PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644460

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644460

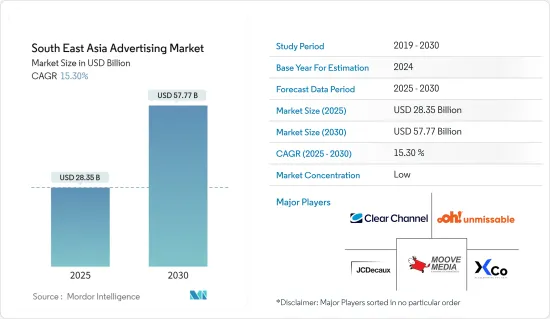

South East Asia Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South East Asia Advertising Market size is estimated at USD 28.35 billion in 2025, and is expected to reach USD 57.77 billion by 2030, at a CAGR of 15.3% during the forecast period (2025-2030).

With the increasing complexity of online advertising and the premium pricing charged for ad blockers, marketing and advertising companies are looking for alternative solutions that may enable them to display their advertisements or messages. This presents the DOOH market with a lucrative opportunity, which may boost its adoption over the forecast period.

Key Highlights

- Southeast Asia represents some of the most significant growth regions for advertising. Out-of-home advertising (OOH) has weathered the digital revolution better than other legacy media formats. Therefore, it is one of the few traditional media segments to increase advertising revenue consistently.

- The Southeast Asian region is also faring well in terms of Digital Out of Home (DOOH) advertising. For instance, the Philippines is expected to see some of the highest digital growth over the next five years, stimulated by the attention of global ad-tech firms, such as Rubicon Project and Dataxu, both of which have made deals with DOOH provider, Aircast, to provide programmatic trading of inventory.

- Programmatic digital OOH is in the infancy stage in Southeast Asia. Vendors are still trying to figure out the complexity of making their inventory available programmatically. Domestic market regulations are a major factor in the penetration of DOOH in Southeast Asia.

- For instance, Singapore has very strict regulations for the OOH market in content and location. There is very limited availability of billboards, so advertisers must ensure their content complies with the shared values of Singapore's society and are not denigrating competitors. In Malaysia, all OOH creative content must be submitted for pre-approval to authorities to ensure they comply with guidelines.

Southeast Asia Advertising Market Trends

Transit Application is Expected to Hold the Highest Market Share

- The increasing demand for digital content and information relevant to travelers has led to interactive ads through different modes of advertisements, such as kiosks, billboards, and signboards, at the platform that accounts for a significant share of growth in transportation media revenues in the region.

- Due to this, there has been a shift in consumer behavior in terms of customer engagement across all modes of transportation, strategically building their brands in the customer mindset. This is expected to drive potential customers against traditional media over the coming years.

- Among various transit environments, airports have proven themselves to be an ideal environment for advertising, particularly for top-tier and luxury brands. Airports are under pressure to figure out ways to generate more revenue. Converting static displays, like posters, to digital displays allow airports to utilize the same space to sell to multiple advertisers instead of just one. That multiplies the amount of revenue exponentially. Additionally, airports can share the cost burden of upgrading to new advertising technologies by bringing in advertising partners.

- The initial setup cost of the digital screen is much higher than that of print signage, which is likely to pose a challenge for this segment in the market in the future.

Malaysia is Expected to Account for the Largest Market Share

- As Malaysia started to loosen pandemic restrictions, marketers are increasingly required to be agile and flexible to maximize their performance from OOH and DOOH spending. Malaysia introduced the Conditional Movement Control Order (CMCO) in 2020 to control the spread of COVID-19. The order prohibited various activities, including inter-state travel and mass gatherings. This move severely affected Malaysia's advertising industry. It resulted in shifting the focus of most brands' marketing to personal and at-home devices, where people spend more time.

- However, some companies in the country planned to get more out of this situation. For instance, Lalamove, a Malaysian on-demand delivery platform, assessed that the CMCO period was a good opportunity to invest in OOH and DOOH media. The company took advantage of cut-price rates on both OOH and DOOH sites.

- Digital outdoor advertising is undergoing significant transformation across the country, with spending expected to grow over the forecast period. The growth is majorly driven by a dense distribution of digital screens, a developed infrastructure, and connected technologies, which facilitate new opportunities for brands.

- The Malaysia Advertisers Association recognizes that OOH and DOOH are increasingly popular mediums for advertisers. However, there were a large number of technology providers with various reliable technologies with different measuring currencies, which became a challenge in measurement.

- Therefore, the Malaysia Advertisers Association agreed with the Media Specialists Association (MSA) to form a joint industry committee with the Outdoor Advertising Association of Malaysia (OAAM) to solve this problem. The formation of the Joint Industry Committee (JIC) and standardizing a single currency are expected to simplify the planning process by introducing simple measurements that media owners commonly utilize. The JIC is working on the framework to select a single measurement metric that multiple technology providers can offer.

Southeast Asia Advertising Industry Overview

The Southeast Asian advertising market is competitive/fragmented and has many global and regional players. These players account for a considerable market share and focus on expanding their client base worldwide. These players focus on R&D activities, strategic alliances, and other organic and inorganic growth strategies to stay in the market landscape over the forecast period.

- October 2022: Aqilliz, a blockchain solutions provider, announced partnering with Moving Walls to facilitate a blockchain-powered Dooh advertising pilot for global mobile food delivery giant Foodpanda. Designed to provide greater transparency to the DOOH market, which is expected to be valued at USD 32.1 billion by 2025, the pilot will offer an independent, real-time view of campaign performance, enabling brands to track whether their purchased impressions and advertising spots were played.

- August 2022: Asiaray Media Group Limited announced a partnership with Hivestack to launch flexible, data-driven advertising technology solutions to host innovative brand campaigns for advertisers and seek to make the cities in which it operates more pleasant by delivering exceptional experiences for audiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Key Global Cues Expected to Find a Way into the SEA Advertising Market

- 4.5 Impact of COVID-19 on the Advertising and DOOH Market

- 4.5.1 Impact on the Advertising Spend

- 4.5.2 Switching from Traditional Medium to Digital Medium Due to Higher Engagement on Major Channels

- 4.5.3 Regional and Country-specific Factors Expected to Influence the Growth Trajectory

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Public Transit Infrastructure

- 5.1.2 Increasing Adoption of Digital Screens

- 5.2 Market Challenges

- 5.2.1 High Installation and Maintenance Costs

6 SEA ADVERTISING MARKET LANDSCAPE

- 6.1 Malaysia

- 6.1.1 Malaysia Advertising Spend (2018-2028)

- 6.1.2 Advertising Spend - Breakdown by Medium

- 6.1.2.1 Television

- 6.1.2.2 Newspaper

- 6.1.2.3 Magazine

- 6.1.2.4 Radio

- 6.1.2.5 Other Advertising Spends (Cinema, etc.)

- 6.1.3 Malaysia OOH Market Estimates in USD billion, 2019-2029

- 6.1.4 Malaysia DOOH Market Estimates in USD billion, 2019-2029

- 6.1.5 Malaysia DOOH Segmentation by Application

- 6.1.5.1 Billboard

- 6.1.5.2 Transit

- 6.1.5.3 Street Furniture

- 6.1.5.4 Malls

- 6.1.5.5 Other Applications

- 6.2 Indonesia

- 6.2.1 Indonesia Advertising Spend (2019-2029)

- 6.2.2 Advertising Spend - Breakdown by Medium

- 6.2.2.1 Television

- 6.2.2.2 Newspaper

- 6.2.2.3 Magazine

- 6.2.2.4 Radio

- 6.2.2.5 Other Advertising Spends (Cinema, etc.)

- 6.2.3 Indonesia OOH Market Estimates in USD billion, 2019-2029

- 6.2.4 Indonesia DOOH Market Estimates in USD billion, 2019-2029

- 6.2.5 Indonesia DOOH Segmentation by Application

- 6.2.5.1 Billboard

- 6.2.5.2 Transit

- 6.2.5.3 Street Furniture

- 6.2.5.4 Malls

- 6.2.5.5 Other Applications

- 6.3 Thailand

- 6.3.1 Thailand Advertising Spend (2019-2029)

- 6.3.2 Advertising Spend - Breakdown by Medium

- 6.3.2.1 Television

- 6.3.2.2 Newspaper

- 6.3.2.3 Magazine

- 6.3.2.4 Radio

- 6.3.2.5 Other Advertising Spends (Cinema, etc.)

- 6.3.3 Thailand OOH Market Estimates in USD billion, 2019-2029

- 6.3.4 Thailand DOOH Market Estimates in USD billion, 2019-2029

- 6.3.5 Thailand DOOH Segmentation by Application

- 6.3.5.1 Billboard

- 6.3.5.2 Transit

- 6.3.5.3 Street Furniture

- 6.3.5.4 Malls

- 6.3.5.5 Other Applications

- 6.4 Vietnam

- 6.4.1 Vietnam Advertising Spend (2019-2029)

- 6.4.2 Advertising Spend - Breakdown by Medium

- 6.4.2.1 Television

- 6.4.2.2 Newspaper

- 6.4.2.3 Magazine

- 6.4.2.4 Radio

- 6.4.2.5 Other Advertising Spends (Cinema, etc.)

- 6.4.3 Vietnam OOH Market Estimates in USD billion, 2019-2029

- 6.4.4 Vietnam DOOH Market Estimates in USD billion, 2019-2029

- 6.4.5 Vietnam DOOH Segmentation by Application

- 6.4.5.1 Billboard

- 6.4.5.2 Transit

- 6.4.5.3 Street Furniture

- 6.4.5.4 Malls

- 6.4.5.5 Other Applications

- 6.5 Philippines

- 6.5.1 Philippines Advertising Spend (2019-2029)

- 6.5.2 Advertising Spend - Breakdown by Medium

- 6.5.2.1 Television

- 6.5.2.2 Newspaper

- 6.5.2.3 Magazine

- 6.5.2.4 Radio

- 6.5.2.5 Other Advertising Spends (Cinema, etc.)

- 6.5.3 Philippines OOH Market Estimates in USD billion, 2019-2029

- 6.5.4 Philippines DOOH Market Estimates in USD billion, 2019-2029

- 6.5.5 Philippines DOOH Segmentation by Application

- 6.5.5.1 Billboard

- 6.5.5.2 Transit

- 6.5.5.3 Street Furniture

- 6.5.5.4 Malls

- 6.5.5.5 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JCDecaux Singapore Pte Ltd

- 7.1.2 Clear Channel Singapore Pte Ltd

- 7.1.3 OOH Media (Mediacorp. Pte Ltd)

- 7.1.4 XCO Media (SMRT Experience Pte Ltd)

- 7.1.5 Moove Media Pte Ltd

- 7.1.6 SPHMBO (Singapore Press Holding Ltd)

- 7.1.7 Cornerstone Financial Holding Ltd

- 7.1.8 Golden Village

- 7.1.9 Mediatech Services Pte Ltd

- 7.1.10 ActMedia Singapore Pte Ltd

- 7.1.11 Spectrum Outdoor Sdn Bhd

- 7.1.12 TAC Media Sdn Bhd

- 7.1.13 Moving Walls

8 INVESTMENT ANALYSIS

9 FUTURE TRENDS