PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445701

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445701

Short-acting Insulin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

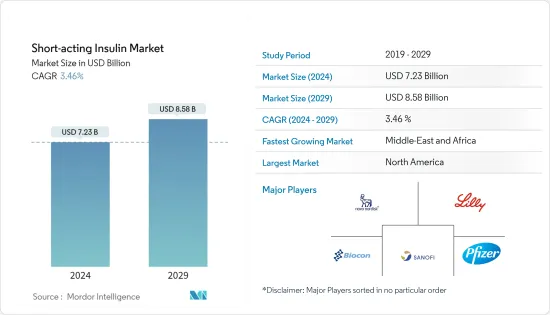

The Short-acting Insulin Market size is estimated at USD 7.23 billion in 2024, and is expected to reach USD 8.58 billion by 2029, growing at a CAGR of 3.46% during the forecast period (2024-2029).

There is not enough data saying that diabetes people are more likely to get COVID-19 than other healthy people, individuals with any kind of diabetes might differ in age, the number of complications they have had, and their level of diabetes management. Whatever kind of diabetes a person has, those who currently have diabetes-related health issues are more likely to experience poorer results if they get COVID-19. Leading suppliers of insulin drugs claim that at the moment, COVID-19 is not affecting their present capacity for producing and distributing products like insulin.

When a person has type 1 diabetes, their pancreas stops producing insulin. They require insulin injections to utilize the glucose from meals since their beta cells have been damaged.

Insulin is produced by people with type 2 diabetes, but their bodies do not respond effectively to it. Some patients with type 2 diabetes require insulin injections or diabetic medications to help their bodies utilize glucose as fuel. Insulin would be broken down during digestion, much like the protein in food, insulin cannot be given orally, to enter the bloodstream, it must be injected into the fat beneath the skin.

Currently, there are five main types of insulins (regular insulin, NPH, short-acting analogs, basal analogs, and pre-mixed insulin) being sold globally. Generally, insulin analogs are priced much higher than regular insulin or NPH, as they are bioengineered with altered amino-acid sequences to provide the desired chemical properties. In recent days, usage of short-acting analogs has been increasing due to the increasing Type 1 diabetes population.

Thus, owing to the above factors it is expected to drive the market growth over the forecast period.

Short-acting Insulin Market Trends

Increase in Type 1 Diabetes Population worldwide during the forecast period.

Diabetes is a chronic, life-threatening disease with no known cure. It has emerged as a global epidemic and affected millions worldwide. Moreover, Type 1 diabetes is caused due to an immune system malfunction. Hence, Type 1 diabetes can be characterized as insulin-requiring. The diabetic population in the United States is expected to cross 40 million by 2045, and in 2022 the United States registered more than 10 million obese population. Monitoring blood glucose levels is necessary, as poor blood glucose levels result in diabetes-related complications, like diabetic retinopathy, diabetic neuropathy, etc. In the United States, the Type 1 diabetes population is expected to witness a CAGR of 1.01% in the coming years. About 1.75 million US citizens are diagnosed with diabetes every year. The country also has the highest obese population, a prominent cause of Type 1 diabetes.

Due to the early age and longer diabetes duration, the youth is at risk of developing diabetes at a younger age, which lessens their quality of life, shortens life expectancy, and increases healthcare costs to society. Hence, the demand for the short-acting insulin drugs market has been on the rise, and its adoption rate is growing, which has been driving the market. Also, with the increasing awareness among Type-1 diabetes patients worldwide, the demand for the insulin drug market has rapidly risen.

Thus, the above factors are expected to drive market growth over the forecast period.

The United States Held Highest Market Share in current Year.

In the current year, the United States accounted for a majority of the revenue share (about 96%) in the market, mainly due to the increasing diabetic population in the country. According to a recent survey, about 9.4% of the total US population is diabetic, and about 1.75 million Americans are diagnosed with diabetes every year. The United States accounts for the highest sales of Humalog across the world, with over 56% of the market share in 2021. As a result, most diabetes drug manufacturing companies consider the country a critical market for improving overall global sales. In the United States, Humalog is available in different varieties under names, like Humalog Mix 75/25, Humalog U-100, Humalog U-200, and Humalog Mix 50/50, for the treatment of diabetes.

The United States had no regulations on the price of pharmaceuticals like insulin till now. Furthermore, the government is taking up initiatives, like the Medicare pilot program, to decrease insulin prices in the country, which may boost the growth of the Short-acting Insulin Market during the forecast period.

Thus, the above factors are expected to drive the market growth over the forecast period.

Short-acting Insulin Industry Overview

The Short-Acting Insulin Market is highly consolidated, with leading companies like Sanofi, Novo Nordisk, and Eli Lilly, having a strong market presence. Each of these companies has established its brands in the market. However, due to intense competition in the local markets, these manufacturers put a lot of effort into penetrating these markets. Hence, they employ powerful competitive strategies to improve their foothold in the market. Additionally, the high profitability of the market provides an incentive for several generic insulins (biosimilars) manufacturers and major companies trying to introduce innovative products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Drug

- 5.1.1 Short-acting Insulins

- 5.1.1.1 Apidra (Glulisine)

- 5.1.1.2 Novolog/Novorapid

- 5.1.1.3 Humalog (Lispro)

- 5.1.1.4 Novolin (Actrapid)

- 5.1.1.5 Insuman

- 5.1.1.6 Humulin

- 5.1.1.7 FIASP

- 5.1.1.8 Admelog

- 5.1.1 Short-acting Insulins

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Latin America

- 5.2.3.1 Mexico

- 5.2.3.2 Brazil

- 5.2.3.3 Rest of Latin America

- 5.2.4 Asia-Pacific

- 5.2.4.1 Japan

- 5.2.4.2 South Korea

- 5.2.4.3 China

- 5.2.4.4 India

- 5.2.4.5 Australia

- 5.2.4.6 Vietnam

- 5.2.4.7 Malaysia

- 5.2.4.8 Indonesia

- 5.2.4.9 The Philippines

- 5.2.4.10 Thailand

- 5.2.4.11 Rest of Asia-Pacific

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Iran

- 5.2.5.3 Egypt

- 5.2.5.4 Oman

- 5.2.5.5 South Africa

- 5.2.5.6 Rest of Middle-East and Africa

- 5.2.1 North America

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novo Nordisk AS

- 7.1.2 Sanofi Aventis

- 7.1.3 Eli Lilly

- 7.1.4 Pfizer

- 7.1.5 Biocon

- 7.2 Company Share Analysis

- 7.2.1 Novo Nordisk AS

- 7.2.2 Sanofi Aventis

- 7.2.3 Eli Lilly

- 7.2.4 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS