PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911310

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911310

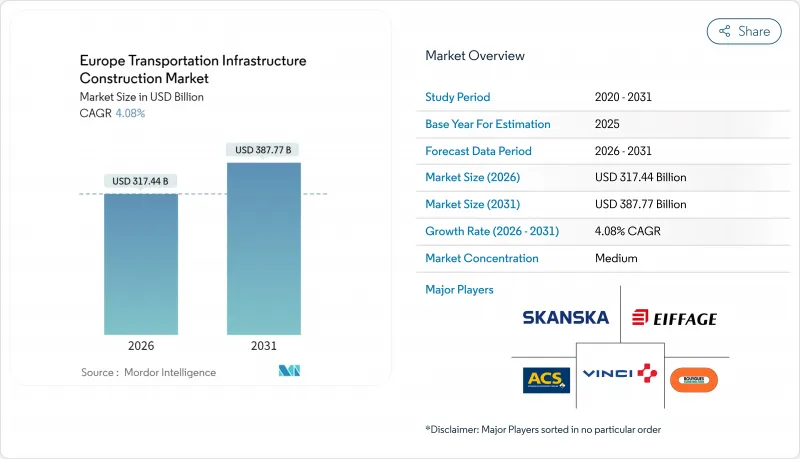

Europe Transportation Infrastructure Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Transportation Infrastructure Construction Market size in 2026 is estimated at USD 317.44 billion, growing from 2025 value of USD 305.0 billion with 2031 projections showing USD 387.77 billion, growing at 4.08% CAGR over 2026-2031.

The growth path is steered by record EU funding, notably a USD 7.7 billion tranche from the Connecting Europe Facility 2.0 in 2024 that prioritized climate-smart, cross-border links. Rapid policy alignment on completing the Trans-European Transport Network (TEN-T) core by 2030, coupled with military-mobility upgrades, has created a predictable, long-term project queue. Rail electrification, hydrogen corridors, and AI-enabled maintenance now vie for the same budget that once favored highway widening, tilting capital toward lower-carbon assets. Contractors with digital design capabilities and ESG-compliant supply chains are winning bids as funding rules explicitly score sustainability metrics. At the same time, widespread labor shortages and extreme-weather repair bills temper the overall expansion pace, nudging private partners to absorb risk through concession agreements.

Europe Transportation Infrastructure Construction Market Trends and Insights

Development of Sustainable, Energy-Efficient Transport Infrastructure

The European Commission earmarked USD 464.2 million for 39 alternative-fuel projects in 2025, accelerating deployment of 4,900 charging points across the TEN-T. Hydrogen corridors such as H2Med (USD 2.8 billion) demand tunnels, stations, and pipelines engineered for dual energy-mobility use. New regulations fix binding national targets, so builders now integrate battery storage, on-site renewables, and smart-grid links by default. Digital project models, as trialed on VINCI's A7 motorway in Germany, shrink maintenance costs through predictive analytics. These shifts embed sustainability into core design, locking in multi-year demand for specialized civil contractors.

Surge in Demand for New Road & Rail Capacity

Mega-schemes such as the Grand Paris Express, 200 km of track, 68 stations, and a USD 62.1 billion budget, illustrate the region's appetite for fresh capacity. Spain follows suit: USD 265.1 million in EU grants cover 22 projects spanning seven regions, with USD 85.8 million devoted to Zaragoza-Teruel-Sagunto rail electrification. Cross-border lines draw equal focus; Rail Baltica's 870 km rail will slash Tallinn-Warsaw travel to seven hours, anchoring modal shift from air to rail. Order books reflect the boom: Bouygues and Eiffage each logged 40%-plus backlog growth in 2024. Governments such as the Netherlands have already ring-fenced USD 16.2 billion for 2025 transport works, ensuring near-term project starts.

Persistent Public-Funding Gaps & Fiscal Rules

Germany invests only 2.1% of GDP in public infrastructure versus the 3.7% EU mean, leaving a USD 495.0 billion shortfall by 2030. Debt-brake rules cap borrowing, nudging governments toward costly PPP deals that add up-front transaction fees and longer negotiation cycles. Deutsche Bahn alone needs USD 165 billion through 2034, yet faces political resistance to deficit spending. One-third of EU municipalities report under-investment in transport, highlighting a structural demand-supply gap. While private bonds ease some pressure, weaker regions struggle to attract investors, dampening the Europe transportation infrastructure construction market's full potential.

Other drivers and restraints analyzed in the detailed report include:

- EU Funding Programs (CEF 2.0, RRF) Unlocking Project Pipeline

- Climate-Resilient Retrofitting Mandates Under 2024 TEN-T Revision

- Rising Climate-Related Repair Costs & Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Railways account for the fastest 5.02% CAGR, although roadways remain atop the Europe transportation infrastructure construction market with a 51.84% revenue slice in 2025. The Brenner Base Tunnel, stretching 64 km under the Alps to move 50 million tons of annual freight, headlines the rail surge. The Lyon-Turin link adds another 57.5 km of high-speed tunnel, with USD 4.4 billion in civil contracts already signed. Such mega-projects make the Europe transportation infrastructure construction market size for rail the standout growth vector.

Roadway investment still rolls on, epitomized by the A24 Blankenburgverbinding that opened in December 2024 with smart tolling and twin tunnels. Yet regulatory pressure trims future highway share by steering freight to waterways like the USD 7.7 billion Seine-Nord Europe Canal. Digital layers, ERTMS Level 2 on 270 km of Dutch track, further tilt capital toward rails as specification complexity rises.

The Europe Transportation Infrastructure Construction Market Report is Segmented by Type (Roadways, Railways, Airways, Ports, and Inland Waterways), by Construction Type (New Construction, Renovation), by Investment Source (Public, Private), and by Geography (Germany, United Kingdom, France, Spain, Netherlands, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- VINCI SA

- ACS Group (incl. HOCHTIEF)

- Bouygues Construction

- Eiffage SA

- Skanska AB

- Ferrovial SE

- Webuild SpA

- Colas SA

- Balfour Beatty plc

- BAM Group

- Kier Group

- Costain Group

- Implenia AG

- PORR AG

- Salcef Group

- NCC AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development of sustainable, energy-efficient transport infrastructure

- 4.2.2 Surge in demand for new road & rail capacity

- 4.2.3 EU funding programmes (CEF 2.0, RRF) unlocking project pipeline

- 4.2.4 Climate-resilient retrofitting mandates under 2024 TEN-T revision

- 4.2.5 Military-mobility corridor upgrades post-Ukraine war

- 4.2.6 AI-enabled predictive maintenance lowering lifecycle costs

- 4.3 Market Restraints

- 4.3.1 Persistent public-funding gaps & fiscal rules

- 4.3.2 Rising climate-related repair costs & delays

- 4.3.3 Shortage of specialised tunnelling / electrification talent

- 4.3.4 Environmental litigation under new biodiversity rules

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Industry Attractiveness - Porter's Five Force Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of Top European Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Type

- 5.1.1 Roadways

- 5.1.2 Railways

- 5.1.3 Airways

- 5.1.4 Ports and Inland Waterways

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Investment Source

- 5.3.1 Public

- 5.3.2 Private

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Netherlands

- 5.4.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 VINCI SA

- 6.4.2 ACS Group (incl. HOCHTIEF)

- 6.4.3 Bouygues Construction

- 6.4.4 Eiffage SA

- 6.4.5 Skanska AB

- 6.4.6 Ferrovial SE

- 6.4.7 Webuild SpA

- 6.4.8 Colas SA

- 6.4.9 Balfour Beatty plc

- 6.4.10 BAM Group

- 6.4.11 Kier Group

- 6.4.12 Costain Group

- 6.4.13 Implenia AG

- 6.4.14 PORR AG

- 6.4.15 Salcef Group

- 6.4.16 NCC AB

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment