Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690901

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690901

Off-Grid Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

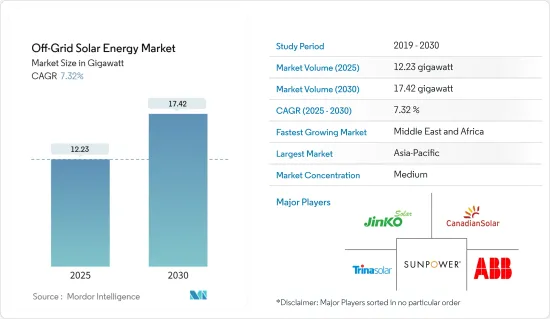

The Off-Grid Solar Energy Market size is estimated at 12.23 gigawatt in 2025, and is expected to reach 17.42 gigawatt by 2030, at a CAGR of 7.32% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors like decreasing the price of solar panels and batteries are expected to drive the market.

- On the other hand, high installation costs and poor maintenance practices hinder the market's growth.

- However, countries like the United States, the United Kingdom, Germany, China, and India have set ambitious targets to increase the renewable share in their energy mix. Governments across these nations have also planned to increase the renewable energy share by deploying residential and off-grid solar PV systems in the coming years. These are expected to create enormous opportunities for the off-grid solar energy market.

- Asia-Pacific is expected to dominate the market growth, primarily due to the increasing demand for electricity due to the lack of a central grid and reliable electricity supply, mainly in India and China.

Off-Grid Solar Energy Market Trends

The Commercial and Industrial Segments are Expected to Dominate the Market

- The usage of off-grid solar energy systems in the commercial and industrial segments has been mainly driven by small and medium enterprises in regions with unreliable electricity supply by the central grid system. Battery-integrated off-grid solar systems have become an effective and cheaper method of power backup for commercial and industrial entities compared to diesel generators.

- As of 2023, the global off-grid installed capacity was at 4.96 GW compared to 4.55 GW in 2022, registering a growth rate of almost 9.01%. This growth rate is expected to increase during the forecast period.

- Off-grid solar systems have many advantages for the commercial and industrial segments in terms of no hassle of diesel supply chain delays, less noise and pollution, and favorable government policies and subsidies.

- In addition, once the power is cut off and production is disrupted in several industrial entities, it may take hours to bring the systems and equipment back online, leading to huge downtime and financial losses. Therefore, electricity backup is extensively used in the industrial segment.

- Moreover, with the ongoing Israel-Gaza war, the electricity grid swiftly collapsed after the start of the war, leaving hospitals dependent on diesel generators. With only limited supplies of fuel permitted to pass through the Israeli blockade, it soon became almost impossible to carry out operations and deliver essential healthcare services.

- However, off-grid renewable systems, particularly solar panels combined with battery storage, can be a game changer for the healthcare industry. Off-grid solar offers the promise of bringing power to facilities still out of reach of electricity grids while providing a more efficient and reliable backup supply in urban hospitals.

- As mentioned above, the commercial and industrial segments will dominate the market during the forecast period.

Asia-Pacific to Dominate the Market Growth

- In recent years, there has been a steady increase in solar PV installation in the residential and commercial segments. This is due to reduced capital costs for solar projects and increased competition among competitors as the segments mature.

- China is the world's largest photovoltaics and solar thermal energy market. In 2023, the country had a total installed capacity of 609 GW of solar energy.

- Accordingly, by 2023, the existing residential or commercial buildings were required to install a rooftop solar PV system. Under the government's mandate, a minimum percentage of buildings will be essential to install solar PV systems. The solar PV rooftop systems need to be installed on government buildings (at least 50%), public structures (40%), commercial buildings (30%), and rural buildings (20%) across approximately 676 counties.

- Solar power is a fast-developing industry in India. The country's solar installed capacity was 73.10 GW as of December 31, 2023. Solar power generation in India ranked fourth globally in 2023.

- Due to the rise of industrial activity in India, the demand for clean electricity is increasing to mitigate carbon emissions. As a result, rooftop solar installations would provide a robust option for enterprises to become self-reliant, which is expected to increase the rooftop solar market in India.

- Under the National Solar Mission (NSM), a target of 2 GW was kept for off-grid solar PV applications. During Phase I of the mission (2010-2013), the target was 200 MWp, but 253 MWp was sanctioned. In Phase II (2013-2017), the target was 500 MWp, but 713 MWp was sanctioned. Under Phase III of the Off-grid and Decentralised Solar PV Applications Program, a target of 118 MW has been kept, excluding solar pumps to be installed under the PM KUSUM Scheme and solar home lights taken up under the 'Saubhagya' Scheme of the Ministry of Power.

- In January 2023, the country's Ministry of Trade, Industry, and Energy (MOTIE) approved a long-awaited scheme for solar module recycling. The new regulations set up a uniform system for collecting data in the main regions of each country. It aims to ensure a waste panel recycling/reuse rate of more than 80%, which aligns with current EU levels. Such government schemes are expected to lower the prices of solar panels further in the country, thus making it feasible to use them with different off-grid products.

- Therefore, owing to the above points, declining solar PV prices and increasing energy prices in the region are expected to drive the market during the forecast period. Also, supportive policies and incentives from the government will help the off-grid solar energy market to realize its full potential in the coming years.

Off-Grid Solar Energy Industry Overview

The off-grid solar energy market is fragmented. Some of the key players in the market (in no particular order) include ABB Ltd, Canadian Solar Inc., JinkoSolar Holding Co. Ltd, SunPower Corporation, and Trina Solar Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72370

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Falling Costs and Rising Efficiencies of Solar Photovoltaic Panels

- 4.5.2 Restraints

- 4.5.2.1 High Installation And Maintenance Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Residential

- 5.1.2 Commercial and Industrial

- 5.2 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 Italy

- 5.2.2.4 United Kingdom

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 South Korea

- 5.2.3.4 Japan

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 Qatar

- 5.2.4.3 South Africa

- 5.2.4.4 United Arab Emirates

- 5.2.4.5 Nigeria

- 5.2.4.6 Oman

- 5.2.4.7 Egypt

- 5.2.4.8 Algeria

- 5.2.4.9 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Schneider Electric Infrastructure Ltd

- 6.3.3 Canadian Solar Inc.

- 6.3.4 JinkoSolar Holding Co. Ltd

- 6.3.5 SunPower Corporation

- 6.3.6 Trina Solar Ltd

- 6.3.7 LONGi Green Energy Technology Co. Ltd

- 6.3.8 JA Solar Holding

- 6.3.9 Sharp Corporation

- 6.3.10 Tesla Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarters, Revenue, Relevant Products and Services, Operating Sector, Recent Trends, Technology or Projects, Contact Details, etc.) (In Brief Tabular Format)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Solar PV Manufacturing

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.