PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1812634

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1812634

Microgrid Market by Power Generator, Energy Storage System, Controller, Grid-connected, Off-grid, Solar PV, Fuel Cell, Combined Heat and Power (CHP), Natural Gas, Remote Area, Utility and Military Facility - Global Forecast to 2030

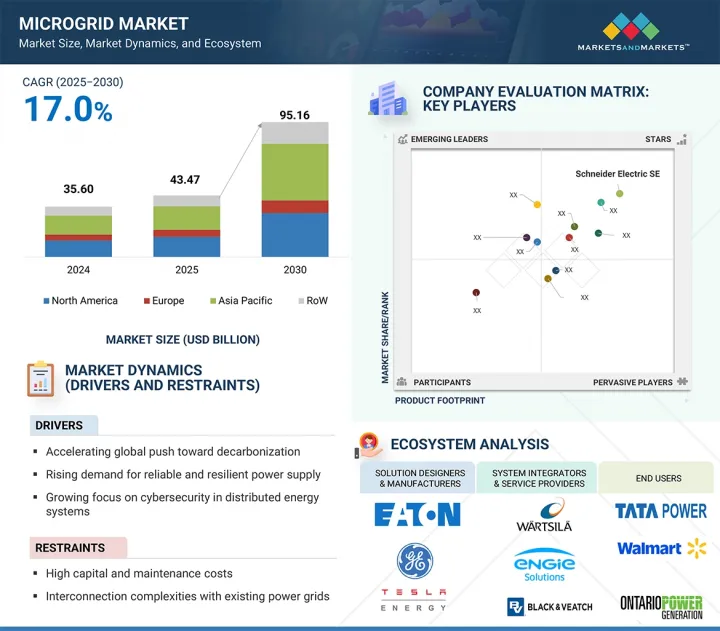

The microgrid market is projected to be valued at USD 43.47 billion in 2025 and USD 95.16 billion by 2030, recording a CAGR of 17.0% during the forecast period. Several factors are driving the global microgrid market. Rising demand for resilient and reliable power supply, coupled with the integration of renewable energy sources, is prompting governments, utilities, and industries to adopt decentralized energy solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Heating Equipment, Cooling Equipment, Ventilation Equipment, Technology, Implementation Type, Service Type, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Supportive policy frameworks, rural electrification initiatives, and the need for grid stability in regions prone to outages further accelerate deployment. Technological advancements in energy storage, advanced controllers, and distributed energy resource (DER) management systems are enhancing the operational efficiency, flexibility, and scalability of microgrids. However, high capital investment requirements, complex regulatory approvals, and interoperability challenges between diverse technologies can hinder adoption. In addition, limited awareness among end users in certain emerging markets and the difficulty quantifying long-term economic benefits remain key barriers. Overcoming these challenges through innovative financing models and standardized frameworks will be critical for sustained market expansion.

"By power source, the fuel cell segment is expected to register the highest CAGR between 2025 and 2030."

The fuel cell segment of the microgrid market is projected to register the highest CAGR during the forecast period, owing to the rising demand for clean, efficient, and reliable distributed power solutions. Fuel cells are increasingly adopted for microgrid applications due to their ability to provide continuous, low-emission power generation, making them ideal for commercial, industrial, and institutional facilities aiming to meet decarbonization and sustainability goals. Their high efficiency, modular scalability, and capability to operate independently or in conjunction with renewable energy sources position them as a key technology for grid-connected and islanded microgrids. Advancements in hydrogen production, storage, and distribution infrastructure are improving the economic feasibility of fuel cell-based microgrids, while supportive policies and incentives are accelerating deployments, particularly in Asia Pacific, North America, and Europe. Key manufacturers focus on enhancing durability, lowering costs, and integrating fuel cells with advanced energy management systems to maximize performance. As energy transition initiatives gain momentum, fuel cells are expected to be pivotal in shaping next-generation microgrid architectures.

"By power rating, the 1-5 MW segment is projected to account for the largest market share from 2025 to 2030."

The 1-5 MW segment of the microgrid market is expected to hold the largest market share from 2025 to 2030, supported by its optimal balance between capacity, scalability, and application versatility. Systems within this power range are ideally suited for commercial complexes, industrial facilities, healthcare institutions, educational campuses, and small communities, offering sufficient capacity to meet diverse energy demands while maintaining cost efficiency. Their ability to integrate multiple distributed energy resources, including solar PV, wind, combined heat and power (CHP), fuel cells, and energy storage, enables enhanced reliability, energy cost savings, and resilience against grid disruptions. The 1-5 MW range also meets the growing requirements of facilities aiming for partial grid independence, renewable integration, and peak load management without incurring the high capital costs associated with larger systems. Strong adoption is observed in Asia Pacific, North America, and Europe, driven by regulatory support, renewable energy targets, and advancements in control and automation technologies that optimize microgrid performance within this segment.

"North America is projected to account for the second-largest market share from 2025 to 2030."

North America is projected to hold the second-largest share of the global microgrid market from 2025 to 2030, driven by increasing demand for resilient and reliable power systems, rising renewable energy integration, and supportive regulatory frameworks. The US and Canada are at the forefront of microgrid adoption, with strong investments from utilities, government agencies, and private enterprises to enhance energy security and reduce carbon emissions. The region's vulnerability to extreme weather events, such as hurricanes and wildfires, has accelerated deployment in critical facilities, including hospitals, military bases, data centers, and community energy systems. Advancements in control software, energy storage, and hybrid power solutions further boost performance and cost efficiency.

Key players such as Schneider Electric SE (France), General Electric Company (US), and Eaton (Ireland) are actively partnering with regional utilities and municipalities to implement scalable, grid-connected, and islandable microgrid solutions. With robust technological capabilities and supportive policies, North America remains a pivotal market for global microgrid expansion.

The break-up of the profile of primary participants in the microgrid market-

- By Company Type: Tier 1 - 50%, Tier 2 - 25%, Tier 3 - 25%

- By Designation: C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, RoW - 15%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the microgrid market with a significant global presence include Schneider Electric (France), Siemens (Germany), General Electric Company (US), Eaton (Ireland), ABB (Switzerland), and others.

Research Coverage

The report segments the microgrid market and forecasts its size by offering, connectivity, power rating, power source, end user, and region. It also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall microgrid market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing emphasis on decarbonization, growing need for reliable and uninterrupted power supply, surging deployment of microgrids for rural electrification, increasing cyberattacks on energy infrastructure, rising demand for electric vehicle (EV) charging infrastructure, increasing need for demand response and load management capabilities, economic and environmental advantages associated with use of microgrids), restraints ( high installation and maintenance costs, complexities in grid interconnections, low economies of scale), opportunities (increasing number of microgrid projects across different industries and sectors , growing energy demand and adoption of renewable energy in Asia Pacific, rising interest of investors in energy-as-a-service (EaaS) business model to minimize cost, rising government support for microgrid projects, digitalization and smart grid integration), and challenges (lack of standardization and regulatory frameworks related to microgrid operations, technical challenges related to microgrids operating in island mode, complexities associated with standardizing scalability of microgrids , difficulties in planning and designing large-sized microgrids)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches, agreements, partnerships, acquisitions, and contracts in the microgrid market

- Market Development: Comprehensive information about lucrative markets - the report analyses the microgrid market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the microgrid market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/service offerings of leading players, including Schneider Electric SE (France), Siemens (Germany), General Electric Company (US), Eaton (Ireland), ABB (Switzerland), Hitachi Energy Ltd (Switzerland), Honeywell International Inc. (US), Caterpillar (US), S&C Electric Company (US), and Tesla (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.1.2 Demand-side analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.2.2 Supply-side analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MICROGRID MARKET

- 4.2 MICROGRID MARKET, BY POWER RATING

- 4.3 MICROGRID MARKET, BY POWER SOURCE

- 4.4 MICROGRID MARKET, BY CONNECTIVITY

- 4.5 MICROGRID MARKET, BY OFFERING

- 4.6 MICROGRID MARKET, BY END USER

- 4.7 MICROGRID MARKET, BY REGION

- 4.8 MICROGRID MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Accelerating global push toward decarbonization and renewable integration

- 5.2.1.2 Growing focus on resilient power supply amid extreme weather events and grid failures

- 5.2.1.3 Expanding microgrid deployment for rural and remote electrification

- 5.2.1.4 Rising integration of EV charging infrastructure with microgrids

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital and lifecycle maintenance costs

- 5.2.2.2 Interconnection complexities and delays in grid synchronization

- 5.2.2.3 Uncertainty in long-term revenue models and business case viability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Implementation of government incentives, policy support, and decentralization mandates

- 5.2.3.2 Advancements in digitalization, smart grid, and AI/Gen AI-powered optimization solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Absence of unified standards and regulatory frameworks

- 5.2.4.2 Technical challenges in islanded mode and grid resynchronization

- 5.2.4.3 Growing cybersecurity threats associated with distributed energy systems

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF MICROGRIDS, BY END USER AND POWER RATING, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF UTILITY-BASED MICROGRID PROJECTS, BY REGION, 2021-2024

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Blockchain

- 5.8.1.2 Microgrid smart controllers

- 5.8.1.3 AI/ML-driven control systems

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Next-gen battery storage systems

- 5.8.2.2 Advanced solar photovoltaics (PV)

- 5.8.2.3 5G/IoT communication networks

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Virtual power plants (VPPs)

- 5.8.3.2 Advanced materials for microgrid components

- 5.8.3.3 Digital twin

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SKAGERAK ENERGI LEVERAGES HITACHI ENERGY'S PV TECHNOLOGY TO POWER ODD SOCCER CLUB'S SKAGERAK ARENA IN NORWAY

- 5.11.2 CUMMINS IMPLEMENTS AUSTRALIA'S LARGEST HYBRID RENEWABLE ENERGY MICROGRID AT GOLD FIELDS' SITE

- 5.11.3 UNIVERSITY OF ONTARIO INSTITUTE OF TECHNOLOGY USES GE VERNOVA'S CAMPUS-BASED MICROGRID SYSTEM TO OPTIMIZE GRID OPERATIONS

- 5.11.4 NAVY SHIPYARD PROJECT IN PHILADELPHIA ADOPTS GE VERNOVA'S RESILIENT AND RELIABLE POWER SUPPLY SYSTEMS TO MEET ELECTRICITY NEEDS

- 5.11.5 ACE NATURAL CONTRACTS SOLAR ONE ENERGY FOR HOMER GRID TO MODEL ENERGY COSTS

- 5.11.6 HALF MOON VENTURES TURNS TO S&C ELECTRIC COMPANY FOR EPC SERVICES FOR MICROGRID PROJECT IN OHIO

- 5.11.7 ERGON ENERGY USES S&C ELECTRIC COMPANY'S ENERGY STORAGE SYSTEMS FOR MICROGRIDS TO IMPROVE POWER QUALITY

- 5.11.8 AEG POWER SOLUTIONS PROVIDES GRID-FORMING INVERTER TO MBOGO VALLEY TEA FACTORY FOR UNINTERRUPTED POWER SUPPLY

- 5.11.9 HITACHI ENERGY TRANSFORMS GENERATOR BACKUP SYSTEM INTO INNOVATIVE MICROGRID SOLUTION IN SOUTH AFRICA

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 8501)

- 5.12.2 EXPORT SCENARIO (HS CODE 8501)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.15.3 REGULATIONS

- 5.16 IMPACT OF AI/GEN AI ON MICROGRID MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON MICROGRID MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USERS

6 MICROGRID TYPES

- 6.1 INTRODUCTION

- 6.2 AC MICROGRIDS

- 6.3 DC MICROGRIDS

- 6.4 HYBRID MICROGRIDS

7 AREAS OF MICROGRID DEPLOYMENT

- 7.1 INTRODUCTION

- 7.2 URBAN/METROPOLITAN

- 7.3 SEMI-URBAN

- 7.4 RURAL/ISLAND

8 MICROGRIDS ARCHITECTURE TYPES

- 8.1 INTRODUCTION

- 8.2 TRADITIONAL

- 8.3 MODERN

- 8.4 ADVANCED/NEXT-GENERATION

9 MICROGRID MARKET, BY POWER RATING

- 9.1 INTRODUCTION

- 9.2 LESS THAN 1 MW

- 9.2.1 ABILITY TO PROVIDE ELECTRICITY IN REMOTE AREAS AND TEMPORARY CONSTRUCTION SITES TO BOOST SEGMENTAL GROWTH

- 9.3 1-5 MW

- 9.3.1 INTEGRATION WITH RENEWABLE ENERGY TO DELIVER RELIABLE AND SUSTAINABLE ELECTRICITY TO FUEL SEGMENTAL GROWTH

- 9.4 >5-10 MW

- 9.4.1 HIGH ADOPTION IN HOSPITALS, MILITARY BASES, AND DATA CENTERS TO ACCELERATE SEGMENTAL GROWTH

- 9.5 ABOVE 10 MW

- 9.5.1 ABILITY TO SUPPORT SMART CITY INITIATIVES AND POWER INDUSTRIAL COMPLEXES TO AUGMENT SEGMENTAL GROWTH

10 MICROGRID MARKET, BY POWER SOURCE

- 10.1 INTRODUCTION

- 10.2 NATURAL GAS

- 10.2.1 HIGH EMPHASIS ON EFFICIENT POWER GENERATION AND ENHANCING GRID RESILIENCE TO EXPEDITE SEGMENTAL GROWTH

- 10.3 SOLAR PV

- 10.3.1 EMERGENCE AS RELIABLE AND ABUNDANT ENERGY SOURCE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.4 COMBINED HEAT AND POWER (CHP)

- 10.4.1 STRONG FOCUS ON ENERGY EFFICIENCY, SUSTAINABILITY, AND RESILIENCE TO BOOST SEGMENTAL GROWTH

- 10.5 DIESEL

- 10.5.1 COMPACT, PORTABLE, AND IDEAL FOR REMOTE/OFF-GRID LOCATIONS TO ACCELERATE SEGMENTAL GROWTH

- 10.6 FUEL CELL

- 10.6.1 COST-EFFECTIVENESS, RELIABILITY, MODULARITY, AND SCALABILITY FEATURES TO DRIVE MARKET

- 10.7 OTHER POWER SOURCES

11 MICROGRID MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- 11.2 GRID-CONNECTED

- 11.2.1 COST SAVINGS, IMPROVED POWER QUALITY, AND LOW ENVIRONMENTAL IMPACT TO FOSTER SEGMENTAL GROWTH

- 11.3 OFF-GRID

- 11.3.1 ENERGY INDEPENDENCE AND RELIABLE POWER SUPPLY TO BOOST ADOPTION

12 MICROGRID MARKET, BY OFFERING

- 12.1 INTRODUCTION

- 12.2 HARDWARE

- 12.2.1 POWER GENERATORS

- 12.2.1.1 Ability to balance supply-demand fluctuations and maintain grid stability to fuel segmental growth

- 12.2.2 ENERGY STORAGE SYSTEMS

- 12.2.2.1 Use to ensure continuous power supply and reduce reliance on grid-supplied electricity to foster segmental growth

- 12.2.2.2 Lithium-ion batteries

- 12.2.2.3 Lead-acid batteries

- 12.2.2.4 Flow batteries

- 12.2.2.5 Flywheels

- 12.2.2.6 Other energy storage systems

- 12.2.3 CONTROLLERS

- 12.2.3.1 Focus on delivering optimized, cost-effective, and reliable power to contribute to segmental growth

- 12.2.1 POWER GENERATORS

- 12.3 SOFTWARE

- 12.3.1 EMPHASIS ON DELIVERING AI-DRIVEN ENERGY OPTIMIZATION AND PREDICTIVE ANALYTICS ACROSS DISTRIBUTED ENERGY RESOURCES TO DRIVE MARKET

- 12.4 SERVICES

- 12.4.1 USE TO ENSURE OPERATIONAL RELIABILITY AND SUSTAINABILITY OF MICROGRID DEPLOYMENTS TO ACCELERATE SEGMENTAL GROWTH

- 12.4.2 CONSULTING & ADVISORY SERVICES

- 12.4.3 ENGINEERING, PROCUREMENT & CONSTRUCTION (EPC) SERVICES

- 12.4.4 MICROGRID OPERATION & ASSET MANAGEMENT

13 MICROGRID MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 COMMERCIAL & INDUSTRIAL BUILDINGS

- 13.2.1 REQUIREMENT FOR UNINTERRUPTED ELECTRICITY TO LOWER DOWNTIME AND IMPROVE EFFICIENCY TO BOLSTER SEGMENTAL GROWTH

- 13.3 REMOTE AREAS

- 13.3.1 NEED TO ESTABLISH POWER PROJECTS IN REMOTE AREAS TO ACCELERATE SEGMENTAL GROWTH

- 13.4 MILITARY FACILITIES

- 13.4.1 FOCUS ON MAINTAINING ENERGY RESILIENCE AND ENABLING UNINTERRUPTED CRITICAL OPERATIONS TO DRIVE MARKET

- 13.5 GOVERNMENT BUILDINGS

- 13.5.1 NEED FOR UNINTERRUPTED POWER SUPPLY IN EMERGENCY RESPONSE CENTERS AND MUNICIPAL BUILDINGS TO BOOST SEGMENTAL GROWTH

- 13.6 UTILITIES

- 13.6.1 HIGH EMPHASIS ON MANAGING ENERGY USAGE AND ENHANCING POWER SUPPLY QUALITY TO AUGMENT SEGMENTAL GROWTH

- 13.7 INSTITUTES & CAMPUSES

- 13.7.1 ADOPTION OF MICROGRIDS TO REDUCE CARBON EMISSIONS AND PROMOTE ENVIRONMENTAL INITIATIVES TO SUPPORT MARKET GROWTH

- 13.8 HEALTHCARE FACILITIES

- 13.8.1 NEED FOR RELIABLE POWER SOURCE TO OPERATE LIFE-SAVING EQUIPMENT AND PROVIDE TREATMENT TO EXPEDITE SEGMENTAL GROWTH

14 MICROGRID MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 Increasing investment in clean energy sources for power generation to drive market

- 14.2.3 CANADA

- 14.2.3.1 Rising microgrid installations in remote areas to foster market growth

- 14.2.4 MEXICO

- 14.2.4.1 Growing support for renewable energy to ensure grid resilience to augment market growth

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 UK

- 14.3.2.1 Growing emphasis on preventing waste heat generation to boost market growth

- 14.3.3 GERMANY

- 14.3.3.1 Increasing deployment of solar PV technologies to fuel market growth

- 14.3.4 FRANCE

- 14.3.4.1 Rising focus on clean energy generation to augment demand

- 14.3.5 ITALY

- 14.3.5.1 Increasing need to enhance renewable energy integration to contribute to market growth

- 14.3.6 SPAIN

- 14.3.6.1 Growing emphasis on meeting climate and renewable targets to support market growth

- 14.3.7 POLAND

- 14.3.7.1 Increasing adoption of distributed energy to contribute to market growth

- 14.3.8 NORDICS

- 14.3.8.1 High renewable penetration and strong policy support for decarbonization to drive market

- 14.3.9 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 AUSTRALIA

- 14.4.2.1 Growing emphasis on grid reliability and providing electricity to unserved areas to accelerate market growth

- 14.4.3 CHINA

- 14.4.3.1 Increasing implementation of supportive regulatory frameworks to foster market growth

- 14.4.4 JAPAN

- 14.4.4.1 Growing focus on enhancing energy resilience to contribute to market growth

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Increasing effort to diversify energy mix to bolster market growth

- 14.4.6 INDIA

- 14.4.6.1 Rising renewable integration and rural electrification strategies to expedite market growth

- 14.4.7 INDONESIA

- 14.4.7.1 Growing focus on electrification using renewable sources to augment market growth

- 14.4.8 THAILAND

- 14.4.8.1 Increasing renewable penetration and smart city initiatives to fuel market growth

- 14.4.9 VIETNAM

- 14.4.9.1 Rapid expansion of economy and manufacturing sector to accelerate market growth

- 14.4.10 MALAYSIA

- 14.4.10.1 Mounting demand for resilient and clean energy systems in industries to drive market

- 14.4.11 REST OF ASIA PACIFIC

- 14.5 ROW

- 14.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 14.5.2 MIDDLE EAST

- 14.5.2.1 Growing healthcare sector and demand for reliable power supply to contribute to market growth

- 14.5.2.2 GCC countries

- 14.5.2.3 Rest of Middle East

- 14.5.3 AFRICA

- 14.5.3.1 Rising need to improve energy access in remote areas to drive market

- 14.5.4 SOUTH AMERICA

- 14.5.4.1 Brazil

- 14.5.4.1.1 Requirement for decentralized electrification to support market growth

- 14.5.4.2 Argentina

- 14.5.4.2.1 Strong focus on strengthening grid resilience in underserved regions to boost market growth

- 14.5.4.3 Rest of South America

- 14.5.4.1 Brazil

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 15.3 MARKET SHARE ANALYSIS, 2024

- 15.4 REVENUE ANALYSIS, 2020-2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 End user footprint

- 15.7.5.4 Offering footprint

- 15.7.5.5 Connectivity footprint

- 15.7.5.6 Power rating footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 SCHNEIDER ELECTRIC

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches/developments

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.3.4 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths/Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses/Competitive threats

- 16.1.2 SIEMENS

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches/developments

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Other developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths/Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses/Competitive threats

- 16.1.3 GE VERNOVA

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches/developments

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths/Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses/Competitive threats

- 16.1.4 EATON

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches/developments

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths/Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses/Competitive threats

- 16.1.5 ABB

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths/Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses/Competitive threats

- 16.1.6 HITACHI ENERGY LTD

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches/developments

- 16.1.6.3.2 Deals

- 16.1.6.3.3 Other developments

- 16.1.7 HONEYWELL INTERNATIONAL INC.

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches/developments

- 16.1.7.3.2 Deals

- 16.1.8 CATERPILLAR

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.3.2 Other developments

- 16.1.9 S&C ELECTRIC COMPANY

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches/developments

- 16.1.9.3.2 Expansions

- 16.1.10 TESLA

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Developments

- 16.1.1 SCHNEIDER ELECTRIC

- 16.2 OTHER PLAYERS

- 16.2.1 HOMER ENERGY

- 16.2.2 EMERSON ELECTRIC CO.

- 16.2.3 PARETO ENERGY

- 16.2.4 SPIRAE LLC

- 16.2.5 KOHLER CO.

- 16.2.6 AMERESCO

- 16.2.7 SAFT

- 16.2.8 FERROAMP AB

- 16.2.9 CANOPY POWER PTE LTD.

- 16.2.10 POWERSECURE, INC.

- 16.2.11 POLARIS

- 16.2.12 ANBARIC DEVELOPMENT PARTNERS, LLC.

- 16.2.13 WARTSILA

- 16.2.14 AGGREKO

- 16.2.15 POWER ANALYTICS

- 16.2.16 BLOOM ENERGY

- 16.2.17 ENGIE

- 16.2.18 ROLLS-ROYCE PLC

- 16.2.19 ENEL X S.R.L.

- 16.2.20 XENDEE INC.

- 16.2.21 BOXPOWER, INC.

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MICROGRID MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 KEY FORECAST ASSUMPTIONS

- TABLE 4 MICROGRID MARKET: RESEARCH ASSUMPTIONS

- TABLE 5 MICROGRID MARKET: RISK ANALYSIS

- TABLE 6 ROLE OF COMPANIES IN MICROGRID ECOSYSTEM

- TABLE 7 AVERAGE SELLING PRICE OF MICROGRIDS, BY END USER AND POWER RATING, 2024 (USD MILLION/MW)

- TABLE 8 AVERAGE SELLING PRICE TREND OF UTILITY-BASED MICROGRID PROJECTS, BY REGION, 2021-2024 (USD MILLION/MW)

- TABLE 9 IMPACT OF PORTER'S FIVE FORCES

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 12 IMPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 LIST OF KEY PATENTS, 2021-2024

- TABLE 15 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 STANDARDS RELATED TO MICROGRIDS

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 MICROGRID MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 23 MICROGRID MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 24 LESS THAN 1 MW: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 LESS THAN 1 MW: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 1-5 MW: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 1-5 MW: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 >5-10 MW: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 >5-10 MW: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ABOVE 10 MW: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 ABOVE 10 MW: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 MICROGRID MARKET, BY POWER SOURCE, 2021-2024 (USD MILLION)

- TABLE 33 MICROGRID MARKET, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 34 NATURAL GAS: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 NATURAL GAS: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 SOLAR PV: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 SOLAR PV: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 COMBINED HEAT AND POWER (CHP): MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 COMBINED HEAT AND POWER (CHP): MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 DIESEL: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 DIESEL: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 FUEL CELL: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 FUEL CELL: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 OTHER POWER SOURCES: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 OTHER POWER SOURCES: MICROGRID MARKET FOR POWER GENERATORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 47 MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 48 GRID-CONNECTED: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 GRID-CONNECTED: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 OFF-GRID: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 OFF-GRID: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 MICROGRID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 53 MICROGRID MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 54 HARDWARE: MICROGRID MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 HARDWARE: MICROGRID MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 HARDWARE: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 HARDWARE: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 POWER GENERATORS: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 POWER GENERATORS: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 ENERGY STORAGE SYSTEMS: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 ENERGY STORAGE SYSTEMS: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 CONTROLLERS: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 CONTROLLERS: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 SOFTWARE: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 SOFTWARE: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 SERVICES: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 SERVICES: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 MICROGRID MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 69 MICROGRID MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 70 COMMERCIAL & INDUSTRIAL BUILDINGS: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 COMMERCIAL & INDUSTRIAL BUILDINGS: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 REMOTE AREAS: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 REMOTE AREAS: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 MILITARY FACILITIES: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 MILITARY FACILITIES: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 GOVERNMENT BUILDINGS: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 GOVERNMENT BUILDINGS: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 UTILITIES: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 UTILITIES: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 INSTITUTES & CAMPUSES: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 INSTITUTES & CAMPUSES: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 HEALTHCARE FACILITIES: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 HEALTHCARE FACILITIES: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 MICROGRID MARKET, BY REGION, 2021-2024 (MW)

- TABLE 87 MICROGRID MARKET, BY REGION, 2025-2030 (MW)

- TABLE 88 NORTH AMERICA: MICROGRID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: MICROGRID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: MICROGRID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: MICROGRID MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: MICROGRID MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: MICROGRID MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: MICROGRID MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: MICROGRID MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 102 US: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 103 US: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 104 CANADA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 105 CANADA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 106 MEXICO: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 107 MEXICO: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: MICROGRID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 EUROPE: MICROGRID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: MICROGRID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: MICROGRID MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 113 EUROPE: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: MICROGRID MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 115 EUROPE: MICROGRID MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2021-2024 (USD MILLION)

- TABLE 119 EUROPE: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: MICROGRID MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 121 EUROPE: MICROGRID MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 122 UK: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 123 UK: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 124 GERMANY: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 125 GERMANY: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 126 FRANCE: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 127 FRANCE: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 128 ITALY: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 129 ITALY: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 130 SPAIN: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 131 SPAIN: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 132 POLAND: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 133 POLAND: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 134 NORDICS: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 135 NORDICS: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 136 REST OF EUROPE: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 137 REST OF EUROPE: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MICROGRID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MICROGRID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MICROGRID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MICROGRID MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MICROGRID MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MICROGRID MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MICROGRID MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MICROGRID MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 152 AUSTRALIA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 153 AUSTRALIA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 154 CHINA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 155 CHINA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 156 JAPAN: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 157 JAPAN: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH KOREA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 159 SOUTH KOREA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 160 INDIA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 161 INDIA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 162 INDONESIA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 163 INDONESIA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 164 THAILAND: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 165 THAILAND: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 166 VIETNAM: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 167 VIETNAM: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 168 MALAYSIA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 169 MALAYSIA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 172 ROW: MICROGRID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 173 ROW: MICROGRID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 174 ROW: MICROGRID MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 175 ROW: MICROGRID MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 176 ROW: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 177 ROW: MICROGRID MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 178 ROW: MICROGRID MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 179 ROW: MICROGRID MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 180 ROW: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 181 ROW: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 182 ROW: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2021-2024 (USD MILLION)

- TABLE 183 ROW: MICROGRID MARKET FOR POWER GENERATORS, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 184 ROW: MICROGRID MARKET, BY POWER RATING, 2021-2024 (USD MILLION)

- TABLE 185 ROW: MICROGRID MARKET, BY POWER RATING, 2025-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST: MICROGRID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 187 MIDDLE EAST: MICROGRID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 190 AFRICA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 191 AFRICA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: MICROGRID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: MICROGRID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: MICROGRID MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: MICROGRID MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 196 MICROGRID MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-AUGUST 2025

- TABLE 197 MICROGRID MARKET: DEGREE OF COMPETITION, 2024

- TABLE 198 MICROGRID MARKET: REGION FOOTPRINT

- TABLE 199 MICROGRID MARKET: END USER FOOTPRINT

- TABLE 200 MICROGRID MARKET: OFFERING FOOTPRINT

- TABLE 201 MICROGRID MARKET: CONNECTIVITY FOOTPRINT

- TABLE 202 MICROGRID MARKET: POWER RATING FOOTPRINT

- TABLE 203 MICROGRID MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 204 MICROGRID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 205 MICROGRID MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-AUGUST 2025

- TABLE 206 MICROGRID MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 207 MICROGRID MARKET: EXPANSIONS, JANUARY 2021-AUGUST 2025

- TABLE 208 MICROGRID MARKET: OTHER DEVELOPMENTS, JANUARY 2021-AUGUST 2025

- TABLE 209 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 210 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 212 SCHNEIDER ELECTRIC: DEALS

- TABLE 213 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 214 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 215 SIEMENS: COMPANY OVERVIEW

- TABLE 216 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 SIEMENS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 218 SIEMENS: DEALS

- TABLE 219 SIEMENS: OTHER DEVELOPMENTS

- TABLE 220 GE VERNOVA: COMPANY OVERVIEW

- TABLE 221 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 GE VERNOVA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 223 GE VERNOVA: DEALS

- TABLE 224 GE VERNOVA: OTHER DEVELOPMENTS

- TABLE 225 EATON: COMPANY OVERVIEW

- TABLE 226 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 EATON: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 228 EATON: DEALS

- TABLE 229 EATON: OTHER DEVELOPMENTS

- TABLE 230 ABB: COMPANY OVERVIEW

- TABLE 231 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 ABB: DEALS

- TABLE 233 ABB: OTHER DEVELOPMENTS

- TABLE 234 HITACHI ENERGY LTD: COMPANY OVERVIEW

- TABLE 235 HITACHI ENERGY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 HITACHI ENERGY LTD: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 237 HITACHI ENERGY LTD: DEALS

- TABLE 238 HITACHI ENERGY LTD: OTHER DEVELOPMENTS

- TABLE 239 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 240 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 242 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 243 CATERPILLAR: COMPANY OVERVIEW

- TABLE 244 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 CATERPILLAR: DEALS

- TABLE 246 CATERPILLAR: OTHER DEVELOPMENTS

- TABLE 247 S&C ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 248 S&C ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 S&C ELECTRIC COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 250 S&C ELECTRIC COMPANY: EXPANSIONS

- TABLE 251 TESLA: COMPANY OVERVIEW

- TABLE 252 TESLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 TESLA: DEVELOPMENTS

List of Figures

- FIGURE 1 MICROGRID MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MICROGRID MARKET: DURATION COVERED

- FIGURE 3 MICROGRID MARKET: RESEARCH FLOW

- FIGURE 4 MICROGRID MARKET: RESEARCH DESIGN

- FIGURE 5 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 6 PRIMARY INTERVIEW PARTICIPANTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 9 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 10 MICROGRID MARKET: RESEARCH APPROACH

- FIGURE 11 MICROGRID MARKET: BOTTOM-UP APPROACH

- FIGURE 12 MICROGRID MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 13 MICROGRID MARKET: TOP-DOWN APPROACH

- FIGURE 14 MICROGRID MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 15 REVENUE GENERATED FROM SALES OF MICROGRID HARDWARE, SOFTWARE, AND SERVICES

- FIGURE 16 MICROGRID MARKET: DATA TRIANGULATION

- FIGURE 17 MICROGRID MARKET SNAPSHOT

- FIGURE 18 1-5 MW SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 19 SOLAR PV SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 20 GRID-CONNECTED SEGMENT TO DOMINATE MICROGRID MARKET FROM 2025 TO 2030

- FIGURE 21 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 REMOTE AREAS SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 23 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 RISING RURAL ELECTRIFICATION AND RENEWABLE INTEGRATION TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN MICROGRID MARKET

- FIGURE 25 ABOVE 10 MW SEGMENT TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 26 SOLAR PV SEGMENT TO DOMINATE MICROGRID MARKET BETWEEN 2025 AND 2030

- FIGURE 27 GRID-CONNECTED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025 AND 2030

- FIGURE 28 HARDWARE SEGMENT TO DOMINATE MICROGRID MARKET DURING FORECAST PERIOD

- FIGURE 29 REMOTE AREAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 30 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2025 AND 2030

- FIGURE 31 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MICROGRID MARKET DURING FORECAST PERIOD

- FIGURE 32 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 33 IMPACT ANALYSIS: DRIVERS

- FIGURE 34 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 35 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 36 IMPACT ANALYSIS: CHALLENGES

- FIGURE 37 SUPPLY CHAIN ANALYSIS

- FIGURE 38 KEY COMPANIES IN MICROGRID ECOSYSTEM

- FIGURE 39 AVERAGE SELLING PRICE OF MICROGRIDS, BY END USER AND POWER RATING, 2024

- FIGURE 40 AVERAGE SELLING PRICE TREND OF UTILITY-BASED MICROGRID PROJECTS, BY REGION, 2021-2024

- FIGURE 41 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 42 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 43 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 45 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 46 IMPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 47 EXPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 48 PATENT APPLIED AND GRANTED, 2015-2024

- FIGURE 49 IMPACT OF AI/GEN AI ON MICROGRID MARKET

- FIGURE 50 MICROGRID TYPES

- FIGURE 51 MICROGRID PATTERNS

- FIGURE 52 1-5 MW SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 53 MICROGRID MARKET, BY POWER SOURCE

- FIGURE 54 SOLAR PV TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 55 MICROGRID MARKET, BY CONNECTIVITY

- FIGURE 56 OFF-GRID SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 57 MICROGRID MARKET, BY OFFERING

- FIGURE 58 SOFTWARE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 59 MICROGRID HARDWARE MARKET, BY TYPE

- FIGURE 60 MICROGRID MARKET, BY END USER

- FIGURE 61 REMOTE AREAS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 62 ASIA PACIFIC TO HOLD LARGEST SHARE OF MICROGRID MARKET IN 2030

- FIGURE 63 NORTH AMERICA: MICROGRID MARKET SNAPSHOT

- FIGURE 64 EUROPE: MICROGRID MARKET SNAPSHOT

- FIGURE 65 ASIA PACIFIC: MICROGRID MARKET SNAPSHOT

- FIGURE 66 MARKET SHARE ANALYSIS OF COMPANIES OFFERING MICROGRIDS, 2024

- FIGURE 67 MICROGRID MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 68 COMPANY VALUATION

- FIGURE 69 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 70 BRAND/PRODUCT COMPARISON

- FIGURE 71 MICROGRID MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 72 MICROGRID MARKET: COMPANY FOOTPRINT

- FIGURE 73 MICROGRID MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 74 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 75 SIEMENS: COMPANY SNAPSHOT

- FIGURE 76 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 77 EATON: COMPANY SNAPSHOT

- FIGURE 78 ABB: COMPANY SNAPSHOT

- FIGURE 79 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 80 CATERPILLAR: COMPANY SNAPSHOT

- FIGURE 81 TESLA: COMPANY SNAPSHOT