PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692129

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692129

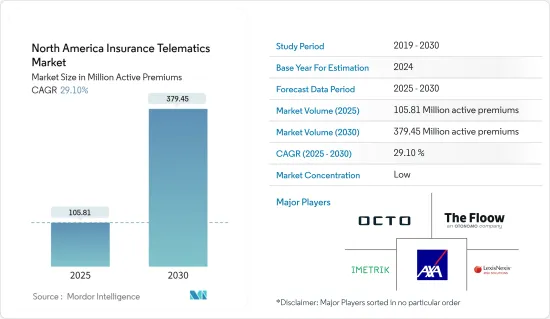

North America Insurance Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Insurance Telematics Market size is estimated at 105.81 million active premiums in 2025, and is expected to reach 379.45 million active premiums by 2030, at a CAGR of 29.1% during the forecast period (2025-2030).

The growing demand for telematic devices among the insurance and automotive sectors propels the market's growth. Many automotive companies invest in advanced telematics systems to gain a competitive edge. From application-specific telematics and computer imaging, fleet managers can access a wealth of information about the condition of their vehicles.

Key Highlights

- Rising congestion and road traffic have made people's safety a top priority. Improving advanced vehicle features is a significant factor aiding the growth of the demand for vehicle insurance telematics. According to the National Safety Council, some 47,000 road traffic fatalities occurred in the United States in 2021, which was the most significant number of deaths recorded in the country since 2012. This fatality volume was slightly dipped in 2022, down to nearly 46,300. Motor vehicle crashes are a frequent cause of death in the United States.

- In addition, according to the official source, in 2023, there were 6,102,936 police-reported vehicle accidents in the United States. Of those, 39,508 were fatal. Such increases in road accidents may further create demand for insurance telematics in the region.

- Various governments are taking initiatives in road safety to avoid accidents or car crashes, which may create demand for insurance telematics in the region. Furthermore, Canada's fourth national road safety plan, the Road Safety Strategy (RSS) 2025, was launched by the Council of Ministers Responsible for Transportation and Highway Safety in early 2016. The goal remains to achieve downward trends in fatalities and severe injuries throughout a five-year duration, comparing multi-year rolling averages with the established baseline period.

- However, a lack of awareness of insurance telematics and privacy and security concerns somewhat hinder the market. On the other hand, increasing innovation in the automotive enterprise and untapped potential in emerging economies present new opportunities in the upcoming years.

- The COVID-19 pandemic had a positive impact on the insurance telematics industry. This is attributed to telematics directly addressing consumer needs to pay lower premiums when the vehicles had limited utilization during the lockdown.

- In addition, the pandemic changed insurers' demands from traditional actuarial and underwriting models to pay-as-you-drive (PAYD) models. In addition, increased acceptance of digital tools in the policy binding and claims process among consumers, combined with a need for insurers to design premium policies more precisely, are significant factors that notably contribute to the market's growth.

North America Insurance Telematics Market Trends

Increase in Innovation in the Automotive Industry Across the Region to Witness Growth

- Innovation in the automotive sector is a key driver of the growth of insurance telematics, creating opportunities for insurers to leverage technology to offer more personalized and data-driven insurance products. The proliferation of connected car technologies, including embedded telematics systems, onboard sensors, and in-vehicle communication networks, provide insurers with real-time data on vehicle performance, driver behavior, and environmental conditions. These data streams enable more accurate insurance policy risk assessments and pricing models.

- Moreover, developing autonomous and semi-autonomous vehicle technologies is reshaping the automotive industry and presenting new opportunities for insurance telematics. Insurers can leverage telematics data to assess the impact of ADAS and autonomous features on driving behavior, safety, and risk exposure. With the rise of connected and autonomous vehicles, telematics is even more important as these new systems need to monitor effectively and report data related to driving behavior. Telematics technology has become a crucial element in modern vehicles, enabling insurers to precisely determine premiums by assessing a driver's real-time behavior rather than relying on mere speculation.

- The United States is anticipated to be the significant market for connected cars due to the significant presence of automotive OEMs, higher technological awareness among the general car buyers, preference for infotainment and telematics in vehicles, widespread adoption of 4G/5G, and increasing sales of electric, connected and autonomous cars in the country.

- According to the Insurance Institute for Highway Safety, it is anticipated that there will be around 3.5 million self-driving vehicles on US roads by 2025 and 4.5 million by 2030. However, the institute cautioned that these vehicles would not be fully autonomous but would operate autonomously under certain conditions. Recognizing the symbiotic relationship between insurers and autonomous vehicle manufacturers, insurers are actively engaging in collaborations. By working closely with manufacturers, insurers gain insights into the technology, safety features, and potential risks associated with autonomous vehicles.

- This collaborative approach helps insurers craft policies that align with the evolving landscape of self-driving cars. For instance, Connected Analytic Services, LLC (CAS), an affiliate of Toyota Insurance Management Solutions USA, expanded its partnership with Toyota Motor North America to add new product offerings to enhance the ownership experience for owners of enrolled Toyota vehicles. For Toyota customers who wish to use their driving data to obtain potential insurance savings, CAS is Toyota's exclusive data aggregation service, providing telematics and vehicle build data to insurance companies. Major players in the market are expanding their presence in digital mobility to cater to the increased demand for connected cars.

United States to Hold Major Market Share

- Decreasing the cost of development and technology, altering consumer behavior, and stringent government regulations drive the growth of the market studied in the United States. In the United States, consumers prefer usage-based insurance (UBI) snapshot programs. In other regions, motor insurance telematics policies are preferred.

- Introducing insurance telematics has several advantages for insurers and consumers, which are expected to fuel market growth. For consumers, it will promote safe driving, resulting in the mitigation of accident severity and frequency. Over the forecast period, the insurers' claim-handling expenses will likely decrease by at least half, contributing to the market's growth.

- Various US consumers are switching insurers because their premiums have increased despite driving less. Measures imposed during the lockdown during the pandemic led consumers to drive less and ultimately demanded policies that analyzed auto usage to provide personalized policies based on mileage.

- According to Lloyd's of London, the value of the motor vehicle insurance sector in the United States is expected to amount to approximately USD 224.7 billion in 2015. It was projected to grow to about USD 358.51 billion by 2025.

- According to BEA, in May 2023, 1.07 million vehicles were sold in the United States, including light trucks, which remained the most significant United States auto market segment, contributing to sales of 1.06 million units.

- The United States is anticipated to be the significant market for connected cars in the country due to the substantial presence of automotive OEMs, high levels of technology awareness amongst the general car buyers, preference for infotainment and telematics in vehicles, widespread adoption of 4G/5G and increasing sales of electric, connected and autonomous cars in the country.

North America Insurance Telematics Industry Overview

The North American insurance telematics market is fragmented, with major players like Octo Telematics SpA, IMERTIK Global Inc., AXA SA, The Floow Limited, and LexisNexis Risks Solutions (RELX Group). Market participants employ partnerships and acquisitions to improve their product offerings and secure a lasting competitive edge.

- In October 2023 - OCTO Telematics announced a partnership with Flexcar, the smart alternative to car ownership, focused on adding OCTO's connected vehicle capabilities to Flexcar's fleet across the United States.

- In October 2023 - PowerFleet Inc. intends to merge with MiX Telematics Ltd, a fleet management tech firm based in South Africa, creating a single company with a combined subscriber base of some 1.7 million users. The deal is expected to close in the first quarter of 2024, and the combined business will be branded as PowerFleet. Its primary listing will be on Nasdaq, and its headquarters will be in Woodcliff Lake, New Jersey.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Usage-based Insurance by Insurance Companies

- 5.1.2 Increase in Innovation in the Automotive Industry Across the Region to Witness the Growth

- 5.2 Market Challenge

- 5.2.1 Data Quality and Compatibility Issues

6 USAGE BASED INSURANCE TELEMATICS - REVENUE MODELS

- 6.1 Pay-as-you-drive

- 6.2 Pay-how-you-drive

- 6.3 Manage-how-you-drive

7 COMPARATIVE ANALYSIS OF VARIOUS TYPES OF TELEMATICS HARDWARE-BASED INSURANCE SOLUTIONS

- 7.1 Portable

- 7.2 Embedded

- 7.3 Smartphone Based

8 MARKET SEGMENTATION

- 8.1 By Country

- 8.1.1 United States

- 8.1.2 Canada

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Octo Telematics SpA

- 9.1.2 IMERTIK Global Inc.

- 9.1.3 AXA SA

- 9.1.4 The Floow Limited

- 9.1.5 LexisNexis Risks Solutions (RELX Group)

- 9.1.6 PowerFleet Inc.

- 9.1.7 Cambridge Mobile Telematics

- 9.1.8 State Farm Mutual Automobile Insurance Company

- 9.1.9 GEICO (Berkshire Hathaway Inc.)

- 9.1.10 Nationwide Mutual Insurance Company

10 INVESTMENT ANALYSIS

11 FUTURE TRENDS