PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640656

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640656

Latin America Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

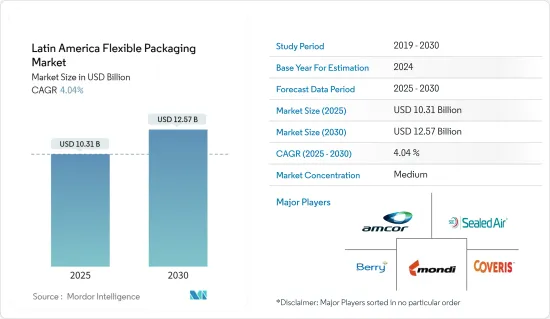

The Latin America Flexible Packaging Market size is estimated at USD 10.31 billion in 2025, and is expected to reach USD 12.57 billion by 2030, at a CAGR of 4.04% during the forecast period (2025-2030).

Key Highlights

- Manufacturers benefit from substantial cost savings as flexible packaging consumes less raw materials and energy during production. Its efficient wrapping capabilities and reduced storage space requirements further boost its demand in the market.

- Trends like innovative packaging and digital printing are energizing the market, showcasing technological advancements. These include creative consumer engagement solutions, such as serialized QR codes. Additionally, the lightweight nature of flexible packaging cuts down transportation costs and fuel usage, making it a favored choice for snacks and potato chip packaging in the studied regions.

- In response to rising demand, several market players are forging collaborations and partnerships to enhance their revenues. For example, in May 2024, SGK's team in Brazil partnered with Johnson & Johnson Brazil to launch SEMPRE LIVRE. Their sustainability efforts earned them the Popular Vote category at the 20th ABRE Brazilian Packaging Award. SGK and Johnson & Johnson broke new ground with their first flexible film packaging. They crafted a thinner insert for female care products, using 33% post-consumer resin, and achieved a commendable 10.25% carbon footprint reduction over traditional packaging.

- The Argentine packaging sector grappled with challenges during the economic downturn, worsened by the pandemic. A significant drop in purchasing power among low and middle-income groups stifled innovation and premium packaging ventures. With wages plummeting, unemployment rising, and consumption habits shifting, the effects were felt across various packaging types and sizes.

- In the past decade, there has been a marked surge in public awareness about the detrimental effects of plastic. Latin American governments have spearheaded numerous public campaigns and initiatives, amplifying this awareness. Consequently, the consumption of plastic packaging has seen a pronounced shift in recent years.

Latin America Flexible Packaging Market Trends

The Pouches Segment is Expected to Grow Significantly

- Pouches, widely utilized across Europe, can be categorized into stand-up and flat types. Stand-up pouches encompass a range of varieties, including retort, bottom gusset, flat bottom, side gusset, spouted, and shaped pouches. Flat pouches are divided into pillow, four-side seal, three-side seal, and vacuum pouches.

- The demand for pouches in the market is fueled by their durability and logistical convenience. Their cost-effectiveness is prompting manufacturers to increasingly adopt pouch packaging, further propelling the growth of this flexible format. Additionally, pouches' lightweight nature makes them a preferred choice over traditional packaging formats like PET bottles.

- Kraft paper is in high demand for applications like wrapping, pouches, and sacks. The rising trend of eco-friendly packaging has spurred interest in kraft papers, especially since their pulping process facilitates easy waste recovery and recycling. In line with this trend, in 2020, TC Transcontinental, a Montreal-based packaging manufacturer with operations in the United States and Latin America, unveiled plans to boost post-consumer recycled content in its flexible offerings, including pouches. The company has also invested in equipment to convert flexible plastics sourced from sorting facilities and other avenues.

- In February 2023, ProAmpac, a frontrunner in flexible packaging and material science, introduced new additions to its ProActive Sustainability Portfolio: ProActive Recyclable R-2050 and ProActive Post Industrial Recycled Content (PIR).

- Pouches emerged as a dominant choice for packaging e-commerce products. They are increasingly favored in the food, beverage, personal care, and pharmaceutical sectors, especially for products targeting the e-commerce market. E-commerce players are gravitating toward pouch packaging due to its efficiency and cost-effectiveness.

Brazil is Expected to Hold a Significant Share in the Market

- Brazil is a frontrunner in Latin America, showcasing robust economic growth and attracting significant foreign direct investment (FDI). The nation, with its substantial appetite for food and industrial goods, heavily relies on imports. The region is increasingly turning to flexible packaging solutions to safeguard these products from damage. As the middle class expands, so does the appetite for packaged foods, paving the way for the expanding flexible packaging market.

- In 2023, Brazil achieved a trade surplus in beauty and personal care products, as per a report by Beautycare Brazil (ABIHPEC & ApexBrasil). The South American powerhouse exported cosmetics and hygiene products worth over USD 911 million to global markets.

- In March 2024, SIG, a leading supplier of aseptic cartons, partnered with DPA Brasil, a prominent dairy company, to roll out innovative spouted pouch packaging for the Chamyto yogurt brand. This new packaging, featuring the SIG CloverCap 85RO closure and SIG Prime 120 filling equipment, has a lightweight yet robust design, making it especially user-friendly for children. The strawberry-flavored Chamyto yogurt marks DPA Brasil's inaugural product to adopt this cutting-edge packaging format. DPA Brasil also plans to expand this packaging innovation to other offerings, including Chamyto fruit vitamin yogurts, Chambinho Recreio, and Ninho Lancheirinha.

- Additionally, the market is witnessing a trend towards premiumization. While Brazilians are generally price-sensitive but increasingly willing to invest in cosmetics. This shift is driving the demand for flexible packaging. Flexible plastic materials like polyamine and polypropylene enhance package visibility and appeal and incorporate essential safety features.

Latin America Flexible Packaging Industry Overview

The Latin American flexible packaging market comprises several global and regional players and is moderately consolidated. As the market poses low barriers to entry for the new players, several new entrants have gained traction. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition. Sustainable competitive advantage can be gained through design, technology, and application innovation. Some of the major players operating in the market are Amcor PLC, Berry Global Inc., Mondi Group, and Sealed Air Corporation.

- May 2024: SGK's team in Brazil collaborated with Johnson & Johnson Brazil to introduce SEMPRE LIVRE. Their sustainability initiatives garnered them the Popular Vote category at the 20th ABRE Brazilian Packaging Award. In partnership with Johnson & Johnson, SGK spearheaded innovation by developing the inaugural flexible film packaging. They designed a thinner insert, incorporating 33% post-consumer resin for female care products, achieving a notable 10.25% reduction in carbon footprint compared to existing packaging.

- October 2023: PAC Worldwide relocated its operations from Pedro Escobedo, Mexico, to a new 83,000 sq. ft plant in Vistha San Juan Del Rio as part of its strategy to enhance manufacturing capabilities in Central America. This comprehensive, flexible packaging facility is two hours north of Mexico City.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Convenient Packaging

- 4.3 Market Challenges

- 4.3.1 Concerns Regarding Environment and Recycling

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of the Microeconomic Factors on the Industry

5 SUSTAINABLE PACKAGING AND TECHNOLOGICAL ADVANCEMENTS IN THE LATIN AMERICAN FLEXIBLE PACKAGING MARKET

- 5.1 Light Weighting

- 5.2 Recycled and Recyclable Polymers

- 5.3 Sustainable Coatings for Pouch Packaging

- 5.4 Barrier Developments

- 5.5 Active Packaging

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastics

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Bi-orientated Polypropylene (BOPP)

- 6.1.1.3 Cast Polypropylene (CPP)

- 6.1.1.4 Polyvinyl Chloride (PVC)

- 6.1.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.1.2 Paper

- 6.1.3 Aluminum Foil

- 6.1.1 Plastics

- 6.2 Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Films and Wraps

- 6.2.4 Other Product Types

- 6.3 End-user Industry

- 6.3.1 Food

- 6.3.1.1 Frozen Food

- 6.3.1.2 Dairy Products

- 6.3.1.3 Fruits and Vegetables

- 6.3.1.4 Meat, Poultry, and Seafood

- 6.3.1.5 Baked Goods and Snack Foods

- 6.3.1.6 Candy and Confections

- 6.3.1.7 Other Food Products

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Industries

- 6.3.1 Food

- 6.4 Geography

- 6.4.1 Brazil

- 6.4.2 Argentina

- 6.4.3 Mexico

- 6.4.4 Rest of Latin America (Colombia, Venezuela, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi Group

- 7.1.4 Sealed Air Corporation

- 7.1.5 Coveris Holdings SA

- 7.1.6 Tetra Pak International SA

- 7.1.7 Cascades Flexible Packaging

- 7.1.8 Novolex Holdings Inc.

- 7.1.9 WIPF Doypack (Wipf AG)

- 7.1.10 FlexPak Services LLC

- 7.1.11 Transcontinental Inc.

- 7.1.12 American Packaging Corporation

- 7.1.13 Sonoco Products Company

- 7.1.14 Inteplast Group

- 7.1.15 Oben Holding Group

- 7.1.16 Toray Plastics (America) Inc.

- 7.1.17 Sigma Plastic Group

- 7.1.18 Clifton Packaging SA De CV

- 7.1.19 PO Empaques Flexibles SA De CV

- 7.1.20 ProAmpac LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET