Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685956

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685956

China Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

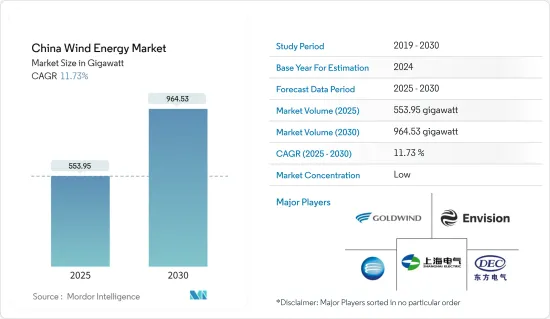

The China Wind Energy Market size is estimated at 553.95 gigawatt in 2025, and is expected to reach 964.53 gigawatt by 2030, at a CAGR of 11.73% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as government regulations and decreasing cost per kilowatt of electricity generated through renewables are expected to drive the market. Rising demands for renewable energy projects within the country are expected to propel the growth of the wind energy market during the forecast period.

- On the other hand, the high competition from other energy sources such as solar, hydro, and fossil fuels is expected to restrain the growth of the market.

- Nevertheless, the development of building-integrated wind turbines (BIWTs) is expected to create a growth opportunity for the market in the future.

China Wind Energy Market Trends

The Offshore Segment is Expected to Witness Significant Growth

- Offshore wind energy power generation has evolved over the last five years to maximize the electricity produced per megawatt capacity installed to cover more sites with lower wind speeds. In recent years, wind turbines have become more extensive, with taller hub heights, broader diameters, and larger wind turbine blades.

- With a coastline of approximately 18,000 km, China has more than 1,000 GW of technical potential for offshore wind at a hub height of 90 meters. China has no long-term national offshore wind target, but coastal provinces have set ambitious official targets.

- According to the International Renewable Energy Agency RE Capacity 2024, offshore installations in China reached 37,290 megawatts in 2023, an increase from 30,460 megawatts in 2022.

- According to the Global Wind Energy Council, China ranked first globally in terms of annual offshore wind development for the sixth year in a row in 2024, with 6.8 GW commissioned in 2023. These additions made up 58% of global additions and brought China's total offshore wind installations close to 38 GW, 4.9 GW higher than Europe combined.

- According to the Global Wind Energy Council (GWEC), China is expected to host more than a fifth of the world's offshore wind turbines, equating to approximately 52 GW of offshore wind by 2030.

- Coastal provinces in China have been focused on developing new offshore wind capacity. Guangdong aims to install 18 GW of offshore capacity by 2025, while Fujian, Zhejiang, and Jiangsu aim to install 13.3 GW, 6 GW, and 9 GW of offshore wind power projects by 2025, respectively.

- In February 2024, China Huaneng Group Co. Ltd, the second-largest power utility in the world by installed capacity, increased investments in 222 new energy projects, including solar and offshore wind power, as part of efforts toward green and low-carbon transformation.

- Owing to such development activities, the offshore segment is expected to grow significantly in the upcoming years.

The Rising Demand for Renewable Energy is Expected to Drive the Market

- China is the largest energy consumer and renewable energy market globally, and the country is rapidly expanding its renewable energy capacity to satiate its domestic energy demand. As the country has been suffering from air pollution caused primarily by fossil-fuel-fired power plant emissions, it is focused on expanding its renewable energy capacity to meet its growing energy demands while reducing overall emissions.

- As part of its 14th five-year plan (2021-2025), by 2025, the country aims to supply 33% of national power consumption from renewables, up from 29% in 2021. The country aims to increase renewable energy generation to 3,300 TWh by 2030.

- In its latest updated Nationally Determined Contributions (NDC), China committed to reaching peak emissions by 2030 and achieving carbon neutrality as part of its commitments under the Paris Agreement. In terms of energy targets, the country aims to cut CO2 emissions per unit of GDP by more than 65% from 2005 levels and increase the total installed wind plus solar capacity to 1,200 GW.

- According to CarbonBrief, based on the rapid growth of the renewable energy industry in the country, it is estimated that China will reach its target of 1,200 GW of wind+solar deployment significantly ahead of its 2030 deadline. Such rapid growth in the installed wind energy capacity is due to the rising demand created as a result of environmental commitments, and the rising domestic energy consumption is expected to drive the wind energy market during the forecast period.

- China's provinces have set up individual targets for renewable energy projects as a part of national targets. The largest targets have been set up by the northwestern provinces of Inner Mongolia and Gansu to leverage the presence of large tracts of uninhabited desert lands. These two provinces plan to add a cumulative 190 GW of wind and solar projects by 2025.

- According to the International Renewable Energy Agency RE Capacity 2024, wind installed capacity in China in 2023 reached 441.89 gigawatts, increasing from 365.96 gigawatts in 2022, clearly indicating the role of wind energy in increasing renewable energy capacity in China.

- According to the Global Wind Energy Council's Global Wind Report 2024, at the country level, China and the United States remained the world's two largest markets for onshore wind additions, followed by Brazil, Germany, and India.

- In November 2023, the world's first maritime renewable energy project with a capacity to generate 96,000 kWh of electricity daily, which combines deep-sea floating wind energy and aquaculture, developed by Longyuan Power Group and Shanghai Electric Wind Power Group in China, was completed, enabling a significant step forward for the Chinese wind energy sector.

- Thus, increasing investments from state-owned companies and favorable government policies in wind energy generation are expected to drive the growth of the Chinese wind energy market during the forecast period.

China Wind Energy Industry Overview

The Chinese wind energy market is fragmented. Some of the major players in the market include Xinjiang Goldwind Science & Technology Co. Ltd, ENVISION GROUP, Shanghai Electric, Dongfang Electric Corporation, and Mingyang Smart Energy Group Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49925

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions And Market Definition

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Demand for Renewable Energy

- 4.5.1.2 Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources

- 4.5.2 Restraints

- 4.5.2.1 Increasing Installation of Other Renewable Sources Such as Solar Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION - BY LOCATION

- 5.1 Onshore

- 5.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Xinjiang Goldwind Science & Technology Co. Ltd

- 6.3.3 General Electric Company

- 6.3.4 Siemens Gamesa Renewable Energy SA

- 6.3.5 Vestas Wind Systems AS

- 6.3.6 Envision Group

- 6.3.7 Shanghai Electric Group Company Limited

- 6.3.8 Dongfang Electric Corporation

- 6.3.9 Ming Yang Smart Energy Group Limited

- 6.3.10 Hanwha Group

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Development of Building-integrated Wind Turbines (BIWTs)

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.