PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445700

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445700

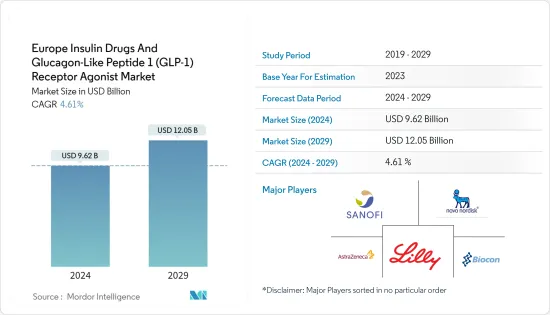

Europe Insulin Drugs And Glucagon-Like Peptide 1 (GLP-1) Receptor Agonist - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Insulin Drugs And Glucagon-Like Peptide 1 Receptor Agonist Market size is estimated at USD 9.62 billion in 2024, and is expected to reach USD 12.05 billion by 2029, growing at a CAGR of 4.61% during the forecast period (2024-2029).

The COVID-19 epidemic has significantly affected the market for insulin drugs and devices. Patients with type-1 diabetes are more affected by COVID-19. Since people with diabetes already have weakened immune systems, COVID-19 causes those immune systems to deteriorate rapidly. Those with diabetes are more likely to experience significant complications than healthy persons. During COVID-19, the manufacturers of insulin drugs worked with local governments to provide insulin drugs to diabetes patients.

NovoNordisk stated on their website that 'Since the start of COVID-19, our commitment to patients, our employees and the communities where we operate has remained unchanged, we continue to supply our medicines and devices to people living with diabetes and other serious chronic diseases, safeguard the health of our employees, and take actions to support doctors and nurses as they work to defeat COVID-19.' Doctors around the world suggested diabetes patients check their diabetes levels more often to be careful and the intake of medicine has increased, which lead to an increase in the usage of insulin drugs.

The rates of newly diagnosed Type 1 and Type 2 diabetes cases are seen increasing among the youth in Europe. The prevalence of diabetes among all ages in the European region is increasing, mainly due to obesity, unhealthy diet, and physical inactivity. The prevalence of autoimmune Type 1 diabetes is also increasing in Europe, and as per sources, Europe has the highest number of children with Type 1 diabetes. Though Type 2 patients are initiated with oral drugs, insulin may also be required when glucose levels are not well controlled due to an unhealthy lifestyle. Thus, the demand for insulin also exists among Type 2 diabetes patients.

Each drug is unique in the way it works in helping patients with diabetes to keep their condition under control. Certain drugs have similar actions, and they are grouped in the same class. They can also be classified in the way they are administered, with some medicines taken orally and others injected directly into the blood (insulin and GLP-1).

Byetta was the first GLP-1 that received approval in 2005. The glucagon-like peptide receptor agonist is administered subcutaneously and is used by Type 2 diabetes patients to control their blood glucose levels.

The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure in Europe are indications of the increasing usage of diabetic drug products. Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Europe Insulin Drugs and Glucagon-Like Peptide 1 (GLP-1) Receptor Agonist Market Trends

The rise in Insulin Drug Pricing in Europe

Insulins have been in the market for decades. However, the cost of insulin has always been a primary concern. A recent example is the pull-out of Tresiba from Germany due to the pricing pressure after the authorities said they would price the long-acting basal insulin on par with old human insulin injections. Though biosimilar competition in Europe increased, allowing insulin prices to be low, branded drugs have always been the order of the day. Moreover, leading players have gotten multiple extensions by making incremental improvements to their branded drugs. In recent years, diabetes prevalence has increased alarmingly throughout the European continent. People with diabetes must make several adjustments daily to keep their blood glucose levels within acceptable ranges. Examples include taking oral anti-diabetic medicine or consuming more carbs while monitoring their blood glucose levels. Obesity, a poor diet, and lack of exercise are the main causes of the rise in newly diagnosed Type 1 and Type 2 diabetes cases. Diabetes medicine usage is on the rise, as evidenced by the fast-rising incidence, prevalence, and healthcare costs of diabetes individuals. R&D of diabetes is crucial from many perspectives. Around 10% of all healthcare costs in Italy are related to diabetes. Diabetes represents a major public health challenge in Italy. R&D of diabetes is extensive across the world and in Italy itself. Italy ranks 3rd globally in the peer-reviewed publication of research on endocrine-metabolic topics. However, the incidence of diabetes is increasing due to lifestyle and nutrition factors.

Despite the increasing insulin drug prices, with the increasing type-1 population in Europe, the market for insulin drugs is increasing, and there is no alternative.

Germany Held the Highest Market Share in Current Year

In current year, Germany dominated the insulin market and is expected to continue its dominance during the forecast period. The rise is due to the high prevalence of diabetes among the country's population. In Germany, according to an estimate, the number of patients with Type 1 and Type 2 diabetes is gradually increasing. Pharmaceutical manufacturers in the country, including Novo Nordisk, have assured diabetes patients that there is no current impact of COVID-19 on their supply chain. Furthermore, companies regularly monitor their supply chain to assess the situation better and act proactively to ensure minimal or no disruption in the availability of insulin drugs for the diabetes population in the country. Insulin drug pricing is a major concern in many countries, and Germany is no exception. The German government regulates the prices of drugs; thus, pharmaceutical companies focus on pricing the products at minimal rates.

Over the next twenty years, type 2 diabetes will become more prevalent in Germany. By 2040, up to twelve million people could have the metabolic disorder, according to DZD researchers. The rapid rise in type 1 and type 2 diabetes among the aging population will present significant issues for the German Diabetes Medications system in the years to come. The German Diabetes Center (DDZ) estimates that at least 7.2% of the population in Germany presently has diabetes, and that number will rise dramatically over the next 20 years. Obesity, a poor diet, and lack of exercise are the main causes of the rise in newly diagnosed Type 1 and Type 2 diabetes cases. Healthcare spending and the fast-rising incidence and prevalence of diabetic individuals are signs of market expansion. A cap on out-of-pocket medical expenses and coverage of all medically required treatments, including insulin medications, are mandated by German law for public insurance plans. T1 International, an organization that advocates for individuals with diabetes, claims that out-of-pocket expenses for German diabetes patients are among the lowest globally. In Germany, strict government rules and supportive WHO regulations incentivize businesses to create novel products. These solutions' market penetration in Germany helps regional clinical research organizations (CROs) with their clinical research trials and assures managerial simplicity, which speeds up the discovery process.

As a result, the studied market is expected to develop throughout the analysis period due to the rising prevalence of diabetes.

Europe Insulin Drugs and Glucagon-Like Peptide 1 (GLP-1) Receptor Agonist Industry Overview

The Europe Insulin Drugs and GLP-1 receptor agonist market is largely consolidated in nature, with the presence of leading companies like Sanofi, Novo Nordisk, and Eli Lilly. They account for more than 80% of the supply in Europe. All these companies have established their brands in the market. However, due to intense competition in the local markets for insulin, consumer penetration for their products must be achieved through constant work and effort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 GLP-1 Receptor Agonists

- 5.1.1 Exenatide

- 5.1.1.1 Byetta

- 5.1.1.2 Bydureon

- 5.1.2 Liraglutide (Victoza)

- 5.1.3 Lixisenatide (Lyxumia)

- 5.1.4 Dulaglutide (Trulicity)

- 5.1.5 Semaglutide (Ozempic)

- 5.1.1 Exenatide

- 5.2 Insulin Drugs

- 5.2.1 Basal or Long-acting Insulins

- 5.2.1.1 Lantus (Insulin glargine)

- 5.2.1.2 Levemir (Insulin detemir)

- 5.2.1.3 Toujeo (Insulin glargine)

- 5.2.1.4 Tresiba (Insulin degludec)

- 5.2.1.5 Basaglar (Insulin glargine)

- 5.2.2 Bolus or Fast-acting Insulins

- 5.2.2.1 NovoRapid/Novolog (Insulin aspart)

- 5.2.2.2 Humalog (Insulin lispro)

- 5.2.2.3 Apidra (Insulin glulisine)

- 5.2.2.4 FIASP (Insulin aspart)

- 5.2.2.5 Admelog (Insulin lispro)

- 5.2.3 Traditional Human Insulins

- 5.2.3.1 Novolin/Actrapid/Insulatard

- 5.2.3.2 Humulin

- 5.2.3.3 Insuman

- 5.2.4 Combination Insulins

- 5.2.4.1 NovoMix (Biphasic Insulin aspart)

- 5.2.4.2 Ryzodeg (Insulin degludec/Insulin aspart)

- 5.2.4.3 Xultophy (Insulin degludec/Liraglutide)

- 5.2.4.4 Soliqua/Suliqua (Insulin glargine/ Lixisenatide)

- 5.2.5 Biosimilar Insulins

- 5.2.5.1 Insulin Glargine Biosimilars

- 5.2.5.2 Human Insulin Biosimilars

- 5.2.1 Basal or Long-acting Insulins

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 Rest of Europe

6 MARKET INDICATORS BY COUNTRY

- 6.1 Type -1 Diabetes Population

- 6.2 Type -2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novo Nordisk

- 7.1.2 Sanofi

- 7.1.3 Eli Lilly

- 7.1.4 AstraZeneca

- 7.1.5 Biocon

- 7.1.6 Pfizer

- 7.1.7 Wockhardt

- 7.1.8 Julphar

- 7.1.9 Exir

- 7.1.10 Sedico

- 7.2 Company Share Analysis

8 MARKET OPPORTUNITIES AND FUTURE TRENDS