- TABLE 80 DRUG SCREENING MARKET FOR COCAINE: MAJOR PLAYERS & OFFERINGS

- TABLE 81 DRUG SCREENING MARKET FOR COCAINE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 DRUG SCREENING MARKET FOR OPIOIDS: MAJOR PLAYERS & OFFERINGS

- TABLE 83 DRUG SCREENING MARKET FOR OPIDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 DRUG SCREENING MARKET FOR AMPHETAMINES & METHAMPHETAMINES: MAJOR PLAYERS & OFFERINGS

- TABLE 85 DRUG SCREENING MARKET FOR AMPHETAMINES & METHAMPHETAMINES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 DRUG SCREENING MARKET FOR OTHER DRUGS: MAJOR PLAYERS & OFFERINGS

- TABLE 87 DRUG SCREENING MARKET FOR OTHER DRUGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 89 DRUG SCREENING MARKET FOR DRUG TESTING LABORATORIES: MAJOR PLAYERS & OFFERINGS

- TABLE 90 DRUG SCREENING MARKET FOR DRUG TESTING LABORATORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 91 DRUG SCREENING MARKET FOR WORKPLACES: MAJOR PLAYERS & OFFERINGS

- TABLE 92 DRUG SCREENING MARKET FOR WORKPLACES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 US: DRUG SCREENING MARKET FOR WORKPLACES, BY TYPE, 2019-2026 (USD MILLION)

- TABLE 94 DRUG SCREENING MARKET FOR CRIMINAL JUSTICE SYSTEMS & LAW ENFORCEMENT AGENCIES: MAJOR PLAYERS & OFFERINGS

- TABLE 95 DRUG SCREENING MARKET FOR CRIMINAL JUSTICE SYSTEMS & LAW ENFORCEMENT AGENCIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 96 DRUG SCREENING MARKET FOR HOSPITALS: MAJOR PLAYERS & OFFERINGS

- TABLE 97 DRUG SCREENING MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 98 DRUG SCREENING MARKET FOR DRUG TREATMENT CENTERS: MAJOR PLAYERS & OFFERINGS

- TABLE 99 DRUG SCREENING MARKET FOR DRUG TREATMENT CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 100 DRUG SCREENING MARKET FOR INDIVIDUAL USERS: MAJOR PLAYERS & OFFERINGS

- TABLE 101 DRUG SCREENING MARKET FOR INDIVIDUAL USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 102 DRUG SCREENING MARKET FOR PAIN MANAGEMENT CENTERS: MAJOR PLAYERS & OFFERINGS

- TABLE 103 DRUG SCREENING MARKET FOR PAIN MANAGEMENT CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 104 DRUG SCREENING MARKET FOR SCHOOLS & COLLEGES: MAJOR PLAYERS & OFFERINGS

- TABLE 105 DRUG SCREENING MARKET FOR SCHOOLS & COLLEGES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 106 DRUG SCREENING MARKET FOR OTHER END USERS: MAJOR PLAYERS & OFFERINGS

- TABLE 107 DRUG SCREENING MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 108 DRUG SCREENING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 110 NORTH AMERICA: DRUG SCREENING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 US: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 124 US: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 US: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 US: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 US: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 US: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 129 US: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 US: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 US: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 US: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 133 US: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 134 US: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 135 CANADA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 136 CANADA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 CANADA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 CANADA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 CANADA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 CANADA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 141 CANADA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 CANADA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 CANADA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 CANADA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 145 CANADA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 146 CANADA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 EUROPE: MACROECONOMIC INDICATORS

- TABLE 148 EUROPE: DRUG SCREENING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 150 EUROPE: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 EUROPE: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 EUROPE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 EUROPE: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 155 EUROPE: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 EUROPE: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 EUROPE: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 EUROPE: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 159 EUROPE: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 160 EUROPE: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 161 GERMANY: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 162 GERMANY: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 GERMANY: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 GERMANY: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 GERMANY: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 GERMANY: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 167 GERMANY: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 GERMANY: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 GERMANY: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 GERMANY: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 171 GERMANY: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 172 GERMANY: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 173 FRANCE: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 174 FRANCE: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 FRANCE: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 FRANCE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 FRANCE: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 FRANCE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 179 FRANCE: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 FRANCE: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 FRANCE: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 FRANCE: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 183 FRANCE: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 184 FRANCE: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 185 UK: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 186 UK: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 UK: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 UK: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 UK: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 UK: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 191 UK: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 UK: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 UK: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 UK: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 195 UK: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 196 UK: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 197 ITALY: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 198 ITALY: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 ITALY: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 ITALY: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 ITALY: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 ITALY: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 203 ITALY: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 ITALY: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 ITALY: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 ITALY: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 207 ITALY: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 208 ITALY: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 209 SPAIN: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 210 SPAIN: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 SPAIN: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 SPAIN: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 SPAIN: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 SPAIN: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 215 SPAIN: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 SPAIN: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 SPAIN: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 SPAIN: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 219 SPAIN: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 220 SPAIN: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 221 REST OF EUROPE: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 222 REST OF EUROPE: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 REST OF EUROPE: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF EUROPE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 REST OF EUROPE: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 REST OF EUROPE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 227 REST OF EUROPE: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 REST OF EUROPE: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 REST OF EUROPE: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 REST OF EUROPE: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 231 REST OF EUROPE: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 232 REST OF EUROPE: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 233 ASIA PACIFIC: MACROECONOMIC INDICATORS

- TABLE 234 ASIA PACIFIC: DRUG SCREENING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 235 ASIA PACIFIC: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 236 ASIA PACIFIC: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 ASIA PACIFIC: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 ASIA PACIFIC: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 241 ASIA PACIFIC: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 ASIA PACIFIC: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 ASIA PACIFIC: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 ASIA PACIFIC: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 245 ASIA PACIFIC: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 246 ASIA PACIFIC: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 247 CHINA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 248 CHINA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 CHINA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 CHINA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 CHINA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 CHINA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 253 CHINA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 CHINA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 CHINA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 CHINA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 257 CHINA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 258 CHINA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 259 JAPAN: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 260 JAPAN: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 JAPAN: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 262 JAPAN: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 263 JAPAN: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 JAPAN: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 265 JAPAN: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 JAPAN: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 JAPAN: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 JAPAN: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 269 JAPAN: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 270 JAPAN: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 271 INDIA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 272 INDIA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 INDIA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 INDIA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 INDIA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 INDIA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 277 INDIA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 INDIA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 INDIA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 INDIA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 281 INDIA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 282 INDIA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 283 AUSTRALIA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 284 AUSTRALIA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 AUSTRALIA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 AUSTRALIA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 AUSTRALIA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 AUSTRALIA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 289 AUSTRALIA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 AUSTRALIA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 AUSTRALIA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 AUSTRALIA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 293 AUSTRALIA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 294 AUSTRALIA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 295 SOUTH KOREA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 296 SOUTH KOREA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 SOUTH KOREA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 298 SOUTH KOREA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 299 SOUTH KOREA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 SOUTH KOREA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 301 SOUTH KOREA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 SOUTH KOREA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 SOUTH KOREA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 304 SOUTH KOREA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 305 SOUTH KOREA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 306 SOUTH KOREA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 307 REST OF ASIA PACIFIC: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 308 REST OF ASIA PACIFIC: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 REST OF ASIA PACIFIC: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 REST OF ASIA PACIFIC: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 REST OF ASIA PACIFIC: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 312 REST OF ASIA PACIFIC: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 313 REST OF ASIA PACIFIC: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 REST OF ASIA PACIFIC: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 REST OF ASIA PACIFIC: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 316 REST OF ASIA PACIFIC: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 317 REST OF ASIA PACIFIC: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 318 REST OF ASIA PACIFIC: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 319 LATIN AMERICA: MACROECONOMIC INDICATORS

- TABLE 320 LATIN AMERICA: DRUG SCREENING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 321 LATIN AMERICA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 322 LATIN AMERICA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 LATIN AMERICA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 324 LATIN AMERICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 325 LATIN AMERICA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 326 LATIN AMERICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 327 LATIN AMERICA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 LATIN AMERICA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 329 LATIN AMERICA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 330 LATIN AMERICA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 331 LATIN AMERICA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 332 LATIN AMERICA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 333 BRAZIL: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 334 BRAZIL: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 BRAZIL: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 336 BRAZIL: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 337 BRAZIL: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 338 BRAZIL: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 339 BRAZIL: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 BRAZIL: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 BRAZIL: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 342 BRAZIL: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 343 BRAZIL: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 344 BRAZIL: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 345 MEXICO: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 346 MEXICO: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 347 MEXICO: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 MEXICO: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 349 MEXICO: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 350 MEXICO: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 351 MEXICO: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 352 MEXICO: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 MEXICO: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 354 MEXICO: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 355 MEXICO: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 356 MEXICO: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 357 REST OF LATIN AMERICA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 358 REST OF LATIN AMERICA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 359 REST OF LATIN AMERICA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 360 REST OF LATIN AMERICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 361 REST OF LATIN AMERICA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 362 REST OF LATIN AMERICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 363 REST OF LATIN AMERICA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 364 REST OF LATIN AMERICA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 365 REST OF LATIN AMERICA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 366 REST OF LATIN AMERICA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 367 REST OF LATIN AMERICA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 368 REST OF LATIN AMERICA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 369 MIDDLE EAST & AFRICA: MACROECONOMIC INDICATORS

- TABLE 370 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 371 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 372 MIDDLE EAST & AFRICA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 373 MIDDLE EAST & AFRICA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 374 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE,2023-2030 (USD MILLION)

- TABLE 375 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 376 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 377 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 378 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 379 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 380 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 381 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 382 MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 383 GCC COUNTRIES: DRUG SCREENING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 384 GCC COUNTRIES: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 385 GCC COUNTRIES: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 386 GCC COUNTRIES: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 387 GCC COUNTRIES: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 388 GCC COUNTRIES: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 389 GCC COUNTRIES: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 390 GCC COUNTRIES: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 391 GCC COUNTRIES: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 392 GCC COUNTRIES: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 393 GCC COUNTRIES: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 394 GCC COUNTRIES: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 395 GCC COUNTRIES: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 396 SAUDI ARABIA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 397 SAUDI ARABIA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 398 SAUDI ARABIA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 399 SAUDI ARABIA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 400 SAUDI ARABIA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 401 SAUDI ARABIA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 402 SAUDI ARABIA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 403 SAUDI ARABIA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 404 SAUDI ARABIA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 405 SAUDI ARABIA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 406 SAUDI ARABIA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 407 SAUDI ARABIA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 408 UAE: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 409 UAE: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 410 UAE: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 411 UAE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 412 UAE: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 413 UAE: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 414 UAE: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 415 UAE: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 416 UAE: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 417 UAE: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 418 UAE: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 419 UAE: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 420 REST OF GCC COUNTRIES: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 421 REST OF GCC COUNTRIES: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 422 REST OF GCC COUNTRIES: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 423 REST OF GCC COUNTRIES: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 424 REST OF GCC COUNTRIES: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 425 REST OF GCC COUNTRIES: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 426 REST OF GCC COUNTRIES: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 427 REST OF GCC COUNTRIES: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 428 REST OF GCC COUNTRIES: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 429 REST OF GCC COUNTRIES: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 430 REST OF GCC COUNTRIES: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 431 REST OF GCC COUNTRIES: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 432 SOUTH AFRICA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 433 SOUTH AFRICA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 434 SOUTH AFRICA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 435 SOUTH AFRICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 436 SOUTH AFRICA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 437 SOUTH AFRICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 438 SOUTH AFRICA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 439 SOUTH AFRICA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 440 SOUTH AFRICA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 441 SOUTH AFRICA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 442 SOUTH AFRICA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 443 SOUTH AFRICA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 444 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 445 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 446 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 447 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 448 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR BREATHALYZERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 449 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR ANALYTICAL INSTRUMENTS, BY MODALITY, 2023-2030 (USD MILLION)

- TABLE 450 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR RAPID TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 451 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR URINE TESTING DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 452 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET FOR CONSUMABLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 453 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY SAMPLE TYPE, 2023-2030 (USD MILLION)

- TABLE 454 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY DRUG TYPE, 2023-2030 (USD MILLION)

- TABLE 455 REST OF MIDDLE EAST & AFRICA: DRUG SCREENING MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 456 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DRUG SCREENING, JANUARY 2022-DECEMBER 2025

- TABLE 457 DRUG SCREENING MARKET: DEGREE OF COMPETITION

- TABLE 458 DRUG SCREENING MARKET: REGION FOOTPRINT

- TABLE 459 DRUG SCREENING MARKET: OFFERING FOOTPRINT

- TABLE 460 DRUG SCREENING MARKET: SAMPLE TYPE FOOTPRINT

- TABLE 461 DRUG SCREENING MARKET: DRUG TYPE FOOTPRINT

- TABLE 462 DRUG SCREENING MARKET: END-USER FOOTPRINT

- TABLE 463 DRUG SCREENING MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 464 DRUG SCREENING MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS, BY REGION

- TABLE 465 DRUG SCREENING MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS, BY OFFERING

- TABLE 466 DRUG SCREENING MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022- DECEMBER 2025

- TABLE 467 DRUG SCREENING MARKET: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 468 DRUG SCREENING MARKET: OTHER DEVELOPMENTS, JANUARY 2022-DECEMBER 2025

- TABLE 469 LABCORP: COMPANY OVERVIEW

- TABLE 470 LABCORP: PRODUCTS & SERVICES OFFERED

- TABLE 471 LABCORP: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 472 QUEST DIAGNOSTICS INCORPORATED: COMPANY OVERVIEW

- TABLE 473 QUEST DIAGNOSTICS INCORPORATED: PRODUCTS & SERVICES OFFERED

- TABLE 474 QUEST DIAGNOSTICS INCORPORATED: PRODUCT & SERVICE LAUNCHES, JANUARY 2022-DECEMBER 2025

- TABLE 475 QUEST DIAGNOSTICS INCORPORATED: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 476 ABBOTT: COMPANY OVERVIEW

- TABLE 477 ABBOTT: PRODUCTS & SERVICES OFFERED

- TABLE 478 ORASURE TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 479 ORASURE TECHNOLOGIES INC.: PRODUCTS & SERVICES OFFERED

- TABLE 480 ORASURE TECHNOLOGIES INC.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 481 ALFA SCIENTIFIC DESIGNS INC.: COMPANY OVERVIEW

- TABLE 482 ALFA SCIENTIFIC DESIGNS INC.: PRODUCTS & SERVICES OFFERED

- TABLE 483 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 484 THERMO FISHER SCIENTIFIC INC.: PRODUCTS & SERVICES OFFERED

- TABLE 485 THERMO FISHER SCIENTIFIC INC.: PRODUCT DEVELOPMENTS, JANUARY 2022-DECEMBER 2025

- TABLE 486 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2022-DECEMBER 2025

- TABLE 487 DRAGERWERK AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 488 DRAGERWERK AG & CO. KGAA: PRODUCTS & SERVICES OFFERED

- TABLE 489 DRAGERWERK AG & CO. KGAA: PRODUCT LAUNCHES, JANUARY 2022-DECEMBER 2025

- TABLE 490 LIFELOC TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 491 LIFELOC TECHNOLOGIES, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 492 LIFELOC TECHNOLOGIES, INC.: OTHER DEVELOPMENTS, JANUARY 2022-DECEMBER 2025

- TABLE 493 MPD INC.: COMPANY OVERVIEW