PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851148

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851148

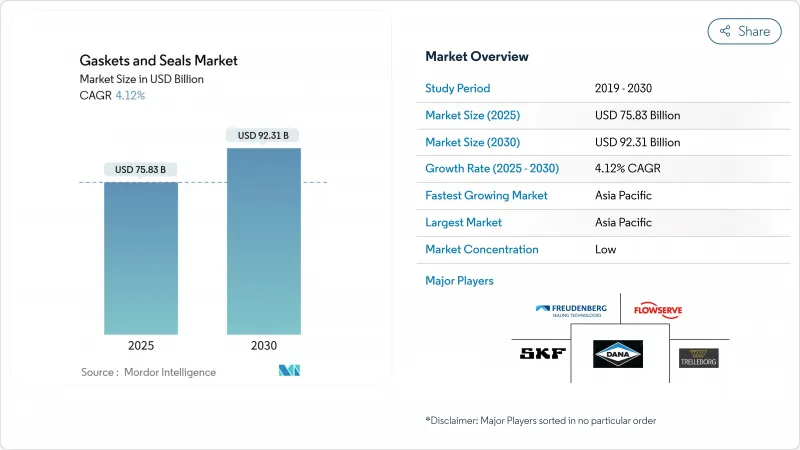

Gaskets And Seals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Gaskets And Seals Market size is estimated at USD 75.83 billion in 2025, and is expected to reach USD 92.31 billion by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

Robust demand from oil and gas, chemical processing, automotive electrification, and industrial automation will continue reinforcing steady expansion. Rapid material innovation, particularly in bio-based elastomers and PFAS-free compounds, removes performance trade-offs that once limited sustainable options. Digital monitoring transforms static components into data points, enabling predictive maintenance services that cut unplanned downtime and create new revenue streams. Manufacturers are responding with acquisitions in lubrication management and service agreements that lock in long-term aftermarket value. Supply chain pressures surrounding fluoro-rubber feedstocks are prompting dual-sourcing strategies and accelerated research into alternative chemistries, reducing vulnerability to price shocks.

Global Gaskets And Seals Market Trends and Insights

Increase in the Use of Gaskets and Seals in the Oil and Gas Industry

The exploration of unconventional reserves and tighter safety rules is pushing operators to specify advanced sealing solutions that survive extreme pressures and aggressive media. Nitrile and Viton O-rings are now standard in blowout preventers and wellheads due to their strong chemical resistance. Mechanical seals that prevent fugitive emissions support regulatory compliance while reducing lost product and greenhouse-gas releases. Purpose-built products such as Pipeotech's DeltaV-Seal provide a 10-year gas-tight warranty for flange connections. Adoption is strongest in liquefied natural gas export terminals, where downtime costs escalate rapidly. Capital spending on midstream assets across the Middle East and North America keeps the gaskets and seals market firmly linked to energy infrastructure growth.

Growing Demand from the Chemical and Petrochemical Sectors

Process intensification and wider chemical portfolios expose sealing materials to harsher solvents, oxidizers, and acids, requiring greater material compatibility. Flexible graphite seals now support temperatures up to 5,400°F in high-temperature reactors. Manufacturers are tailoring perfluoroelastomer blends for green-chemistry feedstocks that attack legacy compounds. Investment announcements totaling USD 87 billion for new Asian petrochemical capacity indicate large volumes of static and dynamic seals will be needed once plants come online. Integrated suppliers bundle engineered sealing sets with predictive monitoring modules, locking in future aftermarket contracts. Together, these moves sustain the gaskets and seals market even as chemical companies decarbonize.

Regular Maintenance and Lubrication

Industrial operators strive to extend runtimes, yet seals still rely on correct lubrication to avoid premature wear. Bearing failures linked to lubricant starvation remain a top cause of downtime. SKF addressed this gap by acquiring John Sample Group's lubrication and flow-management businesses to deliver integrated lubrication programs. Although self-lubricating designs exist, higher upfront costs limit widespread adoption outside high-value machinery. Smaller processing plants often delay preventive maintenance, exposing operators to sudden seal leaks. This need for routine service restrains rapid scaling of maintenance-free solutions and adds operating cost for end-users.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from the Automotive Industry

- Surge in Aerospace and Defense Investments

- Volatility in Fluoro-Rubber Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seals held 67% of 2024 revenue and are projected to post a 5.3% CAGR through 2030 as rotating machinery upgrades and electric-vehicle platforms expand. Shaft seals for pumps and compressors see strong unit growth because reliability requirements tighten in volatile energy and chemical markets. Soft-sensor technology that infers friction power from temperature readings offers real-time insight without disassembly, lowering service costs and boosting user confidence.

Gaskets remain integral to static joints, and innovation is focused on all-metal designs that withstand thermal cycling in hydrogen pipelines. One-piece DeltaV-Seal units eliminate the need for torque retention after installation, simplifying commissioning tasks. Although this sub-segment trails in absolute revenue, higher unit pricing lifts gaskets and seals market value whenever operators retrofit older assets with premium products. Equipment builders increasingly specify gasket-seal kits during quoting, ensuring cross-compatibility and minimizing reorder complexity.

Metals contributed a 35% share of the gaskets and seals market size in 2024. Stainless steel spiral-wound gaskets and Inconel spring-energized seals remain default choices for severe service. However, rubber compounds show the fastest momentum with a 6.3% CAGR forecast. TFE maintains a strategic niche for ultra-low friction valves, but PFAS scrutiny drives parallel testing of modified PEKK and PEEK blends. Over the forecast window, mixed-material solutions that pair metal carriers with elastomer overlays are expected to gain share, balancing rigidity and elasticity for differential thermal expansion.

Manufacturers segment product lines by material origin, granting buyers transparent options to meet internal sustainability targets. Large buyers, especially in Europe, embed life-cycle analysis thresholds into tenders, which favors suppliers able to validate bio-attributed content. These dynamics increase differentiation inside the gaskets and seals market and create pricing corridors that reward documented carbon savings.

The Gaskets and Seals Market Report Segments the Industry by Product (Gaskets and Seals), Material (Fiber, Graphite and Flexible Graphite, and More), Sales Channel (OEM and After-market/MRO), Application (Aerospace and Defense, Automotive OEM, Electronics, Oil and Gas, Power Generation, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific dominated the gaskets and seals market with a 47% revenue share in 2024 and is tracking 6.2% CAGR to 2030. Industrialization programs in China, India, and Southeast Asia underpin large volumes of rotating equipment that rely on shaft seals and gasket sets. Government incentives in India for petrochemical capacity spur fresh demand, and regional suppliers align portfolios with strict local content rules.

The United States' deepwater exploration and shale processing in North America need robust gasket materials to prevent blowouts, raising average selling prices. Adoption of Perceptiv-enabled seals spreads across food processing and pulp and paper mills, proving the commercial value of digital maintenance platforms. Mexico's expanding automotive clusters absorb high-volume molded seals, aided by trade agreements that tighten regional content thresholds.

Europe presents a mature yet innovation-driven landscape. Automakers push fire-resistant battery-module gaskets while off-highway equipment producers convert to PFAS-free hydraulic seals ahead of regulatory deadlines.

- AMG Sealing

- BRUSS

- Cooper Standard

- Dana Limited

- Datwyler Holding Inc.

- Dechengwang

- ElringKlinger AG

- Enpro Inc. (Garlock)

- Flowserve Corporation

- Freudenberg Sealing Technologies

- IGP

- James Walker Group

- KLINGER Holding

- NICHIAS Corporation

- PARKER HANNIFIN CORP

- Phelps

- SKF

- Smiths Group plc (John Crane)

- Tenneco Inc.

- Trelleborg AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in the Use of Gaskets and Seals in the Oil and Gas Industry

- 4.2.2 Growing Demand from the Chemical and Petrochemical Sectors

- 4.2.3 Increasing Demand from the Automotive Industry

- 4.2.4 Rise in Industrial Automation

- 4.2.5 Surge in Aerospace and Defense Investments

- 4.3 Market Restraints

- 4.3.1 Regular Maintenance and Lubrication

- 4.3.2 Volatility in Fluoro-Rubber Feedstock (HF and F-Alkenes) Prices

- 4.3.3 Stringent Quality Standards

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Gaskets

- 5.1.1.1 Metallic Gasket

- 5.1.1.2 Rubber Gasket

- 5.1.1.3 Cork Gasket

- 5.1.1.4 Non-asbestos Gasket

- 5.1.1.5 Spiral Wound Gasket

- 5.1.1.6 Other Gaskets (Semi-Metallic Gasket)

- 5.1.2 Seals

- 5.1.2.1 Shaft Seals

- 5.1.2.2 Molded Seals

- 5.1.2.3 Motor Vehicle Body Seals

- 5.1.2.4 Other Seals (Fork Seal and Piston Seal)

- 5.1.1 Gaskets

- 5.2 By Material

- 5.2.1 Fiber

- 5.2.2 Graphite and Flexible Graphite

- 5.2.3 PTFE

- 5.2.4 Rubbers

- 5.2.5 Others

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 After-market / MRO

- 5.4 By Application

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive OEM

- 5.4.3 Electronics

- 5.4.4 Oil and Gas

- 5.4.5 Power Generation

- 5.4.6 Others

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AMG Sealing

- 6.4.2 BRUSS

- 6.4.3 Cooper Standard

- 6.4.4 Dana Limited

- 6.4.5 Datwyler Holding Inc.

- 6.4.6 Dechengwang

- 6.4.7 ElringKlinger AG

- 6.4.8 Enpro Inc. (Garlock)

- 6.4.9 Flowserve Corporation

- 6.4.10 Freudenberg Sealing Technologies

- 6.4.11 IGP

- 6.4.12 James Walker Group

- 6.4.13 KLINGER Holding

- 6.4.14 NICHIAS Corporation

- 6.4.15 PARKER HANNIFIN CORP

- 6.4.16 Phelps

- 6.4.17 SKF

- 6.4.18 Smiths Group plc (John Crane)

- 6.4.19 Tenneco Inc.

- 6.4.20 Trelleborg AB

7 Market Opportunities and Future Outlook

- 7.1 Government is Increasing Investments to Enhance Domestic Manufacturing Capabilities

- 7.2 White-space and Unmet-need Assessment