PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689933

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689933

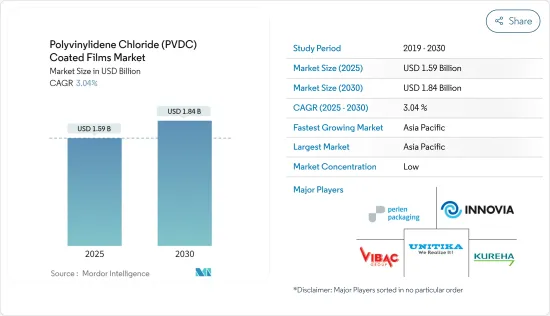

Polyvinylidene Chloride (PVDC) Coated Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Polyvinylidene Chloride Coated Films Market size is estimated at USD 1.59 billion in 2025, and is expected to reach USD 1.84 billion by 2030, at a CAGR of 3.04% during the forecast period (2025-2030).

In 2020, COVID-19 had a detrimental effect on the market. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The major factors driving the market studied are the growing processed food industry and the increasing demand for PVDC-coated films in food packaging.

- On the other hand, the availability of substitutes is expected to hinder the growth of the market during the forecast period.

- Developing new technologies to recycle film structures involving PVDC is expected to offer various lucrative opportunities for market growth.

- Asia-Pacific is expected to dominate the global market, with the largest consumption coming from China, Japan, and India.

PVDC Coated Films Market Trends

Increasing Application in Food Packaging

- The food packaging segment captures the major portion of the market regarding the packaging sector. This segment is expected to dominate the market, owing to the superior properties of PVDC-coated films, such as their high chemical resistance, inertness, and low odor.

- PVDC-coated films are optically clear with a high degree of gloss and have oxygen and moisture barrier properties comparable to metalized films. PVDC is also highly resistant to many chemicals, including grease and oil.

- PVDC-coated films are used for packaging food as they have low stretch, excellent bond strength, and low water absorption. They also have good cling properties, making them an ideal choice for food wrapping applications.

- According to the United States Department of Agriculture, the total consumption value of packaged organic food and beverages in India in 2021 was 96 million US dollars. In 2022, the USDA projected that the total consumption value would increase to 108 million dollars.

- Food packaging plays an essential role in preserving and transporting food items to the required location without affecting the taste or quality. It protects the contents from toxins and moisture, prevents spillage and tampering, and helps retain their shape and quality.

- According to the Food and Agriculture Organization, world meat production reached around 360 million metric tons in 2022, up by 1.2 percent from 2021. Global meat supply will expand to meet rising demand over the projection period, reaching 377 million tons by 2031.

- Hence, owing to the growing food packaging sector, the demand for PVDC-coated films is expected to increase over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for PVDC-coated films during the forecast period. Due to the high demand from countries like China, India, and Japan, the market for PVDC-coated films is growing.

- The packaging industry in China is expected to register tremendous growth with a growth rate of nearly 6.8%, reaching CNY 2 trillion (USD 290 billion) by 2025, as per the report of the Chinese government. China has one of the largest food industries in the world.

- The country is expected to witness consistent growth during the forecast period due to the rise of customized and flexible packaging in the food segment, like microwave, snack, and frozen foods, along with increasing exports. This has increased the demand for innovative packaging, which in turn will boost the PVDC-coated films market during the forecasted period.

- According to the Packaging Industry Association of India (PIAI), the country's packaging sector is the fifth largest sector of India's economy. The association has predicted that the packaging sector will reach USD 204.81 billion by 2025. This will likely boost the demand for PVDC-coated films during the forecasted period.

- Japan is currently the world's 3rd-largest and one of the fastest-growing e-commerce markets globally. As per the government of Japan, revenue in the e-commerce market in Japan is expected to generate USD 232.20 billion by 2023 and is further expected to register a 11.23% annual rate between 2023 and 2027, resulting in a market volume of USD 355.40 billion by 2027. The increasing penetration of e-commerce in the country is anticipated to enhance the demand for PVDC-coated films during the forecasted period.

- The factors above, coupled with government support, may contribute to the increasing demand for PVDC-coated films during the forecast period.

PVDC Coated Films Industry Overview

The polyvinylidene chloride (PVDC) coated films market is fragmented in nature. Some of the major players in the market include Innovia Films, KUREHA CORPORATION, UNITIKA LTD, Vibac Group S.p.a., and Perlen Packaging, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Processed Food Industry

- 4.1.2 Usage Of PVDC Coated Films In Fresh Meat Packaging

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Film Substrate Type

- 5.1.1 Bi-axially Oriented Polypropylene (BOPP)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Other Film Substrate Types

- 5.2 Application

- 5.2.1 Food Packaging

- 5.2.2 Pharmaceutical Blister Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACG

- 6.4.2 Cosmo Films

- 6.4.3 Innovia Films

- 6.4.4 Jindal Poly Films Limited

- 6.4.5 Kaveri Metallising & Coating Ind. Private Limited

- 6.4.6 Perlen Packaging

- 6.4.7 POLINAS

- 6.4.8 UNITIKA LTD

- 6.4.9 Vibac Group S.p.a.

- 6.4.10 Glenroy Inc.

- 6.4.11 KUREHA CORPORATION

- 6.4.12 Asahi Kasei Corporation

- 6.4.13 Huawei Pharma Foil Packaging

- 6.4.14 Klockner Pentaplast

- 6.4.15 Liveo Research

- 6.4.16 Polyplex

- 6.4.17 Qingdao Kingchuan Packaging

- 6.4.18 RMCL

- 6.4.19 Solvay

- 6.4.20 Tekni-Plex Inc.

- 6.4.21 Tipack Group

- 6.4.22 Transparent Paper Ltd.

- 6.4.23 Valtec Italia SRL

- 6.4.24 Bilcare Limited

- 6.4.25 Caprihans India Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Research on Recycling PVDC