PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690880

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690880

Process Analytical Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

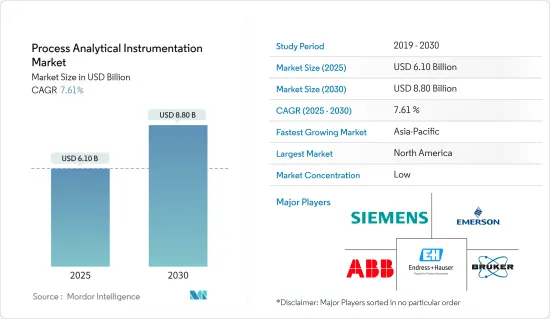

The Process Analytical Instrumentation Market size is estimated at USD 6.10 billion in 2025, and is expected to reach USD 8.80 billion by 2030, at a CAGR of 7.61% during the forecast period (2025-2030).

Key Highlights

- Process gas chromatography is a vastly used analysis for process engineering. It is the most utilized method for gas analysis since it permits multiple components to be analyzed alongside. Gas chromatographs have plenty of downtime and need a lot of supervision. The gas chromatograph consists of a process modular oven choice that another module may fix and replace. Furthermore, this may decrease equipment downtime and improve process productivity.

- The growth of automation in the manufacturing industry has driven the development of the market studied. With the worldwide impact of Industry 4.0, the manufacturing industry is going toward automation. Process analytical instruments are a good fit with this evolving trend. For instance, integrating digital communication technologies and standards such as foundation fieldbus and electronic device description language constructs the information collected by the instruments and makes it readily accessible to enhance the process and deliver persistent accuracy.

- In current years, the growth in the market studied has been driven by factors like the increasing use of the equipment in process engineering, high investments in pharmaceuticals worldwide, strict regulations on drug safety, growing emphasis on the quality of food products, rising crude and shale gas production, and technological advancements in mass spectrometers. Spectrometers are discovering applications in environmental, petrochemical, food safety, metallurgical, geochemical, and clinical toxicology research. These products are primarily used in markets such as China, India, and Latin America to help comply with growing stringent international environmental and consumer safety regulations.

- Software licensing of analytical instrumentation should be considered among the major challenges to the market studied, as different companies have different licenses. For instance, some allow the use of software on other computers for data processing, while others require the purchase of a second license for this purpose. Hence, such issues may negatively impact the growth of the market studied during the forecast period.

- During the COVID-19 pandemic, the global economy was under stress. After many years of strong growth, global trade slowed, mainly due to the accumulation of problems in Europe and the United States. Similar issues might arise in emerging economies in the future. However, these short-term dynamics should clarify the longer-term structural changes in the global trading system, which is anticipated to work in favor of the market studied.

Process Analytical Instrumentation Market Trends

Pharmaceutical and Biotechnology Segment Observing Significant Market Growth

- The biopharmaceutical manufacturing industry relies on analytical testing to help improve productivity, optimize and monitor processes, characterize biologics and biosimilars, and provide real-time product quality control. All these are essential in creating a more streamlined process within biomanufacturing, resulting in lower costs, more consistent product quality, and more efficient manufacturing across the board.

- The pharmaceutical industry has always searched for ways to improve product quality. Over time, as instrument accuracy and precision have improved, the industry has begun focusing more on efficiency. Hence, the growing investments in pharmaceutical research and development are expected to create a favorable outlook for the growth of the market studied.

- Furthermore, crucial analytical tools like chromatography and spectroscopy are gaining new ground. Since chromatography (GC) machines can analyze tiny and light compounds, GC is used in post-production. In other words, GC is a standard process during quality control. However, identifying volatile impurities is the primary use of GC within the pharmaceutical industry.

- There are several optical spectroscopy techniques, and each excels at various manufacturing stages. While some methods enjoy wide acceptance, such as near-infrared (NIR) and Fourier transform infrared (FTIR) absorption spectroscopy, broader adoption of newer techniques, such as terahertz Raman spectroscopy, can also benefit pharmaceutical production.

- More recently, spectroscopy has also begun to focus on the structural composition and distribution of pharmaceutical products. It has additional applications in quality control, which help validate that manufacturing processes and end products meet strict compliance and regulatory controls. Such trends will favor the growth of the market studied in the future.

- In April 2023, India's Science and Technology Minister unveiled the SUPREME program. This initiative aims to offer financial backing to maintain and upgrade analytical instrumentation facilities (AIFs) established with the ministry's backing. Through SUPREME, the government will not only aid in the maintenance and repair of these facilities but also support their enhancement by acquiring additional attachments.

North America Projected to Hold a Significant Market Share

- Process analytical technology (PAT) and instrument vendors across North America have continually advanced their technology's usability, accuracy, reliability, and efficacy in the past few years. Companies in this industry have introduced technological developments and other innovations to better support lab and QA/QC operations.

- In industries such as oil and gas, metal and mining, and pharmaceuticals, the traditional production processes involve manufacturing the finished products and laboratory analysis to verify their quality. However, these traditional methods have some drawbacks, such as recurring manufacturing difficulties, constant process optimization, and the probability of failed batches. Thus, to overcome these glitches, the new technology known as PAT was introduced by the US Food and Drug Administration (FDA) to change the mode of operation.

- The US FDA has outlined a regulatory framework for PAT implementation. With this framework, the FDA tries to motivate the pharmaceutical industry to enhance the production process. Owing to the existence of the United States and Canada, which are countries that spend a substantial amount on research and development and hold a prominent share in the life sciences, oil and gas, materials sciences, pharma, and biopharma industries, North America holds a major share of the global process analytical instrumentation market. According to Pharmaceutical Commerce, the pharmaceutical market is on the rise in the United States.

- The approval of new drugs is on the rise across regional countries, propelling the demand for pharmaceutical solutions. This surge underscores the need for process analytical instruments. These instruments play a crucial role in analyzing the chemical composition and physical properties of solutions during drug manufacturing. In June 2024, Waters Corporation introduced its latest innovation, the Xevo MRT. This benchtop mass spectrometer (MS) not only sets new benchmarks but also caters to the demands of large-scale populations and epidemiology studies. The Xevo MRT MS is a fusion of multi-reflecting time-of-flight (MRT) and hybrid quadrupole time-of-flight (QTof) technologies housed in a versatile benchtop design. By harnessing next-generation MRT technology, the Waters Xevo MRT Mass Spectrometer achieves exceptional resolution and speed, ensuring top-notch analytical performance.

Process Analytical Instrumentation Industry Overview

The process analytical instrumentation market is fragmented, with several major companies operating in it. These companies continuously invest in strategic partnerships and product developments to increase their market share. Major players in the market include ABB Ltd, Siemens AG, Bruker Corporation, Emerson Electric Co., and Endress & Hauser. Some of the recent developments in the market are:

- April 2024 - The United States Pharmacopeia (USP) announced that it was crafting a dedicated General Chapter on Process Analytical Technology (PAT). This initiative seeks to define PAT, outline its key attributes, identify its enablers, and shed light on its practical applications within the pharmaceutical industry. The chapter's primary goal is to harmonize with prevailing scientific and regulatory benchmarks, with a strong emphasis on real-time monitoring, control, and quality assurance across pharmaceutical manufacturing. It also delves into the realm of PAT's role in enhancing process understanding and optimization, notably in Continuous Process Verification (CPV) and Real-Time Release Testing (RTRT).

- April 2024 - Valmet announced that it had finalized its acquisition of Siemens AG's Process Gas Chromatography & Integration business. This sector of Siemens AG specializes in the MAXUM II Gas Chromatograph platform, Systems Integration, and Customer Services. Gas chromatographs play a pivotal role in analyzing the chemical composition of gases and evaporable liquids across various production phases. Leveraging extensive expertise in chemical processes, liquefied natural gas (LNG), refining, and biofuels, this business equips its clients with crucial insights to enhance quality, sustainability, and safety globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Impact of Microeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Introduction of High-efficiency Motors

- 5.1.2 Increasing Adoption of Power Management and Predictive Maintenance Solutions

- 5.2 Market Challenges

- 5.2.1 Dynamic Global Economy

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Gas Chromatographs

- 6.1.2 Gas Analyzers

- 6.1.3 Liquid Analyzers

- 6.1.4 Spectrometers

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals & Petrochemicals

- 6.2.3 Pharmaceutical & Biotechnology

- 6.2.4 Metal & Mining

- 6.2.5 Water & Wastewater

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Siemens AG

- 7.1.3 Bruker Corporation

- 7.1.4 Emerson Electric Co.

- 7.1.5 Endress & Hauser AG

- 7.1.6 Extrel CMS LLC

- 7.1.7 Focused Photonics Inc.

- 7.1.8 Hach Company

- 7.1.9 Horiba Ltd

- 7.1.10 Mettler Toledo

- 7.1.11 MKS Instruments Inc.

- 7.1.12 Neo Monitors AS

- 7.1.13 Schneider Electric SE

- 7.1.14 ServomexGroup Limited

- 7.1.15 SICK AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET