PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910950

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910950

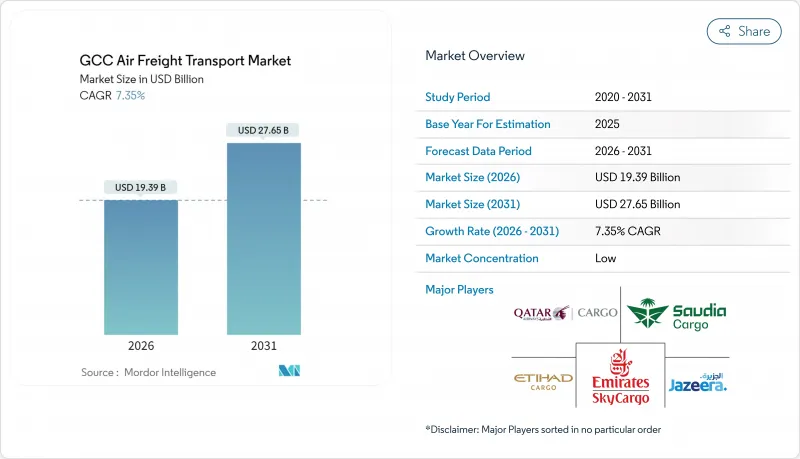

GCC Air Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

GCC Air Freight Transport Market size in 2026 is estimated at USD 19.39 billion, growing from 2025 value of USD 18.06 billion with 2031 projections showing USD 27.65 billion, growing at 7.35% CAGR over 2026-2031.

The expansion is shaped by national vision programs that funnel record infrastructure capex into airports, growing cross-border e-commerce volumes, and the region's hub position between Asia, Europe, and Africa. Rising cargo digitization, new freighter orders from incumbent airlines, and specialized cold-chain corridors for pharmaceuticals and perishables further underpin momentum. Competitive intensity is increasing as incumbents race to add main-deck capacity and digital booking links, while secondary airports carve out niche roles through cargo-village projects and express parcel handling. At the same time, volatile jet-fuel prices and intermittent geopolitical airspace closures represent material headwinds that pressure yield management and schedule reliability.

GCC Air Freight Transport Market Trends and Insights

Boom in Cross-Border E-Commerce

Cross-border online shopping is transforming shipment profiles as the GCC e-commerce market is on track to reach USD 49.78 billion by 2027, rising at an 11% annual pace. Young, digitally native consumers and >90% smartphone penetration underpin growth. Cainiao's 2025 rollout of a pan-GCC cross-border network accelerates two-day delivery ambitions. Airlines respond by launching direct-to-consumer products such as Emirates Delivers, introduced in Saudi Arabia in 2024. Higher frequency of small parcels increases demand for belly-hold capacity, yet peak-season surges are nudging carriers to add dedicated freighters. Integrated payment and tracking APIs further shorten booking lead times, cementing e-commerce as a structural cargo demand driver.

Vision 2030/2050 Logistics Capex Wave

Saudi Arabia alone has earmarked USD 266 billion to add 59 logistics centers across 100 million m2 and expand Riyadh's airport to six runways by 2030. Parallel projects in Qatar and the UAE include new concourses at Hamad International and the Al Maktoum International mega-expansion, creating a synchronized capacity build-out. Network effects emerge as freight forwarders exploit multi-hub routings that consolidate loads and reduce transit times. New entrant Riyadh Air received its Air Operator Certificate in April 2025, underscoring the competitive shake-up. Over the medium term, the capex wave lifts throughput ceilings and offers airlines runway slots tailored for night-time cargo waves.

Volatile Jet-Fuel Surcharges

Fuel averages of USD 87 per barrel in 2025 equate to around 30% of airline operating costs, exposing carriers to earnings swings. Dynamic surcharge formulas help recover spikes yet risk eroding price-sensitive volumes. Carriers hedge and retrofit winglets to pare burn rates, while sustainability mandates push them toward costlier SAF blends. Emirates established a USD 200 million sustainability fund and signed multi-year SAF offtakes, partly buffering volatility with environmental differentiation. Nevertheless, persistent oil-market turbulence remains an immediate profit headwind.

Other drivers and restraints analyzed in the detailed report include:

- Geo-Strategic Asia-Europe-Africa Hub Role

- Pharma & Perishables Corridor Accreditations

- Geopolitical Air-Space Closures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

International routes generated 80.45% of 2025 tonnage, underlining the GCC air freight transport market's role as a trans-shipment bridge rather than a pure consumption zone. The segment benefits from hub-and-spoke strategies that pool cargo from Asia for onward lift to Europe and Africa. Saudia Cargo's "Landing in China in 24" initiative exemplifies tailored corridor products for exporters. Domestic uplift is poised for a 4.65% CAGR to 2031 as Saudi industrial clusters and UAE northern-emirate logistics parks escalate inter-city flows. Intra-GCC e-commerce parcel volumes additionally shorten haul lengths yet increase frequency, supporting secondary night-time freighter rotations.

International dominance fortifies the GCC air freight transport market size through yield diversity, but domestic acceleration offers incremental resiliency by tapping intra-regional consumption. Regulatory harmonization across customs single windows is gradually lowering clearance times, encouraging manufacturers to divert time-critical components from road to air. Heightened dangerous-goods compliance, reflected in the IATA DGR 66th-edition addendum, imposes uniform training standards on both destination categories.

Belly-hold lift accounted for 66.20% of the value in 2025 as passenger networks furnish widebody frequency at marginal cost. High seat-density deployments on Gulf super-connectors maximize lower-deck pallet positions, aligning with small-parcel e-commerce demand. Yet special-cargo complexity and peak-season constraints push operators toward purpose-built freighters. Emirates' USD 1 billion purchase of five 777Fs slated for 2025-26 delivery will raise main-deck capacity 30%, illustrating the shift. Parallel orders from Gulf Air for twelve 787s augment belly capacity while preserving flexibility.

Growing freighter fleets diversify revenue and buffer passenger-cycle shocks, positioning carriers to lock in multi-year contracts for pharma and oversized industrial cargo. However, the dual-model approach inflates training and maintenance overhead. ICAO's revised dangerous-goods syllabus demands operator-specific instruction, raising compliance spend but favoring scale players with in-house academies. Over 2026-2031, the GCC air freight transport market share of freighters is forecast to edge higher as e-commerce consolidators charter block space on trunk lanes.

The GCC Air Freight Transport Market Report is Segmented by Destination (Domestic and International), Carrier Type (Belly Cargo and Freighter), Cargo Type (General Cargo and Special Cargo), End-User Industry (E-Commerce & Retail, Manufacturing & Automotive, High-Tech & Electronics, and More), Country (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Emirates SkyCargo

- Qatar Airways Cargo

- Saudia Cargo

- Etihad Cargo

- Jazeera Airways Cargo

- Maximus Air

- Gulf Air Cargo

- Oman Air Cargo

- Bahrain Air Cargo

- Air Charter Service

- Chapman-Freeborn

- Turkish Cargo

- Kuwait Airways Cargo

- Texel Air

- EGYPTAIR

- Royal Jordanian Cargo

- Middle East Airlines (MEA) Cargo

- Silk Way West Airlines

- Cathay Cargo

- Cargolux

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Boom in cross-border e-commerce

- 4.2.2 Vision 2030/2050 logistics capex wave

- 4.2.3 Geo-strategic Asia-Europe-Africa hub role

- 4.2.4 Pharma & perishables corridor accreditations

- 4.2.5 Cargo Digital Community Systems rollout

- 4.2.6 Carbon-neutral FTZ slot incentives

- 4.3 Market Restraints

- 4.3.1 Volatile jet-fuel surcharges

- 4.3.2 Geopolitical air-space closures

- 4.3.3 DG-handler talent shortage at secondary airports

- 4.3.4 Landside cold-chain bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Pricing Analysis

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Dangerous Goods Standards Review

- 4.10 Impact of Geo-Political Events on the Market

5 Market Size & Growth Forecasts

- 5.1 By Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 By Carrier Type

- 5.2.1 Belly Cargo

- 5.2.2 Freighter

- 5.3 By Cargo Type

- 5.3.1 General Cargo

- 5.3.2 Special Cargo

- 5.4 By End-User Industry

- 5.4.1 E-commerce & Retail

- 5.4.2 Manufacturing & Automotive

- 5.4.3 Healthcare & Pharmaceuticals

- 5.4.4 Perishables & Fresh Produce

- 5.4.5 High-Tech & Electronics

- 5.4.6 Others

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Bahrain

- 5.5.6 Oman

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Emirates SkyCargo

- 6.4.2 Qatar Airways Cargo

- 6.4.3 Saudia Cargo

- 6.4.4 Etihad Cargo

- 6.4.5 Jazeera Airways Cargo

- 6.4.6 Maximus Air

- 6.4.7 Gulf Air Cargo

- 6.4.8 Oman Air Cargo

- 6.4.9 Bahrain Air Cargo

- 6.4.10 Air Charter Service

- 6.4.11 Chapman-Freeborn

- 6.4.12 Turkish Cargo

- 6.4.13 Kuwait Airways Cargo

- 6.4.14 Texel Air

- 6.4.15 EGYPTAIR

- 6.4.16 Royal Jordanian Cargo

- 6.4.17 Middle East Airlines (MEA) Cargo

- 6.4.18 Silk Way West Airlines

- 6.4.19 Cathay Cargo

- 6.4.20 Cargolux

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment