PUBLISHER: Mind Commerce | PRODUCT CODE: 1892157

PUBLISHER: Mind Commerce | PRODUCT CODE: 1892157

Valuation Implications of Domestic Rare Earth Supply Chain Reshoring: A Market and Corporate Analysis of Leading Mining and Processing Beneficiaries

Overview:

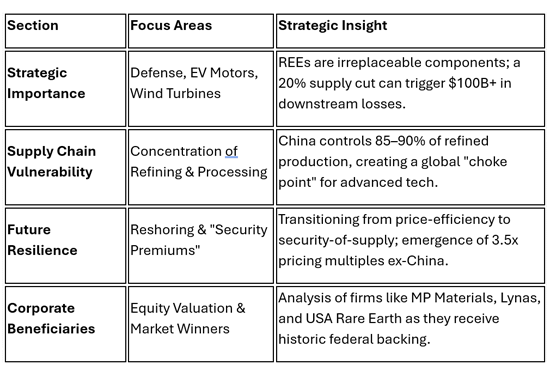

In a landscape where technological sovereignty is the new global currency, this report, " Valuation Implications of Domestic Rare Earth Supply Chain Reshoring: A Market and Corporate Analysis of Leading Mining and Processing Beneficiaries," serves as an indispensable roadmap for institutional investors and strategic planners navigating the decoupling of Western industrial bases from Chinese dominance.

By meticulously deconstructing the Strategic Importance of these elements (including EV motors, and renewable energy grids) this analysis exposes the profound Supply Chain Vulnerability of a West currently reliant on a single geographic source for nearly 90% of its refined output.

Most critically, the report provides a high-stakes Market and Corporate Analysis, identifying the specific beneficiaries" poised to capture a massive security premium, a valuation multiple where domestic supply reliability justifies costs 250-350% above historical Chinese benchmarks.

For those looking to capitalize on the Future Resilience of the U.S. industrial base, this document offers the data-driven clarity needed to identify which mining and processing firms are successfully bridging the "mine-to-magnet" gap, and which are merely riding the wave of geopolitical speculation.

Report Structure & Key Findings

Leading Global Rare Earth Mining Companies: A Geopolitical Supply Chain Analysis

The report provides a granular look at the competitive landscape, examining how "regime-specific risk" is now a primary driver of stock volatility. It evaluates the shift from traditional commodity pricing to a geopolitical risk matrix, analyzing how companies in Australia and North America are being repositioned as "strategic anchors" for Western autonomy.

Strategic Analysis of Domestic Rare Earth Processing and U.S. National Security

Moving beyond raw extraction, this section highlights why processing is the true bottleneck. It details how U.S. national security is contingent on establishing domestic separation facilities (like the Aclara and MP Materials expansions) to prevent the "weaponization" of supply chains.

United States Rare Earth Supply Chain: Corporate Beneficiaries and Equity Valuation Implications

For the first time, investors can access a "Price-to-NAV" analysis adjusted for political risk. This section identifies the equity winners of the Defense Production Act and Section 232 actions, projecting which firms will achieve long-term viability through government-guaranteed offtake agreements and price floors.

Selection of Companies Analyzed in the Report:

Leading Global Mining and Processing Companies

- MP Materials Corporation (MP): The leading U.S. producer, operating the Mountain Pass mine in California. It is the only fully integrated U.S. producer, pursuing a "mine-to-magnet" vertical supply chain.

- Lynas Rare Earths Ltd (Lynas): The largest producer outside of China, operating the high-grade Mount Weld mine in Australia. It is expanding processing facilities in Australia, Malaysia, and the U.S.

- Iluka Resources (Iluka): An Australian entity building a fully integrated refinery (the Eneabba project) to process light and heavy rare earth oxides.

- Energy Fuels Inc. (UUUU): A domestic pioneer in rare earth processing that uses its White Mesa Mill in Utah to produce separated NdPr from monazite feedstocks.

Chinese State-Controlled Entities (The "Big Six")

- China Northern Rare Earth Group (CNREG): The world's largest rare earth entity, controlling the massive Bayan Obo deposit with a fully integrated mine-to-magnet structure.

- China Minmetals Corporation: One of the six major state-controlled entities in China.

- Aluminum Corporation of China (Chinalco): A major Chinese SOE involved in the rare earth sector.

- Xiamen Tungsten: One of China's top rare earth conglomerates.

- China Southern Rare Earth Group: A member of China's state-controlled "Big Six".

- Guangdong Rising Nonferrous Metals Group: A state-controlled enterprise involved in nonferrous metals mining and processing.

Emerging Technology and Downstream Players

- Vulcan Elements: A private entity that received a $620 million conditional loan from the DoD's Office of Strategic Capital (OSC) for domestic magnet manufacturing.

- ReElement Technologies: A subsidiary of American Resources Corp focusing on advanced separation and refining using proprietary Purdue University technology.

- USA Rare Earth (USAR): A company pursuing an end-to-end "mine to magnet" strategy with a magnet manufacturing facility scheduled for Oklahoma in 2026.

- Cyclic Materials: A company focused on recycling high-purity magnet production by-products, having a 10-year partnership with VACUUMSCHMELZE.

- Rare Element Resources Ltd. (RER): Operates a demonstration plant in Wyoming to process ore using proprietary, cost-competitive technology.

- TdVib LLC: An Iowa-based company that licensed a novel hydrometallurgical process from the DOE to extract rare earths from e-waste.

Major Industrial Customers and Strategic Partners

- General Motors (GM): Has off-take agreements for rare earth magnets with MP Materials.

- Apple: Secured long-term off-take agreements from MP Materials.

- VACUUMSCHMELZE (VAC): An exclusive recycling partner with Cyclic Materials for its Sumter, South Carolina facility.

- Arnold Magnetic Technologies Corporation: Signed a supply agreement with USA Rare Earth's subsidiary, Less Common Metals (LCM), for rare earth materials and alloy feedstock.

- Lockheed Martin, RTX, and Northrop Grumman: Major defense prime contractors required to find non-Chinese rare earth suppliers due to the 2027 DFARS ban.

Table of Contents

Strategic Importance, Supply Chain Vulnerability, and Future Resilience of Rare Earth Elements

1. The Criticality Thesis

2. Defining the Rare Earth Ecosystem and Technological Imperative

- 2.1. Taxonomy, Abundance, and the Purification Bottleneck

- 2.2. The Material Science Imperative: Permanent Magnets

3. REMs in Consumer Electronics and Information Technology

- 3.1. Enabling Portable Devices

- 3.2. Displays, Lighting, and Data Storage

4. Enterprise and Industrial Applications: Driving Global Decarbonization

- 4.1. The Electrification Revolution (EVs)

- 4.2. Renewable Energy Infrastructure

- 4.3. Catalytic and Chemical Industry Reliance

5. National Security: The Defense Technology Reliance

- 5.1. Enabling Advanced Military Capabilities

- 5.2. Defense Magnetics and Thermal Resilience

- 5.3. Specific Defense Applications

- 5.4. Strategic Vulnerability and Non-Kinetic Threat

6. The Geopolitical and Economic Choke Point

- 6.1. Analyzing Supply Concentration: China's Full-Spectrum Control

- 6.2. Strategic Leverage: Economic Coercion in Practice

- 6.3. Quantifying Vulnerability

7. Pathways to Resilience: Diversification and Circularity

- 7.1. Global Primary Production Diversification

- 7.2. The Circular Economy: Technology and Feasibility of REE Recycling

- 7.3. Research into Substitution and Efficiency Improvements

8. Conclusions and Strategic Recommendations

- 8.1. Synthesis of Risk

- 8.2. Strategic Recommendations for Long-Term Resilience

Global Rare Metals Market Forecast and Strategic Supply Chain Outlook (2025-2030)

1. The Critical Minerals Security Trilemma

2. Macro Market Size, Valuation, and Price Volatility Forecast (2025-2030)

- A. Rare Earth Elements (REEs): Valuation and Growth Drivers

- B. Platinum Group Metals (PGMs): Transitioning Demand Vectors

- C. Price Volatility and Market Risk Assessment

3. Core Demand Drivers and Volume Projections by End-Use

- A. The Energy Transition Mandate and Aggregate Demand

- B. Battery Metals (Lithium, Nickel, Cobalt, Graphite)

- C. Strategic Magnet Demand (NdPr, Dy, Tb)

- D. The Hydrogen Economy Catalyst Challenge

4. Geopolitical Risk Assessment and Supply Chain Concentration (The 2030 Chokepoints)

- A. China's Midstream Dominance and Geopolitical Leverage

- B. Impact Assessment of China's 2025 Export Controls (Escalation)

- C. Supply Chain Resilience and the "Midstream Gap"

5. Western Diversification Strategies and 2030 Capacity Pipeline

- A. European Critical Raw Materials Act (CRMA) Benchmarks

- B. US Inflation Reduction Act (IRA) and Strategic Investment

- C. Global Mining Pipeline vs. Needs

6. Technology and Circular Economy Mitigation

- A. The Rise of Sodium-Ion Batteries (SIBs)

- B. Accelerating Lithium-Ion Battery Recycling

- C. Material Efficiency and Substitution in PGMs

7. Strategic Recommendations for 2025-2030

- A. Investment Prioritization: Shifting Focus to Midstream Resilience

- B. Geopolitical Risk Hedging and Demand Coherence

- C. Accelerating Technology and Circular Economy Deployment

- D. Mitigation for Niche Constraints (Hydrogen)

Leading Global Rare Earth Element Mining Companies: A Geopolitical Supply Chain Analysis

A. The Global Rare Earth Strategic Landscape

B. The Structural Crisis: Geopolitics and the Rare Earth Ecosystem

- B.1. Global Production Concentration and Reserve Dynamics

- B.2. The Processing Bottleneck: China's Midstream Monopoly

- Insight: The SOE Price Suppression Mechanism

- Insight: The Vertical Integration Imperative

C. The Chinese Leviathan: State-Controlled Market Dominance

- C.1. Industrial Consolidation: The "Big Six" and Centralized Control

- C.2. China Northern Rare Earth Group (CNREG) and Bayan Obo: Scale and Strategy

- Insight: From Resource Control to Technology Weaponization

- Insight: Centralization for Resilience (Internal & External)

D. Profiles of Leading Ex-China Miners: The Diversification Front

- D.1. MP Materials Corporation (US): The Mine-to-Magnet Model

- D.2. Lynas Rare Earths Ltd (Australia/Malaysia): Capacity and Geographical Risk

- D.3. Iluka Resources (Australia): The Integrated Australian Hub

- D.4. Energy Fuels Inc. (US): Domestic Processing Pioneer

- Insight: De-risking via Government Offtake and Financing

- Insight: The Monazite Feedstock Trend

E. ESG, Environment, and Social License to Operate

- E.1. Environmental and Health Externalities: Radioactivity and Chemical Contamination

- E.2. Controversies and Mitigation: Bayan Obo, Kuantan, and Zero-Discharge

- Insight: ESG as a Non-Price Competitive Lever

- Insight: Recycling as Supply Chain Resilience

F. Global Policy Response and Strategic Outlook

- F.1. Allied Diversification Frameworks

- F.2. Investment Opportunities and Risk Assessment

- Insight: The HREE Security Imperative

- F.3. Strategic Outlook

- Insight: Price Parity vs. Strategic Resilience (The Security Premium)

G. Conclusion and Strategic Assessment

Strategic Analysis of Domestic Rare Earth Processing and Its Importance to U.S. National Security

1. Strategic Implications

- 1.1. The Criticality Chasm: Global REE Concentration and U.S. Vulnerability

- 1.2. Status of Domestic REE Processing: The Three Pillars of US Capacity

- 1.3. Summary of Strategic Recommendations

2. The Geopolitical and Economic Context of Rare Earths Dependency

- 2.1. Defining the Rare Earth Spectrum: LREEs vs. HREEs

- 2.2. China's Structural Dominance: A Global Supply Chain Review

- 2.3. The Strategic Threat Landscape

3. The U.S. Domestic Rare Earth Processing Ecosystem: Company Deep Dive

- 3.1. Fully Integrated Leadership: MP Materials and the Mountain Pass Ecosystem

- 3.2. Strategic HREE Resilience: Energy Fuels and the White Mesa Mill

- 3.3. Vertical Integration for Reshoring: USA Rare Earth (USAR)

- 3.4. Key Allied Contributions: Lynas Rare Earths in Texas

4. Strategic Importance: Mitigating Critical Vulnerabilities

- 4.1. Defense Industrial Base Security

- 4.2. Economic Competitiveness in the Energy Transition

- 4.3. Enhancing Geopolitical Leverage and Price Stability

5. Policy Frameworks and Capital Deployment

- 5.1. Federal Financial Intervention (DOD and DOE)

- 5.2. Regulatory and Legislative Drivers

6. Challenges and Recommendations

- 6.1. Operational and Environmental Hurdles

- 6.2. Policy and Regulatory Friction

- 6.3. Recommendations for Industrial Base Fortification

- Recommendation 1: Accelerated HREE Commercialization

- Recommendation 2: Establish a National REE Recycling Standard

- Recommendation 3: Operationalize Allied Frameworks

Corporate Beneficiaries and Equity Valuation Implications

1. The American Rare Earth Renaissance and Investment Outlook

- 1.2 Key Rare Earth Metals Investment Recommendations

- 1.3 Summary of Critical Bottleneck Solutions

2. Geopolitical and Regulatory Drivers: Creating the Supply Chain Moat

- A. China's Hegemony and Geopolitical Weaponization

- B. US Policy Mandates and the Industrial Base Buildout

- Regulatory Exclusion: The 2027 DFARS Deadline

- Targeted Funding Programs (DOE, DoD, OSC)

3. Profile of Core US Integrated Producers: MP Materials and Energy Fuels

- A. MP Materials Corp. (NYSE: MP) The Vertical Integration Mandate

- B. Energy Fuels Inc. (NYSE: UUUU) Processing Agility and Diversification

4. Strategic Alliances and The Magnetics Bottleneck

- A. Lynas Rare Earths Ltd. (ASX: LYC) The HREE Security Solution

- B. The Downstream Leap: Vulcan Elements and ReElement Technologies

5. The Role of Recycling and Novel Technologies in Supply Resilience

- A. Cyclic Materials and the Circular Economy Advantage

- B. Other Emerging Processing and Recycling Players

6. Conclusions, Valuation Scenarios, and Strategic Recommendations

- A. Integrated Risk Assessment

- B. Valuation Scenarios Linked to Strategic Milestones

- C. Strategic Investment Recommendations