PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689850

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689850

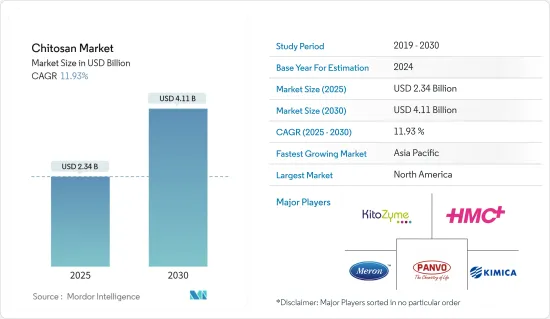

Chitosan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Chitosan Market size is estimated at USD 2.34 billion in 2025, and is expected to reach USD 4.11 billion by 2030, at a CAGR of 11.93% during the forecast period (2025-2030).

It is experiencing a significant growth rate, driven by several key factors shaping its trajectory. These market drivers are closely tied to the expanding applications of chitosan across industries like water treatment, biomedical, pharmaceutical sectors, and the food and beverage industry.

Megatrends Shaping the Market: Increasing focus on sustainable, eco-friendly materials and growing healthcare needs are key mega market trends propelling the Chitosan industry. Rising demand for natural ingredients across industries further boosts Chitosan's market position. Chitosan's versatility aligns with global challenges, offering solutions in sectors ranging from environmental remediation to healthcare innovation.

Rising Water Treatment Activities: Water quality management is becoming a critical concern globally, driving demand for effective treatment solutions. Chitosan's ability to adsorb metal ions due to its hydroxyl and amino groups makes it highly effective in removing contaminants like heavy metals and oils. Chitosan is widely used as a coagulant aid in water treatment, enhancing the effectiveness of traditional coagulants. Composite materials, such as graphene oxide/chitosan adsorbents, are emerging as highly effective in removing metal ions from wastewater. Innovations like chitosan derivatives, including trimethyl chitosan (TMC), show promise in mitigating environmental issues, such as cyanobacterial blooms, in freshwater sources.

Growing Product Application in Biomedical, Cosmetics, and Food and Beverage Industries: Chitosan's versatility has led to its adoption in various industries. Market analysis highlights its widespread use in biomedical applications, within which, it is used for wound dressing, drug delivery, tissue engineering, and gene therapy. Chitosan's antibacterial, antioxidant, and bio adhesive properties make it effective for drug delivery and wound care. In cancer therapy, chitosan enhances immunotherapy by accumulating at tumor sites, triggering immune responses. In cosmetics, chitosan's ability to prevent inflammatory reactions and infections makes it valuable in skin care formulations. In the food industry, chitosan is increasingly used as a food additive and antimicrobial agent, with approvals in key markets such as Japan and Korea.

Strong Advancements in Healthcare and Medical Industry: The market share of chitosan is rising in healthcare sector as the sector is innovating around chitosan's unique properties, particularly in drug delivery and tissue engineering. Market analysis reveals that Chitosan-based nanoparticles are advancing targeted drug delivery, especially in cancer treatments. In dentistry, chitosan composites improve cell adhesion and bone regeneration, offering new possibilities in dental implants and enamel preservation. Chitosan's biocompatibility is increasingly important in tissue engineering, with applications in skin, bone, and cartilage regeneration becoming more common. These advancements underscore Chitosan's growing role in healthcare.

Chitosan Market Trends

Shrimp-Derived Chitosan: Dominating the Source Landscape

Segment Overview: Shrimp-derived chitosan remains the cornerstone of the market, commanding 42% of the chitosan market share. This segment's dominance is driven by the superior quality and availability of shrimp chitosan, making it valuable across sectors like biomedical, water treatment, and food preservation.

Growth Drivers: Shrimp-derived chitosan aligns with the global demand for sustainable materials, driving its adoption across industries. The growing aquaculture industry, particularly in Asia-Pacific, ensures a steady supply of raw materials, while the demand for high-quality chitosan for applications in biomedicine and environmental management continues to rise.

Competitive Landscape: Market leaders and players are adopting vertical integration strategies to maintain their dominance in shrimp-derived chitosan. Innovations in extraction techniques are also key differentiators, with companies focusing on increasing chitosan quality and purity. Sustainable farming practices are being developed to mitigate the environmental impact of shrimp aquaculture, ensuring continued growth, rising market share and leadership in this segment.

Asia-Pacific: The Epicenter of Chitosan Market Growth

Regional Dynamics: Asia-Pacific stands out as the fastest-growing segment in the global chitosan market, with a projected CAGR of 12.38% between 2024 and 2029. Rapid industrialization, R&D investments, and increasing awareness of chitosan applications are driving the regional APAC market growth.

Growth Catalysts: The booming pharmaceutical and biomedical industries in countries like China and India, alongside growing investments in healthcare infrastructure, are key market growth drivers. The need for advanced water treatment solutions in these rapidly developing nations is also expanding Chitosan's applications. Additionally, the rising consumer preference for natural ingredients in cosmetics and food is boosting chitosan demand in these industries.

Strategic Imperatives: Industry players are focusing on building local partnerships and distribution networks to penetrate diverse Asia-Pacific markets. Companies are also establishing R&D centers in countries like Japan and South Korea to develop region-specific products. Navigating Asia's complex regulatory landscape and addressing sustainability concerns are essential for long-term success.

Chitosan Industry Overview

Market Characteristics: Diverse Players in a Fragmented Market

This global market is highly fragmented, with numerous small to medium-sized enterprises alongside larger corporations. Companies like Panvo Organics Pvt. Ltd, KitoZyme LLC, and KIMICA Corporation are notable players, each specializing in different Chitosan-based products.

Market Leaders: Innovation and Diversification Drive Success

Key market leaders, such as Dainichiseika Color & Chemicals Mfg Co. Ltd and KIMICA Corporation, excel through innovation and diversification. These companies invest heavily in R&D to discover new chitosan applications and focus on expanding their product portfolios, catering to various industry needs. Their commitment to sustainability and high-quality production processes sets them apart in the competitive landscape.

Strategies for Future Success: Research, Sustainability, and Market Expansion

Future market success will depend on intensifying R&D efforts to discover novel biomedical and pharmaceutical applications. Companies must focus on sustainable production methods, addressing environmental concerns associated with chitosan extraction. Expanding into emerging markets, particularly in Asia-Pacific, is a strategic imperative. Local partnerships, coupled with region-specific product development, will drive market growth in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Water Treatment Activities

- 4.2.2 Growing Product Application in the Biomedical, Cosmetics, and Food and Beverage Industries

- 4.2.3 Strong Advancements in the Healthcare/Medical Industry

- 4.3 Market Restraints

- 4.3.1 Regulatory Framework

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Source

- 5.1.1 Shrimps

- 5.1.2 Prawns

- 5.1.3 Crabs

- 5.1.4 Other Sources

- 5.2 By Application

- 5.2.1 Water treatment

- 5.2.2 Cosmetics

- 5.2.3 Pharmaceutical and Biomedical

- 5.2.4 Food and Beverage

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Panvo Organics Pvt Ltd

- 6.1.2 GTC Bio Corporation

- 6.1.3 Dupont Corporation

- 6.1.4 KitoZyme SA

- 6.1.5 KIMICA Corporation

- 6.1.6 Dainichiseika Color & Chemicals Mfg Co. Ltd

- 6.1.7 Heppe Medical Chitosan GmbH

- 6.1.8 Meron Biopolymers

- 6.1.9 Qingdao Yunzhou

- 6.1.10 Biophrame Technologies

- 6.1.11 ChitoTech

- 6.1.12 Marshal Marine

- 6.1.13 BIO21 Co. Ltd

- 6.1.14 Austanz Chitin Pty Ltd

- 6.1.15 KiOmed Pharma

7 MARKET OPPORTUNITIES AND FUTURE TRENDS