PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846356

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846356

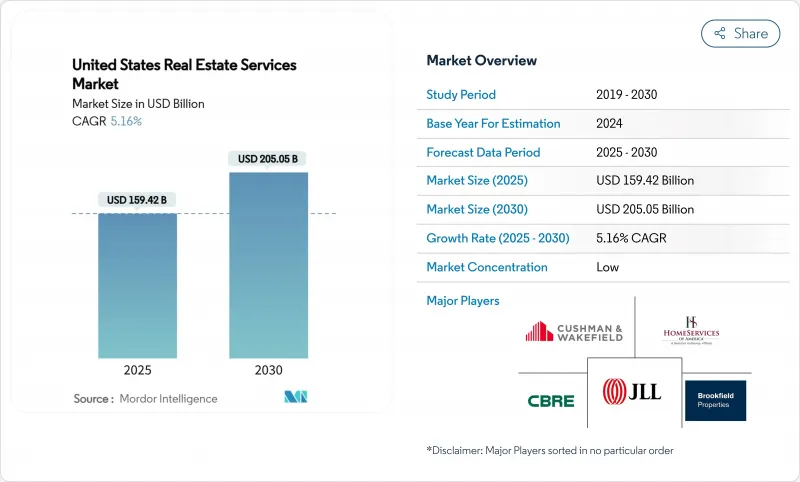

United States Real Estate Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States real estate services market stands at USD 159.42 billion in 2025 and is forecast to reach USD 205.05 billion by 2030, advancing at a 5.16% CAGR.

This trajectory signals continued resilience despite elevated borrowing costs and evolving workplace habits. Institutional capital keeps pouring into single-family rentals and data-rich industrial assets, while office portfolios undergo resizing as hybrid work cements lower daily occupancy. Technology platforms that automate valuations, leasing, and property operations are widening efficiency gaps between digitally enabled firms and traditional brokers. Consolidation is gathering pace as scale becomes vital for regulatory compliance, ESG reporting, and nationwide service delivery, giving well-capitalized players an edge in winning large corporate mandates. Policy changes-including anti-money-laundering rules for residential deals effective December 2025 and the post-settlement overhaul of commission structures-add urgency to business-model innovation across the value chain.

United States Real Estate Services Market Trends and Insights

Surge in Institutional Investment in Single-Family Rentals (SFRs)

Institutional ownership of single-family rentals continues to scale, with major operators lining up 13,000-unit pipelines and keeping average occupancy near 96%. Rental costs remain 28% below ownership expenses in key metros, encouraging large funds to expand Sunbelt portfolios. Demand for valuation, acquisition, and ongoing management work therefore rises in tandem, anchoring steady fee streams even as home sales cool. Service providers able to integrate data-driven sourcing tools and centralized maintenance platforms capture a durable competitive edge.

High Activity in Industrial and Data Center Leasing

Vacancy in primary data-center hubs dropped to 1.9%, and 80% of new capacity is pre-leased before delivery. Industrial absorption stays robust as e-commerce, AI training, and cloud computing raise power-dense space requirements. Investors allocated more than USD 6.5 billion to the segment last year, while 97% intend further commitments. The surge translates into recurring leasing, project management, and facility operations assignments for firms versed in high-spec infrastructure.

Persistently High Interest Rates and Financing Costs

With the Federal Reserve holding policy rates at 4.5%, bank lending for commercial deals remains 65% below pre-pandemic norms, and CMBS loans in special servicing exceed USD 51 billion. Elevated borrowing costs shrink the buyer pool and prolong bid-ask gaps, curbing transaction volumes and trimming success-based fees. Advisory demand rises, yet revenue mix shifts toward lower-margin consulting until capital markets stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Migration Patterns and Sunbelt Market Expansion

- Demand for Portfolio Optimization Due to Hybrid Work

- Volatility in Commercial Real Estate (CRE) Valuations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential assets accounted for 54.6% of the United States real estate services market in 2024, anchored by institutional expansion in single-family rentals and steady home-buying pipelines. Operators such as American Homes 4 Rent keep occupancy near 96%, sustaining fee visibility. In contrast, commercial assets-still smaller in absolute terms-are projected to log a 5.67% CAGR, underscoring the pull of data centers, industrial logistics, and selective, high-amenity office clusters. Within commercial, data-center vacancy sits at 3%, and 80% of new builds are fully committed prior to delivery. These dynamics illustrate how specialized know-how in power procurement, ESG reporting, and mission-critical operations fetch premium pricing. The residential subsector remains resilient, but commercial services are set to widen their revenue mix through 2030 as occupiers prioritize efficiency and digital backbone capacity.

The divergence forces service firms to rebalance talent and capital toward growth areas. Providers deep in residential retain predictable annuity streams, yet competitive intensity rises as proptech entrants automate tenant onboarding and maintenance workflows. Conversely, commercial teams able to finance and deliver complex industrial and hyperscale digital campuses secure multi-year contracts with global tenants, insulating margins. Accordingly, the United States real estate services market rewards platforms that blend residential scale with commercial specialization.

The United States Real Estate Services Market Report is Segmented by Property Type (Residential, Commercial), by Service (Brokerage Services, Property Management Services, Valuation Services and More), by Client Type (Individuals/Households, Corporates & SMEs and More), and by States (Texas, California, Florida, New York, Illinois, Rest of US). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- CBRE Group Inc.

- Jones Lang LaSalle Incorporated (JLL)

- Cushman & Wakefield PLC

- Brookfield Properties LLC

- HomeServices of America Inc.

- Anywhere Real Estate Inc. (formerly Realogy)

- RE/MAX LLC

- Keller Williams Realty Inc.

- Redfin Corporation

- Colliers International Group Inc.

- Marcus & Millichap Inc.

- SVN International Corp.

- Long & Foster Companies Inc.

- Howard Hanna Real Estate Services

- Silverpeak Real Estate Partners LP

- NAI Global

- John L. Scott Real Estate

- Zillow Group Inc. (Premier Agent Services)

- Opendoor Technologies Inc. (iBuyer Services)

- Compass Inc.

- Prologis Property Management Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Institutional Investment in Single-Family Rentals (SFRs)

- 4.2.2 High Activity in Industrial and Data Center Leasing

- 4.2.3 Migration Patterns and Sunbelt Market Expansion

- 4.2.4 Demand for Portfolio Optimization Due to Hybrid Work

- 4.2.5 ESG Compliance and Green Certification Requirements

- 4.2.6 Adoption of PropTech-Enabled Service Delivery

- 4.3 Market Restraints

- 4.3.1 Persistently High Interest Rates and Financing Costs

- 4.3.2 Volatility in Commercial Real Estate (CRE) Valuations

- 4.3.3 Rising Insurance and Operational Costs in Disaster-Prone Areas

- 4.3.4 Tech Layoffs and Downsizing Impacting Office Demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Services Segment

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Billion)

- 5.1 By Property Type

- 5.1.1 Residential

- 5.1.1.1 Single-Family

- 5.1.1.2 Multi-Family

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Logistics

- 5.1.2.4 Others

- 5.1.1 Residential

- 5.2 By Service

- 5.2.1 Brokerage Services

- 5.2.2 Property Management Services

- 5.2.3 Valuation Services

- 5.2.4 Others

- 5.3 By Client Type

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By State

- 5.4.1 Texas

- 5.4.2 California

- 5.4.3 Florida

- 5.4.4 New York

- 5.4.5 Illinois

- 5.4.6 Rest of US

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 CBRE Group Inc.

- 6.3.2 Jones Lang LaSalle Incorporated (JLL)

- 6.3.3 Cushman & Wakefield PLC

- 6.3.4 Brookfield Properties LLC

- 6.3.5 HomeServices of America Inc.

- 6.3.6 Anywhere Real Estate Inc. (formerly Realogy)

- 6.3.7 RE/MAX LLC

- 6.3.8 Keller Williams Realty Inc.

- 6.3.9 Redfin Corporation

- 6.3.10 Colliers International Group Inc.

- 6.3.11 Marcus & Millichap Inc.

- 6.3.12 SVN International Corp.

- 6.3.13 Long & Foster Companies Inc.

- 6.3.14 Howard Hanna Real Estate Services

- 6.3.15 Silverpeak Real Estate Partners LP

- 6.3.16 NAI Global

- 6.3.17 John L. Scott Real Estate

- 6.3.18 Zillow Group Inc. (Premier Agent Services)

- 6.3.19 Opendoor Technologies Inc. (iBuyer Services)

- 6.3.20 Compass Inc.

- 6.3.21 Prologis Property Management Services

7 Market Opportunities & Future Outlook