PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438273

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438273

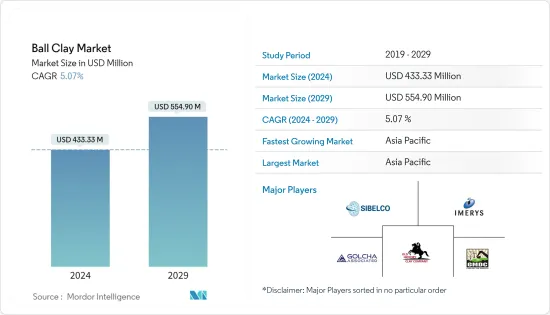

Ball Clay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Ball Clay Market size is estimated at USD 433.33 million in 2024, and is expected to reach USD 554.90 million by 2029, growing at a CAGR of 5.07% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the market negatively. However, the market has now reached pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- The major factor driving the market's growth is the increasing demand for sanitary ware in Asia-Pacific.

- The availability of substitutes for ball clay is likely to hinder the market's growth.

- Growing usage of ball clay in non-ceramic applications is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and register the highest CAGR during the forecast period.

Ball Clay Market Trends

Use of Wall and Floor Tiles in the Construction Industry

- Ball clay is used as wall and floor tiles in the construction industry by mixing with talc, feldspar, kaolin, and quartz/silica, as it increases the plasticity and improves bonding properties.

- With increasing investments in the construction industry worldwide, the use of tiles for walls and floors is increasing, resulting in the increased consumption of ball clay.

- The Asia-Pacific construction sector has witnessed steady growth in the recent past due to the presence of fast-growing economies, rapid urbanization, and rising infrastructure spending.

- The increasing presence of foreign companies in the Asia-Pacific region also created the demand for new offices, buildings, production houses, etc., thus driving the growth of the region's construction sector.

- Therefore, such factors are expected to boost the demand for ball clay worldwide during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific construction sector is the largest globally. It is growing at a healthy rate due to the rising population, increasing middle-class incomes, and urbanization.

- China's construction industry developed rapidly in the recent past due to the central government's push for infrastructure investment to sustain economic growth.

- However, the country is now reeling under the Evergrande Debt struggle that may put China under recession.

- India and ASEAN countries have also been focusing on infrastructure development.

- Furthermore, restrictions on foreign investment in land development, high-end hotels, office buildings, international exhibition centers, and the construction and operation of large theme parks have been lifted in the region.

- Owing to these factors, the demand for sanitary ware, wall and floor tiles, and other ceramics is expected to increase in the region, thus boosting the demand for ball clay over the forecast period.

Ball Clay Industry Overview

The ball clay market is partially consolidated. Some of the major players in the market (in no particular order) include Golcha Associated (Associated Soapstone Distribution Company Pvt. Ltd), Old Hickory Clay Company, Gujarat Mineral Development Corporation Ltd, Imerys Ceramics, and Sibelco.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Sanitary Ware in Asia-Pacific

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for Ball Clay

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 End Use

- 5.1.1 Ceramic

- 5.1.1.1 Sanitary Ware

- 5.1.1.2 Wall and Floor Tiles

- 5.1.1.3 Tableware

- 5.1.1.4 Bricks

- 5.1.1.5 Other Ceramics (Construction Ceramics and Refractories)

- 5.1.2 Non-ceramic

- 5.1.2.1 Adhesives and Sealants

- 5.1.2.2 Rubbers and Plastics

- 5.1.2.3 Fertilizers and Insecticides

- 5.1.2.4 Other Non-ceramics

- 5.1.1 Ceramic

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Amarnath Industries

- 6.4.2 Ashok Alco - chem Limited (AACL)

- 6.4.3 Golcha Associated (Associated Soapstone Distribution Company Pvt. Ltd)

- 6.4.4 Gujarat Mineral Development Corporation Ltd

- 6.4.5 Modkha Marine Sdn Bhd

- 6.4.6 Stephan Schmidt KG

- 6.4.7 Imerys

- 6.4.8 JLD Minerals

- 6.4.9 Mota Ceramic Solutions

- 6.4.10 Old Hickory Clay Company

- 6.4.11 Sibelco

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Usage in Non-ceramic Applications