PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440315

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440315

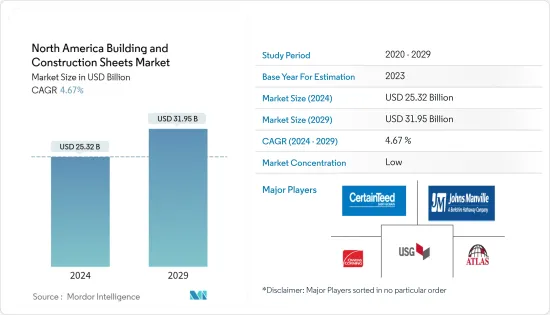

North America Building and Construction Sheets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Building and Construction Sheets Market size is estimated at USD 25.32 billion in 2024, and is expected to reach USD 31.95 billion by 2029, growing at a CAGR of 4.67% during the forecast period (2024-2029).

Key Highlights

- The goal of building and construction sheets is to give you protection and insulation, plus cladding and other great features at a great price. Corrugated sheets are the most common type of roofing material. Polycarbonate sheets and metal sheets are also popular options.

- The US and Canadian governments are planning to spend more money on construction to meet the growing demands of industry and public infrastructure, which will lead to more demand for products used in construction.

- The construction sheets market is expected to grow significantly in the roofing applications market in the US due to the growing demand for polymers and metal sheets in the industrial and residential sectors. The market is also expected to grow in HVAC applications due to the need for metal sheets to improve overall ventilation capabilities.

- The construction sheets are commonly used in industrial buildings like factories, warehouses, and manufacturing plants as they provide fire and corrosion resistance, making them safer for industrial use.

North America Building And Construction Sheets Market Trends

Demand for Construction Sheets Increasing in the US Residential Sector

Spending on public residential construction in the United States increased significantly between 2002 and 2022. The public sector spent nearly USD 9.3 billion on residential construction projects in 2021, a slight decrease from 2020. The biggest year-on-year increase occurred in 2020 when public residential spending reached USD 9.5 billion, a record high. The total value of residential construction completed in the United States is expected to continue to grow over the next few years. Due to the increase in the construction of residential property roofing, the industry has grown in the last few years.

Increasing Usage of Asphalt Roofing in the Canadian Construction Industry

Canadian construction is booming in both residential and non-residential construction in 2023. The government of Canada and the government of Yukon are investing USD 8.32 million to construct at least nine new low-cost dwellings in the city and to support significant renovations and improvements to a transitional home for women called Kaushee's Place, located near downtown Whitehorse.

The Rapid Housing Initiative (RHI) is set to be extended for a second two-year period, beginning in the 2022-23 budget year. Budget 2022 proposes USD 1,5 billion to support the extension of the RHI, with the aim of creating a minimum of 6,000 units of affordable housing. At least 25% of the new funding will be earmarked for women-centered housing projects.

To support affordable housing construction across the country, Canadian financial services provider BMO Financial Group announced a commitment of CAD 12 billion (USD 9.4 billion) to support affordable housing projects across Canada until 2030. Additionally, the long-term output in the Canadian construction industry will also be supported by the government's plan (announced in February 2021) to invest CAD 14.9 billion (USD 12 billion) in public transport projects over the next eight years.

North America Building And Construction Sheets Industry Overview

The North American buildings and construction sheets market is highly fragmented, with no player holding a significant share to influence the market. Some of the key players in the North American market include Owens Corning Corporation, Certainteed LLC, Johns Manville Corporation, United States Gypsum Company, and Atlas Roofing Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Innovations in Building and Construction Sheets

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of Government Regulations and Initiatives in Building and Construction Sheets Industry

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing construction spending by governments

- 5.1.2 Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets

- 5.2 Market Restraints

- 5.2.1 Shortage of Raw Materials

- 5.3 Market Opportunities

- 5.3.1 Bio-Based Polymer Sheets

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Bitumen

- 6.1.2 Rubber

- 6.1.3 Metal

- 6.1.4 Polymer

- 6.1.5 Other Materials

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.2.4 Other End-Users

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Owens Corning Corporation

- 7.1.2 Certainteed LLC

- 7.1.3 Johns Manville Corporation

- 7.1.4 United States Gypsum Company

- 7.1.5 Atlas Roofing Corporation

- 7.1.6 Spartech Corporation

- 7.1.7 North American Roofing Services Inc.

- 7.1.8 Etex

- 7.1.9 National Gypsum Services Company

- 7.1.10 Elasto Proxy Inc.*

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX