PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435242

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435242

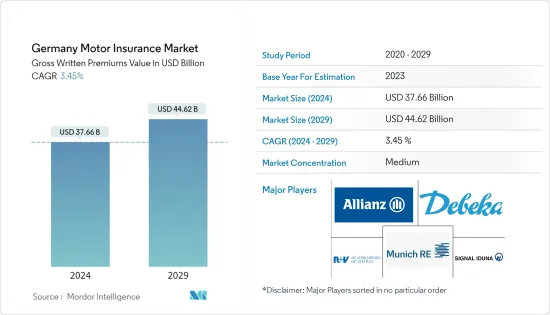

Germany Motor Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Germany Motor Insurance Market size in terms of gross written premiums value is expected to grow from USD 37.66 billion in 2024 to USD 44.62 billion by 2029, at a CAGR of 3.45% during the forecast period (2024-2029).

The impact of the ongoing COVID-19 pandemic is expected to result in a non-life re/insurance market loss of between EUR 1.25 billion to EUR 1.75 billion (USD 1.47 billion - USD 2.1 billion) in Germany, influenced mostly by nationwide business closures.

Some form of car insurance must cover all drivers in Germany, and people cannot register a vehicle without it. If a person is a long-term resident of Germany, they need German car insurance. Foreign car insurance is not enough even if they have brought a car from abroad to Germany.

Digitalization is a central concern of the German insurance industry. Many insurance companies are modernizing their IT infrastructures, moving to cloud solutions or investing in new technologies such as artificial intelligence (AI) or blockchain to provide enhanced products and services to their customers. In 2021, German insurers spent USD 416.77 million in total on IT. One of the key investment priorities in insurance companies includes the optimization of business processes, the operating organization, and the insurance IT. This weighting has increased further by the momentum of Digitization and its dynamic effects on competitiveness.

German Motor Insurance Market Trends

Increase in Number of Contracts in Motor Insurance

Automotive is the largest segment of the insurance industry in Germany. Most German non-life insurers are reasonably focused on auto insurance, with Auto insurance holding the largest share of non-life insurance premiums on the insurance market, which is EUR 2.2 billion in 2021. This has surged the number of contracts in motor insurance year-on-year, thus driving the growth of the motor insurance industry.

Increase in Electric Cars Sales is Driving the Demand for Motor Insurance

In the full calendar year 2021, Volkswagen was the top-selling electric car brand in Germany, supplying the German market with over a fifth of all battery-electric cars sold. Tesla moved ahead of Renault while Hyundai outsold Smart. The Tesla Model 3 was Germany's favorite electric car model in 2021, ahead of the VW Up and the VW ID3. Electric car sales in Germany increased by 83%, and market share doubled to 13.6%.

New electric passenger vehicle registrations in Germany in 2021 increased by 83.3% to 355,961 battery-electric cars. This more than doubled electric cars' share of the German new car market from 6.65% in 2020 to a new record high of 13.6% in 2021.

The total German new car market contracted by 10.1% in 2021 to only 2,622,132 cars compared to 2,917,678 in 2020. These two years were the weakest for the German vehicle market since 2010. Although petrol remained by far the largest component of new cars, its market share slipped to 37.1% (46.7% in 2020), while the share for diesel was down to 20.1% (28.1% in 2020).

German Motor Insurance Industry Overview

The German motor insurance market report covers the major players operating in the German motor insurance market. The market is moderately consolidated. Moreover, the market is expected to grow during the forecast period due to increased automobile sales and many other factors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the Industry

- 4.6 Key Market Insights

- 4.6.1 Key Trends in Germany Insurance Industry and Insurtech Market

- 4.6.2 Impact of Government Regulations and Initiatives on the Insurance Industry

5 MARKET SEGMENTATION

- 5.1 By Motor Insurance Type

- 5.1.1 Third Party Liability

- 5.1.2 Partial Coverage

- 5.1.3 Comprehensive insurance

- 5.2 By Channel of Distribution

- 5.2.1 Brokers

- 5.2.2 Agency

- 5.2.3 Banks

- 5.2.4 Direct

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Munchener Ruckversicherungs-Gesellschaft Aktiengesellschaft in Munchen

- 6.2.2 Allianz Beratungs- und Vertriebs-AG

- 6.2.3 Debeka Lebensversicherungsverein auf Gegenseitigkeit Sitz Koblenz am Rhein

- 6.2.4 R+V VERSICHERUNG AG

- 6.2.5 SIGNAL IDUNA Lebensversicherung a. G.

- 6.2.6 Versicherungskammer Bayern Versicherungsanstalt des offentlichen Rechts

- 6.2.7 VHV Vereinigte Hannoversche Versicherung a.G.

- 6.2.8 Axa konzern AG

- 6.2.9 CHECK24 GmbH

- 6.2.10 GOTHAER Versicherungsbank VVaG*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US