PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906861

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906861

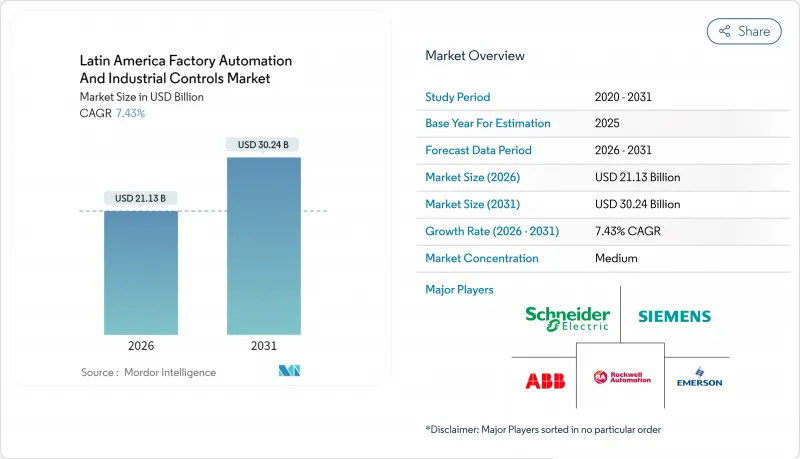

Latin America Factory Automation And Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Latin America factory automation and industrial controls market was valued at USD 19.67 billion in 2025 and estimated to grow from USD 21.13 billion in 2026 to reach USD 30.24 billion by 2031, at a CAGR of 7.43% during the forecast period (2026-2031).

Accelerated digital transformation, growing nearshoring activity, and government incentives are creating sustained demand for end-to-end automation solutions. Manufacturers across diverse sectors are prioritizing real-time analytics, predictive maintenance, and flexible production lines to reduce downtime and meet export-oriented quality standards. Vendor strategies emphasize localized production, value-added services, and domain-specific partnerships to mitigate currency volatility and supply chain disruptions. The region is also witnessing rapid uptake of collaborative robots, AI-enabled digital twins, and cloud-based supervisory systems as plants modernize legacy assets.

Latin America Factory Automation And Industrial Controls Market Trends and Insights

Rising Industry 4.0 and IIoT Adoption Across Manufacturing

Brazil's Industry 4.0 spending is forecast to triple by 2028, catalyzing enterprise-wide sensor rollouts and edge analytics. Arca Continental uses a cloud-based platform to connect 45 plants and serve 125 million consumers across four countries, enabling real-time performance dashboards. Manufacturers are shifting from monthly metrics to near-instant KPIs, elevating responsiveness and trimming production bottlenecks. Cement major Votorantim Cimentos reduced corrective maintenance costs by BRL 23 million (USD 4.6 million) per site through the use of predictive analytics, improving asset reliability by 6%. As a result, the Latin America factory automation and industrial controls market continues to embed smart-sensor networks and data-driven workflows across both discrete and process industries.

Government Incentive Programs Accelerating Smart-Factory Investments

Brazil earmarked BRL 186.6 billion (USD 37.3 billion) for modernizing industrial facilities, while Mexico reported USD 48 billion in new manufacturing commitments during the first seven months of 2024, over half of which was tied to automation initiatives. Targeted subsidies, tax credits, and technical residencies lower adoption barriers for small and mid-sized enterprises, a priority segment for the Latin America factory automation and industrial controls market. WEG alone plans USD 122 million in dual-country capacity expansions that integrate robotic picking, conveyance, and MES platforms. Argentina's mining policy also grants duty exemptions on advanced controls, supporting its position as the region's fastest-growing adopter. These incentives deliver a multiplier effect by blending public finance with private capital, thereby accelerating the diffusion of technology.

High Upfront Capex and ROI Uncertainty for SMEs

Survey data show that Brazilian SMEs lag behind large firms by as much as 2 times in automation adoption, constrained by access to finance and technical know-how. Collaborative robots narrow this gap, costing 20-30% less to deploy than traditional robots and offering quick paybacks, yet total investment still stretches capital budgets. Leasing models and vendor-led training mitigate some risk, but the Latin America factory automation and industrial controls market must further adapt financing structures to unlock SME potential. Public institutions, such as SENAI, offer low-cost simulation workshops that enable companies to validate ROI scenarios before committing to equipment purchases.

Other drivers and restraints analyzed in the detailed report include:

- Cost-Reduction Pressure and Productivity Optimization Mandates

- Rapid Uptake of AI-Enabled Digital-Twin Pilots in Brownfield Plants

- Acute Skilled-Labor Shortage for Advanced Automation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial Control Systems (ICS) represented 30.38% of the Latin America factory automation and industrial controls market in 2025, underpinned by deployments of PLC, SCADA, and DCS across oil and gas, mining, and food plants. Petrobras leverages predictive analytics to optimize refineries, while PEMEX employs region-wide pipeline SCADA for leak detection and flow control. Upgrades frequently bundle MES and HMI layers, enabling operators to streamline batch sequencing and regulatory reporting. The segment's growth remains steady as process industries refresh aging controllers and expand cybersecurity safeguards.

Field Devices are advancing at an 8.46% CAGR, the fastest pace within the Latin America factory automation and industrial controls market, propelled by surging robot installations and smart-sensor retrofits. Brazil added 1,595 new industrial robots in 2021, with cobots outpacing conventional units by a factor of four. Vision systems for quality inspection and autonomous guided vehicles for intralogistics are gaining traction in the electronics, metals, and pharmaceutical industries. Energy-efficient drives also support sustainability mandates, as manufacturers target lower kilowatt-hour intensity and reduced maintenance bills.

Hardware retained a 30.25% share of the Latin America factory automation and industrial controls market size in 2025, supported by mega-projects such as the USD 5 billion Sucuriu pulp mill that requires extensive sensors, actuators, and switchgear. However, component margins are tightening due to global supply chain rebalancing and currency fluctuations.

Services are expanding at 8.07% CAGR as clients demand turnkey integration, training, and predictive maintenance, positioning vendors for recurring revenue streams. Outcome-based contracts are common, with Votorantim Cimentos paying service fees tied to the avoidance of downtime. Software, at roughly one-quarter market share, anchors these models by providing asset-centric analytics and multi-site visibility.

The Latin America Factory Automation and Industrial Controls Market Report is Segmented by Product Type (Industrial Control Systems, Field Devices), Component Type (Hardware, Software, Services), End-User Industry (Automotive, Food and Beverages, and More), Deployment Mode (On-Premise, Cloud, Hybrid), and Country (Brazil, Mexico, Argentina, Chile, Colombia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens AG

- ABB Ltd

- Rockwell Automation Inc.

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- General Electric Co.

- Dassault Systemes SE

- Autodesk Inc.

- Aspen Technology Inc.

- Bosch Rexroth AG

- Yokogawa Electric Corporation

- Omron Corporation

- FANUC Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Festo SE and Co. KG

- Endress+Hauser Group Services AG

- WEG Industrias S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Industry 4.0 and IIoT adoption across manufacturing

- 4.2.2 Government incentive programmes accelerating smart-factory investments

- 4.2.3 Cost-reduction pressure and productivity optimisation mandates

- 4.2.4 Powershoring to Brazil for low-carbon renewable-energy manufacturing

- 4.2.5 Maquiladora-linked near-shoring surge driving automation demand in Mexico

- 4.2.6 Rapid uptake of AI-enabled digital-twin pilots in brownfield plants

- 4.3 Market Restraints

- 4.3.1 High upfront capex and ROI uncertainty for SMEs

- 4.3.2 Acute skilled-labour shortage for advanced automation

- 4.3.3 Local-currency volatility stalling long-cycle investments

- 4.3.4 Escalating cyber-physical attacks on industrial control systems

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Industrial Control Systems

- 5.1.1.1 Distributed Control System (DCS)

- 5.1.1.2 Programmable Logic Controller (PLC)

- 5.1.1.3 Supervisory Control AND Data Acquisition (SCADA)

- 5.1.1.4 Manufacturing Execution System (MES)

- 5.1.1.5 Product Lifecycle Management (PLM)

- 5.1.1.6 Human Machine Interface (HMI)

- 5.1.1.7 Enterprise Resource Planning (ERP)

- 5.1.2 Field Devices

- 5.1.2.1 Machine Vision

- 5.1.2.2 Robotics (Industrial)

- 5.1.2.3 Sensors and Transmitters

- 5.1.2.4 Motors and Drives

- 5.1.2.5 Relays and Switches

- 5.1.1 Industrial Control Systems

- 5.2 By Component Type

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverages

- 5.3.3 Oil and Gas

- 5.3.4 Chemical and Petrochemical

- 5.3.5 Power and Utilities

- 5.3.6 Pharmaceutical

- 5.3.7 Electronics and Electrical

- 5.3.8 Mining and Metals

- 5.3.9 Other End-user Industries

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Mexico

- 5.5.3 Argentina

- 5.5.4 Chile

- 5.5.5 Colombia

- 5.5.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 ABB Ltd

- 6.4.3 Rockwell Automation Inc.

- 6.4.4 Schneider Electric SE

- 6.4.5 Emerson Electric Co.

- 6.4.6 Honeywell International Inc.

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 General Electric Co.

- 6.4.9 Dassault Systemes SE

- 6.4.10 Autodesk Inc.

- 6.4.11 Aspen Technology Inc.

- 6.4.12 Bosch Rexroth AG

- 6.4.13 Yokogawa Electric Corporation

- 6.4.14 Omron Corporation

- 6.4.15 FANUC Corporation

- 6.4.16 Yaskawa Electric Corporation

- 6.4.17 KUKA AG

- 6.4.18 Festo SE and Co. KG

- 6.4.19 Endress+Hauser Group Services AG

- 6.4.20 WEG Industrias S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment