PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445420

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445420

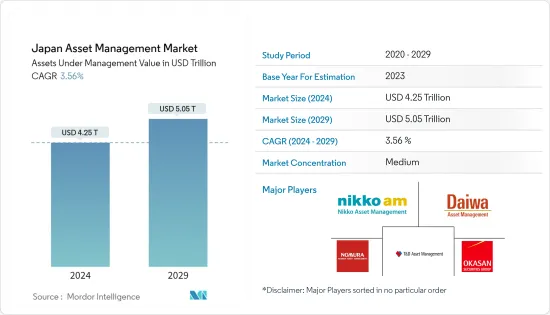

Japan Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Japan Asset Management Market size in terms of assets under management value is expected to grow from USD 4.25 trillion in 2024 to USD 5.05 trillion by 2029, at a CAGR of 3.56% during the forecast period (2024-2029).

Asset management is a systematic approach to the governance and realization of value from what a group or entity is responsible for over its whole life cycle. It may apply to tangible assets (physical objects such as buildings or equipment) and intangible assets (such as human capital, intellectual property, goodwill, or financial assets). Asset management is systematically developing, operating, maintaining, upgrading, and disposing of assets cost-effectively (including all costs, risks, and performance attributes).

Japanese individuals' financial assets are managed by the world's largest institutional investors like Japan Post Bank, GPIF, and Norinchukin Bank. Due to continued low domestic growth rates and low-interest rates, Japanese investment money is always looking for overseas investment opportunities in search of higher returns, which means those large Japanese institutional investors are always looking for excellent foreign managers to let them manage their foreign assets portfolio.

Japan might need to be used to being an easy market for foreign asset managers because of the language barrier, tax rate disadvantages, and strict/complicated regulations. But now, the Japanese government is trying to promote Tokyo as a global financial hub and making many changes to remove those obstacles to market entry.

Approximately 60% of companies replied that the importance of ESG initiatives increased due to the spread of COVID-19. An awareness gap existed between companies and investors regarding the impact of 'business model transformation,' which was selected by only approx-20% of companies. But approximately 40% of investors said it would be considered an important initiative in the future.

Japan Asset Management Market Trends

Japanese Pension Funds: Slow but Better Returns

The Government Pension Investment Fund (GPIF) and private pension funds are the two main institutional investors in Japanese pension funds, which are retirement savings plans. With more than USD 1.32 trillion in assets under management as of 2022, the GPIF is the biggest pension fund in the world. It was founded in 2001 to oversee the administration of the country's pension system and makes investments across various asset classes, such as domestic and international stocks, bonds, and alternative investments.

Corporate pension funds, which are set up by businesses for their employees, and mutual aid associations, set up by groups of people with similar interests or occupations, are examples of private pension funds in Japan. Additionally, these funds make investments across various asset classes, such as domestic and international stocks and bonds.

Due to an aging population and a low birth rate, which resulted in a declining labor force and strain on the pension system, Japan experienced difficulties with its pension system in recent years. The government responded by implementing several reforms, including raising the retirement age and encouraging enrollment in private pension plans.

Technological Advancements are Driving the Market

As in many other parts of the world, technological advancements are indeed driving the asset management industry in Japan. Technology advances increase efficiency and lower asset management costs, enabling businesses to provide clients with lower-cost goods and services.

Robo-advisors are automated investment platforms that offer services like portfolio management and investment advice. They are becoming increasingly well-liked in Japan, especially among younger investors who are easily using technology and seeking affordable investment options. Blockchain technology is used in Japan to increase security and transparency in the asset management sector. Asset ownership and transfer can be tracked using blockchain, lowering the possibility of fraud and mistakes.

Asset managers in Japan are analyzing massive amounts of data with big data analytics tools to learn more about market trends and investor behavior. Asset managers can manage risk and make better investment decisions as a result.

As businesses work to increase productivity, cut costs, and offer clients more sophisticated investment solutions, technological advancements are a major force behind innovation and growth in the Japanese asset management sector.

Japan Asset Management Industry Overview

The Japanese asset management market includes sluggish growth with very low returns. The market presents opportunities for growth during the forecast period, which is expected to drive the market competition further. Some of the major players in the sector include Nikko Asset Management, Daiwa Asset Management, T & D Asset Management, Okasan Asset Management, and Nomura Asset Management. With multiple domestic players holding significant shares, the market studied is competitive.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on Impact of Technology and Innovation in Operation in Asset Management

- 4.5 Insights on Performance of Asset Managers in Japan

- 4.6 Industry Policies and Government Regulations on Asset Management Industry in Japan

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Client Type

- 5.1.1 Retail

- 5.1.2 Pension Fund

- 5.1.3 Insurance Companies

- 5.1.4 Banks

- 5.1.5 Other Institutions

- 5.2 By Type of Mandate

- 5.2.1 Investment Funds

- 5.2.2 Discretionary Mandates

- 5.3 By Asset Class

- 5.3.1 Equity

- 5.3.2 Fixed Income

- 5.3.3 Cash/Money Market

- 5.3.4 Other Asset Classes

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Nomura Asset Management

- 6.2.2 Nikko Asset Management

- 6.2.3 Daiwa Asset Management

- 6.2.4 Okasan Asset Management

- 6.2.5 T & D Asset Management

- 6.2.6 Meiji Yasuda Asset Management

- 6.2.7 Schroder Investment Management

- 6.2.8 Aberdeen Standard Investment Limited

- 6.2.9 Norinchukin Zenkyoren Asset Management

- 6.2.10 Nissay Asset Management Corporation*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US