PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849968

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849968

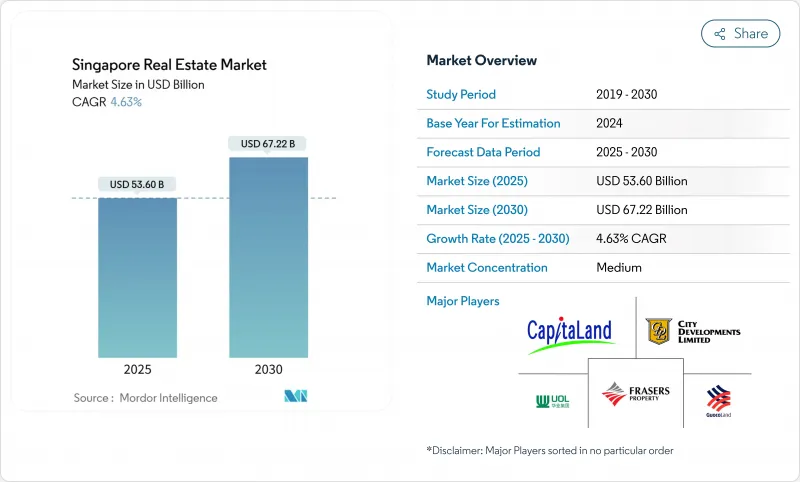

Singapore Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Singapore Real Estate size is estimated at USD 53.6 billion in 2025, and is expected to reach USD 67.22 billion by 2030, at a CAGR of 4.63% during the forecast period (2025-2030). Stable governance, transparent regulations, and an active pipeline of government-led city-building programs continue to attract a broad spectrum of investors. Luxury housing retains global appeal, while demand for modern logistics, data centers, and mixed-use assets is buoyed by e-commerce growth, advanced manufacturing, and the expansion of Singapore's regional head-office role. Tight supply, limited land reclamation capacity, and stricter loan-to-value rules moderate speculative activity but have not derailed long-term capital flows. Developers are differentiating through PropTech adoption, prefabricated construction, and new-generation low-carbon designs that align with Green Mark 2021 requirements.

Singapore Real Estate Market Trends and Insights

Robust Foreign Investor Interest Driven by Political Stability and Strong Legal Frameworks

Foreign capital continues to view Singapore as a low-risk base due to contract enforceability, clear taxation, and efficient dispute resolution. The Economic Development Board registered USD 10 billion in fixed-asset commitments during 2024, channeling funds into semiconductor, biopharma, and AI projects that indirectly enlarge prime office and industrial absorption. The Overseas Networks & Expertise Pass, introduced in 2023, sustains inflows of global talent and underpins premium rental demand. Together, these forces reinforce the long-run attractiveness of the Singapore real estate market.

Government-Backed Urban Planning Spurring Long-Term Development

The Urban Redevelopment Authority Draft Master Plan 2025 sets an integrated, climate-resilient blueprint that will reshape the Singapore real estate market over the next decade. Flagship projects include the 2,000-acre Greater Southern Waterfront and the 800-hectare Long Island reclamation, both adding mixed housing, commercial clusters, and 20 kilometers of waterfront recreation while enhancing coastal defense. Planned MRT extensions such as the Tengah and Seletar Lines will connect more than 400,000 households, encouraging value migration into previously underserved districts.

Stringent Cooling Measures and Stamp Duties Tempering Speculative Residential Investment

Higher stamp duties, tighter loan-to-value ceilings and a 15-month wait-out period for private-to-HDB movers have slowed transactional velocity. HDB resale price growth eased to 1.6% in Q1 2025 following the 2024 policy package. Private new-home sales fell below 350 units in May 2025, underscoring policy effectiveness, yet structural demand remains intact thanks to wage growth and immigration.

Other drivers and restraints analyzed in the detailed report include:

- Sustained Demand in Luxury and High-End Residential Segment from Global UHNWIs

- Strategic Positioning as Regional Business Hub Supporting Office and Mixed-Use Growth

- Limited Land Supply and High Land Acquisition Costs Constraining New Development

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The residential segment commanded 53.1% of 2024 revenue, underscoring Singapore's real estate market size leadership in people-centric development. Government plans to launch more than 50,000 Build-to-Order flats between 2025 and 2027 reinforce a stable base of owner-occupiers. Classification of Standard, Plus, and Prime flats links subsidies to location value, encouraging balanced demand across townships. Private projects now favor integrated formats where residences sit above retail podiums and community amenities, supporting resilient pipeline absorption.

Commercial stock is expanding fastest at a 5.13% CAGR through 2030 as the economy digitalizes. Logistics and industrial assets gain from Singapore's role in semiconductor and e-commerce supply chains; the construction of an enlarged Changi air-freight zone and Tuas Port automation will lift warehouse take-up. Meanwhile, investors target data-center campuses and decentralized offices with green credentials, signaling a pivot toward income streams less tied to traditional retail or single-tenant offices. This reorientation underpins the forward trajectory of the Singapore real estate market.

The Singapore Real Estate Market Report is Segmented by Property Type (Residential and Commercial), by Business Model (Sales and Rental), by End User (Individuals/Households, Corporates & SMEs and Others), and by Region (Core Central Region (CCR), Rest of Central Region (RCR) and Outside Central Region (OCR)). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- CapitaLand

- City Developments Limited

- UOL Group Limited

- Frasers Property Limited

- GuocoLand Limited

- Far East Organization

- Keppel Land

- Mapletree Investments

- Oxley Holdings

- Wing Tai Holdings

- Bukit Sembawang Estates

- Allgreen Properties

- Sim Lian Group

- Hoi Hup Realty

- Tuan Sing Holdings

- Ascendas REIT

- ESR-LOGOS REIT

- Capitaland Integrated Commercial Trust (CICT)

- Frasers Centrepoint Trust

- GLP (Global Logistics Properties)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Commercial Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Robust foreign investor interest driven by political stability and strong legal frameworks

- 4.9.2 Government-backed urban planning (e.g., Master Plan, Greater Southern Waterfront) spurring long-term development

- 4.9.3 Sustained demand in the luxury and high-end residential segment from global UHNWIs

- 4.9.4 Strategic positioning as a regional business hub supporting office, co-working, and mixed-use growth

- 4.9.5 Booming e-commerce and advanced manufacturing driving logistics and industrial real estate demand

- 4.9.6 Rising adoption of smart and sustainable building technologies encouraged by government incentives

- 4.10 Market Restraints

- 4.10.1 Stringent cooling measures and stamp duties tempering speculative residential investment

- 4.10.2 Limited land supply and high land acquisition costs constraining new development

- 4.10.3 Geopolitical and economic headwinds impacting foreign capital flow and tenant demand

- 4.10.4 Supply-demand imbalances in select asset classes (e.g., oversupply in suburban retail or fringe office locations)

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.11.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.11.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.11.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.11.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.11.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers/Occupiers

- 4.12.3 Bargaining Power of Suppliers (Developers/Builders)

- 4.12.4 Threat of Substitutes

- 4.12.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Property Type

- 5.1.1 Residential

- 5.1.1.1 Apartments & Condominiums

- 5.1.1.2 Villas & Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Logistics

- 5.1.2.4 Others (industrial real estate, hospitality real estate, etc.)

- 5.1.1 Residential

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By Region

- 5.4.1 Core Central Region (CCR)

- 5.4.2 Rest of Central Region (RCR)

- 5.4.3 Outside Central Region (OCR)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.3.1 CapitaLand

- 6.3.2 City Developments Limited

- 6.3.3 UOL Group Limited

- 6.3.4 Frasers Property Limited

- 6.3.5 GuocoLand Limited

- 6.3.6 Far East Organization

- 6.3.7 Keppel Land

- 6.3.8 Mapletree Investments

- 6.3.9 Oxley Holdings

- 6.3.10 Wing Tai Holdings

- 6.3.11 Bukit Sembawang Estates

- 6.3.12 Allgreen Properties

- 6.3.13 Sim Lian Group

- 6.3.14 Hoi Hup Realty

- 6.3.15 Tuan Sing Holdings

- 6.3.16 Ascendas REIT

- 6.3.17 ESR-LOGOS REIT

- 6.3.18 Capitaland Integrated Commercial Trust (CICT)

- 6.3.19 Frasers Centrepoint Trust

- 6.3.20 GLP (Global Logistics Properties)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment