PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690841

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690841

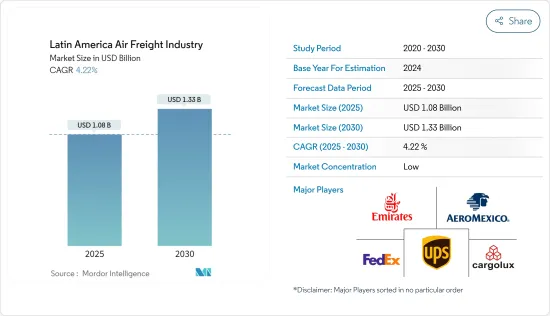

Latin America Air Freight Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Latin America Air Freight Industry is expected to grow from USD 1.08 billion in 2025 to USD 1.33 billion by 2030, at a CAGR of 4.22% during the forecast period (2025-2030).

The air trade in Latin America is growing with increased capacity addition and demand for fresh Latin American perishable goods across the globe. However, the archaic regulations and slow growth in infrastructure are hindering the continent from realizing its full potential.

As per the industry experts, in August 2022, the region had a 9.0% increase in freight volumes for airlines compared to August 2021. Among other areas, Latin America witnessed a significant growth rate. The growth is mainly attributed to the offering of new routes and capacity. The region is also expected to invest more in aircraft for air cargo in the upcoming months. The capacity increased by 24.3%.

The most robust year-on-year performance was achieved by Latin American carriers, with a 2.0% increase in demand for international operations between 2022 and 2023 compared to +1.9%. Capacity also significantly increased by 13.2% (+16.9% for international operations).

The air freight sector is experiencing several difficulties, including planes being grounded, routes being cut, and a drop in demand. Certain global air freight corporations indicate a slackened demand compared to the pandemic.

In contrast to the booming consumer demand that characterized the preceding two years, the air freight sector is currently facing a decline in customer demand, notwithstanding the time of year. Due to several circumstances, air freight companies anticipate a subdued fourth quarter in 2022. These included the broken supply chain, the protracted war, the slowdown of the world economy, and the possibility of a worldwide recession.

Latin America Air Freight Industry Market Trends

Growth of E-commerce Increases The Transport Service

As per industry experts, cross-border e-commerce is one of the significant opportunities for logistics providers due to the lower density of physical retail space, limited product availability, high penetration of smartphones, and purchase savings throughout the region. The industry continuously innovates to leverage the latest technologies and develop fraud protection solutions and authentication technologies that allow vital players, merchants, and banks to identify online shoppers by leveraging solutions such as biometric data for identity authentication. Several factors are behind this growth, the most important being the large numbers of millennials making purchases and the massive proliferation of smartphones.

In Latin America, social commerce is starting to overtake e-commerce. More than half of the Latin American shoppers polled in Brazil, Colombia, and Mexico engaged in social commerce. Comparing social commerce to traditional e-commerce, such as official corporate websites or marketplace websites like Amazon, Rappi, or MercadoLibre, the latter is gaining ground in Latin America.

More than 40% of customers from Brazil, Colombia, and Mexico cited the increased selection of payment options as a critical advantage of social commerce, as per experts. Nearly one-third of social commerce transactions in Argentina, Colombia, and Mexico involved currency coupons from convenience stores. It demonstrates that, besides relying on bank transfers, cards, and PayPal, even tech-savvy social media users favor cash as their preferred payment option. In 2023, compared to September 2022, the cargo volume increased by 2.3% for South American carriers. Compared to the previous month, this was a significant decrease in performance by 6.2%. In September 2023, capacity increased by 14.4% compared with the corresponding month in 2022.

Brazil Evolving As An Important Market For The Growth In The Air Freight Industry

Brazil's assistance of air cargo through its customs and border regulations ranked 52nd in the E-freight Friendliness Index (EFFI) globally in 2022. The air cargo transportation market has grown considerably in the country due to its various benefits, such as incredible speed and safety in the movement of products inside and outside the country.

The United States is Brazil's second-largest trading partner due to a solid commercial relationship and a commitment to joint prosperity. The complexity of domestic legislation and tax rules frequently makes it difficult for exporters despite the high local demand for U.S. brands and products. To achieve export success in Brazil, it is therefore essential to have an in-depth knowledge of local market trends and regulations. Brazil exported goods worth USD 39,122 million and imported goods worth USD 44,808 million in 2023 from the US.

One of the critical advantages of air freight is its dependability. Even though weather conditions can affect flight schedules, the availability of daily flights makes it simple to board the following trip. Consolidating shipments might be assisted by a knowledgeable air freight forwarding business. Combining airport terminal pickup, customs brokerage, cargo delivery, and affordable air carrier rates can help simplify logistics administration. Vendors can then concentrate more on expedited shipping in this fashion.

Latin America Air Freight Industry Industry Overview

The Latin American air freight industry is moderately fragmented. However, the industry is dominated by major players like FedEx, UPS, Emirates, and many more. The growing demand for air freight transportation services has opened new challenges for air cargo service providers. E-commerce also pushes air cargo toward greater visibility and transparency throughout the supply chain, with Brazil being the most significant market. Companies like Azul focus on expanding their presence in the country via collaborations and partnerships with e-retailers like Amazon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 Extension of new air routes and capacity

- 4.3.1.2 Constant Need to Transport Temperature-Sensitive Products

- 4.3.2 Restraints

- 4.3.2.1 Market Uncertainty

- 4.3.3 Opportunities

- 4.3.3.1 Implementation of Several Software Solutions

- 4.3.1 Drivers

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Government Regulations and Initiatives

- 4.7 Supply Chain/Value Chain Analysis

- 4.8 Technology Snapshot and Digital Trends

- 4.9 Spotlight on Key Commodities Transported by Air

- 4.10 Elaboration on Air Freight Rates

- 4.11 Insights into Key Ground Handling Equipment in Airports

- 4.12 Review and Commentary on Standards and Regulations on the Safe Transport of Dangerous Goods

- 4.13 Brief on Cold Chain Logistics in the Air Cargo Sector

- 4.14 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Transport

- 5.1.2 Forwarding

- 5.1.3 Other Services

- 5.2 By Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 By Carrier Type

- 5.3.1 Belly Cargo

- 5.3.2 Freighter

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Colombia

- 5.4.5 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 FedEx (Federal Express)

- 6.2.2 United Parcel Service

- 6.2.3 Emirates Skycargo

- 6.2.4 Aeromexico

- 6.2.5 Cargolux

- 6.2.6 LATAM Cargo

- 6.2.7 Qatar Airways

- 6.2.8 Azul Cargo Express

- 6.2.9 Kuehne + Nagel

- 6.2.10 IAG Cargo

- 6.2.11 Avianca Cargo

- 6.2.12 DHL

- 6.2.13 United Airlines

- 6.2.14 American Airlines

- 6.2.15 Delta Airlines

- 6.2.16 Copa Airlines*

- 6.3 Other Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX